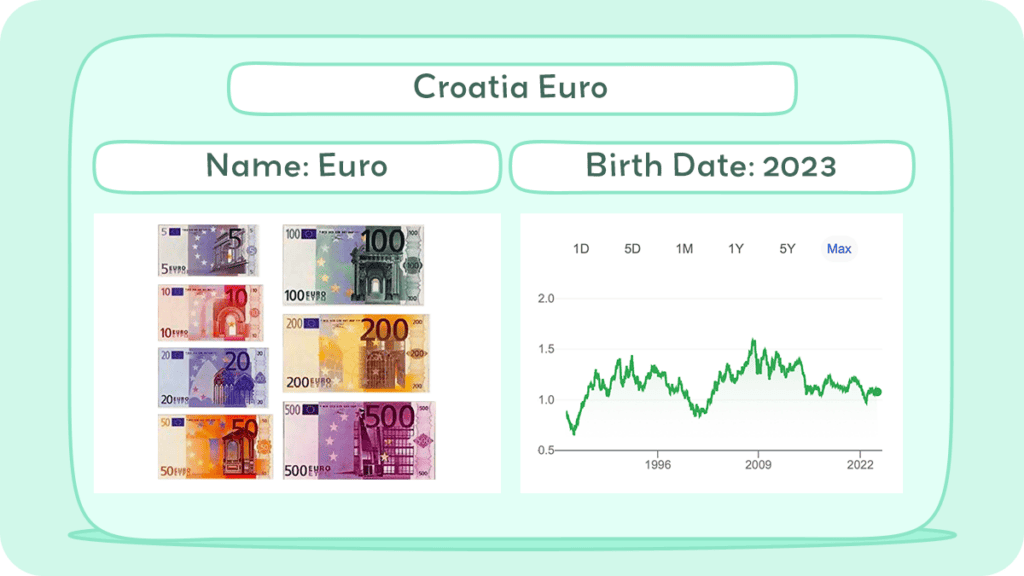

The official currency of Croatia is the Euro, which was adopted on January 1st, 2023, replacing the kuna. This change was a result of Croatia’s entry into the Eurozone, a monetary union of 19 European Union countries that use the Euro as their official currency.

Before 2023, the kuna was the official currency of Croatia, and it had been in use since 1994. The kuna was subdivided into 100 lipa, and it was issued by the Croatian National Bank. While the kuna is no longer in use, it may still be possible to exchange it for Euros at certain locations, such as banks or exchange offices.

Understanding the currency in Croatia is essential for any traveler, as it affects everything from shopping to dining out. With the Euro now the official currency, it’s important to know how to exchange, use, and pay with Euros in Croatia.

Historical Journey of Croatia Currency

Croatia has a rich history of currency, dating back to the early days of the Croatian territory. The first recorded currency used in the area was the Roman currency, which was used up until the 7th century. After that, many different empires and kingdoms rose and fell, each with their own currency.

In 1527, the Croatian lands became part of the Habsburg Monarchy, and the first official currency of Croatia was introduced, the Kreutzer. This was a silver coin that was used throughout the Habsburg Empire.

In 1868, the Austro-Hungarian Empire introduced the Austro-Hungarian krone as its official currency, which was also used in Croatia.

After World War I, Croatia became part of the Kingdom of Serbs, Croats, and Slovenes, which later became Yugoslavia. The Yugoslav dinar was introduced as the official currency, and it was used until Croatia gained independence in 1991.

In 1994, the modern Croatian currency, the kuna, was introduced. The kuna is divided into 100 lipa, and it has been the official currency of Croatia ever since. The kuna has gone through several changes over the years, including a redesign of the banknotes and coins in 2012.

Despite its relatively short history, the kuna has had its fair share of challenges, including inflation and changes in buying power. In the early 2000s, Croatia experienced high inflation rates, which led to a decrease in the value of the kuna. However, the Croatian National Bank implemented measures to combat inflation, which helped stabilize the currency.

Kuna

The Croatian kuna, introduced on 30 May 1994, was the official currency of Croatia until its replacement by the euro in 2023. The kuna was divided into 100 lipa, with the Croatian National Bank issuing the banknotes and the Croatian Mint producing the coins.

The name “kuna” translates to “marten” in Croatian, a reference to the use of marten pelts as a medium of exchange in medieval times. Similarly, “lipa” means “linden (lime) tree,” which had significance in historical trading.

