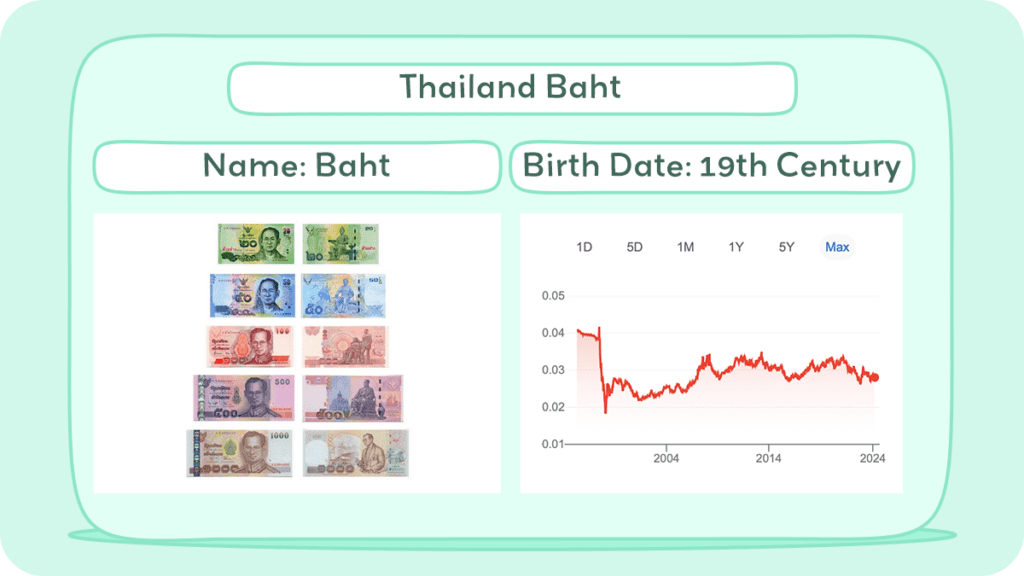

The official currency of Thailand is the Thai baht (THB), which is divided into 100 satang. The baht has been the currency of Thailand since 1897 when it replaced the previous currency, the tical.

The Thai baht is divided into 100 satang, with coins available in denominations of 25 and 50 satang, as well as 1, 2, 5, and 10 baht. Banknotes come in denominations of 20, 50, 100, 500, and 1,000 baht.

The Thai baht is a stable currency and widely accepted throughout Thailand. This article takes you on an exploration of the Thai baht, Thailand’s currency. We cover its history, evolution, and its role in today’s Thai economy.

Historical Journey of Thailand Currency

Thailand has a rich history of currency that dates back to the days of barter trade and ancient beads.

The first Thai currency was the bullet coin, which was used during the Sukhothai period in the 14th century. These coins were made of silver and were shaped like bullets, hence the name.

Over the years, Thailand’s currency has gone through several changes, including its design and denominations.

In the 19th century, the Thai baht was introduced as a unit of currency for the country, replacing the baked clay coin that had been used for centuries. Today, the Thai baht is the official legal currency of the Kingdom of Thailand.

The baht is divided into 100 satangs comparable to cents in Canadian or US dollars. The issuance of currency is the responsibility of the Bank of Thailand, which authorizes all minting of Thai coins and printing of Thai banknotes.

Inflation has been a major concern for the Thai economy, and the buying power of the Thai baht has fluctuated over the years. Inflation rates were high during the 1970s and early 1980s, but have since stabilized.

As of 2024, the Thai baht has a relatively stable exchange rate and is ranked as the 10th most frequently used world payment currency by SWIFT.

Overall, the historical journey of Thailand’s currency reflects the country’s rich cultural heritage and economic development. The Thai baht remains an important symbol of the country’s economic growth and stability.

History of Coins

The history of Thai coinage is a fascinating journey from ancient currency forms to the sophisticated monetary system in place today.

Initially, the Thai economy relied on natural and simple forms of currency, such as cowrie shells from the Mekong River, used for small transactions during the Sukhothai period between 1248-1438 CE.

