Imagine you’re watching a space thriller. The astronauts are going through an asteroid field and their ship is taking damage. They need to get out there to repair the ship, and the bravest astronaut volunteers for the job. So what do they do?

The really important thing here is to put on a space suit. People are really best suited to be on Earth, breathing some crisp pure Earth air, not dying in the vacuum of space. To phrase this somewhat oddly, they wrap themselves up to be able to survive in a different environment—exactly like a wrapped token.

In this article, we are going to explain what wrapped tokens are, how they work, and why we need them.

What Actually is a Wrapped Token?

The many different layers and situations can make this concept confusing, but at its most basic, a wrapped token is just an asset in disguise. You take an asset, wrap it up, and it can then work on a different blockchain.

To really understand this, we have to understand tokens. You can watch our video on coins vs tokens, but basically what you have to know is that each blockchain has its own coin, but developers on that blockchain can create their own tokens.

Benefits of a Wrapped Token

The problem is that tokens are tough to use on different blockchains. For example, say you want to deposit some BTC on a popular blockchain application called AAVE.

We have a whole video about AAVE but it is basically an application that allows you to earn an interest rate by lending out your crypto. However, AAVE is only available on the Ethereum network; you can’t use your bitcoins on it. What can you do?

You can wrap your BTC and make it a token called wrapped bitcoin (wBTC). That’s it! What you are really doing is locking up your true bitcoin, and then you get wBTC as a token on Ethereum to use. Then you have a token you can use on the Ethereum network, but is a representation of your original bitcoin.

The point is that some blockchains can do things that other blockchains can’t and some coins aren’t available. What did early developers do? They made representations of them called wrapped tokens so that you essentially have the main coin but can use it as if it were really on another network.

A good way to think about using wrapped tokens is collateral. Imagine you’re trying to buy a house, but you don’t have enough cash for it, so you get a mortgage. If you have something else that has value, you can take a loan on it, because the bank or party loaning the money knows you have something valuable they can take if you don’t pay them.

A wrapped token is similar to this.

Wrapped tokens are actually similar to stablecoins, or cryptocurrencies that are pegged to a fiat currency’s value. A wrapped token, like wBTC, retains the value of the wrapped asset, in this case bitcoin. So 1 wBTC always equals 1 bitcoin.

Stablecoins do the same thing. They are basically “wrapped” fiat currencies used for improved transaction efficiency. How do they do this? Well, if you own 1 wBTC, you can actually turn it in for a REAL bitcoin at any time, so they are 100% actually backed by a real asset they are representing, so traders are incentivized to keep the price of the wrapped token the same as the real coin.

Depending on which coin you have and which blockchain you want to use, the benefits of wrapped tokens can vary. But if you have an asset with a slow blockchain and want the transaction done faster, this can be an advantage.

