Upbit is a South Korean cryptocurrency exchange that offers many pairs in the Korean won fiat currency. It was founded in 2017 and is based in Seoul, South Korea. Upbit has partnered with Bittrex, a leading US crypto exchange, that serves US users, but US users cannot use the Upbit exchange itself.

The exchange requires KYC (Know Your Customer) identity verification or document protocols to be completed for use of the exchange. Upbit offers two separate exchange options: Upbit Korea and Upbit Global, which is based in Singapore.

History of Upbit

Upbit is operated by Dunami, one of the highest-value startups in South Korea. The exchange launched in South Korea in Oct 2017 with the help of their partnership with the American cryptocurrency exchange Bittrex.

Sirgoo Lee was named CEO of Dunami, Upbit’s parent company in 2017. Just two months after its launch, Upbit at the time became the top global crypto exchange in terms of 24H trading volume. Today in 2022, Upbit is regularly in the top 5-6 exchanges in terms of daily trading volume.

Since September 2021, South Korea started to regulate digital asset service providers such as Upbit so international customers have faced more scrutiny with KYC requirements.

Upbit is best for:

-

All types of cryptocurrency spot investors who desire access to crypto instruments on a top-tier Asian exchange, along with a core offering of major crypto coins and high daily volume along with good liquidity. Especially great for investors in Singapore, Thailand, Indonesia, and South Korea

-

Spot traders who are ok with a reliable, well-known exchange with relatively high fees with a flat fee schedule irrespective of volume tiers and the same fees for both makers and takers

