Banks only reserve a fraction of their depositors’ funds in the traditional banking system. They lend the majority to borrowers. This is known as fractional reserve banking. Following the 2008 financial crisis, there were proposals and discussions to implement a full reserve banking system.

Full reserve banking (FRB) is where your bank keeps an equivalent amount of your deposit in its reserves. This means that every dollar you deposit is matched by a dollar held in reserve. This system is designed to reduce the risks associated with bank runs and the lending practices that can lead to financial instability.

Understanding full reserve banking is essential because it represents a significant shift from most banks’ operations. It highlights a more stable, albeit less common, banking practice that could address some of the inherent risks in the financial system, especially during economic downturns.

The Concept of Full Reserve Banking

Every dollar you deposit into a bank is held there and not lent out. Think of it like a vault where your money sits securely. The bank acts as a guardian rather than a typical commercial bank lender using your funds.

As a result, banks cannot create money through loans, as is common in fractional reserve banking. This impacts the process of money creation in the economy.

Pros and Cons of Full Reserve Banking

There are advantages and disadvantages of using a full reserve banking system.

Pros:

- Financial stability: Decreased risk of bank runs, as your money is always available for withdrawal.

- Transparency: You know exactly where your money is and what it’s being used for.

Cons:

- Credit availability: It may limit the amount of credit available in the economy, as banks can’t lend out deposits.

- Economic growth: Potential to slow economic growth due to reduced lending.

History and Evolution

The Great Depression catalyzed discussions about full reserve banking due to widespread bank failures and economic collapse. Post-1930s regulations and banking reforms were introduced to stabilize the financial system but did not implement full reserve banking.

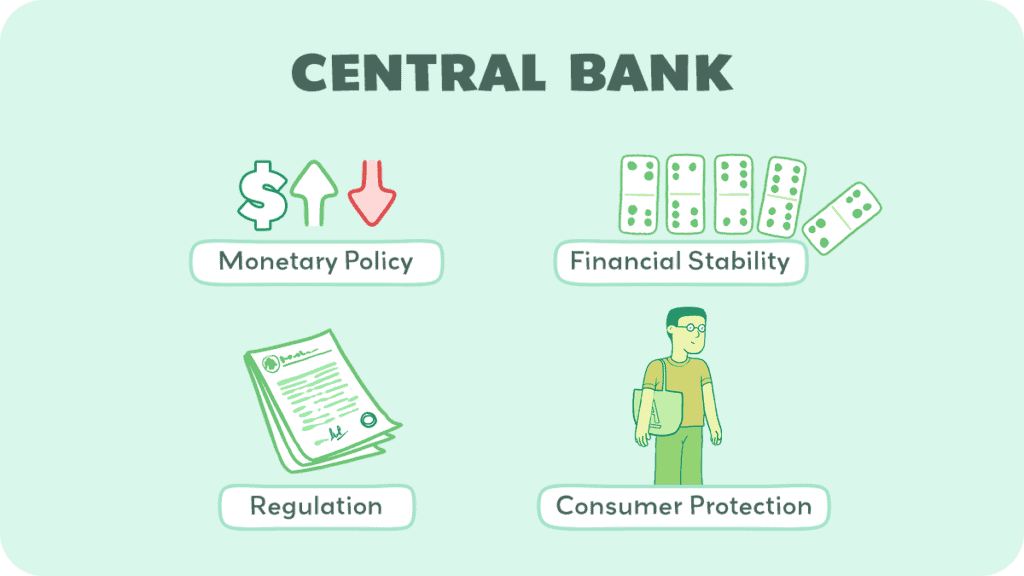

The central bank plays a critical role in implementing and regulating reserve banking within the banking system, ensuring that the rules are adhered to and that the reserve requirements are consistently met by banks.

Comparison With Fractional Reserve Banking

Full reserve banking and fractional reserve banking are distinctly different models of banking that define how banks handle your deposits and generate profits.

Operational Differences

Here are the key differences in how banks treat your deposits:

| Full Reserve Banking | Fractional Reserve Banking |

| Holds 100% of deposits | Holds a fraction of deposits |

| Does not lend out your deposits | Lends out most of your deposits |

Fractional reserve banking differs because the bank only holds a fraction of your deposits as reserves. The rest is loaned out to borrowers or invested. This system effectively multiplies money through the lending process, as each deposit can lead to a chain of new deposits and loans elsewhere.

A fractional reserve bank must meet reserve requirements. This is a minimum percentage of depositors’ balances that the bank must keep on hand. For example, if the reserve requirement is 10%, the bank can lend out 90% of your deposit.

Risks and Financial Stability

Full reserve banking attempts to offer a no-risk environment to your deposits.

This reduces the risk of a bank run. However, it doesn’t allow banks to leverage deposits for loans. This will lead to lower profitability and reduce the bank’s ability to support economic growth through lending activities.

