Ecuador uses the United States dollar as its official currency, making it easy for American tourists and residents to shop, eat, and travel. This has been the case since the year 2000, when Ecuador decided to abandon its former currency, the sucre, due to high inflation rates.

Ecuador’s currency history, transitioning from the sucre to the U.S. dollar, reflects its economic and political shifts. The sucre, introduced in 1884 and named after General Antonio José de Sucre, saw stability until economic challenges led to its replacement in 2000 adopting the U.S. dollar

This article explores Ecuador’s currency history, focusing on how and why the US dollar became its official currency, and the economic and political factors that influenced this decision.

Historical Journey of Ecuador Currency

Before the adoption of the US dollar in 2000, Ecuador’s official currency was the sucre. The sucre was linked to the US dollar at a fixed exchange rate of 25,000 sucres per US dollar.

However, due to hyperinflation and a severe economic crisis in the late 1990s, the sucre lost its value rapidly, and the government was forced to declare a banking holiday.

The currency used in Ecuador has undergone several changes, and the current currency of Ecuador is the United States dollar. In this section, we will take a closer look at the history of Ecuador’s currency.

Sucre

Ecuador used the sucre, named after Antonio José de Sucre, as its currency from 1884 to 2000. Initially backed by silver, it shifted to a gold standard in 1898.

However, the sucre faced inconvenience and devaluation, leading to various reforms and exchange rate adjustments. By the late 1990s, hyperinflation severely devalued the sucre, prompting Ecuador to adopt the US dollar in 2000.

Coinage history began in 1884 with various denominations, transitioning materials, and designs over the years. The last silver coins were struck in 1944, with later coins made of different metals like cupro-nickel and nickel-clad steel. High inflation in the 1990s led to the introduction of bi-metallic coins.

Ecuadorian banknotes, initially issued by private banks, were later issued by the Central Bank. Starting with denominations of 1 to 1000 sucres, the banknotes evolved in design, security features, and denominations, reflecting changes in the economy and printing technologies.

As inflation rose, higher denominations were introduced, but the persistent economic crisis led to the eventual replacement of the sucre with the US dollar.

Ecuador officially adopted the US dollar as its currency in 2000, replacing the Ecuadorian sucre. Since then, the US dollar has been the official currency of Ecuador

The adoption of the US dollar in Ecuador brought stability to the country’s currency. Before its adoption, the Ecuadorian sucre was subject to high inflation rates and devaluation, leading to economic instability.

Since the adoption of the US dollar, inflation rates have decreased, and the economy has become more stable.

US Dollar

In January 2000, Ecuador officially adopted the US dollar as its official currency. The dollarization process was a response to the economic crisis that had plagued the country for years. The adoption of the US dollar brought stability to Ecuador’s currency, curbed inflation, and reduced recession in Ecuador in recent decades.

Today, the US dollar remains the official currency of Ecuador, and the country has one of the most stable currencies in the region. Ecuador’s currency history is a testament to the resilience and adaptability of the country’s economy.

The U.S. dollar originated from the Spanish-American silver dollar. Minted in various places like Mexico, Potosí, and Lima, it was widely used from the 16th to the 19th centuries.

The Coinage Act of 1792 established the U.S. dollar, aligning it with the Spanish dollar’s silver content. Even after this, Spanish and Mexican dollars remained legal tender until 1857.

Alexander Hamilton finalized the Coinage Act, specifying the silver and gold content of various coins. The dollar’s value was based on the Spanish dollar’s silver content. The early U.S. currency depicted mythological figures, not presidents.

After the American Revolution, the Continental Congress issued paper currency, but it depreciated. The Constitution later restricted states from making anything other than gold and silver coins legal tender.

From 1792 to 1900, the U.S. operated on a bimetallic standard, linking the dollar to silver and gold. The Gold Standard Act of 1900 shifted to a gold standard. After the Nixon Shock in 1971, the U.S. dollar floated freely.

Paper money, like Treasury Notes and United States Notes, played roles in financing wars. The emergence of Federal Reserve Notes in 1913 marked the exclusive issuance of U.S. dollar notes.

The dollar gained global significance after World War II, becoming the primary reserve currency under the Bretton Woods Agreement.

The Federal Reserve System, established in 1913, conducts U.S. monetary policy. The U.S. has often financed its spending through borrowing in its currency, a privilege referred to as the “exorbitant privilege.”

