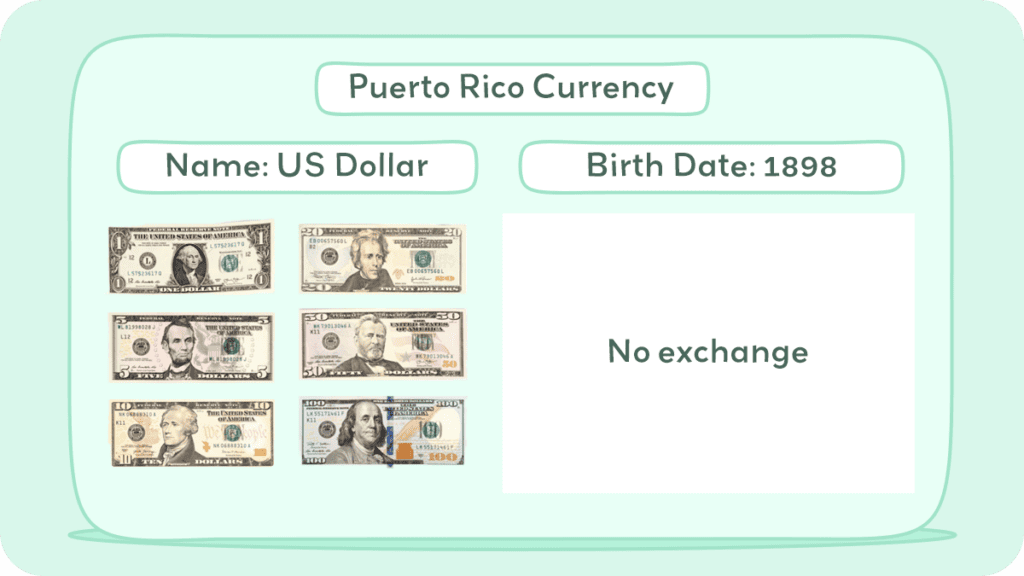

The official currency of Puerto Rico is the United States dollar, which means you can use the same currency as you would in the mainland United States. This makes it convenient for American travelers, as there’s no need to exchange money or worry about exchange rates.

Puerto Rico has been using the US dollar as its official currency since 1898 when the island became a territory of the United States. This means that the US dollar is widely accepted throughout the island, and you’ll find that prices are similar to those in the mainland US.

This article examines Puerto Rico’s currency system, focusing on the history and role of the US dollar as the island’s official currency. It provides a comprehensive overview of how and why Puerto Rico adopted the dollar and a blend of historical and economic perspectives to understand the complexities of its monetary system.

Historical Journey of The Puerto Rico Currency

Puerto Rico has a long and fascinating history when it comes to currency. From the time it was discovered in 1493 until the US exchanged the Puerto Rican “peso” to the dollar in 1899, the coins of many countries circulated freely on the island. During the colonization of Puerto Rico, the money that was used in Puerto Rico was that of Spain.

The US dollar has been the official currency of Puerto Rico since 1898 when the island became a territory of the United States. Since then, the US dollar has been widely accepted throughout the island, and you’ll be able to use it to pay for goods and services almost anywhere you go.

Puerto Rican Peso

The currency history of Puerto Rico is a fascinating reflection of its colonial past and changing political affiliations. Initially, the indigenous Taíno people used a barter system.

With Spanish colonization in 1502, the Spanish real was introduced, but Puerto Rico’s economy struggled after its gold reserves were depleted. Spain provided financial support through the Situado Mexicano, a regular shipment of gold from New Spain.

In the 17th century, Puerto Rico started producing banknotes, becoming the first Spanish Overseas Province to do so.

The 19th century saw the end of the Situado, leading to an economic crisis. Governor Salvador Meléndez Bruna initiated the printing of provincial banknotes, creating the Puerto Rican peso.

