Okcoin is one of the largest crypto exchanges in the world. It is a US-based cryptocurrency exchange that launched in 2013 that serves over 100K registered investors in 190+ countries.

The exchange requires KYC (Know Your Customer) identity verification protocols to be completed for use of the exchange, based on jurisdiction requirements. US users can use the services as per TOS.

History of Okcoin

Okcoin was founded in China by founder Star Xu but today is globally licensed and has offices in San Francisco, Miami, Malta, Hong Kong, Singapore, and Japan. The company employs over 100K people. The exchange is licensed and permissioned to operate in 180+ countries including the US and EU.

Founder Xu had a background in technology management and previous experience at Yahoo and Alibaba with the development of search algorithms. Since its start, Okcoin has developed into one of the largest and fastest growing exchanges in the world. It is still a private company with Series B funding with at least $10M in funding.

US residents are allowed to access the platform through Okcoin USA, which is a money transmitter and registered MSB with the US Treasury Department. Individuals of certain states may not use the exchange, such as Hawaii and some others.

In 2013 when the Chinese government cracked down on cryptocurrency exchanges and businesses, the exchange had to halt trading for local customers that year and again in 2017. When China banned all ICOs, Okcoin decided to halt CNY fiat pairs. As of today, Okcoin operates its exchange for non-Chinese customers around the world.

Okcoin is best for:

-

All types of cryptocurrency investors and spot traders looking for a top global exchange with high volume and liquidity

-

Traders and investors who desire a transparent, tiered fee schedule starting at 0.10% for makers and 0.20% for takers, with volume and significant maker incentives, as well with other products such as an OTC desk and staking options

PROS

- Global exchange

- Okay selection of coins and trading pairs

- Automatic investing feature

- Advanced charting

- Order books and advanced order types

- Mobile and desktop friendly

- Affiliate program

- Earn program for staking

- Institutional services

- OTC desk

- Grants program for developers

CONS

- Only spot trading

- Staking, yield and interest earning limited

- Not available to some jurisdictions

- KYC required

Pros & Unique Features

The best parts of Okcoin are its overall comprehensive exchange services for traders and investors that put it in the top 10 exchanges by volume around the world.