Before the advent of modern minting techniques in 1860, Thailand utilized a traditional form of coinage known as “bullet” coinage. These were essentially bars of metal, thicker in the middle and bent to form a complete circle, with stamped marks for identification.

This system included a variety of denominations in both silver and gold, with the gold baht traditionally valued at sixteen times that of the silver baht. Notably, foreign trade coins were also accepted and stamped by the government for use within Thailand between 1858 and 1860.

The evolution of Thai coinage saw significant developments under the reigns of Rama III and Rama IV (19th century), with various denominations introduced, ranging from the bia, a calcium carbonate piece, to the substantial 80 baht silver coin, all bearing the State Ensign of Rattanakosin.

This era also marked the beginning of Thailand’s transition to modern coinage, with Rama III being the first monarch to explore the use of flat coins to prevent the killing of creatures living in cowrie shells.

By 1860, Thailand had introduced modern-style coins, including denominations such as the sik, fuang, salung, and baht in silver, alongside tin and gold coins in subsequent years.

This period also saw the introduction of the first coins denominated in satang in 1897, expanding the currency system to include smaller denominations and facilitating broader economic transactions.

The coin designs evolved to include various symbols of the Kingdom of Siam, including the Crowned Monogram of Rama V, reflecting the nation’s identity and royal lineage.

The mid-20th century brought further innovations, introducing coins made from different materials such as cupronickel, aluminium bronze, and even unique alloys incorporating copper, nickel, silver, and zinc.

The transition towards more durable and cost-effective materials was accompanied by the introduction of new denominations and the gradual phasing out of older coin types.

In 1972, the introduction of cupronickel 5 baht coins marked another milestone, followed by the adoption of bimetallic and cupronickel-clad steel coins, enhancing the durability and security of the currency.

A significant modernization effort was undertaken in 2008 when the Ministry of Finance and the Royal Thai Mint announced a new series of coins, aimed at reducing production costs and updating the imagery to reflect the current king’s portrait.

This series included a variety of denominations, from the humble 1 satang to the 10 baht coin, featuring a mix of materials to differentiate each denomination while maintaining the aesthetic continuity of Thailand’s rich numismatic history.

In 2018, a new series was released, featuring King Maha Vajiralongkorn, maintaining the standard specifications of previous issues but with updated portraits and designs, signifying the continuation of the monarchy’s role in the nation’s currency.

This ongoing evolution of Thai coinage, from its early forms to the contemporary series, illustrates Thailand’s rich cultural heritage and its adaptation to modern economic demands, symbolizing the country’s progress while honoring its past.

History of Bills

The Thai baht banknotes, managed by the Bank of Thailand, have evolved significantly since their initial issuance in 1851, with denominations ranging from 1 to 1,000 baht. The current series in circulation include the 15th, 16th, and 17th series, featuring denominations from 20 to 1,000 baht.

