Certain metals are widely used in society as a way of saying something has great value. You may have heard the saying “good as gold” or your favorite recording artist may have won a silver, gold, or platinum record. Have you ever wondered what makes these metals so valuable?

These elements are known as “precious metals” and they have a long history of being valued across societies. In this article, we will examine what makes precious metals more valuable than other metals, how they have been used in economics throughout history, and what else they are used for.

Precious Metals

Precious metals are metals that are rare and have high economic value. There are multiple reasons for their economic value.

When we say they are rare, we mean that their supply is limited.

Additionally, precious metals tend to have high luster. Basically, this means they are shiny. Still, this is economically important because this shine makes them beautiful, and they are widely desired for their beauty (in economic terms, there is high demand for them).

This combination of rarity and demand leads to a high price, and thus high economic value.

Precious metals include:

- Gold

- Silver

- Platinum

- Palladium

- Ruthenium

- Rhodium

- Iridium

- Osmium

Use as Money

In the early days, people simply bartered with one another for what they needed.

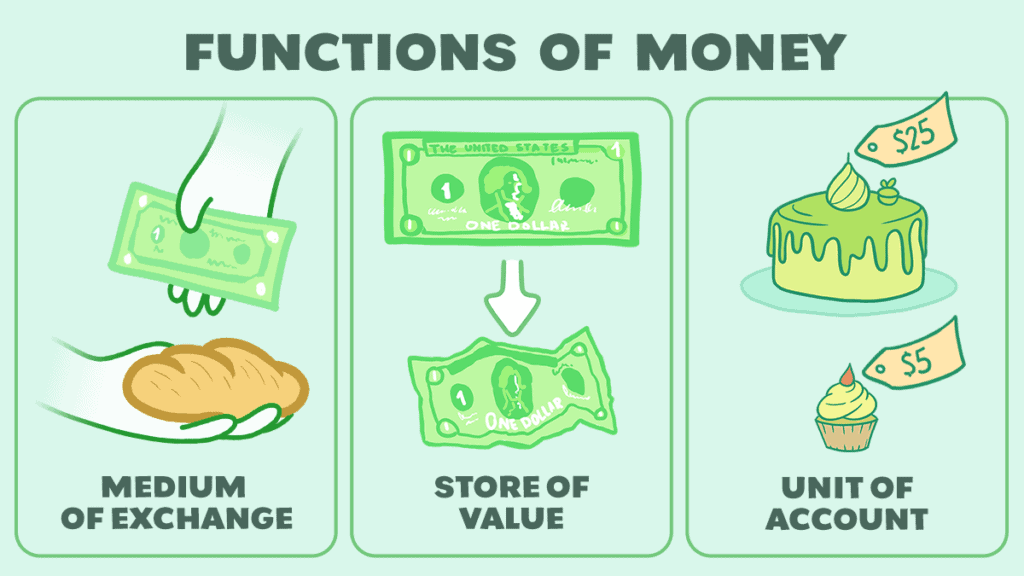

When they realized this was inefficient, they developed money, beginning to accept various items as a common medium of exchange. That is, something they could accept as trade for almost anything else since they could then use it to trade for almost anything else again.

In addition to being a medium of exchange, money serves two other purposes: it’s a unit of account and a store of value.

Precious metals quickly became the most widely used commodity to trade in this manner. This is because, in addition to the high luster and rarity we already discussed, precious metals have two other traits that make them useful as money: they are malleable and less reactive than other metals.

Their malleability allowed the gold to be divided into smaller amounts and, later, to be made into standardized coins. This allowed them to be used as a unit of account, first by measuring the weight of the gold and then by the use of standardized coinage.

The fact that they don’t react with other elements as readily as other elements makes them durable. For example, unlike other metals, they don’t rust or corrode. This allows them to be effective as a store of value.

Commodity Money

At first, the precious metals themselves were traded directly as commodity money due to their intrinsic value.

