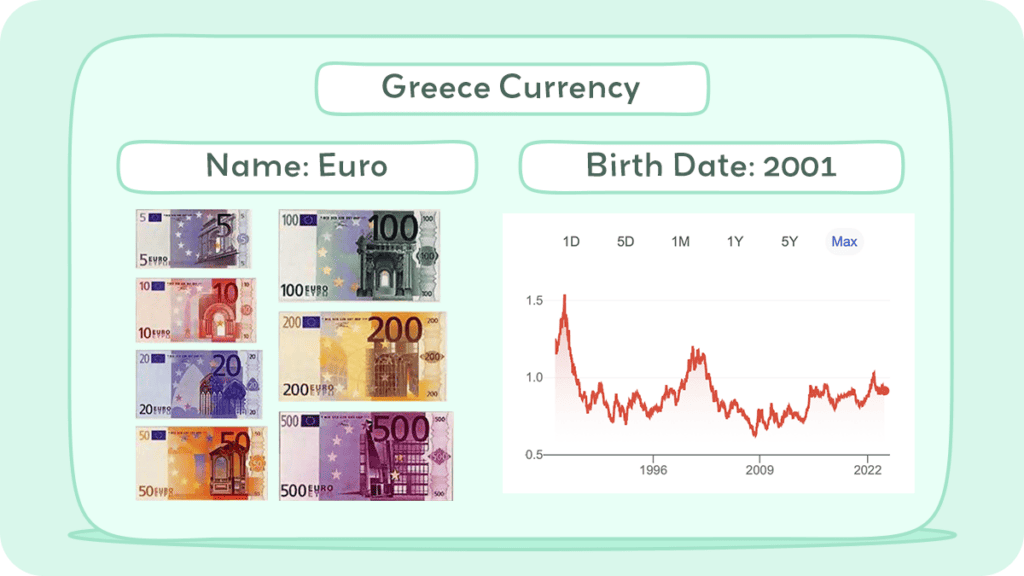

Greece has been using the euro as its official currency since 2001 when it became a member of the Eurozone. The euro is the second most traded currency in the world, after the US dollar.

It is divided into 100 cents and comes in denominations of €500, €200, €100, €50, €20, €10, and €5. Euro coins come in various denominations, including €2 and €1 coins as well as smaller value coins in denominations of 50 cents, 20 cents, 10 cents, 5 cents, 2 cents, and 1 cent.

The history of Greek currency is a fascinating journey that spans thousands of years. This article will explore the various denominations of the euro, both in coins and banknotes, and the historical evolution of Greek currency, from ancient times through the Drachma era to the current use of the euro.

Historical Journey of The Greece Currency

Greece has a long and rich history of currency that dates back to ancient times. The currency used by the ancient Greeks was not standardized and consisted of commodities such as wheat, barley, and metal coins. The modern Greek currency, the drachma, was introduced in 1832 after the country gained independence from the Ottoman Empire.

The drachma was the official currency of Greece until 2001 when it was replaced by the euro. The exchange rate between the drachma and the euro was fixed at 340.75 drachmas per euro. The euro became the official currency of Greece on January 1, 2002, and the drachma ceased to be legal tender.

Drachma

The modern drachma was reintroduced in Greece in 1832, replacing the phoenix as the official currency. Initially, it was subdivided into 100 lepta. Early coinage included copper, silver, and gold coins, with the drachma coin containing 90% silver.

In 1868, Greece joined the Latin Monetary Union, aligning the drachma’s value and weight with the French franc. This led to the issuance of new copper, silver, and gold coins. However, by 1912, coin issuance ceased due to World War I and the collapse of the Latin Monetary Union.

From 1926 to 1930, new coins were introduced for the Hellenic Republic, including cupro-nickel and nickel coins. The first modern drachma saw its last coins issued during this period.

Banknotes were issued by the National Bank of Greece from 1841 to 1928, and subsequently by the Bank of Greece until 2001. Early notes ranged from ₯10 to ₯500, with smaller denominations introduced later.

The Greek economy faced challenges, including a forced loan in 1922 to finance the budget deficit, leading to the devaluation of banknotes. Hyperinflation during the German-Italian occupation in World War II resulted in high denomination notes.

In 1944, the second modern drachma was introduced, with old drachmas exchanged for new ones at a rate of ₯50,000,000,000 to ₯1. This period saw high inflation, leading to the issuance of various denominations by both the government and the Bank of Greece.

The third modern drachma was introduced in 1953, joining the Bretton Woods system, and revalued in 1954 at a rate of ₯1,000 to ₯1. Despite initial stability, the drachma’s value declined over the years.

Coins during the third drachma featured historical figures and were made in various metals, including cupro-nickel and aluminium-bronze. The last series of coins was issued in 1976, with themes reflecting Greek history and culture.