PROS

- High volume and good liquidity

- Low-frill exchange

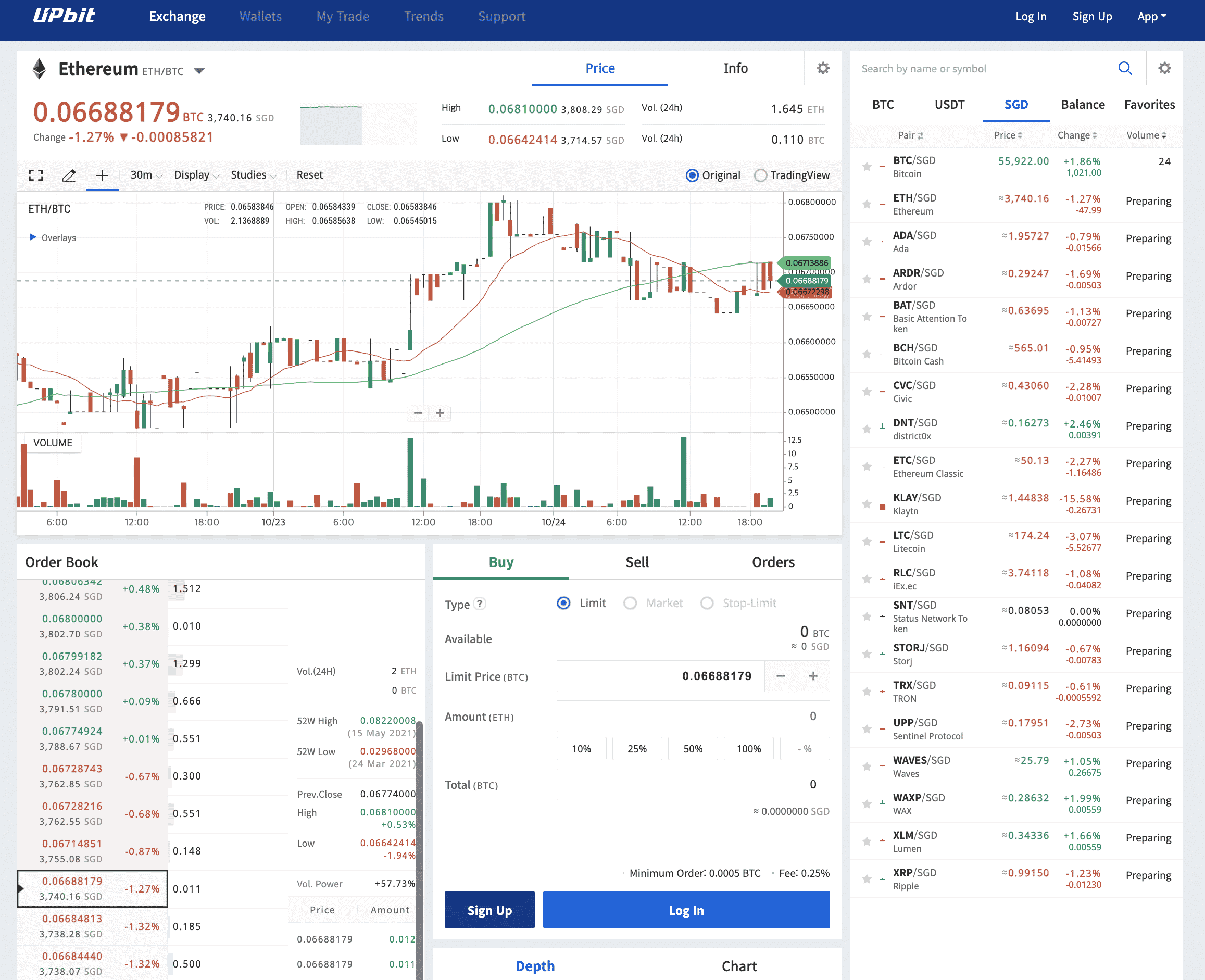

- Charting, order book, and advanced order types

- Custody wallet option

- Various ranking and tracking tools

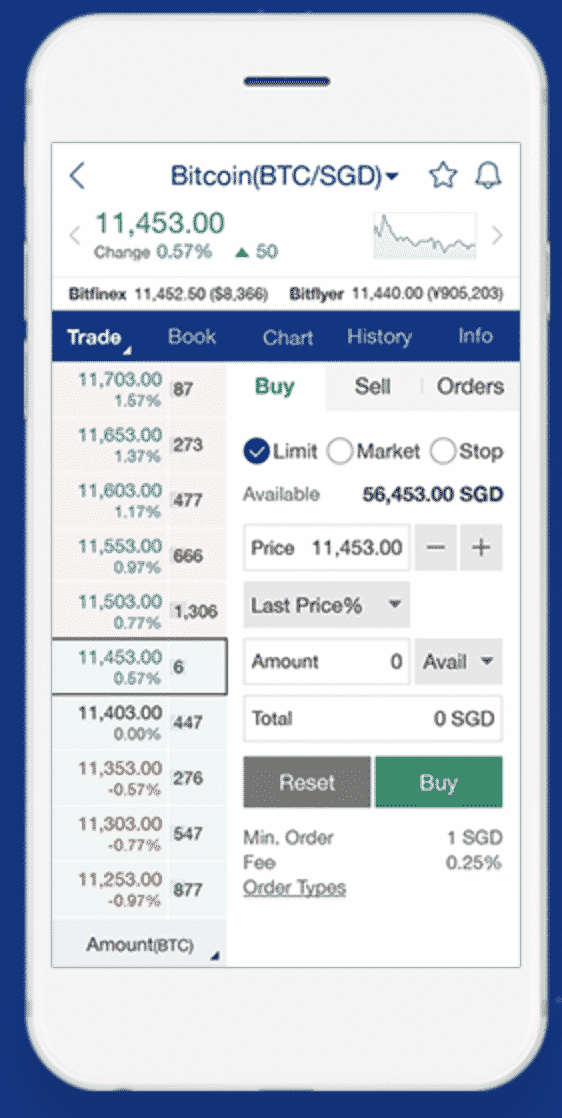

- Mobile and desktop friendly

CONS

- Only spot trading available

- No lending or staking services

- Limited asset options

- Flat fee model

Pros & Unique Features

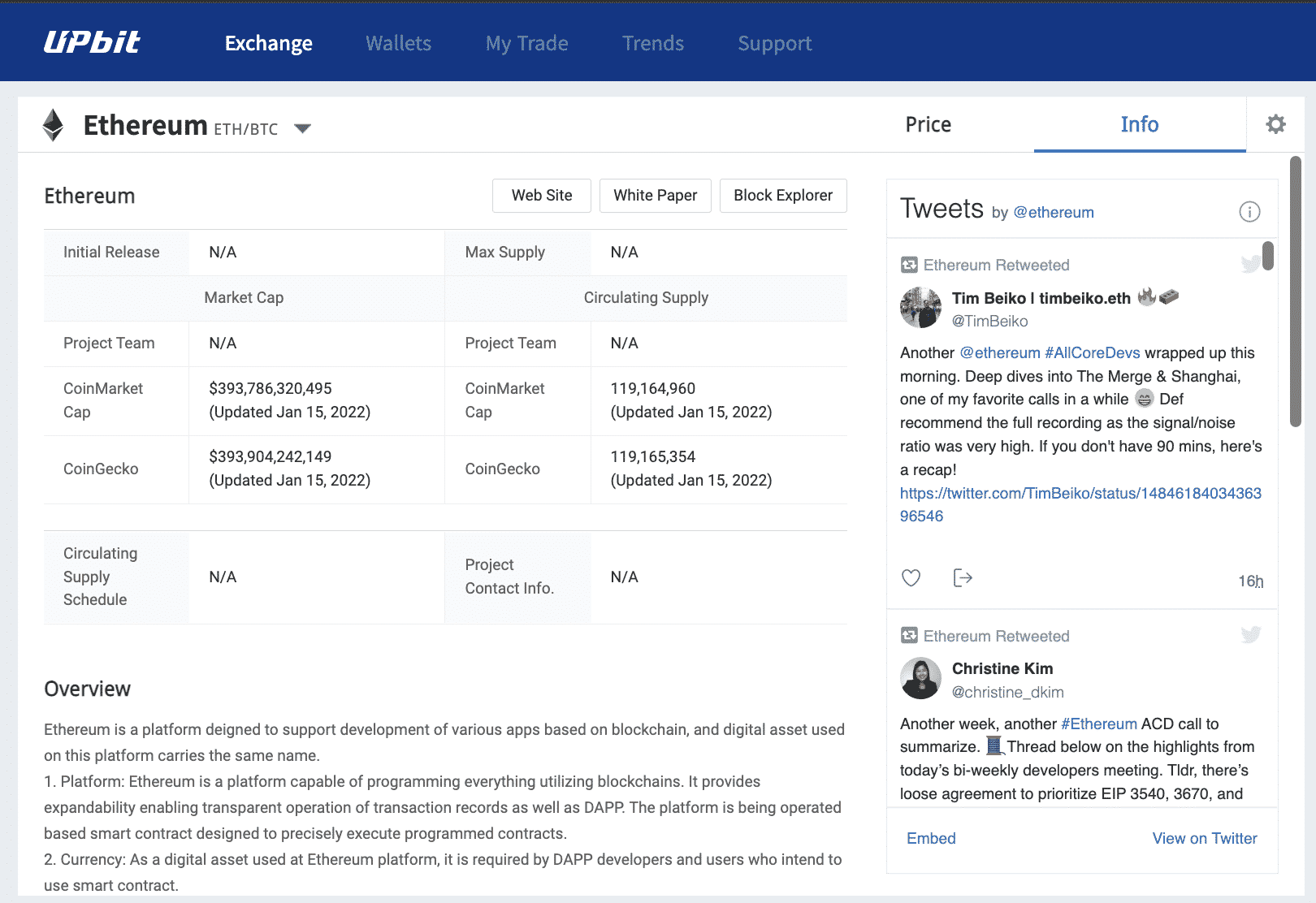

Upbit offers 41 digital assets and 42 markets for trading pairs. The main benefits of Upbit are that it’s a low-frill exchange with high volume and good liquidity for investors and traders, and without all the complicated features other exchanges that focus more on a complete financial services ecosystem may have.

Upbit Global offers international customers an exchange with charting, order book, advanced order types, and full-featured trading functionality.

