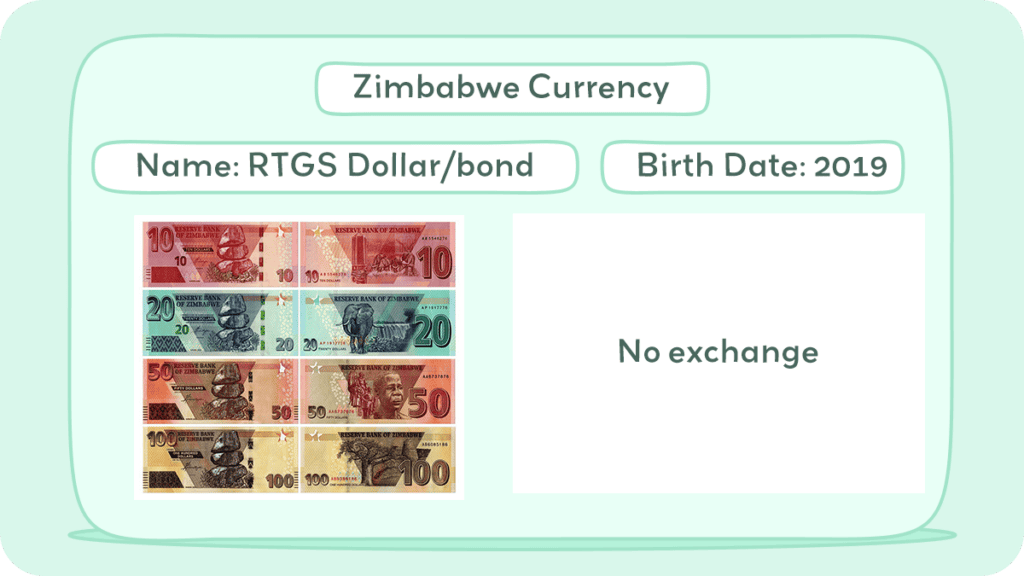

The official currency of Zimbabwe is the RTGS Dollar (ZWL), also known as the bond dollar. It was introduced in 2019 and is the primary legal tender for most transactions.

While the RTGS Dollar is official, a multi-currency system is still in place. This means several foreign currencies, especially the US Dollar (USD), Euro (EUR), South African Rand (ZAR), and Botswana Pula (BWP), are also accepted for transactions in Zimbabwe.

In this article, we will delve into the tumultuous history and intriguing facts surrounding Zimbabwe’s current currency, the RTGS dollar. From the turbulent era of hyperinflation and currency demonetization, the RTGS dollar emerged as a symbol of both resilience and ongoing economic challenges.

Historical Journey of the Zimbabwe Currency

Zimbabwe’s currency history is remarkable, featuring extreme hyperinflation, the removal of its original currency, and the introduction of the RTGS dollar. This section will delve into the period of severe hyperinflation in 2007-2008, leading to the retirement of the ZWD and the adoption of a multi-currency system. The introduction of the RTGS dollar (ZWL) in 2019 and the reinstatement of the multi-currency system in 2020 mark significant chapters in Zimbabwe’s complex monetary history.

Zimbabwean Dollar

The Zimbabwean Dollar, introduced in 1980 as a replacement for the Rhodesian Dollar, initially held value comparable to the US Dollar. However, severe hyperinflation from the late 20th to the early 21st century led to its dramatic devaluation, resulting in three redenominations and the issuance of a $100 trillion banknote.

The currency’s first redenomination in 2006 introduced the second dollar, and by 2007, due to continued inflation, plans for a third dollar were shelved, and inflation was declared illegal. A second redenomination in 2008 introduced the third dollar, and in 2009, a third redenomination brought in the fourth dollar, removing 12 zeros.

By 2009, it was abandoned as an official currency and later demonetized in 2015. Zimbabwe then adopted a multi-currency system, including the US Dollar and the South African Rand, among others.

