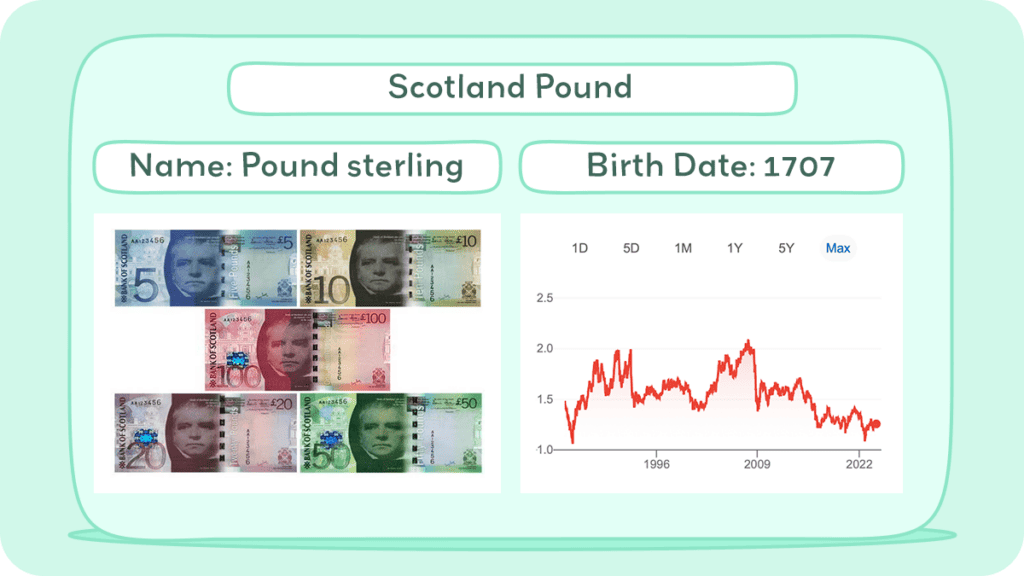

Scotland currency is the British pound sterling (£), which is also used in other parts of the United Kingdom. The pound sterling banknotes currently in use are from the Series G issued by the Bank of England, available in £5, £10, £20, and £50 denominations.

Scotland’s banknotes are still legal currency in Scotland, and they are issued by three banks: the Bank of Scotland, the Royal Bank of Scotland, and Clydesdale Bank.

This article explores the history and current state of Scotland’s currency, focusing on the pound sterling. We’ll trace its evolution in Scotland from its origins to its role today, interesting facts about the Scottish pound, and an overview of how the pound sterling is used in Scotland now, covering both banknotes and coins.

Historical Journey of Scotland Currency

Scotland has a long and fascinating history when it comes to its currency. The first coins in Scotland were minted in the 12th century during the reign of David I. These coins were minted on the Carolingian monetary system of a pound, shilling, and penny. The pound was the highest denomination and was made of silver.

Over the years, the currency of Scotland went through various changes and developments. In the 14th century, Scotland had its own currency, the pound Scots, which was made of silver. However, debasement of the coinage was a common problem until the end of the 16th century.

In the 17th century, the Scottish Parliament passed an act to establish the Bank of Scotland, which issued banknotes backed by silver. These banknotes were used as a form of currency, and they were accepted throughout Scotland. Other banks also issued their own banknotes, which were backed by gold and silver.

In 1707, the Act of Union was passed, which united Scotland and England into one country, Great Britain. This meant that the currency of Scotland was replaced by the pound sterling, which was the currency of England. However, Scotland still had its own banknotes, which were issued by various banks.

Overall, the history of Scotland’s currency is a fascinating journey that reflects the country’s rich and unique history. From the first coins minted in the 12th century to the banknotes issued today, Scotland’s currency has gone through many changes and developments, and it continues to be an important part of the country’s identity.

History of Coins

The history of British coinage before the decimal system is rich and spans many centuries, beginning with the silver penny in the 8th century, which remained the primary currency until the 13th century.

