The Philippine peso has a rich history that dates back to the Spanish colonial period. It was first introduced in 1852 as a Spanish colonial peso and was used as the country’s official currency until the Philippine-American War in 1898. The US dollar was then introduced as the country’s official currency, but the Philippine peso was reintroduced in 1946 after the country gained independence.

Today, the peso is one of the most traded currencies in Southeast Asia and is widely accepted in the country for all transactions. In this article, we’ll explore the long and fascinating history of the Philippine peso that dates back centuries. With a basic understanding of the Philippine peso and its history, you’ll be better equipped to navigate the country’s financial landscape during your travels.

Historical Journey of Philippine Currency

The history of Philippine money goes back to the pre-Hispanic era when gold Piloncitos and other items were used as currency. However, it was only during the Spanish colonial period that the official currency, the Philippine peso, was introduced.

Over the years, the peso has seen changes in design and value. The first peso, introduced in 1861, was equivalent to eight reales during the Spanish colonial period. In 1903, it was revalued to be equivalent to two and a half pesos of the old value.

During World War II, Japanese forces replaced the Philippine peso with their own currency. After the war, the peso was reintroduced but underwent devaluations until the mid-1960s when it was pegged to the US dollar.

History of Coins

The Bangko Sentral ng Pilipinas issues Philippine peso coins for circulation in the country. These coins are currently available in seven denominations. The use of the Philippine peso dates back to Spanish rule, and its history involves influences from the Spanish dollar and other currencies.

During the pre-Hispanic era, gold served as a vital medium of exchange, represented by stamped gold beads known as piloncitos and gold barter rings. The original silver currency unit was the rupee or rupiah, introduced through trade with India and Indonesia.

Under Spanish administration, the Spanish silver peso, equivalent to eight reales, was introduced in 1521 by the Magellan expedition and brought in large quantities by the Manila galleons after the 1565 conquest. The local salapi continued as a half-peso coin. Gold onzas or eight-escudo coins were also introduced.

Before the establishment of the Manila Mint in 1857, the Philippines relied on coins brought by Spain, China, and neighboring countries. The mint produced gold and silver coins in various denominations.

During the United States administration (1903-1945), coins were struck for use in the Philippines, ranging from 1⁄2 centavo to one peso. The designs depicted Filipino and American themes, symbolizing the collaborative efforts in nation-building.

The Culion leper colony, established in 1906, issued its own currency due to concerns about leprosy transmission through regular money. The coins were struck in aluminum and later copper-nickel alloy.

After gaining independence in 1946, the Philippines introduced various coin series, including the English Series, Pilipino Series, Ang Bagong Lipunan Series, and Flora and Fauna Series. These series featured different designs, reflecting changes in leadership, language, and national symbols.

In 1995, the Bangko Sentral ng Pilipinas introduced the BSP Series, which included 1, 5, 10, and 25-sentimo, 1-piso, and 5-piso coins. The New Generation Currency Coin Series, launched in 2018, features native Philippine flora on the obverse and portraits of national heroes on the reverse. The series aims to replace the older coin designs.

Commemorative coins have been issued to mark significant events and honor historical figures. These coins hold legal tender status and contribute to numismatic interest among collectors.

As of 2022, the latest addition is the New Generation Currency Coin Series, which includes various denominations featuring native flora and portraits of national heroes. The series was introduced in 2018 and aims to replace older coin designs. Additionally, commemorative coins continue to be issued to mark important events and honor historical figures, contributing to numismatic interest among collectors.