In 2019, the Reserve Bank of Zimbabwe reintroduced a new Zimbabwe Dollar (RTGS Dollar), which remained the sole currency until 2020, when multiple foreign currencies were allowed again.

Hyperinflation plagued all four versions of the currency, exacerbated by the printing of more banknotes. The introduction of the RTGS Dollar in 2019 was an attempt to stabilize the economy, but high inflation continued due to public distrust and currency shortages.

In 2022, the Reserve Bank began removing lower denomination banknotes from circulation and introduced gold coins as a store of value. The relationship with foreign currencies has been unstable, reflecting the ongoing economic challenges in Zimbabwe.

Over the next few years, Zimbabwe transitioned from using the Zimbabwe dollar to adopting multiple currencies like the Botswana pula (BWP), Indian rupee (INR), euro (EUR), U.S. dollar (USD), and South African rand (ZAR). The country had at least nine different currencies that were considered legal tender.

US Dollar

The U.S. dollar originated from the Spanish-American silver dollar. Minted in various places like Mexico, Potosí, and Lima, it was widely used from the 16th to the 19th centuries. The Coinage Act of 1792 established the U.S. dollar, aligning it with the Spanish dollar’s silver content. Even after this, Spanish and Mexican dollars remained legal tender until 1857.

Alexander Hamilton finalized the Coinage Act, specifying the silver and gold content for various coins. The dollar’s value was based on the Spanish dollar’s silver content. The early U.S. currency depicted mythological figures, not presidents.

After the American Revolution, Continental Congress issued paper currency, but it depreciated. The Constitution later restricted states from making anything other than gold and silver coins legal tender.

From 1792 to 1900, the U.S. operated on a bimetallic standard, linking the dollar to silver and gold. The Gold Standard Act of 1900 shifted to a gold standard. After the Nixon Shock in 1971, the U.S. dollar floated freely.

Paper money, like Treasury Notes and United States Notes, played roles in financing wars. The emergence of Federal Reserve Notes in 1913 marked the exclusive issuance of U.S. dollar notes. The dollar gained global significance after World War II, becoming the primary reserve currency under the Bretton Woods Agreement.

The Federal Reserve System, established in 1913, conducts U.S. monetary policy. The U.S. has often financed its spending through borrowing in its own currency, a privilege referred to as the “exorbitant privilege.”

The United States dollar (USD) is the official currency of the U.S. and some other countries. It was introduced in 1792, aligned with the Spanish silver dollar, and divided into 100 cents. U.S. banknotes, known as greenbacks, are issued by the Federal Reserve System.

The U.S. dollar was initially defined based on a bimetallic standard, later linked solely to gold in 1900. It became a significant global reserve currency after World War I, surpassing the pound sterling by the Bretton Woods Agreement after World War II. The dollar is widely used in international transactions and is a free-floating currency.

As of September 20, 2023, approximately US$2.33 trillion is estimated to be in circulation. The U.S. Constitution grants Congress the power to coin money, and laws prescribe the forms in which U.S. dollars should be issued.

The dollar’s denominations include coins and Federal Reserve Notes. The term “buck” is colloquially used for dollars, and “greenback” refers to the 19th-century Demand Note dollars. Other nicknames include “dead presidents” for the portraits on bills and “bigface notes” for the newer designs.

The $ symbol for the dollar originated from the abbreviation “ps” for the peso, the Spanish dollar. It evolved into the $ sign, possibly influenced by the Pillars of Hercules on the Spanish Coat of arms or the letters U and S written on top of each other.

US Dollar coins

The United States Mint has produced legal tender coins annually since 1792. Common denominations for circulation include the penny, nickel, dime, quarter, half dollar, and dollar.

The U.S. coinage includes several denominations, each with its unique features. The Penny (1¢) showcases Abraham Lincoln on the front and the Union Shield on the back, weighing 2.5 grams with a diameter of 0.75 inches.