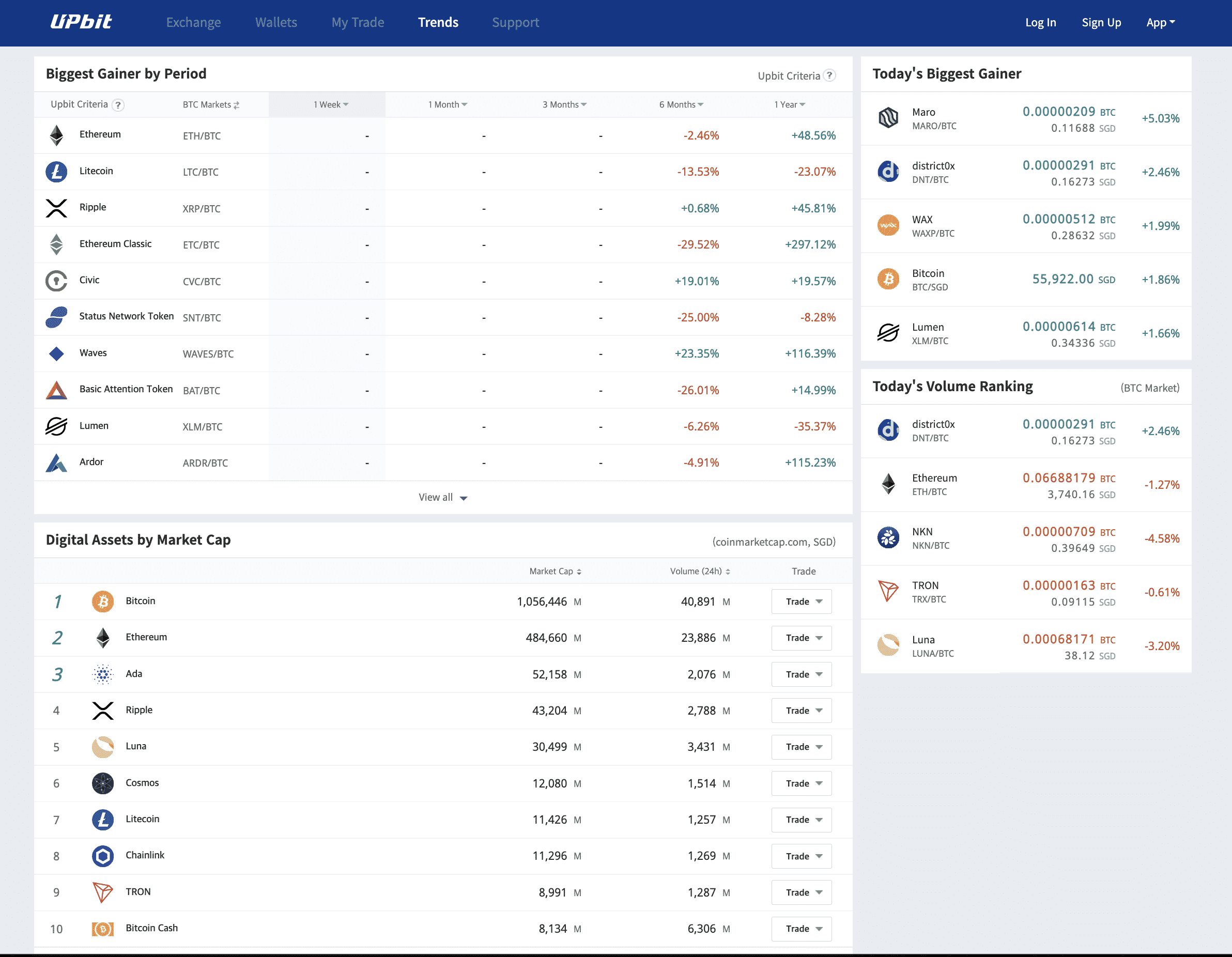

The exchange also offers wallets for custodying digital assets with the exchange, like many other exchanges do. There is also a tracker for daily gainers, trending coins, and ranking the digital assets offered by the exchange.

Lastly, the exchange offers a full-featured mobile app for both iPhone and Android with trading functionality as well. For trading on both the app and the online exchange, only spot trading is offered.

As for customer support, Upbit offers a support service center customers can access via logging in and submitting a request.

Cons & Disadvantages

The main disadvantages of Upbit are its lack of crypto financial services compared to other top comparable exchanges on the market, as well as its lack of futures and other advanced derivatives offerings, or even margin trading. There do not even seem to be any basic lending or staking services offered as of 2022, which has become standard across the industry even for simple exchanges.

This makes the exchange functionality quite limited for active traders and better suited to investors. However, Upbit is not accessible in many countries globally, but is ideal to use for South Korean residents and some other Asian countries in which it is allowed. Also, the exchange’s asset and trading pairs selection is quite limited.

Thus, Upbit may be an exchange that is better geared to investors and spot traders, whereas advanced and high volume margin, or futures traders would prefer options such as BitMEX, FTX, or Binance. Another disadvantage is the lack of volume-tiered fee schedule that is common for crypto exchanges. Upbit instead uses a flat fee of 0.20% for spot BTC and USDT markets (for both makers and takers) and 0.25% for SGD markets. This fee is quite high when compared to many other competitor exchanges.

US users who wish to transact with more functionality or trading pairs and access may opt to use competitors like ByBit for futures or Bittrex for spot, thereby gaining access to a much wider selection of trading instruments such as margin and futures as well.