History of Bills

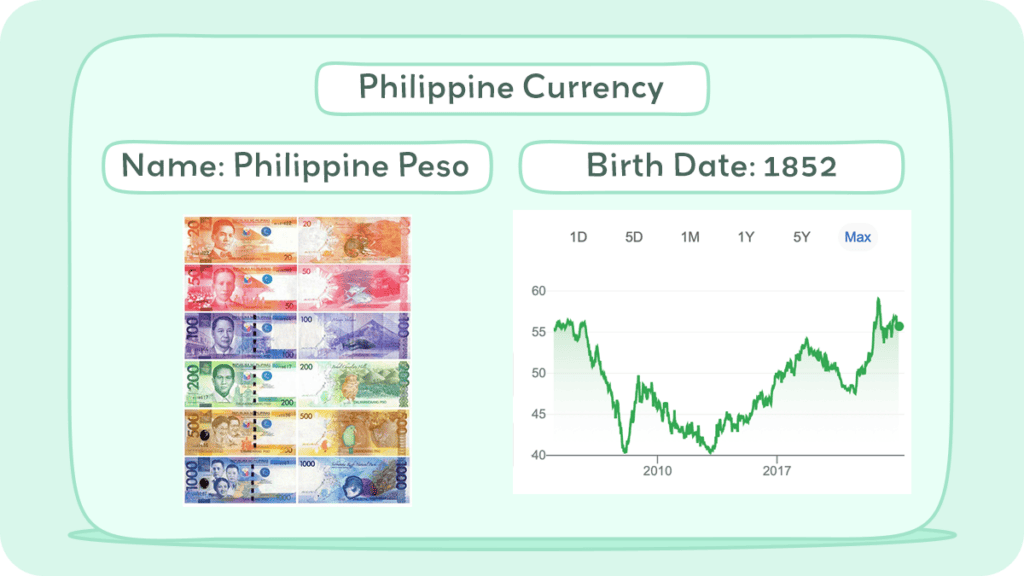

The banknotes of the Philippine peso, issued by the Bangko Sentral ng Pilipinas (Central Bank of the Philippines), hold a significant role in the country’s economic landscape. These notes, ranging from ₱20 to ₱1000, showcase a blend of historical figures, events, landmarks, and fauna, contributing to a rich narrative of the Philippines’ cultural and political evolution.

The dimensions of Philippine peso banknotes have remained consistent at 16 x 6.6 cm since the US-Philippine administration, a standardization introduced during William Howard Taft’s governor-general tenure. This size, initiated in 1928, aligns with that of the United States Federal Reserve Notes, highlighting the historical connection between the two nations.

The issuance of banknotes in the Philippines traces back to 1852 when El Banco Español Filipino de Isabel II released denominations like 10, 25, 50, and 200 pesos fuertes. Over the years, various banks, such as the Bank of the Philippine Islands (BPI) and the Philippine National Bank (PNB), played roles in issuing different notes. The Silver Certificates in 1918 replaced the earlier certificates, backed by bonds from the United States Government.

The English Series, circulating from 1949 to 1969, was succeeded by the Pilipino Series (1969–1974) and the Ang Bagong Lipunan Series (1973–1996). The latter, undergoing Filipinization, was eventually demonetized in 1993 due to concerns about its potential use in influencing elections.

The New Design/BSP Series (1985–2018) featured security upgrades and a shift in presidential signatures. In 2010, the New Generation Currency (NGC) Series was introduced, emphasizing enhanced security and durability. Presidents Gloria Macapagal Arroyo and Benigno Aquino III approved this series, making it the only one endorsed by two presidents.

In 2017, the NGC series underwent design updates, including changes to font size, italicized scientific names, and alterations to specific images on selected denominations. Subsequently, the Enhanced NGC series in 2020 introduced tactile markings for the visually impaired, improved security threads, and other features to enhance accessibility.

Despite the NGC series’ advancements, certain errors have been identified, such as the exclusion of Batanes from the Philippine map and the mislocations of natural landmarks. Design Systemat, the company responsible for the bills, explained practical printing constraints affecting color reproduction.

The signatures of the President of the Philippines and the Governor of the Bangko Sentral ng Pilipinas are notable features on the banknotes. Over the years, different pairs have appeared on the notes, reflecting leadership changes.

The evolution of Philippine peso banknotes reflects not only economic transitions but also the nation’s history, culture, and political shifts. The meticulous design, security features, and the continuous pursuit of improvement demonstrate the commitment to preserving the integrity of the currency and its representation of Filipino identity.

