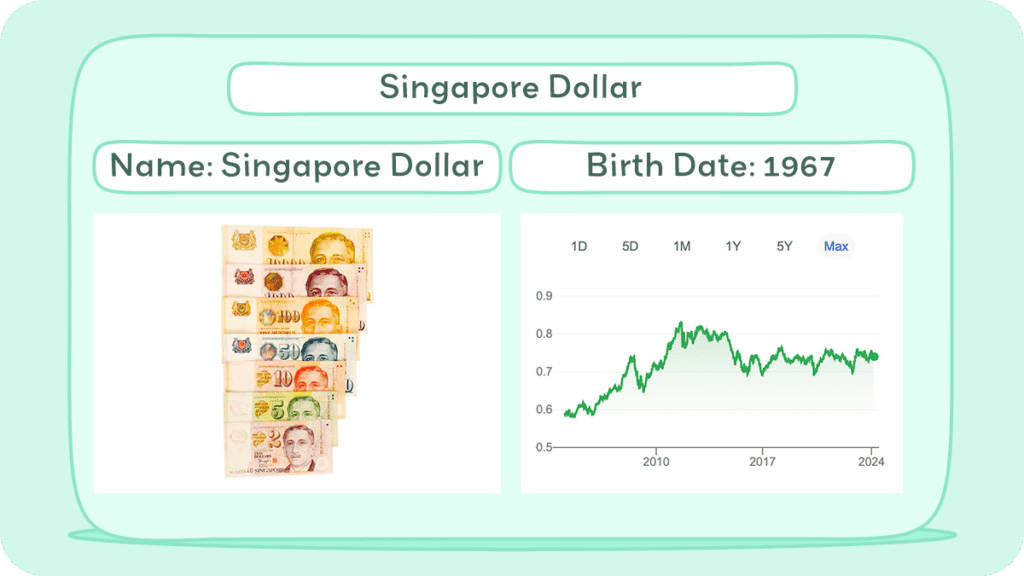

The Singapore dollar (SGD) is the official currency of the Republic of Singapore and is abbreviated with the dollar sign ($). One SGD is divided into 100 cents.

The Monetary Authority of Singapore (MAS) issues banknotes and coins of the Singapore dollar. The banknotes come in denominations of $2, $5, $10, $50, $100, $1,000, and $10,000. Coins come in denominations of 1, 5, 10, 20, and 50 cents, as well as $1.

The Singapore dollar is widely accepted throughout the country, and most major credit cards are also accepted at many establishments.

This article explores the Singapore dollar, detailing its evolution from a small-scale currency to a significant player in the global financial market.

Historical Journey of Singapore Currency

Singapore’s currency history dates back to the pre-colonial era, where various coins from different parts of the world were used as a medium of exchange.

In 1845, the Straits Settlements, which included Singapore, Malacca, and Penang, introduced a uniform currency system. This system used the Indian rupee as the standard currency, and other currencies such as the Spanish dollar, Mexican dollar, and British pound were also in circulation.

During the Japanese Occupation, the Japanese Military Administration introduced the Japanese Occupation Dollar as the official currency, which remained in circulation until 1945.

After World War II, Singapore became a separate Crown Colony, and the Malayan dollar became the official currency, which was used until 1967.

In 1967, Singapore issued its own currency, the Singapore dollar, which replaced the Malayan dollar. The introduction of the Singapore dollar was a significant milestone in Singapore’s history, marking its independence as a nation.

The Monetary Authority of Singapore (MAS) was established in 1971, which gave the government the sovereign power to undertake monetary policy as it deemed most appropriate.

Over the years, Singapore’s economy grew, and its trade links diversified to many other countries and regions. As a result, Singapore moved towards pegging its currency against a fixed and undisclosed trade-weighted basket of currencies from 1973 to 1985. This allowed Singapore to maintain a stable exchange rate and promote economic stability.

Today, the Singapore dollar is widely recognized as a stable and reliable currency, and it is used not only in Singapore but also in other countries in the region.

It is also one of the most traded currencies in the world, with a high level of liquidity. Singapore’s currency history is a testament to the country’s economic growth and stability, and it continues to be an important factor in its success as a global financial hub.

History of Coins

In 1967, Singapore introduced its first series of coins in denominations of 1, 5, 10, 20, and 50 cents, and 1 dollar. These coins, designed by Stuart Devlin, featured various wildlife and scenes associated with Singapore, similar to the sizes of the Malaysian ringgit and based on the old Malaya and British Borneo dollar.

The 1-cent coin was initially bronze and later changed to copper-clad steel in 1976. By 1985, the production of this series had ceased.

In 1985, the second series of coins, known as the Floral Series, was introduced. These smaller coins, designed by Christopher Ironside, featured a floral theme.

