Indian currency is a topic that is of interest to many people, whether they are planning a trip to India or simply curious about the country’s financial system. The official currency of India is the Indian rupee, which is symbolized by ₹ and has the code INR. The rupee is subdivided into 100 paise, with coins available in denominations of 1, 2, 5, and 10 rupees, as well as 40 paise.

Understanding the Indian currency system is also important for anyone doing business with or investing in India. This article explores the journey of Indian rupees, from its ancient roots to its current form as a modern currency used in the world’s fastest-growing economy.

If you are planning to visit India, you will need to familiarize yourself with the Indian currency, the Indian Rupee (INR). This article will delve into topics like the history of Indian currency, its role in the economic growth of India, and the challenges it faces in a rapidly changing world.

Historical Journey of The Indian Rupee (INR)

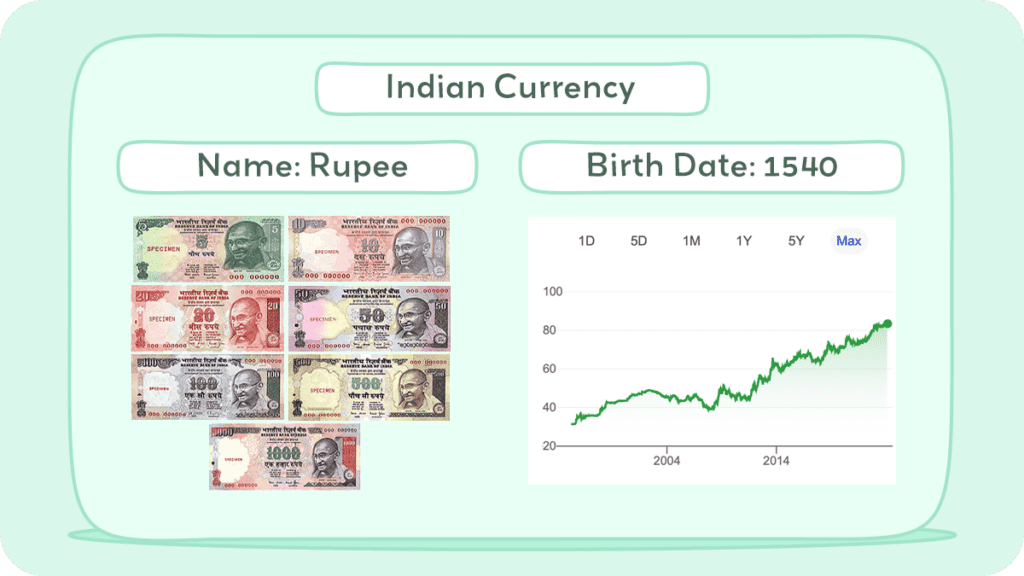

The Indian Rupee (INR) has a rich and fascinating history that spans centuries. The currency has come a long way from its early days as a silver coin. Today, it is the official currency of India, used by over 1.3 billion people.

History of Coins

The history of the Indian Rupee can be traced back to ancient times when coins were first introduced in the country. The first coins were made of silver and were known as “rupiya”. These coins were issued by Sher Shah Suri during his reign from 1540 to 1545 CE. The word “rupiya” is derived from the Sanskrit word “rupya” which means “wrought silver”.

Over the years, the design and composition of the coins changed, reflecting the political and economic changes in the country. In 1835, the British East India Company introduced the “Anna” coin, which was named after the Tamil word for “four”. The Anna was worth one-sixteenth of a Rupee.

After gaining independence, India introduced its first set of coins in 1950, featuring denominations such as 1 pice, 1⁄2, one, and two annas, as well as 1⁄4, 1⁄2, and one rupee. These coins closely resembled the final regal issues, except for the one-pice coin, which was made of bronze but not pierced.

