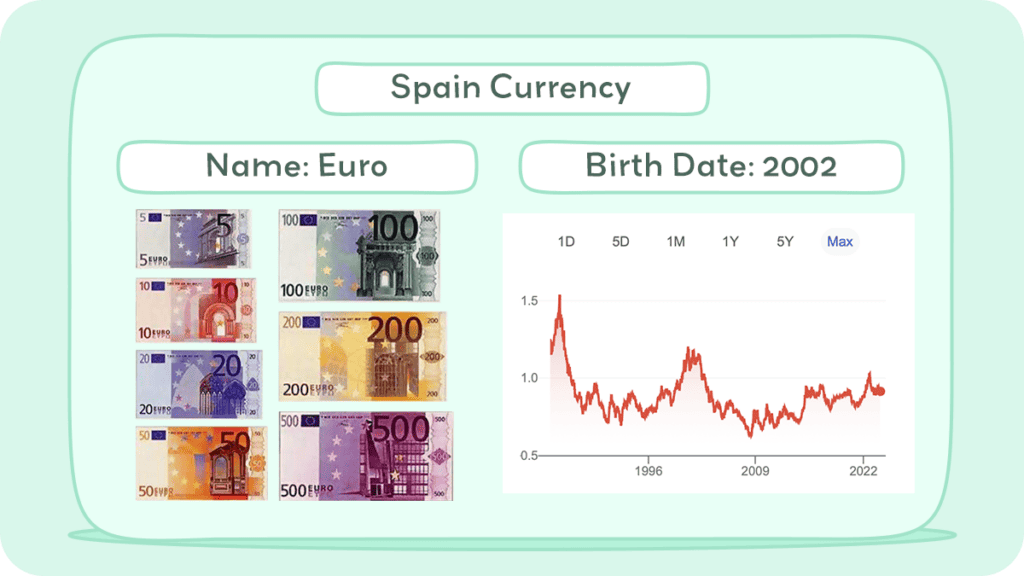

Spain is a member of the European Union and uses the Euro as its official currency. The Euro is the second most traded currency in the world, and it is widely accepted throughout Spain.

The Euro is represented by the symbol € and is divided into 100 cents. The Euro notes are in denominations of 5, 10, 20, 50, 100, 200, and 500. The coins are in denominations of 1, 2, 5, 10, 20, and 50 cents, as well as €1 and €2 coins.

Understanding the Euro and its usage in Spain is essential for any traveler visiting the country. In this article, you will be familiarized with Spain’s currency as well as the best practices for exchanging and using the Euro in Spain so you can ensure a smooth and hassle-free trip.

Historical Journey of The Spain Currency

Spain has a rich history of currency dating back to the Roman Empire. Throughout the centuries, Spain has used various forms of currency, including copper and silver coins and gold bars. The most recent currency used in Spain before the adoption of the Euro was the Peseta.

Peseta

The peseta, the currency of Spain from 1868 to 2002, holds a unique place in the country’s financial history. Its origin lies in the Catalan word “peceta,” a diminutive form of “peça,” meaning a piece or coin, rather than the Spanish “peso.”

The term “peseta” had colloquial usage as early as 1737, referring to a coin worth 2 reales provincial or 1⁄5 of a peso. While coins labeled as “pesetas” were briefly issued in 1808 during French occupation in Barcelona, the formal introduction of the peseta as a currency unit took place in 1868.

Initially proposed as a subdivision of the Spanish peso, with 1 peso duro equal to 5 pesetas, the peseta replaced various earlier currencies, including silver escudos and reales de vellón. The adoption of the Latin Monetary Union was considered but not formalized. The peseta initially adhered to a silver standard, later transitioning to the gold standard in 1873.

Historical fluctuations, such as the suspension of free silver minting and the fiduciary standard during the late 19th century, marked the peseta’s evolution. In 1883, it departed from the gold standard, resulting in a floating exchange rate. Political turbulence in the early 20th century contributed to the disbandment of the Latin Monetary Union by 1927. The Spanish Civil War (1936-1939) saw the withdrawal of gold and silver coinage, replaced by copper-nickel coins.

Spain joined the Bretton Woods System in 1959, pegging the peseta at Pts 60 = US$1. Subsequent devaluations, especially in the 1990s, were prompted by economic challenges. Notably, a Pts 5,000 note was introduced in 1976, and commemorative coins celebrated the 1982 FIFA World Cup and the 1992 Summer Olympics.

The peseta faced significant inflation, and in 1999, it was linked to the euro, which became its successor in 2002 at an exchange rate of €1 = Pts 166.386. The transition marked the end of the peseta’s long and diverse history.

Coins played a crucial role in the peseta’s circulation. Spanish coins employed a unique dating system until 1982. The denominations evolved over the years, reflecting changes in materials, designs, and commemorations, including the introduction of a Pts 2,000 coin.

