Whether you’re new to cryptocurrency or you’ve been doing research for a while you’ve most likely heard the debate between Proof of Work (PoW) and its counterpart Proof of Stake (PoS).

Proof of Work (PoW) is a blockchain consensus mechanism where miners solve complex mathematical puzzles to validate transactions and create new blocks. This process requires substantial computational effort, ensuring network security and preventing fraudulent activities.

Some investors think Proof of Work is better than other consensus mechanisms. While it does have features that aren’t desirable, it was the first consensus mechanism and the “big bad bitcoin” model still uses it.

What is Proof-of-Work (PoW)

If you search the word on Google and other search engines, you’d be told PoW is a consensus mechanism on the Bitcoin network. Yes, it is a consensus mechanism, but there’s more to it.

In technical terms, proof-of-work is an algorithm or system that uses a significant amount of effort to deter or eliminate fake uses of computing power.

Launched on the Bitcoin network in 2009, Proof of Work was designed to solve the problems of double spending, decentralization, and fair rewards for network participation.

Double Spending

What is double spending? Imagine Bob has $10. Basically, we wanted to make sure Bob didn’t pay Alice $10, and then go and pay Sally $10 as well, even when he didn’t have it. One of the jobs of PoW is to ensure this doesn’t happen.

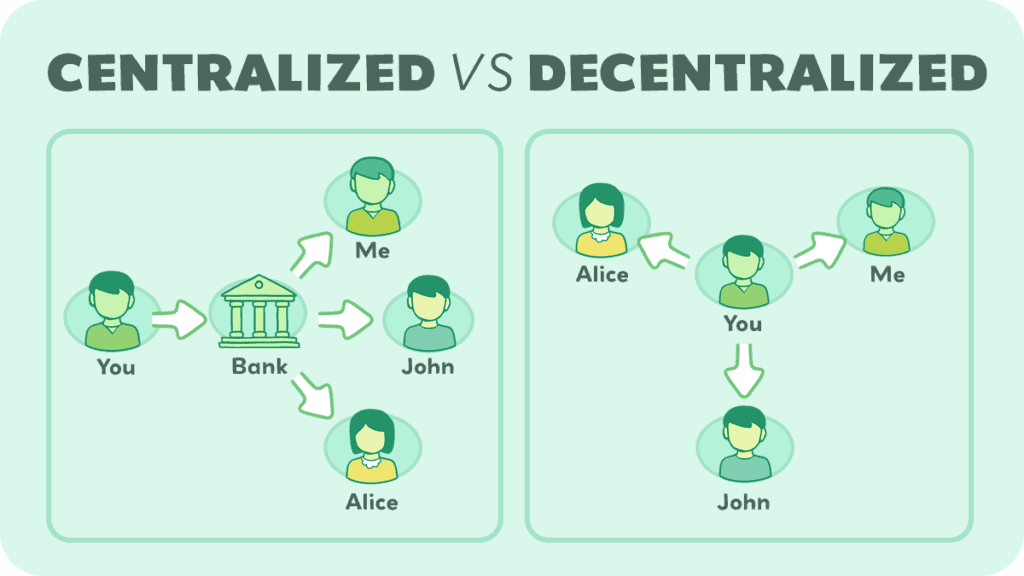

While this is easier on a centralized system because of the central authority, (in other words, one person can check and make sure it didn’t happen by looking at their records) it is much harder and even trickier to solve this problem on a blockchain, where millions of people have their own records.

Double spending on a network is bad, it makes duplicate coins, reduces the value of the coin, and basically makes the currency worthless and unpredictable.

Decentralization

Additionally, PoW helps in maintaining decentralization, a core principle of blockchain technology.

In a PoW system, anyone with the necessary computing power can become a miner, participating in the process of validating transactions and creating new blocks.

This open participation model prevents any single entity or group from dominating the network. Because miners are spread across the globe and operate independently, it’s extremely difficult for any one party to gain enough computational power to control the blockchain.