The subdivision of the drachma, the lepton, became practically obsolete by 1990 due to inflation. The Greek government didn’t attempt a redenomination, which could have eased the transition to the euro.

In 2002, the euro replaced the drachma, but the transition was challenging due to the complex exchange rate and initial public confusion over the value of euro coins compared to drachma coins. The euro’s introduction led to price adjustments for various goods, including bottled water.

Euro

Greece became a member of the European Union in 1981 and adopted the euro in 2001, joining the first group of countries to introduce euro banknotes and coins on January 1, 2002. The euro initially existed as ‘book money’ for a transitional period of one year before the physical banknotes and coins were introduced.

The period of dual circulation, where both the Greek drachma and the euro were legal tender, ended on February 28, 2002. The National Central Bank of Greece exchanged drachma coins until March 1, 2004, and drachma banknotes until March 1, 2012.

Euro coins

The euro, introduced in 1999, is the official currency of the Eurozone, consisting of 20 member countries. It is divided into eight coin denominations, ranging from one cent to two euros, each featuring a common reverse side depicting a map of Europe.

However, the obverse side varies among member countries, showcasing unique designs. In addition to Eurozone members, four European microstates (Andorra, Monaco, San Marino, and Vatican City) use the euro with their own designed coins. The coins are minted at national mints, adhering to strict quotas, while the European Central Bank manages the common side.

Over the years, the euro’s design has evolved, with changes in 2007 reflecting the EU’s enlargement and updates in 2017 for some denominations. The euro’s introduction aimed to foster economic and monetary union, contributing to stability and collaboration among member states.

The coins incorporate security features, and their design considers tactile elements for the visually impaired. While national sides of regular coins can be updated every 15 years, commemorative coins may vary more frequently. As of 2023, 24 countries issue euro coins with their national sides, reflecting the diversity within the Eurozone.

Euro bills

Euro banknotes, the common currency of the eurozone, have evolved since their 1999 inception. Initially, under ES1, these €5 to €500 notes featured a uniform design with the European flag, a map, and “euro” in Latin and Greek.

The designs, by Robert Kalina, resulted from a 1996 competition. ES1, made of pure cotton, excluded non-EU Cyprus and Malta. ES2, or Europa series, introduced size changes and enhanced durability with updated security features. Reinhold Gerstetter redesigned the notes, featuring Mario Draghi’s signature post-March 2012.

Anticipated in 2024, the third series will redesign notes based on public-voted themes. Security features include confidential elements like holograms and watermarks. The Europa series introduced Europa’s face, reflecting EU expansion and adding Bulgaria’s Cyrillic alphabet. Circulating since 2013, it phased out the €500 note due to concerns about criminal use.

Security features include watermarks, holograms, color-changing ink, and more, with consultation for the visually impaired. A 2021 plan outlines the next redesign with potential themes like “European culture.” The ECB monitors euro banknote circulation and stock, ensuring integrity since its 2002 introduction. The euro’s history involves expansion, formalized political authority through the Lisbon Treaty, and usage across multiple EU countries. The seven denominations feature stylized historical European architectural illustrations on both sides.

Inflation and Buying Power of Euro

The inflation rate in Greece has been volatile in recent years, with a high of 4.2% in 2017 and a low of -1.1% in 2014. Inflation can have a significant impact on the buying power of the Greek currency, as it affects the cost of goods and services.

Greece’s adoption of the euro has had a significant impact on its economy. The Eurozone is an economic and monetary union of 19 European Union (EU) member states that have adopted the euro as their currency.

Being part of the Eurozone has made trade and travel easier for Greece, as it eliminates the need for currency exchange and reduces transaction costs. However, it has also limited Greece’s ability to use monetary policy to address economic issues, as the European Central Bank (ECB) sets interest rates for the entire Eurozone.

The modern currency system in Greece is based on the euro, which has both benefits and drawbacks. While it has made trade and travel easier, it has also limited Greece’s ability to use monetary policy to address economic issues.

Currency Usage in Greece

In Greece, the Euro (EUR) is the official currency, used in all transactions. It’s available in banknotes (€5 to €500) and coins (€1, €2, and cents ranging from 1 to 50). Credit and debit cards are widely accepted, especially in urban areas and tourist spots. However, carrying some cash is recommended, particularly for smaller islands or rural locations.

ATMs are common and accept international cards, though they may charge fees. Smaller places often prefer cash, and it’s also useful for tips and small purchases. Currency exchange is available at banks, airports, and exchange offices, but rates vary. It’s wise to compare these before exchanging money.

Prices in Greece include Value Added Tax (VAT), and as a tourist, you might be eligible for VAT refunds on certain purchases. There’s no restriction on carrying cash within Greece, but amounts over €10,000 must be declared when entering or leaving the EU.

