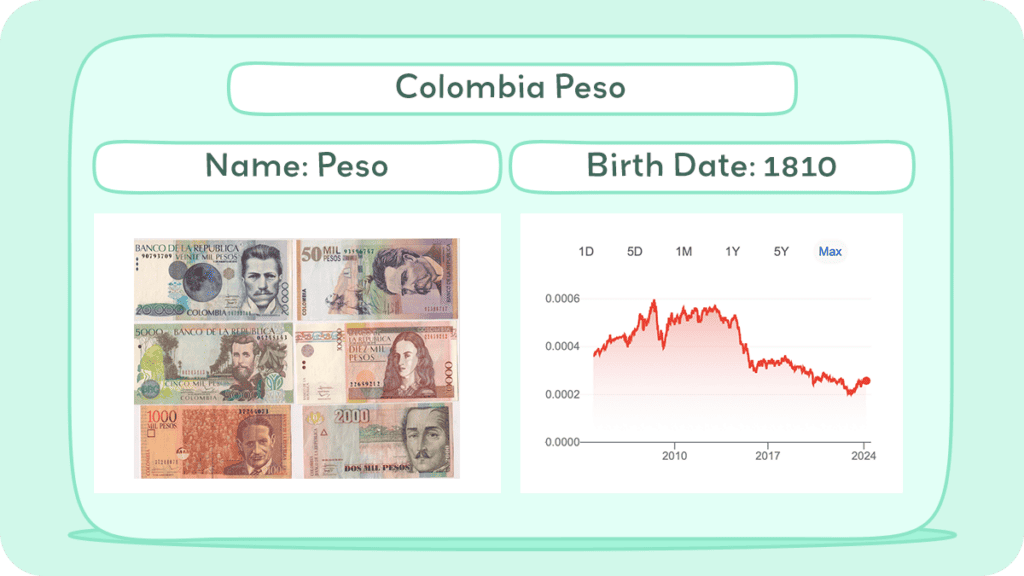

The official currency of Colombia is the Colombian peso (COP), which was introduced in 1837. The Colombian peso has a fascinating story that spans centuries. The history of the Colombian peso dates back to 1810 when the country declared independence from Spain.

At that time, the country used the Spanish colonial real as its currency. After independence, the Colombian peso replaced the Spanish colonial real. Since then, the Colombian peso has undergone many changes.

This article explores the Colombian peso, Colombia’s official currency. It covers its history, from early coins to current banknotes and digital forms, the peso’s historical value changes, and its purchasing power, providing a thorough insight into the Colombian peso.

Historical Journey of the Colombian Peso

The Colombian peso is a symbol of Colombia’s national identity and economic resilience. Between the Spanish colonization in the 16th century and the 1810 Colombian War of Independence, various currencies were used. The War of Independence led to the peso’s birth.

Despite early challenges like dependence on silver and political turmoil, the 19th century brought stability with the coffee export boom. The 20th century witnessed significant changes, including the Great Depression’s impact and inflation challenges, leading to economic reforms and the establishment of the Central Bank of Colombia.

In the 21st century, the peso navigates the globalized economy, facing challenges like oil price fluctuations but remaining a national pride symbol.

This section notes the peso’s redenominations, its division into 100 centavos, its ranking as the 18th most traded currency, and its regulation by the Central Bank of Colombia. The peso’s history mirrors Colombia’s trials and triumphs, playing a crucial role in its ongoing development.

History of Coins

From 1837 to 1839, Colombia introduced various silver and gold coins, including 1⁄4, 1⁄2, 1, 2, and 8 real coins in silver, and 1, 2, and 16 pesos in gold, transitioning from the escudo to peso denominations. In 1847, the currency was decimalized with new copper and silver coins.

Gold coins continued to be introduced until 1856, including a 5 peso coin. Between 1859 and 1862, the Grenadine Confederation and then the United States of New Grenada issued various silver and gold coins.

In 1862, the United States of Colombia issued new coin denominations in silver and gold. In 1872, centavos were introduced with silver and cupro-nickel coins, followed by more denominations over the years. In 1886, the Republic of Colombia issued cupro-nickel 5 centavos, and in the following years, added silver coins.

In 1907, after stabilizing paper money, new cupro-nickel peso coins were introduced. Gold coins pegged to sterling were introduced in 1913. In 1918, pesos p/m coins were replaced by centavo coins. Bronze coins were introduced in 1942 and 1948, and by 1958, cupro-nickel replaced silver in some coins.

Copper-clad-steel and nickel-clad-steel coins were introduced in 1967. In 1977, bronze 2 pesos were introduced, and by 1984, production of coins below 1 peso ceased. High inflation led to the introduction of higher denominations from 1980 to 1996. However, the 1000 pesos coin was withdrawn in 2002 due to counterfeiting.

