The official currency of Afghanistan is the Afghan afghani, which has been in use since the 1920s. The afghani is nominally subdivided into 100 puls, although there are currently no pul coins in circulation.

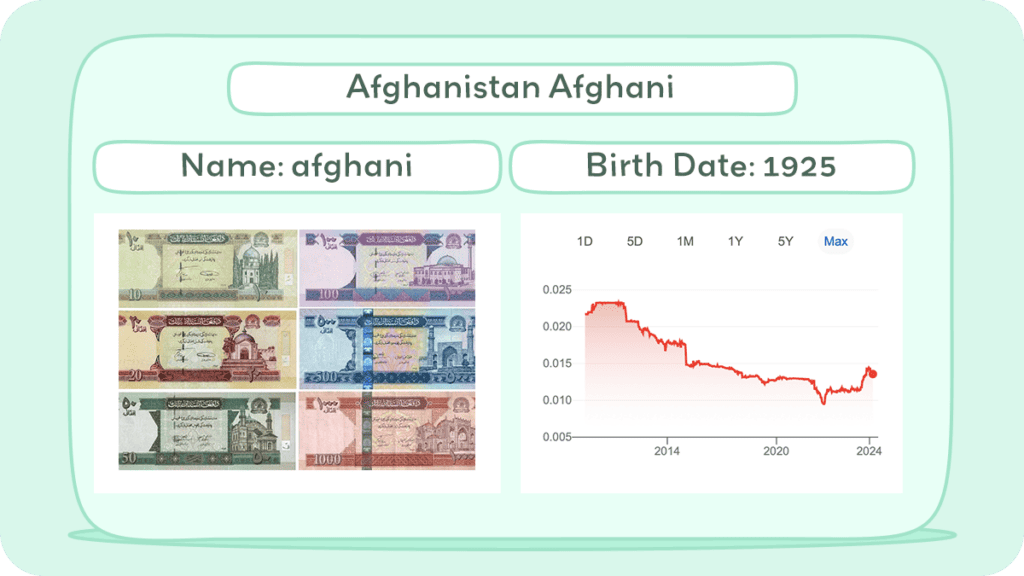

Afghanistan’s currency, AFN, is denoted by ϋ or Af and issued by the central bank, Da Afghanistan Bank. The currency’s history has evolved since 1925, with treasury notes introduced in 1925, more denominations added in 1936, and Afs. 5,000 and 10,000 notes introduced in the 1990s.

When traveling in Afghanistan, it’s important to have a good understanding of the local currency to avoid any confusion or misunderstandings. In this article, you will learn the afghani notes and coins, as well as how to exchange your money for local currency.

Historical Journey of Afghanistan Currency

Afghanistan has a long history of currency. The first Afghan currency was introduced in 1925. The Afghan rupee was the official currency of Afghanistan from 1891 to 1925. The Afghan afghani replaced the Afghan rupee in 1925.

The currency has seen many changes since then. The Afghan afghani has been devalued many times due to political instability, war, and economic turmoil. The currency has also undergone many reforms to stabilize the economy and combat inflation.

During the Taliban regime, the currency was not recognized internationally.

The currency traded at 73,000 afghani per US dollar in September 2001. After the collapse of the Taliban regime in November 2001, the currency sharply rose to 23,000 afghani per USD. It later slipped down to 36,000 afghani per USD in January 2002. By that time, about seven different variants of the currency were in circulation.

In 2003, the current version of the Afghan afghani was introduced to stabilize the economy and combat inflation. The current exchange rate of the Afghan afghani is around 70 afghani for 1 United States dollar (as of November 2023).

History of Coins

The first afghani currency was introduced in 1923, replacing the Afghan rupee. It was subdivided into 100 puls, with 20 afghanis equal to one amani. The currency initially contained silver and was part of a broader move to standardize measurements in Afghanistan.

Over the years, Afghanistan experienced various exchange rate regimes, including fixed and free market rates, significantly impacted by political changes and conflicts.

