Blockchain.com is an originally UK-based centralized cryptocurrency exchange launched as a company in 2011, making it one of the oldest established crypto companies with a history as an early pioneer of infrastructure for the crypto community.

Note that Blockchain.com is a global exchange and US residents are allowed to use it. The exchange services require KYC (Know Your Customer) identity verification protocols to be completed for all accounts.

History of Blockchain.com

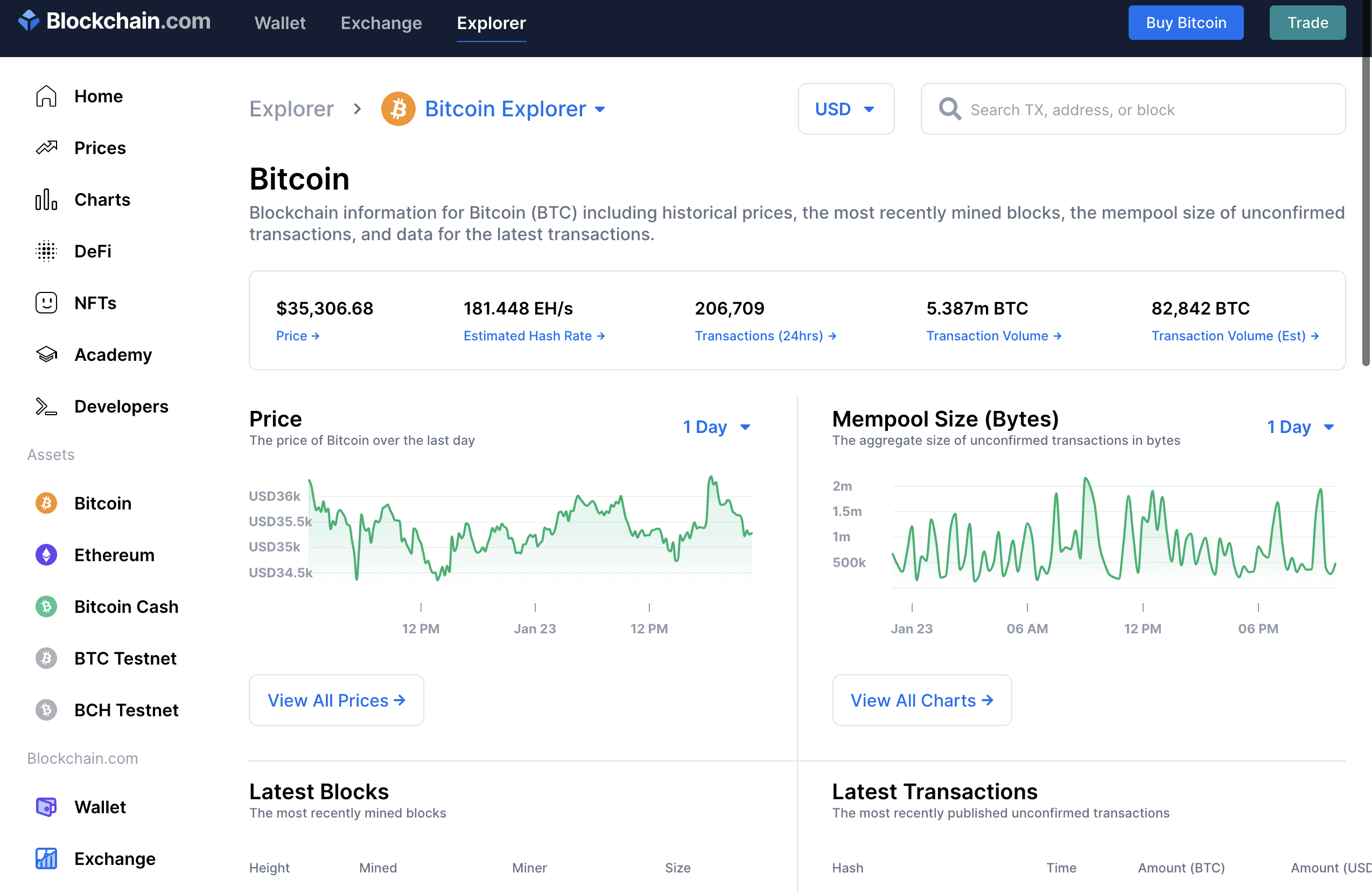

Blockchain.com started originally with a blockchain explorer that enabled anyone to examine and study transactions on the Bitcoin blockchain as well as an API that enabled companies to build on Bitcoin.

