If you’re here, it’s probably because you are somewhat familiar with cryptocurrencies like Ethereum or Avalanche, and are curious how they work. You may have heard about consensus mechanisms and have a general sense of how blockchains work, but if not, you’re in the right place!

Staking is a term that often pops up in discussions about blockchain and cryptocurrencies. At its core, it involves holding onto your cryptocurrency to support the network and, in return, earning rewards.

Think of it as earning interest in a savings account, but in the digital currency world. Why is this important? Because it’s not just about holding crypto; it’s about actively participating in its ecosystem and reaping potential benefits.

Proof Of Stake (PoS) is a blockchain verification method that is much more energy-efficient and less risky than the more common Proof of Work (PoW) method. Only one miner is chosen at a time to validate the blockchain, but the miner must lock up some of their coins as collateral to be chosen.

What is Staking?

Think of staking like planting a seed in a garden. In staking, your cryptocurrency is the seed. When you “plant” it (or stake it) in a blockchain network, you’re helping to maintain the ecosystem of that particular cryptocurrency, much like watering a plant helps it grow.

Staking not only helps secure the network but also creates an opportunity for stakers to earn rewards. These rewards are similar to interest in a traditional bank account.

By staking your coins, you’re essentially lending support to the network’s functionality and, in return, you receive a reward, typically in the form of additional coins. This reward compensates you for the use of your assets and the risks associated with staking, such as price volatility.

Staking vs Mining

Let’s look at another analogy to compare the PoS consensus mechanism with PoW.

What is a consensus mechanism? A consensus mechanism is a set of rules and procedures that blockchain networks use to agree on the state of a ledger and validate transactions. It ensures that all participants in the network have a consistent view of the data, maintaining the integrity and security of the blockchain. When you stake, you’re actively participating in transaction validation.

In Proof of Work, let’s say you have runners lining up for a race. All 8 racers are racing to the finish line, but some racers have an advantage given the amount of resources they have, they have stronger legs or weigh less.

Even though all racers get to the finish line eventually… only one person wins and gets the reward (a shiny bitcoin) while the others still run down the track. Those who didn’t win essentially wasted their energy for no reward.

With Proof of Stake, all the runners would line up at the starting line and the user would be selected on a few factors (which we will talk about soon) and then only a single racer would be selected. This way, we don’t waste electricity or energy! And nobody runs without a reward.

| Feature | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Basic Concept | Miners solve complex mathematical problems to validate transactions and create new blocks. | Validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake”. |

| Energy Usage | High, due to the intensive computational work required. | Low, as it eliminates the need for extensive computational work. |

| Speed & Scalability | Slower and less scalable due to resource-intensive process. | Faster and more scalable, as it requires less computational power. |

| Security | Secured by the computational work; risk of 51% attacks if a single miner gets too much control. | Secured by the value of staked coins; risk of centralization if few have large stakes. |

| Reward System | Miners are rewarded with new coins and transaction fees for solving the block. | Validators earn transaction fees and, sometimes, network-specific rewards. |

| Barrier to Entry | High, requires significant computational power and energy. | Lower, requires holding a certain amount of the cryptocurrency. |

| Example Cryptocurrencies | Bitcoin (BTC), Litecoin (LTC), Dogecoin (DOGE). | Ethereum (post-Ethereum 2.0), Cardano (ADA), Polkadot (DOT). |

When it comes to coins that use proof-of-work (like bitcoin), many large mining companies compete to solve a block’s reward the fastest.

Proof of Work also isn’t fair to DIY miners who don’t have access to powerful machines that can win the “puzzle-solving” task the quickest.

We want there to be lots of miners so that the coin is truly “decentralized” and the blockchain is safe. If those large companies join together… they could start making fake transactions, because the blockchain is “majority vote”. If they get even 51%… you can kiss your bitcoins goodbye.

Proof of Stake attempts to fix this, by only selecting one “validator” (which is what Proof-Of-Stake coins call miners). The validator (or miner) then gets to solve the “puzzle” and earn the reward, while other validators double check them. It’s much more fair this way.

Validation

One key thing when it comes to proof-of-stake, is that since only one validator is selected, it is very important that they solve it correctly, otherwise we will have to select someone else and wait for them to solve it correctly. In the crypto space, time is money.

To solve this, we make sure they “lock up” some of their coins. Other validators can double check their work, and if they are wrong, we penalize them and take some of their coins. This process of “locking their coins up as collateral” is called staking.

So in short, to participate in a Proof of Stake coin, you need to own some of that coin. Then you lock it up so you can’t use it and wait to get chosen as a validator. If you validate transactions correctly, you receive a staking reward. However, if you validate incorrectly or act maliciously, you get penalized and could lose some of the coin you initially locked up.

The way we select who gets to be the validator is important too!

In many cases, Proof of Stake coins will bias those who are staking the most coins—they have the most to lose. Sometimes we also calculate how long they have been locking those coins up, because if they have them and haven’t lost them, they probably are making lots of good calculations.