The United States dollar (USD) is the official currency of the U.S. and some other countries. It was introduced in 1792, aligned with the Spanish silver dollar, and divided into 100 cents. U.S. banknotes, known as greenbacks, are issued by the Federal Reserve System.

The U.S. dollar was initially defined based on a bimetallic standard, later linked solely to gold in 1900. It became a significant global reserve currency after World War I, surpassing the pound sterling by the Bretton Woods Agreement after World War II. The dollar is widely used in international transactions and is a free-floating currency.

As of September 20, 2023, approximately US$2.33 trillion is estimated to be in circulation. The U.S. Constitution grants Congress the power to coin money, and laws prescribe the forms in which U.S. dollars should be issued.

The dollar’s denominations include coins and Federal Reserve Notes. The term “buck” is colloquially used for dollars, and “greenback” refers to the 19th-century Demand Note dollars. Other nicknames include “dead presidents” for the portraits on bills and “bigface notes” for the newer designs.

The $ symbol for the dollar originated from the abbreviation “ps” for the peso, the Spanish dollar. It evolved into the $ sign, possibly influenced by the Pillars of Hercules on the Spanish Coat of arms or the letters U and S written on top of each other.

US Dollar coins

The United States Mint has produced legal tender coins annually since 1792. Common denominations for circulation include the penny, nickel, dime, quarter, half dollar, and dollar.

The U.S. coinage includes several denominations, each with its unique features. The penny (1¢) showcases Abraham Lincoln on the front and the Union Shield on the back, weighing 2.5 grams with a diameter of 0.75 inches.

The nickel (5¢) features Thomas Jefferson on the obverse and Monticello on the reverse, weighing 5.0 grams and having a diameter of 0.835 inches.

The dime (10¢) depicts Franklin D. Roosevelt on one side and symbols like an olive branch, torch, and oak branch on the other. It weighs 2.268 grams and measures 0.705 inches in diameter.

The quarter (25¢) displays George Washington on the front and has changing designs on the reverse (five designs per year). It weighs 5.67 grams and has a diameter of 0.955 inches.

The half dollar (50¢) showcases John F. Kennedy on the front and the Presidential Seal on the back, weighing 11.34 grams with a diameter of 1.205 inches.

Lastly, the dollar coin ($1), known as the golden dollar, features Sacagawea on the obverse and changing designs on the reverse (four designs per year). It weighs 8.10 grams and has a diameter of 1.043 inches.

Gold and silver coins circulated from the 18th to the 20th centuries, with the last gold coins minted in 1933 and 90% silver coins in 1964.

The United States Mint currently produces circulating coins at the Philadelphia and Denver Mints. The one-dollar coin has not gained popularity due to the continued use of the one-dollar bill. Half-dollar coins were common but fell out of use in the mid-1960s.

The nickel has remained unchanged in size and composition (5 grams, 75% copper, and 25% nickel) since 1865. Efforts have been made to eliminate the penny due to its low value.

Collector coins, with higher numismatic or precious metal value, include American Eagle bullion coins and commemorative coins such as the Presidential dollar coins.

US Dollar bills

Federal Reserve Notes, or U.S. banknotes, serve as the official currency of the United States. The United States Bureau of Engraving and Printing produces these notes in accordance with the Federal Reserve Act of 1913.

The Board of Governors of the Federal Reserve System issues them to Federal Reserve Banks, which then distribute the notes to their member banks. This process makes the notes liabilities of the Reserve Banks and obligations of the United States.

With legal tender status, Federal Reserve Notes bear the statement “this note is legal tender for all debts, public and private.” These notes are backed by financial assets, mainly Treasury and mortgage agency securities obtained through open market transactions.