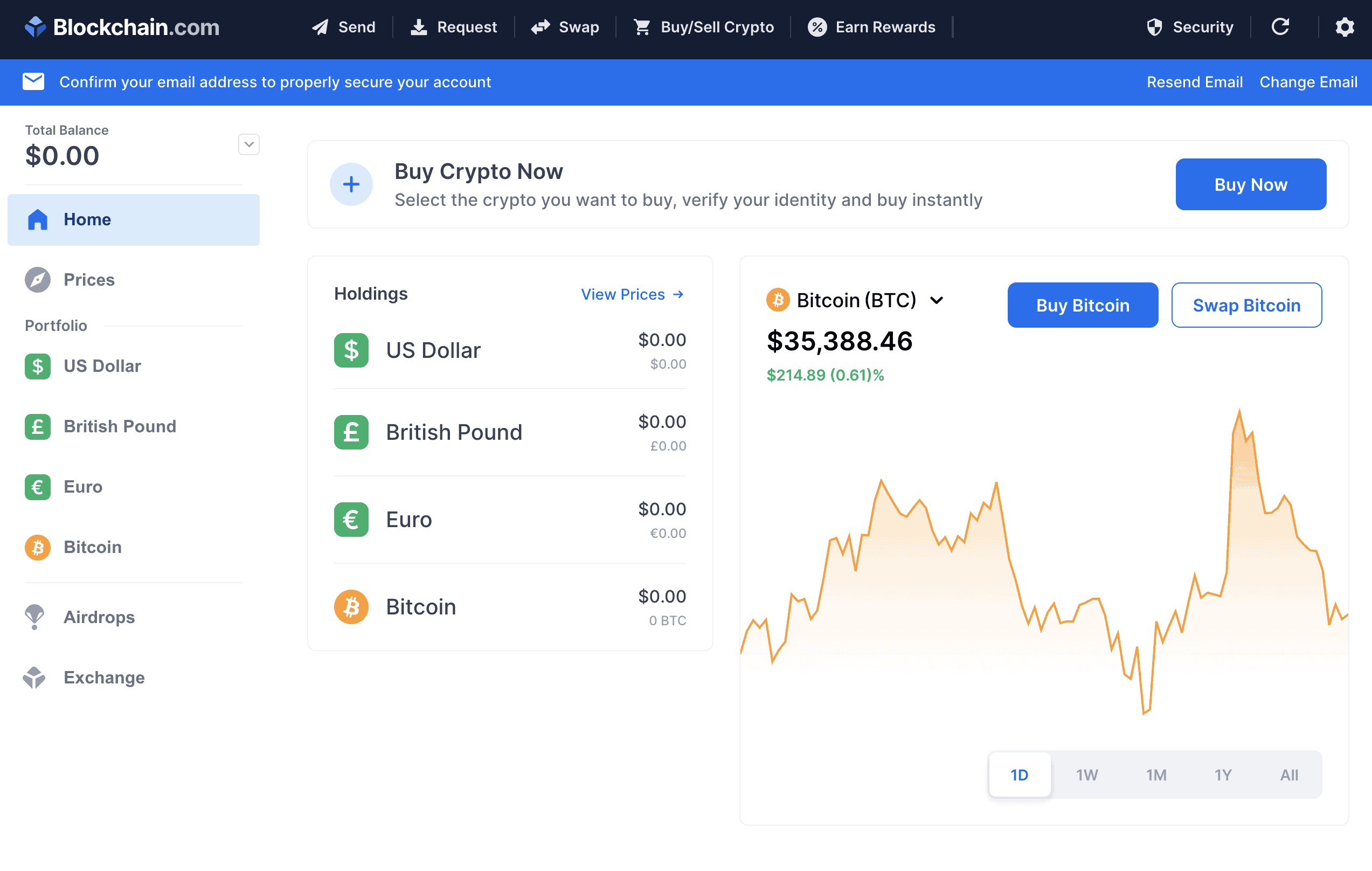

Blockchain.com is also known for its self custody crypto wallet that has become very widely used—the wallet accounted for 28% of all bitcoin transactions between 2012 and 2020.