Notably, during the civil war and the Taliban’s control, the currency faced severe devaluation and instability, with multiple versions of banknotes in circulation.

In 2002, the afghani was redenominated to stabilize the economy and simplify transactions. This new currency replaced the old afghanis at different rates for banknotes issued by different authorities.

The introduction of the new afghani was an important step in Afghanistan’s economic recovery, moving towards a single currency under central bank control and adopting a floating exchange rate regime.

By 2009, the afghani had appreciated against the US dollar, reflecting increased confidence in the currency. However, after the 2021 re-establishment of the Islamic Emirate of Afghanistan and the freezing of the nation’s foreign assets, the afghani’s value fell, though it later became the best-performing currency in the world by the third quarter of 2023.

Afghanistan’s coinage history includes the introduction of various denominations over the years, such as aluminium and nickel-clad steel coins in the mid-20th century and more recent issues of copper-plated steel, stainless steel, and brass coins in 2005.

These coins feature national symbols and denominational values, reflecting Afghanistan’s rich cultural and historical heritage.

History of Bills

Afghanistan’s banknote history has evolved significantly over the years. Initially, in 1925, treasury notes were introduced in denominations like Afs. 5, Afs. 10, and Afs. 50.

By 1936, more denominations were added, and in 1939, Da Afghanistan Bank took over the issuance of banknotes, extending the range up to Afs. 1,000. The smaller denominations of Afs. 2 and Afs. 5 were eventually replaced by coins in 1958. In the 1990s, high inflation led to the introduction of Afs. 5,000 and Afs. 10,000 notes.

Notable banknotes included a variety of designs, such as national landmarks and cultural activities, like Buzkashi—Afghanistan’s national sport—depicted on the Afs. 500 note from 1990.

The 1978 series introduced banknotes with main colors and images representing Afghanistan’s heritage, including the Salang Pass on the Afs. 10 note and the Darul Aman Palace on the Afs. 50 note.

In 2002, a new series was introduced with denominations ranging from Af. 1 to Afs. 1,000, incorporating enhanced security features over time to prevent counterfeiting.

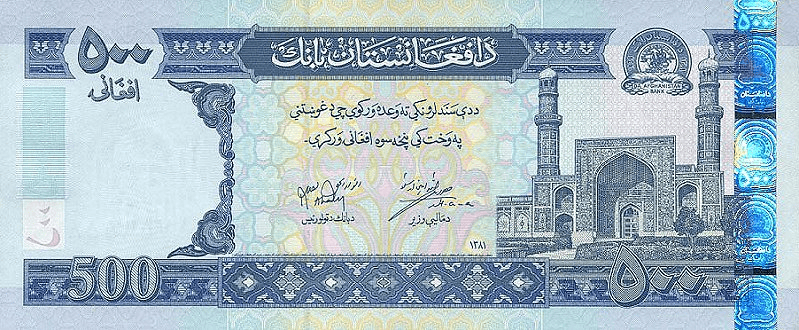

This series included imagery of historical and cultural significance, such as the Shrine of Ali on the Afs. 1,000 note and the Great Mosque of Herat on the Afs. 500 note.

By 2005, the lowest denominations were replaced by coins, and in 2014, a new Afs. 1,000 note was introduced with updated security features to further address counterfeiting concerns.

Inflation and Buying Power of Afghanistan Currency

The Afghanistan currency, afghani, has been facing high inflation rates for a while now. Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

The inflation rate in Afghanistan was recorded at 4.5% in 2020, and it is projected to rise to double digits in the coming years. This means that the buying power of an afghani is decreasing, and it is becoming more expensive to buy goods and services.

The high inflation rate is attributed to various factors such as political instability, low economic growth, and high levels of corruption.

The recent Taliban takeover of Afghanistan has further worsened the economic situation in the country, leading to a further decline in the value of afghani. The value of afghani has been falling steadily, and it has lost more than 50% of its value against the US dollar in the past few years.

