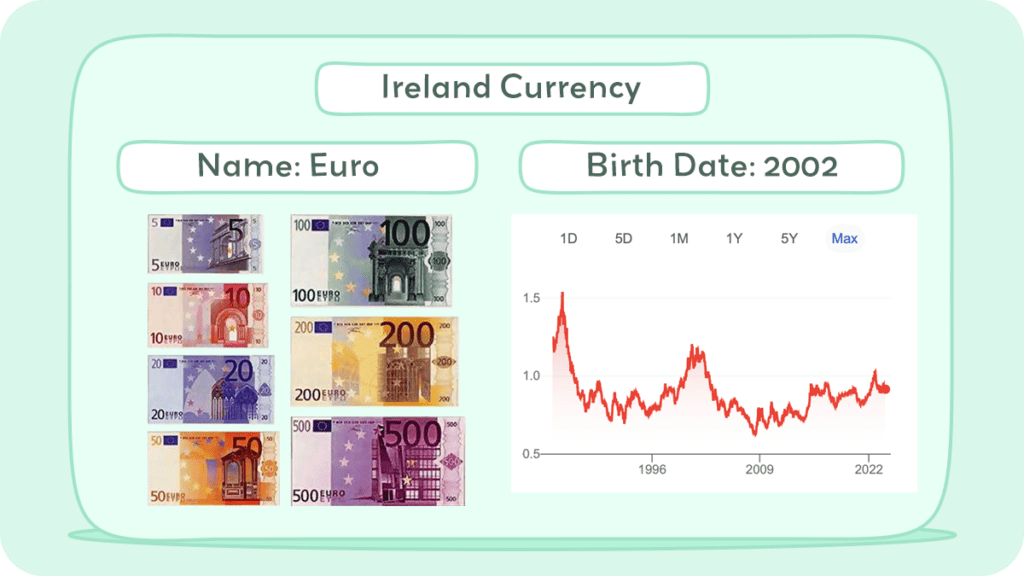

Ireland uses the euro as its official currency, which is also used by 18 other European Union countries. The euro is divided into 100 cents and comes in banknotes of €5, €10, €20, €50, €100, €200, and €500, as well as coins of 1c, 2c, 5c, 10c, 20c, 50c, €1, and €2.

However, if you plan on visiting Northern Ireland, which is part of the United Kingdom, you’ll need to use pound sterling. The pound is divided into 100 pence and comes in banknotes of £5, £10, £20, £50, and £100, as well as coins of 1p, 2p, 5p, 10p, 20p, 50p, £1, and £2. Some shops located near the border accept both euro and pound sterling, so it’s always a good idea to have both currencies on hand if you plan on traveling between the Republic of Ireland and Northern Ireland.

Understanding Ireland’s currency is important for any traveler to the country. In this article, we will tackle the Euro and the British Pound Sterling, as well as exchange rates and payment methods so you can ensure a smooth and hassle-free trip.

Historical Journey of Irish Currency

The official currency of the Republic of Ireland is the euro, while Northern Ireland uses the pound sterling. This means that if you’re traveling between the two regions, you’ll need to be aware of the different currencies in use.

Irish Pound

The Irish pound, or punt, served as the official currency of the Republic of Ireland until the year 2002 when it was replaced by the euro. With its ISO 4217 code IEP and symbol £ (or £Ir for distinction), the Irish pound had a rich historical journey marked by various developments and transformations.

Dating back to the late 10th century, the earliest Irish coinage operated on an £sd system, dividing one pound into twenty shillings, each comprising twelve silver pence. The establishment of parity with the English pound by King John in 1210 aimed to facilitate the flow of Irish silver into the English economy. However, divergences emerged in 1460 when Irish coins deviated in silver content from their English counterparts, leading to differing values.