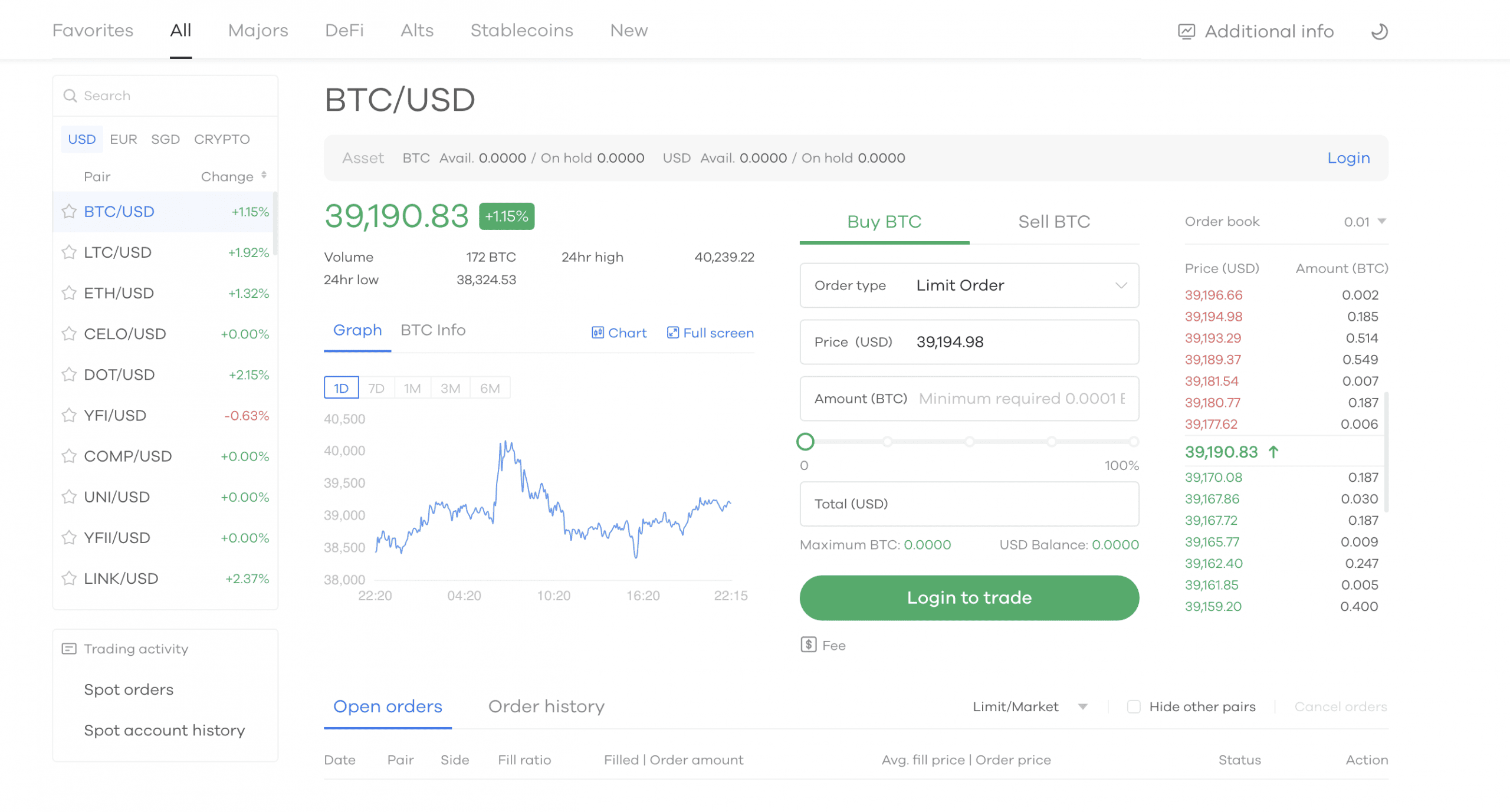

As far as its crypto offerings, the exchange offers only spot trading at this time, with 64 coins and 77 trading pairs offered. Investors can use the automatic investing features for recurring buys. Users of all types can fund their account with payment rails available via Apply Pay and instant deposits, as well as with credit cards. There is fiat support for USD, EUR, and SGD pairs, as well as crypto-to-crypto pairs.

