If you’re new to the world of crypto, it’s pretty complicated. Just 7 months ago, I set up my very first Metamask wallet and deposited some ether. Today, I’m actually writing smart contracts, but back then, I knew absolutely nothing about how many scams were out there.

In fact, I lost a decent amount of money, somewhere around $5000 probably due to certain scams that I fell prey to. The cool thing about the blockchain, is that the information is available to everyone, so I could even share the transactions with you where I definitely lost money.

In this article, we are going to explain some of the most common crypto scams, including one that’s so new you probably haven’t even heard of it, and of course, how to avoid them.

Let’s dig into the top 10 worst scams inside the World Wide Web 3 that you might encounter.

1) Any website asking for private keys

Do you remember the first time you ever set up a crypto wallet? You didn’t know if you were doing things correctly and everything was really complicated? Well at least it was for me.

Scammers take advantage of this all the time. The first trick they use is very simple: they ask for your personal information, specifically for your private key. It’s really sad to me how many scammers out there take advantage of someone’s lack of knowledge and then try to get you to tell them your seed phrase. By doing this, they get access to ALL your funds.

Some might say, “Hey, I want to send you money, what is your key?” or “You just won 1 whole ether, tell us your seed phrase so we can deposit the funds in your account”.

They will try every trick possible to fool newbies into giving them access to their funds. When it comes to crypto, you get two keys: a private key that you should NEVER, EVER share, and a public key that is like your email address.

Many people confuse these, which leads to them getting scammed. You can learn more about them both by watching our video on asymmetric encryption, which is a complicated topic that we break down so simple your grandpa could understand.

2) Asking to invest for you as a trusted creator

The second trick is something you might be used to if you have looked at the comment section of some of my videos, or if you are in a couple of crypto Discord and Telegram servers.

Scammers will create a bot that seems official, or impersonate a project, specifically a team member, and then DM you so they can seem official, with the hopes of scamming you in some way. One of the most common scams this way is they ask for $100 and say they can turn it into $2000 or something crazy like that, claiming to invest your money for you.

This happens all the time on my channel. In fact, I even messaged one scammer just to see how the scam worked, so never reach out to someone you met in the comment section!

Especially if they look like me—I promise it’s not me asking for you to reach out. Once you reach out, a scammer will send you a DM moments later, saying they are a project team member and they can assist you.

Scammers will sometimes change their username and their profile picture to impersonate a real team member on Discord. For those cases, something you can do is look at the Discord handle (username) and check if it matches the information of the impersonated team member.

For example, mine is whiteboardcrypto and no one can copy that.

Remember, no legit project team member will ever give you a WhatsApp telephone number so you can reach them, and we will NEVER ask to invest your money for you.

3) Burning a percentage of a trade or sending it to a dev wallet

Another scam, so to say, that token developers will implement is a burn feature. They say “Every time this token is traded, a portion of the trade is burned forever”.

So if you send 100 tokens, 5 tokens are burned, or sent to an account that nobody has access to. This makes you believe that one day there won’t be very many of these tokens out there, and if you buy now and hold, the value of your tokens will increase.

Well, let me tell you something. If my dog ate something one day that turned his poop orange, that might be the only day in his entire life that he poops something orange, but just because it’s scarce doesn’t mean it has value… nobody is going to want my dog’s orange-colored poop.

Other people have to want that orange poop for it to have value. Keep this in mind with tokens that have a deflationary feature.

