Germany has been using the euro as its sole currency since 2002. The euro is the official currency of 20 of the 27 member states of the European Union, including Germany. Each euro is divided into 100 cents, and the currency code for the euro is EUR.

When you’re in Germany, you’ll see the euro symbol € used to show prices. It’s important to note that while the euro is the official currency of Germany, Deutsche Mark (DM) was the official currency of West Germany from 1948 until 1990 and later unified Germany from 1990 until the adoption of the euro in 2002. If you come across any old DM bills or coins, they are no longer valid and cannot be used as a means of payment.

From dual circulation to the phasing out of the Deutsche Mark, this article delves into the intricacies of Germany’s currency transition and its impact on the nation’s economic landscape.

Historical Journey of The German Currency

Germany, presently the European Union’s strongest economy and the world’s fourth-largest, boasts a 2017 Gross Domestic Product (GDP) of €3.3 trillion. Its currency history is a fascinating narrative influenced by historical events such as division, war, recession, and hyperinflation.

In the 19th century, the German Confederation featured a patchwork of regional currencies. However, the Vienna Monetary Treaty in 1857 introduced a standardized currency known as the Vereinstaler. The creation of the German Empire in 1871 brought forth the Goldmark, underpinned by gold received from French reparations post the Franco-German War. The disruption of World War I led to the introduction of the Papiermark, severed from the gold standard, resulting in hyperinflation.

To stabilize the currency, the Rentenmark and later the Reichsmark were introduced, providing stability until the challenges of World War II. Post-war, West Germany introduced the Deutsche Mark, while East Germany utilized the East German Mark. The reunification of Germany in 1990 marked the conclusion of the East German Mark, and the Deutsche Mark continued until 2002 when it was succeeded by the Euro in 1999. Presently, the Euro serves as the official currency for Germany and the eurozone, while the Deutsche Mark can still be exchanged at a fixed rate.

Germany’s currency history reveals a tumultuous journey marked by war, hyperinflation, and economic hurdles, eventually leading to the adoption of the Euro. Before the unification of Germany in 1871, diverse regions issued their currencies, often linked to the Vereinsthaler. The Goldmark, introduced in 1873, replaced the Gold-backed Mark after France paid reparations in gold. However, World War I necessitated the abandonment of the gold standard, resulting in the emergence of the Papiermark in 1914. Hyperinflation ensued, prompting the introduction of the stable interim currency, the Rentenmark, in 1923.

The Reichsmark followed in 1924, aiming to restore pre-war stability but faced challenges during World War II. Post-war, Germany witnessed a unique “cigarette currency” era due to barter economies. In 1948, the Deutsche Mark replaced the Reichsmark, coexisting with the East German Mark until German reunification in 1990. Finally, in 1999, Germany embraced the Euro as its official currency, bringing an end to a complex and dynamic currency evolution.

Deutschmark (DEM)

The Deutschmark (DEM), Germany’s official currency until 2002, was adopted formally in 1948 by the Federal Republic of Germany, commonly known as West Germany. It remained legal tender in the unified German state until the euro’s final adoption in 2002.

With a stable and reliable reputation, the Deutschmark was traded on forex markets throughout much of the 20th century. Even after its cessation, the German central bank, Deutsche Bundesbank, allows the conversion of Deutschmarks into euros. Before the Deutschmark, Germany experienced a series of currencies, including the Papiermark, Rentenmark, and Reichsmark.

The introduction of the Deutschmark in 1948 was a significant step after World War II, providing a stable alternative to existing currencies. Its stability was attributed to factors like the prudence of the Bundesbank and intelligent political interference.

East Germany had its counterpart, the Ostmark, controlled by the communist government. However, with the reunification in 1990, the Deutschmark became the common currency, eventually transitioning to the euro in 2002. Despite its replacement, Deutschmarks can still be exchanged for euros at German federal bank locations.

