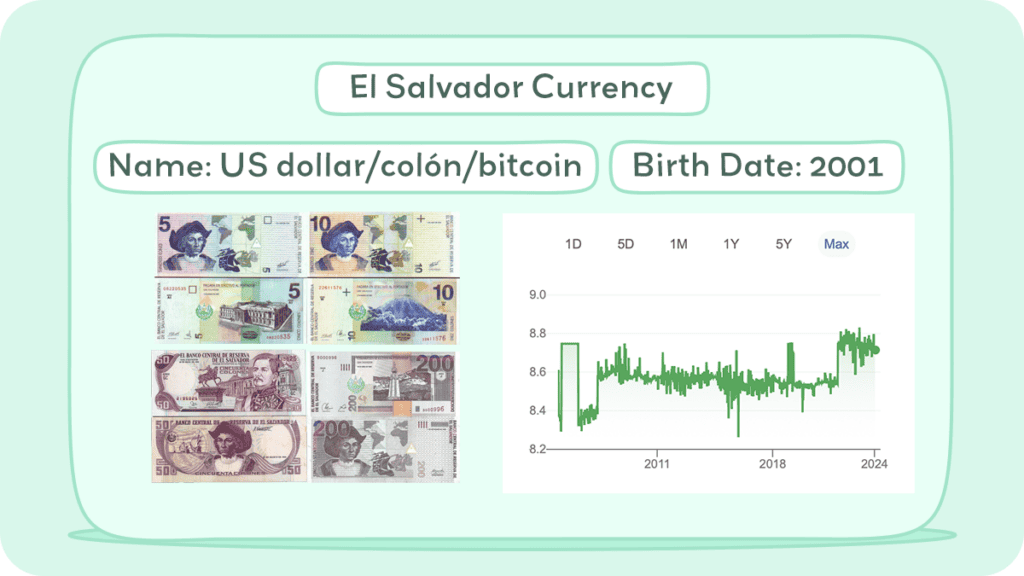

El Salvador has a unique currency system that includes the United States dollar, the Salvadoran colón, and Bitcoin cryptocurrency. This system is the result of a law passed in 2001 that made the US dollar the official currency of El Salvador.

In this article, we will dive into El Salvador’s currency, the US Dollar. We delve into the historical journey that led to its adoption in 2001, examining the evolution of the Salvadoran colón and the factors motivating its replacement.

Historical Journey of The El Salvador Currency

El Salvador’s currency history is diverse, involving a transition from ancient cacao bean trading to modern-day use of the US dollar. Initially, indigenous communities used cacao beans as currency. Post-Spanish colonization, the economy shifted towards cotton, and Spanish reales and pesos became prevalent, influencing the design of banknotes.

In 1892, El Salvador introduced the colón, named after Christopher Columbus. Initially pegged to the silver peso, it later had a fluctuating exchange rate. The colón saw periods of stability and high inflation, mirroring the country’s economic and political changes.

In 2001, El Salvador adopted the US dollar to combat inflation, attract foreign investment, and ease trade and remittances, particularly with the U.S. This shift, known as dollarization, had mixed effects: it stabilized the economy and reduced inflation but led to loss of monetary policy control, possibly increased income inequality, and challenges for small businesses.

El Salvador’s currency evolution reflects its historical, economic, and social changes. The ongoing debate about dollarization and its impact highlights the complex relationship between a nation’s currency and its broader economic landscape.

Salvadoran colón

The colón, El Salvador’s currency from 1892 to 2001, played a crucial role in the nation’s economic history. Named after Christopher Columbus and subdivided into 100 centavos, it was symbolized by “₡.” The colón’s unique character made it distinct from other currency symbols like the cent sign (¢) or the cedi sign ₵. Locally, the ‘¢’ symbol was often used to denote the colón.