The first minted currency in Slavonia was the frizatik in the 13th century, followed by the marten-adorned silver banovac.

The concept of a kuna currency resurfaced in 1939 under the Banovina of Croatia and again in 1941 with the Independent State of Croatia kuna, which circulated until 1945. After this period, the Yugoslav dinar replaced the kuna.

The modern kuna, introduced in 1994, marked the transition from the Croatian dinar used since 1991. Initially pegged to the German Mark, the kuna later aligned its value with the euro.

The choice of the name “kuna” was controversial due to its association with the Independent State of Croatia, but it was also historically used during the Banovina of Croatia and by the ZAVNOH.

Croatia’s long-standing policy was to maintain the kuna’s exchange rate stability against the euro. Croatia joined the EU in 2013 and the Exchange Rate Mechanism in 2020. The kuna was finally replaced by the euro in 2023, with a two-week transition period for dual circulation.

The kuna coins, introduced in 1994, came in various denominations. They featured names of plants or animals in Croatian or Latin, depending on the year of issue. Due to their low value, 1 and 2 lipa coins became rarely used and were later minted mainly for collectors.

Croatian banknotes, designed by Miroslav Šutej and Vilko Žiljak, featured notable Croatians and architectural motifs, with tactile features for the visually impaired and microprinted national anthem segments.

The first series was issued in 1993, with subsequent series in 2001, 2004, 2012, and 2014, featuring enhanced security and similar designs. The older series were gradually withdrawn but remained exchangeable at the Croatian National Bank.

Euro

Since joining the European Union, Croatia has adopted the euro as its official currency, effective from 1 January 2023. The euro replaced the kuna and is now the sole legal tender in Croatia. Euro banknotes come in denominations of 5, 10, 20, 50, 100, and 200 euros.

Additionally, euro coins are available in 1 and 2 euros, as well as in smaller denominations of 1, 2, 5, 10, 20, and 50 cents. Although the issuance of 500 euro banknotes ceased in 2019, they remain legal tender and can still be used in transactions.

Euro Coins

The euro, introduced in 1999, is the official currency of the Eurozone, consisting of 20 member countries. It is divided into eight coin denominations, ranging from one cent to two euros, each featuring a common reverse side depicting a map of Europe.

However, the obverse side varies among member countries, showcasing unique designs. In addition to Eurozone members, four European microstates (Andorra, Monaco, San Marino, and Vatican City) also use the euro with their own designed coins. The coins are minted at national mints, adhering to strict quotas, while the European Central Bank manages the common side.

Over the years, the euro’s design has evolved, with changes in 2007 reflecting the EU’s enlargement and updates in 2017 for some denominations. The euro’s introduction aimed to foster economic and monetary union, contributing to stability and collaboration among member states.

The coins incorporate security features, and their design considers tactile elements for the visually impaired. While national sides of regular coins can be updated every 15 years, commemorative coins may vary more frequently. As of 2023, 24 countries issue euro coins with their national sides, reflecting the diversity within the Eurozone.

Euro Bills

Euro banknotes, the common currency of the eurozone, have evolved since their 1999 inception. Initially, under ES1, these €5 to €500 notes featured a uniform design with the European flag, a map, and “euro” in Latin and Greek.

The designs, by Robert Kalina, resulted from a 1996 competition. ES1, made of pure cotton, excluded non-EU Cyprus and Malta. ES2, or Europa series, introduced size changes and enhanced durability with updated security features. Reinhold Gerstetter redesigned the notes, featuring Mario Draghi’s signature post-March 2012.

Anticipated in 2024, the third series will redesign notes based on public-voted themes. Security features include confidential elements like holograms and watermarks. The Europa series introduced Europa’s face, reflecting EU expansion and adding Bulgaria’s Cyrillic alphabet. Circulating since 2013, it phased out the €500 note due to concerns about criminal use.

Security features include watermarks, holograms, color-changing ink, and more, with consultation for the visually impaired. A 2021 plan outlines the next redesign with potential themes like “European culture.”

The ECB monitors euro banknote circulation and stock, ensuring integrity since its 2002 introduction. The euro’s history involves expansion, formalized political authority through the Lisbon Treaty, and usage across multiple EU countries. The seven denominations feature stylized historical European architectural illustrations on both sides.

Inflation and Buying Power of Euro

The transition to the euro in Croatia, which took place in 2023, has had a relatively minor impact on inflation and the buying power of the currency. An analysis focusing on major Croatian retailers revealed that around 65% of product prices remained unchanged after the euro changeover.