Upbit Fees

Upbit uses a flat fee model. This model is irrespective of trading volume or maker-taker status unlike with other exchanges.

Trading fees are 0.2% for BTC spot makers for both makers and takers, 0.2% for USDT markets for both makers and takers, and 0.25% for SGD markets for both makers and takers.

This fee schedule is simple and easy to understand, however lacks the benefits of reduced fees for higher volume traders or even rebates or preferable rates for liquidity providers (market makers).

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

Other Fees

Upbit charges the following deposit, withdrawal, and other fees:

- No deposit fees for any digital asset

- Withdrawal fees depend on the asset in question and are free for Lighting Transfer (between Upbit accounts). The fee list is here.

There are no fees for signing up or for having an inactive exchange account, nor any fees for holding funds in an exchange account, and users may hold assets as long as desired.

Account Tiers & Limits

There are four levels of verification that all come with different account limits.

- Verification Level 1 (not verified): cannot deposit any digital assets nor fiat SGD, nor withdraw any

- Level 2 (identity verification): Unlimited digital asset deposits, cannot deposit any fiat, 5,000 daily digital asset withdrawal limit, cannot withdraw fiat SGD

- Level 3 (residential address verification) enjoys 100,000 daily digital asset withdraw limit, with everything else the same

- At the highest verification level, Level 4 (bank account verification), digital asset withdrawals are unlimited, fiat SGD withdrawals are unlimited, digital asset daily withdrawal limit is at a max of 100,000 per day, 50,000 SGD per transaction withdrawal limit, and 100,000 SGD daily withdrawal limit

The daily withdrawal limit resets at 06:30AM every day. The withdrawal limit of digital assets is managed using the estimated SGD value at the time of withdrawal. Withdrawals can be blocked in the event of a suspicious trade.

Crypto Security

Upbit suffered a hack of almost $50M in Ethereum in 2019 from its exchange hot wallets. At the time of hack, Upbit executives promised to cover the stolen funds and that customers would not be impacted except for a two-week timeframe for deposit and withdrawal services to resume.

Since then, Upbit has implemented the use of a hardware-based cold wallet storage system that is not connected to the Internet. Upbit also underwent a greater security overhaul since then, with changes relating to asset housing. The security infrastructure of relevant personnel as well as dispersed storage of crypto assets was implemented.

Since the overhaul, the exchange also urged users to ensure to use 2-factor authentication methods without SMS, and to delete any old deposit addresses, and instead to use newly generated wallet addresses.

Other security features implemented at Upbit include address whitelisting, anti-phishing features, and cold storage for assets.

Upbit Review Conclusion

Upbit is a good general choice of crypto exchange for investors and spot traders in Asia, specifically in a select few countries, as well as investors or traders in other parts of the world including Europe and Africa.

The exchange offers a strong core offering of top 42 crypto coins and trading pairs, high volume and great liquidity, spot only trading, a full-featured charting and trading platform, and a no-frills experience without all the bells and whistles of other complicated exchanges in the modern day.

Users have exactly what they need and every user pays the same fees to transact, irrespective of their trading volume or maker/taker status. However, the exchange can leave much to be desired for many users who have grown accustomed to the range of crypto financial services at other top-tier exchanges, such as lending and staking, competitions, cashback cards, margin and futures access, and more features.

US users cannot access Upbit and KYC is required to use the exchange at all verification levels.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable.

- Upbit offers access to 41 coins and 42 trading pairs, for only spot trading

- Intermediate to advanced traders trading margin who desire access to advanced trading tools and charting would prefer to pick a different exchange, Upbit is better suited to spot investors primarily in Asia, but also in several other international countries. South Korean digital asset compliance laws however must be adhered to by Upbit and as the regulatory landscape changes, it may make more sense for users to opt for exchanges in their own jurisdiction.

Other Alternatives

For customers who desire access to a simpler user interface with far more trading pairs, or those who do not desire to participate in cryptocurrency futures trading, either Bittrex (Upbit’s American partner), Coinbase, and Voyager can make decent alternatives with a more competitive amount of cryptocurrencies offered to trade and more competitive trading fees and functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a much larger selection of cryptocurrencies offered compared to Upbit—402 pairs vs. Upbit’s 41 coins—while active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ, and they all use volume-tiered fee schedules unlike Upbit, which uses a flat fee structure (0.20% for all volumes, for both makers and takers).