This series included a new 1-dollar coin made of aluminium-bronze, replacing the one-dollar banknote. Additionally, limited numbers of commemorative bimetallic 5-dollar coins were issued. The 1 cent coin was eventually phased out of circulation in 2002.

The third and current series, known as the Iconic Series, was introduced on 25 June 2013. It includes 5, 10, 20, 50 cents, and 1 dollar coins, featuring Singapore’s national icons and landmarks. These coins are made from multi-ply plated-steel and have enhanced security features to prevent counterfeiting.

The designs include the Merlion on the one-dollar coin, the Port of Singapore on the fifty-cent coin, Changi International Airport on the twenty-cent coin, public housing on the ten-cent coin, and the Esplanade on the five-cent coin.

The second and third series coins have a medallic orientation, and the new one-dollar coin is bimetallic.

History of Bills

Singapore has a rich history of issuing various series of banknotes, each with unique designs and security features.

Orchid Series (1967-1976). The first series featured nine denominations, with each note displaying an orchid (the national flower of Singapore) on the front and different scenes of Singapore on the back. Key features included the Coat of Arms, a lion head watermark, the signature of the Minister for Finance, and embedded security threads.

Bird Series (1976-1984). Replacing the Orchid Series, this set also had nine denominations but included a $20 note instead of the $25. Each note showcased a bird species on the front, symbolizing Singapore’s aspirations for progress. They retained the standard security features of the previous series.

Ship Series (1984-1999). This series reflected Singapore’s maritime heritage, with different types of ships on the notes’ front and various scenes of Singapore’s achievements on the back. The $20 note was replaced with a $2 note in this series.

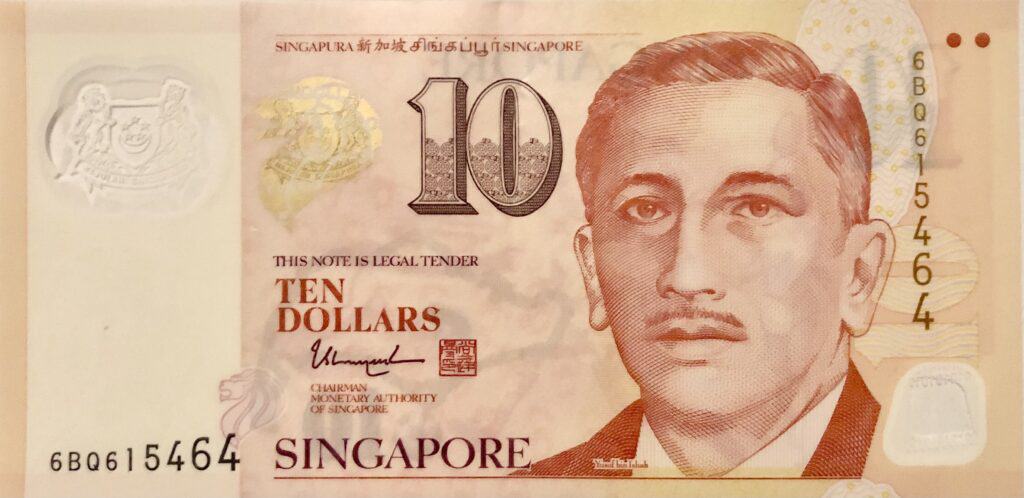

Portrait Series (1999-present). The current series features the portrait of Yusof bin Ishak, Singapore’s first president, on the front. The reverse side highlights different aspects of Singapore’s civic life. This series includes both paper and polymer notes, with Braille patterns for the visually impaired.

Singapore has also issued commemorative banknotes for special occasions, such as anniversaries and significant national events. These notes are usually limited in quantity and feature unique designs relevant to the occasion they commemorate.

Examples of commemorative notes include those for Singapore’s independence anniversary, the Currency Interchangeability Agreement with Brunei, the millennium celebration, and the Singapore Bicentennial.

These special edition notes often become collectors’ items due to their limited release and unique designs.

Inflation and Buying Power of the Singaporean Dollar

The inflation rate is a measure of the increase in the price of goods and services over time.

The inflation rate in Singapore has been relatively stable over the past few years. According to MAS, the inflation rate has been hovering around 2-3% since 2018.

Inflation can affect the buying power of the Singapore dollar, which is the amount of goods and services that you can purchase with a given amount of money.

The buying power of the Singapore dollar is affected by various factors such as inflation, interest rates, and exchange rates. When inflation is high, the buying power of the Singapore dollar decreases.

This means that you need more Singapore dollars to purchase the same amount of goods and services. Conversely, when inflation is low, the buying power of the Singapore dollar increases. This means that you need fewer Singapore dollars to purchase the same amount of goods and services.

The Singapore government has implemented various measures to keep inflation in check. For instance, the MAS carries out monetary policy by managing the Singapore dollar exchange rate.