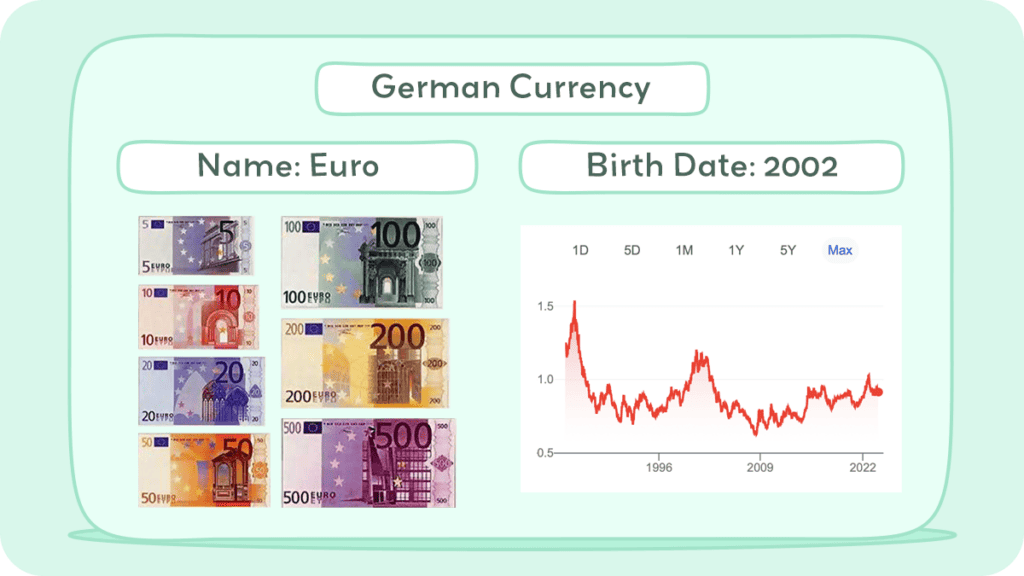

Euro

Germany’s adoption of the euro marked a significant milestone in its economic and monetary journey. With a strong economy ranking fourth globally and being the powerhouse of the European Union, Germany’s move from the Deutsche Mark to the euro aimed at fostering economic stability. The formal process commenced with the signing of the Maastricht Treaty in 1992, establishing the European Union and introducing the euro.

The transition timeline saw the introduction of the euro as an electronic currency in 1999, followed by the issuance of banknotes and coins in 2002, rendering the Deutsche Mark obsolete. The fixed exchange rate of 1.95583 Deutsche Marks to 1 Euro allowed people to convert their Deutsche Marks at central banks across Germany. The adoption of the euro aimed to simplify cross-border trade, enhance economic integration, and create a unified European market.

Leveraging its robust economy and industrial strength, Germany played a pivotal role in bolstering the euro’s stability within the Eurozone. In essence, this transition reflected Germany’s commitment to broader European integration, streamlining financial transactions, and solidifying its standing as a key economic force in the region.

Euro coins

The euro, introduced in 1999, is the official currency of the Eurozone, consisting of 20 member countries. It is divided into eight coin denominations, ranging from one cent to two euros, each featuring a common reverse side depicting a map of Europe.

However, the obverse side varies among member countries, showcasing unique designs. In addition to Eurozone members, four European microstates (Andorra, Monaco, San Marino, and Vatican City) also use the euro with their own designed coins. The coins are minted at national mints, adhering to strict quotas, while the European Central Bank manages the common side.

Over the years, the euro’s design has evolved, with changes in 2007 reflecting the EU’s enlargement and updates in 2017 for some denominations. The euro’s introduction aimed to foster economic and monetary union, contributing to stability and collaboration among member states. The coins incorporate security features, and their design considers tactile elements for the visually impaired. While national sides of regular coins can be updated every 15 years, commemorative coins may vary more frequently. As of 2023, 24 countries issue euro coins with their national sides, reflecting the diversity within the Eurozone.

Euro Bills

Euro banknotes, the common currency of the eurozone, have evolved since their 1999 inception. Initially, under ES1, these €5 to €500 notes featured a uniform design with the European flag, a map, and “euro” in Latin and Greek. The designs, by Robert Kalina, resulted from a 1996 competition. ES1, made of pure cotton, excluded non-EU Cyprus and Malta. ES2, or Europa series, introduced size changes and enhanced durability with updated security features. Reinhold Gerstetter redesigned the notes, featuring Mario Draghi’s signature post-March 2012.

Anticipated in 2024, the third series will redesign notes based on public-voted themes. Security features include confidential elements like holograms and watermarks. The Europa series introduced Europa’s face, reflecting EU expansion and adding Bulgaria’s Cyrillic alphabet. Circulating since 2013, it phased out the €500 note due to concerns about criminal use.

Security features include watermarks, holograms, color-changing ink, and more, with consultation for the visually impaired. A 2021 plan outlines the next redesign with potential themes like “European culture.” The ECB monitors euro banknote circulation and stock, ensuring integrity since their 2002 introduction. The euro’s history involves expansion, formalized political authority through the Lisbon Treaty, and usage across multiple EU countries. The seven denominations feature stylized historical European architectural illustrations on both sides.

Inflation and Buying Power of Euro

In October, Germany witnessed a significant easing of inflation, dropping to 3.0%, the lowest level since August 2021, as reported by the Federal Statistics Office. This points to a notable cooling in headline inflation across the Eurozone. The harmonized consumer prices for comparison with other EU countries had risen by 4.3% year-on-year in September.