Moving into the decimal system from 1957 onwards, India underwent significant changes in its coinage. In 1964, aluminum coins were introduced for denominations up to 20 paise. The initial decimal coins included 1, 2, 5, 10, 25, and 50 naye paise, along with 1 rupee. The materials varied, with the 1 naya paisa in bronze, the 2, 5, and 10 naye paise in cupro-nickel, and the 25 naye paise, 50 naye paise, and 1-rupee coins in nickel. In 1964, the coins were renamed, removing the words “naya/naye.”

From 1957 to 1967, aluminum coins of one, two, three, five, and ten paise were introduced. Subsequent years saw changes, including the introduction of nickel-brass 20-paise coins in 1968, replaced by aluminum coins in 1982. Between 1972 and 1975, cupro-nickel replaced nickel in the 25- and 50-paise coins and the 1-rupee coin. In 1982, cupro-nickel two-rupee coins were introduced, and in 1988, stainless steel coins of 10, 25, and 50 paise were introduced, followed by 1- and 5-rupee coins in 1992. Brass five-rupee coins were minted by the Reserve Bank of India (RBI).

In 1997, the 20 paise coin was discontinued, followed by the 10 paise coin in 1998, and the 25 paise coin in 2002. Between 2005 and 2008, new, lighter coins of fifty paise, one, two, and five rupees were introduced, made from ferritic stainless steel. The move aimed to counter the melting-down of older coins with a face value lower than their scrap value. The demonetization of the 25-paise coin and all coins below it occurred, and a new series of coins, including 50 paise, one, two, five, and ten rupees with the new rupee sign, was circulated in 2011. In 2016, the 50 paise coin was last minted. Commonly circulating coins include one, two, five, ten, and twenty rupees.

The technical specifications of these coins vary, with materials such as ferritic stainless steel, cupro-nickel, and bimetallic compositions. The designs feature the Emblem of India, various symbols, and expressions from Bharata Natyam Dance. The coins are minted at the India Government Mints in Mumbai, Kolkata, Hyderabad, and Noida. The government plans to introduce new versions of the ₹1, ₹2, ₹5, and ₹10 coins, along with a new ₹20 coin, featuring a dodecagonal shape and bi-metallic composition.

Minting is regulated by the Government of India through the Coinage Act of 1906, and coins are issued for circulation through the Reserve Bank of India. Additionally, commemorative coins are minted to honor significant events and figures in Indian history. The historical context also includes pre-independence issues under the British East India Company, featuring diverse coinages across the Bengal, Bombay, and Madras Presidencies until 1835. The regal coin issues from 1862 to 1947 marked a transition in designs and materials, reflecting the changing times.

History of Bills

The first paper currency in India was introduced by the British during the 18th century. These notes were issued by the Bank of Hindostan, the General Bank in Bengal and Bihar, and the Bengal Bank. However, the first official paper currency was introduced in 1861 by the Government of India. These notes were known as “Victoria Portrait” notes and were issued in denominations of Rs. 10, 20, 50, 100 and 1,000.

Following independence, India introduced new banknote designs, replacing those featuring George VI. While the Re1 note continued to be issued by the government, the Reserve Bank of India (RBI) issued other denominations, including the ₹5,000 and ₹10,000 notes introduced in 1949. All pre-independence banknotes were officially demonetized on April 28, 1957.

During the 1970s, ₹20 and ₹50 notes were introduced, and denominations higher than ₹100 were demonetized in 1978. The ₹500 note was introduced in 1987, followed by the ₹1,000 note in 2000, with ₹1 and ₹2 notes discontinued in 1995.

The design of banknotes is approved by the central government, following recommendations from the central board of the Reserve Bank of India. The Mahatma Gandhi Series of banknotes, introduced in 1996, replaced all issued banknotes of the Lion Capital Series. The series features a portrait of Mahatma Gandhi on the obverse of each note. The RBI initiated the series with ₹10 and ₹500 banknotes in 1996. The ₹5 notes, which had stopped earlier, resumed printing in 2009.

In January 2012, the new ‘₹’ sign was incorporated into banknotes of the Mahatma Gandhi Series. The RBI announced the withdrawal of currency notes printed prior to 2005, with the deadline initially set for March 31, 2014, later extended to January 1, 2015, and further extended to June 30, 2016.