CEO Peter Smith is the CEO and co-founder. Today, the exchange operates as a crypto financial services company offering exchange services as well as providing institutional markets lending business and data, charts, and analytics. Blockchain.com has also partnered with Unstoppable Domains to introduce username-based transactions to 32M verified customers in June 2021.

The company started selling services for institutional cryptocurrency in 2018 and launched its exchange in 2019. The company raised a $120M funding round in Feb. 2021 and was recently valued at $5.2B. In Aug. 2021, the platform crossed $1T in crypto transactions and announced it was mulling an IPO by 2023.

Blockchain.com is best for:

- Beginner to intermediate cryptocurrency investors and spot traders who desire access to spot trading instruments on a global exchange with a history in the ecosystem, with a core offering of major coins, standard security and custody protocols, and strong support

- Crypto-only traders (no stocks offered) who wish to obtain access to the entire Blockchain.com suite of products—the self-hosted wallet, exchange, institutional services, its blockchain explorer, and more crypto financial services

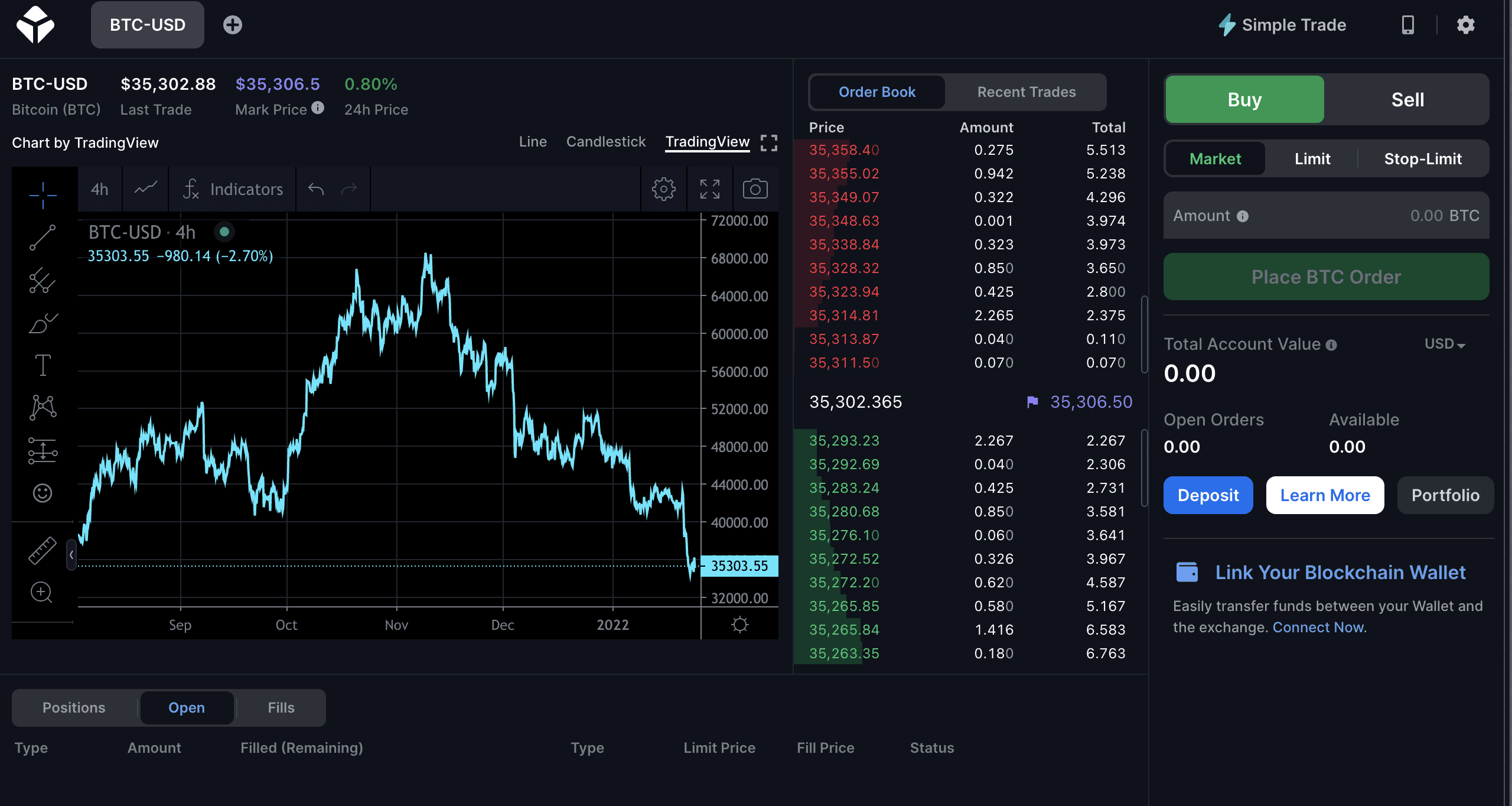

- Active traders who desire a high latency platform, average rate trading fees with a clearly defined & tiered, trading volume based pricing structure for makers and takers, and up to 5X margin available to trade BTC/USD spot only

PROS

- Easy to use ecosystem

- Don’t need KYC for some services

- Self-custody wallet option

- Institutional services

- Blockchain explorer

- 5x max margin for non-US users, but only for BTC/USD pair

- Mobile and desktop-friendly

- Advanced charting features

- Beta NFT project

- Free Learning Portal

CONS

- Only 30 coins and 81 pairs available

- No derivatives products

- Limited ecosystem of products and services

- Moderate fee structure

Pros & Unique Features

The biggest perks of Blockchain.com are its wide range of well-functioning products and services that are easy to use without being too complex of an ecosystem. Users do not need to make an account or KYC with the exchange in order to use certain offerings such as the block explorer or the self-custody wallet, but KYC is required to use the exchange.

The company offers an exchange with which users can custody funds, institutional services with bespoke solutions and a lending desk geared for institutional participants such as crypto funds, a blockchain explorer for open source data for several blockchains, a self custody wallet that allows users to store their own private keys, and more.