These notes were produced both by hand and mechanically, but counterfeiting became a significant issue. In 1814, following the Spanish constitutional changes, Alejandro Ramírez of Puerto Rico commissioned new banknotes from Philadelphia, marking a shift in monetary practices.

The Spanish-American War in 1898 resulted in Spain ceding Puerto Rico to the United States. The Banco Español de Puerto Rico became the Bank of Puerto Rico, issuing bills equivalent to the U.S. dollar and creating the Puerto Rican dollar.

By 1913, after multiple series of banknotes, Puerto Rico’s economy and monetary system fully integrated with the United States, transitioning to the U.S. dollar.

US Dollar

The Spanish-American War in 1898 marked another shift, as Puerto Rico became a U.S. territory, leading to the gradual adoption of the U.S. dollar.

By 1904, the dollar was the official currency, facilitating economic ties with the U.S. but also sparking concerns about monetary autonomy and local economic impacts.

Today, the U.S. dollar is still Puerto Rico’s legal tender, with ongoing debates about its monetary future and the island’s economic and political relationship with the U.S.

The U.S. dollar originated from the Spanish-American silver dollar. Minted in various places like Mexico, Potosí, and Lima, it was widely used from the 16th to the 19th centuries. The Coinage Act of 1792 established the U.S. dollar, aligning it with the Spanish dollar’s silver content. Even after this, Spanish and Mexican dollars remained legal tender until 1857.

Alexander Hamilton finalized the Coinage Act, specifying the silver and gold content of various coins. The dollar’s value was based on the Spanish dollar’s silver content. The early U.S. currency depicted mythological figures, not presidents.

After the American Revolution, the Continental Congress issued paper currency, but it depreciated. The Constitution later restricted states from making anything other than gold and silver coins legal tender.

From 1792 to 1900, the U.S. operated on a bimetallic standard, linking the dollar to silver and gold. The Gold Standard Act of 1900 shifted to a gold standard. After the Nixon Shock in 1971, the U.S. dollar floated freely.

Paper money, like Treasury Notes and United States Notes, played roles in financing wars. The emergence of Federal Reserve Notes in 1913 marked the exclusive issuance of U.S. dollar notes. The dollar gained global significance after World War II, becoming the primary reserve currency under the Bretton Woods Agreement.

The Federal Reserve System, established in 1913, conducts U.S. monetary policy. The U.S. has often financed its spending through borrowing in its currency, a privilege referred to as the “exorbitant privilege.”

The United States dollar (USD) is the official currency of the U.S. and some other countries. It was introduced in 1792, aligned with the Spanish silver dollar, and divided into 100 cents. U.S. banknotes, known as greenbacks, are issued by the Federal Reserve System.

The U.S. dollar was initially defined based on a bimetallic standard, later linked solely to gold in 1900. It became a significant global reserve currency after World War I, surpassing the pound sterling by the Bretton Woods Agreement after World War II. The dollar is widely used in international transactions and is a free-floating currency.

As of September 20, 2023, approximately US$2.33 trillion is estimated to be in circulation. The U.S. Constitution grants Congress the power to coin money, and laws prescribe the forms in which U.S. dollars should be issued.

The dollar’s denominations include coins and Federal Reserve Notes. The term “buck” is colloquially used for dollars, and “greenback” refers to the 19th-century Demand Note dollars. Other nicknames include “dead presidents” for the portraits on bills and “bigface notes” for the newer designs.

The $ symbol for the dollar originated from the abbreviation “ps” for the peso, the Spanish dollar. It evolved into the $ sign, possibly influenced by the Pillars of Hercules on the Spanish Coat of arms or the letters U and S written on top of each other.

US Dollar coins

The United States Mint has produced legal tender coins annually since 1792. Common denominations for circulation include the penny, nickel, dime, quarter, half dollar, and dollar.

The U.S. coinage includes several denominations, each with its unique features. The Penny (1¢) showcases Abraham Lincoln on the front and the Union Shield on the back, weighing 2.5 grams with a diameter of 0.75 inches.