4) Sending you a seed phrase or private key with money in it

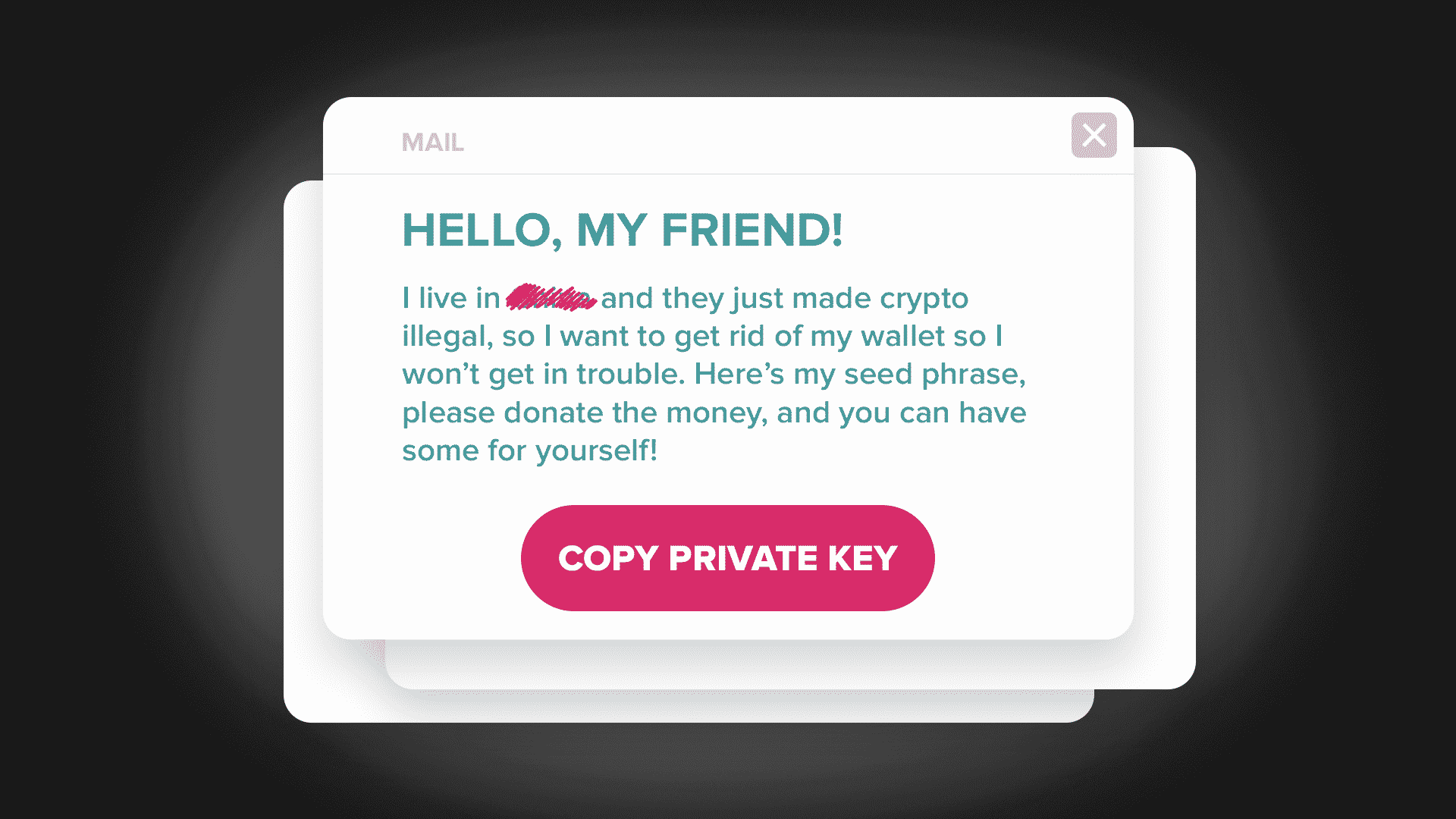

This is a scam that I recently saw. Here’s the set up. Someone contacts you and says something like “Hey, I live in China and they just made crypto illegal, so I want to get rid of my wallet so I won’t get in trouble. Here’s my seed phrase, please donate the money, and you can have some for yourself.”

Then they will actually give you a seed phrase to an actual account with actual money in it.

The one I saw had $3000 worth of Tether. Now, here’s the trick. To get the Tether out, you must first have some ether to pay the gas fee. If you don’t know, every transaction on the Ethereum blockchain requires some money first.