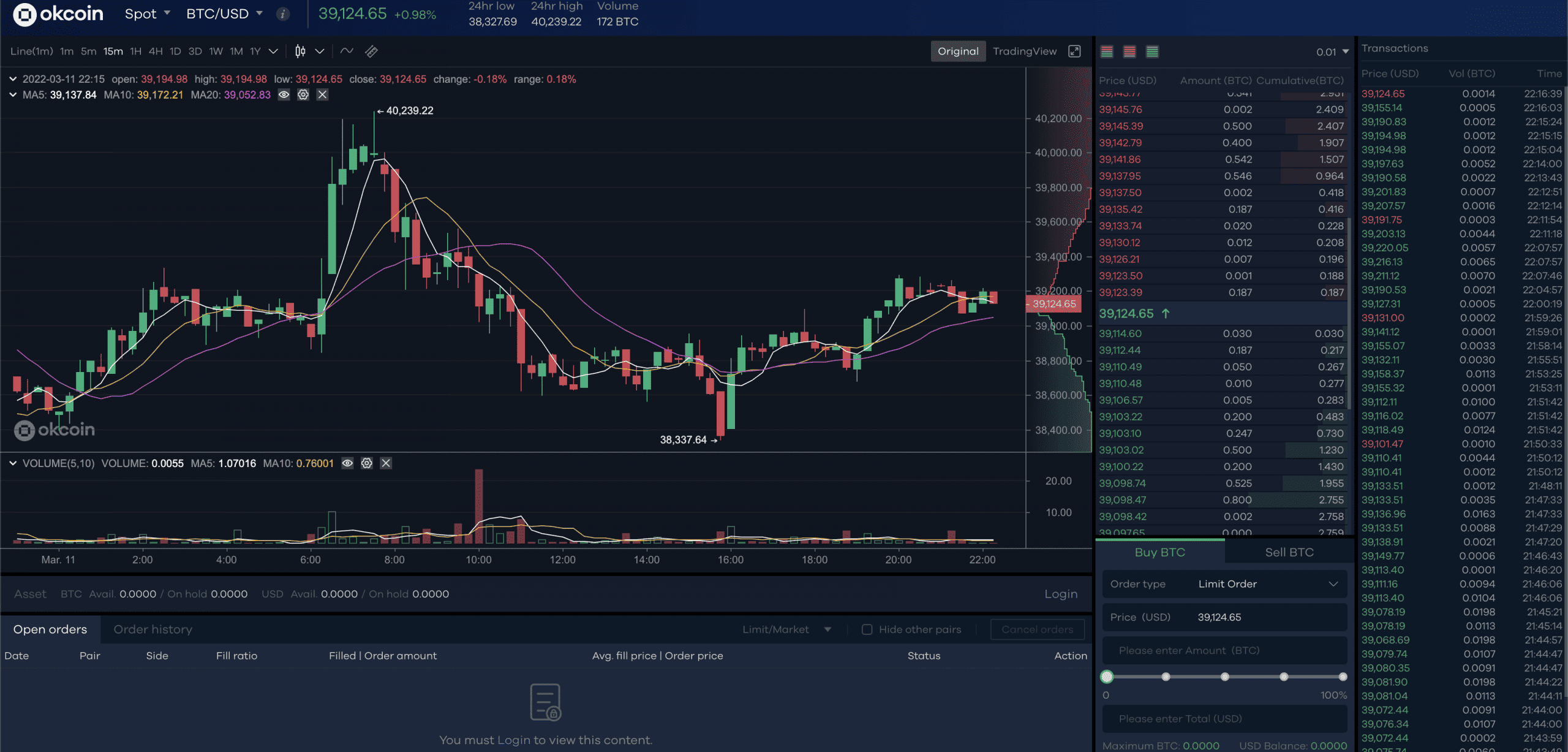

As far as the exchange and trading interface itself, advanced charting is integrated with TradingView and order books and advanced order types are present for more advanced traders to use.

Okcoin also offers mobile apps for users to be able to trade on the go for both Android and iOS. There is also an affiliate program for users to receive up to 30% of their trading fees refunded.