This decentralized structure enhances the security and integrity of the blockchain, ensuring that it remains a democratic and trustless system where no single point of failure exists.

Distribution of Rewards

In Proof of Work (PoW) blockchains, the distribution of new coins is closely tied to the mining process. When miners use their computational power to solve complex puzzles and validate transactions, they help maintain the network’s integrity.

As a reward for their efforts, miners receive new coins, a process often referred to as “block rewards.”

This system ensures that the distribution of new coins is based on a fair and competitive process. Miners are incentivized to contribute resources to the network, as their chances of earning rewards increase with more computational power invested.

This competitive nature encourages a diverse group of participants, preventing any single entity from monopolizing the coin supply.

Moreover, this method of distributing coins through mining also helps to gradually introduce new coins into the system, mimicking the process of mining precious metals like gold.

This controlled release of new coins helps manage inflation and maintains the currency’s value over time.

Consensus Mechanisms

To understand what Proof of Work (PoW) is, we need to know what a consensus model is, and why it is needed.

In a normal database system that holds information, for example, medical reports, a single person or computer is given the responsibility to manage the whole database.

It is only their job to update, maintain, delete, and add new patient information to the database, nobody else has access to it. Technically, they could delete your account, or say that you owe them $10,000 at will.

For blockchains, this is completely different. Being what is called a “distributed ledger”, this technology is self-governing—which means there isn’t one person who can control it or make changes.

Contributions come from all of the hundreds of thousands of users who participate in the network to make it function properly. If one person said you owe them $10,000, they would be quickly outed as a fraud by the rest of the people on the network. This is the first benefit of a consensus model.

In an ever-changing system like the blockchain, you really need a reliable, fair, real-time, efficient, and transparent mechanism that will ensure that transactions that are executed are genuine and that there’s a consensus on the network.

That was a lot of words, but most simply, consensus means that everyone is on the same page. Essentially, if Bob pays Alice $10, we want to make sure everyone knows what happened and also that Bob’s account goes down $10 and Alice’s goes up $10.

Proof of work is one way to make sure everyone has the same database, that they reach “consensus”.

How PoW Works

Proof of Work (PoW) operates on a simple yet effective principle. Miners around the world compete to solve complex mathematical puzzles using their computational power.

These puzzles are difficult to solve but easy to verify. When a miner successfully solves a puzzle, they get the opportunity to add a new block of transactions to the blockchain. This process is known as ‘mining’.

Upon adding a block, the miner presents their solution to the network for verification. Other participants in the network check if the solution is correct. If it is, the new block is added to the blockchain, and the miner is rewarded with new coins, known as the block reward.

This reward serves as an incentive for miners to contribute their computing power and keep the network secure.

Through this mechanism, PoW ensures the integrity and security of the blockchain. Every transaction in each block is confirmed and recorded across the network, making it nearly impossible to alter any information without the network detecting the change.

This process not only creates new coins but also plays a critical role in maintaining the decentralized and tamper-proof nature of the blockchain.

