Have you ever wanted to eat your money? It may seem like a silly question, but think about it—if you were stuck on a desert island, what good would your money be? Aside from the fact that other people accept your money in exchange for goods and services, your money is pretty much useless.

What if your money had intrinsic value—that is to say, it had value in and of itself. Even if no one is willing to accept it as money, it can still be used for another purpose.

What you’re describing is commodity money. In fact, it was one of the first forms of money used and is still used in some circumstances today. In this article, we’ll look at what commodity money is, why it was the first money used, and explore its advantages and disadvantages.

What is Commodity Money?

Commodity money is money whose underlying value exists outside its use as a medium of exchange. In other words, it is useful even if others refuse to accept it for trade.

Take, for example, gold, which is probably the most famous type of commodity money. People value it for its beauty, and, even if people didn’t accept it as a form of payment, you could still use it in computers, dentistry, or fashioning jewelry.

Compare this with the money in your pocket or your bank account. If people stopped accepting it as a medium of exchange and you could no longer buy things with it, it would be useless. Maybe you could use it to fan yourself, take notes on, or start a fire, but that’s about it.

History of Commodity Money

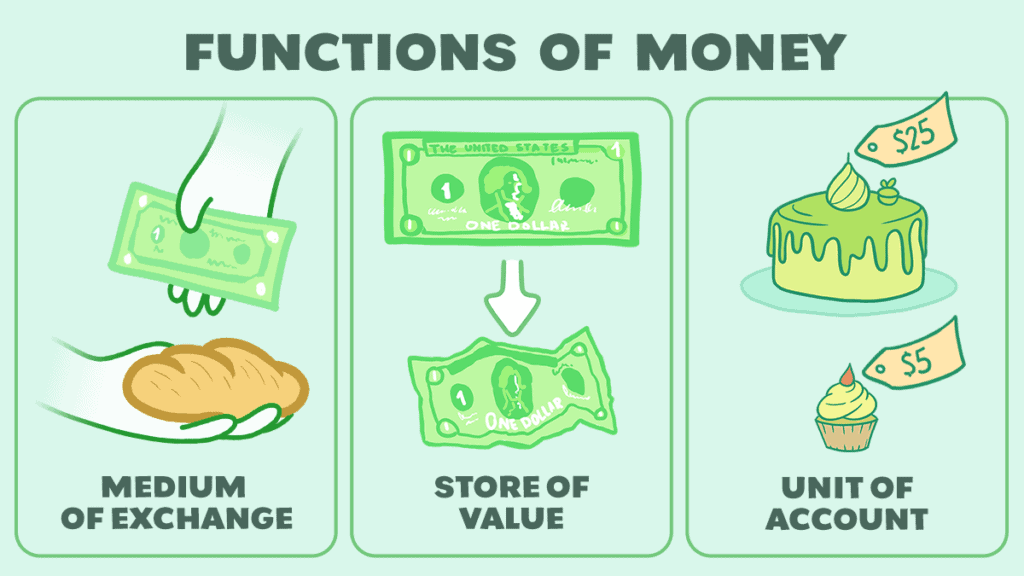

As we mentioned earlier, commodity money was the first form of money—anything that is used as a medium of exchange, store of value, and unit of account.

In primitive economies, people simply bartered. They would trade one good for another.

But, finding people seeking the exact inverse of the trade you were looking for could become burdensome, so people began accepting commonly traded goods such as cattle, knowing that they would have the option either to use the good itself or exchange it with somebody else later on.

Over time, people found a variety of things that could be exchanged for money. All that really mattered was that it was commonly accepted as a medium of exchange. Gold and other precious metals rose to the forefront, and the ancient Kingdom of Lydia took advantage of this to mint the first gold coins.

However, multiple items have been used as commodity money throughout history. Here are a few other examples:

- alcohol

- silk

- cocoa beans

- salt

- sea shells

- tea

- tobacco

Characteristics of Commodity Money

Though many things have been used as commodity money throughout the ages, not all have been equally effective. Certain characteristics lead to some items being more suitable for use as money than other items. These characteristics are:

1) Durability – To be effective as a store of value, the item must retain its intrinsic value over time. Cattle die or grow old and diseased; meat and produce rot. Thus, if these are used as commodity money, they must be spent or consumed relatively quickly. By contrast, precious metals retain their value over time, allowing them to be held onto for later use.