Banknotes, issued by the Bank of Spain, portrayed notable figures and underwent design changes over time. In 1982, the Pts 100 note transitioned to a coin. Noteworthy denominations included Pts 5,000 and Pts 10,000 notes.

The peseta had a parallel existence in Andorra during the Spanish Civil War, with a pegged exchange rate. After being replaced by the euro, pesetas, and peseta-denominated coins remained exchangeable until 2021.

The peseta’s journey reflects Spain’s economic and political transformations over more than a century. Its transition to the euro symbolized a new era, leaving behind a rich monetary legacy.

Euro

When it comes to currency in Spain, the Euro is the official currency. The Euro is the authorized currency of the European Union and is used by 19 of the 27 EU member states. It was propelled on 1 January 2002 and swapped national currencies such as the French franc and the German mark.

The introduction of Euro banknotes and coins in Spain on 1 January 2002 marked the end of a three-year transitional period when the euro was the official currency, while the dual circulation period saw both the Spanish peseta and the euro become legal tender.

The Euro is divided into 100 cents, and when you’re buying currency for Spain, look out for the currency code EUR. Once you’re in Spain, you’ll see the symbol € used to show prices.

Euro coins

The euro, introduced in 1999, is the official currency of the Eurozone, consisting of 20 member countries. It is divided into eight coin denominations, ranging from one cent to two euros, each featuring a common reverse side depicting a map of Europe.

However, the obverse side varies among member countries, showcasing unique designs. In addition to Eurozone members, four European microstates (Andorra, Monaco, San Marino, and Vatican City) also use the euro with their own designed coins. The coins are minted at national mints, adhering to strict quotas, while the European Central Bank manages the common side.

Over the years, the euro’s design has evolved, with changes in 2007 reflecting the EU’s enlargement and updates in 2017 for some denominations. The euro’s introduction aimed to foster economic and monetary union, contributing to stability and collaboration among member states.

The coins incorporate security features, and their design considers tactile elements for the visually impaired. While national sides of regular coins can be updated every 15 years, commemorative coins may vary more frequently. As of 2023, 24 countries issue euro coins with their national sides, reflecting the diversity within the Eurozone.

Euro bills

Euro banknotes, the common currency of the eurozone, have evolved since their 1999 inception. Initially, under ES1, these €5 to €500 notes featured a uniform design with the European flag, a map, and “euro” in Latin and Greek.

The designs, by Robert Kalina, resulted from a 1996 competition. ES1, made of pure cotton, excluded non-EU Cyprus and Malta. ES2, or Europa series, introduced size changes and enhanced durability with updated security features. Reinhold Gerstetter redesigned the notes, featuring Mario Draghi’s signature post-March 2012.

Anticipated in 2024, the third series will redesign notes based on public-voted themes. Security features include confidential elements like holograms and watermarks. The Europa series introduced Europa’s face, reflecting EU expansion and adding Bulgaria’s Cyrillic alphabet. Circulating since 2013, it phased out the €500 note due to concerns about criminal use.

Security features include watermarks, holograms, color-changing ink, and more, with consultation for the visually impaired. A 2021 plan outlines the next redesign with potential themes like “European culture.” The ECB monitors euro banknote circulation and stock, ensuring integrity since its 2002 introduction. The euro’s history involves expansion, formalized political authority through the Lisbon Treaty, and usage across multiple EU countries. The seven denominations feature stylized historical European architectural illustrations on both sides.

Inflation and Buying Power of Euro

In Spain, inflation has been relatively low in recent years, hovering around 1-2% per year. This has helped to maintain the buying power of the euro, which is the currency used in Spain. However, it’s important to note that inflation can be influenced by a wide range of factors, including government policies, global economic conditions, and more.

The European Central Bank aims to keep inflation around two percent, considering it a healthy level. High inflation can signal economic overheating and comes with risks. However, economists generally agree that little inflation is better than deflation (negative interest rates). In 2022, global inflation was estimated at 8.7%, with Spain’s rate slightly higher at 8.83%, expected to be 4.87% in 2023.

In Spain, inflation is measured using the Consumer Price Index (CPI). The CPI looks at average price changes in a basket of goods and services, using a base year with a value of 100. If the CPI is above 100, it means prices rose (inflation), and if below, prices fell (deflation). The National Statistics Institute (INE) in Spain calculates the CPI based on 220,000 prices of 479 items.

Breaking down the CPI into groups, prices increased in all categories in 2022, except for communications. Significant increases were observed in food, non-alcoholic beverages, clothing, and footwear. Despite economic challenges in 2020 and the Russia-Ukraine war’s impact, Spain’s inflation rate remained positive.