The exchange itself offers a moderate market offering of 30 coins and 81 trading pairs on the spot markets, with 5X max margin recently added as a feature for non-US users, only for the BTC/USD spot pair.

There is also an easy-to-use Blockchain.com wallet mobile app for both iPhone and Android with self-custody features but not including exchange services.

The trading platform offers advanced charting features integrated as well as order book and advanced order functionality. Note the exchange is a spot-only exchange and does not offer derivatives products such as futures trading pairs or leveraged tokens.

Blockchain.com has announced a beta NFT product waitlist that will allow users to trade NFTs on the platform. There is also a product offered called the Learning Portal for users to learn about crypto at a beginner level for free.

As for customer support, Blockchain.com offers support via website or chat. Users can access support via the mobile app or the online interface. The team also runs a blog with industry-related updates and company news.

Cons & Disadvantages

The main disadvantage of Blockchain.com is that its ecosystem of products and crypto financial services is much more limited than its competitors such as Binance and FTX.

Blockchain.com’s fees are also not as low as those of competitors, but unlike some other exchanges such as Bybit and Phemex, fees are reduced based on volume tiers and on market-maker status, which is advantageous for larger volume traders providing market liquidity. The fee structure for Blockchain.com however does not offer rebates for market makers and even at over $1B USD in 30-day trading volume, the lowest taker fee is still at 0.06%. Competitors offer far more competitive trading fees with rebates and other incentives.

The cryptocurrency offerings are also quite limited with only 30 top coins, leaving a lot of selection to be desired. At the time of writing there is not a staking or lending program offered for users to earn interest on their crypto assets, which is a feature that many other exchanges offer today. However, the self-custody wallet does offer interest rewards.

Additionally, Blockchain.com offers only spot trading, with the exception of a maximum of 5X margin on only the BTC/USD pair which is restricted for US and some EU users. There are no other derivatives products offered such as options, futures, or leveraged tokens, so advanced derivatives traders will prefer other exchanges that cater to a more active trading audience, such as FTX. The exchange only offers 30 cryptos and 81 pairs, so it is missing a large selection for users who value newly listed coins especially.