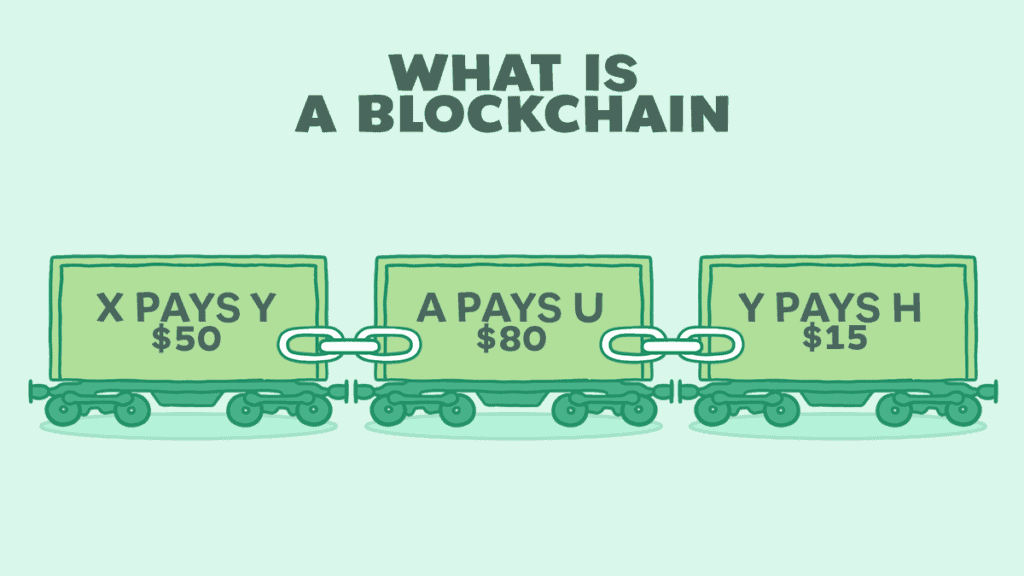

What Are Blocks?

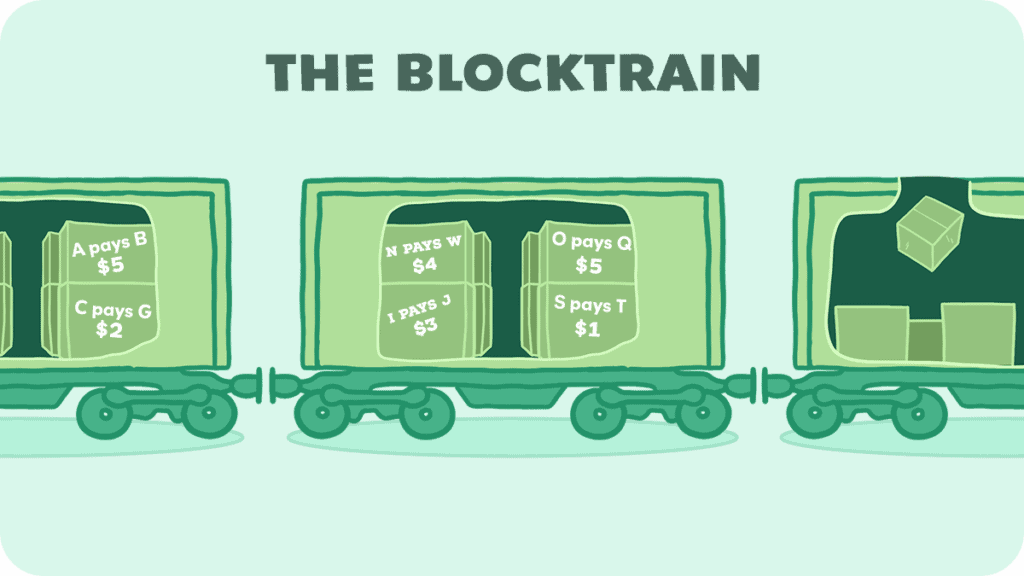

Basically, a blockchain exists as a decentralized ledger that has the responsibility of storing information permanently and safely.

As the name implies, a blockchain comprises “blocks” which when verified are added to the network’s chain. Each of the blocks contains information of the recent transactions verified.

Most simply, a blockchain is a list of transactions in a specific time period. For example one block might have Bob pays Alice $10, Alice pays Sally $5, and Alice pays Bob $5.

A real block can contain hundreds of transactions, but you get the idea. This means you can go back and see EVERY transaction in the blockchain, because new blocks are directly tied to the previous block, which makes this a chain!

Miners

Miners is the term for people using their computers to participate in the network to add new blocks. Miners execute proof-of-work each time a new block is added. PoW is a literal description for what they do—prove that they found the solution to the math puzzles mentioned above.