The high inflation rate and the depreciation of afghani have had a significant impact on purchasing power. The costs of essential goods such as food, fuel, and medicine have skyrocketed, making it difficult for the people to afford them.

The economic crisis in Afghanistan is expected to worsen in the coming years, and it is essential for the government to take immediate measures to stabilize the economy and improve the living conditions of the people.

Afghan Afghani

The 2002 Series of Afghan banknotes showcases the country’s heritage through a range of denominations, each featuring distinctive designs and vibrant colors.

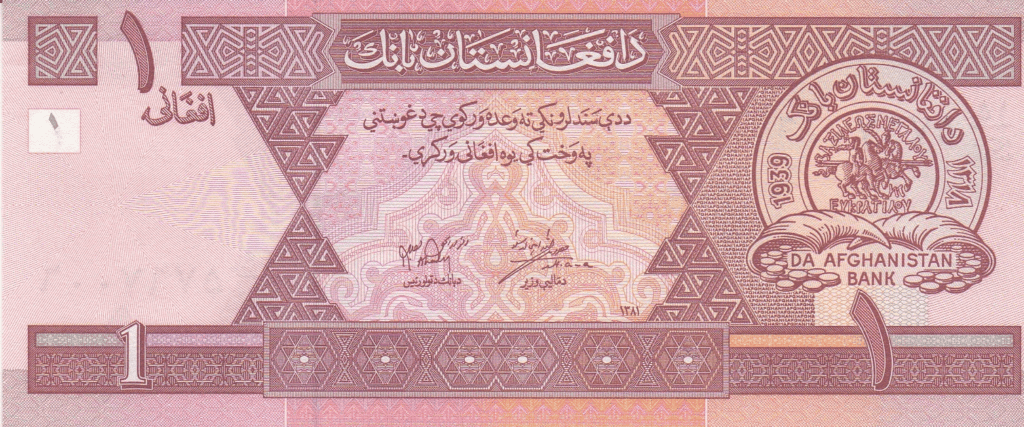

Af. 1

The series starts with the pink Af. 1 note, depicting the Seal of Da Afghanistan Bank and an ancient coin on the front, and a mosque in Mazar-i-Sharif on the back.

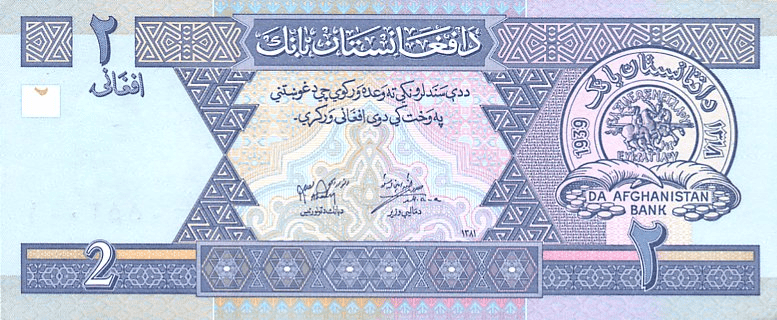

Af. 2

The blue Afs. 2 note highlights Taq-e Zafar on both sides, while the brown Afs. 5 note features the Bala Hissar fortress.

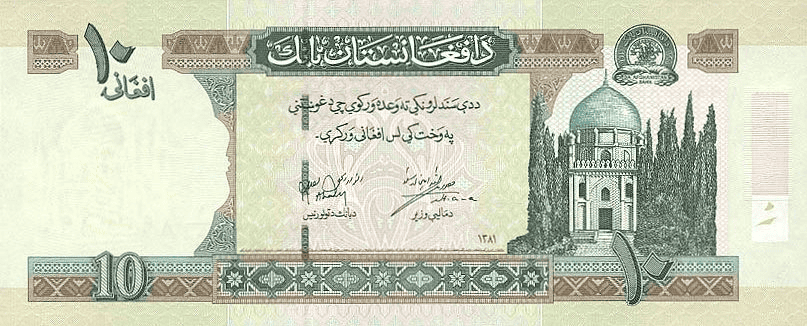

Af. 10

The yellow-green Afs. 10 note illustrates the Ahmad Shah Durrani mausoleum and the Lion Gate.