US users who wish to transact with more functionality without KYC may opt to use competitors like KuCoin, thereby gaining access to a much wider selection of trading instruments such as margin and futures. All exchange users of Blockchain.com are required to complete KYC procedures, but KYC is not required to use the wallet or block explorer.

Blockchain.com Fees

Blockchain.com uses a maker-taker fee schedule with tiers for the user’s trailing 30-day USD trading volume.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled.

In general, for a maker-taker fee schedule, taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (adding to the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook.

The table below shows the tiered fee structure for Blockchain.com’s spot markets and can be found here. The fees for margin trading are noted below for the only margin pair currently offered: BTC/USD at 5x max margin.

Blockchain.com Fee Schedule Based on 30-Day Trading Volume (USD)

| Tier | 30-Day Volume (USD) | Maker Fee % | Taker Fee % |

|---|---|---|---|

| 1 | < $10K | 0.20% | 0.40% |

| 2 | < $50K | 0.12% | 0.22% |

| 3 | < $100K | 0.10% | 0.20% |

| 4 | < $500K | 0.08% | 0.18% |

| 5 | < $1M | 0.07% | 0.18% |

| 6 | < $2.5M | 0.06% | 0.18% |

| 7 | < $5M | 0.05% | 0.18% |

| 8 | < $25M | 0.04% | 0.16% |

| 9 | < $100M | 0.03% | 0.14% |

| 10 | < $500M | 0.02% | 0.11% |

| 11 | < $1B | 0.01% | 0.08% |

| 12 | <$1B+ | 0.00% | 0.06% |

Margin Trading Fees

The margin trading fees for both makers and takers is 0.02% and margin interest is charged every 4 hours at a rate of 0.02% which is significantly higher than most exchanges who charge variable funding rates at every 8 hours.

Other Fees

Blockchain.com charges the following deposit, withdrawal, and other fees:

- For card buys, additional 2% processing fees are applied to orders

- Small fees charged on withdrawals from the exchange, but the fee amount is not noted openly. Minimum withdrawal amounts exist but are minimal.

There are no fees for signing up or for having an inactive exchange account, nor any fees for holding funds in a exchange account, and users may hold assets as long as desired.

Account Tiers & Limits

Blockchain.com requires at least basic KYC (all identifying info including email name, DOB, address) to use its exchange services. There are otherwise three tiers to the exchange and users of all tiers can deposit as much crypto into the exchange as desired.

However, the amount users can withdraw is determined by their verification level. Silver and Platinum tiers require a government issued ID to be uploaded along with a selfie for full KYC verification. US residents must provide their SSN if the amount of their deposits equals or exceeds $2K USD.

Tier 1: Silver

- Unlimited crypto deposits

- No fiat deposits allowed

- Crypto withdrawal limit: $2000 annually

- No fiat withdrawals allowed

Tier 2: Gold

- Unlimited crypto deposits

- Unlimited fiat deposits

- Crypto withdrawal limit: $200K daily

- Fiat withdrawals: $100K daily, $500K monthly

Tier 3: Platinum

- Unlimited crypto deposits

- Unlimited fiat deposits

- Crypto withdrawal limit: $5M weekly

- Fiat withdrawals: $500K weekly

The documents required for KYC verification include the user’s current and valid government identity document such as a passport or driver’s license and a proof of residency document such as a bank statement as noted here for Platinum users.

Crypto Security

Blockchain.com offers ultra-secure offline funds and private key management. 95% of all funds are stored in offline cold wallets that are distributed across the world in hyper secure facilities in locations that specialize in physically securing valuable items.

Multi-signature validation is used so no single party can unilaterally access funds including employees. Private keys do not leave hardware security modules where funds are stored, as per best practices.

The wallet and exchange both support using 2FA which all users should use. They both also use AES-256 encryption, and private keys for custodied funds are stored in FIPS 140-2 certified devices. Strong cyphers are used to enforce storage encryption across the cloud and physical facilities. There is also a bug bounty offered with a $2000 reward.

Blockchain.com does not track non-custodial funds held in Private Key Wallets, but only custodies and tracks funds held in the exchange. AML and KYC compliance ensures users can trust the exchange and any counterparty. As far as its security record, Blockchain.com has never been hacked.