The Nickel (5¢) features Thomas Jefferson on the obverse and Monticello on the reverse, weighing 5.0 grams and having a diameter of 0.835 inches.

The Dime (10¢) depicts Franklin D. Roosevelt on one side and symbols like an olive branch, torch, and oak branch on the other. It weighs 2.268 grams and measures 0.705 inches in diameter.

The Quarter (25¢) displays George Washington on the front and has changing designs on the reverse (five designs per year). It weighs 5.67 grams and has a diameter of 0.955 inches.

The Half Dollar (50¢) showcases John F. Kennedy on the front and the Presidential Seal on the back, weighing 11.34 grams with a diameter of 1.205 inches.

Lastly, the Dollar Coin ($1), known as the golden dollar, features Sacagawea on the obverse and changing designs on the reverse (four designs per year). It weighs 8.10 grams and has a diameter of 1.043 inches.

Gold and silver coins circulated from the 18th to the 20th centuries, with the last gold coins minted in 1933 and 90% silver coins in 1964.

The United States Mint currently produces circulating coins at the Philadelphia and Denver Mints. The one-dollar coin has not gained popularity due to the continued use of the one-dollar bill. Half-dollar coins were common but fell out of use in the mid-1960s.

The nickel has remained unchanged in size and composition (5 grams, 75% copper, and 25% nickel) since 1865. Efforts have been made to eliminate the penny due to its low value.

Collector coins, with higher numismatic or precious metal value, include American Eagle bullion coins and commemorative coins such as the Presidential dollar coins.

US Dollar bills

Federal Reserve Notes, or U.S. banknotes, serve as the official currency of the United States. The United States Bureau of Engraving and Printing produces these notes in accordance with the Federal Reserve Act of 1913.

The Board of Governors of the Federal Reserve System issues them to Federal Reserve Banks, which then distribute the notes to their member banks. This process makes the notes liabilities of the Reserve Banks and obligations of the United States.

With legal tender status, Federal Reserve Notes bear the statement “This note is legal tender for all debts, public and private.” These notes are backed by financial assets, mainly Treasury and mortgage agency securities obtained through open market transactions.

Various denominations of U.S. banknotes feature different historical figures and iconic symbols. For example, the One Dollar bill showcases George Washington and the Great Seal of the United States, while the Two Dollar bill displays Thomas Jefferson and the Declaration of Independence.

Other bills highlight Abraham Lincoln, Alexander Hamilton, Andrew Jackson, Ulysses S. Grant, and Benjamin Franklin, each paired with significant landmarks. These bills are part of different series, such as Series 1963, Series 1976, Series 2006, Series 2004A, Series 2009A, and Series 2017A.

Congress, according to the U.S. Constitution, has the power to borrow money on the credit of the United States. Federal Reserve Banks issue Federal Reserve Notes, considered “obligations of the United States” and redeemable in lawful money. Federal Reserve Notes are legal tender for debt payment. There are other types of banknotes, including United States Notes and Federal Reserve Bank Notes, but only Federal Reserve Notes remain in circulation.

Federal Reserve Notes are printed by the Bureau of Engraving and Printing on cotton fiber paper. Modern U.S. currency sizes match those of Philippine peso banknotes issued under the U.S. administration. Currently printed denominations include $1, $2, $5, $10, $20, $50, and $100.

Larger denominations like $500, $1,000, $5,000, $10,000, and $100,000 were discontinued after 1946. Post-2004 series banknotes incorporate additional colors for better distinction. Plans for future redesigns include raised tactile features for accessibility, larger numerals, more color differences, and currency readers to assist the visually impaired.