If we only selected based on the age of their stake, or who has the most stake, we would probably be selecting the big and rich staking facilities again… To solve this, some PoS blockchains also add in a bit of a random number picker.

This random number picker, often referred to as a “randomized block selection” method or a “lottery system,” is used to add an element of chance to the validator selection process.

This mechanism works alongside the stake size to determine who gets to validate a block. The idea is to prevent the richest stakeholders from dominating the validation process, thus ensuring a more decentralized and fair system.

Here’s how validator selection typically works:

- Stake Size: Validators with a larger stake still have a higher chance of being chosen, as their stake represents a greater commitment to the network’s wellbeing.

- Random Selection: The system generates a random value or number. Validators whose stakes match or are closest to this value are more likely to be selected. This randomness ensures that even smaller stakeholders have a chance of being chosen, though less frequently than larger stakeholders.

- Stake Age: Some systems also consider the age of the stake. The longer a stake has been active, the higher the chances of being selected, up to a certain limit. This encourages long-term commitment to the network.

By combining stake size, random selection, and sometimes stake age, PoS systems aim to strike a balance between rewarding commitment and ensuring decentralization.

This approach helps to mitigate the risk of centralization, where only the largest stakeholders dominate the process, and ensures network security and fairness in validator selection.

Staking Rewards

One of the most attractive aspects of staking in cryptocurrency is the potential to earn rewards. When you stake your digital assets, you’re not just holding onto them; you’re actively participating in the network’s growth and security. In return, you can earn various forms of rewards.

Let’s break down how these rewards work and what influences them.

1. Types of Rewards

Regular Payouts: Most commonly, stakers receive rewards in the form of additional coins. These payouts are typically distributed at regular intervals, such as daily, weekly, or monthly.

Percentage Yields: The rewards are often expressed as a percentage yield, similar to interest rates in traditional finance. This percentage is based on the amount of cryptocurrency you have staked.

Network-Specific Bonuses: Some networks may offer additional bonuses or incentives. These can include extra rewards for validators who consistently participate or for those who stake their coins for longer periods.

2. Factors Influencing Rewards

Amount Staked: Generally, the more you stake, the higher your potential rewards. This is because a larger stake often means a greater chance of being chosen as a validator.

Network Conditions: The overall condition of the blockchain network, such as the number of active stakers and total amount staked, can affect reward rates.

Inflation Rate: Some cryptocurrencies have a built-in inflation rate, where new coins are generated as staking rewards. The rate of new coin creation can impact the value of staking rewards.

Lock-up Period: Many networks require a minimum lock-up period for staking. Longer lock-up periods might offer higher reward rates as an incentive for the added commitment.

3. Compounding Rewards

One of the unique features of staking rewards is the possibility of compounding. By reinvesting your rewards to increase your staked amount, you can potentially earn more over time, much like compounding interest in a savings account.

Risks of Staking

While staking can be a good way to earn passive income in the world of cryptocurrency, it’s not without its risks. Understanding these risks is super important for making informed decisions.

Risk 1: Locking Period

When you go to stake your coin, it’ll be moved into what is called a “locked” state. During this time you won’t be able to move your coins—you can’t send or cash them out. Sometimes you have to lock them up for a certain amount of time, like a month minimum. Which leads us to…

Risk 2: Market Volatility

The value of staked coins can fluctuate wildly due to the inherently volatile nature of cryptocurrencies. This means the value of your staked assets and rewards can decrease significantly, and if you can’t remove them, you have no way of getting out if you think you need to.

Risk 3: Technical Knowledge

In almost every case, it’s not as easy as downloading software then pushing a button. You usually have to know how to code, how to set up your computer to validate, and how to accept rewards into a wallet. If there’s an issue, you are liable to fix it.

The issue might not just be on your end of the equation either. There are general network risks to think about, which are more likely in newer or less-used blockchains. Any issues like bugs, attacks, or network failures can impact the staking process and your rewards.

Risk 4: Validator Commission

If that sounds too technical for you, you don’t have to set up the validating process yourself—you can give your coins to someone who has the knowledge and equipment to do it all.

These platforms usually require a validator commission for the use of their computers. This could cut your profit and they could change it at any point.

Not to mention you don’t control the behavior of the person you’re lending your coins to. If the validator is a bad actor, there’s a risk of losing a portion of your stake (slashing) if they fail to validate transactions correctly or if your node goes offline. This can result in a direct financial loss.

Risk 5: Rewards Duration

Depending on the network you choose, it could take minutes, days, and even weeks to see the payout of your staking position. This is why it’s crucial to see the networks rewards payout time.

Risk 6: Tax & Regulatory Implications

The evolving regulatory landscape for cryptocurrencies can affect staking practices and rewards. New regulations or policies can introduce unforeseen challenges. And having unclear rules can mean you get in trouble for something you didn’t know you did wrong.

Thus, it’s super important to make sure you’re familiar with your local regulations so you don’t get hit with fines—or worse—down the road.

