The Federal Reserve, often called “the Fed,” plays a crucial role in the U.S. and global economies.

The Federal Reserve is the central bank of the United States. It oversees the nation’s monetary policy and maintains economic stability through interest rate adjustments.

The Fed lowers rates to stimulate growth and increases rates to curb inflation. Additionally, the Fed buys and sells government securities to inject or withdraw money from the economy.

The Fed’s responsibilities include influencing interest rates, regulating banks, and managing the money supply. Its activities promote maximum employment, stable prices, and moderate long-term interest rates.

These activities have a ripple effect on your everyday life, affecting everything from the interest rates on your loans to the amount of cash circulating in the economy.

The Central Bank Explained

As the central bank, the Fed is responsible for the financial stability and health of the U.S. economy. So, what led to the creation of this central bank?

Federal Reserve Act

Well, it all started with the Federal Reserve Act in 1913.

This act was passed by Congress to establish the Federal Reserve System, giving the United States a more stable and flexible financial system.

The Fed works to maintain low inflation, stable prices, and employment. This helps provide you with a predictable environment to manage your finances, plan for the future, and maintain a stable standard of living.

As an independent entity, the Fed is not swayed by partisan politics or the whims of any specific government administration. Its goal is to promote the overall health of the U.S. economy, which directly affects your finances.

Structure of the Federal Reserve

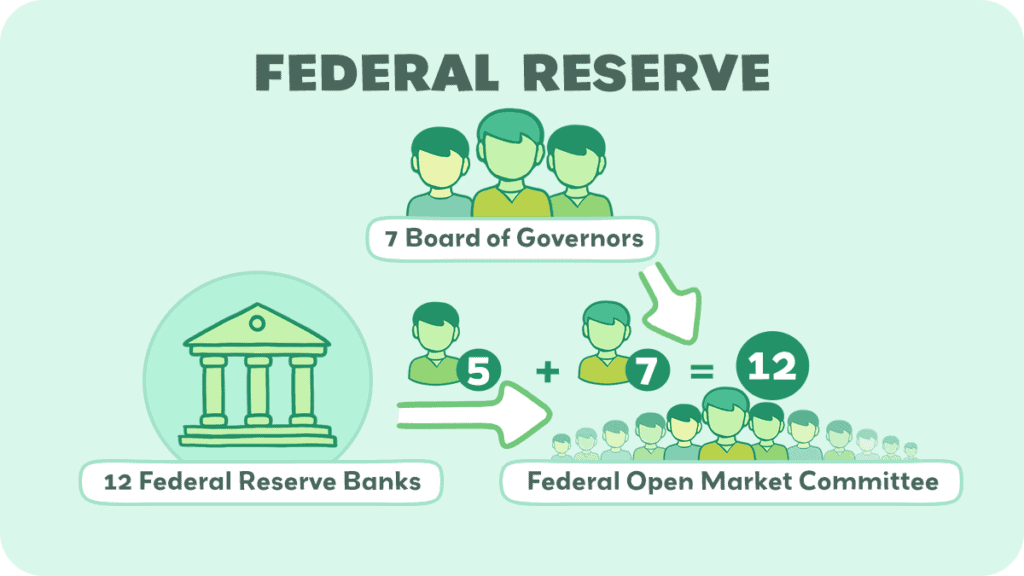

Let’s explore the main components of this system: the Board of Governors, the Federal Reserve Banks, and the Federal Open Market Committee.

Board of Governors

The Board of Governors is the central governing body of the Federal Reserve System.

It comprises seven members, including a Chair and two Vice Chairs, all appointed by the President and confirmed by the Senate. These Governors serve staggered 14-year terms, ensuring that the Board remains independent and insulated from political pressure.

In addition to guiding monetary policy and supervising the Federal Reserve Banks, the Board is responsible for crafting regulations and overseeing the nation’s banking system.

The Board frequently collaborates with other entities, such as the U.S. Department of the Treasury and the President’s Council of Economic Advisers, to ensure a stable economic environment.

Federal Reserve Banks

There are 12 regional Federal Reserve Banks that operate somewhat independently but under the general oversight of the Board of Governors.

These institutions function as the decentralized arm of the Federal Reserve System. They perform various tasks, such as conducting economic research, providing financial services to other banks, and implementing monetary policy in their regions.

Each Federal Reserve Bank has its own president and a board of directors, which includes representatives from local banks and other economic sectors.