It’s important to budget for your trip, considering the cost of living, especially in touristy areas. While digital payments are common, cash is still a significant part of transactions, particularly in less developed areas. The Euro has made travel and economic transactions within Europe easier.

Is USD Accepted?

If you’re traveling to Greece, you may be wondering whether you can use USD in the country. While some tourist-heavy areas may accept USD, the official currency in Greece is the Euro. Therefore, it’s recommended that you exchange your USD for Euros before traveling to Greece. You can exchange your currency at banks, exchange offices, or ATMs throughout the country.

Exchanging Currency in Greece

The official currency in Greece is the Euro (EUR). You can exchange your currency for Euros at banks, exchange offices, and some hotels. However, keep in mind that exchange rates may vary between different locations, so it is best to compare rates before exchanging your money.

Where can I exchange Greece Currency?

When it comes to using the euro in Greece, you’ll find that it is widely accepted. You can use cash or credit cards at most businesses, including restaurants, shops, and hotels. However, it’s always a good idea to carry some cash with you, especially if you plan to visit more rural areas where credit card acceptance may be limited.

Banks are the most reliable and secure places to exchange your currency. They offer competitive exchange rates and do not charge high fees. You can find banks in most major cities and tourist areas. Exchange offices are also available, but they may have higher fees and less favorable exchange rates. You can also exchange currency at some hotels, but their exchange rates may not be as competitive as banks.

What to Know Before Exchanging

One thing to keep in mind is that Greece has a cash-based culture, so you may find that some smaller businesses prefer cash payments. Additionally, it’s important to note that Greece has a value-added tax (VAT) of 24% on most goods and services, so be prepared for slightly higher prices than you may be used to. Understanding the currency in Greece is an important part of planning your trip and will help ensure a smooth and hassle-free experience.

Before exchanging your currency, be sure to check the current exchange rate. You can use online currency converters such as Xe to get an idea of the current rate. Also, make sure to bring your passport or ID with you when exchanging currency, as it is required by law in Greece.

It is also important to note that some exchange offices and hotels may advertise “commission-free” exchanges, but they may have hidden fees or unfavorable exchange rates. Therefore, it is best to compare rates and fees between different locations before exchanging your money.

Choosing between USD and Greece Currency

When traveling in Greece, it’s generally best to use the Euro for transactions. Although US dollars might be accepted in some tourist areas, the Euro is the official currency and is widely accepted everywhere in the country. Using Euros can also help you avoid any potential issues with exchange rates and additional fees.

Both currencies are widely accepted in the country, but there are some factors to consider when choosing which one to use.

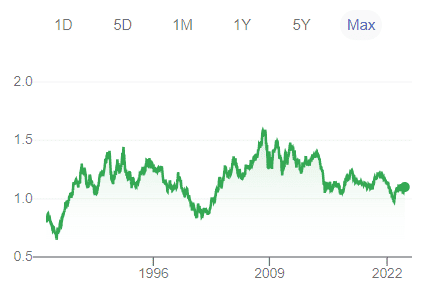

Exchange Rate

While USD may be accepted in some areas of Greece, it’s recommended that you exchange your currency for Euros before traveling to the country. When choosing between USD and Greece currency for transactions, it’s important to consider the exchange rate and any associated fees.

The exchange rate is the value of one currency with another. For Greece, the currency is the Euro. Keep in mind that exchange rates can fluctuate frequently, so it is important to keep an eye on them if you plan on traveling or conducting business in Greece.

Convenience

When it comes to using money in Greece, you have two main options: cash and cards. While cash is accepted almost everywhere, it’s always a good idea to have a credit or debit card on hand as well. Many hotels, restaurants, and shops accept credit cards, but smaller establishments may only accept cash.

It’s important to note that some ATMs in Greece may charge a fee for withdrawing cash, so it’s a good idea to check with your bank before you go. Additionally, some credit cards may charge foreign transaction fees, so it’s a good idea to check with your credit card company to see if they offer a card with no foreign transaction fees.

Fees

When traveling to Greece, it’s important to have an understanding of the country’s currency and how to manage your money. The official currency in Greece is the Euro, and it’s recommended to exchange your money at a bank or exchange office for the best rates. Avoid exchanging currency at hotels or tourist areas, as they often charge higher fees.

Credit and debit cards are widely accepted in Greece, with Visa and Mastercard being the most commonly used. However, it’s important to be aware of any international transaction fees that your bank may charge. You may also want to inform your bank of your travel plans to prevent any issues with your cards being blocked.

ATMs are readily available throughout Greece, and they accept most major debit and credit cards. However, some ATMs may charge a fee for withdrawals, so it’s important to check with your bank beforehand. Additionally, some ATMs may have lower withdrawal limits, so plan accordingly.

