Fractional reserve banking is the cornerstone of your everyday banking system. It plays a critical role in the way money flows within the economy.

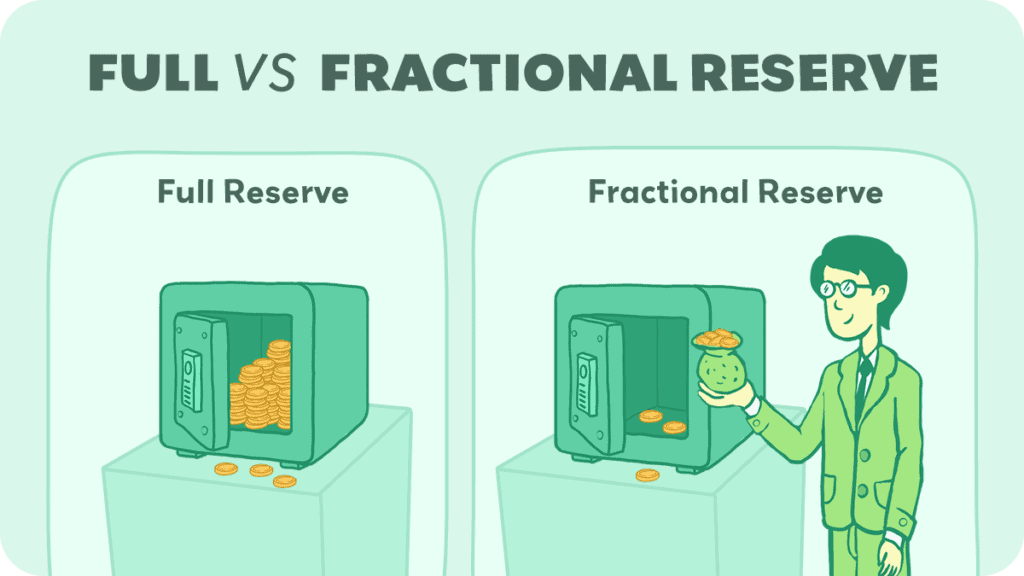

Fractional reserve banking allows banks to keep only a portion of their depositors’ funds as reserves. They can use the rest to extend loans and credit. It may seem like a simple idea, but it’s a fundamental process that enables banks to support economic growth and manage liquidity.

As a bank account holder, you’re not just stashing it away for safekeeping when you deposit your money in a bank.

The bank uses a part of your deposit to lend to others who need capital. Whether it’s for buying a home, starting a business, or financing education.

This use of deposits to make loans is essential for creating credit. It can expand the money supply in the economy, fueling growth and enabling financial opportunities.

This banking practice is an intricate balance of risk and reward. It’s designed to fulfill the needs of both savers and borrowers. Your bank is responsible for holding enough funds to cover your withdrawal requests while generating income through lending activities.

Central banks closely regulate this balance to ensure stability and maintain trust in the financial system.

Evolution of Fractional Reserve Banking

Fractional reserve banking didn’t just appear overnight.

It evolved over centuries as merchants and goldsmiths began holding gold and money for others. They realized they could lend out some of the money they were holding, as most people didn’t need to access all their money at once.

This set the foundations for the modern banking system, where commercial banks can lend most of their deposits and keep only a fraction as reserves.

Role of Reserve Requirements

The reserve requirement is a central bank regulation that dictates the minimum amount of reserves a bank must hold against deposits.

You can think of it like this: for every dollar you deposit, the bank can only lend a certain amount. The rest must be kept on hand or with the central bank to satisfy withdrawal demands.

These requirements ensure that banks maintain enough liquidity to meet their short-term obligations while influencing the money supply.

Central banks, like the Federal Reserve, set and adjust these reserve ratios. They control the availability of money in the economy, mitigating inflation and stabilizing the financial system.

Process of Deposit and Loan Creation

The core function of a bank is to accept deposits and issue loans.

When you deposit your $1,000 paycheck, the bank doesn’t just safeguard your money; it puts it to work. The banking system lends most of that money to other individuals or businesses needing a loan.

If the reserve requirement is 10%, the bank can lend out $900 of your deposit. The person or entity who receives that $900 may spend it and the recipient of that $900 might deposit it into their bank, which can again keep a fraction and lend out the rest.