In 1892, during President Carlos Ezeta’s tenure, El Salvador replaced the Salvadoran peso with the colón at par value. Initially pegged to the U.S. dollar at 2 colones to 1 dollar, El Salvador departed from the gold standard in 1931, allowing the colón’s value to float.

On June 19, 1934, the Central Bank was established, becoming the singular authority for monetary policy and currency issuance. Fast forward to January 1, 2001, under President Francisco Flores, El Salvador underwent a significant change with the Law of Monetary Integration. This law facilitated the adoption of the U.S. dollar, marking the end of the colón’s era. However, the colón has not lost its legal tender status.

In the mid-19th century, tin sheets from farms served as a unique form of currency. These sheets, bearing the farm’s name, were used as payment but only held value in the issuing farm’s store, creating a localized monopoly. The collapse of the Central American Federation led to the issuance of the first national currency, “Reales,” including silver coins and gold coins known as “Escudos.”

Adopting the peso as a monetary unit under Dr. Rafael Zaldívar’s presidency in 1883 marked a shift from the Spanish system. Paper money gained importance at the end of the 19th century, and private banks, such as Banco International, played a role in issuing banknotes. Carlos Ezeta’s presidency in 1892 led to the reformation of monetary law, renaming the currency “Colón.”

Despite economic prosperity in the 1920s, the worldwide depression of 1929, falling coffee prices, and deregulation caused a national economic crisis. The absence of a specialized institution to control banking activities and currency value prompted the hiring of Englishman Frederick Francis Joseph Powell. The resulting recommendation led to the creation of the Central Bank of El Salvador on June 19, 1934, emphasizing currency and credit control.

The introduction of coins and banknotes accompanied the colón’s history. Even after the colón replaced the peso at par, some coins, like the 1 and 5 centavos, retained their design. Various materials, including cupro-nickel and silver, were used for coins until nickel coins were introduced in 1970. The Central Reserve Bank issued the first uniform family of banknotes on August 31, 1934, with denominations ranging from 1 to 100 colones. The bank continued to authorize new banknotes, including the 50-colón and 200-colón notes, in subsequent years.

Salvadoran banknotes were distinct for having validation overprints on the reverse. This practice originated from the government’s supervision of commercial banknote issuance. From 1961 to 2001, the Superintendency of the Central Reserve Bank was responsible for validating Salvadoran banknotes. Although validation overprints ceased with the 1997 series, differences in dates between the front and reverse persisted until dollarization.

The culmination of El Salvador’s monetary history occurred with dollarization on January 1, 2001. The U.S. dollar became the official currency, ending the colón’s long-standing presence. Despite this transition, the colón has retained its legal tender status, serving as a historical reminder of El Salvador’s economic journey.

US Dollar

In 2001, El Salvador switched to using the US Dollar (USD) as its official currency, replacing the Colon. This change aimed to stabilize the economy, attract foreign investment, and reduce inflation. The Colon was no longer used in transactions, and now all financial dealings take place in US Dollars. The Central Reserve Bank of El Salvador still oversees the country’s monetary policy and financial system.

The U.S. dollar originated from the Spanish-American silver dollar. Minted in various places like Mexico, Potosí, and Lima, it was widely used from the 16th to the 19th centuries. The Coinage Act of 1792 established the U.S. dollar, aligning it with the Spanish dollar’s silver content. Even after this, Spanish and Mexican dollars remained legal tender until 1857.

Alexander Hamilton finalized the Coinage Act, specifying the silver and gold content for various coins. The dollar’s value was based on the Spanish dollar’s silver content. The early U.S. currency depicted mythological figures, not presidents.

After the American Revolution, Continental Congress issued paper currency, but it depreciated. The Constitution later restricted states from making anything other than gold and silver coins legal tender.

From 1792 to 1900, the U.S. operated on a bimetallic standard, linking the dollar to silver and gold. The Gold Standard Act of 1900 shifted to a gold standard. After the Nixon Shock in 1971, the U.S. dollar floated freely.