In 2009, the minting of 5, 10, 20 peso coins ceased, and cash transactions began rounding to the nearest 100 pesos. In 2012, new Bi-metallic 500 and 1000 peso coins were issued.

Today, the Colombian peso is divided into 100 centavos, although centavo coins are no longer in circulation. The coins currently in circulation are 50, 100, 200, 500, and 1000 pesos.

History of Bills

From 1857 to 1880, various Colombian provinces issued their banknotes in denominations ranging from 10¢ to 100 pesos. In the 1860s, notes in similar denominations, including reales, were issued.

The Banco Nacional introduced new notes in 1881, with denominations expanding up to 1,000 pesos by 1895. The Treasury took over note production in 1904, issuing a range of denominations, and in 1910, the Conversion Board introduced additional notes.

Over sixty retail banks issued banknotes between 1865 and 1923 in various denominations. In 1923, the Banco de la República began exclusively producing notes, introducing peso oro denominations and later issuing silver certificates in 1932 and 1941. The bank also produced smaller half peso oro notes by cutting 1 peso notes in half in 1943.

Significant changes occurred from 1974 onwards, with the introduction of higher denominations like 200 and 1,000 pesos oro, and the gradual cessation of smaller denominations.

In 1993, the term “oro” was dropped from the currency. New notes, including high denominations like 20,000 and 50,000 pesos, were introduced in the following years.

In 2006, the Banco de la República reduced the size of the heavily used 1,000 and 2,000 peso notes. In 2010, a 2,000 peso note with Braille was issued. A new series of banknotes was introduced in 2016, featuring biodiversity themes, cultural elements, and notable Colombian figures, including the highest denomination of 100,000 pesos. This series completed its rollout by the end of 2016.

The history of the Colombian peso is a long and fascinating one. From the Spanish colonial real to the current peso, the currency has undergone many changes over the years. The Banco de la República has played a significant role in the development of the Colombian peso, including the introduction of new banknotes and coins.

Inflation and Buying Power of the Colombian Peso

The inflation rate in Colombia has been fluctuating over the years. According to the inflation calculator, the inflation rate between 1971 and 2022 was 91,513.76%. This means that the purchasing power of the Colombian Peso has significantly decreased over the years.

For example, 100 pesos in 1971 is equivalent to 91,613.76 pesos in 2022. In other words, the purchasing power of $100 in 1971 equals $91,613.76 in 2022.

The average annual inflation rate between these periods was 14.31%. This high inflation rate has made it challenging for Colombians to maintain their buying power. However, the inflation rate has been decreasing in recent years.

The inflation rate between 2021 and today has been 26.61%, which translates into a total increase of $26.61. This means that 100 pesos in 2021 are equivalent to 126.61 pesos in 2023. The average annual inflation rate between these periods has been 12.52%.

The Colombian government has implemented several measures to control inflation and stabilize the currency. One of the measures is the adoption of an inflation-targeting strategy by the Banco de la República. The strategy has two objectives.

First, it allows the bank to have an independent monetary policy that takes into account the state of the Colombian economy and allows it to fulfill its constitutional duties.

Second, it allows the bank to maintain price stability, which is essential for economic growth and development.

Despite the high inflation rate, the Colombian peso is widely used in the country. The currency is used for daily transactions, such as buying groceries, paying bills, and other expenses.

The Colombian peso is also used for international transactions, such as importing and exporting goods and services. The currency is relatively stable, and its value is determined by the foreign exchange market.

The high inflation rate in Colombia has significantly affected the purchasing power of the Colombian Peso over the years. However, the government has implemented measures to control inflation and stabilize the currency.

Colombian Peso

Over the years, the design and denomination of Colombian banknotes have changed. Today, banknotes are issued in denominations of 1000, 2000, 5000, 10,000, 20,000, 50,000, and 100,000 pesos. The banknotes feature images of famous Colombian figures, landmarks, and animals.

2,000

The 2000 Colombian peso banknote has the following designs: On the front (obverse), it features Débora Arango, a famous Colombian artist, along with images of birds and a landscape. On the back (reverse), it depicts Caño Cristales, a renowned river in Serranía de la Macarena, and additional images of birds.

5,000

The 5000 Colombian peso banknote features these designs: On the front, there is poet Jose Silva in the center surrounded by a honeycomb pattern, which includes geometric shapes and the name of the issuing bank. On the back, it shows the Andes mountains with rivers, Colombian paramos, a bear, a condor, and a bumblebee.