The time it takes to mine a new block in a Proof of Work (PoW) system can vary depending on the specific blockchain. However, most PoW blockchains are designed to have a consistent average block time.

For example, in Bitcoin, the most well-known PoW blockchain, a new block is mined approximately every 10 minutes. This is not a fixed duration but an average, as the actual time for each block can vary.

The block time is regulated by the network’s difficulty adjustment algorithm. As more miners join the network and contribute their computational power, solving the puzzles becomes more competitive.

To maintain the average block time, the network automatically adjusts the difficulty of the puzzles. If there are fewer miners, the difficulty decreases, and if there are more miners, the difficulty increases.

This system ensures a relatively steady rate of new block creation, which is crucial for maintaining the stability and predictability of the blockchain. It also plays a key role in managing the rate at which new coins are distributed and in keeping the network secure.

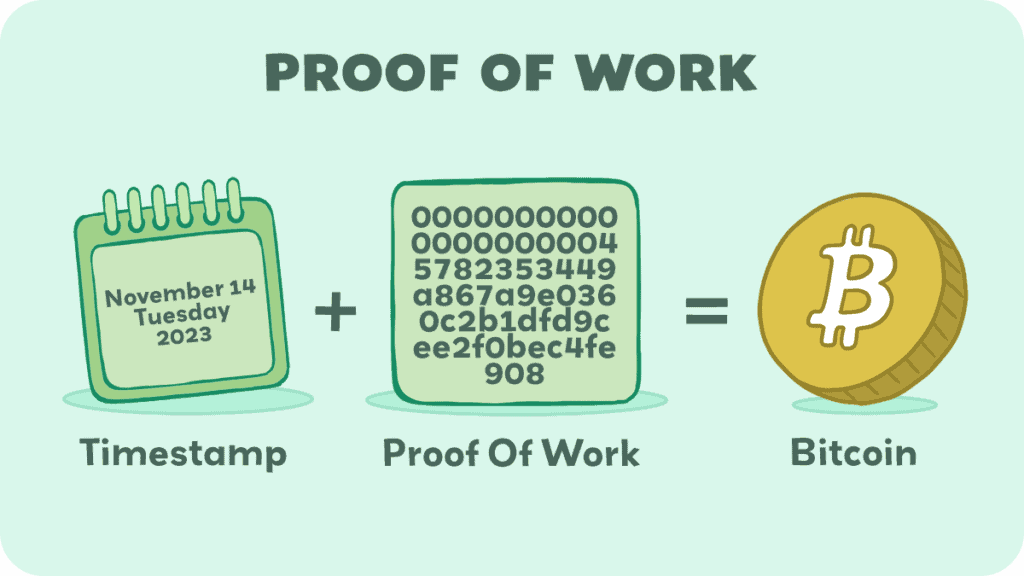

How do miners prove they did the work? This proof is a special number called a “nonce.” The miner combines this nonce with the block’s data and runs it through a special formula, producing a unique code (hash) that meets certain criteria, like starting with a bunch of zeros.

They then send this nonce and the new block to the network. Other network members check this by using the same formula. If they get the same unique code, it proves the miner did the work, and the new block is added to the blockchain.

Once you prove you did the work, you get a reward, which is a certain amount of bitcoin. The transactions in that block are then “validated” and the records of everyone on the network are updated.