Early on, to make change, pennies were often cut into halves and quarters, and only a few gold coins like the rare gold penny were minted. Significant changes occurred in 1279 with the introduction of the groat (worth 4d) and later the gold noble in 1344 (valued at 6 shillings and 8 pence), followed by various reforms and new coins such as the shilling in 1487 and the pound (sovereign) in 1489.

Henry VIII’s era saw a notable debasement of currency, which was rectified in 1552 with the introduction of new silver coinage. Elizabeth I further innovated by introducing the “milled” coins using a horse-drawn screw press.

The union of English and Scottish thrones under James VI led to new gold coinages, and the 17th century saw the introduction of base metal coins and the reform of coinage with the guinea’s introduction in 1663.

The 18th century experienced a silver coin shortage, prompting the use of Spanish dollars counterstamped for circulation by the Bank of England.

The decimal system was introduced in the late 20th century, starting with the 5p and 10p coins in 1968, leading to the complete decimalization in 1971 with new denominations.

The system evolved with the introduction of the bi-metallic £2 coin in 1998 and a significant redesign in 2008, culminating in the introduction of a twelve-sided £1 coin in 2017 to combat forgery.

As of 2020, the oldest coins in circulation are the 1p and 2p coins minted in 1971, reflecting a streamlined currency system adapted to modern economic needs while retaining a connection to its rich historical origins.

History of Bills

The history of banknotes in the UK begins with the Bank of England’s foundation in 1694, initially issuing handwritten notes. By the mid-18th century, printed denominations ranging from £20 to £1,000 were introduced, with smaller denominations like £10, £5, £2, and £1 notes following.

The introduction of entirely printed notes came in 1855, standardizing the process and expanding the range of denominations.

Scottish banks, starting with the Bank of Scotland in 1695, and Irish banks following the extension of sterling to Ireland in 1825, also began issuing their own sterling-denominated notes.

Regulations eventually standardized the smallest note Scottish banks could issue to £1, unlike in England where smaller denominations were limited.

Private banknotes issued by banks outside London were common until the Bank Charter Act of 1844 and subsequent legislation gradually centralized note issuance to the Bank of England, especially after the last English private banknotes were issued in 1921.

World War II significantly impacted the Bank of England’s note production, leading to the cessation of higher denomination notes over £5 to prevent mass forgery. Post-war, inflation and devaluations prompted the reintroduction of higher denominations and the replacement of some notes with coins.

Modern UK banknotes feature advanced security measures like raised print, watermarks, metallic threads, holograms, and fluorescent ink, using a combination of printing techniques and specialized inks.

The Bank of England also produces “giant” and “titan” notes for internal banking use, representing one million and one hundred million pounds, respectively.

Transitioning to polymer, Northern Ireland’s Northern Bank (now Danske Bank) issued a polymer £5 note in 2000, pioneering the move towards more durable and secure banknotes.

The Bank of England introduced its own polymer £5 note in 2016, followed by £10, £20, and £50 notes, gradually phasing out paper notes. These polymer notes are part of an ongoing effort to enhance the durability and security of the UK’s currency, marking a significant evolution in the design and production of banknotes.

Inflation and Buying Power of Scotland Currency

When it comes to the value of a currency, one of the most important factors to consider is inflation. Inflation refers to the rate at which prices for goods and services increase over time. I

f inflation is high, it means that the buying power of a currency is decreasing, which can have a significant impact on the economy.

For Scotland, the inflation rate has been relatively stable in recent years. According to gov.scot, the inflation rate in Scotland was 1.5% in 2023. This is slightly higher than the UK inflation rate of 1.2% for the same period.

Despite this, the Scottish currency has remained relatively stable in terms of buying power. This means that the currency has maintained its value and has not significantly decreased in terms of what it can buy.

One reason for this is that the Scottish economy is diverse, with a range of industries contributing to its growth.

Another factor that can impact the buying power of a currency is its exchange rate. The exchange rate is the value of one currency compared to another. If the exchange rate is high, it means that the currency is strong and can buy more of another currency. If the exchange rate is low, it means that the currency is weak and can buy less of another currency.