The invention of standardized coinage by the Lydians in the late 600s BCE revolutionized trade. By melting down the precious metals and recasting them into standardized molds, transactions could occur by ‘tale’, or count.

Instead of weighing the precious metal with each transaction, you could simply hand a merchant ten coins, knowing that they were all of the same weight.

This allowed the Kingdom of Lydia to prosper through both internal and external trade. Though they were soon conquered by the Persian Empire, their innovation lived on as later empires attempted to replicate their commercial success by minting their own coins.

Minting coins continued to be the practice up through the Middle Ages. The precious metals were used directly as money, especially once they standardized the amount of precious metal in each coin.

Backing for Representative Money

As wealth grew through the Middle Ages, people began to find it more convenient to store their precious metals in banks or depositories. The reason for this is simple enough—nobody wanted to carry around tons and tons of gold, and carrying around large quantities of wealth could make one a target for robberies.

They’d deposit the gold in a bank, and the bank would issue a note entitling the holder to a certain amount of the precious metal. This marked the beginning of representative money—money that can be redeemed for a set amount of the commodity backing it.

Soon, national governments began to issue currencies based on the same principle. They’d issue paper notes backed by precious metal. During the gold standard, it was exclusively gold. Prior to the gold standard, however, many nations used a bimetallic system to back their currencies with both gold and silver.

Though people would conduct their daily transactions with these paper bills, nobody really wanted little pieces of paper printed off by the government. They wanted the gold (or silver) the piece of paper could be redeemed for. The paper simply acted as a convenient stand-in—at least, for a time.

Precious Metals as Commodities

Eventually, this practice became so widespread that governments could simply print money, say it was money, and people would value it as such—even with nothing backing it. This is known as fiat money and is what is most widely used today.

Fiat money first occurred when governments decoupled their currencies from precious metals to pay for World War 1, then again during the Great Depression. It became permanent (at least so far) in 1971 when the United States abandoned the gold standard.

Nevertheless, precious metals are still widely traded. They continue to be valued, and people invest in them as commodities.

The most common form of investment in precious metal is in the form of bullion—the pure form of the metal—and is covered at length in another article, including how individuals can invest.

Because precious metals are intrinsically valued, they are often used as a hedge against inflation. They are likely to retain their value even as investments linked to currencies, such as stocks and bonds, may falter should the currency become devalued.

Additionally, they are often used to store value in times of economic or political turmoil. In addition to the speculative fluctuations in their price, these metals have other uses that can impact their demand (and, thus, their price).

Other Uses for Precious Metals

One of the reasons precious metals have been so useful is because they have value and usage aside from their use as money.

The most notable is jewelry. As we mentioned, gold and other precious metals are shiny and beautiful. This beauty makes them prized in the crafting of jewelry and other decorations, like the original dome of the Taj Mahal.

It doesn’t hurt that, in addition to being beautiful, precious metals are widely recognized as projecting wealth, power, and status.

In addition, precious metals have more practical uses. Gold can be used in dentistry (we’ve all heard of gold teeth) and in electronics as bonding wire.

Silver can be used to make conductive pastes and electrical contacts. Platinum can be used in chemotherapy and to make glass fiber bushings, gauzes, and sensors, and iridium is used for spark plugs in automobiles.

Multiple precious metals can be used as catalysts due to their unique physical and chemical properties—in particular, they have a high resistance to corrosion, high melting points, and excellent catalytic activity.

Demand for metals in these other industries can impact the price of metal on the global market. Likewise, an increase in the price of precious metals can impact these industries by raising costs.

Conclusion

Precious metals have been an important part of the economy from ancient history until today.

Historically, they have been used as money. At first, they were used directly as money. Later, they were used to back the currencies issued by nations. Though this is no longer the case today, they continue to be important as investments, particularly for those looking to protect against economic uncertainty.

Additionally, precious metals continue to be a symbol of wealth, power, prestige, and social status.

Thank you for joining us for this look at precious metals—we hope you learned something, and that you’ll join us again for another interesting, informative article.