However, fractional reserve banking can heighten the risk of financial instability due to the inherent nature of lending out more money than is kept in reserves. Suppose too many depositors wish to withdraw their funds simultaneously. In that case, the bank might fail to meet these demands, leading to a bank run.

To mitigate such risks in fractional reserve banking, a central bank often acts as a lender of last resort. This means they will provide liquidity to banks in times of need. This function supports financial stability by ensuring that banks can continue to operate even when faced with large withdrawals.

The balance between the reserve a bank holds and the amount it lends out is a crucial factor in the overall stability of a financial system.

Economic Implications of Full Reserve Banking

1) Effect on Money Supply and Inflation

Under full reserve banking, every deposit you and others make is fully backed by actual reserves.

Therefore, the central bank has tighter control over the money supply (i.e., only the central bank can create an additional money supply in the economy). This model potentially leads to a decrease in inflation rates.

2) Impact on Economic Growth

Full reserve banking significantly alters the lending landscape, as banks can only loan out funds from time deposits (where the money is deposited for a fixed term) or other long-term investments.

This could lead to higher interest rates for savers since banks would likely pay more to attract deposits. Higher savings rates encourage more people to save. At the same time, higher borrowing rates discourage investment and spending, which are critical drivers of economic growth.

Fewer loans can lead to less investment in businesses and the economy. This could result in more stable economic growth, albeit slower, reflecting actual savings rather than credit expansion.

Regulatory and Political Aspects

Regulatory and political aspects guide the implementation of full reserve banking and shape the debates surrounding its potential impact on the economy.

1) Government Policies and Regulations

When you look at government policies regarding reserve banking, you will notice that they are often aimed at stabilizing the banking system.

For instance, insurance mechanisms like the Federal Deposit Insurance Corporation (FDIC) provide a safety net for depositors. Under full reserve banking, the FDIC could be fundamentally restructured or rendered unnecessary.

Central banks, such as the Federal Reserve, operate under a fractional reserve banking system and influence monetary policy considerably. A shift to full reserve banking would necessitate significant changes in their operational frameworks.

2) Monetary Reforms and Debates

Monetary reforms, including debates around full reserve banking, often reference significant historical proposals such as the Chicago Plan from the 1930s. This plan suggested that banks could only issue loans backed by actual deposits, directly applying full reserve banking principles.

Prominent figures like the economist Jesús Huerta de Soto advocate for the system. He cites its potential to eliminate bank runs and provide a more stable economic environment.

Similarly, financial journalists such as Martin Wolf have supported sovereign money systems, which resonate with the full reserve banking philosophy.

Global Perspectives and Case Studies

When exploring full reserve banking, you’ll find that international approaches differ, and the history includes a mix of experiences with the model.

You’ll note that full reserve banking is not widely implemented today. Still, it has been a topic of interest across the globe.

Iceland was considering a form of full reserve banking after its financial collapse in 2008. The proposed system was centered on the idea that private banks would no longer create money, leaving this role exclusively to the central bank.

In 2018, Swiss voters faced a decision on the “Sovereign Money Initiative,” a proposal pushing for a switch to full reserve banking within the Swiss monetary system. However, the proposal was rejected, which means the current fractional reserve system remained in place.

“Positive Money,” a movement based in the U.K., advocates for the transition to full reserve banking. Founded in the aftermath of the 2008 financial crisis, it highlights the issues with the current system where banks create the majority of money as debt. They argue that such a system could prevent banking crises and ensure a more stable economy.

Full Reserve Banking and Digital Currencies

With the advent of digital currencies, new opportunities arise to implement full reserve banking principles in a modern context.

Firstly, digital currencies, especially those based on blockchain technology, inherently support the concept of full reserve banking. Since blockchain provides a transparent ledger of transactions, it can verify that a digital currency is backed one-to-one by actual reserves.

- Security: Cryptocurrencies can offer enhanced security features, which align well with the risk-averse foundation of full reserve banking.

- Transparency: The transparency of blockchain helps you ensure that a bank maintains full reserves.

- Efficiency: Digital transactions can be processed quickly and without physical cash management.

Here’s how full reserve banking could synchronize with specific digital financial innovations:

- Stablecoins: These are a type of cryptocurrency tied to an asset like the U.S. dollar, which could be used in a full reserve banking model to represent digital deposits.

- Digital Wallets: Your digital wallet could hold digital currency backed by a full reserve bank, giving you access to your funds at any time and complete confidence in their availability.

- Smart Contracts: Automated blockchain agreements can enhance how full reserve banks operate, providing clear rules for managing and using your money.

Conclusion

Full reserve banking presents a paradigm shift in the banking sector. It fundamentally alters how banks operate and interact with the economy.

The debate around full reserve banking is not just technical; it encompasses broader regulatory, political, and economic considerations. This reflects the complex interplay between financial stability, economic growth, and monetary policy.

Thanks for reading, we hope you learned something!