Benefits of Proof of Work

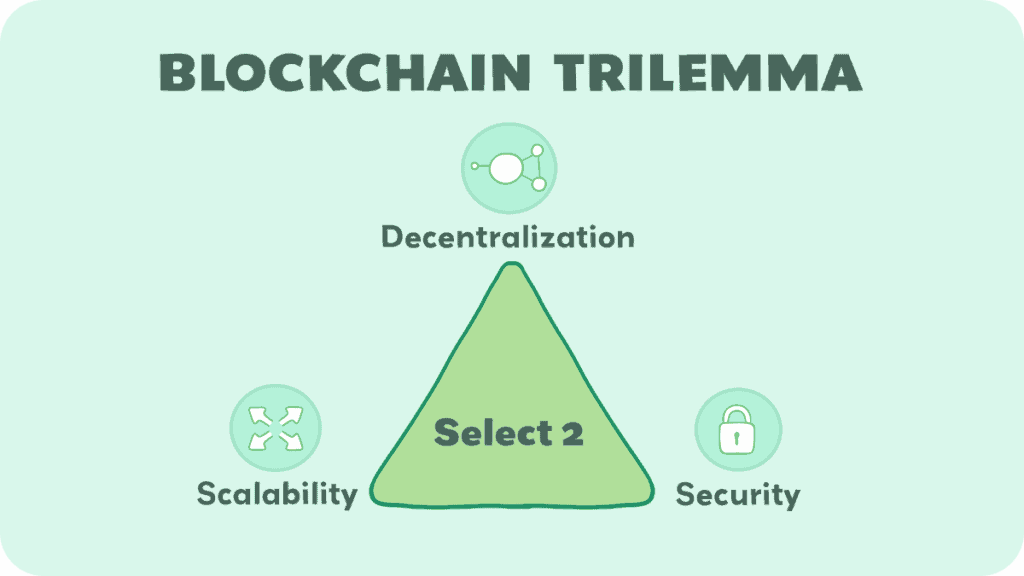

A blockchain might choose to use Proof of Work (PoW) over other consensus mechanisms for several reasons. Namely, security, decentralization, proven track record, and resistance to certain kinds of attacks.

Security

The singular purpose of integrating this system into crypto projects is to offer a reliable, safe, permanent, fair, and transparent system that will form a consensus based on network participants’ contributions.

PoW is known for its high level of security. The effort required to solve the cryptographic puzzles makes it extremely difficult for a bad actor to manipulate the blockchain.

Altering any block in the chain would require re-mining all subsequent blocks at a huge computational cost, making attacks unfeasible. Not to mention, to create fraudulent transactions, you would need to control 51% of the network’s power, which is equal to hundreds of billions of dollars in hardware today.

Don’t get us wrong—all consensus mechanisms are secure in one way or another. So what makes PoW unique? Misbehavior from a miner on a PoW mechanism may result in being entirely cut off from attempting to add new blocks.

Decentralization

PoW promotes a more decentralized network than other consensus mechanisms. Since anyone with the necessary computational resources can participate in mining, it allows for a wider distribution of network validators.

This reduces the risk of central control by a few large players, a concern in some other consensus mechanisms, such as Proof of Stake.

Track Record

PoW is the original consensus mechanism used by Bitcoin, the first and most well-known blockchain. Its long-term operation has proven its effectiveness and reliability in maintaining a secure and functional decentralized ledger.

Attack Resistance

PoW is resistant to certain types of attacks that can be a concern in other mechanisms.

“Nothing-at-stake”: Unlike Proof of Work (PoW), where miners must expend significant computational resources to add a block, Proof of Stake (PoS) validators can support several blockchain forks simultaneously without extra cost.

This could potentially lead to security issues. PoW, by demanding substantial effort for each block mined, ensures miners are committed to a single, consistent version of the blockchain, enhancing its security.

51% Attack Resistance: In a 51% attack, an attacker gains control of more than half of the network’s mining power, potentially allowing them to manipulate transactions and double-spend coins.

While this is theoretically possible in PoW, it’s extremely costly and difficult because an attacker would need immense computational resources to achieve such dominance.

Double Spending Prevention: PoW makes double spending difficult. To reverse a transaction, an attacker would have to re-mine all the blocks from the point of the transaction, which becomes increasingly impractical as more blocks are added.

Sybil Attack Resistance: In a Sybil attack, an attacker creates a large number of pseudonymous identities to gain a disproportionately large influence on a network. PoW mitigates this by tying mining power to computational work, not the number of identities. This means creating more identities doesn’t give an attacker any advantage without the corresponding computational power.