10,000

The 10,000 Colombian peso banknote has the following designs: On the front, it features Virginia Gutiérrez. On the back, it depicts the Amazon natural region, a river, a snake, a Victoria Regia water lily, and a man in a canoe.

20,000

The 20,000 Colombian peso banknote features Alfonso López Michelsen on the front and, on the back, it shows the La Mojana channels in the Zenú people’s region and a sombrero vueltiao (a traditional Colombian hat).

50,000

The 50,000 Colombian peso banknote has Gabriel García Márquez on the front and, on the back, it features indigenous people, the Ciudad Perdida, and the Sierra Nevada de Santa Marta.

100,000

The 100,000 Colombian peso banknote displays President Carlos Lleras Restrepo on the front. On the back, it features the Valle de Cocora with wax palms and an image of a harvester on a trunk.

Currency Usage in Colombia

Colombia’s official currency is the Colombian peso (COP). The most commonly used denominations of Colombian peso banknotes are 1,000, 2,000, 5,000, 10,000, 20,000, 50,000, and 100,000 pesos.

Each denomination features distinct designs and colors that showcase the country’s cultural heritage. Coins come in denominations of 50, 100, 200, 500, and 1,000 pesos.

When traveling to Colombia, it’s recommended to exchange your currency to Colombian pesos. Most hotels, restaurants, and shops in Colombia accept Colombian pesos only.

However, some high-end establishments may accept US dollars, but it’s always best to have Colombian pesos on hand to avoid any confusion or exchange rate discrepancies.

Is USD Accepted in Colombia?

While some establishments may accept US dollars, it’s important to note that the exchange rate may not be favorable. It’s always best to have Colombian pesos on hand to avoid any confusion or exchange rate discrepancies.

Additionally, if you plan to exchange your US dollars for Colombian pesos, it’s recommended to do so at an official exchange house or bank to ensure you receive the best exchange rate and avoid counterfeit bills.

Exchanging Currency in Colombia

When traveling to Colombia, it’s important to know how to exchange your currency for the local Colombian Peso (COP). You can exchange your currency at banks, exchange bureaus, and some hotels. However, it’s important to note that exchange rates can vary between different locations and times.

Where Can I Exchange Colombian Currency?

Banks are generally considered to be the safest and most reliable place to exchange your currency. They typically offer competitive exchange rates and charge lower fees compared to exchange bureaus.

Some popular banks in Colombia include Banco de Bogotá, Banco de Occidente, and Bancolombia.

Exchange bureaus are another option, but they often charge higher fees and offer less favorable exchange rates. If you choose to use an exchange bureau, make sure to compare rates and fees before making a transaction.

Hotels may also offer currency exchange services, but they are typically more expensive than banks and exchange bureaus. It’s best to avoid exchanging currency at airports, as they often charge high fees and offer unfavorable exchange rates.

What to Know Before Exchanging Currency in Colombia

Before exchanging your currency, it’s important to know the current exchange rate. You can check the current exchange rate online or by using a currency converter app. Additionally, make sure to bring your passport or another form of identification when exchanging currency.

Exchange rates can fluctuate frequently, so it’s always a good idea to check the current rate before exchanging money. You can easily find currency exchange offices throughout Colombia, particularly in major cities and tourist areas.

While credit cards are widely accepted in Colombia, it’s always a good idea to carry some cash with you, especially if you plan to visit more rural areas or smaller towns. ATMs are also widely available throughout the country, although you may be charged a fee for using them.

When exchanging money or using ATMs, be sure to keep an eye out for counterfeit bills, as this can be a problem in some areas.

It’s also a good idea to exchange only the amount of money you need, as you may lose money when exchanging it back to your home currency.

Lastly, keep in mind that some businesses in Colombia may not accept foreign currency, so it’s best to have enough Colombian Pesos on hand for your trip.

By following these tips, you can safely and efficiently exchange your currency in Colombia.

Choosing Between USD and Colombian Peso

When traveling to Colombia, you may be wondering whether to use USD or the local currency, Colombian Pesos (COP). Here are some factors to consider when making your decision.

Exchange Rate

In Colombia, the exchange rate is determined by market forces, but the Central Bank of Colombia intervenes in the foreign exchange market to maintain stability in the exchange rate. The exchange rate of the Colombian peso to the US dollar is the most widely used in Colombia.

The exchange rate between USD and COP can fluctuate, so it is important to keep an eye on the rate when exchanging money. Generally, it is more favorable to exchange money in Colombia rather than in your home country.

However, if you need to exchange money before your trip, look for a reputable exchange service with competitive rates. If you are traveling to Colombia, it is important to understand the exchange rate and how it will impact your costs.