Here’s a list of where the 12 Federal Reserve Banks are located:

- Boston

- New York

- Philadelphia

- Cleveland

- Richmond

- Atlanta

- Chicago

- St. Louis

- Minneapolis

- Kansas City

- Dallas

- San Francisco

These strategically placed banks serve their surrounding areas and represent the diverse interests of their respective regions.

The presidents of the regional banks gather for regularly scheduled meetings, known as the Federal Open Market Committee (FOMC), to discuss and set monetary policy.

Federal Open Market Committee

The FOMC’s primary role is to oversee the nation’s open market operations, which involve buying and selling government securities. This is a major tool the Federal Reserve uses to influence monetary policy and control inflation.

The FOMC has twelve members, including the seven members of the Federal Reserve Board of Governors and five of the twelve Federal Reserve Bank presidents.

The President of the Federal Reserve Bank of New York is a permanent member, while the other four spots are filled on a rotating basis by the other Reserve Bank presidents.

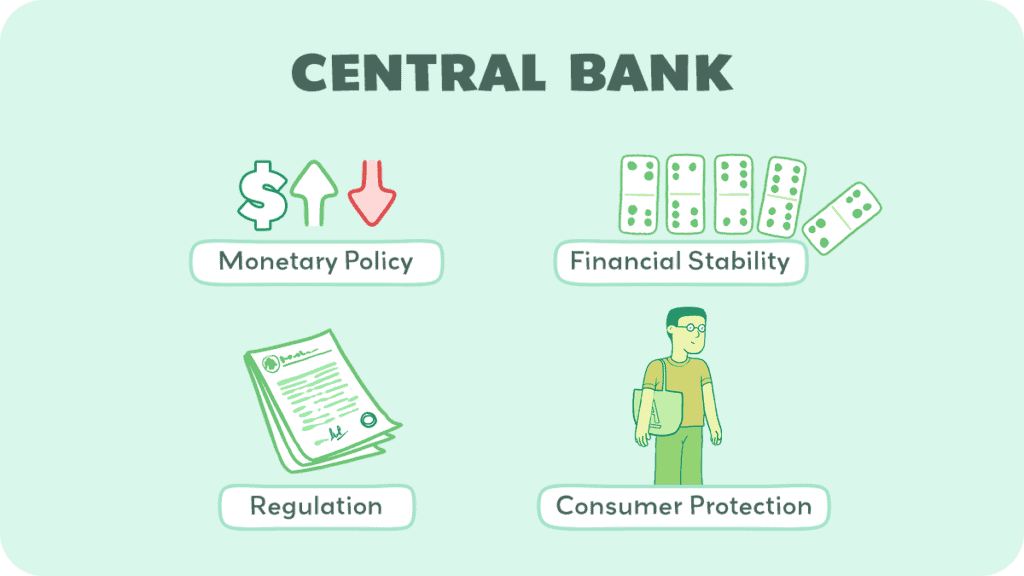

Roles and Responsibilities of the Central Bank

Now that we’ve covered the structure, it’s also important to understand its various roles and responsibilities.

1) Monetary Policy

The FOMC takes the lead here, working to achieve stable prices, maximum employment, and modest long-term interest rates.

So, how do they achieve these goals?

It’s all about controlling the money supply, a balancing act critical for promoting economic health and growth.

The FOMC employs tactics like open market operations, setting reserve requirements, and adjusting interest rates to influence the money supply and, in turn, stimulate or slow down economic growth.

This helps maintain that sweet spot between inflation and recession for you and corporations alike.

2) Financial Stability

The central bank makes it a top priority to keep the U.S. financial system safe and sound.

When financial crises or economic downturns occur, the central bank leaps into action, providing stability and preventing a domino effect that could have catastrophic consequences (it was a near miss during 2008, though!).

The Fed continuously identifies and addresses risks to financial stability by monitoring financial markets, institutions, and infrastructure.

3) Regulatory and Supervisory Role

As if monetary policy and financial stability weren’t already hefty responsibilities, the Fed also plays a regulatory and supervisory role.

This means providing oversight and guidance to commercial banks, bank holding companies, and financial services providers.

By supervising banks and ensuring they comply with federal laws and regulations, the Fed enhances the integrity of the U.S. banking system. This oversight helps protect your deposits, checks, loans, and other financial transactions, ultimately bolstering the entire economy.

4) Consumer Protection

Last but certainly not least, the Federal Reserve serves as a guardian for you and fellow consumers, ensuring your rights are protected within the realm of credit and financial services.

Thanks to the Dodd-Frank Wall Street Reform and Consumer Protection Act, this role has been further strengthened, and the central bank now aims to keep the playing field fair, promoting a competitive marketplace.