2) Divisibility/ Measurablity – If you are selling something, you are going to want to know how much you are getting for it. Likewise, if you’re buying something, you want to know how much it costs. To be an effective form of commodity money, you must be able to measure it.

Additionally, it’s useful if you can divide the commodity into smaller portions. It is fine and dandy if you want to buy something that costs exactly one cow, but what if you think it’s only worth half a cow?

There’s no way to effectively divide the cow in half that doesn’t involve butchering it, at which point it would lose some of its value. Gold and silver work well due to their ability to be divided, as do items like salt.

3) Portability – Let’s face it—nobody wants to take a herd of cows with them to the market. The more convenient something is to carry around with you, the better a form of commodity money that something will make. Gold works well in this regard because it can be put into a sack and carried with the owner.

4) Rarity – A final thing that makes a commodity useful as money is its rarity. If a commodity is plentiful, the money supply would be almost infinite, leading to massive inflation, thereby making the money worthless. A rare commodity, such as gold, limits the supply, thereby allowing the commodity money to maintain its value.

The flip side of this is that, as the economy grows, the demand for money grows. The supply of money must be able to also grow in order to meet this growing demand. We’ll examine this in more detail shortly, as we examine the decline of commodity money.

It is largely due to the possession of these characteristics that gold and other precious metals became the most widely used form of commodity money.

The Decline of Commodity Money

Commodity money in the form of gold coins remained the standard in Europe throughout the Middle Ages. During this time, there was plenty of gold to meet the demands of the economy, bolstered by colonial acquisitions in North America which provided European governments with new sources of precious metal and, as a result, money.

People began to deposit their gold coins into banks, and first banks, then governments, issued paper notes that could be exchanged for the equivalent amount of gold on demand.

People would carry around these notes and use them to conduct their daily business out of convenience—they were more portable, that is, easier to carry around, than their equivalence in gold.

By the 1870s, the gold standard was adopted. Each nation would issue a national currency based on its gold reserves. However, during the First World War, the demand of governments for money outstripped their supply of gold.

As such, they ended the convertibility of their currency to gold and continued to print and make payments with inconvertible paper currency. Though the gold standard made a comeback during the 1920s, the Great Depression created a similar situation such that every country abandoned the gold standard by 1937.

Following World War II, forty-four Allied nations entered the Bretton Woods Agreement—an agreement for the US to set its dollar to gold, and each nation, in turn, to set its currency to the dollar.

However, supply and demand again became an issue, and as the supply of US dollars in the global economy overcame the United States’ supply of gold, President Nixon unilaterally took the US off the gold standard in 1971.

Though meant as a temporary measure, this became permanent in 1973 and ushered in the modern era of fiat money—money issued by the government with no material backing that is accepted as money because the government says so.

Advantages and Disadvantages

The first and most obvious advantage of commodity money is its intrinsic value. Even if the economy collapses, your money itself would still have value.

The second is its stability. Because it consists of something rare, sudden increases in the money supply are unlikely to occur. Contrast this with fiat money, which can be printed by the government at will.

Reckless government printing of money can lead to hyperinflation, as occurred in the Weimar Republic in 1923 or Zimbabwe under President Robert Mugabe.

However, inflation can still occur with the discovery of new sources of the commodity—for example, new gold mines could rapidly deflate the value of gold.

Furthermore, anyone can produce commodity money; not just the government. Anyone with access to gold mines can produce more gold, including those only interested in their own accumulation of wealth with no regard for the stability of the overall economy.

The opposite problem can also occur. Since producing more money would require producing more of the commodity, the demand for money can grow faster than the commodity can be produced, as we discussed earlier with the gold standard during World War I.

Commodity money can also be expensive to produce. For example, gold must be mined. For these reasons, commodity money can make exercising monetary policy difficult since it relies on the government’s ability to control the money supply.

In the same way that reckless government policies can lead to hyperinflation and economic ruin, good government policies can help keep unemployment and inflation low. For this reason, modern economies generally disfavor commodity money in favor of fiat money.

Conclusion

Though commodity money has generally fallen out of use in favor of fiat money, it can still be used on occasion today. Outside of the black market, commodity money is often used in war-torn areas or areas experiencing monetary collapse.

Examples of this can be found in the Siege of Sarajevo in 1993 and, more recently, in Russian-occupied Kherson.

We hope you enjoyed this article and it helped give you a more complete view of a historically important form of currency. Please subscribe to see more informative articles on similar subjects.