Core inflation, excluding volatile food and energy prices, also saw a decline to 4.3% in October from the previous month’s 4.6%. Despite the anticipation of further easing in headline inflation in the coming months, Commerzbank economist Ralph Solveen expects core inflation to stabilize around 3% by spring. This projection indicates that underlying inflation could remain notably higher than the European Central Bank’s (ECB) desired level in the upcoming year.

Higher-than-expected inflation poses a significant risk, potentially extending central banks’ tightening campaigns and keeping interest rates elevated for an extended period. Eurozone inflation, expected to ease to 3.2% in October from September’s 4.3%, aligns with concerns about persistently high inflation levels.

Demographic factors, derisking efforts, and decarbonization contribute to upward pressure on prices, presenting challenges to the ECB’s inflation target of 2.0%. Germany’s economy contracted slightly in the third quarter, falling by 0.1% quarter on quarter, which is less than the forecasted 0.3% shrinkage. Weak purchasing power and higher interest rates continue to weigh on Europe’s largest economy.

The ongoing impact of the ECB’s monetary policy tightening, coupled with geopolitical uncertainties, is expected to persistently impact the German economy, possibly leading to contraction or stagnation in the coming year. Household consumption, adversely affected by high inflation eroding purchasing power, declined in the third quarter, while capital investment made a positive contribution. Despite some positive factors, Germany’s economic outlook remains uncertain, suggesting a challenging road ahead.

Currency Usage in Germany

The official currency of Germany is the Euro (EUR), which is used by all 19 member countries of the Eurozone. Since its introduction in 2002, the Euro has become the sole currency of Germany, replacing the Deutsche Mark (DM). The Euro is divided into 100 cents and is available in banknotes of €5, €10, €20, €50, €100, €200 and €500, and coins of €1 and €2, and 1, 2, 5, 10, 20, and 50 cents.

Germany is a cash-based society, and you will find that most transactions are carried out in cash. It is common for small businesses to only accept cash, and larger businesses may have a minimum card transaction amount. ATMs can be found all over the country, and most of them accept foreign cards. However, it is advisable to check with your bank about any fees they may charge for using foreign ATMs.

Is USD accepted in Germany?

Although the Euro is the official currency of Germany, some businesses may accept US Dollars (USD) as a form of payment. However, it is not common, and you may find that the exchange rate offered is not favorable. It is always best to carry Euros when traveling in Germany to avoid any inconvenience.

In conclusion, the Euro is the official currency of Germany and is widely used throughout the country. While some businesses may accept USD, it is not common, and it is advisable to carry Euros when traveling in Germany. Cash is still the preferred method of payment in Germany, and ATMs can be found all over the country.

Exchanging Currency in Germany

If you’re planning a trip to Germany, you’ll want to make sure you have some cash on hand. While many places in Germany accept credit cards, you may find that some smaller shops and restaurants only accept cash. It’s a good idea to exchange some money before you go so that you’re prepared for any situation.

Where can I exchange German currency?

There are several options for exchanging currency in Germany. You can exchange money at banks, exchange offices, or even at the airport. Banks typically offer the best exchange rates, but they may charge a fee for the service. Exchange offices may offer slightly lower exchange rates, but they may not charge a fee. You can also exchange money at ATMs, but be aware that your bank may charge a fee for using an out-of-network ATM.

What to know before exchanging currency in German

Before you exchange currency in Germany, there are a few things you should know. First, be sure to compare exchange rates and fees at different banks and exchange offices to find the best deal. You should also be aware that some places may not accept certain types of bills or coins, so it’s a good idea to have a mix of denominations. Additionally, be sure to keep your receipts so that you can exchange any leftover currency when you leave the country.

Overall, exchanging currency in Germany is a straightforward process. Just be sure to plan ahead, compare rates and fees, and keep your receipts. With a little preparation, you’ll be ready to enjoy your trip without worrying about money.

Choosing Between USD and German Currency

If you are planning to travel to Germany or conduct business with German companies, you may be wondering whether to use US dollars (USD) or German currency. This section will explore the factors you should consider when choosing between USD and German currency.

One of the first things to consider when choosing between USD and German currency is the purpose of your transaction. If you are traveling to Germany, it may be more convenient to use German currency to avoid the hassle of exchanging money. On the other hand, if you are conducting business with German companies, they may prefer to use USD for international transactions.