Tips

Greece can be an affordable destination, but it’s important to budget accordingly. Prices can vary depending on the time of year and location, so it’s a good idea to do some research before you go.

One way to save money is to stay in budget accommodations, such as hostels or guesthouses. These types of accommodations can be found throughout Greece and can be much cheaper than hotels. Additionally, eating at local tavernas and markets can be a great way to save money on food.

It’s also important to budget for transportation. While public transportation is available in most major cities, it may be necessary to rent a car or take a taxi to get to more remote locations. Finally, don’t forget to budget for activities and attractions, such as museums and tours.

By planning and budgeting accordingly, you can make the most out of your trip to Greece without breaking the bank.

The official currency of Greece is the Euro (EUR), which is used by 19 countries in Europe. As a result, you can use the Euro to settle all financial obligations in Greece, including paying for goods and services, taxes, and debts.

There are no restrictions on the amount of foreign currency you can bring into Greece, but if you’re carrying more than €10,000 (or its equivalent in another currency), you must declare it to the customs authorities upon arrival. Failure to do so can result in fines or legal action.

Greece has implemented various measures to prevent the circulation of counterfeit currency. One of the most effective measures is the use of holograms on banknotes, which are difficult to replicate and provide a visual cue for identifying genuine currency.

To ensure that you’re receiving genuine currency, it’s recommended that you exchange money at authorized exchange offices or banks. Be wary of street vendors or individuals offering to exchange currency, as they may be dealing in counterfeit money.

If you suspect that you’ve received a counterfeit banknote, you should contact the police immediately. It’s important to note that knowingly passing counterfeit currency is a criminal offense in Greece, punishable by fines and imprisonment.

Cost of Living in Greece

The cost of living in Greece can vary depending on where you live and what your lifestyle is like. According to Numbeo, the cost of living index for Greece is 57.95, which is lower than the United States’ index of 72.56. This means that, on average, the cost of living in Greece is lower than in the US. However, it is important to note that certain expenses such as rent, utilities, and transportation can still be significant.

Greece is known for its Mediterranean weather, amazing food, hospitable people, and the opportunity for island-hopping. Besides these attractions, the cost of living in Greece is another factor that might draw you to this beautiful country. Compared to the U.S., living expenses from housing to dining and healthcare are generally lower in Greece.

Housing costs in Greece vary based on location. Mainland villages are usually more affordable than major cities like Athens or Thessaloniki. Islands can be pricier, with costs depending on the island’s popularity. The cost of buying property has slightly increased due to the Golden Visa program. For example, in Athens, a furnished two-bedroom apartment costs about $1200 monthly to rent and $295,000 to purchase. In Chania, Crete, rent is around $860, and buying costs about $250,000. Nafplio, a city by the sea on the Peloponnese, has similar rent prices but lower purchase costs at around $160,000.

Greek cuisine is not only delicious and healthy but also caters to various dietary needs. Despite some price increases in 2023, grocery shopping and dining out remain reasonable. The quality of food, especially fresh, locally sourced produce, is a highlight. For instance, a dozen eggs cost around $3.10, a kilogram of rice is $1.85, and dining out for two at an average restaurant is about $40. Grocery costs for two people average approximately $345 per month.

Transportation costs depend on your location and reliance on public transport. Athens has a comprehensive and affordable public transportation system. For example, a single ticket costs $1.30, and a 30-day pass is $29.00. Taxi fares and car ownership costs have risen with fuel prices. Owning a car is more economical in remote areas without extensive public transport. Insurance is cheaper compared to the U.S., but petrol prices are high at $2.10/liter.

Utilities have increased due to inflation but are still lower than in many EU countries and the U.S. Average monthly costs for electricity, including local taxes for services like rubbish removal, are around $45. Water bills average $32 monthly. Mobile phone services cost about $21.50 per month, and internet and cable TV are around $45 monthly.

If you’re considering relocating to Greece, it’s essential to research and plan your move carefully. Understanding the cost of living, housing options, healthcare, and daily expenses can help you make a well-informed decision. With its lower cost of living, beautiful landscapes, and rich culture, Greece could be the ideal place for those seeking a new adventure in life.

Don’t get scammed tips

While traveling in Greece, it’s important to be aware of potential scams and take precautions to avoid them. Here are some tips to help you avoid scams:

- Be cautious of people offering to exchange money on the street, as they may be offering counterfeit currency.

- When paying with a credit card, keep an eye on your card and make sure it’s not being skimmed or cloned.

- Be wary of people offering to help with your luggage or guide you around, as they may be trying to scam you for money.

- When using an ATM, make sure to cover the keypad when entering your PIN to prevent anyone from seeing it.

By following these tips, you can help ensure a safe and hassle-free experience when managing your money in Greece.