During the Williamite War of 1689–1691, King James II, no longer in power in England and Scotland, issued an emergency base-metal coinage known as gun money. In 1701, a fixed relationship between the Irish pound and sterling was set at £13 Irish to £12 sterling, allowing for the circulation of Irish copper coins with English silver coins. Despite the Kingdom of Ireland becoming part of the United Kingdom in 1801, the Irish pound continued until January 1826 when it merged with the pound sterling. Post-1826, Irish banks issued paper currency denominated in sterling, and distinctly Irish coins were not minted until the establishment of the Irish Free State in the 20th century.

Following independence in 1922, the Irish Free State introduced its currency in 1928. The new Free State pound was pegged at a 1:1 ratio with sterling and maintained this de facto parity for fifty years. The £sd system persisted, featuring distinctive coins and notes, including a commemorative 10/– coin in 1966. In 1937, the state’s name changed to “Ireland,” and on May 10, 1938, the currency officially became the Irish pound.

The path to decimalization unfolded in the mid-20th century, with the Decimal Currency Act of 1969 replacing the shilling and penny with a centesimal subdivision, the “new penny.” Although the pound itself remained unchanged, a 50p coin replaced the 10/– note due to inflation. The changeover occurred on Decimal Day, February 15, 1971, overseen by the Irish Decimal Currency Board.

In the 1970s, Ireland joined the European Monetary System, breaking the one-for-one link with the pound sterling in 1979 with the introduction of exchange rates. The Currency Centre at Sandyford was established in 1978 for domestic production of banknotes and coinage, marking a shift from reliance on specialized printers in England and the British Royal Mint.

The late 20th century saw a free-floating Irish currency until 1986 when redesigned coins deviated in size from their UK counterparts. The Irish 20p and £1 coins introduced in 1986 and 1990, respectively, differed significantly from their UK counterparts. Notably, despite not being legal tender, British sterling coins of similar size were accepted in Ireland.

The replacement with the euro was initiated on December 31, 1998, with fixed conversion rates. Although the euro became the official currency on January 1, 1999, the withdrawal of Irish pound coins and notes began on January 1, 2002, concluding on February 9, 2002. Irish coins and banknotes, both decimal and pre-decimal, can be redeemed for euros at Ireland’s Central Bank in Dublin. The currency transition marked a significant chapter in Ireland’s economic history, aligning it with the broader European currency landscape.

Euro

In 1999, Ireland joined the European Union and adopted the euro as its official currency. The euro replaced the Irish pound, which had been in circulation since 1928. Today, the euro is used by over 340 million people in 19 European countries.

Ireland’s adoption of the euro currency marked a significant shift in its economic landscape and integration into the broader European Union (EU). The process of transitioning from the Irish pound (punt) to the euro unfolded over several years and had far-reaching implications for Ireland’s economy, trade relationships, and financial systems.

The decision to adopt the euro was a formal commitment by Ireland to join the European Economic and Monetary Union (EMU). The euro was initially introduced as an electronic currency for banking and financial transactions on January 1, 1999, marking the commencement of the “euro era.” However, it was not until January 1, 2002, that physical euro banknotes and coins entered circulation.

Before embracing the euro, Ireland had a well-established currency in the Irish pound, which had undergone historical changes, including a shift to a decimal system in 1971. The decision to switch to the euro was motivated by several factors, primarily aiming to foster economic stability, facilitate cross-border trade within the EU, and eliminate uncertainties associated with exchange rates.

A crucial aspect of the adoption process was the establishment of fixed exchange rates between the Irish pound and the euro. On December 31, 1998, conversion rates were set, laying the groundwork for a smooth transition and ensuring a well-defined value for the new currency, the euro, concerning the outgoing Irish pound.

The practical implementation of the currency changeover occurred in phases. While the euro became the official currency for electronic transactions in 1999, the physical replacement of Irish pound banknotes and coins with their euro equivalents took place on January 1, 2002. This gradual transition allowed businesses and individuals to adapt to the new currency over time.

The adoption of the euro brought several advantages to Ireland. Being part of a common currency area eliminated the need for currency exchange when trading with other Eurozone countries, promoting seamless cross-border transactions and reducing transaction costs. Additionally, it contributed to increased price transparency and stability, fostering a more integrated and competitive European market.