For Scotland, the exchange rate with the pound sterling has been a topic of discussion in recent years. Some have suggested that an independent Scotland would need to establish its own currency, while others have argued that a currency union with the UK would be the best option.

Ultimately, the impact of inflation and exchange rates on the buying power of the Scottish currency will depend on a range of factors, including the strength of the Scottish economy and the decisions made by policymakers.

Pound Sterling

The current Bank of England notes in circulation are part of the Series G polymer series, available in £5, £10, £20, and £50 denominations. Each note features a portrait of Queen Elizabeth II, which was first introduced in 1990.

Bank notes featuring King Charles III will begin to be issued in 2024, but will not replace the notes featuring Queen Elizabeth II.

£5

The £5 note is turquoise/blue and showcases a 1941 portrait of Winston Churchill by Yousuf Karsh, the Elizabeth Tower, and the maze at Blenheim Palace. It includes Churchill’s famous quote from a 1940 speech and the Nobel Prize medal.

£10

The £10 note features an orange hue and carries a portrait of author Jane Austen by James Andrews (based on an original by her sister Cassandra), a quote from “Pride and Prejudice,” an illustration of Elizabeth Bennet, and a view of Godmersham Park in Kent.

£20

The £20 note, in purple, displays a self-portrait of artist J.M.W. Turner, his painting “The Fighting Temeraire,” a quote from an 1818 lecture, and a copy of Turner’s signature from his will.

£50

The £50 note is red and honors mathematician and computing pioneer Alan Turing with a 1951 photographic portrait, formulae from Turing’s proof, technical drawings of the Bombe machine, and a quote from a 1949 interview with The Times, set against a background of Pilot ACE.

These polymer notes represent significant figures in British history and culture, featuring advanced security features and durability.

Currency Usage in Scotland

If you are planning to visit Scotland, it is important to know about the currency used in the country. The official currency of Scotland is the British pound sterling (GBP), which is also used throughout the United Kingdom.

The currency is denoted by the symbol £ and the currency code GBP. Scotland also has its own banknotes, which are legal tender in Scotland.

Is USD accepted in Scotland?

While Scottish businesses may accept USD, it is not a widely accepted currency in Scotland. It is recommended to exchange your USD for GBP before your trip to Scotland.

You can exchange your currency at banks, exchange offices, or ATMs in Scotland. It is important to note that exchange rates may vary depending on the location and the exchange method.

When using your credit card in Scotland, it is important to check with your bank about any foreign transaction fees that may apply. Most major credit cards are widely accepted in Scotland, with Visa and MasterCard being the most widely used.

In conclusion, when traveling to Scotland, it is important to have British pounds sterling in cash or on your credit card to avoid any inconvenience. While USD may be accepted in some places, it is not widely used, and you may need to exchange your currency to GBP.

Exchanging Currency in Scotland

If you’re planning a trip to Scotland, it’s important to know how to exchange your currency. Here are some things to keep in mind:

Where can I exchange Scotland currency?

You can exchange currency at banks, airports, Bureau de Change kiosks, and some hotels. It’s a good idea to compare exchange rates and fees before deciding where to exchange your currency. Some places may charge higher fees or offer lower exchange rates than others.

What to know before exchanging currency in Scotland

Before exchanging currency for a trip to Scotland, remember that the official currency is the Pound Sterling (GBP), identical across the UK. However, Scotland issues its own banknotes, which might not be accepted outside Scotland or internationally.

It’s essential to check the current exchange rate and be prepared for some businesses, especially smaller ones, to prefer cash transactions and possibly decline Scottish banknotes, suggesting the utility of carrying English banknotes as well.

Plan to exchange your foreign currency before arriving in Scotland, either at a bank or a Bureau de Change, paying attention to varying exchange rates and fees to ensure a favorable deal.

Lastly, keep your exchange receipts, as they might be required for converting any remaining GBP back to your original currency after your visit.

By keeping these things in mind, you can ensure that you have the currency you need for your trip to Scotland.