Blockchain.com Review Conclusion

Blockchain.com is an average choice of cryptocurrency exchange for investors and traders, though it caters to spot investors over derivative traders, since only spot products are offered to trade and the only margin offered is in the newly added max 5X on only the BTC/USD pair.

The exchange’s fee structure is high and not very competitive and its choice of trading pairs and coins are limited. However, the fee schedule follows the maker-taker model with volume-based incentives, however there are no rebates and even at $1B in 30-day trading volume, the taker fee is still as high at 0.06%, when many other exchanges allow users to reach lower fees for much lower volume tiers.

Blockchain.com however offers a widely used self-custody wallet and explorer product and has a long track record of being on the market since 2011, a high performance trading platform with reliable execution and order matching albeit low choice, institutional market services, dedicated account managers for high net worth clients, and the standard level of service one would expect in a US-compliant exchange today, without the bells and whistles of a brand with an extensive product offering like Binance.

- Blockchain.com offers only 30 cryptocurrencies and 81 trading pairs, so while its selection is nowhere near as extensive as that of Binance or KuCoin for example, it offers the core top 20-30 cryptocurrencies for spot investors

- Investors and traders of all skill levels who desire the choice between both a simple and high-performance platform for both spot buy-and-hold investing, with a good user experience, built-in charting functionality, and US and EU compliance will enjoy Blockchain.com

- Advanced traders who wish to use 20X leverage futures trading with a much larger selection of futures pairs and users who wish to participate in margin lending or borrowing will prefer FTX or Binance

Other Alternatives

For customers who desire access to an equally simple user interface with even more trading pairs, or those who do not desire to participate in cryptocurrency futures trading either Bittrex, Coinbase, and Voyager can make great alternatives with a more competitive amount of cryptocurrencies offered to trade and similarly competitive trading fees and functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning, an area where Blockchain.com lacks.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a much larger selection of cryptocurrencies offered compared to Blockchain.com—402 pairs vs. Blockchain.com’s 81 pairs—while active traders who need access to order books and advanced charting functionality will prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and are all lower than what is charged at Blockchain.com for both spot and margin trading.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Blockchain.com include Gemini, Crypto.com, and BitStamp.

Blockchain.com vs Coinbase

The only advantage Blockchain.com offers over Coinbase is its slightly lower starting fee schedule for both makers and takers, but it may be easier for higher volume traders to hit lower fee tiers faster on Coinbase. Neither exchange offers other fee incentives besides trading volume tiers.

Both exchanges offer the option of advanced charting and (limited in Blockchain.com’s case) crypto-to-crypto trading pairs using Coinbase’s Coinbase Pro product and Blokchain.com’s online platform. One disadvantage is that Blockchain.com does not currently offer a mobile app.

However, whereas Coinbase offers no margin or futures products, Blockchain.com has recently added margin trading at 5X max leverage for only the BTC/USD pair, though it is not available for US or some EU users.

Blockchain.com only offers 30 coins and 81 pairs to trade, while Coinbase offers 139 coins and 402 pairs, so Coinbase’s selection is much more extensive.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Blockchain.com is compliant in both the US and EU, but is not currently a public company.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either FTX or Coinbase offer may find the choices below equally valuable.

Blockchain.com vs FTX

FTX International really shines against Blockchain.com for even intermediate traders, offering 323 coins and 492 trading pairs. Derivatives traders who want to trade margin, futures pairs, or leveraged tokens and options will prefer FTX by far since Blockchain.com does not offer any of those options except for limited margin on only BTC spot.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while Blockchain.com cannot compete in selection of cryptos nor in trading products, but has an extensive history in the industry with pioneering other products before its exchange.

FTX cannot be used by US persons, and instead offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection, and FTX International’s fees are more competitive than FTX US’s low fees. Blockchain.com offers a similar size selection of coins to trade as FTX US and is available for US persons to use, so US users may be ok using either, however international users who can use FTX International will definitely prefer FTX, especially if trading.

Blockchain.com vs Gemini

Blockchain.com and Gemini are similar exchanges in terms of the ranges of their product offerings.

There is a slight difference in fees: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, which Blockchain.com does not have due, but the minimum tier at Blockchain.com starts at 0.20% for makers and 0.40% for takers, and requires greater volume to reduce tiers.