Paper money, like Treasury Notes and United States Notes, played roles in financing wars. The emergence of Federal Reserve Notes in 1913 marked the exclusive issuance of U.S. dollar notes. The dollar gained global significance after World War II, becoming the primary reserve currency under the Bretton Woods Agreement.

The Federal Reserve System, established in 1913, conducts U.S. monetary policy. The U.S. has often financed its spending through borrowing in its own currency, a privilege referred to as the “exorbitant privilege.”

The United States dollar (USD) is the official currency of the U.S. and some other countries. It was introduced in 1792, aligned with the Spanish silver dollar, and divided into 100 cents. U.S. banknotes, known as greenbacks, are issued by the Federal Reserve System.

The U.S. dollar was initially defined based on a bimetallic standard, later linked solely to gold in 1900. It became a significant global reserve currency after World War I, surpassing the pound sterling by the Bretton Woods Agreement after World War II. The dollar is widely used in international transactions and is a free-floating currency.

As of September 20, 2023, approximately US$2.33 trillion is estimated to be in circulation. The U.S. Constitution grants Congress the power to coin money, and laws prescribe the forms in which U.S. dollars should be issued.

The dollar’s denominations include coins and Federal Reserve Notes. The term “buck” is colloquially used for dollars, and “greenback” refers to the 19th-century Demand Note dollars. Other nicknames include “dead presidents” for the portraits on bills and “bigface notes” for the newer designs.

The $ symbol for the dollar originated from the abbreviation “ps” for the peso, the Spanish dollar. It evolved into the $ sign, possibly influenced by the Pillars of Hercules on the Spanish Coat of arms or the letters U and S written on top of each other.

US Dollar coins

The United States Mint has produced legal tender coins annually since 1792. Common denominations for circulation include the penny, nickel, dime, quarter, half dollar, and dollar.

The U.S. coinage includes several denominations, each with its unique features. The Penny (1¢) showcases Abraham Lincoln on the front and the Union Shield on the back, weighing 2.5 grams with a diameter of 0.75 inches.

The Nickel (5¢) features Thomas Jefferson on the obverse and Monticello on the reverse, weighing 5.0 grams and having a diameter of 0.835 inches.

The Dime (10¢) depicts Franklin D. Roosevelt on one side and symbols like an olive branch, torch, and oak branch on the other. It weighs 2.268 grams and measures 0.705 inches in diameter.

The Quarter (25¢) displays George Washington on the front and has changing designs on the reverse (five designs per year). It weighs 5.67 grams and has a diameter of 0.955 inches.

The Half Dollar (50¢) showcases John F. Kennedy on the front and the Presidential Seal on the back, weighing 11.34 grams with a diameter of 1.205 inches.

Lastly, the Dollar Coin ($1), known as the golden dollar, features Sacagawea on the obverse and changing designs on the reverse (four designs per year). It weighs 8.10 grams and has a diameter of 1.043 inches.

Gold and silver coins circulated from the 18th to the 20th centuries, with the last gold coins minted in 1933 and 90% silver coins in 1964.

The United States Mint currently produces circulating coins at the Philadelphia and Denver Mints. The one-dollar coin has not gained popularity due to the continued use of the one-dollar bill. Half dollar coins were common but fell out of use in the mid-1960s.

The nickel has remained unchanged in size and composition (5 grams, 75% copper, and 25% nickel) since 1865. Efforts have been made to eliminate the penny due to its low value.

Collector coins, with higher numismatic or precious metal value, include American Eagle bullion coins and commemorative coins such as the Presidential dollar coins.

US Dollar bills

Federal Reserve Notes, or U.S. banknotes, serve as the official currency of the United States. The United States Bureau of Engraving and Printing produces these notes in accordance with the Federal Reserve Act of 1913.

The Board of Governors of the Federal Reserve System issues them to Federal Reserve Banks, which then distribute the notes to their member banks. This process makes the notes liabilities of the Reserve Banks and obligations of the United States.