Currency Usage in Spain

The official currency of Spain is the Euro (EUR), which is used by all 19 member countries of the Eurozone. Since its introduction in 2002, the Euro has become the sole currency of Spain, replacing the Peseta. The Euro is divided into 100 cents and is available in banknotes of €5, €10, €20, €50, €100, €200 and €500, and coins of €1 and €2, and 1, 2, 5, 10, 20, and 50 cents.

In Spain, cash is still king, and it is common to pay for small purchases with cash. However, credit and debit cards are widely accepted in most establishments, including restaurants, hotels, and shops. ATMs are also readily available in most cities and towns, and they usually accept international debit and credit cards. It is advisable to inform your bank of your travel plans to avoid any issues with your card while abroad.

It is important to be aware of the currency usage and acceptance in Spain to ensure a smooth and hassle-free trip. By carrying Euros and using them for all transactions, you can avoid any confusion or inconvenience and enjoy your time in Spain to the fullest.

Is USD Accepted in Spain?

While the Euro is the only legal tender in Spain, some businesses may accept US dollars (USD) or other foreign currencies as payment. However, it’s important to note that the exchange rate may not be favorable and you may end up paying more than you would if you used Euros.

It’s always a good idea to carry some Euros with you for small transactions and to avoid any confusion or inconvenience. If you need to exchange USD or other foreign currencies for Euros, you can do so at banks, currency exchange offices, and ATMs throughout Spain.

In general, it’s best to use Euros for all transactions in Spain to avoid any confusion or unexpected fees. Most businesses in Spain prefer to be paid in Euros, and it’s the easiest and most convenient way to pay for goods and services.

Exchanging Currency in Spain

When exchanging money in Spain, it is best to do so at a bank or a reputable exchange office. Avoid exchanging money at airports or tourist areas, as they tend to have higher exchange rates and additional fees. It is also important to check the exchange rate before exchanging money to ensure that you are getting a fair rate.

Be aware as well of the fees charged by different providers. Some banks and currency exchange offices may charge higher fees than others, so it’s a good idea to compare rates and fees before exchanging your money. ATMs usually offer the best exchange rates, but they may also charge a fee for transactions.

Where Can I Exchange Spain Currency?

You can exchange your currency for euros at banks, exchange offices, and some hotels in Spain. Banks are typically the most reliable and offer the best exchange rates. You can find bank branches in most major cities and tourist areas. Exchange offices and hotels may offer more convenient locations, but they may have less favorable exchange rates and additional fees.

Banks typically offer the best exchange rates, but they may charge a commission or a fee for the service. Exchange offices and hotels may offer more convenient locations, but they may have less favorable exchange rates and additional fees.

If you need to exchange money outside of regular banking hours, you can use an ATM. Most ATMs in Spain accept international debit and credit cards but be aware that your bank may charge a fee for using an out-of-network ATM.

What to Know Before Exchanging Currency in Spain

Before exchanging your currency in Spain, there are a few things you should know. First, be sure to bring your passport or a government-issued ID. You will need to provide identification when exchanging currency at a bank or exchange office.

Second, be aware of the exchange rate and any fees associated with the transaction. Banks typically offer the best exchange rates, but they may charge a commission or a fee for the service. Exchange offices and hotels may have less favorable exchange rates and additional fees.

It is important to note that while most places in Spain accept credit cards, it is always a good idea to have some cash on hand. Smaller businesses and markets may not accept credit cards, and tipping in cash is also a common practice in Spain. Familiarizing yourself with the country’s currency before your trip can help you save money and avoid any potential issues during your travels.

Finally, be sure to keep your receipts and any other documentation related to the exchange. This can be helpful if you need to exchange money back into your home currency or if you have any issues with the transaction.

Exchanging currency in Spain can be a straightforward process if you are prepared and informed. By understanding the basics of currency exchange, you can ensure that you get the most out of your money while traveling in Spain.

Choosing Between USD and Spain Currency

When traveling to Spain, you will need to consider the currency you will be using. While the US dollar is widely accepted in some tourist areas, it is generally recommended to use the Euro for transactions in Spain. Here are some factors to consider when choosing between USD and Spain currency.

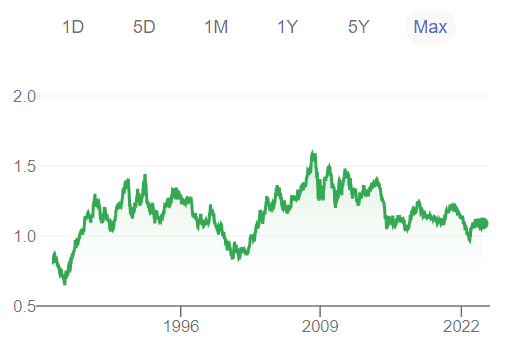

Exchange Rate

An important factor that influences the value of Spain’s currency is the exchange rate. The exchange rate is the value of one currency of another currency. The exchange rate can be influenced by a wide range of factors, including interest rates, inflation, government policies, and more.