This means that the MAS adjusts the exchange rate of the Singapore dollar to keep inflation within a target range. Additionally, the government has implemented various subsidies and rebates to help Singaporeans cope with rising costs.

Overall, the inflation rate and buying power of the Singapore dollar are important factors to consider when making financial decisions. It is important to keep track of inflation rates and adjust your spending and investment strategies accordingly.

Singaporean Dollar

The Portrait Series of Singapore banknotes, currently in general circulation, features the portrait of Yusof bin Ishak, the first president of Singapore, on the front.

Each denomination has a unique design on the reverse that reflects different aspects of Singapore’s culture and history, along with a cowrie shell pattern on the obverse, signifying different values.

$2

$2 Banknote: Features the money cowrie and focuses on education, depicting historic educational buildings. Yusof bin Ishak’s connection to education is highlighted as he was a student at Victoria School and Raffles Institution and later became the Chancellor of the National University of Singapore.

$5

$5 Banknote: Showcases the gold-ringed cowrie and emphasizes Singapore as a Garden City. It features the tembusu tree from the Singapore Botanic Gardens and the national flower, Vanda Miss Joaquim. Yusof bin Ishak’s past as an orchid gardener is noted.

$10

$10 Banknote: Displays the wandering cowrie and celebrates sports, depicting various athletes. Reflecting Yusof bin Ishak’s sporting background, including his achievements in boxing and weightlifting, this note was the first in the series to be printed in polymer.

$50

$50 Banknote: Highlights the cylindrical cowrie and focuses on the arts, with images of musical instruments representing Singapore’s cultural diversity and paintings by local artists Cheong Soo Pieng and Chen Wen Hsi.

$100

$100 Banknote: Features the swallow cowrie with a theme of youth, showing a National Service officer and uniformed youth organizations, symbolizing the youthful spirit and civic duty.

$1,000

$1,000 Banknote: Presents the beautiful cowrie and depicts Singapore’s government institutions, representing the legislative, judiciary, and executive branches. Unique to this note is the microprint of Singapore’s national anthem.

$10,000

$10,000 Banknote: Contains the onyx cowrie and illustrates Singapore’s economy, highlighting sectors like biotechnology and research. This high-value note, one of the world’s highest in circulation, reflects Yusof bin Ishak’s background as a businessman and newspaper founder.

Currency Usage in Singapore

If you are planning to visit Singapore, you may be wondering about the currency usage in the country. The official currency of Singapore is the Singapore dollar (SGD). You can easily exchange your currency for SGD at the airport, banks, or money changers.

Is USD accepted in Singapore?

While the US dollar is widely accepted in some tourist areas, it is not the official currency of Singapore. Therefore, it may not be accepted in all establishments. It is recommended to exchange your currency for SGD before you start your trip.

Most shops, restaurants, and hotels in Singapore accept credit cards, so you may not need to carry a lot of cash. However, it is always a good idea to have some cash on hand for small purchases or in case of emergencies.

To get the best exchange rate, it is advisable to use a credit card or withdraw money from an ATM instead of exchanging cash at a money changer. Some ATMs and credit cards may charge a fee for foreign transactions, so it is recommended to check with your bank before you travel.

Exchanging Currency in Singapore

If you’re planning a trip to Singapore, you’ll need to exchange your currency for Singapore dollars (SGD). Here’s what you need to know about exchanging currency in Singapore.

Where can I exchange Singapore currency?

There are several places where you can exchange currency in Singapore. Banks and money changers are the most common options. Banks typically offer better exchange rates, but they may charge higher fees. Money changers can be found throughout the city and offer competitive rates.

One popular option is the Mustafa Center in Little India, which is open 24 hours and offers good rates. Other options include The Arcade at Raffles Place, Lucky Plaza on Orchard Road, and Parkway Parade in the East Coast.

What to know before exchanging currency in Singapore

Before exchanging your currency in Singapore, there are a few things to keep in mind. First, be aware of the current exchange rate. You can check the current rate online or at a money changer.

Second, make sure to bring your passport with you when exchanging money. Money changers are required by law to ask for identification, and they will not exchange money without it.

Third, be mindful of fees and commissions. Banks and money changers may charge fees or commissions for exchanging currency. Make sure to ask about these fees before exchanging your money.

Fourth, avoid exchanging currency at the airport if possible. Airport exchange rates are typically much higher than rates in the city. If you must exchange money at the airport, only exchange a small amount for immediate needs and exchange the rest in the city.

Finally, if you are traveling to Singapore, it is recommended to carry some Singapore dollars with you for daily expenses, such as food, transportation, and shopping. Most places in Singapore accept credit cards, but it is always good to have some cash on hand, especially when visiting hawker centers and small shops.