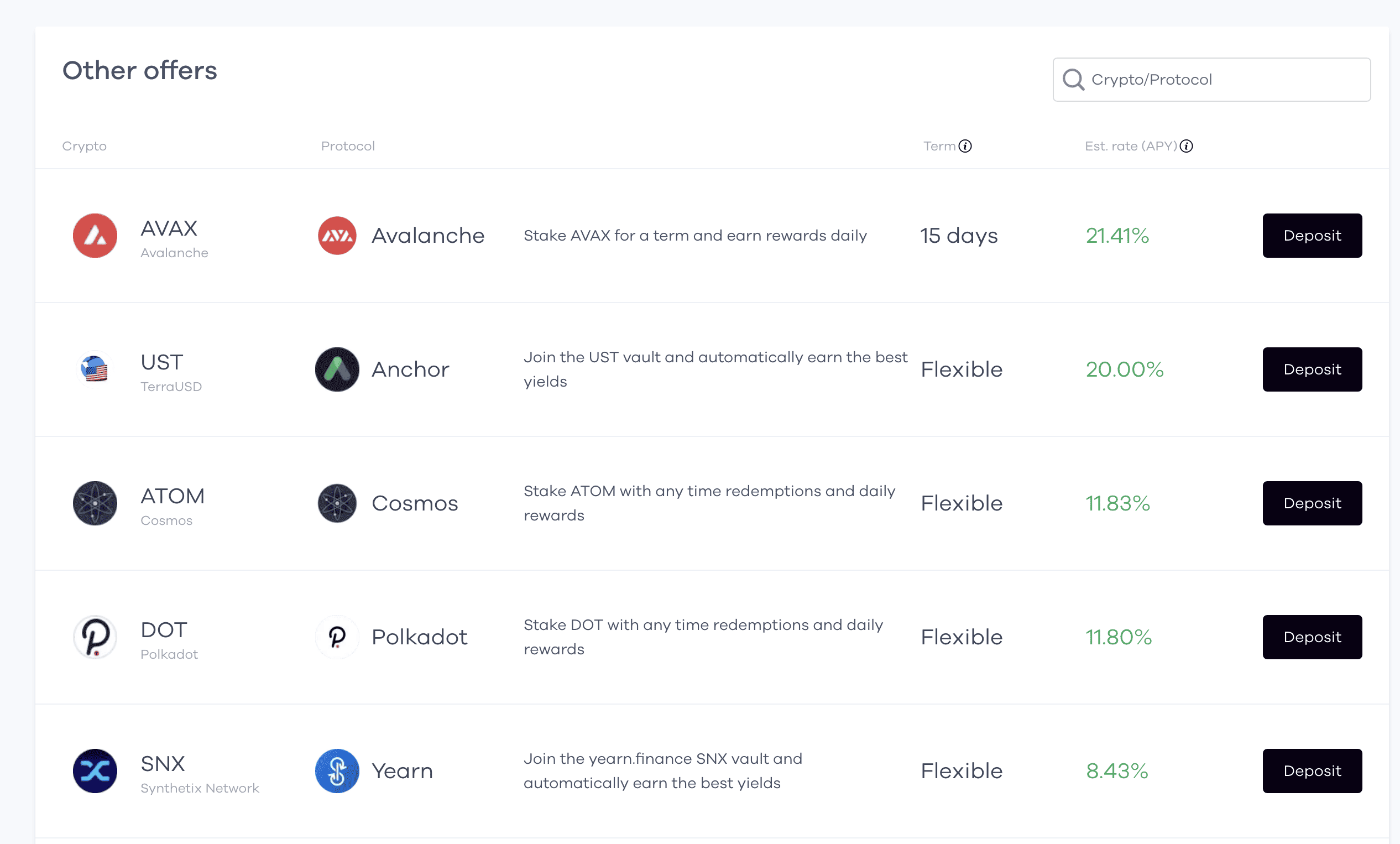

Okcoin offers a product called Earn for users to earn crypto rewards with DeFi and staking. There are options available at this time for users to earn up to 265% APY on select coins, with a range of fixed and flexible terms.

Okcoin also offers institutional services for institutions such as asset managers and hedge funds, intermediaries, liquidity providers, trading firms, and more. This is done with the exchange’s more advanced trading platform geared for institutional use, 24/7 global client services, flexible settlement options, and account management APIs. The more advanced trading platform can be seen here.