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Upbit include Bybit, Phemex, and Kraken.

Upbit vs Coinbase

Coinbase is better in all aspects of functionality and range of trading coins and products offered if compared to Upbit.

Both exchanges offer no margin trading, and Coinbase wins in the fee department for higher than $100K 30-day volume traders, because maker fees drop to 0.10%, half of that of Upbit, which offers only homogenous fees for both maker and takers, and no volume tiers. A major advantage for high volume traders will be the volume-tiered fees at Coinbase, which decrease most rapidly over 20M in 30-day trading volume.

Coinbase also offers almost 10x the selection of trading pairs as is offered at Upbit, with 440 trading pairs, compared to 42 at Upbit.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Upbit is not regulated in the US and US users cannot use it.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either FTX or Coinbase offer may find the choices below equally valuable.

Upbit vs FTX

FTX will win against Upbit for even intermediate traders, as it offers 323 coins and 492 trading pairs, which is higher than Upbt’s 41 coins and 42 trading pairs.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since Upbit offers only spot trading and no derivatives instruments of any kind.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while Upbit also offers a full-featured trading experience with top 10 exchange trading volume, however FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed.

Neither Upbit nor FTX can be used by US persons, and FTX instead offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection.

International users who can use FTX International may prefer FTX for these reasons over Upbit. US users trading at FTX US need to do KYC procedures. Fees are more competitive at FTX by far, plus FTX offers fee incentives for volume and for holders of its FTT token.

Upbit vs Gemini

Upbit and Gemini are two exchanges with similarities in their offerings, higher fee structure, and lack of extensive crypto financial services.

There is a slight difference in fees to start: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, which Upbit offers flat fees irrespective of volume or rebates, but they are always a flat 0.20% for both makers and takers, irrespective of volume.

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, and neither does Upbit.

Gemini offers 62 coins and 86 trading pairs which is a bit larger as compared to that of Upbit’s 41 coins and 42 trading pairs. Additionally, Gemini’s Gemini Earn product has far more staking selection and higher APY offered than Upbit’s staking services and other financial services products currently offered.

Upbit vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, which is a win over Upbit’s lack of any margin or leverage offerings. Simply put, US users may prefer Kraken for its regulatory compliance and strong track record.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which more competitive even at the entry volume tier level than Upbit’s flat structure of 0.20% for both makers and takers for all volume levels. Kraken offers no other fee incentives such as rebates or reductions except for volume, and Upbit only uses a flat fee structure.

Kraken offers a much larger variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer Kraken by far, depending on their jurisdiction.

If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may prefer other exchanges such as Bybit, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins. For South Koreans or other Asians for which regulatory compliance is important, Upbit may be their reference.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while Upbit is regulated in South Korea.

Upbit vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Upbit—over 351 coins and over 1300 pairs.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs that are not offered even on FTX, the other derivatives leader, at the moment.

Binance’s base maker-taker fee is better in its competitiveness compared to that of Upbit, starting at 0.1%, however Binance offers further 25% reduction in fees if paid in BNB, so this is a win for Binance, alongside its offering of reduced fee tiers for higher volume and even maker rebates.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Upbit. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is still more than that of Upbit.

Binance requires full KYC now to trade even spot products, and Upbit requires full KYC compliance as well to use.

Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is Upbit Safe?

While Upbit has suffered a hack of almost $50M in Ethereum in 2019 from its exchange hot wallets, the exchange has made amends to customers who lost assets, and also improved its custody and safety protocols.

Since then, Upbit has implemented the use of a hardware-based cold wallet storage system that is not connected to the Internet. Upbit also underwent a greater security overhaul since then, with changes relating to asset housing. The security infrastructure of relevant personnel as well as dispersed storage of crypto assets was implemented.

The exchange also urged users to ensure to use 2-factor authentication methods without SMS, and to delete any old deposit address, and instead to use newly generated wallet addresses.

Other security features implemented at Upbit include address whitelisting, anti-phishing features, and cold storage for assets.

How long does Upbit Withdrawal take?

Withdrawals are processed as requested and the withdrawal processing time for fiat SGD can take up to 30-45 minutes to complete. Note that fiat SGD withdrawal is only available to level 4 verified users, which requires bank account verification in addition to standard KYC verification of identity.