On November 8, 2016, the RBI announced the issuance of new ₹500 banknotes in a new series after the demonetization of older ₹500 and ₹1,000 notes. The new series included denominations of ₹200, ₹100, and ₹50, forming the Mahatma Gandhi New Series to replace the older Mahatma Gandhi Series. The ₹1,000 note was suspended.

From 2017 to 2019, the remaining banknotes of the Mahatma Gandhi New Series were released in denominations of ₹10, ₹20, ₹50, ₹100, and ₹200. As of May 20, 2023, current circulating banknotes include denominations of ₹5, ₹10, ₹20, ₹50, ₹100 from the Mahatma Gandhi Series and ₹10, ₹20, ₹50, ₹100, ₹200, ₹500 from the Mahatma Gandhi New Series.

The new banknote series feature micro-printed texts in various locations, including Gandhi’s spectacles and collar. The notes incorporate 17 languages on the reverse panel.

The historical context includes pre-independence issues, where the Government of India introduced its first paper money in 1861, featuring denominations like ₹10, ₹5, ₹10,000, ₹100, ₹50, ₹500, and ₹1,000. In 1917, ₹1 and ₹2 1⁄2 notes were introduced, and the Reserve Bank of India started banknote production in 1938, issuing various denominations. The government continued issuing ₹1 notes but demonetized the ₹500 and ₹2 1⁄2 notes.

Inflation and Buying Power of The Indian Rupee (INR)

When it comes to the Indian Rupee (INR), inflation has been a major factor that has impacted its buying power over the years. According to inflationtool.com, the inflation rate in India between 1958 and 2022 was 8,808.16%, which translates into a total increase of $8,808.16. This means that 100 rupees in 1958 are equivalent to 8,908.16 rupees in 2022. In other words, the purchasing power of $100 in 1958 equals $8,908.16 in 2022. The average annual inflation rate between these periods was 7.27%.

As per in2013dollars.com, the rupee had an average inflation rate of 7.27% per year between 1958 and today, producing a cumulative price increase of 9,468.22%. This means that today’s prices are 95.68 times as high as average prices since 1958, according to the OECD and the World Bank consumer price index for India.

High inflation erodes the purchasing power of a currency and can lead to its depreciation. Therefore, it is important to keep inflation in check. The level of interest rates in India also can impact the rupee. Higher interest rates can attract foreign capital, strengthening the Rupee, while lower rates can have the opposite effect. GDP growth is closely linked to the rupee’s performance.

The Indian Rupee (INR)

The Indian Rupee is abbreviated as INR and is subdivided into 100 paise. The symbol for the Indian Rupee is ₹, which is derived from the Devanagari script. It is a combination of the Devanagari consonant “र” (ra) and the Latin capital letter “R”. The symbol was adopted by the Indian government in 2010 and is now widely used in India.

The Indian Rupee is available in the form of banknotes and coins. The banknotes come in denominations of 10, 20, 50, 100, 200, 500, and 2,000. The Reserve Bank of India (RBI) is responsible for issuing the banknotes. The coins come in denominations of 1, 2, 5, and 10.

10-rupee (₹10)

Introduced in 1996 as part of the Mahatma Gandhi Series, it coexists with the Mahatma Gandhi New Series launched in 2018, working alongside the 10 rupee coin. The Mahatma Gandhi (New) Series features a redesigned ₹10 banknote, issued on January 5, 2018, portraying the Sun Temple, Konark, showcasing the country’s cultural heritage with a chocolate brown base color.

Security features include a see-through register, micro letters, and a windowed demetalized security thread. The historical journey of the 10-rupee note includes iterations from the George VI Series, Lion Capital Series, and the earlier Mahatma Gandhi Series, with distinct designs, colors, and security elements.