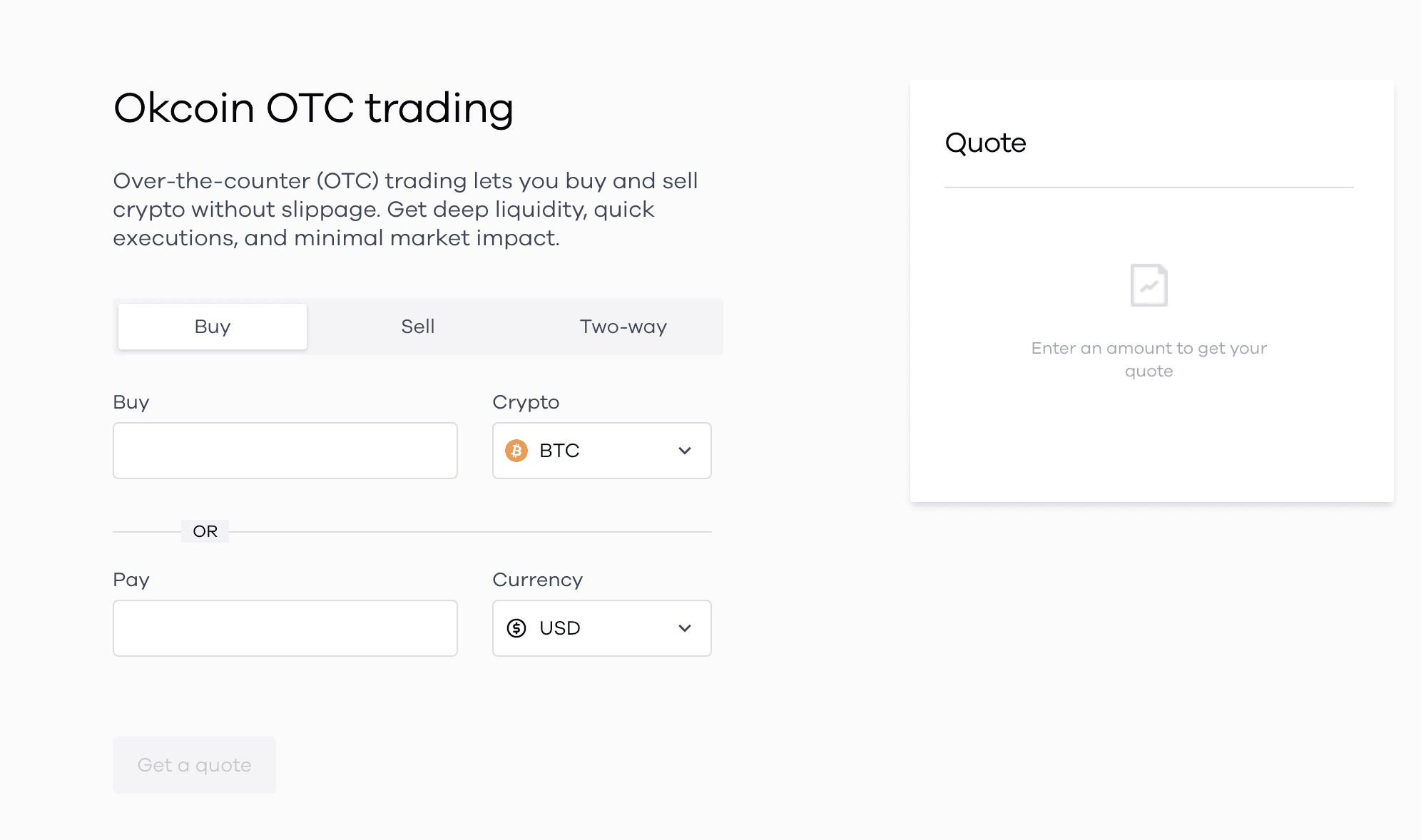

In addition, there is also an OTC desk for buying and selling large amounts of crypto without slippage. Okcoin offers deep liquidity and quick executions with this service.

Lastly, Okcoin also runs a grants program for supporting developers, especially those working on bitcoin core development. There is also an exclusive trading program called Okcoin Premier for professional traders and business partners. Premier members receive access to dedicated coverage, accelerated fiat processing, and a range of other exclusive product features.

As for customer support, Okcoin offers support via email and logging in. Users can also access support via logging into the exchange. The Okcoin team also maintains a blog with announcements.

Cons & Disadvantages

The main disadvantage of Okcoin is its relative lack of crypto financial services when compared to a large competitor exchange such as Binance. Its options for staking and earning yield or interest are much more limited in comparison.

In addition, the exchange’s total selection of trading products is limited to only a moderate amount of spot trading options. As such, Okcoin cannot compare to more derivatives heavy exchanges such as OKX, FTX, or Binance.

However, the fee schedule at Okcoin is quite competitive and goes head-to-head with these other top exchanges, so it still works well for advanced and high volume traders.

However, as stated, there is no margin or futures trading or any other derivatives at all for US, EU, and Singapore, but margin may be available in some cases for jurisdictions outside of these.

Lastly, Okcoin does require various levels of KYC requirements to be completed to use the exchange for all jurisdictions as per its KYC/AML policy, so this may be a con for those looking for a KYC-free service or exchange.

Okcoin Fees

Okcoin uses a variable, maker-taker fee model with tiers based on both transaction volume and maker status.

Trading fees are incurred when an order is filled by the exchange’s matching engine or P2P service. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

Taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (adding to the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook. If an order goes on the order book partially or fully (a maker order), any subsequent trades coming from that order will be as a “maker.”

Okcoin Spot Trading Fees

| User Tier | 30-day Trading Volume (USD) | Maker Fee | Taker Fee |

|---|---|---|---|

| P0 | < 100,000 | 0.10% | 0.20% |

| P1 | ≥ 100,000 | 0.09% | 0.18% |

| P2 | ≥ 500,000 | 0.07% | 0.16% |

| P3 | ≥ 1,000,000 | 0.04% | 0.14% |

| P4 | ≥ 5,000,000 | 0.02% | 0.10% |

| P5 | ≥ 10,000,000 | 0.00% | 0.08% |

| P6 | ≥ 25,000,000 | 0.00% | 0.06% |

| P7 | ≥ 50,000,000 | 0.00% | 0.05% |

| P8 | ≥ 100,000,000 | 0.00% | 0.04% |

| P9 | ≥ 250,000,000 | 0.00% | 0.03% |

| P10 | ≥ 500,000,000 | 0.00% | 0.02% |

The user’s trading fees are determined by trailing 30-day volume which is recalculated every day at midnight UTC+8. All volume is converted to USD using the exchange rate of the digital asset at the time of the transaction. Transactions in non-USD base pair markets are also converted.

Transaction fees are charged in the asset purchased. For example, if a user buys BTC/USD, the fee is charged in BTC. Rebates are paid in the asset sold. For example, if the user buys BTC/USD, the rebate is paid in USD.

Okcoin also charges margin interest rates for its institutional users only. These can be found here.

Other Fees

Okcoin charges the following deposit, withdrawal, and other fees:

- 1% fee for Brazilian customers trading in BRL

- For instant transfer via ACH, a $0.99 fee applies

- For card payment, a 3.99% fee applies

- For ApplyPay, a 4.25% fee applies

- Third-party provider fees apply with Visa debit/credit cards charged at 3.99% and the minimum transaction amount set at 10 USDNo account creation or maintenance fee

- No deposit fees for any digital asset or for fiat deposits otherwise unless using SEPA for EUR or card transfers (info)

- Withdrawal fees for digital assets range depending on the asset in question

Account Tiers & Limits

All users of Okcoin are required to undergo KYC verification procedures as per its KYC/AML terms. Users who perform successful Level 2 KYC can enjoy increased transaction limits which are not publicly noted. All users have to complete at the minimum Level 1 KYC to obtain access to funding the exchange wallet.