For crypto withdrawals, on average, it takes from 30 minutes to several hours for a transaction to be confirmed. However, sometimes it can take from 2 to 14 days if the network is overloaded, but this is rare.

Please note that for crypto, the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

After processing fiat withdrawals, the usual timeframe for ACH withdrawals to reach the user’s bank is 2-4 business days, excluding weekends and holidays.

Is Upbit a good exchange?

Upbit is a good general choice of crypto exchange for investors and spot traders in Asia, specifically in a select few countries, as well as investors or traders in other parts of the world including Europe and Africa.

The exchange offers a strong core offering of top 42 crypto coins and trading pairs, high volume and great liquidity, spot only trading, a full-featured charting and trading platform, and a no-frills experience without all the bells and whistles of other complicated exchanges in the modern day.

Users have exactly what they need and every user pays the same fees to transact, irrespective of their trading volume or maker/taker status. However, the exchange can leave much to be desired for many users who have grown accustomed to the range of crypto financial services at other top-tier exchanges, such as lending and staking, competitions, cashback cards, margin and futures access, and more features.

US users cannot access Upbit and KYC is required to use the exchange at all verification levels.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable.

Where is Upbit located?

Upbit is located and registered in South Korea, and Upbit Global, partnered with its US partner Bittrex, is located in Singapore.

Does Upbit require KYC?

Yes, the exchange requires KYC verification for all intents and purposes. There are four levels of verification at Upbit.

- Verification Level 1 (not verified): cannot deposit any digital assets nor fiat SGD, nor withdraw any. Users at this level have an exchange account but effectively cannot use any features.

- Level 2 (identity verification): Unlimited digital asset deposits, cannot deposit any fiat, 5,000 daily digital asset withdrawal limit, cannot withdraw fiat SGD

- Level 3 (residential address verification) enjoys 100,000 daily digital asset withdraw limit, with everything else the same

- At the highest verification level, Level 4 (bank account verification), digital asset withdrawals are unlimited, fiat SGD withdrawals are unlimited, digital asset daily withdrawal limit is at a max of 100,000 per day, 50,000 SGD per transaction withdrawal limit, and 100,000 SGD daily withdrawal limit

To summarize, KYC verification of identity, residential address, and bank account is required to use the exchange at the highest limit present, however at the minimum, identity verification is required to use the exchange at all.

What are the Deposit and Withdrawal Methods and Fees for Upbit?

Upbit offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto assets: deposits and withdrawals – no deposit fees. Withdrawal fees depend on the asset in question and are free for Lighting Transfer (between Upbit accounts). The fee list is here.

- Fiat SGD deposits and withdrawals via wire transfer and bank transfer. Accounts must be at the highest verification level (level 4), with bank accounts verified, to be able to use fiat deposits and withdrawals.

- Fiat SGD withdrawal fee of 5 SGD per transaction

What is the Minimum Withdraw Amount for Upbit?

The minimum withdrawal amount for fiat SGD is 1 SGD. The minimum withdrawal amount for crypto assets is not noted publicly.

How do you withdraw from Upbit?

Instructions for withdrawing from users accounts can be found here from official support.

Users can withdraw from the wallet by navigating to the Main page of their Wallet Menu and select SGD for fiat withdrawals, or crypto for crypto asset withdrawals. Then, select the “Withdrawal” button.

From there, the user should select the destination address to which he or she wishes to withdraw, or the linked and verified bank account for fiat withdrawals. Then, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal.

Is Upbit a wallet?

No, Upbit is a full-featured cryptocurrency trading exchange, but offers users several custodial wallets as part of its exchange services.

How to use Upbit?

Using Upbit can be done by going to upbit.com, creating an account on the platform, first undergoing KYC verification procedures, and then depositing any trading funds into the account via crypto assets (level 2 verification for KYC and above required) or fiat SGD only (level 4 verification required) and then getting access to the market offerings and begin trading.

User Reviews

- A reddit user questions why Upbit is so unheard of despite having such a high trading volume. “Its interesting to me that this influential exchange seems to fly under the radar.”

- Users compare other Korean exchange Bithumb to Upbit and their product offerings. u/Tradebully says, “Upbit & Bithumb are HUGE!!! Koreans use Upbit more than Bithumb because Upbit has more ALT choices and better rep.”

- Users of the Google Play store review the Upbit mobile app, averaging around 3/5 stars.

- Users on Revain review Upbit’s past performance and current products, though only average ~2.7/5.