This cycle of depositing and lending can repeat multiple times, thereby expanding the money supply in the economy.

The Multiplier Effect

The money multiplier is a formula that illustrates how much the money supply can increase with each round of the lending cycle.

It’s calculated as the inverse of the reserve requirement ratio.

For instance, with a reserve requirement of 10% (or 0.10), the money multiplier is 1 ÷ 0.10, which equals 10. This means that, theoretically, $1,000 can increase the total money supply by up to $10,000 through repeated cycles of lending and deposits.

Changes in reserve requirements have a direct impact on the money supply. A lower reserve requirement means a higher money multiplier, allowing more money to be created through loans.

Contrarily, a higher reserve requirement decreases the multiplier effect, thus tightening the money supply.

Central banks often use this tool to steer economic activity by encouraging spending (low reserve requirements) and lending or limiting it (high reserve requirements).

Understanding these mechanics helps you see how your initial deposit acts as a catalyst in the financial system.

This system facilitates various forms of investment, and the money flows through financial intermediaries like investment banks. They help to multiply the initial sum into a much larger pool of capital within the economy.

Implications for the Economy

1) Economic Growth and Expansion

Fractional reserve banking plays a significant role in the economic landscape by affecting growth, liquidity, and the balance between inflation and interest rates.

This process leads to an increase in the overall credit available in the economy and thereby can stimulate economic growth. The availability of loans can help businesses expand and individuals purchase goods and services, sparking overall economic activity.

However, this system also carries the risk of bank runs, as not all deposits are available for withdrawal at the same time.

A bank run is when too many people lose faith in the bank so they try to remove their funds, but the bank can’t fulfill all the requests so ends up going bankrupt, or needing to be bailed out by the government.

2) Interest Rates and Inflation Control

The Federal Reserve uses policies that influence fractional reserve banking to help control inflation and manage the economy.

Adjusting the reserve requirements and influencing interest rates—for instance, through the Federal funds rate—can make borrowing more or less attractive.

Lower interest rates generally encourage more borrowing and spending, helping to stimulate economic growth. Conversely, higher rates can help curb inflation but may slow down the economy.

The delicate balance the Federal Reserve pursues is crucial in maintaining the economy’s health.

Regulatory Framework

When dealing with fractional reserve banking, it’s important to understand the regulatory bodies’ role. The stringent regulations are designed to maintain stability within the financial system.

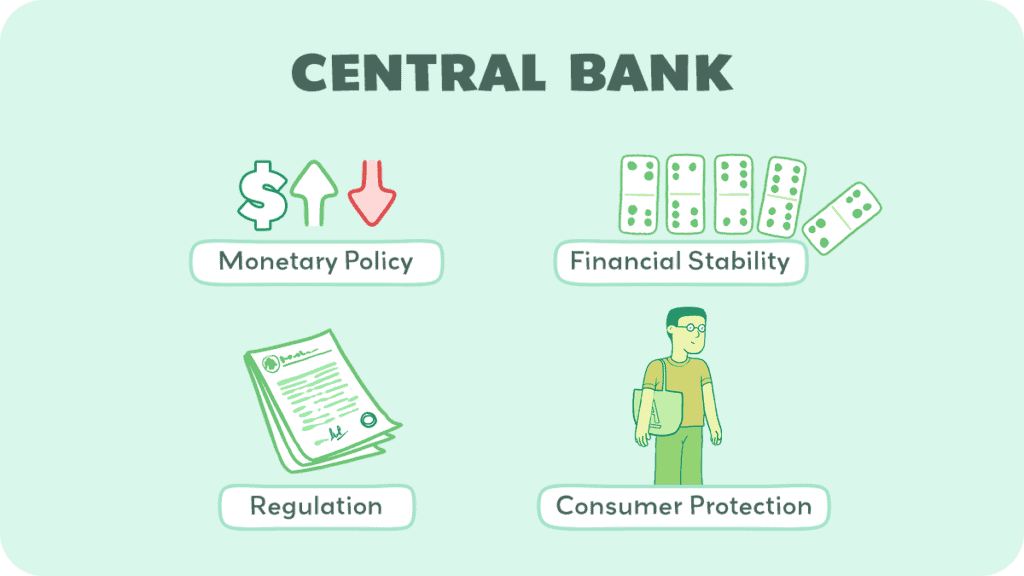

Central Banks’ Oversight

Your bank operates under the watchful eye of the central banks. Along with setting the reserve requirements, central banks are pivotal in setting the tone for monetary policy. This also affects how banks manage deposits and loans.