With legal tender status, Federal Reserve Notes bear the statement “this note is legal tender for all debts, public and private.” These notes are backed by financial assets, mainly Treasury and mortgage agency securities obtained through open market transactions.

Various denominations of U.S. banknotes feature different historical figures and iconic symbols. For example, the One Dollar bill showcases George Washington and the Great Seal of the United States, while the Two Dollar bill displays Thomas Jefferson and the Declaration of Independence.

Other bills highlight Abraham Lincoln, Alexander Hamilton, Andrew Jackson, Ulysses S. Grant, and Benjamin Franklin, each paired with significant landmarks. These bills are part of different series, such as Series 1963, Series 1976, Series 2006, Series 2004A, Series 2009A, and Series 2017A.

Congress, according to the U.S. Constitution, has the power to borrow money on the credit of the United States. Federal Reserve Banks issue Federal Reserve Notes, considered “obligations of the United States” and redeemable in lawful money. Federal Reserve Notes are legal tender for debt payment. There are other types of banknotes, including United States Notes and Federal Reserve Bank Notes, but only Federal Reserve Notes remain in circulation.

Federal Reserve Notes are printed by the Bureau of Engraving and Printing on cotton fiber paper. Modern U.S. currency sizes match those of Philippine peso banknotes issued under U.S. administration. Currently printed denominations include $1, $2, $5, $10, $20, $50, and $100.

Larger denominations like $500, $1,000, $5,000, $10,000, and $100,000 were discontinued after 1946. Post-2004 series banknotes incorporate additional colors for better distinction. Plans for future redesigns include raised tactile features for accessibility, larger numerals, more color differences, and currency readers to assist the visually impaired.