By following these tips, you can exchange your currency in Singapore with confidence and get the best rates possible.

Choosing Between USD and Singapore Currency

When traveling to Singapore, you may wonder whether you should carry Singapore currency or US dollars. Here are some factors to consider:

Exchange Rate

The exchange rate between USD and Singapore currency fluctuates regularly. Check the current exchange rate before your trip to determine which currency to carry. You can use online currency converters like XE to check the latest exchange rate.

Convenience

While US dollars are widely accepted in Singapore, it’s still more convenient to carry Singapore currency. You can easily withdraw Singapore currency from ATMs or exchange currency at banks or money changers.

Carrying Singapore currency also allows you to avoid the hassle of constantly calculating exchange rates.

Fees

When exchanging currency, be aware of the fees involved. Banks and money changers may charge a commission or fee for exchanging currency. Additionally, some ATMs may charge a withdrawal fee. Check with your bank to see if they have partner banks in Singapore to avoid withdrawal fees.

Tips

When using ATMs in Singapore, choose ATMs located in well-lit and populated areas to avoid theft. It’s also a good idea to inform your bank of your travel plans to avoid any issues with your account.

When exchanging currency, compare rates and fees at different banks and money changers to get the best deal.

While Singapore is a relatively expensive destination compared to other Southeast Asian countries, the Singapore dollar is generally stable and has a strong exchange rate against many other currencies.

You can easily convert your currency to SGD at banks, exchange offices, or ATMs throughout the country. Be sure to check the current exchange rate before your trip to ensure you’re getting the best value for your money.

Cost of Living in Singapore

If you are planning to move to Singapore, it is important to have an idea of the cost of living in the country. Singapore is known to be one of the most expensive cities in the world, and this is reflected in the cost of living.

Housing is one of the biggest expenses in Singapore. The cost of housing varies depending on the location, size, and type of property. If you are a single person, you can expect to pay around SGD 1,500 to SGD 2,500 (~$1116-1861 USD) per month for a one-bedroom apartment in a central area.

For a couple, a two-bedroom apartment can cost around SGD 2,500 to SGD 4,000 per month. Families may require a larger apartment or a house, which can cost between SGD 4,000 and SGD 10,000 per month.

Singapore is known for its diverse food culture, and you can find a variety of cuisines at different price points. Eating out at hawker centers and food courts can be a cheap and delicious option, with meals costing around SGD 4 to SGD 10.

If you prefer to cook at home, groceries can be quite expensive, with prices higher than in other countries. However, you can still find affordable options at local markets and supermarkets.

Transportation in Singapore is convenient and efficient, with an extensive public transportation system. The cost of transportation depends on the mode of transport and distance traveled.

A one-way trip on the MRT (Mass Rapid Transit) can cost between SGD 1.20 to SGD 3.20, while a bus ride can cost around SGD 1.50 to SGD 2.00. Taxis are also available, but they can be quite expensive.

Utilities such as water, electricity, and gas are essential expenses in Singapore. The cost of utilities varies depending on the size of your home and usage. On average, a monthly bill for utilities can range from SGD 150 to SGD 300.

Other expenses to consider when living in Singapore include healthcare, education, and entertainment. Healthcare costs in Singapore can be quite high, but the quality of healthcare is generally good.

Education costs can also be expensive, especially for international schools. However, there are many free or low-cost entertainment options in Singapore, such as parks, museums, and cultural events.

Overall, the cost of living in Singapore can be high, but with proper planning and budgeting, you can still enjoy a comfortable lifestyle in the city.

Don’t Get Scammed Tips

Singapore has a reputation for being one of the safest countries in the world. However, it is still important to be aware of potential scams when dealing with currency. Here are a few tips to help you avoid being scammed:

1. Know the Security Features of Singapore Currency

Singapore currency has various advanced security features that minimize the risk of counterfeiting. It is important to familiarize yourself with these features to distinguish between genuine and counterfeit currency.

The Monetary Authority of Singapore provides a guide on identifying genuine currency on their website here.

2. Be Wary of Job Scams

Job scams are one of the most common types of scams in Singapore. Scammers often pose as recruiters or employers and offer high-paying job opportunities to lure victims. They may ask you to pay a fee for processing your application or for a work visa. Be wary of any job offer that requires you to pay money upfront.

3. Don’t Fall for Investment Scams

Investment scams are another common type of scam in Singapore. Scammers may approach you with investment opportunities that promise high returns in a short period of time. They may ask you to invest in a company or a scheme that sounds too good to be true. Always do your due diligence before investing your money.

4. Protect Your Personal Information

Scammers may try to obtain your personal information, such as your bank account details or your NRIC number, to commit fraud. Be careful when giving out your personal information and only share it with trusted sources.

By following these tips, you can protect yourself from potential scams when dealing with Singapore currency.