Inflation and Buying Power of Puerto Rico

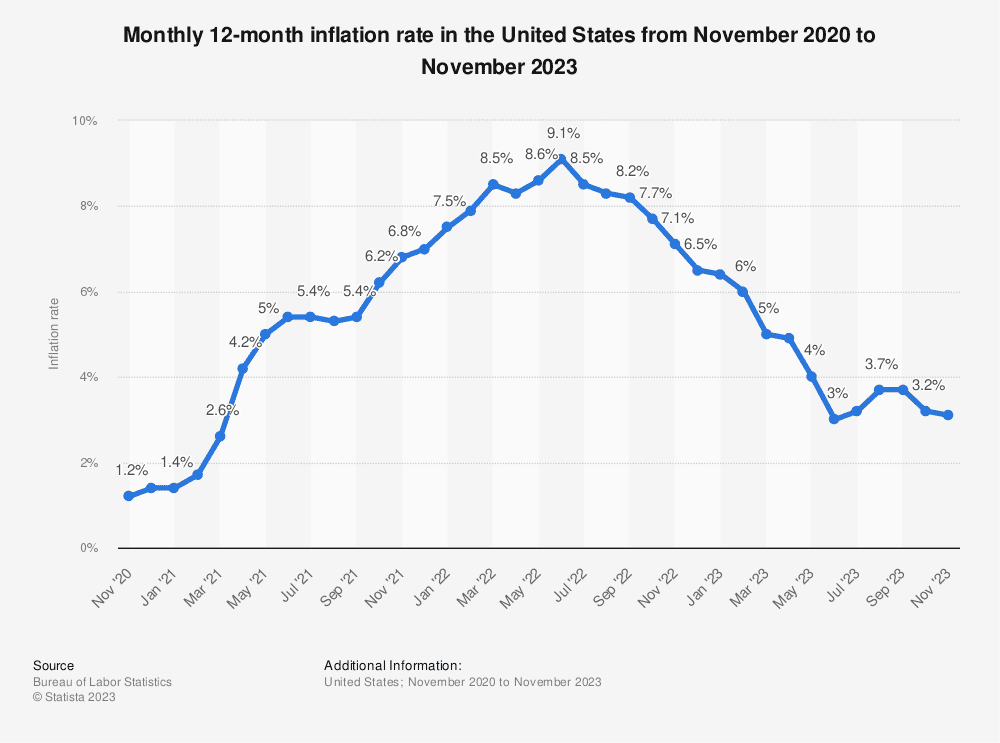

Puerto Rico’s economy has been struggling with inflation for a while now. Inflation is the rate at which the general level of prices for goods and services is rising, and it can have a significant impact on the buying power of the country’s currency. In Puerto Rico, the inflation rate measures a broad rise or fall in prices that consumers pay for a standard basket of goods.

According to Trading Economics, the inflation rate in Puerto Rico decreased to 2.70 percent in October 2023 from 3.30 percent in September of the same year. While this is good news, it’s important to note that inflation can still have a significant impact on the buying power of the currency.

Puerto Rico’s purchasing power parity (PPP) is another factor that affects its buying power. PPP is the number of currency units required to buy goods equivalent to what can be bought with one US dollar (US$). According to Knoema, in 2022, purchasing power parity for Puerto Rico was 0.9 LCU per international dollar. This means that Puerto Rico’s currency has less buying power than the US dollar, which can make it more expensive for Puerto Ricans to purchase goods and services.

Inflation can also affect the cost of living in Puerto Rico. As prices rise, it can become more expensive for people to afford basic necessities like food, housing, and healthcare. This can have a disproportionate impact on low-income families, making it difficult for them to make ends meet.

Overall, while the recent decrease in the inflation rate is a positive sign, it’s important to keep an eye on Puerto Rico’s economy and its buying power. Inflation and PPP are just two factors that can have a significant impact on the cost of living and the financial well-being of Puerto Ricans.

The US Dollar

The U.S. dollar, renowned as the world’s reserve currency, features banknotes that are globally recognized. Despite their familiar appearance, these notes contain intricate details and sophisticated elements. They represent more than just monetary value; they embody intricate artistry, advanced security features, and a rich history reflected in their design.