The Nickel (5¢) features Thomas Jefferson on the obverse and Monticello on the reverse, weighing 5.0 grams and having a diameter of 0.835 inches.

The Dime (10¢) depicts Franklin D. Roosevelt on one side and symbols like an olive branch, torch, and oak branch on the other. It weighs 2.268 grams and measures 0.705 inches in diameter.

The Quarter (25¢) displays George Washington on the front and has changing designs on the reverse (five designs per year). It weighs 5.67 grams and has a diameter of 0.955 inches.

The Half Dollar (50¢) showcases John F. Kennedy on the front and the Presidential Seal on the back, weighing 11.34 grams with a diameter of 1.205 inches.

Lastly, the Dollar Coin ($1), known as the golden dollar, features Sacagawea on the obverse and changing designs on the reverse (four designs per year). It weighs 8.10 grams and has a diameter of 1.043 inches.

Gold and silver coins circulated from the 18th to the 20th centuries, with the last gold coins minted in 1933 and 90% silver coins in 1964.

The United States Mint currently produces circulating coins at the Philadelphia and Denver Mints. The one-dollar coin has not gained popularity due to the continued use of the one-dollar bill. Half dollar coins were common but fell out of use in the mid-1960s.

The nickel has remained unchanged in size and composition (5 grams, 75% copper, and 25% nickel) since 1865. Efforts have been made to eliminate the penny due to its low value.

Collector coins, with higher numismatic or precious metal value, include American Eagle bullion coins and commemorative coins such as the Presidential dollar coins.

US Dollar bills

Federal Reserve Notes, or U.S. banknotes, serve as the official currency of the United States. The United States Bureau of Engraving and Printing produces these notes in accordance with the Federal Reserve Act of 1913.

The Board of Governors of the Federal Reserve System issues them to Federal Reserve Banks, which then distribute the notes to their member banks. This process makes the notes liabilities of the Reserve Banks and obligations of the United States.

With legal tender status, Federal Reserve Notes bear the statement “this note is legal tender for all debts, public and private.” These notes are backed by financial assets, mainly Treasury and mortgage agency securities obtained through open market transactions.

Various denominations of U.S. banknotes feature different historical figures and iconic symbols. For example, the One Dollar bill showcases George Washington and the Great Seal of the United States, while the Two Dollar bill displays Thomas Jefferson and the Declaration of Independence.

Other bills highlight Abraham Lincoln, Alexander Hamilton, Andrew Jackson, Ulysses S. Grant, and Benjamin Franklin, each paired with significant landmarks. These bills are part of different series, such as Series 1963, Series 1976, Series 2006, Series 2004A, Series 2009A, and Series 2017A.

Congress, according to the U.S. Constitution, has the power to borrow money on the credit of the United States. Federal Reserve Banks issue Federal Reserve Notes, considered “obligations of the United States” and redeemable in lawful money. Federal Reserve Notes are legal tender for debt payment. There are other types of banknotes, including United States Notes and Federal Reserve Bank Notes, but only Federal Reserve Notes remain in circulation.

Federal Reserve Notes are printed by the Bureau of Engraving and Printing on cotton fiber paper. Modern U.S. currency sizes match those of Philippine peso banknotes issued under U.S. administration. Currently printed denominations include $1, $2, $5, $10, $20, $50, and $100.

Larger denominations like $500, $1,000, $5,000, $10,000, and $100,000 were discontinued after 1946. Post-2004 series banknotes incorporate additional colors for better distinction. Plans for future redesigns include raised tactile features for accessibility, larger numerals, more color differences, and currency readers to assist the visually impaired.

Zimbabwean Dollar

Zimbabwe introduced a new banknote series in 2019 with various denominations:

$2

$2 note (Green): Features Domboremari with trees, the Eternal Flame at the National Heroes Acre, and the Old Parliament House on the reverse.