Additionally, financial markets eagerly await the minutes of central bank meetings. The minutes provide details on policies and future plans.

For example, if a central bank plans to inject more money into the economy (called “quantitative easing”), it can lift stock markets, often leading to lower interest rates and encouraging investment.

Banking Regulations and Acts

The banking landscape is not just shaped by the central banks but also by various banking regulations and acts.

For instance, the National Bank Act of 1863 provided a framework for establishing and operating national banks and outlined the regulatory requirements banks must follow.

Another critical piece of legislation in banking regulation history is the Federal Reserve Act. This established the Federal Reserve System and introduced a centralized bank structure. It set the stage for federal oversight in monetary policy and open market operations.

This legal infrastructure ensures that the banking system remains robust and your money is protected.

Risks and Safeguards

Your savings account is not just sitting in the vault; it’s part of a larger financial system with risks like bank runs and tools like lenders of last resort to safeguard it.

Bank Runs and the Lender of Last Resort

Bank runs occur when many depositors worry about a bank’s solvency—or, ability to pay their debts—and withdraw their funds simultaneously. This panic can lead to a financial crisis if unchecked, as even healthy banks may not have enough liquidity—immediate cash—to cover these withdrawals.

However, safeguards such as the presence of a “lender of last resort”—typically a country’s central bank—exist to provide emergency liquidity to solvent banks and restore confidence among savers.

For example, central banks stepped in during the US banking crisis in 2023 to provide extraordinary liquidity.

The lender of last resort acts as a safety net to prevent bank failures by offering loans to banks with sufficient reserve balance—the funds they keep on hand to manage day-to-day operations.

Managing Financial Crises

To manage a financial crisis, regulators use several tools to protect your deposits and ensure the banking system’s resilience.

Your savings account is insured up to a certain amount, which means that even in the case of a bank failure, your savings are protected. In the US, the Federal Deposit Insurance Corporation covers up to $250,000 per depositor per institution.

Regulatory bodies also monitor banks to maintain adequate reserve balances and assess their ongoing liquidity. By conducting stress tests and implementing stringent regulations, authorities work to preempt financial instabilities that could lead to a loss of confidence in the financial system.

This safeguards both individual depositors and the broader economy.

Fractional Reserve Banking in the Digital Age

The digital era has revolutionized how you interact with money, challenging traditional financial systems and introducing new concepts like electronic money and digital currencies.

Technological Advancements and Banking

Technological advancements have transformed the banking industry. Electronic money, transferred with a click, has become the norm, reducing the need for physical cash.

The shift towards digital has spurred banks to adjust their reserve management. They need to ensure they have sufficient funds to meet withdrawal demands. To do this, they have invested in secure, innovative systems to manage loans and deposits.

Additionally, you may see a shift in lending practices as banks respond to a marketplace where digital wallets and peer-to-peer lending platforms become more common.

Banks now often utilize sophisticated algorithms and predictive analytics tools to decide which loans to give out and what interest rates to set. Real-time processing means banks can better manage liquidity and ensure compliance with reserve requirements.

Experts predict a movement towards greater efficiency and transparency in banking operations. The focus will be on blockchain technology, which offers secure and instantaneous transactions. This could translate to faster loan approvals and a more personalized banking experience.

Changing Regulations and Global Trends

The impact of digital advancements on fractional reserve banking also has regulatory implications.

As global financial markets evolve, regulatory frameworks adapt, pushing towards more stringent reserve requirements to ensure stability in the face of digital volatility.

The potential integration of a central bank digital currency (CBDC) could redefine the relationship between cash reserves and digital transactions. With CBDCs, central banks might directly issue digital currencies. This could influence how commercial banks implement fractional reserve practices.

As you look forward, expect to observe dynamic shifts in how your bank handles your deposits and extends credit as the digital age advances. This could fundamentally alter the financial landscape, affecting how you engage with everyday banking and traditional banks’ role in the broader economy.