Each denomination, from the widely circulated $1 bill to higher values, showcases unique imagery and symbols, serving as a testament to the economic and cultural significance of the U.S. dollar in the global financial landscape.

$1

One Dollar features George Washington on the front and the Great Seal of the United States on the reverse. Circulation includes Series 1963 and Series 2017A.

$2

Two Dollars displays Thomas Jefferson on the front and the Declaration of Independence by John Trumbull on the reverse. Limited circulation includes Series 1976 and Series 2017A.

$5

Five Dollars shows Abraham Lincoln on the front and the Lincoln Memorial on the reverse. Circulation includes Series 2006 and Series 2021.

$10

Ten Dollars depicts Alexander Hamilton on the front and the Treasury Building on the reverse. Circulation includes Series 2004A and Series 2017A.

$20

Twenty Dollars features Andrew Jackson on the front and the White House on the reverse. Circulation includes Series 2004 and Series 2017A.

$50

Fifty Dollars displays Ulysses S. Grant on the front and the United States Capitol on the reverse. Circulation includes Series 2004 and Series 2017A.

$100

One Hundred Dollars shows Benjamin Franklin on the front and Independence Hall on the reverse. Circulation includes Series 2009A and Series 2017A.

Currency Usage in Puerto Rico

If you’re planning a trip to Puerto Rico, you may be wondering about the currency usage on the island. Here’s what you need to know.

In Puerto Rico, the U.S. dollar is the primary currency, streamlining transactions with the mainland U.S. and boosting tourism.

The dollar’s dominance brings benefits like easier access to U.S. markets and potential foreign investment but also concerns about economic dependence and limited local economic flexibility.

Is USD accepted in Puerto Rico?

Yes, the official currency of Puerto Rico is the US dollar. This means that you can use US dollars to pay for goods and services in Puerto Rico, just like you would in the United States. You don’t need to exchange your money for Puerto Rican currency.

While the currency is the same, costs can vary greatly between the island and the states. For example, some goods and services may be more expensive in Puerto Rico due to the cost of importing them to the island. It’s always a good idea to research prices and budget accordingly before your trip.

Using credit cards is widely accepted in Puerto Rico. However, it’s a good idea to carry some cash with you, especially if you plan to visit smaller businesses or rural areas where credit card machines may not be available. ATMs are widely available throughout the island, so you can easily withdraw cash as needed.

Overall, you don’t need to worry about exchanging your money or learning a new currency when you visit Puerto Rico. Just bring your US dollars and enjoy all that the island has to offer.

Exchanging Currency in Puerto Rico

If you are traveling to Puerto Rico, you will need to exchange your currency for the United States dollar (USD), as Puerto Rico uses the USD as its official currency. Here are some things you should know about exchanging currency in Puerto Rico.

Where can I exchange Puerto Rico Currency?

You can exchange your currency for USD at many locations in Puerto Rico, including banks, airports, and currency exchange offices.

Most banks and airports have designated offices to exchange all currencies for the USD. Banco Popular is a popular bank in Puerto Rico that offers foreign exchange services. They have an extensive network of branches and ATMs throughout the island.

Currency exchange offices are also available in popular tourist areas, such as Old San Juan and Condado. However, these offices may charge higher fees and offer less favorable exchange rates than banks and airports. It is recommended to compare exchange rates and fees before exchanging your currency.

What to know before exchanging currency in Puerto Rico Currency

Before exchanging currency, it’s important to be aware of a few key points for a smooth transaction. Firstly, check the current exchange rate, which fluctuates daily, either online or at a currency exchange office.

Be mindful of varying fees that banks and exchange offices may charge, and always ask about these before proceeding.

You’ll also need to provide valid identification, such as a passport or driver’s license, and some places might request additional ID.