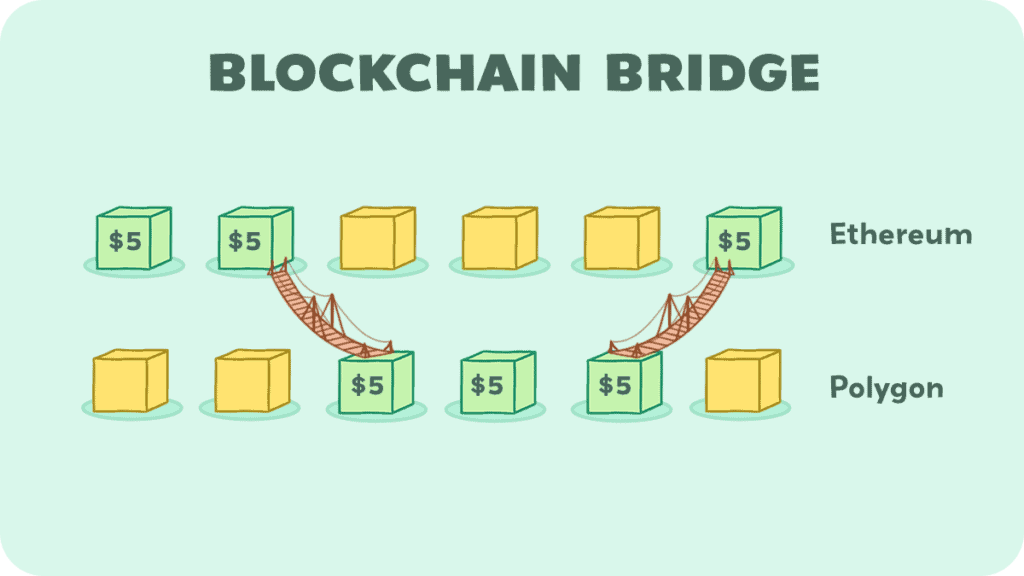

A blockchain like Ethereum clears blocks quicker than Bitcoin, which of course provides a speed advantage to users of the chain. Polygon is even faster, and the native coin is MATIC, so many users use wrapped ether (wETH) on the Polygon blockchain to do things they would do on the Ethereum blockchain, but much quicker and with much lower fees.

What Happens to the Tokens Afterwards?

Okay, great, so we have a cool shiny new tool to use crypto more effectively. But doesn’t this create other problems? What actually happens to the wrapped tokens when it’s done being used? Doesn’t creating another asset of the same value mean you’re just doubling your money out of thin air?

There are a few things to sort out here. First, wrapping a token does not mean you are any richer than before. It’s like if you write a check from your checking account—writing the check doesn’t create a new asset. It’s still tied to your original asset that has value.

Because of the security or double spending issues this could potentially cause, there of course has to be what is called a custodian. This can be a smart contract, a third party, a DAO, or many other things.

The point is that you have a way to verify that you have a certain amount of the currency you say you have. This way, nobody could simply create a wrapped token based on money they don’t have. The custodian verifies that the person creating the wrapped token actually has the original valuable collateral coin.

In short, someone has to initially take your real bitcoin and then give you the corresponding amount of wrapped bitcoin. Then if someone else comes to them with wrapped bitcoin they have to give them a real bitcoin.

Usually, this is all done with code, it’s not a real person, so we don’t have to trust that someone won’t run away with all our real coins, or print a ton of fake tokens.

So if there are lots of these transactions, won’t there eventually be too many wrapped tokens? Won’t they decrease in value as the supply goes up?

The short answer is no. In the same way there can only ever be 21 million bitcoins, there could only ever be 21 million wrapped bitcoins because you have to verify that you own the asset through a custodian.

Once you wrap your bitcoin, trade it, and the transaction is over, the wBTC token is given to the person you sold it to. Eventually, that person might come back to the custodian and say “I want a real bitcoin.” The custodian will take their wrapped bitcoin and give them a real bitcoin, and then destroy that wrapped bitcoin forever.

Once an astronaut comes back to the ship after their spacewalk, they can safely shed their spacesuit. They don’t destroy the space suit as they destroy wrapped tokens, but the idea is the same.

A wrapped token is not really the asset you want to have, it’s just an intermediary for the real thing designed to retain its value, so that you can do more things with them.

Who Uses Wrapped Tokens?

The example we have been working with so far is a simple one (wrapped bitcoin) so we can understand the underlying concept. This is a great use case, and the share of bitcoin being used just for wrapped bitcoin is over 1% and increasing.

This is of course not a massive amount, but it is steadily increasing as the demand for the Ethereum network and dApps (decentralized applications) increases over time.

As DeFi (decentralized finance) grows, the demand for wrapping all kinds of coins to use on Ethereum is also growing.

For example, the computer browser Brave’s BAT (Basic Attention Token) which rewards users for viewing ads, is now available for use as a wrapped token, which massively increases its liquidity.

A company called Ren has expanded blockchain interoperability using what they call the RenVM protocol. This lets users create wrapped tokens on Ethereum, like wrapped bitcoin, Zcash, bitcoin cash (BCH) and more.

Conclusion

Wrapped tokens may seem like a simple idea that just lets people improve how they make transactions, but the problems it solves is actually much bigger.

Interoperability—the ability to move easily between blockchains—is becoming a very important and remunerative problem to solve as the entire DeFi landscape expands.

Whether the eventual solution to this problem is wrapped tokens or something else, wrapped tokens are certainly a viable solution that is only becoming more popular.

Thanks for reading, we hope you enjoyed it, and we really hope you learned something.