Users with Level 1 KYC can deposit up to 500 USD per day and withdrawals are not allowed.

Users with Level 2 KYC can make deposits and withdrawals up to 1,000,000 USD per day. Corporate accounts can include 20 or more designated individuals). This verification level requires a bank statement, utility bill, and a photocopy of government issued ID in addition to information required for Level 1 KYC.

The requirements for documents for KYC and account tiers can be noted here. Some countries such as the EU, UK, and Singapore require Level 3 KYC to use Okcoin. Trading itself has no limits for either verification tier. Institutional or corporate accounts must pursue Level2 KYC. Margin trading is not available in the US, EU, or Singapore.

For KYC overal, users are required to submit their name, address, DOB, nationality, government-issued ID, and a valid photo holding said ID, in addition to a valid email address and a mobile phone number.

Crypto Security

Okcoin takes several steps to ensure optimal exchange security. Firstly, they focus on platform security by partnering with external cybersecurity experts to hunt down security vulnerabilities and run periodic internal audits.

They also use a microservices architecture to authenticate and authorize every access request that is made to a user’s account. This means that all user sessions are secure and validated with complete identity protection. Accounts also use multi-factor authentication so users are prompted for deposit, withdrawal, and trade orders.

Okcoin also takes steps to ensure data security by using SSL encryption during data transmission with AES encryption and using secure techniques when destructing data. Lastly, Okcoin keeps over 95% of funds in offline cold storage and a small fraction on multisig hot wallets so funds are safe because they are inaccessible with a single key and need at least 3 to 5 signatures approved before they can be processed.

There have been no reported hacks of Okcoin and users are encouraged as always to use 2-factor authentication, secure passwords, a new email, and always check links for possible phishing attempts, as always.

More security information from the Okcoin team can be found here.

Okcoin Review Conclusion

Okcoin is a top tier overall great choice of exchange for spot traders for worldwide users and has been established in the crypto industry for a long time. The exchange uses sufficient security protocols and is trustworthy. While its trading offerings are limited and its crypto financial services offerings leave room to be desired, the offerings are sufficient for the average trader and investor as well as for institutional clients, and the fees are quite competitive in line with other top exchanges on the market.

While KYC is needed for any significant functions and full KYC and additional verification is needed to use the exchange at the highest level, the exchange has a good quality product, albeit limited in its relative lack of margin or futures trading options.

Users can also enjoy market maker rebates as well as high volume trading incentives with lower fees.

-

Okcoin offers access to 60+ cryptos and simple to advanced trading interfaces, mobile apps, an OTC desk, and interest options for a holistic exchange product

-

Intermediate to advanced traders trading margin or futures who desire access to even more advanced trading instruments, would prefer to pick a different exchange especially if desiring one not requiring KYC, but the fee schedule is competitive for spot trading at Okcoin

Other Alternatives

For customers who desire access to an even more comprehensive crypto exchange that also offers a host of financial services such as more flexible interest terms and even cashback cards, either Crypto.com, Gemini, and Coinbase can make great alternatives with potentially more trading choices as well.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users—Coinbase offers 402 pairs vs. Okcoin’s 64 coins and neither offer margin or futures for US users.

Active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures slightly differ.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Okcoin include OKX, Kraken, Vauld, and eToro.

Okcoin vs Coinbase

Coinbase is better for many core aspects of crypto trading and products offered if compared to Okcoin, even if only for its much more expanded coin offerings.

Coinbase has a wider range of services suited for both new users and advanced users with Coinbase Pro, while Okcoin focuses more on a smaller range of spot only products and institutional offerings that are done well.

Okcoin and Coinbase both offer only spot trading. Coinbase’s fee schedule starts higher and does not reduce as fast as Okcoin’s does, so fees are a clear win for Okcoin, with strong marker and volume incentives.

Coinbase also offers much more of a selection of trading pairs compared to that offered at Okcoin, with 440 trading pairs, compared to 64 coins at Okcoin, as well as advanced charting, accessible order books, and advanced order types.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Okcoin is not, but both are US based.