Choosing the Right Coin for Staking

Okay, so you’ve come this far and you still want to stake but you aren’t sure where to start. Let’s look at a few factors that you should consider when deciding which network to participate in.

| Criteria | Description |

|---|---|

| Project Credibility and Longevity | Assess the development team, vision, community support, and track record of the project. |

| Network Stability and Security | Evaluate the blockchain’s robustness and security to ensure a stable staking environment. |

| Reward Potential and Return Rates | Consider the rewards and return rates, factoring in the coin’s inflation rate. |

| Staking Requirements and Conditions | Understand the minimum stake, lock-up periods, and any penalties for non-compliance. |

| Community and Support | Look for a strong, active community and available resources for stakers. |

| Liquidity and Market Presence | Check the coin’s market liquidity and ease of trading. |

| Regulatory Compliance | Stay informed about the regulatory status and implications for staking. |

| Personal Investment Goals | Align the coin choice with your personal risk tolerance and investment strategy. |

Let’s look at some examples of the most common PoS networks. Remember that staking rewards vary based on a bunch of different factors, and there’s no guarantee that yields will remain high.

If you’re looking at a new network, or a network that offers consistently double-digit yield returns, it very well may be a scam, so be careful! Always try to answer the question “where is the money coming from?”

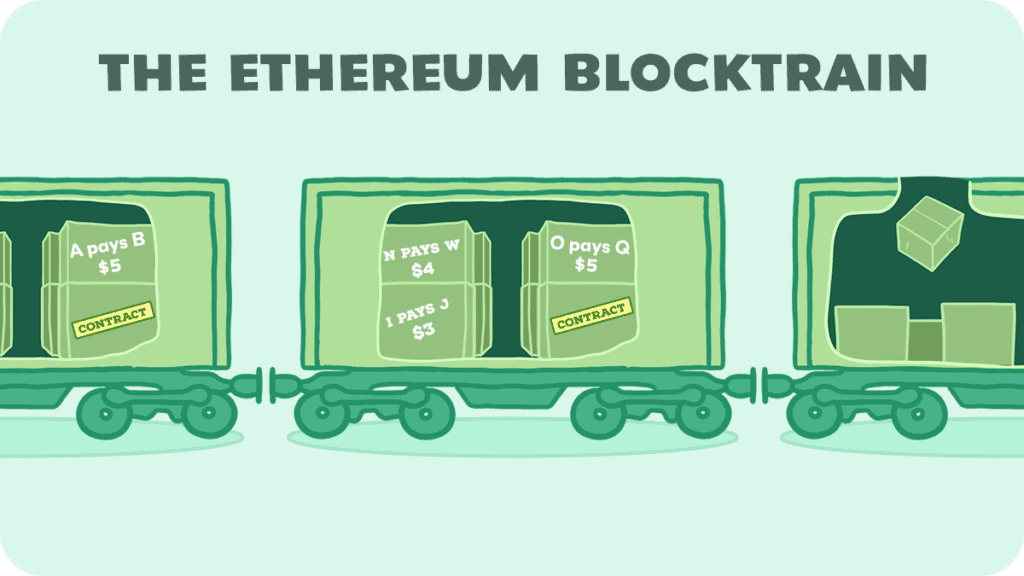

Ethereum (ETH)

Ethereum’s 2023 upgrade to a PoS consensus mechanism improved scalability, security, and sustainability. It’s one of the most prominent blockchain platforms, supporting a wide range of decentralized applications (dApps) and smart contracts.

The annual yield for staking Ethereum typically ranges between 4-7%, but this can vary.

Cardano (ADA)

Cardano is known for its strong focus on sustainability, scalability, and transparency, offering a secure and scalable blockchain platform for the development of dApps and smart contracts.

Staking rewards for ADA are usually around 4-6% annually.

Polkadot (DOT)

Polkadot enables different blockchains to transfer messages and value in a trust-free fashion; sharing their unique features while pooling their security.

The average annual staking reward for DOT is typically around 12-14%.

Tezos (XTZ)

Tezos is designed to provide the safety and code correctness required for assets and other high-value use cases, with an emphasis on modularity and upgradability.

Tezos offers an average annual yield of approximately 5-6% for staking.

Cosmos (ATOM)

Cosmos bills itself as a project that solves some of the “hardest problems” facing the blockchain industry. It aims to offer an antidote to “slow, expensive, unscalable and environmentally harmful” PoW protocols.

Staking rewards for ATOM are around 8-10% per year.

Algorand (ALGO)

Algorand focuses on speed and efficiency in its blockchain protocol and aims to be both scalable and secure, with a broad use in traditional finance and decentralized financial systems.

The annual yield for staking ALGO is typically around 5-6%.

Conclusion

Staking presents a unique opportunity for individuals to actively participate in blockchain networks, contributing to their stability and security, while potentially earning rewards.

Remember, while staking offers the allure of passive income and the excitement of being part of a digital revolution, it’s important to approach it with a balanced view, considering both the rewards and the risks.

As the cryptocurrency landscape continues to evolve, staying informed and conducting thorough research will remain key to making wise staking decisions.

Thanks for reading, we hope you learned something, and we hope to see you again soon!