Inflation and Buying Power of US Dollar

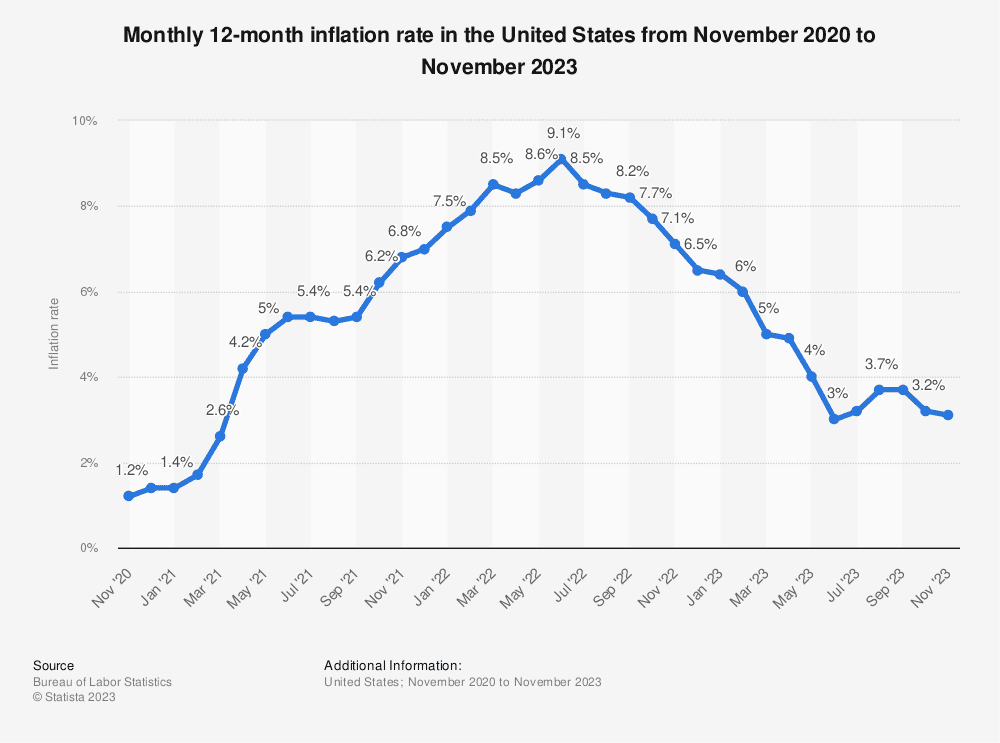

El Salvador switched to using the US dollar as its official currency in 2001, aligning its economy with the United States. This means that inflation in El Salvador is closely tied to US inflation. As of November 2023, El Salvador’s inflation rate is 7.4%, which is a bit higher than the US’s rate of 6.5%. In the US, the Consumer Price Index (CPI) has risen to 6.5% from 1.4% in January 2021.

In El Salvador, the high inflation affects buying power, especially because many goods are imported. The cost of these imports rises with global inflation, hitting low-income families hardest. In contrast, the US dollar remains strong internationally. This strength benefits El Salvador in trade and remittances, as dollars sent from Salvadorans abroad have more value.

El Salvador’s use of the US dollar brings currency stability but limits its government’s ability to control inflation through monetary policy. Even with the dollar as the official currency, local businesses may adjust prices based on El Salvador’s economic conditions and demand.

While the US dollar remains stable against itself, its purchasing power in El Salvador is declining due to inflation. This higher inflation has led to a reduction in the purchasing power of the US dollar in El Salvador, making goods and services more expensive.

It’s important to note that inflation rates may not always align perfectly between the US and El Salvador due to local factors affecting specific goods. Despite some benefits of dollarization, such as lower interest rates and increased foreign investment, it also limits El Salvador’s ability to independently manage its monetary policy.

The US Dollar

The U.S. dollar, renowned as the world’s reserve currency, features banknotes that are globally recognized. Despite their familiar appearance, these notes contain intricate details and sophisticated elements. They represent more than just monetary value; they embody intricate artistry, advanced security features, and a rich history reflected in their design.

Each denomination, from the widely circulated $1 bill to higher values, showcases unique imagery and symbols, serving as a testament to the economic and cultural significance of the U.S. dollar in the global financial landscape.

$1

One Dollar features George Washington on the front and the Great Seal of the United States on the reverse. Circulation includes Series 1963 and Series 2017A.

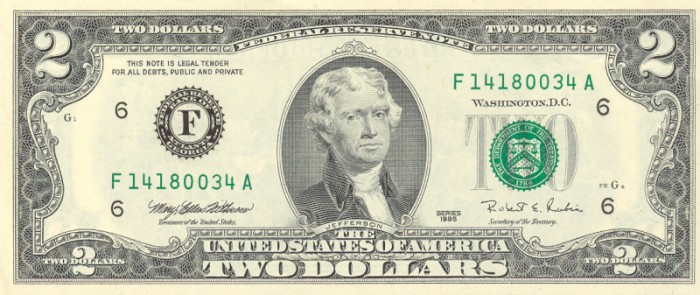

$2

Two Dollars displays Thomas Jefferson on the front and the Declaration of Independence by John Trumbull on the reverse. Limited circulation includes Series 1976 and Series 2017A.

$5

Five Dollars shows Abraham Lincoln on the front and the Lincoln Memorial on the reverse. Circulation includes Series 2006 and Series 2021.

$10

Ten Dollars depicts Alexander Hamilton on the front and the Treasury Building on the reverse. Circulation includes Series 2004A and Series 2017A.