Advanced users who desire both competitive fees and a greater selection of trading products than what either Okcoin or Coinbase offer may find the choices below equally valuable.

Okcoin vs FTX

FTX will win against Okcoin for all intermediate or advanced traders, as FTX offers 323 coins and 492 trading pairs, which is far higher than Okcoin 64 spot coins and lack of any futures pairs or other strong product offerings. Plus, FTX offers access to more fiat rails as well as more expanded suite of products such as its NFT marketplace and even leveraged tokens.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since Okcoin offerings here are nonexistent for US and EU users. Meanwhile, FTX offers a max of 20X leverage.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, and traders can use third party bots at FTX as well, while Okcoin does offer charting as well at a high level.

FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed. FTX cannot be used by US persons however Okcoin can, and both require KYC.

International users who can use FTX International may prefer FTX. US users trading at FTX US need to do KYC procedures and may prefer it over Okcoin as well, but the two are similar in strengths. Fees will be more competitive at FTX as a trader’s volume is higher and the fee structure is transparent and clear, since FTX offers both fee incentives for volume and for holders of its FTT token.

Okcoin vs Gemini

Gemini is focused on its holistic crypto financial services for Americans primarily, while Okcoin serves global markets, but both exchanges are otherwise very similar in their scope of services.

Okcoin easily wins in the fee department as its fees start much lower, while minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, which is quite high.

There is also a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, while Okcoin charges variable trading fees for both makers and takers and offers incentives for makers and for volume which make fees decreases quickly.

US investors and traders are allowed to use Gemini with KYC verification only, since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products. Okcoin offers only spot offerings as well, and also does allow US investors.

Gemini offers 62 coins and 86 trading pairs which is about the same as the amount offered by Okcoin. Another similarity is in Gemini’s presence of crypto financial services offerings, which are also similar to Okcoin’s Earn product.

Okcoin vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while Okcoin offers none, so if margin access is a concern then Kraken is a clear choice. US users will prefer Kraken for its regulatory compliance and strong track record if they are traders especially.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is not quite as competitive as Okcoin’s starting fee schedule, but is still pretty fair. Market makers enjoy reduced fees however at Kraken and fees also reduce with volume, same as at Okcoin.

Kraken offers a slightly greater variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer Kraken over Okcoin.

If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may prefer other exchanges such as OKX, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while worldwide users can use Okcoin with KYC, as well as US users.

Okcoin vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Okcoin—over 351 coins and over 1300 pairs.

The two exchange’s offerings are varied in their scope, with Okcoin being an exchange catering primarily to spot traders and institutional accounts, while Binance is focused on being a global leader and fast innovator in every crypto product with a notable brand name behind it.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs not found anywhere else besides potentially OKX or FTX.

Binance’s maker-taker fee schedule is unique in its competitiveness compared to that of other exchanges, starting at 0.1% which is the more competitive than Okcoin fee schedule, plus Binance also offers further 25% reduction in fees if paid in BNB, alongside offering reduced fee tiers for higher volume and even maker rebates. Binance wins in the fee department easily due to its incentives and reductions. Okcoin also offers some reductions but its reductions are not as aggressive as those by Binance.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Okcoin.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is quite similar to that of Okcoin. Hence, US users who cannot use Binance International may opt for Okcoin or Binance US equally.

Binance requires full KYC now to trade even spot products, and Okcoin requires full KYC as well to use. Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is Okcoin Safe?

Yes, Okcoin is a safe exchange to use.

Okcoin takes several steps to ensure optimal exchange security. Firstly, they focus on platform security by partnering with external cybersecurity experts to hunt down security vulnerabilities and run periodic internal audits.

They also use a microservices architecture to authenticate and authorize every access request that is made to a user’s account. This means that all user sessions are secure and validated with complete identity protection. Accounts also use multi-factor authentication so users are prompted for deposit, withdrawal, and trade orders.

Okcoin also takes steps to ensure data security by using SSL encryption during data transmission with AES encryption and using secure techniques when destructing data. Lastly, Okcoin keeps over 95% of funds in offline cold storage and a small fraction on multisig hot wallets so funds are safe because they are inaccessible with a single key and need at least 3 to 5 signatures approved before they can be processed.

There have been no reported hacks of Okcoin and users are encouraged as always to use 2-factor authentication, secure passwords, a new email, and always check links for possible phishing attempts, as always.

More security information from the Okcoin team can be found here.

How long does Okcoin Withdrawal take?

All crypto transactions at Okcoin are instant after being approved if required, but fiat withdrawals are noted to be able to take up to 2-5 business days for bank transfers to complete.