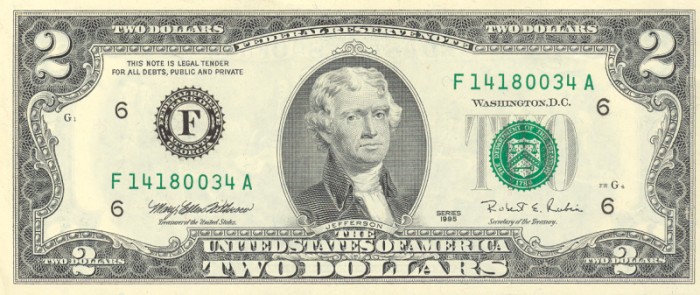

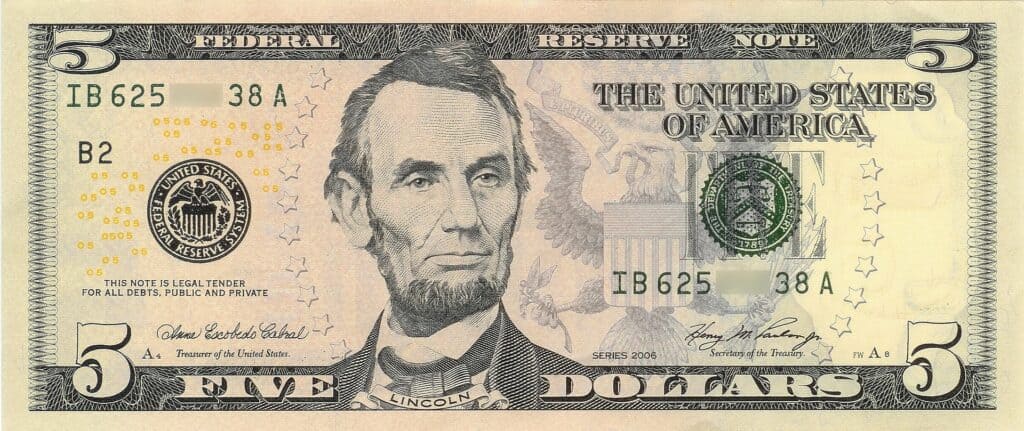

Various denominations of U.S. banknotes feature different historical figures and iconic symbols. For example, the one dollar bill showcases George Washington and the Great Seal of the United States, while the two dollar bill displays Thomas Jefferson and the Declaration of Independence.

Other bills highlight Abraham Lincoln, Alexander Hamilton, Andrew Jackson, Ulysses S. Grant, and Benjamin Franklin, each paired with significant landmarks. These bills are part of different series, such as Series 1963, Series 1976, Series 2006, Series 2004A, Series 2009A, and Series 2017A.

Congress, according to the U.S. Constitution, has the power to borrow money on the credit of the United States. Federal Reserve Banks issue Federal Reserve Notes, considered “obligations of the United States” and redeemable in lawful money.

Federal Reserve Notes are legal tender for debt payment. There are other types of banknotes, including United States Notes and Federal Reserve Bank Notes, but only Federal Reserve Notes remain in circulation.

Federal Reserve Notes are printed by the Bureau of Engraving and Printing on cotton fiber paper. Modern U.S. currency sizes match those of Philippine peso banknotes issued under U.S. administration. Currently printed denominations include $1, $2, $5, $10, $20, $50, and $100.

Larger denominations like $500, $1,000, $5,000, $10,000, and $100,000 were discontinued after 1946. Post-2004 series banknotes incorporate additional colors for better distinction.

Plans for future redesigns include raised tactile features for accessibility, larger numerals, more color differences, and currency readers to assist the visually impaired.

Inflation and Buying Power of Ecuador Currency

Ecuador has a history of high inflation rates, which have negatively affected its economy. The country has gone through several economic crises due to its unstable currency.

In 2000, Ecuador experienced one of the worst economic crises in its history, which led to the adoption of the US dollar as its official currency.

Before the dollarization, the country’s inflation rate was over 60%, and the rate of devaluation exceeded 300%. The value of the Ecuadorian sucre fell drastically, and the purchasing power of the people was significantly affected.

Since the adoption of the US dollar, Ecuador’s inflation rate has stabilized, and the purchasing power of the people has improved.

According to an inflation calculator, the purchasing power of $1000 in Ecuador has increased from $1000 in 2000 to $1436.84 in 2023. This means that people can buy more goods and services with the same amount of money as they could in 2000.

However, it is worth noting that the inflation rate in Ecuador is still higher than that of the United States. According to the same inflation calculator, the inflation rate in Ecuador was 0.55% in 2023, while the inflation rate in the United States was 0.83%.

Therefore, while the purchasing power of the US dollar in Ecuador is higher than it was in the past, it is still subject to inflation.

The US Dollar

The U.S. dollar, renowned as the world’s reserve currency, features banknotes that are globally recognized. Despite their familiar appearance, these notes contain intricate details and sophisticated elements. They represent more than just monetary value; they embody intricate artistry, advanced security features, and a rich history reflected in their design.