Interestingly, about 25% of products actually experienced a price decrease, while only around 10% saw an increase. This indicates that retail chains generally adhered to legal rounding rules which required them to convert prices using the full amount of the conversion rate and round to the nearest cent.

Moving forward, it’s expected that retailers will adjust their pricing strategies to new attractive levels, a process observed in other countries following the euro adoption. However, any price adjustments are likely to be a part of regular changes rather than an unwarranted impact on inflation.

Economic activity in Croatia, including the implications of the euro changeover, is projected to be subdued in 2023, with a gradual recovery expected in the following years. The country’s GDP growth for 2023 is anticipated to be 1.3%, an improvement from the 0.8% forecasted earlier.

This growth, however, is restrained by various factors, including the fallout from Russia’s invasion of Ukraine, persistent high inflation, and tighter financial conditions. The region’s economic output is expected to grow by 1.4% in 2023, with a more substantial increase to an average of 2.7% over 2024-2025 as inflation eases and domestic demand recovers.

Croatia’s inflation rate, which had peaked at 13.5% in November 2022, is predicted to average around 7.2% in 2023.

Currency Usage in Croatia

Croatia officially adopted the euro as its currency on January 1, 2023. Prior to this, the Croatian kuna (HRK) was the official currency. The euro is now the only legal tender in Croatia, and all transactions must be conducted in euros.

Is USD Accepted in Croatia?

While some businesses in Croatia may accept US dollars (USD), it is not a widely accepted currency. It is recommended that you exchange your USD for euros before traveling to Croatia. Many banks and exchange offices in Croatia offer currency exchange services. It is advisable to use these services to avoid any potential scams or frauds.

When exchanging currency, it is important to be aware of the exchange rates and fees charged by the bank or exchange office. Some banks may charge a commission fee for currency exchange, while others may offer better rates but charge a higher commission fee. It is recommended that you compare exchange rates and fees before exchanging currency.

In Croatia, credit and debit cards are widely accepted, especially in larger cities and tourist areas. However, it is still advisable to carry cash for smaller transactions or in case of emergencies.

ATMs are available throughout Croatia, and most accept international cards. It is recommended that you inform your bank of your travel plans to avoid any issues with accessing your funds.

Overall, it is best to use the euro for all transactions in Croatia. While USD may be accepted in some places, it is not a widely accepted currency and may result in higher fees or unfavorable exchange rates.

Exchanging Currency in Croatia

If you’re planning a trip to Croatia, you’ll need to exchange your foreign currency for the euro. Here’s what you need to know about exchanging currency in Croatia.

Where can I exchange Croatia currency?

You can exchange currency at banks, exchange offices, and ATMs in Croatia. Banks usually offer the best exchange rates, but they may charge a commission. Exchange offices are also a good option, but be sure to compare rates and fees before exchanging your money.

ATMs are widely available in Croatia, and they usually offer a fair exchange rate. However, be aware that your bank may charge additional fees for using an ATM abroad.

What to know before exchanging currency in Croatia

Before exchanging currency for the euro, it’s important to check the current exchange rate as it can fluctuate. Always bring your passport for identification at banks or exchange offices.

It’s advisable to avoid currency exchange services at hotels due to their typically high fees and unfavorable rates. In Croatia, be cautious of counterfeit money by examining bills carefully and requesting a different one if you have doubts.

Lastly, always keep your currency exchange receipts, as they might be necessary for re-exchanging euro to your home currency when leaving Croatia.

Exchanging currency in Croatia is easy and convenient. Just be sure to compare rates and fees before exchanging your money, and be aware of the potential pitfalls. With a little knowledge and preparation, you can get the most out of your money while traveling in Croatia.

Choosing Between USD and Croatia Currency

When traveling to Croatia, you will need to decide whether to use USD or the local currency, the euro (EUR). Here are some factors to consider when making your decision.

Exchange Rate

The exchange rate between USD and EUR can fluctuate, so it’s important to check the current rate before making any transactions. You can use online currency converters like Xe or Wise to get the most up-to-date rates.

Keep in mind that the exchange rate you see online may not be the same rate you receive when exchanging currency or using your credit card.

Convenience

While some places in Croatia may accept USD, it’s generally more convenient to use the local currency. Most shops, restaurants, and other businesses in Croatia only accept EUR. Additionally, if you plan on using public transportation or visiting local markets, you will need to have kuna on hand.