Users should still note that crypto transactions on average can take from 30 minutes to several hours for a transaction to be confirmed due to the blockchain. Once on the blockchain, the transaction needs a number of network confirmations before it’s completed.

Is Okcoin a good exchange?

Okcoin is a top tier overall great choice of exchange for spot traders for worldwide users and has been established in the crypto industry for a long time. The exchange uses sufficient security protocols and is trustworthy. While its trading offerings are limited and its crypto financial services offerings leave room to be desired, the offerings are sufficient for the average trader and investor as well as for institutional clients, and the fees are quite competitive in line with other top exchanges on the market.

While KYC is needed for any significant functions and full KYC and additional verification is needed to use the exchange at the highest level, the exchange has a good quality product, albeit limited in its relative lack of margin or futures trading options.

Users can also enjoy market maker rebates as well as high volume trading incentives with lower fees.

Where is Okcoin located?

Okcoin is globally licensed and has offices in San Francisco, Miami, Malta, Hong Kong, Singapore, and Japan.

Does Okcoin require KYC?

Yes, all users of Okcoin are required to undergo KYC verification procedures as per its KYC/AML terms. Users who perform successful Level 2 KYC can enjoy increased transaction limits which are not publicly noted.

All users have to complete at the minimum Level 1 KYC to obtain access to funding the exchange wallet.

What are the Deposit and Withdrawal Methods and Fees for Okcoin?

Okcoin offers the following deposit and withdrawal methods, with the corresponding fees:

-

Crypto assets: deposits and withdrawals – no deposit fees (free). Withdrawal fees depend on the asset (and blockchain network) in question.

-

Fiat deposits and withdrawals, fees depend on the mode of deposit or withdrawal

-

Free ACH, domestic, and international wire for US and most other users. European SEPA users face EUR 0.20 + 0.3% fees and 1.5 EUR withdrawal fees

-

Users may purchase crypto with a credit or debit card with a 3.99% fee, with a 10 USD minimum

-

ApplePay fee of 4.25%

-

Instant transfer (ACH) fee of $0.99The full deposit and withdrawal methods with corresponding fees can be noted here.

What is the Minimum Withdraw Amount for Okcoin?

The minimum withdrawal amount for Okcoin is listed on this page and ranges from $50 USD for wires for fiat withdrawals to no minimums for ACH fiat. International wires may have $100 minimums for some regions. Crypto assets do not have a minimum withdrawal listed at this time.

How do you withdraw from Okcoin?

Users can withdraw from the wallet by navigating to the “Assets” drop down in the upper right after logging in, clicking on “Withdrawal,” or by going to “My Assets,” and then clicking on “Withdrawal.”

From there, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed, or add or pick the correct bank account for a fiat withdrawal. The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal. The 2FA code is also required for security if this feature is turned on by the user.

The transaction will show in the blockchain network in question and process therein.

There are instructions from support for withdrawal here.

Is Okcoin a wallet?

No, Okcoin is a cryptocurrency trading exchange that also offers a custodial wallet for trading services, but is not a non-custodial standalone wallet.

How to use Okcoin?

Using Okcoin can be done by going to http://okcoin.com, clicking the “Sign Up” button on the top right, creating an account on the platform, first undergoing at least Level 1 KYC verification procedures, waiting for verification to complete, and then depositing any crypto asset trading funds into the account (or one of the multiple fiat options) and then getting access to the market offerings and begin trading.

User Reviews

- A user on Reddit reports some issues with Okcoin’s KYC procedures. “One of the bad providers you can find. They are arrogant and they treat you like a scammer.” But the vast majority of commenters didn’t have a problem.

- Okcoin has fairly good reviews on TrustPilot—4 out of 5 stars with over 1000 reviews, 59% of which are a full five stars.

- Users on Quora discuss the performance of Okcoin and the exchange’s legitimacy. The most succinct response is, “OKCoin is a safe cryptocurrency exchange as they use the latest encryption technology to help to secure its website from hackers and enables two-factor authentication for logins and withdrawals.”

- OP on Reddit asks why OKcoin isn’t more popular: “I have been using it for some time now, and today I was really impressed that it supports Polygon and Avalanche network. It even has options to choose Ethereum or other blockchains when you withdraw (if applicable). It also has a quite cheap trading fee and reasonable withdrawal fee. Not to mention it supports a lot of tokens.” The top commenter says, “User error and distrust mainly. A healthy suspicion is good, especially in crypto, but I’ve had nothing but good experiences with them.”