Moreover, the euro provided Ireland with a stable and credible currency, enhancing investor confidence and supporting economic growth. Governed by the European Central Bank (ECB), the shared monetary policy within the Eurozone aimed to maintain price stability and ensure sustainable economic development across member states.

While the adoption of the euro brought numerous benefits, it also presented challenges. Adapting to a new currency required adjustments in financial systems, accounting practices, and consumer behaviors. Businesses had to update pricing structures, and the public needed to familiarize themselves with the new denominations and coins.

Ireland’s adoption of the euro symbolized a strategic commitment to European integration and economic cooperation. The move aligned Ireland with a common currency shared by multiple EU member states, fostering economic collaboration and stability in the ever-closer union of European nations.

Overall, the history of Irish currency is a fascinating journey that reflects the country’s rich cultural and economic heritage. From the early days of hacksilver to the introduction of the euro, the currency of Ireland has undergone many changes and transformations over the centuries.

Euro coins

The euro, introduced in 1999, is the official currency of the Eurozone, consisting of 20 member countries. It is divided into eight coin denominations, ranging from one cent to two euros, each featuring a common reverse side depicting a map of Europe.

However, the obverse side varies among member countries, showcasing unique designs. In addition to Eurozone members, four European microstates (Andorra, Monaco, San Marino, and Vatican City) also use the euro with their own designed coins. The coins are minted at national mints, adhering to strict quotas, while the European Central Bank manages the common side.

Over the years, the euro’s design has evolved, with changes in 2007 reflecting the EU’s enlargement and updates in 2017 for some denominations. The euro’s introduction aimed to foster economic and monetary union, contributing to stability and collaboration among member states. The coins incorporate security features, and their design considers tactile elements for the visually impaired. While national sides of regular coins can be updated every 15 years, commemorative coins may vary more frequently. As of 2023, 24 countries issue euro coins with their national sides, reflecting the diversity within the Eurozone.

Euro Bills

Euro banknotes, the common currency of the eurozone, have evolved since their 1999 inception. Initially, under ES1, these €5 to €500 notes featured a uniform design with the European flag, a map, and “euro” in Latin and Greek. The designs, by Robert Kalina, resulted from a 1996 competition. ES1, made of pure cotton, excluded non-EU Cyprus and Malta. ES2, or Europa series, introduced size changes and enhanced durability with updated security features. Reinhold Gerstetter redesigned the notes, featuring Mario Draghi’s signature post-March 2012.

Anticipated in 2024, the third series will redesign notes based on public-voted themes. Security features include confidential elements like holograms and watermarks. The Europa series introduced Europa’s face, reflecting EU expansion and adding Bulgaria’s Cyrillic alphabet. Circulating since 2013, it phased out the €500 note due to concerns about criminal use.

Security features include watermarks, holograms, color-changing ink, and more, with consultation for the visually impaired. A 2021 plan outlines the next redesign with potential themes like “European culture.” The ECB monitors euro banknote circulation and stock, ensuring integrity since their 2002 introduction. The euro’s history involves expansion, formalized political authority through the Lisbon Treaty, and usage across multiple EU countries. The seven denominations feature stylized historical European architectural illustrations on both sides.

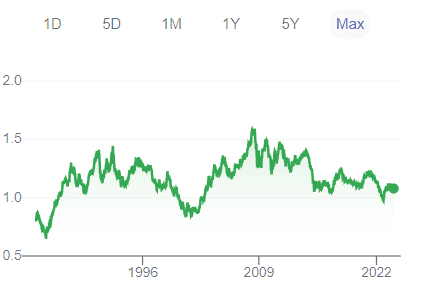

Inflation and Buying Power of Euro

In Ireland, inflation rates have been relatively stable in recent years, with an average rate of 1.1% between 2016 and 2021. This stability is due in part to the country’s strong economic growth and low unemployment rate.