For convenience, consider changing your currency before arriving in Puerto Rico, but if you need to do it there, aim to do so during regular business hours.

Currency exchange in Puerto Rico is generally straightforward and can be done at banks, airports, and currency exchange offices, but always compare rates, understand fees, and have your ID ready.

Choosing Between USD and Puerto Rico Currency

If you’re planning a trip to Puerto Rico, you may be wondering whether you should bring US dollars or exchange your money for Puerto Rico currency. Here are some factors to consider when making your decision.

Exchange Rate

The exchange rate between USD and Puerto Rico currency is 1:1, meaning that you won’t lose or gain any money by using either currency. However, keep in mind that prices in Puerto Rico may be different from the prices in the US, so you may end up spending more or less money depending on the items you purchase.

Convenience

Since Puerto Rico uses USD as its currency, you won’t have to worry about exchanging money or dealing with exchange rates. This can be a convenient option if you’re traveling from the US or plan on visiting other US territories. Additionally, many businesses in Puerto Rico accept credit cards, so you can avoid carrying large amounts of cash.

Fees

When exchanging money, you may be subject to fees and commissions, which can add up quickly. If you choose to use USD, you won’t have to worry about these fees. However, if you do need to exchange money, be sure to do so at a reputable exchange bureau to avoid getting scammed.

Tips

Tipping is customary in Puerto Rico, and you should plan on leaving a 15-20% tip at restaurants and for other services. You can leave the tip in USD or Puerto Rico currency, but keep in mind that some businesses may prefer one currency over the other.

By considering these factors, you can make an informed decision about whether to use USD or Puerto Rico currency during your trip.

Cost of Living in Puerto Rico

Living in Puerto Rico is generally less expensive than the average in the United States, with a cost of living of $1,443 and an average salary after taxes of $2,288. This salary can cover living expenses for about 1.6 months.

In Mercer’s 2023 Cost of Living Survey, San Juan ranks comparably to cities like Edinburgh and Barcelona. Accommodation costs are significant, with apartments being more affordable than houses, and prices varying between city centers and suburbs.

Outside of San Juan, smaller cities are cheaper. Public transport in San Juan is affordable, but in other areas, owning a car is common, albeit with higher costs and challenging driving conditions.

Grocery costs are higher due to many items being imported from the mainland U.S. Entertainment and dining offer a range of options, from affordable local eateries serving traditional dishes to more expensive tourist-centric restaurants.

The cost of education varies greatly between free public schools and costly private institutions. Healthcare is more affordable compared to the U.S., with comprehensive yet reasonably priced health insurance available.

While Puerto Rico generally has a lower cost of living compared to the U.S. average, it’s important to thoroughly research and plan your budget based on your personal needs and preferences.

Taking into account the various factors like housing, groceries, transportation, and taxes will help you make a well-informed decision about relocating to Puerto Rico.

Don’t Get Scammed Tips

Traveling to Puerto Rico can be a delightful experience if you’re aware of potential scams. Here are some tips to keep your trip hassle-free:

- Be Taxi Savvy: Use only authorized taxis with official emblems and meters. Negotiate the fare upfront and avoid unmarked cars offering cheap rides. Ride-sharing apps are a good alternative.

- Smart Car Rentals: Choose reputable rental companies, inspect the car for damage, and avoid unnecessary insurance fees. Trust companies with positive reviews.

- Secure Accommodation Booking: Use reliable platforms like Booking.com or Airbnb, and read reviews thoroughly. Pick accommodations in safe, well-lit areas and trust your instincts about the place.

- Tourist Awareness: Book activities with authorized companies. Get pricing and details in writing and research operators through reviews and forums.

- Trust Your Instincts: Stay alert, especially in crowded areas. A basic understanding of Spanish can be helpful. Don’t show off expensive items, and if a situation feels wrong, don’t hesitate to leave.

By keeping these tips in mind, you can enjoy a safe and memorable vacation in Puerto Rico.