Each denomination, from the widely circulated $1 bill to higher values, showcases unique imagery and symbols, serving as a testament to the economic and cultural significance of the U.S. dollar in the global financial landscape.

$1

One dollar features George Washington on the front and the Great Seal of the United States on the reverse. Circulation includes Series 1963 and Series 2017A.

$2

Two dollars displays Thomas Jefferson on the front and the Declaration of Independence by John Trumbull on the reverse. Limited circulation includes Series 1976 and Series 2017A.

$5

Five dollars shows Abraham Lincoln on the front and the Lincoln Memorial on the reverse. Circulation includes Series 2006 and Series 2021.

$10

Ten dollars depicts Alexander Hamilton on the front and the Treasury Building on the reverse. Circulation includes Series 2004A and Series 2017A.

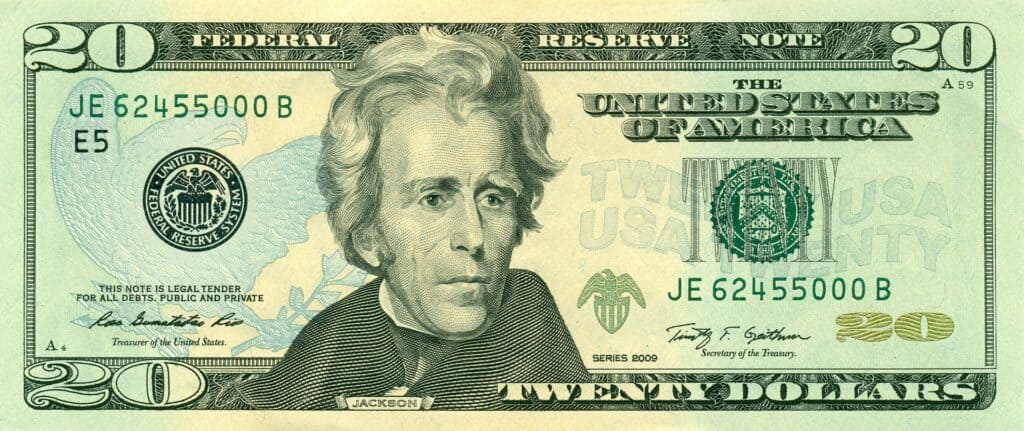

$20

Twenty dollars features Andrew Jackson on the front and the White House on the reverse. Circulation includes Series 2004 and Series 2017A.

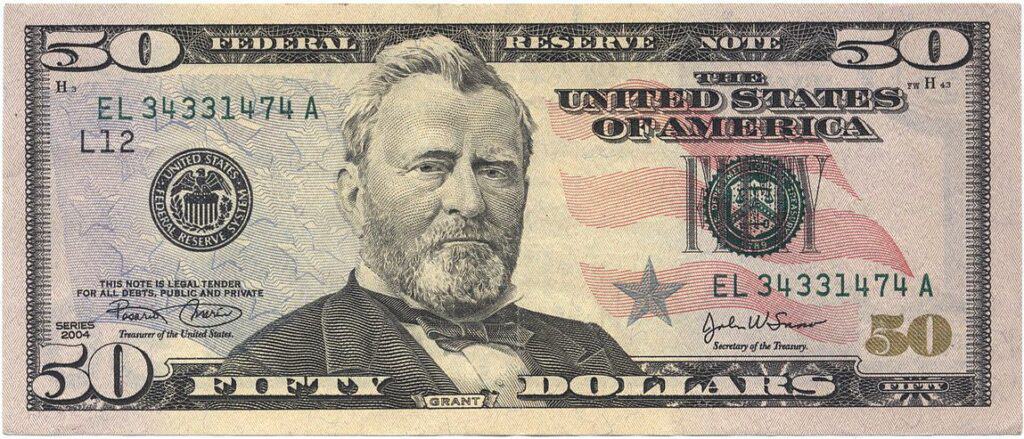

$50

Fifty dollars displays Ulysses S. Grant on the front and the United States Capitol on the reverse. Circulation includes Series 2004 and Series 2017A.