Convenience

The Colombian peso (COP) is the official currency of Colombia and is widely used in daily life. You will find that most businesses, including restaurants, shops, and street vendors, only accept cash. It is recommended to carry small bills and coins, as larger denominations can be difficult to break.

ATMs are widely available in cities and towns, and most accept international cards. However, it is important to be cautious when withdrawing money, especially at night or in remote areas.

While USD is widely accepted in tourist areas, it may not be accepted in smaller shops or local markets. It is always a good idea to carry some Colombian Pesos with you for smaller purchases.

Additionally, using local currency can help you avoid confusion over exchange rates and potentially save you money on fees.

Fees

When exchanging money, be aware of any fees that may be charged. Some banks and exchange services may charge a flat fee or a percentage of the transaction amount.

Additionally, some ATMs may charge a fee for withdrawals. Research your options and compare fees to find the most cost-effective way to exchange money.

Tips

For effective currency exchange, check the exchange rate before traveling, use ATMs for cash withdrawals while being aware of fees, use credit cards for larger purchases for better rates and fraud protection, keep small bills and coins for minor expenses, and avoid exchanging money with unauthorized street vendors or unverified sources.

While USD is widely accepted in Colombia, it is a good idea to carry some Colombian Pesos with you for smaller purchases. Be aware of the exchange rate and any fees that may be charged when exchanging money, and consider using a credit card for larger purchases.

Cost of Living in Colombia

If you are planning to move to Colombia, it is important to understand the cost of living in this country. Colombia is a relatively affordable country compared to many other countries in the world.

According to Numbeo, a single person’s estimated monthly costs are $510.8 (1,966,328.3Col$) without rent. The cost of living in Colombia is, on average, 58.6% lower than in the United States. Rent in Colombia is, on average, 80.9% lower than in the United States.

The cost of living in Colombia varies depending on the city or region you live in. For example, the cost of living in Bogotá, the capital city, is higher than in other cities.

However, it is still relatively affordable compared to other major cities around the world. The cost of living in Colombia is influenced by factors such as housing, food, transportation, entertainment, and healthcare.

Housing is one of the biggest expenses in Colombia. The cost of renting an apartment or a house varies depending on the location, size, and condition of the property. However, you can find affordable housing options in Colombia if you are willing to live in a less central area or a smaller apartment.

Food is generally affordable in Colombia. You can find fresh fruits, vegetables, and meats at local markets and supermarkets. Eating out at restaurants is also relatively affordable, especially if you go to local restaurants that serve traditional Colombian food.

Transportation in Colombia is also affordable. Public transportation options such as buses and metro systems are available in major cities. Taxis are also relatively cheap compared to other countries.

Inflation rates in Colombia have been relatively stable in recent years. According to Trading Economics, the inflation rate in Colombia was 2.8% in December 2023. This is a relatively low inflation rate compared to other countries in the region. The Colombian government has implemented policies to control inflation and maintain economic stability in the country.

In conclusion, the cost of living in Colombia is relatively affordable compared to other countries in the world. The cost of housing, food, and transportation is generally lower than in many other countries. Inflation rates in Colombia have been stable in recent years, which is a positive sign for the country’s economy.

Don’t Get Scammed Tips

When it comes to handling money in Colombia, it is important to be vigilant and aware of common scams. Here are some tips to avoid getting scammed:

1. Exchange Money at Official Exchange Houses

Avoid exchanging money with strangers on the street, as they may offer counterfeit bills or shortchange you. Instead, exchange money at official exchange houses, which are regulated by the government and offer competitive rates.

2. Check Your Change

Always check your change carefully before leaving a store or restaurant. Counterfeit bills are common in Colombia, particularly the 20,000-peso and 50,000-peso notes, as well as the 100,000-peso note. Be especially careful when receiving change for large bills.

3. Use ATMs Wisely

ATMs are a safe and convenient way to withdraw cash in Colombia, but they can also be targeted by scammers. Always use ATMs located inside banks or shopping centers, and avoid using them at night or in isolated areas. Be sure to cover the keypad when entering your PIN, and check for any suspicious devices attached to the machine.

4. Be Wary of Strangers

Be cautious when approached by strangers offering to exchange money or sell goods on the street. These individuals may be trying to scam you by offering counterfeit bills or stolen items. Similarly, be wary of anyone who approaches you claiming to be a police officer or government official, as they may be trying to extort money from you.

5. Keep Your Valuables Safe

Pickpocketing and theft are common in Colombia, particularly in crowded areas such as markets and public transportation. Keep your valuables close to your body and avoid carrying large amounts of cash or wearing expensive jewelry. If possible, leave your passport and other important documents in a secure location such as a hotel safe.