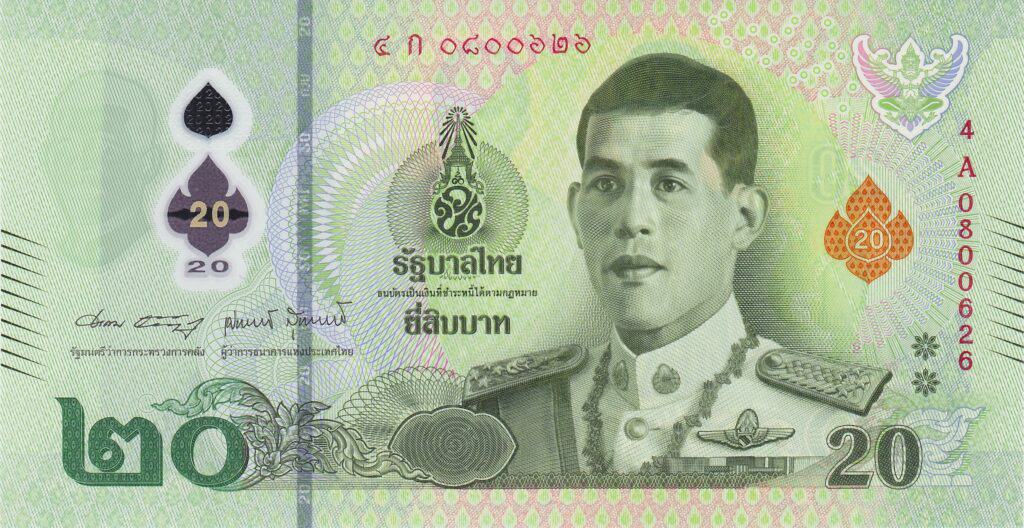

These banknotes are distinct for displaying portraits of Thai kings, both on the obverse, showing the current king, and on the reverse, featuring notable kings and their significant contributions to Thailand.

The banknotes occasionally include King Bhumibol’s sayings, reflecting the monarch’s influence and legacy.

The history of Thai banknotes is marked by various milestones, starting with the issuance of notes for fractions of a tical in 1851 and expanding to include larger denominations over time. Notably, in 1892, the treasury commissioned notes from Giesecke & Devrient, which were never circulated.

A significant reform in 1902, led by Prince Jayanta Mongkol, marked the beginning of modern paper money in Thailand.

Over the years, the Bank of Thailand has introduced several series of banknotes, each with unique features and security enhancements, including the use of the EURion constellation since 2003.

The 15th series, issued between 2003 and 2005, remains in circulation and includes notes from 20 to 1,000 baht, showcasing Thailand’s rich history and royal legacy.

The 16th series, introduced from 2012 to 2015, continued this tradition, with special editions released to honor King Bhumibol after his passing.

The 17th series, starting in 2018, features King Vajiralongkorn and celebrates the contributions of the Chakri dynasty kings, with a focus on improving the country.

In 2022, a significant update was made to the 20 baht note, transitioning it to a polymer material to enhance durability and incorporate advanced security features. This change reflects the banknote’s status as the most widely used denomination, necessitating improvements in quality to withstand frequent handling.

Throughout their history, Thai banknotes have not only served as a medium of exchange but also as cultural artifacts that narrate the country’s history, honor its leaders, and symbolize national pride.

Commemorative notes have been issued to mark important royal and national milestones, further embedding the currency within the social and historical fabric of Thailand.

These banknotes, from their design to their security features, encapsulate Thailand’s journey through time, paying tribute to its heritage while embracing technological advancements in currency production.

Inflation and Buying Power of Thai Baht

If you’re planning to visit Thailand or invest in its economy, it’s important to understand the country’s inflation and the buying power of its currency. Inflation is the rate at which the general level of prices for goods and services is rising, and it affects the purchasing power of the currency.

According to World Bank data, Thailand’s average inflation rate from 1960 to 2022 was 4.06%. However, the inflation rate has been relatively stable in recent years, with an average rate of 1.18% between 2010 and 2022.

This means that the prices of goods and services in Thailand have been rising at a slower rate compared to the previous years.

One way to measure the buying power of the Thailand currency is through purchasing power parity (PPP). PPP is the exchange rate that equalizes the purchasing power of different currencies by eliminating the differences in price levels between countries.

As of 2022, Thailand’s PPP was 11.7 LCU per international dollar, according to Knoema. This means that one international dollar can buy 11.7 times more goods and services in Thailand than in the United States.

Despite the stable inflation rate and relatively high PPP, it’s important to note that the value of the Thailand currency can fluctuate due to various factors such as political instability, economic growth, and global events.

Thai Baht

The 17th series of Thai baht banknotes, released from 2018 onwards, features modern designs that pay tribute to Thailand’s monarchy and national heritage.

On the front, these notes carry a portrait of the current King, Vajiralongkorn (Rama X), depicted in the uniform of the commander of the Royal Thai Air Force. The reverse side showcases previous kings and important cultural or historical scenes:

20 THB

The 20 baht note, issued in both paper (2018) and polymer (2022) forms, displays Kings Phra Buddha Yodfa Chulaloke (Rama I) and a scene from Enau, reflecting the cultural heritage of Thailand.