Choosing Between USD and Scotland Currency

When traveling to Scotland, you may be wondering whether to use USD or Scotland’s currency, the pound sterling. Here are some factors to consider when making your decision.

Exchange Rate

The exchange rate between USD and GBP fluctuates constantly. It’s important to keep an eye on the exchange rate and exchange your currency at a favorable rate to get the most out of your money.

Convenience

While some places in Scotland may accept USD, it’s generally more convenient to use GBP as it’s the official currency. You can exchange your USD for GBP at banks, exchange bureaus, or ATMs. Keep in mind that some places may not accept credit cards, so it’s always a good idea to have some cash on hand.

Fees

When exchanging currency, you may encounter fees. Some banks and exchange bureaus charge a flat fee or a percentage of the amount exchanged. Additionally, your bank may charge fees for using ATMs abroad.

To avoid unnecessary fees, it’s a good idea to shop around for the best exchange rates and check with your bank about their international fees.

Tips

Before heading to Scotland, it’s wise to familiarize yourself with the current exchange rate and estimate the amount of money you’ll need for your trip.

To avoid potentially high exchange fees at airports or tourist spots, consider exchanging your currency before leaving. Seek out currency exchange bureaus that offer good rates and minimal fees.

If you plan to withdraw cash from ATMs in Scotland, verify any international transaction fees with your bank beforehand and opt for ATMs that don’t impose extra charges.

Although major credit cards like Visa and MasterCard are widely accepted across Scotland, having some cash is advisable, especially when visiting rural areas where credit card use might be less common.

Always have a small amount of cash ready for places that may not accept credit cards.

Overall, it’s generally more convenient to use GBP when traveling in Scotland. However, it’s important to keep an eye on the exchange rate and shop around for favorable rates and low fees when exchanging currency.

Cost of Living in Scotland

When planning a trip to Scotland, it’s important to consider the cost of living. According to Livingcost.org, the cost of living in Scotland is $1624 (roughly £1,291), which is 1.2 times less expensive than the average in the United Kingdom. This means that your money will go further in Scotland than in other parts of the UK.

This includes expenses such as rent, utilities, food, and transportation. However, keep in mind that the cost of living can vary depending on the city you’re in.

For example, if you compare rents to New York City, Aberdeen is 80% less expensive, Dundee is 77% less expensive, Glasgow is 71% less expensive, and Edinburgh is 68% less expensive.

If you’re planning to live in Scotland long-term, it’s important to consider your budget carefully. You may want to consider finding a job to help cover your expenses. The average salary after taxes in Scotland is $2816 (roughly £2,239.09), which is enough to cover living expenses for 1.7 months.

Overall, while the cost of living in Scotland can vary depending on the city you’re in, it’s generally less expensive than other parts of the UK. With careful budgeting and planning, you can enjoy all that Scotland has to offer without breaking the bank.

Don’t Get Scammed Tips

When traveling to Scotland, it’s important to be aware of currency scams that could leave you with less money than you expected. Here are some tips to help you avoid currency scams and keep your money safe:

1. Exchange Currency at Reputable Locations

Exchange currency only at reputable locations such as banks, post offices, or currency exchange offices. Be wary of exchanging money on the street or from an individual, as they may offer a less favorable rate or even counterfeit currency.

2. Check the Exchange Rate

Before exchanging currency, check the current exchange rate to ensure you are getting a fair deal. You can easily do this by using a currency converter app or website.

3. Avoid Dynamic Currency Conversion

When using your credit card in Scotland, you may be asked if you want to pay in your home currency or the local currency. Always choose the local currency to avoid dynamic currency conversion fees, which can add up quickly.

4. Watch Out for Hidden Fees

Be aware of hidden fees when using ATMs or credit cards. Some ATMs may charge a withdrawal fee, and some credit cards may charge a foreign transaction fee. Check with your bank or credit card company before traveling to Scotland to see if they charge any fees for international transactions.

5. Be Cautious of Pickpockets

Pickpocketing can happen anywhere, so be aware of your surroundings and keep your money and valuables secure. Avoid carrying large amounts of cash and keep your wallet or purse close to your body.