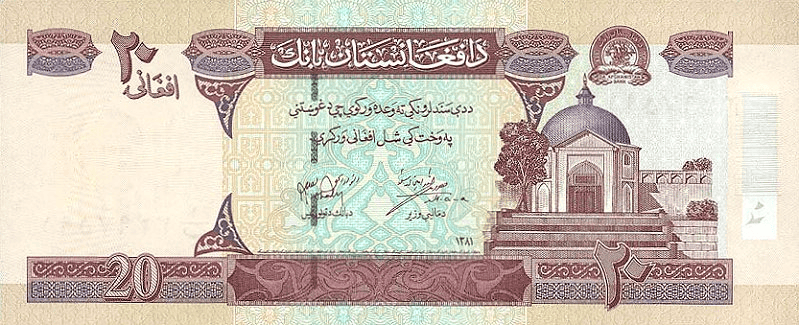

Af. 20

The brown Afs. 20 note displays Mahmud of Ghazni’s Tomb and the Arg King’s Palace.

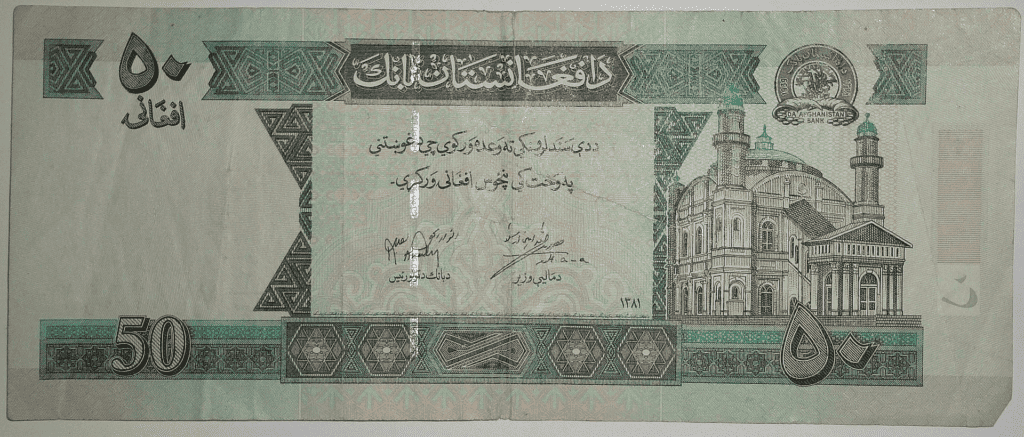

Af. 50

The dark green Afs. 50 note depicts the Shah-Do Shamshira Mosque and the Salang Pass.

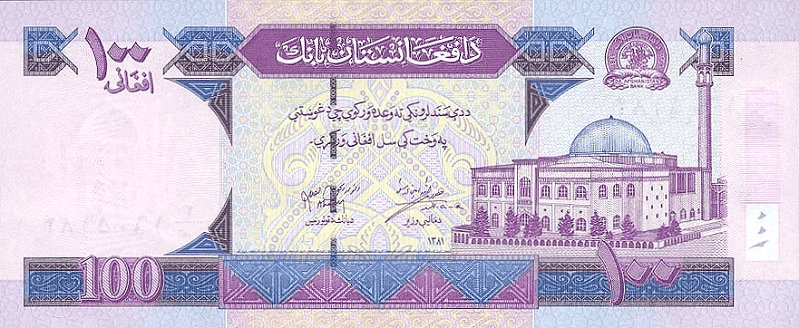

Af. 100

The violet Afs. 100 note and the blue Afs. 500 note showcase the Pul-e Khishti Mosque and the Great Mosque of Herat, respectively, with the latter also featuring the Kandahar International Airport tower.