So, you’re kinda smart and think you’ll grab the Tether for yourself, so you go ahead and deposit like $50 of ether so that you can transact the money out of the account. The fee to transact a token right now is like $50 while the fee to send Ethereum is like $10.

So you deposit $50 and immediately the scammer sends the money to their account, profiting $40. I’m talking like within 10 seconds, they have a computer running a program that checks if there’s funds in there and then automatically sends the Ethereum to their account.

So there is absolutely no way to get the $3000 out of there. The sad part of this is that the blockchain is available for everyone to see. So you can literally look at the account on etherscan and see the 30 people who were scammed around $2800 in total.

Maybe this idea deserves a whole article, and if we get enough comments about it, I’ll explain it in more detail. In short, if someone gives you their seed phrase, and their wallet has money in it… DO NOT deposit money for any reason.

Technically if they were in China and didn’t want to be connected to the account, they wouldn’t have to give it to someone, that’s just bad logic.

5) Smart contract bug

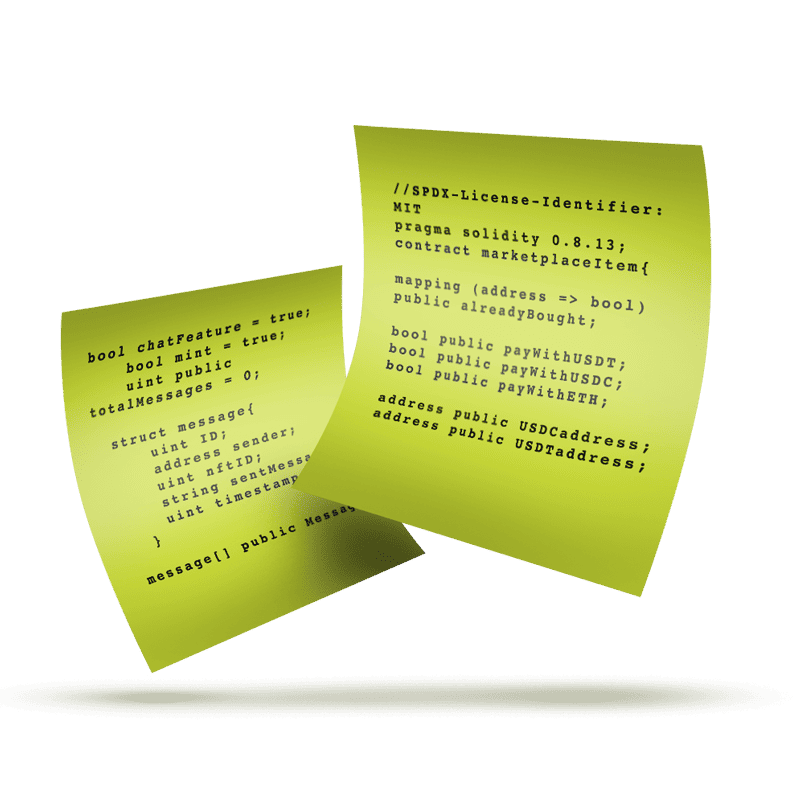

Another trick that scammers use, which you may not even be aware of, is a bug where people can buy a token, but cannot sell it.

How is it possible? There are 3 ways of doing this. First, when the devs created the token, they simply disabled the “approve” function in the ERC20 token contract, meaning decentralized exchanges cannot get your approval for putting the token to be sold.

The other way is to add a rebase function into the token contract so at the moment you try to sell the token, you will lose 99.9999% of it.

Third, they can easily write a few lines of code that prevents their token from being sold to a dex, only bought or supplied. This means a lot of money is coming into the project and none is going out, making it a perfect situation for the scammers to run with all the money.

Even more so, they could make it so when you sell your token, that the money you would’ve gotten goes to the developers. I’m not saying you should learn how to read smart contract code, but I’m saying before making any buy over $1000 you should find a friend who can.

6) Phishing on fake websites

The next technique is something you really need to be careful of and keep an eye on when you discover a new project or browse using a new device or computer.