Inflation and Buying Power of the Philippine Peso

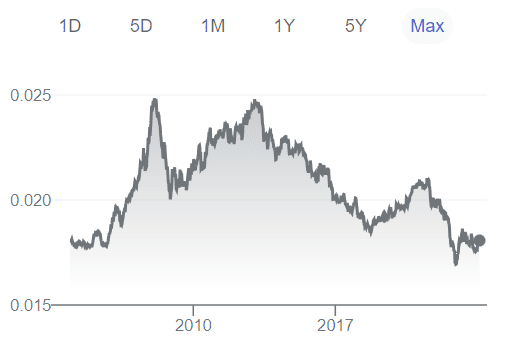

Over the years, the value of the Philippine Peso has fluctuated due to various economic and political factors. Inflation has been a major issue in the country, with the value of the peso decreasing over time. In 1946, the exchange rate was 2 Philippine pesos to 1 US dollar. By 2023, the exchange rate had increased to around 55 Philippine pesos to 1 US dollar.

In recent years, the Philippines has experienced significant challenges related to inflation and the buying power of the Philippine peso. This has had far-reaching implications for the economy and the daily lives of Filipino citizens.

According to a report by IBON, the Philippines has the highest inflation rate in Southeast Asia. In November 2023, the inflation rate in the Philippines hit a 14-year high of 8%, as reported by Scholastic Inc. This surge in inflation has significantly impacted the cost of living for many Filipinos. The Philippine Statistics Authority (PSA) reported a headline inflation rate of 8.0% in November 2023, indicating a significant increase in the overall price level compared to the base year.

The purchasing power of the Philippine peso has been affected by inflation. As prices rise, the real value of the peso diminishes, impacting the ability of individuals and families to afford goods and services.

According to Worlddata.info, the purchasing power of the peso has been eroded over time. For example, a purchasing power of 1,000 pesos in 1960 corresponds to only 3.00 pesos at the beginning of 2023 due to inflation.

The impact of inflation on the buying power of the peso has far-reaching implications for the economy. As reported by the Bangko Sentral ng Pilipinas, the trimmed mean represents the average inflation of the weighted middle 70 percent, highlighting the broad impact of rising prices on the population.

Moreover, the International Monetary Fund (IMF) data shows that the purchasing power parity for the Philippines was 18.8 LCU per international dollar in 2022, indicating the challenges faced by the Filipino population in maintaining their purchasing power.

The Bangko Sentral ng Pilipinas (BSP) plays a crucial role in implementing monetary policies to stabilize prices and support economic growth. Through mechanisms such as interest rate adjustments and liquidity management, the BSP aims to manage inflation.

Addressing the challenges related to inflation and the purchasing power of the peso is crucial for ensuring the well-being of the Filipino population and the stability of the economy. Policy measures aimed at controlling inflation and strengthening the purchasing power of the peso will be essential for mitigating the impact of rising prices.

The Philippine Peso

The Philippine Peso (PHP) serves as the official currency of the Philippines. Represented by the symbol “₱,” the peso can be denoted as “₱100” or “100 PHP.” Additionally, when expressing amounts in words, the format “One hundred Philippine Pesos” is commonly used.

To navigate financial transactions effectively in the Philippines, it is crucial to identify various denominations of Philippine currency, which comes in both coins and bills. Philippine bills, made of polymer for durability and counterfeit resistance, come in denominations of 20, 50, 100, 200, 500, and 1000 pesos. Each bill boasts a unique design, with the 100 peso bill, featuring Apolinario Mabini, a Filipino revolutionary leader, predominantly blue in color.

The Philippine Peso is a vital aspect of the country’s financial landscape. Understanding its symbol, denominations, and security features is essential for smooth financial transactions. Whether using “₱” or “PHP,” this knowledge is instrumental in navigating the Philippine monetary system with confidence.