Fees

When exchanging currency, be aware of any fees associated with the transaction. Banks and exchange offices may charge a commission or a flat fee for exchanging currency.

Additionally, if you use your credit card to make purchases in Croatia, you may be charged a foreign transaction fee. Check with your bank or credit card company to see what fees may apply.

Tips

When choosing between using USD and EUR in Croatia, it’s beneficial to have euros for everyday expenses like public transportation and local market purchases. It’s important to stay updated on the current exchange rate to make informed decisions.

Also, be aware of any fees for currency exchange or credit card usage. For exchanging USD to EUR, banks or exchange offices usually offer better rates and lower fees compared to hotels or tourist shops.

By considering these factors, you can make an informed decision about whether to use USD or EUR when traveling to Croatia.

Cost of Living in Croatia

If you are planning to live in Croatia, it is essential to consider the cost of living in the country. According to Numbeo, the cost of living in Croatia is, on average, 39.0% lower than in the United States. Here’s a breakdown of the cost of living in Croatia:

Housing is one of the most significant expenses in Croatia. The cost of rent depends on the location and the size of the apartment.

For instance, renting a one-bedroom apartment in the city center can cost around 552 EUR ($540) per month, while a three-bedroom apartment can cost around 912 EUR ($1,000) per month. If you are on a tight budget, you can consider living in the suburbs where the rent is relatively cheaper.

The cost of food and drinks in Croatia is relatively affordable. You can find a variety of local and international cuisines in restaurants and cafes. A meal in an inexpensive restaurant can cost around 10 EUR ($10 USD), while a three-course meal for two people in a mid-range restaurant can cost around 53 EUR ($57 USD).

If you prefer to cook at home, the cost of groceries is relatively cheaper. For instance, a loaf of bread can cost around 1.23 EUR ($1.34 USD), while a liter of milk can cost around 1.09 EUR ($1 USD).

The cost of transportation in Croatia is relatively affordable. You can use public transport such as buses and trams to get around the city. A one-way ticket can cost around 1.40 EUR ($1.52 USD), while a monthly pass can cost around 44.08 EUR ($47 USD). If you prefer to drive, you can rent a car for around 28 EUR ($31) per day.

The healthcare system in Croatia is relatively affordable and accessible. If you are a resident, you can access public healthcare services for free or at a subsidized cost. Private healthcare services are also available, but they can be relatively expensive.

The cost of utilities such as electricity, water, and gas is relatively affordable in Croatia. If you are renting an apartment, the cost of utilities may be included in the rent. However, if you own a house, you may need to pay for utilities separately. For instance, the cost of basic utilities for a 85m2 apartment can cost around 150.26 ($162 USD) per month.

Overall, the cost of living in Croatia is relatively affordable compared to other European countries. However, the cost of living may vary depending on your lifestyle and location.

Don’t Get Scammed Tips

When traveling to Croatia, it’s important to be aware of potential scams related to currency exchange. Here are some tips to help you avoid being scammed:

1. Use official exchange offices

Make sure to only exchange your currency at official exchange offices, banks, or ATMs. Avoid exchanging money on the street or from individuals who approach you. These unofficial exchanges may offer better rates, but they are often scams that will leave you with counterfeit money or less money than you expected.

2. Check exchange rates

Before exchanging your money, check the official exchange rates to make sure you are getting a fair deal. You can find the official exchange rates on the Croatian National Bank website or by using a currency exchange app. Be wary of exchange offices that offer rates that are significantly different from the official rates.

3. Count your money

Always count your money before leaving the exchange office or ATM. Make sure you have received the correct amount and that the bills are not counterfeit. If you suspect that you have been given counterfeit money, notify the exchange office or bank immediately.

4. Pay attention to fees

Exchange offices and ATMs may charge fees for exchanging currency or withdrawing money. Make sure you are aware of these fees before making a transaction. Some exchange offices may advertise “no commission,” but they may have hidden fees or offer worse exchange rates to compensate.

5. Use credit cards

Using a credit card is a safe and convenient way to pay for goods and services in Croatia. Most hotels, restaurants, and shops accept credit cards, and you will get a fair exchange rate. Just be aware that some places may charge a fee for using a credit card.

By following these tips, you can avoid being scammed when exchanging currency in Croatia. Always be aware of your surroundings and use common sense when dealing with money.