$5

$5 note (Purple): Depicts Domboremari with trees on the obverse and three giraffes, and the Zimbabwe Aloe on the reverse.

$10

$10 note (Red): Displays Domboremari with trees on the obverse and the New Reserve Bank Tower, and four African buffaloes on the reverse.

$20

$20 note (Blue): Illustrates Domboremari with trees on the obverse and an African elephant, and Victoria Falls (Mosi-oa Tunya) on the reverse.

$50

$50 note (Brown): Features Domboremari with trees on the obverse and the Tomb of the Unknown Soldier at the National Heroes Acre, and Mbuya Nehanda on the reverse.

$100

$100 note (Yellow): Depicts Domboremari with trees on the obverse and an African baobab (Adansonia digitata), and the ruins of Great Zimbabwe on the reverse.

Inflation and Buying Power of the Zimbabwean Dollar

Zimbabwe’s currency history is marked by extreme hyperinflation, especially in the early 2000s, leading to the collapse of the Zimbabwe dollar. Zimbabwe’s inflation issues began before 2007, tracing back to 1998 when its inflation rate was 47%.

The rate consistently increased, except for a slight drop in 2000, leading to hyperinflation. Early financial discipline after independence in 1980 shifted as the government prioritized political support over fiscal responsibility.

In 1997, financial concerns arose due to payments to war veterans and the forced acquisition of White-owned farms for redistribution to Black citizens, leading to currency depreciation and rising import prices.

The situation worsened in 2000 with the government’s land reform, disrupting agricultural production and causing a supply shock that increased prices.

In response, the central bank tightened monetary policy in 2004, which initially slowed inflation but strained the financial system. To counteract this, the central bank implemented quasi-fiscal policies, inadvertently causing demand-pull inflation and leading to hyperinflation by 2007. This hyperinflation persisted until foreign currencies replaced the Zimbabwean dollar.

Inflation is influenced by economic expectations, and once high, it’s difficult to control. For instance, in Zimbabwe, by the end of 2008, 1 US dollar was equal to over 2.6 trillion Zimbabwe dollars, a significant increase from 10,000 Zimbabwe dollars in 2005.

In 2009, the Zimbabwean dollar was revalued by removing twelve zeros from its banknotes, but this measure proved insufficient. Following three decades in power, President Robert Mugabe was ousted in 2017.

This hyperinflation severely impacted Zimbabwe’s economy, leading to a low GDP per capita and a financially struggling government.

In 2018, Zimbabwe’s inflation was 10.61% and was expected to surge to 577.21% by 2020. However, forecasts suggest a gradual decline thereafter. Given Zimbabwe’s history of poor monetary policy and extreme hyperinflation, these projections might be overly optimistic.

As of 2020, inflation rates soared to 540%, a lingering effect of this tumultuous period.

Zimbabweans now primarily seek to hold foreign currencies like US dollars, euros, or the more commonly available South African rand. However, the rand’s weak performance against other currencies highlights the ongoing challenge for Zimbabweans in finding a stable currency.

Currency Usage in Zimbabwe

In Zimbabwe, the official currency is the RTGS Dollar (ZWL), primarily used for most transactions. However, a multi-currency system allows the use of US Dollars (USD), Euros (EUR), South African Rand (ZAR), and Botswana Pula (BWP) in some cases.

USD is commonly used for larger transactions and imports, while RTGS Dollar is preferred for daily expenses like groceries and local transport. The RTGS Dollar’s value fluctuates against foreign currencies, and current exchange rates can be found at banks and online.

Visitors should bring USD for convenience and exchange some for RTGS Dollars at banks or authorized bureaus. It’s important to check with vendors about accepted currencies and use ATMs for accessing RTGS Dollars.

Is USD accepted in Zimbabwe?

In Zimbabwe, both the official RTGS Dollar and USD are commonly used, with USD being the preferred currency for larger purchases, imports, and in the tourism sector.