In Spain, the exchange rate is primarily influenced by the policies of the European Central Bank (ECB), which sets monetary policy for the eurozone. It’s important to keep in mind that the value of Spain’s currency is influenced by a wide range of economic factors, some of which are within the control of the government and others that are influenced by global economic conditions.

By staying informed about these factors, you can make more informed decisions about how to manage your finances and investments in Spain.

Convenience

Using the Euro will be more convenient because it is the official currency of Spain, and you will not have to worry about currency exchange rates. It is also widely accepted, and you will not have to worry about currency exchange rates. However, if you are traveling from the US, you may find it convenient to carry some US dollars with you for emergencies or to pay for items in some tourist areas that accept USD.

You can withdraw Euros from ATMs or exchange currency at banks or exchange offices. However, if you choose to use USD, you may have to look for exchange offices or banks that accept USD, which may not be as convenient.

Fees

When exchanging currency, you may have to pay fees, which can add up if you are exchanging a large amount of money. Using an ATM to withdraw Euros may also incur fees, depending on your bank’s policies. However, some banks offer fee-free ATM withdrawals or low foreign transaction fees, so it is recommended to check with your bank before traveling.

Tips

When traveling to Spain, it is recommended to carry a mix of cash and credit cards. Always keep an eye on your belongings, especially in crowded tourist areas, to avoid pickpocketing. It is also recommended to notify your bank of your travel plans to avoid any issues with your cards being blocked due to suspected fraud.

While the US dollar is widely accepted in some tourist areas, it is recommended to use the Euro as the local currency in Spain for convenience and to avoid currency exchange fees. When traveling, it is recommended to carry a mix of cash and credit cards and to be vigilant with your belongings.

Cost of Living in Spain

Spain is known for its beautiful beaches, warm weather, and vibrant culture. If you are planning to move to Spain, it is important to understand the cost of living in the country. Here’s what you need to know.

Housing costs in Spain vary depending on the region. Madrid and Barcelona are the most expensive cities to live in, while smaller cities and towns tend to be more affordable. Monthly rent for a one-bedroom apartment in Madrid or Barcelona can range from €800-€1,200, while in smaller cities it can be as low as €400-€600 per month.

Spain is known for its delicious cuisine, and eating out can be affordable if you know where to go. A meal at a mid-range restaurant can cost around €12-€15 per person, while a three-course meal at a high-end restaurant can cost €50 or more. If you prefer to cook at home, groceries can be affordable. A liter of milk costs around €0.70, a loaf of bread around €1, and a kilogram of chicken around €5.

Public transportation in Spain is reliable and affordable. A single metro or bus ticket costs around €1.50, while a monthly pass costs around €50-€60. If you prefer to drive, gasoline costs around €1.30 per liter.

Spain has a lot to offer in terms of entertainment. Movie tickets cost around €8-€10, while a night out at a bar or club can cost €20-€30. Museums and other cultural attractions can be affordable or even free.

Overall, the cost of living in Spain is lower than in many other European countries. While some expenses, such as housing in major cities, can be high, there are many ways to save money and enjoy all that Spain has to offer.

Don’t Get Scammed Tips

Spain is a beautiful country with a rich history and culture. It’s a popular tourist destination, and while most people have a wonderful experience, it’s important to be aware of potential scams. Here are some tips to help you avoid being scammed when dealing with Spain currency.

- Be Careful When Exchanging Money

When exchanging money in Spain, it’s important to be careful. Some exchange offices charge high fees or offer unfavorable exchange rates. To avoid this, it’s best to use ATMs or banks instead of exchange offices. Make sure to check with your bank to see if they have any partner banks in Spain to avoid additional fees.

- Watch Out for Pickpockets

Pickpocketing is a common problem in Spain, especially in tourist areas. Pickpockets may work alone or in groups, and they often target tourists who are distracted or carrying a lot of valuables. To avoid being a victim, keep your valuables close to you, be aware of your surroundings, and avoid carrying large amounts of cash.

- Avoid Petition Scams

Another common scam in Spain is the petition scam. This involves a group of people soliciting you to sign a petition. The bogus petition will usually be for some charitable cause, and they may even ask you to donate there and then. If you encounter this, it’s best to decline politely and move on.

- Use Credit Cards with Caution

Credit cards are widely accepted in Spain, but it’s important to use them with caution. Some merchants may charge additional fees for using a credit card, so it’s best to ask before making a purchase. Additionally, be sure to keep an eye on your credit card statements to avoid any unauthorized charges.

By following these tips, you can help ensure that your experience with Spain currency or Euro is a positive one. Remember to be aware of your surroundings, use common sense, and don’t be afraid to ask questions.