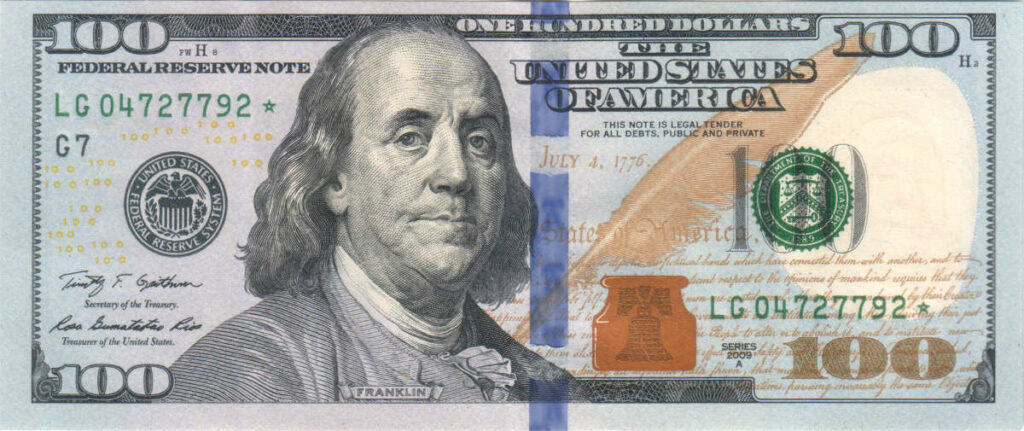

$100

One hundred dollars shows Benjamin Franklin on the front and Independence Hall on the reverse. Circulation includes Series 2009A and Series 2017A.

Currency Usage in Ecuador

Ecuador’s currency landscape is marked by its adoption of the U.S. dollar (USD) in 2000, offering stability but also posing challenges. The country uses U.S. dollar bills and coins for all transactions, providing convenience for travelers.

Dollarization has brought economic stability and increased foreign investment but at the cost of monetary control and potential income inequality.

Is USD accepted in Ecuador?

As the official legal tender in Ecuador, the US dollar is widely accepted in the country. You can use it to settle all financial obligations, including paying for goods, services, taxes, and debts. You can also withdraw US dollars from ATMs in Ecuador.

Exchanging Currency in Ecuador

If you are planning a trip to Ecuador, it’s essential to know how to exchange currency. You will need to exchange your currency for the United States dollar (USD), as Ecuador uses the USD as its official currency. This section will cover everything you need to know about exchanging currency in Ecuador.

Where can I exchange Ecuador Currency?

You can exchange currency in Ecuador at banks, exchange bureaus, and some hotels. Banks usually offer the best exchange rates, but they may have long lines. Exchange bureaus are also an option, but they may charge higher fees. Hotels may offer exchange services, but they may have lower exchange rates.

When it comes to banking in Ecuador, there are several options available to you as a foreigner. Some of the most popular banks for foreigners include Banco Internacional and Banco del Pacífico. These banks offer a range of services, including personal checking and savings accounts, loans, credit cards, and more.

ATMs are also widely available throughout Ecuador, especially in major cities like Quito and Guayaquil. However, it’s important to note that some ATMs may charge convenience fees for withdrawals. To avoid these fees, it’s best to use ATMs that are affiliated with your bank or to withdraw large amounts of cash at once.

What to know before exchanging currency in Ecuador

Before exchanging currency in Ecuador, there are a few things you should know.

First, make sure to bring your passport. You may be required to show your passport when exchanging currency.

Second, only exchange currency at reputable banks or exchange bureaus. Be cautious of people offering to exchange currency on the street, as they may be trying to scam you.

Third, it’s essential to know the current exchange rate. The exchange rate may change daily, so make sure to check the current rate before exchanging currency.

Fourth, be aware of any fees or commissions charged by banks or exchange bureaus. Some places may charge a flat fee, while others may charge a percentage of the amount exchanged.

Finally, don’t exchange too much currency at once. It’s better to exchange smaller amounts more frequently to avoid carrying large amounts of cash.

Choosing Between USD and Ecuador Currency

Ecuador officially uses the US dollar as its currency, which means that most businesses accept USD. When deciding between using the US dollar (USD) and any local currency in Ecuador, it’s important to consider a few subtle differences and practicalities.

Exchange Rate

Ecuador uses the US dollar as its official currency, so you don’t need to exchange your money before you leave.

However, it’s important to note that many small businesses, markets, and street vendors may not accept large bills, so it’s a good idea to carry smaller denominations like $1, $5, and $10 bills with you.

Convenience

Using the US dollar in Ecuador means that travelers don’t need to worry about exchanging money before their trip. It also means that prices are often listed in dollars, making it easy to understand the cost of goods and services.