50 THB

The 50 baht note highlights King Nangklao (Rama III) alongside a Chinese junk and King Mongkut (Rama IV) with the Khao Wang observatory, symbolizing Thailand’s historical connections and advancements in science.

100 THB

The 100 baht note features King Chulalongkorn (Rama V) during his visit to Norway, emphasizing his role in modernizing Thailand, and King Vajiravudh (Rama VI), who founded the Thai Boy Scouts.

500 THB

On the 500 baht note, King Prajadhipok (Rama VII) is commemorated for granting Thailand’s first constitution, alongside King Ananda Mahidol (Rama VIII) depicted during a visit to Sampheng.

1000 THB

The 1,000 baht note honors King Bhumibol Adulyadej (Rama IX) for his dedication to the people, shown accepting a lotus in Nakhon Phanom, and King Vajiralongkorn’s engagement with rural communities.

Currency Usage in Thailand

Thailand’s official currency is the Thai baht (THB), which is divided into 100 satangs. The most commonly used denominations of banknotes are 20, 50, 100, 500, and 1,000 THB. Coins of 1, 2, 5, and 10 THB are also used, as well as coins of 50 and 25 satangs.

When traveling to Thailand, it is recommended that you exchange your currency to Thai baht. Using foreign currencies such as USD or EUR directly to make payments is not accepted in most places around the country.

However, some vendors may accept USD, but it is not commonly used and may not be accepted everywhere.

Is USD accepted in Thailand?

While it is not recommended to use foreign currencies such as USD directly to make payments, you can exchange your USD for Thai baht at banks or currency exchange booths.

Remember that the exchange rates may vary, and you may be charged a commission fee. It is advisable to compare rates and fees before exchanging your currency.

Credit cards are widely accepted in Thailand, especially in tourist areas and major cities. However, small shops and markets may not accept credit cards, so it is always good to carry some cash with you. ATMs are widely available in Thailand, and you can withdraw Thai baht using your debit or credit card.

Exchanging Currency in Thailand

If you’re planning a trip to Thailand, you’ll need to exchange your currency for Thai baht. Here’s what you need to know about exchanging currency in Thailand.

Where can I exchange Thailand currency?

You can exchange currency at banks, exchange offices, and ATMs throughout Thailand. Banks usually offer the best exchange rates, but they have limited hours and may charge higher fees.

Exchange offices are open longer hours and offer competitive rates, but be sure to compare rates and fees before exchanging money. ATMs are widely available and usually offer fair exchange rates, but be aware of withdrawal fees and daily limits.

What to know before exchanging currency in Thailand

Before exchanging currency for your trip to Thailand, ensure your cash is in good condition, as torn or damaged bills may be rejected or exchanged at a lower rate.

Avoid currency exchange at hotels or tourist-heavy areas, which often have higher fees and less favorable rates.

Stay vigilant against scams by counting your money before leaving the exchange office and verify the current exchange rate through online resources or currency converter apps to get the best deal.

Carrying cash in Thailand is crucial, as many small vendors don’t accept credit cards. Exchange your money at banks, dedicated exchange booths, or reputable hotels, and compare rates and fees to avoid financial surprises during your visit.

By following these tips, you can exchange your currency safely and get the best rates possible.

Choosing Between USD and Thailand Currency

If you’re planning a trip to Thailand, you may be wondering whether it’s better to use US dollars or Thai baht for your transactions. Here are some factors to consider when making your decision.

Exchange Rate

The exchange rate between USD and Thai baht fluctuates constantly, so it’s important to keep an eye on the current rate before making any transactions. Keep in mind that currency values are subject to constant fluctuations influenced by various economic factors.

When exchanging your currency for Thai baht, it is important to note that the exchange rates can vary depending on where you exchange your money. It is recommended to exchange your currency at a bank or authorized money exchange counter to ensure you get a fair rate.

Convenience

While some businesses in Thailand may accept US dollars, it’s generally more convenient to use Thai baht for your transactions.