20-rupee (₹20)

The Reserve Bank of India initially introduced the ₹20 note in 1972 as a cost-effective measure in banknote production. This marked the beginning of a significant redesign in the motif of the Lion Capital Series banknotes. In the Mahatma Gandhi New Series, announced in November 2016, the ₹20 note showcases the Ellora Caves, a UNESCO World Heritage site, on the reverse, aligning with the theme of cultural heritage.

The historical journey includes the Lion Capital Series with the obverse featuring the Lion Capital and the reverse depicting the chariot wheel of the Konark Sun Temple. The Mahatma Gandhi Series ₹20 note, sized at 129 × 63 mm, is red-orange and includes Braille for the visually impaired. The reverse features Mount Harriet in the Andaman and Nicobar Islands. Security features include a windowed security thread, latent image of the value, watermark of Mahatma Gandhi, and embedded fluorescent fibers. The denomination is written in 17 languages on both the obverse and reverse, reflecting India’s linguistic diversity.

50-rupee (₹50)

Introduced in 1975 as part of the Lion Capital Series by the Reserve Bank of India (RBI), the ₹50 note underwent design changes over the years. In 1996, it transitioned to the Mahatma Gandhi Series, featuring a watermark of Mahatma Gandhi. The Mahatma Gandhi New Series was announced on November 10, 2016, with a redesigned ₹50 note introduced on August 18, 2017.

This new version showcases Hampi with Chariot on the reverse, reflecting the country’s cultural heritage, and has a fluorescent blue base color. Historical designs include the Lion Capital Series, featuring the Lion Capital on the obverse and Sansad Bhawan on the reverse.

The Mahatma Gandhi Series incorporated the ₹ sign in 2012, and a security-focused withdrawal of pre-2005 notes was initiated in 2014. Security features of the current ₹50 note include a windowed security thread, latent image, watermark of Gandhi, and embedded fluorescent fibers. The denomination is expressed in 17 languages on both the obverse and reverse, encompassing India’s linguistic diversity.

100-rupee (₹100)

The ₹100 banknote is a denomination of the Indian rupee, part of the Mahatma Gandhi New Series introduced in 2018. In continuous production since 1935, when the Reserve Bank of India took over currency functions, the current ₹100 note replaced the Mahatma Gandhi Series. Initially featuring George VI’s portrait, post-independence notes displayed the Emblem of India in the Lion Capital Series. The Mahatma Gandhi Series ₹100 note, measuring 157 × 73 mm in blue-green, showcases Mahatma Gandhi’s portrait and the governor’s signature.

The introduction of the ₹ sign occurred in 2012, and a phased withdrawal of pre-2005 notes was initiated in 2014. The Mahatma Gandhi New Series, announced on November 10, 2016, unveiled a redesigned ₹100 note on July 19, 2018, with a Lavender base color and Rani ki vav motif on the reverse.

Security features include a windowed security thread, latent image, Mahatma Gandhi watermark, and embedded fluorescent fibers. Denominations are inscribed in 17 languages on both sides, reflecting India’s linguistic diversity.

200-rupee (₹200)

The ₹200 banknote is part of the Indian rupee denominations introduced after the 2016 demonetization. Following the 1-2-5 series, a system used for currency denominations, it fills a gap in the Renard series. Proposed by French engineer Charles Renard, this series follows a 1:10 ratio in three steps.

In March 2017, the Reserve Bank of India, in consultation with the Ministry of Finance, decided to introduce ₹200 notes to facilitate transactions. Printed by government units and managed by Bharatiya Reserve Bank Note Mudran Private Limited, the notes were announced in August 2017, featuring Sanchi Stupa on the reverse.

With a bright yellow base color, dimensions of 146 mm x 66 mm, and security features like angular bleed lines, the ₹200 notes were released into circulation on August 25, 2017, during Ganesh Chaturthi. Denominations are inscribed in 17 languages, reflecting India’s linguistic diversity on both sides of the note. The previous ₹200 notes remain legal tender.

500-rupee (₹500)

The ₹500 banknote is a denomination of the Indian rupee, introduced in 1987 and later part of the Mahatma Gandhi New Series since November 10, 2016. The earlier Mahatma Gandhi Series notes, used from October 1997 to November 2016, were demonetized on November 8, 2016, as a measure against corruption and counterfeit currency.