PHP 20

The ₱20 Philippine banknote is the smallest in circulation, featuring President Manuel L. Quezon on the front and the Banaue Rice Terraces and Asian palm civet on the reverse. Its design has evolved through various series, capturing different historical periods. From the pre-independence era with the Mayon Volcano on Silver Certificates (1905–1917) to Quezon’s introduction in the Pilipino series notes (1967), each series reflects unique aspects. The English series (1951–1971) highlighted Katipunan leaders, and the Pilipino series (1969–1973) changed colors and depicted the Malacañan Palace. The Ang Bagong Lipunan series (1973–1985) added text in 1973, and the New Design series (1986–2012) emphasized Quezon’s achievements and the national language. The ongoing New Generation series (2010–present) introduced updates in 2010 and 2017.

PHP 50

The ₱50 Philippine banknote features former President Sergio Osmeña with the First Philippine Assembly, Leyte Landing on the front, and Taal Lake with a Giant Trevally on the reverse. Its history spans diverse design series, starting with Banco Español Filipino De Isabel II in 1852. Osmeña’s presence began in the Pilipino series notes (1967), with subsequent series highlighting figures like Antonio Luna and landmarks like the Old Legislative Building. The Ang Bagong Lipunan (1973–1985) and New Design (1987–2013) series emphasized Osmeña’s achievements, while the ongoing New Generation series (2010–present) saw updates and enhancements in 2010, 2017, and 2020. Commemorative overprints mark events like Osmeña’s 100th Birth Anniversary (1978) and Central Banking milestones (1997, 2009, and 2013), underscoring the cultural and historical significance of the ₱50 Philippine banknote.

PHP 100

The ₱100 Philippine banknote features former president Manuel A. Roxas on the front and the Mayon Volcano and a whale shark on the reverse. Its history dates back to Banco Español Filipino De Isabel II in 1852 and includes various series, like the Philippine Islands Silver Certificates depicting Ferdinand Magellan. Roxas first appeared in the Pilipino series notes in 1967, followed by the Ang Bagong Lipunan (1973–1985) and New Design (1987–2013) series, reflecting design changes and historical events. Commemorative overprints mark events like the Philippine Centennial and UP Centennial. The ₱100 bill serves as a canvas for commemorating cultural, educational, and historical occasions in the Philippines.

PHP 200

The ₱200 Philippine banknote features President Diosdado Macapagal on the front and Chocolate Bohol Hills with a tarsier on the reverse. Its historical roots date back to Banco Español Filipino de Isabel II issuing 200 pesos fuertes notes in 1852. After withdrawal in 1959, the denomination was reintroduced in the 2002 New Design series, highlighting Diosdado P. Macapagal and the Aguinaldo Shrine. An “enhanced” version in 2020 introduced security features, and the 2022 version adopted the redesigned BSP logo. As the rarest in circulation, the ₱200 bill serves as a commemorative canvas for events like the UST Quadricentennial and 60 Years of Central Banking.

PHP 500

The ₱500 Philippine banknote features Senator Benigno Aquino Jr. and President Corazon Aquino on the front, with the Puerto Princesa Subterranean River National Park and the blue-naped parrot on the reverse. Set to release a polymer version in 2023, following the 1000-Piso polymer banknote in April 2022, the bill has a diverse history, originating from 1905 Philippine Islands Silver Certificates. Beyond its monetary value, the ₱500 bill serves as a canvas for commemorating significant events, underlining its cultural and historical importance in the Philippines.

PHP 1,000

The ₱1000 Philippine banknote is notable as the largest denomination in general circulation and stands out as the only peso note with a polymer version, launched in April 2022. The cotton-abaca version highlights significant figures like José Abad Santos, Vicente Lim, and Josefa Llanes Escoda on the front, with the reverse featuring the Tubbataha Reefs Natural Park and the South Sea pearl. The controversial 2021 redesign of the polymer version replaces portraits with that of the Philippine eagle. Its historical journey dates back to World War II, with the New Design series (1991–2012) depicting heroes and iconic landscapes. The 2022 polymer version is currently in limited trial circulation, showcasing the Philippine eagle and natural elements.