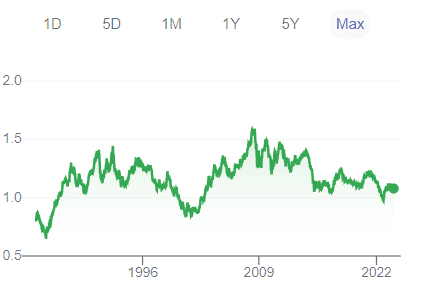

Exchange Rate

Another important factor to consider is the exchange rate between USD and Euro. You can check the current exchange rate on websites such as Xe and Bloomberg.

Convenience

Using USD may be more convenient if you are traveling to Germany and plan to use your credit card for purchases. Many credit cards charge foreign transaction fees, which can add up quickly. However, if you use a credit card that doesn’t charge foreign transaction fees, you can avoid these fees and use your card to make purchases in Germany without having to exchange money.

Fees

When exchanging money, you should also consider the fees involved. Some banks and exchange bureaus charge high fees for exchanging money, which can eat into your budget. To avoid high fees, compare exchange rates and fees at different banks and exchange bureaus before exchanging money.

In conclusion, choosing between USD and German currency depends on the purpose of the transaction, the exchange rate, convenience, and fees involved. Consider these factors carefully before making a decision.

Tips

If you are traveling to Germany, it is important to know some practical tips about German currency. First, familiarize yourself with the current exchange rate before your trip. This will help you avoid getting ripped off by currency exchange services. You can use an online currency converter to get a feel for what your money is worth and make sure you get a fair rate when you buy your travel money.

Second, carry cash with you as many places in Germany don’t accept credit cards. Make sure to withdraw money from ATMs located in banks or other reputable locations to avoid getting scammed. Also, be aware that some ATMs charge a withdrawal fee, so it is best to withdraw larger amounts at once to minimize fees.

Third, when paying with cash, be aware of the different denominations of German currency. The Euro is the official currency of Germany and is divided into 100 cents. Banknotes come in denominations of €5, €10, €20, €50, €100, and €200. Coins come in denominations of €1, €2, 50c, 20c, 10c, 5c, 2c, and 1c. Familiarize yourself with the different notes and coins to avoid confusion when making transactions.

Cost of Living in Germany

If you are planning to visit or move to Germany, it is essential to understand the costs and expenses you might incur. This section will provide you with a brief overview of the cost of living in Germany.

The cost of living in Germany can vary depending on the city you live in. According to Expatistan, the estimated monthly cost of living for a family of four is $4,890 (€4,455), while a single person’s estimated monthly cost is $2,729 (€2,486). These costs include accommodation, food, transportation, and other expenses.

If you are planning to rent an apartment in Germany, the average monthly rent for a one-bedroom apartment in the city center is around €800-€1,200. However, the cost can vary depending on the city. For example, the average monthly rent for a one-bedroom apartment in Berlin is €900-€1,400, while in Munich, it is €1,200-€1,800.

When it comes to food and groceries, the cost can also vary depending on where you shop. For instance, a liter of milk can cost around €0.70-€1.20, while a loaf of bread can cost around €1-€2. If you prefer eating out, a basic lunch menu can cost around €10-€15, while a three-course meal for two people in a mid-range restaurant can cost around €50-€80.

In terms of transportation, Germany has an extensive public transportation system, including buses, trains, and trams. The cost of a single ticket for public transportation can vary depending on the city, but it usually ranges from €2-€3. If you plan to use public transportation frequently, it might be more cost-effective to purchase a monthly pass, which can cost around €60-€80.

Overall, the cost of living in Germany can be relatively high compared to other European countries. However, the quality of life, excellent healthcare, and education systems, and the country’s diverse culture and history make it a desirable place to live or visit.

Don’t Get Scammed Tips in German Currency

To avoid scams and financial fraud in Germany, consider the following tips when dealing with currency:

- It is best to exchange currency at banks or reputable exchange bureaus to avoid getting scammed.

Avoid exchanging currency on the street or with individuals who approach you. These individuals may offer a better exchange rate, but they are likely to be scammers who will give you fake or counterfeit currency.

- Be aware of credit card skimming.

Skimming is when criminals use a device to steal your credit card information when you use your card at an ATM or in a store. To avoid this, always cover the keypad when entering your PIN and check your bank statements regularly for any unauthorized transactions.

- Be aware of pickpockets.

Pickpockets are common in crowded tourist areas, so keep your money and valuables in a secure location. Avoid carrying large amounts of cash with you and keep your wallet in a front pocket or a secure bag.

- Ensure you are using the official currency of Germany, which is the Euro (€).

Be wary of unusual or counterfeit banknotes. Familiarize yourself with security features on banknotes, such as watermarks and holograms. This can help you identify genuine currency.

Remember, being cautious and informed is key to protecting yourself from scams and ensuring a secure financial experience in Germany.