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, but Blockchain.com does not offer margin to US users either and is KYC-compliant as well for all users of the exchange.

Gemini offers 62 coins and 86 trading pairs which is similar to that of Blockchain.com, offering 30 coins and 81 pairs, but Gemini wins in the selection department, and Gemini’s Gemini Earn product has far more staking selection and higher APY offered than Blockchain.com’s staking services and other financial services products currently offered.

Blockchain.com vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while Blockchain.com offers no margin or leverage trading at all for US users, but only for select international users.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is more competitive than the fee schedule for Blockchain.com at its entry level tier. Kraken offers no other fee incentives such as rebates or reductions except for volume, which is typical of volume-based maker-taker fee schedules.

Kraken also offers a much large variety of cryptocurrencies and pairs (93 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer using Kraken by far over Blockchain.com.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while Blockchain.com is also compliant in the USA.

Blockchain.com vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Blockchain.com—over 351 coins and over 1300 pairs.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products will prefer Binance, as it offers many USDT futures pairs that are not offered even on FTX, the other derivatives leader, at the moment. Blockchain.com offers none of these options so advanced traders who desire derivatives will prefer Binance over Blockchain.com.

Binance’s base maker-taker fee is also far more competitive than that of Blockchain.com, starting at 0.1%, and offering further 25% reduction in fees if paid in BNB. Blockchain.com offers no such fee incentives as its entry level fee tier starts much higher especially for takers, at 0.40%.

The Blockchain.com brand overall has existed since 2011 while the Binance brand is much newer since 2017, albeit with a much more extensive network of crypto financial services and product offerings. Binance offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Blockchain.com.

Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs. The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is still a better selection than offered at Blockchain.com.

Binance requires full KYC now to trade even spot products, and Blockchain.com also requires full KYC to use its exchange services.

In summary, advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will prefer Binance. However, users may like to use Blockchain.com’s blockchain explorer and self-custody wallet, although Binance also offers similar products.

FAQ – Frequently Asked Questions

Is Blockchain.com safe?

Yes, Blockchain.com employs best security practices in terms of utilizing advanced security technologies such as ultra-secure offline funds and private key management. 95% of all funds are stored in offline cold wallets that are distributed across the world in hyper secure facilities in locations that specialize in physically securing valuable items.

Multi-signature validation is used so no single party can unilaterally access funds including employees. Private keys do not leave hardware security modules where funds are stored, as per best practices.

The wallet and exchange both support using 2FA which all users should use. They both also use AES-256 encryption, and private keys for custodied funds are stored in FIPS 140-2 certified devices. Strong cyphers are used to enforce storage encryption across the cloud and physical facilities. There is also a bug bounty offered with a $2000 reward.

Blockchain.com does not track non-custodial funds held in Private Key Wallets, but only custodies and tracks funds held in the exchange.

AML and KYC compliance ensures users can trust the exchange and any counterparty. As far as its security record, Blockchain.com has never been hacked.

How long does Blockchain.com withdrawal take?

The usual timeframe for ACH withdrawals to reach the user’s bank is 2-4 business days, excluding weekends and holidays. The transfer is executed immediately on Blockchain.com’s end, however the banking system might need a few additional days to credit the funds to the user’s bank account. If however the funds are not yet credited to the user’s account fully, there may be a need for a 14 day waiting period and for the holding period to be lifted.

Users can check the status of their withdrawals by following the instructions here.

Is Blockchain.com a good exchange?

Blockchain.com is an average choice of exchange for investors and traders, since only spot products are offered to trade, except for margin at 5X max on BTC spot.

However, Blockchain.com however offers a widely used self-custody wallet and explorer product and has a long track record of being on the market since 2011, a high performance trading platform with reliable execution and order matching albeit low choice, institutional market services, dedicated account managers for high net worth clients, and the standard level of service one would expect in a US-compliant exchange today, without the bells and whistles of a brand with an extensive product offering like Binance.

In terms of selection, Blockchain.com offers only 30 cryptocurrencies and 81 trading pairs, so this is not a very competitive selection compared to other choices, but the products offered are well-built.

Where is Blockchain.com located?

Blockchain.com maintains offices today in the UK, Luxembourg, and Miami, USA.

Does Blockchain.com require KYC?