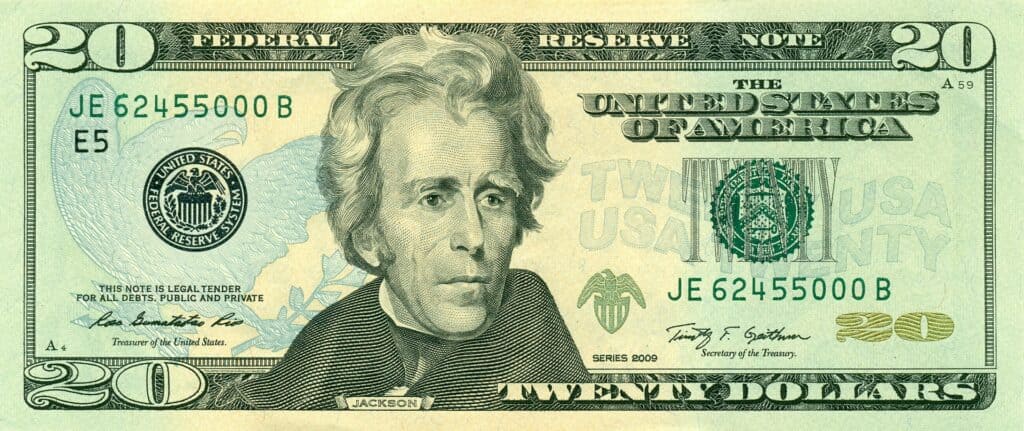

$20

Twenty Dollars features Andrew Jackson on the front and the White House on the reverse. Circulation includes Series 2004 and Series 2017A.

$50

Fifty Dollars displays Ulysses S. Grant on the front and the United States Capitol on the reverse. Circulation includes Series 2004 and Series 2017A.

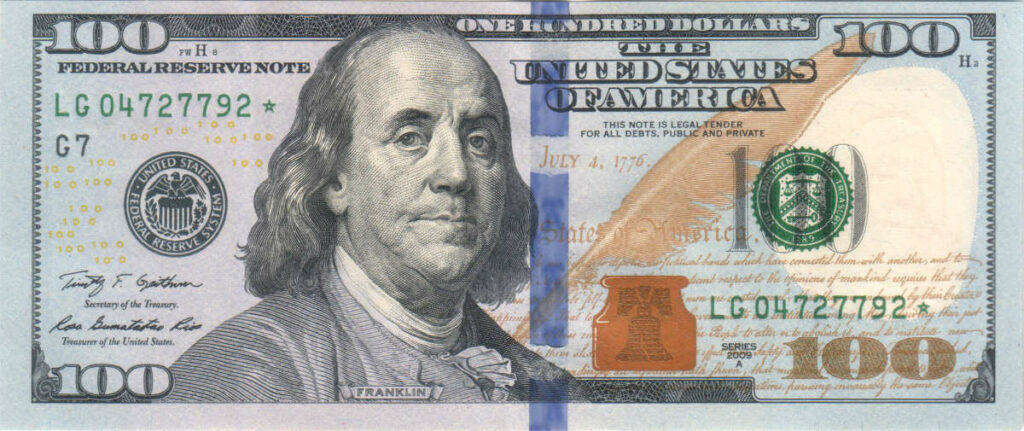

$100

One Hundred Dollars shows Benjamin Franklin on the front and Independence Hall on the reverse. Circulation includes Series 2009A and Series 2017A.

Currency Usage in El Salvador

El Salvador’s currency situation has two key elements. Firstly, since 2001, the country has adopted the US dollar (USD) as its official currency, meaning all transactions are conducted in USD. While this brought stability and lower interest rates, it limited the government’s control over monetary policy.

Secondly, El Salvador made history in September 2021 by recognizing Bitcoin (BTC) as a legal tender alongside the US dollar. Despite government encouragement, Bitcoin adoption has been slow due to infrastructure gaps and technological literacy challenges.

Currently, the US dollar dominates everyday transactions, with Bitcoin use mainly in urban areas among tech-savvy individuals. El Salvador’s currency landscape is dynamic, with the coexistence of the US dollar and Bitcoin shaping its financial future.

Is USD accepted in El Salvador?

Yes, USD is widely accepted in El Salvador as it is the official currency of the country since 2001. All transactions and prices are quoted in USD, so there’s no need to exchange your currency before visiting.