Currency Usage in the Philippines

Understanding the currency usage and value in the Philippines is important for a smooth and hassle-free trip. Here are some important things to know about using currency in the Philippines.

Is USD accepted in the Philippines?

Yes, USD is accepted in the Philippines, but it is not as widely accepted as the Philippine peso. You may encounter some establishments that only accept PHP, especially in smaller towns and rural areas. It is also important to note that paying in USD may result in a lower exchange rate and additional fees.

According to AboutPhilippines.org, USD and other major currencies are not widely accepted in the Philippines, except in tourist establishments, airports, or hotels. It is a good idea to bring some USD with you as emergency cash, but you should be prepared to exchange it for PHP at a bank or currency exchange.

Using PHP instead of USD can be advantageous because exchange rates are typically better. Additionally, some establishments may offer discounts or better prices if you pay in PHP.

If you do decide to use USD, it is important to know the current exchange rate. According to TripSavvy, if you are quoted a price in USD instead of PHP, you should check the current exchange rate to ensure that you are getting a fair deal.

Exchanging Currency in the Philippines

If you are planning to visit the Philippines, you will need to exchange your currency to Philippine Peso (PHP) to pay for goods and services. Here are some things you should know about exchanging currency in the Philippines.

When traveling to the Philippines, it is important to understand the currency exchange and value. The official currency of the Philippines is the Philippine peso (PHP), which is divided into 100 centavos. The Philippine peso comes in denominations of 20, 50, 100, 200, 500, and 1000 pesos.

Where can I exchange Philippine Peso?

There are many places where you can exchange your currency to Philippine Peso. The most common places are banks, hotels, and currency exchange offices. You can also exchange your currency at the airport when you arrive in the Philippines. However, keep in mind that the exchange rate at the airport is usually not as favorable as the exchange rate at other places.

Understanding the currency exchange and value in the Philippines is important for a smooth and hassle-free trip. Make sure to bring a mix of cash and credit cards, exchange your USD to PHP for better rates, and compare rates and fees before exchanging your currency.

What to know before exchanging currency in Philippine Peso

When traveling to the Philippines, exchanging your currency to Philippine Peso (PHP) is necessary for transactions. Here are important considerations before exchanging your money:

Firstly, check the daily fluctuating exchange rate between your currency and PHP to maximize your financial value. Verify the current rate online or at local banks or money changers.

Secondly, be aware of potential exchange fees imposed by banks or money changers. Knowing these fees in advance prevents surprises. Some institutions may offer favorable exchange rates but higher fees, while others provide lower rates with lower fees.

Selecting a reliable money changer is crucial to avoid scams and counterfeit currency. Opt for authorized changers with a positive reputation, steering clear of street exchanges. Although credit and debit cards are widely accepted in urban and tourist hubs, cash remains the preferred payment method in many places. Carrying some cash is advisable for smaller purchases and to address any potential card acceptance issues.

Given the prevalence of counterfeit currency in the Philippines, exercise caution. Check security features like watermarks and security threads to verify the authenticity of the bills you receive. By following these guidelines, you can ensure an optimal currency exchange experience in Philippine Peso.

Choosing Between USD and Philippine Peso

When traveling to the Philippines, you may be wondering whether you should use US dollars or Philippine Peso for your transactions. Both currencies are widely accepted in the country, but there are some factors to consider when choosing which one to use.

Exchange Rate

Before exchanging your currency, it is important to know the current exchange rate. You can check the exchange rate online or at a currency exchange office. It is also important to know that some places may charge a commission or a fee for exchanging currency. Make sure to ask about any fees or commissions before exchanging your currency.

While the USD is a dominant currency in the global market, the Philippine Peso can be subject to fluctuating exchange rates. It’s important to keep an eye on exchange rates to make the most out of your currency.

Convenience

When exchanging your currency, consider the convenience of the location. Banks and hotels may offer a more convenient location but charge higher fees or offer a less favorable exchange rate. Currency exchange offices may offer a better exchange rate, but they may be located in less convenient areas.