Some scammers create a website that is an exact copy of a specific crypto project website, with the same user interface and the same information on it. The only things different from the real one are 2 things:

- The domain. Because scammers can’t have the same domain as the real website, they will create a new one that is almost the same as the real one. For example, scammers could create a fake Whiteboard Crypto website, switching the .com to .org .net .fi .xyz or add an “s” at the end (whiteboardcryptos.com) or remove the “e” (whitboardcrypto.com). They change this little detail so people don’t realize they are not on the right one.

- The contracts. This is the scammy part. The scammers could change the smart contracts’ codes so that if you interact with it, they get access to your funds in your wallet, leading to you losing all your money. In fact, they could make the contract do anything, which is why it’s really important to only connect to applications you trust.

Something I do to make sure I always click on the right links, is to go on trusted websites (like CoinGecko or CoinMarketCap) or on the official project’s Twitter account to find the right links and then bookmark the website to make sure I’ll always use the correct one.

7) Fake ICOs

You know how Kickstarter projects or any crowdfunding projects get money: they show their product, that’s not yet manufactured, and people fund the project in exchange for a great deal (like 2 products for the price of 1 or a special edition version).

In crypto, there is something called ICO, or Initial Coin Offering, that works as a way to gather a lot of money from investors to start the project.

Fake ICOs are an easy way for scammers to present a project to investors with no intention of really creating it and run away with the investors’ money.

How it usually works is that scammers present a really nice/ innovative/ revolutionary project to investors. They ask for money to kick-off their project and lure inexperienced investors with juicy ROI (100% to 1000% for a couple of months or the first year).

The investors give the money, but then the scammers run away with it. Many projects in the crypto space are not regulated, and because of this, unfortunately the scammers get away with it.

A good thing to do before investing in a crypto project is to look for legit whitepapers, a project’s timeline or good tokenomics to back your investment, not just great UI and juicy ROI.

We have a page about how to do research on a coin or token, so be sure to check that out if you aren’t sure what any of that means.

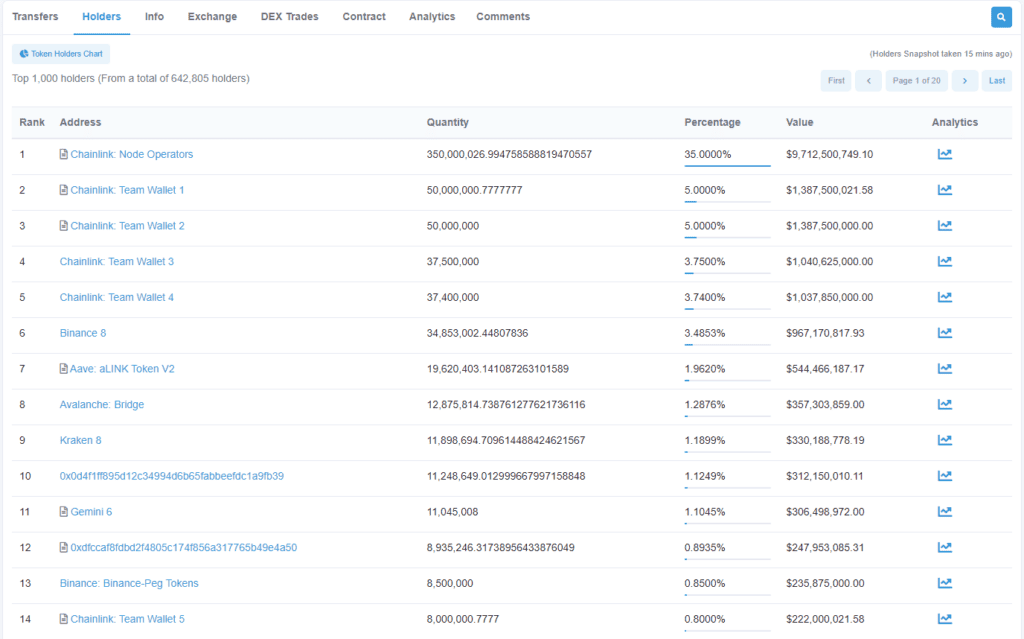

8) Hidden whales

You know how I always say to be careful with projects with a low liquidity or a low marketcap because they can easily be manipulated by a whale, or anyone holding a high percentage of the total tokens out there?