In Ireland, the buying power of the currency has been increasing in recent years. According to the Central Statistics Office, Ireland’s GDP per capita in 2022 was 290.2% of the equivalent EU per capita value, the highest since Ireland’s initial membership of the EU in 1973 when it was 89.5%. This increase in buying power is due in part to the country’s strong economic growth and low unemployment rate.

Overall, the economic indicators for the Ireland currency are positive. Inflation rates have been stable, and the buying power of the currency has been increasing. This suggests that the Ireland currency is a good choice for investors and consumers alike.

Currency Usage in Ireland

The official currency of the Republic of Ireland is the euro, while Northern Ireland uses the pound sterling. This means that if you’re traveling between the two regions, you’ll need to be aware of the different currencies in use.

Is USD accepted in Ireland?

While the official currency of Ireland is the euro, many businesses in popular tourist areas will accept US dollars. However, you may receive change in euros, and the exchange rate may not be favorable. It’s always best to have some euros on hand for smaller purchases and to avoid any surprises.

It is best to have some euros on hand for your trip to Ireland. You can exchange US dollars for euros at banks, exchange services, or ATMs. Just be sure to check the exchange rate and any fees before making the exchange.

Exchanging Currency in Ireland

When traveling to Ireland, it’s important to understand exchange rates. The official currency in Ireland is the Euro (EUR), which is used throughout the country.

If you are exchanging currency, you will want to know the current exchange rate. You can find this information online, or by visiting a currency exchange office. Keep in mind that exchange rates can fluctuate throughout the day, so it’s important to check the rate frequently to ensure you are getting the best deal.

Where can I exchange Irish currency?

If you’re exchanging currency, you can do so at banks, post offices, and currency exchange offices. It’s also possible to exchange money at some hotels and tourist information centers. When exchanging currency, be aware of any fees or commissions that may be charged. It’s a good idea to shop around for the best exchange rate and to avoid exchanging money at airports or train stations, where rates may be less favorable.

What to know before exchanging currency in Ireland?

When traveling to Ireland, it’s important to understand exchange rates. The official currency in Ireland is the Euro (EUR), which is used throughout the country. If you are exchanging currency, you will want to know the current exchange rate. You can use online currency converters like XE or OANDA to get an idea of the current exchange rate.

Keep in mind that exchange rates can fluctuate throughout the day, so it’s important to check the rate frequently to ensure you are getting the best deal.

Also, when exchanging currency, you may be charged fees. These fees can vary depending on the exchange office or bank you use. Some banks may charge a flat fee for exchanging currency, while others may charge a percentage of the total amount exchanged. It’s important to ask about fees before exchanging currency to avoid any surprises.

In addition to exchange fees, you may also incur fees when using your credit or debit card in Ireland. Some banks charge foreign transaction fees, which can add up quickly if you use your card frequently. It’s a good idea to check with your bank before traveling to Ireland to see if they charge any foreign transaction fees. If they do, you may want to consider using a prepaid travel card instead. These cards allow you to load money onto them before your trip and can be used like a debit card without incurring foreign transaction fees.

Overall, it’s important to be aware of exchange rates and fees when traveling to Ireland. By doing your research and planning ahead, you can save money and avoid any unexpected charges.

Choosing Between USD and Euro in Ireland

When traveling to Ireland, you may be wondering whether you should use US dollars or Euro for your transactions. Both currencies are widely accepted in the country, but there are some factors to consider when choosing which one to use.

Here’s what you need to know about using the US dollar in Ireland and making the choice between USD and Euro.

Exchange Rate

When traveling to Ireland, it’s important to understand exchange rates. If you are exchanging currency, you will want to know the current exchange rate. You can find this information online, or by visiting a currency exchange office. Keep in mind that exchange rates can fluctuate throughout the day, so it’s important to check the rate frequently to ensure you are getting the best deal.