Af. 500

The violet Afs. 100 note and the blue Afs. 500 note showcase the Pul-e Khishti Mosque and the Great Mosque of Herat, respectively, with the latter also featuring the Kandahar International Airport tower.

Af. 1,000

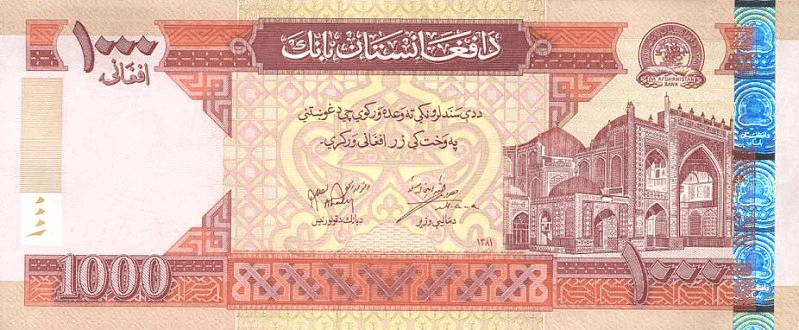

The orange Afs. 1,000 note presents the Shrine of Ali and the Tomb of Ahmad Shah Durrani.

This collection of banknotes, through its colors and depictions, celebrates Afghanistan’s rich cultural and historical legacy.

Currency Usage in Afghanistan

Afghanistan’s official currency is the Afghan afghani (AFN), which has been in circulation since the 1920s. The afghani is nominally subdivided into 100 puls, although there are no pul coins in circulation these days. The afghani is managed solely by the nation’s central bank, Da Afghanistan Bank (DAB).

In Afghanistan, cash is still king, and it is recommended to carry cash for daily transactions. Most transactions in Afghanistan are conducted using the afghani currency. However, in border areas, the currency of neighboring countries such as Pakistan is also used for trade.

Is USD accepted in Afghanistan?

The use of US dollars is widespread in Afghanistan’s markets, and many traders prefer to use USD for transactions. However, the Taliban banned the use of foreign currencies in Afghanistan in November 2021. While the ban is in place, it is recommended to use the afghani currency for all transactions.

Exchanging Currency in Afghanistan

If you are planning to visit Afghanistan, you will need to exchange your currency into Afghan afghani. In this section, we will discuss where you can exchange currency in Afghanistan and what you need to know before exchanging.

Where can I exchange Afghanistan currency?

There are several options available to exchange currency in Afghanistan. You can exchange currency at the airport, banks, and exchange offices. However, it is recommended to exchange currency at banks or authorized exchange offices rather than the airport to avoid scams and get the best exchange rates.

What to know before exchanging currency in Afghanistan?

Before exchanging currency in Afghanistan, there are a few things you should keep in mind:

- Exchange Rates: The exchange rates in Afghanistan can fluctuate frequently, so it is recommended to check the current exchange rates before exchanging currency. You can check the exchange rates online or at exchange offices.

- Exchange Fees: Some exchange offices may charge a commission or fee for exchanging currency. It is recommended to compare the fees and exchange rates at different exchange offices before making a transaction.

- Counterfeit Currency: Counterfeit currency is a common problem in Afghanistan. It is recommended to check the currency carefully before accepting it. Look for the security features such as watermarks, security threads, and holograms.

- Currency Restrictions: There are no restrictions on the amount of currency you can bring into Afghanistan. However, if you are carrying more than $10,000 USD, you need to declare it at the customs office.

In conclusion, exchanging currency in Afghanistan can be a straightforward process if you follow the guidelines mentioned above.

Choosing Between USD and Afghanistan Currency

If you are traveling to Afghanistan, you will need to decide whether to use the local currency, the Afghan afghani (AFN), or the US dollar (USD). Here are some factors to consider when making your decision.