The Mahatma Gandhi Series ₹500 note featured a portrait of Mahatma Gandhi, the Braille feature, and Gyarah Murti on the reverse. In the new Mahatma Gandhi New Series, the ₹500 note, measuring 66mm x 150mm and colored stone grey, presents a portrait of Mahatma Gandhi, the Ashoka Pillar Emblem, and features the Red Fort on the reverse.

Security features include a windowed security thread, latent image, micro letters, and a color-changing ink denomination. The note is also designed for the visually impaired with raised printing and is multilingual, displaying the denomination in 17 languages.

Currency Usage in India

India’s official currency is the Indian Rupee (INR), which is controlled and issued by the Reserve Bank of India. One INR is divided into 100 paise. The symbol for the Indian Rupee is ₹, which resembles both the Devanagari letter “₹” (ra) and the Latin capital letter “R”, with a double horizontal line at the top.

When traveling to India, it’s important to note that the Indian Rupee is the only currency accepted for transactions. While some places may accept foreign currency, it’s not recommended to use them as you may receive unfavorable exchange rates.

If you’re traveling from Pakistan, you’ll need to convert your Pakistani Rupee to Indian Rupee, as the two currencies are not interchangeable. The exchange rate varies daily and can be checked on various websites such as X-Rates. Similarly, if you’re coming from the United States, you’ll need to exchange your US Dollars for Indian Rupees. Again, it’s recommended to check the exchange rate before making any transactions.

If you’re traveling to Dubai, the United Arab Emirates Dirham (AED) is widely accepted in tourist areas, but it’s still best to have Indian Rupees on hand for other transactions.

Is USD Accepted in India?

When exchanging your currency, you may have the option to choose between USD and INR. It’s important to consider the exchange rate and convenience when making this decision. If the exchange rate is better for USD, it may be more convenient to exchange your currency in USD. However, if you plan to use INR for your transactions, it may be more convenient to exchange your currency in INR.

When exchanging currency in India, it’s essential to follow some helpful tips. Firstly, check the current exchange rate to ensure you get the best value. Compare rates and fees at various banks and authorized money changers before deciding where to exchange your currency.

It’s advisable to steer clear of exchanging money at airports and hotels, as they often provide less favorable rates. Opting for debit or credit cards for transactions in India can be beneficial, as they typically offer better exchange rates than dealing with cash. Lastly, remember to retain your receipts and exchange documents in case you need to convert your currency back to your home currency.

Exchanging Currency in India

If you’re planning to travel to India, it’s important to know how to exchange your currency to Indian Rupee (INR). Here are some things you need to know before exchanging your currency.

Where can I exchange Indian currency?

There are several options for exchanging currency in India. You can exchange your currency at banks, airports, hotels, and authorized money changers. It’s important to note that banks and authorized money changers usually offer better exchange rates than airports and hotels.

What to know before exchanging currency in India

The Indian Rupee is a popular currency and is widely accepted throughout India. However, it is not accepted outside of India, so you will need to exchange your currency if you plan to travel abroad. It is recommended that you exchange your currency at authorized money exchange centers to avoid any fraudulent activities.

In conclusion, the Indian Rupee is the official currency of India and is widely used throughout the country. It is available in the form of banknotes and coins and is subdivided into 100 paise. The symbol for the Indian Rupee is ₹, which is derived from the Devanagari script. If you plan to visit India, it is recommended that you exchange your currency at authorized money exchange centers to avoid any fraudulent activities.

Choosing Between USD and Rupee in India

If you are traveling to India, you may be wondering whether you should use US dollars or Indian rupees. Here are some factors to consider when making your decision.

Exchange Rate

The exchange rate between USD and INR fluctuates daily. As of November 27, 2023, 1 USD is equal to 0 INR according to Xe. It is important to check the current exchange rate before exchanging your currency. Keep in mind that exchange rates at airports and hotels may be less favorable than those at banks and exchange offices.