Denial-of-Service (DoS) Attack Resistance: PoW networks are generally resistant to DoS attacks, where the goal is to overwhelm the network with a flood of traffic. The work required to mine a block acts as a deterrent against spamming the network, as each block requires significant effort and resources to be accepted.

Timejacking Attack Mitigation: This is where an attacker attempts to manipulate a node’s network time to disrupt network synchronization. PoW networks use timestamping in block creation, which, along with network consensus, helps prevent the success of such attacks.

Problems with Proof of Work

Inherently flawed, PoW has a ton of problems that have made it almost impossible for mass adoption, which is why other consensus mechanisms, such as PoS, were created.

1) Impact on the Environment

According to a 2019 BBC news article, PoW is estimated to have used as much energy as all of Switzerland. That’s not all, as the network continues to grow and more people begin to jump on the Bitcoin frenzy, the energy usage increases.

The energy consumption level of this network makes it bad for the environment. However, there are reports a large majority of miners are starting to use renewable energy such as solar panels to power their mining operations.

2) Inability to Scale

The unprecedented growth of the cryptocurrency market has opened up opportunities for individuals to make real money either as traders or miners on these networks. With a 24-hour trading volume of around $95 billion and a market cap of $1.7 trillion, the market is booming.

PoW networks typically have slower transaction processing times and lower throughput compared to some other consensus mechanisms, since roughly only one block is solved per 10 mins.

As the number of users and transactions grows, this can lead to network congestion and higher transaction fees, affecting the usability of the network.

3) Centralization Tendencies

Despite its decentralization goals, PoW can lead to some degree of centralization. This happens because individuals or entities with more financial resources can afford more powerful mining equipment, giving them a greater chance of earning block rewards.

Over time, this can lead to a small number of miners controlling a large portion of the network’s mining power.

4) Barrier to Entry for New Miners

The competitive nature of mining in PoW systems and the ongoing arms race for more efficient mining hardware make it increasingly difficult for new, smaller miners to join and be profitable. This can discourage new participants and further contribute to centralization.

5) 51% Attack Vulnerability

Yes, this exists in both benefits and problems.

Although it’s costly and difficult, if an entity manages to control more than 50% of the network’s mining power, they can potentially manipulate the blockchain.

While this is a concern in all blockchain consensus mechanisms, this is especially a risk in smaller, less established networks. It’s very unlikely on Bitcoin, for instance, but far more likely on newer PoW blockchains.

PoW Powered Projects

Aside from being the sole mechanism on the Bitcoin network, PoW powers a couple of other networks:

Litecoin (LTC)

Created by Charlie Lee in 2011, Litecoin is similar to Bitcoin but with faster transaction confirmation times and a different hashing algorithm (Scrypt). It’s often considered the silver to Bitcoin’s gold.

Bitcoin Cash (BCH)

A fork of Bitcoin created in 2017, Bitcoin Cash was developed to address the scalability issues of Bitcoin by increasing the block size, allowing for more transactions per block.

Dogecoin (DOGE)

Originally created as a joke in 2013 by Billy Markus and Jackson Palmer, Dogecoin gained a cult following and became a significant cryptocurrency. It uses a similar mining technology to Litecoin.

Monero (XMR)

Launched in 2014, Monero focuses on privacy and anonymity. It uses a special kind of cryptography to ensure that all of its transactions are untraceable.

Conclusion

Consensus mechanisms have proven to be quite helpful when it comes to maintaining the peace of crypto networks and eliminating double-spending, a huge problem capable of reducing the network’s market value.

Proof of Work, like other mechanisms, is tasked with that responsibility. While it has managed to achieve that effortlessly in the past, there’s growing concern about its inability to scale efficiently and its environmental cost.

Thanks for reading, we hope you learned something, and we hope you enjoyed it!