USD is often used, especially for larger purchases and in tourist areas. However, there can be difficulties like a shortage of small USD bills and varying acceptance of USD, especially in rural areas or for small transactions.

While USD is accepted for big-ticket items like electronics, appliances, imported goods, and services in tourist areas, not every business takes USD. Some small shops and local vendors may only accept the RTGS Dollar.

Cash transactions are predominant so it’s advisable to carry both USD and RTGS Dollar. For travel to Zimbabwe, it’s recommended to bring USD, especially for significant expenses, and exchange some into RTGS Dollar for smaller, everyday purchases.

Exchanging Currency in Zimbabwe

Exchanging currency in Zimbabwe involves several options and understanding them can make the process straightforward. Currency can be exchanged at banks, which are secure but might have longer wait times and less competitive rates, and they often require identification.

Currency exchange bureaus in tourist areas and cities offer quicker service and potentially better rates. Airports also have exchange counters, but their rates may be less favorable. Some hotels provide currency exchange as a last resort, but their rates are usually not the best.

When exchanging, consider fees and fluctuating exchange rates, and compare rates at different providers. It’s generally easier to exchange cash than traveler’s checks, but the latter may offer more security.

Exchange only what you need for immediate expenses to avoid carrying large amounts of cash. Ensure safety by avoiding street vendors for currency exchange, informing your bank of your travel plans, keeping receipts, and being vigilant against scams.

Where can I exchange Zimbabwe currency?

Exchanging currency in Zimbabwe, mainly the RTGS Dollar, can be done through various formal channels and convenience options. Banks like Stanbic Bank and CBZ Bank offer secure but often slower exchanges with less competitive rates and may require identification.

Currency exchange bureaus, found especially in tourist areas and major cities, provide faster service and potentially better rates; notable ones include Travelex and Bureau de Change. Licensed money changers are another option, but ensure they are approved by the Reserve Bank of Zimbabwe.

Hotels and airport counters also offer exchange services but usually at less favorable rates. For convenience, ATMs can be used to withdraw RTGS Dollars directly using a debit/credit card, and prepaid travel cards loaded with currency can be used for expenses.

What to know before exchanging currency in Zimbabwe

Exchanging currency in Zimbabwe is easy with proper planning and awareness. Familiarize yourself with the currency landscape, where the RTGS Dollar is official but USD and other foreign currencies are sometimes accepted.

Research exchange rates on sites like Xe.com and choose where to exchange based on fees, wait times, and security. Inform your bank of your travel plans to prevent blocked card transactions, bring some USD or Euros for major purchases, and consider traveler’s checks for added security.

Always carry identification for exchanges at banks or bureaus. When exchanging, compare rates, check for total costs including fees, count your money carefully, and keep receipts. Stay vigilant against scams and avoid street vendors for currency exchange.

Use ATMs to withdraw RTGS Dollars, but be aware of fees and limits. Prepaid travel cards are an option but compare their fees and rates. Exchange only what you need to minimize carrying large amounts of cash and be prepared to negotiate in markets.

Stay updated on rate fluctuations to make informed exchange and purchase decisions. By following these guidelines, you can confidently manage currency exchange in Zimbabwe and enjoy a hassle-free trip.

Choosing Between USD and Zimbabwe currency

Choosing between USD and Zimbabwe’s RTGS Dollar depends on your activities, location, and spending habits. USD is widely accepted for larger transactions, stable in value, and useful for tourist activities. It’s a good choice for emergencies or expensive purchases.

On the other hand, the RTGS Dollar, being the official currency, is essential for everyday purchases, local transportation, and smaller vendors, and may offer better deals. Tourists should carry some USD for significant expenses and exchange a small amount into RTGS Dollar for daily needs.

Business travelers might prefer USD for official and large transactions. Short-term visitors should use mostly RTGS Dollar for routine expenses, keeping USD for larger or emergency purchases.