Yes, due to its compliance with both US and EU regulations, Blockchain.com requires at least partial KYC to use all exchange services and products. To use the exchange in any meaningful capacity, full KYC will be required, meaning government identification and a selfie. US users will also have to provide their social security numbers.

What are the deposit and withdrawal methods and fees for Blockchain.com?

Blockchain.com offers the following deposit and withdrawal methods, with the corresponding fees:

- Credit/debit card—2% fee added for purchases

- Bank transfer—no fees

- Wire transfer—withdrawal fee of $25 for domestic transfers, $30 for international

- Crypto asset deposits and withdrawals—no deposit fee (except for the blockchain network fee), unlisted, small withdrawal fee as noted here

What is the minimum withdraw amount for Blockchain.com?

The minimum withdrawal amount for USD wire withdrawals is $2500. The minimum withdrawal amounts for crypto assets range and can be found here, but they are minimal, as low as 0.002 ETH for ETH withdrawals and as low as 0.0002 BTC for BTC, for example.

How do you withdraw from Blockchain.com?

Instructions for withdrawing from users accounts can be found here from official support sources.

Users can withdraw from the wallet trading account by navigating to the “Send” section, and choosing the method from the menu.

From there, the user should select the currency and amount and choose the wallet address to withdraw the crypto assets to, or add a new account if necessary.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen. Finally, the user enters in the exact amount he or she wishes to withdraw, the destination wallet address, and clicks the “Submit” button.To withdraw from your Trading Account on mobile, navigate to your wallet’s dashboard and select the cryptocurrency that you wish to send from your Trading Account. The funds will reflect under “Trading Account Balance.” Select “Send to My Wallet,” to have those funds sent to your Private Key Wallet for the currency selected.

If you haven’t made a wallet backup yet, you will be prompted to do so during your first Trading Account withdrawal. Your 12-word Secret Private Key Recovery Phrase will allow you to recover your funds if you ever lose access to your wallet. Once the withdrawal transaction has been processed, sent, and confirmed on the blockchain, the crypto should be available in your Private Key Wallet or at the external address to which it was sent.

Is Blockchain.com a wallet?

Partly. Blockchain.com is a cryptocurrency exchange which provides a multicurrency wallet inside of the user’s exchange account for custody with the exchange.

The company however also runs a separate wallet via online and mobile app that offers users the option to self-custody their funds.

How to use Blockchain.com?Using Blockchain.com can be done by going to blockchain.com, creating an account on the platform, undergoing the required KYC procedures to use the account, deposit any trading funds into the account, and then get access to the spot market offerings and begin trading.

User Reviews

- 4 years ago, a user on Reddit asked if Coinbase or Blockchain.com is better. The answers all suggested that at the time, Blockchain.com wasn’t great. u/bitusher said: “Blockchain.com is a horrible wallet that has been plagued with exploits , bugs and ux issues for years and overcharges on btc. They also lack segwit so tx fees are much higher.”

- u/xvnyr asked why so many people were complaining about Blockchain.com’s self-custody wallet. u/igadjeed responds with a list of common complaints they’d seen on the subreddit and responds to them all, essentiially saying they were mostly user error, but that “the lack of SegWit support is a big deal. It’s 2020. SegWit was implemented 3 years ago. I also need RBF, CPFP, coin control, precise fee control” and “The blockchain.com wallet appears to be closed-source. That removes it from my list completely.”

- A user who held a Blockchain.com wallet since 2013 (posted in 2021) notes that “In that time I’ve tried to have two large cashouts to my UK bank account. Both times they’ve failed,..” When they tried to get support from Blockchain.com, they got no response. They also note, “Some time ago Blockchain split their users’ wallets into two, creating a low fee ‘Trading Wallet'” and when they tried to switch between them, the funds disappeared. Many commenters reported the same problems, though one refutes, saying, “Never had one issue with them. Exchange.blockchain is the way to go.”

- One user, u/kristian77777, details their experience, noting that their funds were put on hold for 7 days, and then when they tried to send it to their Trading Wallet, “I clicked send and all the funds disappeared. I have no idea where the money went. There is nothing under activity showing where the btc was sent.” Commenters also had the same experience. Apparently it’s a known glitch in the system and filing a support ticket may recover the funds.