USD is widely accepted in many countries, making it a convenient currency for travelers and businesses. However, the Philippine Peso may be more accessible in the Philippines, where it’s the official currency. If you’re doing business or traveling in the Philippines, use the local currency to avoid exchange fees and get a better value for your money.

Fees

When exchanging your currency, make sure to ask about any fees or commissions. Some places may charge a commission or a fee for exchanging currency. It is important to know the fees before exchanging your currency to avoid any surprises.

While USD transactions may have lower fees due to their widespread use, it’s important to compare fees for both currencies to determine which one is more cost-effective.

Tips

Be sure to check the current exchange rate before proceeding with the currency exchange. Additionally, inquire about any associated fees or commissions to avoid unexpected charges. The convenience of the exchange location is another factor to consider, as well as the potential drawbacks of exchanging currency at the airport, if possible.

Furthermore, explore the option of using a debit card that does not impose foreign transaction fees for added convenience. By adhering to these guidelines, you can ensure a fair exchange rate and minimize unnecessary fees during your currency exchange in the Philippines.

Overall, the decision to choose between USD and Philippine Peso depends on your individual needs and circumstances. By considering the factors mentioned above, you can make an informed decision and choose the currency that’s right for you.

Cost of Living in the Philippines

If you are planning to move to the Philippines, you might wonder about the cost of living in the country. According to Expatistan, the cost of living in the Philippines is cheaper than in 69% of countries in Asia and 83% of countries in the world.

To give you an idea of the cost of living in the Philippines, a single person’s estimated monthly costs are around $1,591 or Php88,358. This includes accommodation, food, transportation, and other basic necessities.

However, if you want to live more reasonably, expect to pay at least Php25,000 or around $450 for a studio-type apartment. A bigger 2-bedroom apartment for the entire family will set you back at least Php50,000 or around $900.

When it comes to food, the Philippines offers a wide variety of affordable and delicious options. You can eat at a local restaurant for as low as Php50 or $1. A meal at a mid-range restaurant can cost around Php300 or $6. If you prefer to cook your own meals, the cost of groceries is also quite affordable. You can shop at several supermarkets or malls such as Robinsons.

Transportation in the Philippines is also relatively cheap. A one-way ticket for local transportation can cost as low as Php12 or $0.25. If you prefer to use ride-sharing services such as Grab or Angkas, expect to pay around Php200 or $4 for a 10-kilometer ride.

Overall, the cost of living in the Philippines is relatively affordable compared to other countries in the world. However, the cost of living can vary depending on your lifestyle and location. It is important to do your research and budget accordingly.

Don’t Get Scammed Tips

When handling Philippine currency, it’s important to be aware of the potential for scams. Here are some tips to help you avoid getting scammed:

1. Familiarize Yourself with the Security Features

The Bangko Sentral ng Pilipinas, the central bank of the Philippines, regularly updates the security features of Philippine currency to prevent counterfeiting. Familiarize yourself with these features so you can easily spot fake bills. Some of the security features include:

- Watermark: Hold the bill up to the light to see the watermark.

- Security Thread: Look for the security thread embedded in the bill.

- Color-shifting Ink: Tilt the bill to see the color of the ink shift.

- See-through Mark: Hold the bill up to the light to see the see-through mark.

2. Only Exchange Currency at Authorized Locations

When exchanging currency, make sure you only do so at authorized locations such as banks or authorized money changers. Be wary of exchanging currency with street vendors or individuals who approach you on the street.

3. Check the Exchange Rate

Before exchanging currency, check the current exchange rate to ensure you’re getting a fair deal. You can check the exchange rate online or at a bank.

4. Avoid Giving Out Personal Information

Scammers may attempt to obtain your personal information, such as your passport number or bank account information, under the guise of exchanging currency. Be wary of anyone who asks for this information and only provide it to authorized individuals or institutions.

5. Use Caution When Receiving Change

When receiving change, double-check the bills you receive to ensure they are not counterfeit. If you have any doubts, ask for different bills or ask for the assistance of an authorized individual.