You can use USD bills and coins for various expenses like groceries, gas, hotels, and souvenirs. It’s advisable to have smaller denominations like $1s, $5s, and $10s, especially in smaller towns.

Exchanging Currency in El Salvador

Exchanging currency in El Salvador is generally unnecessary as the official currency is the US dollar. However, specific situations may require converting foreign currency to USD before or during your trip. For instance, if you’re arriving from a country with a different currency, exchanging your cash for USD might be necessary.

Where can I exchange El Salvador currency?

Various places in El Salvador offer currency exchange services. Major banks like Banco Agrícola and Davivienda provide these services, but rates may not be the most competitive. Currency exchange bureaus, often called “casas de cambio,” are usually found in tourist areas and offer quicker, more convenient exchanges with potentially better rates than banks.

Although currency exchange counters are available at El Salvador International Airport, rates might be less favorable. It’s advisable to exchange only a small amount for immediate needs and perform the bulk of your exchange elsewhere.

What to know before exchanging currency in El Salvador?

Even though El Salvador uses the US dollar as its official currency, there are scenarios where exchanging your foreign currency might be necessary.

If you’re coming from a country with a different currency, bringing non-USD cash, you may need to exchange these.

Traveler’s checks, though less common, can also be exchanged for USD. For exchange, you can use banks for secure transactions, but they may have less competitive rates and longer wait times.

It’s advised to exchange only a small amount there and do the bulk elsewhere. When exchanging, compare rates and fees at different places, including online services. Be aware of hidden fees such as commissions and per-transaction charges, and only exchange what you need for immediate expenses to avoid risks.

Keep receipts for proof of transactions or refunds. For larger amounts, using debit/credit cards for ATM withdrawals or direct payments can be more convenient and cost-effective.

Consider informing your bank about your travel plans to avoid blocked transactions and be cautious of scams and black market currency exchange offers. Planning ahead and following these tips will ensure a smooth currency exchange experience in El Salvador. Enjoy your trip!

Choosing Between USD and El Salvador currency

In El Salvador, where the official currency is the US dollar, daily transactions are conducted exclusively in USD. However, specific scenarios might arise where you encounter Salvadoran colones (SVC), the former currency, or bring non-USD cash.

If you receive SVC, an uncommon situation, you’ll need to exchange them back to USD, a process that can be done at some banks or authorized currency exchange bureaus. For those bringing non-USD cash, exchange options include banks, airports, or currency exchange bureaus both in your home country and El Salvador.

Traveler’s checks, though less common, can be exchanged for USD at banks or authorized offices, but availability and rates may vary. When deciding on the right option, compare exchange rates and fees, consider convenience, the amount of currency involved, and prioritize security with reputable providers.

Generally, using USD is the most convenient and hassle-free approach, but being informed about other possibilities can help you navigate any unexpected situations during your trip to El Salvador.

Exchange Rates

Exchange rates can be confusing, but it’s important to understand them when choosing between currencies. When exchanging currency, you may encounter different exchange rates depending on where you go.

Banks and exchange offices may offer different rates, and some businesses may offer their exchange rates when accepting foreign currency. Make sure to compare rates and choose the option that gives you the best value for your money.

Choosing between the US dollar and your local currency when traveling to El Salvador depends on your personal preference and the value you want to get for your money. Make sure to have a mix of both currencies on hand, and compare exchange rates to get the best value.

Fees

When exchanging currency, it’s best to avoid exchanging money at the airport or hotels since they often charge high fees. Instead, use ATMs to withdraw cash, which are widely available throughout the country.

However, keep in mind that your bank may charge you a foreign transaction fee, so it’s best to check with your bank before your trip. Additionally, some ATMs in El Salvador may charge a fee for withdrawals, so be sure to check the fee before proceeding with the transaction.