The Federal Reserve and the Economy

1) Impact on the U.S. Economy

Inflation and employment are two key areas where the central bank significantly influences.

During economic recessions and booms, the Federal Reserve takes strategic actions to smoothen the fluctuations and promote steady economic growth.

For instance, during periods of slow growth or recessions, the Fed may lower interest rates to encourage borrowing and spending, which can help stimulate the economy.

Conversely, during rapid growth or inflation (like the current economic climate), the Fed may raise interest rates to cool down the economy and ensure financial stability.

2) Global Influence

The Federal Reserve’s actions affect more than just the United States; they also significantly impact the international financial system.

As the saying goes, when America sneezes, the World catches a cold.

As one of the world’s reserve currencies, the U.S. dollar holds an essential position in global markets, and the Fed’s decisions can often directly and indirectly affect those markets.

For example, when the central bank adjusts interest rates or implements new monetary policies, international investors may move their investments into or out of the U.S. markets, leading to fluctuations in other currencies and stock markets worldwide.

This domino effect emphasizes the Fed’s role in maintaining not only the U.S. economy’s stability but also contributing to the stability of the global financial system.

Recent Developments and Challenges

In this section, we’ll explore recent developments and challenges the Federal Reserve has faced.

We’ll dive into two main sub-sections: post-2008 financial crisis reforms and emerging challenges.

Post-2008 Financial Crisis Reforms

After the 2008 financial crisis (Global Financial Crisis), the Federal Reserve significantly changed its monetary policy approach and implemented enhanced regulatory measures.

The key reforms were aimed at strengthening the financial system and preventing a similar crisis in the future. Here’s an outline of the main reforms:

- Increased Regulation and Oversight: Regulatory bodies worldwide, especially in the United States and Europe, enhanced their oversight of financial institutions. This involved stricter monitoring of banks’ activities and increased scrutiny of financial products.

- Higher Capital Requirements: Banks must maintain higher capital levels to absorb losses better. This was primarily achieved through the Basel III regulations, which set more stringent bank capital requirements.

- Stress Testing of Banks: To withstand economic downturns, financial institutions are subjected to regular stress tests to evaluate their resilience in scenarios similar to the 2008 crisis. This proved vital for the 2023 U.S. banking crisis.

- Improved Risk Management: Banks and other financial institutions were mandated to improve their risk management practices. This included better understanding and managing various types of risks, like market, credit, and operational risks.

- Consumer Protection Measures: Many countries established or strengthened agencies that protect consumers in the financial marketplace. In the U.S., for example, the Consumer Financial Protection Bureau (CFPB) was created.

- Resolution Mechanisms for Failing Banks: New procedures were developed to manage the failure of large banks, aiming to avoid bailouts with taxpayer money. This included plans for orderly liquidation or restructuring.

- Limiting Risky Investments: The Volcker Rule in the U.S. is an example of this type of reform, which restricts high-risk investment activities like proprietary trading.

- Enhanced Transparency and Accountability: Financial institutions were required to provide more transparent reporting of their activities and holdings, aiming to make it easier for regulators and the public to assess their risk profiles.

- Global Coordination: There was a push for better international coordination among regulatory bodies to manage the interconnectedness of the global financial system.

Additionally, the Fed adopted a more data-driven, transparent, and accommodative policy stance, which included keeping interest rates low for an extended period to spur economic growth.

Emerging Challenges

Now, let’s examine some emerging challenges the Federal Reserve is facing.

These include technological advancements, digital currencies, climate change, and sustainable finance.

Technological Advancements and Digital Currencies: You may have noticed the rise of digital currencies and blockchain technology. The Fed closely monitors these developments, as they can affect the central bank’s role in ensuring financial stability and managing monetary policy.

As a result, the Federal Reserve is researching and considering the implications of introducing a central bank digital currency (CBDC).

Climate Change and Sustainable Finance: Climate change poses various risks to the financial system, and the Fed is actively addressing those risks.

They are incorporating climate-related risks into their regulatory and supervisory frameworks and exploring ways to promote sustainable finance.

Conclusion

As we look ahead, the Federal Reserve’s evolving role in a rapidly changing economic landscape becomes a subject of paramount importance. Its actions and strategies will continue to influence the U.S. and the global economy.

The Fed’s impact permeates every aspect of economic life. It influences interest rates, regulates the banking sector, and manages the money supply. These actions directly affect you and corporations alike, shaping everything from savings and loan rates to overall economic health.