Convenience

Most businesses in Ireland accept credit and debit cards, but it’s always a good idea to carry some cash with you, especially if you plan to visit smaller towns or rural areas. ATMs are widely available in Ireland, but be aware that some may charge fees for withdrawals.

While it may be convenient to use US dollars in Ireland, you may end up paying more in the long run due to unfavorable exchange rates and fees. It’s important to note that while many businesses in Ireland accept credit and debit cards, it’s always a good idea to have some cash on hand.

Fees

When exchanging currency, it’s best to do so at a bank or an ATM. Avoid exchanging currency at airports or tourist areas, as they often charge higher fees. Additionally, be aware of any transaction fees that your bank may charge for international withdrawals or purchases.

Tips

When traveling to a foreign country, it’s essential to have access to local currency. In Ireland, the official currency is the Euro. You can exchange your currency at banks, exchange offices, or ATMs. ATMs are widely available throughout Ireland and are the most convenient way to get local currency. Most ATMs accept foreign cards, but it’s always a good idea to check with your bank before you travel to avoid any surprises.

If you prefer to have cash on hand, you can exchange your currency at banks or exchange offices. Banks generally offer the best exchange rates, but they may charge a commission. Exchange offices are available in larger cities and tourist areas, but they may charge higher fees.

Another convenient option is to use a credit or debit card. Most businesses in Ireland accept major credit cards, including Visa, Mastercard, and American Express. You can also use your debit card to withdraw cash from ATMs.

It’s essential to notify your bank before you travel to avoid any issues with your cards. Some banks may block your card if they see unusual activity, such as transactions in a foreign country.

Overall, Ireland offers many convenient options for exchanging and accessing local currency. Whether you prefer to use ATMs, exchange offices, or credit cards, you can easily get local currency to enjoy your trip without any hassle.

Cost of Living in Ireland

When it comes to the cost of living in Ireland, it is generally considered to be on the higher side. According to Expatistan, Ireland is the 3rd most expensive country in Western Europe. However, the cost of living in Ireland varies depending on the city you are in and your lifestyle.

One of the biggest expenses in Ireland is accommodation. Rent prices in cities like Dublin and Cork can be quite high. According to Numbeo, the average monthly rent for a one-bedroom apartment in the city center is around $1,400 (€1,280). However, if you are willing to live outside the city center, you can find cheaper options.

Food and groceries in Ireland are also relatively expensive. According to Expatistan, a single person’s estimated monthly costs for food are around $400 (€366). However, if you are willing to cook at home, you can save money by shopping at budget supermarkets like Aldi and Lidl.

Transportation in Ireland can also be costly, especially if you rely on taxis or private cars. Public transportation, on the other hand, is relatively affordable. The Leap Card is a smart card that allows you to use public transportation in Dublin and other cities in Ireland at a discounted rate.

Overall, the cost of living in Ireland can be high, but it is possible to live on a budget if you are willing to make some adjustments to your lifestyle. By shopping at budget supermarkets, living outside the city center, and using public transportation, you can save money and make the most of your time in Ireland.

Don’t Get Scammed Tips

When exchanging currency in Ireland, be cautious of scams. Always exchange your currency at reputable exchange offices or banks. Avoid exchanging currency with individuals on the street or in tourist areas, as they may offer unfavorable exchange rates or counterfeit currency.

One common scam involves someone approaching you on the street and offering to exchange your money for a “better rate.” This is often a ploy to give you counterfeit money or shortchange you. Always exchange currency at a reputable bank or ATM.

Another scam involves someone offering to help you with your luggage or giving you directions. They may then demand payment for their services. Be wary of anyone who approaches you on the street, and always keep an eye on your belongings.

It is best to exchange your currency for Euros before traveling to Ireland, and to exchange your currency at reputable exchange offices or banks to avoid scams. Use credit or debit cards for purchases whenever possible to avoid carrying large amounts of cash.

In general, it’s a good idea to be cautious when dealing with strangers and to keep an eye on your valuables. By following these tips, you can enjoy your trip to Ireland without falling victim to scams.