Convenience

For convenient and potentially cost-effective access to USD, consider using debit/credit cards for ATM withdrawals; check with your bank regarding foreign transaction fees. However, some smaller businesses may not accept credit cards, so it’s always a good idea to carry cash as a backup.

Tips

In El Salvador, the official currency has been the US dollar since 2001, making the choice between the USD and the local currency irrelevant. All transactions are conducted in USD.

However, in certain circumstances, you might encounter situations involving other currencies or receive Salvadoran colones (SVC), the former currency. Here are some tips for navigating these scenarios.

If you have non-USD cash, exchange it before you travel. Consider doing this at your home country’s banks, airports, or currency exchange bureaus for potentially better rates and convenience compared to El Salvador.

Exchange upon arrival if you haven’t exchanged yet. Utilize banks or currency exchange bureaus in El Salvador, comparing rates and fees before making a choice.

However, if you receive Salvadoran colones, exchange them with authorized providers. Carry and use USD for the most convenient experience. Exchange only what you need, and avoid carrying large amounts of cash in any currency. Also, shop around for the best deals before exchanging any currency.

While the primary emphasis should be on USD in El Salvador, being aware of these tips can help you handle any unexpected situations involving other currencies seamlessly.

Cost of Living in El Salvador

The cost of living in El Salvador is relatively low compared to other countries in the region. This is due in part to the fact that the El Salvador currency is pegged to the US dollar, which helps to keep prices stable.

However, it is important to note that the cost of living can vary depending on where you are in the country. For example, living in San Salvador can be more expensive than living in smaller towns or rural areas.

The cost of living in El Salvador is influenced by factors like lifestyle, location, and spending choices, generally proving more economical than many developed countries, such as the United States.

Accommodation costs vary, with renting a one-bedroom apartment in El Salvador ranging from $500 to $800 per month. Utility expenses, including electricity and water, typically range from $60 to $100 per month, with internet costing between $30 to $50 monthly.

Groceries are affordable, with basic items costing as little as $50 per week, and restaurant meals ranging from $5 to $30 for more upscale dining. Public transportation, primarily buses, is economical, with a one-way ticket ride costing about $0.35, and taxis starting at $5 for short trips.

Additional expenses include free public healthcare, while private services come with a fee, and education costs vary from free public schools to $100-$500 per month for private schools. Entertainment options, such as movie tickets and concerts, are relatively inexpensive.

Overall, living comfortably in El Salvador can be achieved on a budget making it an attractive option for retirees, digital nomads, and those seeking an affordable place to live. It’s essential to note that costs can be higher in tourist areas, and the use of the US dollar as the official currency simplifies budgeting and reduces currency exchange fees.

Don’t Get Scammed Tips

When traveling in El Salvador, it’s crucial to stay vigilant against potential scams to ensure your safety and make the most of your trip.

- Always be aware of your surroundings, particularly in busy areas like markets and public transportation, and keep your belongings close. Don’t openly display valuables like phones or jewelry. Trust your instincts—if a situation feels suspicious, it’s better to leave.

- Be cautious of pickpockets in crowded places and watch out for scams like ‘distraction and steal’, where someone distracts you while another person steals from you. Avoid unlicensed ‘fake guides’ who offer tours, as they may lead to overpriced locations.

- Use ATMs in secure areas to avoid card information theft, and be wary of fake taxi drivers; use only licensed taxis from official stands. Agree on taxi fares in advance to avoid overcharging.

- Embrace local culture and customs to enhance your experience and prevent unintentional offenses. Learn some basic Spanish for effective communication, trust your instincts, stay informed about travel advisories, and seek advice from locals or hotel staff.

- Book accommodations through reputable websites and be mindful of hidden fees in the terms. Additional tips include learning basic Spanish phrases for easier communication, carrying a photocopy of your passport, downloading offline maps for navigation, and getting travel insurance for unforeseen events.

By following these tips and staying alert, you can reduce the risk of scams and fully enjoy your exploration of El Salvador.