However, it’s important to note that while the dollar is widely accepted, smaller businesses and vendors may prefer payment in cash rather than credit cards. It’s a good idea to carry small bills and coins for these situations.

Using USD in Ecuador can be more convenient for travelers because it is widely accepted. You can use USD to pay for most things, including food, transportation, and souvenirs.

Fees

When withdrawing currency or making payments, you may be subject to fees and commissions. If you use an ATM to withdraw money, you may also be charged a fee by your bank and by the ATM owner.

It is important to check with your bank to see if they have any partnerships with banks in Ecuador to avoid fees.

Credit and debit cards are also widely accepted in Ecuador, especially in larger cities and tourist areas. However, it’s important to note that some vendors may charge additional fees for card transactions, so it’s always a good idea to carry cash as a backup.

Cost of Living in Ecuador

If you’re considering moving to Ecuador, one of the things you’re probably wondering about is the cost of living. Ecuador is known for being a budget-friendly destination, with a low cost of living compared to many other countries.

The official currency of Ecuador is the US dollar, which means that you won’t have to worry about exchange rates or dealing with a different currency. This makes budgeting and financial planning much easier.

When it comes to daily expenses, you can expect to pay less for things like groceries, transportation, and dining out than you would in many other countries. According to Numbeo, the cost of living in Ecuador is 55.8% lower than in the United States.

In Ecuador, average costs for everyday expenses are as follows, based on Expatistan data: A meal at a budget-friendly restaurant is around $4.00, a one-way ticket on local transportation costs about $0.30, monthly rent for a one-bedroom apartment in the city center is approximately $300.00, and monthly utilities for such an apartment are around $50.00.

If you are planning a trip to Ecuador, it’s important to budget accordingly. The cost of living in Ecuador is generally lower than in many Western countries, which means that your money can go further. However, it’s still important to be mindful of your spending.

One of the biggest expenses for travelers is accommodation. In Ecuador, you can find a range of options, from budget hostels to luxury hotels. Hostels can cost as little as $10 per night, while mid-range hotels can cost around $50 per night. If you’re looking for luxury, you can expect to pay upwards of $100 per night. It’s important to do your research and find the best deals.

Food is another expense to consider. Ecuadorian cuisine is diverse and delicious, and you can find everything from street food to high-end restaurants. A meal at a mid-range restaurant can cost around $10-15, while street food can cost as little as $1-2. It’s worth noting that alcohol can be expensive in Ecuador, so if you’re planning on drinking, be prepared to spend more.

Of course, the cost of living can vary depending on where you live and your lifestyle. If you choose to live in a more expensive neighborhood or eat at high-end restaurants every night, your expenses will be higher. However, overall, you can expect to live comfortably in Ecuador without breaking the bank.

Don’t Get Scammed Tips

Ecuador is a beautiful country with a rich culture and history, but like any other tourist destination, it is important to be aware of scams and tourist traps. Here are some tips to help you avoid getting scammed in Ecuador:

- Be Careful with Money Exchange

Ecuador uses the US dollar as its official currency, which makes it easy for travelers from the US and other countries to understand the denominations and currency exchange rates.

However, it is important to be cautious when exchanging digital money for cash. Avoid exchanging money on the street or with unlicensed money changers. Instead, withdraw money at banks or authorized exchange bureaus.

- Watch Out for Taxi Scams

Taxi scams are common in Ecuador, especially in tourist areas. One common scam is the “broken meter” scam, where the taxi driver claims that the meter is broken and charges an inflated fare.

To avoid this scam, make sure the taxi has a working meter before getting in. Also, it is a good idea to have an idea of how much the ride should cost before getting in the taxi. You can ask your hotel or a local for an estimate.

- Be Wary of Tourist Traps

Tourist traps are common in Ecuador, especially in popular tourist areas like Quito and the Galapagos Islands. One common tourist trap is the “free” tour, where a guide offers a free tour of a city or attraction and then pressures you to buy something at the end.

To avoid this scam, do your research before going on a tour and choose a reputable tour company. Also, be wary of street vendors who offer “authentic” souvenirs at a high price. It is often better to buy souvenirs from a reputable shop or market.

By following these tips, you can enjoy your trip to Ecuador without falling victim to scams and tourist traps. Remember to be cautious and use common sense, and you will have a safe and enjoyable trip.