Exchange Rate

The exchange rate between the USD and AFN fluctuates regularly, so it is important to check the current rate before making any transactions. You can find up-to-date exchange rates online or at currency exchange offices in Afghanistan.

Convenience

While the USD is widely accepted in Afghanistan, especially in major cities and tourist areas, it may not be accepted everywhere, and it not always legal.

Using the local currency may be more convenient in some situations, such as when shopping at local markets or paying for transportation. Additionally, using the local currency can help you avoid confusion and potential scams that may arise from currency conversion.

Fees

When exchanging currency, it is important to consider any fees that may be charged. Some exchange bureaus and banks may charge high fees for currency exchange, which can significantly reduce the amount of money you receive. It is important to compare exchange rates and fees before making any transactions.

Tips

Here are some tips to help you make the most of your currency exchange:

- Research exchange rates and fees before making any transactions.

- Consider using a credit card that does not charge foreign transaction fees.

- Avoid exchanging money at airports or tourist areas, as these locations may charge higher fees.

- Consider exchanging only the amount of money you need, as exchanging large amounts can be risky and may result in a loss of value due to fluctuations in the exchange rate.

By considering these factors, you can make an informed decision about whether to use the local currency or the USD during your travels in Afghanistan.

Cost of living in Afghanistan

If you are planning to visit or move to Afghanistan, it is important to understand the cost of living in the country.

According to Numbeo, the cost of living in Afghanistan is, on average, 68.8% lower than in the United States. This means that you can expect to pay significantly less for goods and services in Afghanistan compared to the US.

The cost of living in Afghanistan varies depending on the city you are in. For example, the cost of living in Kabul, the capital city, is higher than in other cities.

According to Expatistan, the cost of living in Kabul is 113% more expensive than in Quetta, Pakistan. However, the cost of living in Afghanistan is still relatively low compared to other countries.

One of the biggest expenses in Afghanistan is housing. According to Cost Safety, you can expect to pay around $70 to $120 USD per month for a single-bedroom apartment rental.

However, if you are looking for a family apartment, the cost can go up to $200 USD per month near the city center. It is important to note that the quality of housing in Afghanistan may not be up to Western standards.

Food is another expense that you will need to consider when living in Afghanistan. According to TravelTables, the total cost of living for two people with average consumption for one month will be around $429.70 USD, not including rent. Traditional Afghan cuisine is primarily based on lamb or chicken and rice, and restaurant prices are relatively affordable.

In conclusion, the cost of living in Afghanistan is lower compared to many other countries. However, the quality of housing and other services may not be up to Western standards. It is important to do your research and plan accordingly before moving or visiting Afghanistan.

Don’t Get Scammed Tips

Afghanistan’s currency, the afghani, has been facing a lot of challenges since the Taliban took control of the country. The economy has been in turmoil, and scammers are taking advantage of the situation. Here are some tips to help you avoid getting scammed in Afghanistan currency:

- Be cautious of job offers that require you to pay a fee for visas or other services. Scammers may claim they represent a well-known American company and promise you a job and U.S. work permit, but only if you pay a fee. Remember that legitimate employers will not ask you to pay for a job.

- Be wary of individuals who claim to be attractive American citizens who want to marry you, but only if you send them money for a U.S. visa or “green card.” This is a common romance scam, and it’s important to remember that legitimate relationships are not built on financial transactions.

- Avoid exchanging money on the black market. The Taliban has banned the use of foreign currencies in Afghanistan, and using the black market to exchange money is illegal. Additionally, scammers may offer you a better exchange rate than banks or official exchange offices, but they may give you counterfeit money or shortchange you.

- Always verify the exchange rate before exchanging money. The afghani’s value has been fluctuating rapidly, and scammers may take advantage of your lack of knowledge about the current exchange rate. Check the exchange rate on reputable websites or ask a trusted local for advice.

By following these tips, you can protect yourself from scammers and avoid losing money in Afghanistan’s currency.