Well, since this is kinda obvious, and since scammers are aware that people will look for it before investing money in a project, scammy projects now have found other ways to hide the fact they hold most of their token.

Instead of having 1 wallet with all the money, they split it between multiple wallets.

For example, if the total liquidity of a project was $500,000 and the team was holding $50,000 (10%) of the existing token, they would split the money between 10 different wallets with $5000 (1%) inside of each, to make it look like a safe and legit project.

Now, you can easily check the early transactions of a project’s initial tokens, but this is more work required for you, and I’ve noticed a lot of projects have started doing this because people won’t do anything more than just look at the token holder’s page on Etherscan, note that there are no single whale wallets, and invest blindly.

Here’s a tip: You can check the blockchain, you can spend an hour just looking around and seeing where money is going. It’s very easy, it just takes some time.

The simplest way to make sure the devs don’t hold most of a token is to look at the first transactions and where the money was originally distributed. If the first transaction is to send a lot of money to multiple addresses, it is not a good sign.

9) Psychologically making you think a small price is able to 10x easier

This one is technically not a scam, but it’s tricky. When a project launches, the tokenomics are established by the project’s team. Developers can answer the questions, “What is the max supply of the token?” “What is the initial price of a token?”, “Who gets the early tokens?”

All this stuff is decided in advance. Something quite a few scammy projects do is to print a huge amount of tokens so the price is low, even if there’s a lot of money in the entire project.

Between you and me, owning 100 tokens worth $1 each is the same as owning 100,000 tokens worth $0.001, right? Well in people’s mind, having more tokens with a very low price is more tempting psychologically, because it makes them think, “With a price this low, I’ll easily get x2 x3 x10 x100 in value!” and they get to feel like they own a ton of tokens.

But in reality, going from $0.001 to $1 is as difficult as another token going from $1 to $1000, so this trick is really about making people think their gain opportunity is higher than it really is—to make people invest more into the token.

So make sure you don’t invest in a project only because the price of the token is low, because if you do, it might be a game of limbo and you’ll see how low it can go.

10) Gambling with your trust

The last technique is something we saw with a scam from 2021: the Squid Games Token. They capitalized on the fact a show called Squid Games was really popular and they rode the hype train using the same name so they could get a lot of attention.

But this is not the trick I want to talk about. To create a false feeling of safety, they created a false team. Yeah, you heard me right, they created about 10 fake profiles with fake bios to make it seem like the project had a great and solid team that people could trust.

They even added computer generated pictures of people (that don’t even exist) to make it seem more legit. Crypto scams are getting more and more persuasive, so you’ll have to work harder when making a decision on a project.

Research Tips

If you’re wanting to invest in a project, there are only 2 things I suggest you do. The first is to go to a website called RugDoc.io. What this website does is analyze projects. If there are any possibilities of exploits or scams in the contracts it will tell you how high of a risk it is to invest in it.

The other thing I can suggest is that you can join our Discord and our team will look at the project for you and point out any obvious risks. Obviously we can’t tell you if it’s a good bet or not, but we can point out if it hits anything on this list or any new bugs we find.

You’ll have to sign up to our newsletter to get access to the Discord, and you can find that easily on our homepage.

One more thing I do is research the project a ton before investing. Read the whitepapers and tokenomics, the basics, but there’s a few more advanced things I do that you can learn about if you join the WhiteboardCrypto Club.

Conclusion

This is just a brief overview of some of the most popular crypto scams out there. We are developing many more explanations of scams, so be sure to check those out too.

Thanks for reading, we hope you enjoyed this article, we really hope you learned something.