Before exchanging your currency, it’s important to know the current exchange rate. You can check the current exchange rate online or at a bank. It’s also important to know the fees involved in exchanging your currency. Banks and authorized money changers usually charge a commission fee, while airports and hotels may charge a higher exchange rate.

Convenience

While it is possible to use USD in some places in India, it is generally more convenient to use INR. Most businesses in India only accept INR, and you may have difficulty finding a place to exchange your USD outside of major cities. Additionally, using INR will help you avoid confusion and potential scams involving incorrect exchange rates or counterfeit bills.

Fees

When exchanging currency, you may encounter fees and commissions. Banks and exchange offices may charge a fee for exchanging currency, and some ATMs may charge a fee for withdrawing cash. Check with your bank to see if they have any partnerships with banks in India that may allow you to avoid fees.

Tips

To optimize your currency exchange experience, it’s advisable to have some USD for emergencies but primarily use INR for transactions. Seek the best exchange rates by exchanging currency at a bank or authorized exchange office.

Steer clear of exchanging money at airports or hotels whenever possible. When withdrawing cash from ATMs, be mindful of potential fees. Always check bills for counterfeit marks and verify the current exchange rate before making any currency exchanges. By taking these factors into account, you can make well-informed decisions on whether to utilize USD or INR during your journey in India.

Cost of Living in India

If you’re planning to move to India, it’s essential to have an idea of the cost of living in the country. India is one of the most affordable countries in the world, with a low cost of living compared to other countries. According to Numbeo, a single person’s estimated monthly cost without rent is approximately $334.2 (27,848.1₹).

The cost of living in India varies depending on the city you live in. For instance, Mumbai, New Delhi, and Bangalore are some of the most expensive cities in India. However, smaller cities like Jaipur, Ahmedabad, and Kolkata are much cheaper.

When it comes to accommodation, renting an apartment in India is relatively inexpensive. According to Expatistan, the average rent for a one-bedroom apartment in a city center is around $198.3 (16,500.0₹) per month. If you’re looking for a cheaper option, you can find shared apartments or rooms for rent.

Food is also affordable in India. You can find street food and local restaurants that offer delicious meals at a reasonable price. The cost of groceries is also relatively cheap, especially if you buy from local markets instead of supermarkets.

Transportation in India is also affordable. You can use public transportation like buses, trains, and auto-rickshaws to get around. The fare for a bus ride in a city is around $0.15 (₹10.0).

Overall, the cost of living in India is affordable, and your money can go a long way if you budget wisely.

Don’t Get Scammed Tips in Indian Currency

When it comes to Indian currency, it’s important to be aware of potential scams. Here are some tips to help you avoid being scammed:

1. Check for Watermarks and Security Features

One of the easiest ways to spot fake Indian currency is to check for watermarks and security features. According to ScoopWhoop, Indian currency notes have Mahatma Gandhi’s picture on them, but there’s also a watermark on the other end of the note in the blank space. You can see it if you hold the note up to the light. Additionally, there are several security features built into the currency, such as the security thread, which can help you identify genuine notes.

2. Avoid Unofficial Currency Exchange Services

It’s important to avoid unofficial currency exchange services. These services may offer better exchange rates, but they may also be dealing in counterfeit currency. Always use official currency exchange services, such as banks or authorized currency exchange offices.

3. Be Wary of High-Value Transactions

If you’re making a high-value transaction, it’s important to be extra cautious. According to TripSavvy, significant amounts of fake currency were found in border states including Mizoram, Jammu and Kashmir, Punjab, and Rajasthan. Therefore, it’s important to be extra cautious when dealing with high-value transactions in these areas.

4. Educate Yourself on Genuine Currency

Finally, educate yourself on genuine currency. Familiarize yourself with the security features and watermarks on Indian currency notes. This can help you spot fake currency more easily and avoid being scammed.

By following these tips, you can help protect yourself from scams when dealing with Indian currency.