Long-term residents might need a mix of both, depending on their spending patterns and locations frequented. The choice also varies with location; tourist areas favor USD, while rural areas might only accept RTGS Dollar.

By assessing each currency’s advantages and your specific needs, you can navigate Zimbabwe’s currency system effectively.

Exchange Rate

The exchange rate between the US dollar and Zimbabwean dollars changes with economic conditions. Using US dollars can shield you from exchange rate fluctuations during your trip. But, since prices in Zimbabwe are usually in local currency, exchanging some money is necessary.

Due to a high exchange rate, often more than 1:200, items priced in Zimbabwean dollars might appear very cheap to those exchanging US dollars. However, the local currency is unstable due to inflation, leading to rapidly changing exchange rates.

Convenience

In Zimbabwe, US dollars are commonly used for payments, especially for big purchases and in tourist-focused businesses. But smaller vendors, taxis, and local shops often prefer Zimbabwean dollars. It’s convenient to carry both currencies.

Fees

Banks and currency exchange offices charge fees, often 5-10% of the transaction, for exchanging money. To reduce these fees, you can exchange money before your trip and bring USD with you.

However, carrying large amounts of cash has higher security risks. Exchanging a large amount at once can help minimize fees. While some ATMs give out Zimbabwean dollars, they also have high fees. Exchanging at a bank usually offers better rates.

Tips

Monitor exchange rates to see if exchanging currencies is beneficial for you. A practical approach is to carry a combination of both currencies, ensuring readiness for any financial situation.

For most visitors, using a mix of USD and Zimbabwean dollars is practical. Exchange some currency before your trip, and then more upon arrival as needed, considering the exchange rate and where local currency is more useful. By being careful and using common sense, you can avoid problems and make your money go further in Zimbabwe.

Cost of Living in Zimbabwe

In Zimbabwe, the cost of living varies depending on whether you use USD or local currency. Using USD is convenient for travelers and helps avoid fees, while the Zimbabwean dollar offers a more local experience. Generally, living costs are lower than in Western countries, but as a tourist, you need to budget carefully and watch out for scams.

The cost of living in Zimbabwe varies based on lifestyle, location, and spending habits, and is generally lower than in developed countries. Urban areas like Harare and Bulawayo are more expensive compared to rural areas.

Essentials such as food, transportation, and housing are relatively affordable, while imported and luxury items are pricey. Rent for a one-bedroom apartment in Harare ranges from $300 to $800 per month.

Basic groceries are cheap, but imported foods and dining out can be more expensive, ranging from $5 to $20 per meal. Public transportation is very affordable at around $1 for a bus ride, but taxis start at $5.

Utilities cost between $30 and $50 monthly, with internet $103.12 monthly. Mobile plans start at $16.43 per month, and clothing and essentials are generally cheaper than in developed nations.

However, currency fluctuations and inflation can impact the cost of living, especially for imported goods, and using USD might be more expensive than RTGS Dollar for some purchases.

Don’t Get Scammed Tips

When visiting Zimbabwe, it’s crucial to handle your money carefully to avoid scams. Here are some key points to remember:

- Familiarize yourself with the official RTGS Dollar and other accepted currencies like USD and EUR. Learn to identify fake bills, plan your currency exchange at licensed bureaus or banks, and inform your bank about your travel.

- Be discreet with your cash, avoid showing large amounts in public, and use secure storage like money belts.

- Stay clear of unofficial currency exchanges and be wary of unsolicited helpers offering such services.

- Always confirm prices before transactions and check for counterfeit or damaged bills. Use ATMs in secure locations, and opt for card payments in trusted establishments to minimize cash handling.

- Carry a backup card for emergencies. Remember, if an exchange rate seems too good to be true, it likely is. Trust your instincts, and don’t hesitate to seek help or advice from trusted locals or authorities if unsure about any financial dealings.

By being cautious and using official channels for currency exchange, you can enjoy your trip to Zimbabwe without worrying about currency scams.