Most places in Thailand, including hotels, restaurants, and shops, prefer to be paid in Thai baht. If you do plan to use US dollars, make sure to have smaller denominations, as larger denominations may be difficult to exchange.

Fees

When exchanging currency, you may encounter fees and commissions from banks, exchange booths, or ATMs. These fees can vary depending on the institution and the amount of money you’re exchanging.

It’s important to research the fees associated with exchanging currency before making any transactions. Additionally, some credit cards charge foreign transaction fees, so it’s important to check with your bank before using your card in Thailand.

Tips

When traveling in Thailand, it’s common to tip for services such as massages, taxis, and restaurants. While tipping is not required, it’s appreciated. If you choose to tip, it’s generally best to tip in Thai baht. Keep in mind that some businesses may not accept US dollars as tips.

Cost of Living in Thailand

If you’re planning to move to Thailand, it’s essential to have a good understanding of the cost of living in the country.

Thailand has a reputation for being an affordable destination, and for the most part, this is true. However, the cost of living in Thailand can vary significantly depending on where you live and your lifestyle.

Accommodation is one of the biggest expenses in Thailand. If you’re on a budget, you can find a one-bedroom apartment for as little as 5,000 THB (USD $141) per month outside of Bangkok.

In Bangkok, expect to pay at least 10,000 THB (USD $282) per month for a similar apartment. If you’re looking for something more luxurious, then you can expect to pay upwards of 30,000 THB (USD $846) per month.

Food in Thailand is generally very affordable, and you can find a wide range of options to suit any budget. Street food is particularly cheap, with a typical meal costing around 40-50 THB (USD $1.13 – USD $1.41). If you prefer to eat in restaurants, then expect to pay around 100-200 THB (USD $2.82 – USD $5.64) per meal.

Transportation is another area where you can save money in Thailand. Taxis are relatively cheap, with a typical journey costing around 60-100 THB (USD $1.69 – USD $2.82).

If you’re on a budget, then you can use public transport, which is even cheaper. A journey on the BTS Skytrain or MRT subway in Bangkok costs around 16-42 THB (USD $0.45 – USD $1.18).

Utilities in Thailand are generally affordable, but they can vary depending on where you live.

Electricity is the most expensive utility, with a typical bill for a one-bedroom apartment costing around 1,500 THB (USD $42) per month. Water is relatively cheap, with a typical bill costing around 100-200 THB (USD $2.82 – USD $5.64) per month.

The cost of living in Thailand is relatively low compared to many other countries, but it’s important to remember that costs can vary significantly depending on where you live and your lifestyle.

By budgeting carefully and making smart choices, you can live comfortably in Thailand without breaking the bank.

Don’t Get Scammed Tips

Thailand is a popular tourist destination, and it is important to be aware of currency scams. Here are some tips to avoid getting scammed when exchanging currency in Thailand.

1. Use Reputable Money Exchange Services

One of the easiest ways to avoid money exchange scams in Thailand is to use a reputable money exchange service. Banks, hotels, and authorized money exchange kiosks are often the best options.

These establishments are regulated and have a reputation to maintain, so they are less likely to engage in scams. Check the exchange rate and compare it with other services before making a transaction.

2. Beware of Unofficial Money Changers

Unofficial money changers may offer better exchange rates, but they can also be fraudulent. These money changers may offer counterfeit bills or shortchange you. It is best to avoid these money changers and stick to authorized money exchange services.

3. Check the Currency Exchange Rate

Before exchanging currency, check the current exchange rate. You can find the current exchange rate online or at authorized money exchange services. This will help you to avoid being shortchanged or overcharged.

4. Count Your Money

Always count your money before leaving the money exchange service. Make sure the amount you received matches the amount you exchanged. If you find any discrepancies, inform the money exchange service immediately.

5. Use Credit Cards or ATMs

Using credit cards or ATMs is a safe and convenient way to access your money in Thailand. Make sure to inform your bank that you will be traveling to Thailand to avoid any issues with your card. Be aware of any fees or surcharges that may apply when using your credit card or ATM.

By following these tips, you can avoid currency scams and enjoy your trip to Thailand without any worries.