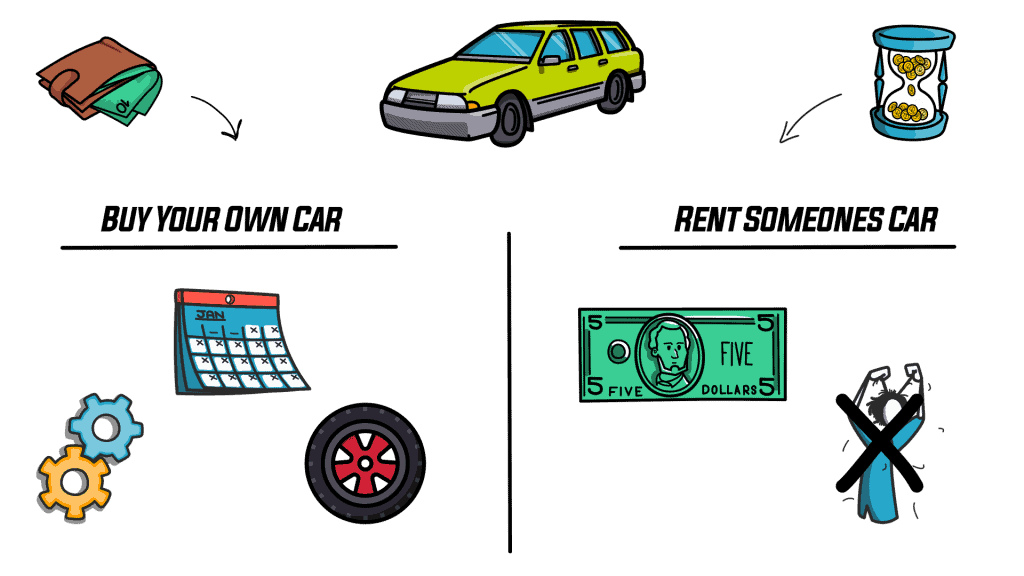

Let’s say you’re wanting a new way to get around.

The way I see it, you can either buy your own car and have to manage that car, keep it up to date, change the oil, replace the tires when needed… overall keep responsibility to that car.

The alternative is you can rent. This means you can borrow a car for a monthly payment, and in that case… you can use it for whatever purposes you might need, pay the owner rent for using the car… and not have to worry about any issues.

Depending on the different factors in your life, you would have to choose which one best fit your needs and which one was wiser to go with. You may not have the cash to buy a new car outright, or maybe you are just super busy and don’t want to take care of the maintenance.

This is pretty much the same as the differences between a coin and a token.

A coin uses its own blockchain to keep track of all the data, which in our car analogy, would be owning the car.

When it comes to a token, you are using a coin’s blockchain as your infrastructure, while you just pay “rent”. You don’t have to create a blockchain, write the full code, worry about how it should be validated and all that, instead you just create a token that runs on that blockchain.

The best example of this would be Ethereum. ETH is it’s own blockchain that both stores value and validates transactions. Ethereum’s team has been working very hard the past few years on improving the system, updating how it works, and patching vulnerabilities. An ERC20 Token uses Ethereum’s blockchain capabilities as it’s backbone and infrastructure.

For example, Basic Attention Token is an ERC20 token built on the Ethereum network. The team decided it was not large enough to create its own mainframe, but wanted to create a system where users could reward the creators they follow in a simple manner. Without going deep into it, the BAT team can focus on providing a great product – that is the Brave browser, a web browser that automatically replaces a website’s advertisements with ads that reward the creator with Brave. This way, the Brave team could rely on Ethereum’s network to provide safety and stability while they focused on their own product.

Also, you should know that a team of developers can migrate from a token to a coin if they decide their project is growing quick enough. If we think about Crypto.com, they just launched their own “mainnet”, which is a fancy way of saying they launched their own coin now, which is now validating their own transactions. They used to have a token, but it got so popular that they decided to create their own blockchain and branch off.

You can’t convert a token straight to a coin. You create a coin that functions the same, then create a “bridge” that allows users to swap out their previous tokens for the new coins. Some coins, like Leo are tokens on multiple networks… for example Leo is on the Ethereum network, the Binance Smart Chain network, and the HIVE network.

One more important thing to know. Some coins are represented as a token on other networks. For example, a few days ago I bought “Binance-Peg Ethereum Token” on the Binance Smart Chain. I did not buy actual ethereum, but instead I bought a representation of Ethereum on the Binance Smart Chain network that mimics the price of Ethereum. Think about if you buy a stock of gold. You just own the stock, but it represents the gold. At any time, you can cash it in for the price of gold… so it’s basically gold – at least for trading purposes.

Hopefully this isn’t too confusing.

While that is the simple version of it there are a few different types of tokens that we can use to categorize the purpose of each token. Let me go over a few examples and maybe you’ll get the hang of it if you haven’t already.

Platform tokens

Platforms tokens are created to support a decentralized application on the blockchain.

For example, Uniswap is a decentralized application that allows users to swap out Ethereum tokens for other Ethereum tokens, and even though they are a decentralized app, they also have their own token – the Uniswap Token. This token is given out to those who invest in their platform, and has the promise that token holders can vote on changes in the future, and maybe even earn some of the profits from traders.

Security tokens

Security tokens are minted to represent ownership of another asset.

For example, say you wanted to buy gold, but didn’t want to actually hold the gold. Someone could create a token that is tracked to the price of gold, so instead of actually owning it, you owned a representation of it. The tricky part here, is that there should be a real asset behind it. For example, I could create a gold token, ask you to invest in it, and not actually have any gold.

Transactional tokens

Transactional tokens are used as a fast and easy way to transfer money.

If we think of the coin xDai on the Ethereum network, it is pegged to the US dollar but it is easy to pay people for.j.. say maybe coffee, or buying that shirt you like at your local store…but the expenses of it are super low. Right now, the transaction fee is 0.000021 USD, that is low. To give you an idea of how cheap this fee is – you could make over 47,000 transactions and only pay $1 in fees for them all. Try doing that on Paypal or through a bank wire!

Utility tokens

Utility tokens are tokens that have a value tied to their ownership.

For example, Basic Attention Token is an ethereum token that can be used to advertise on the Brave browser. In other words, if I wanted to advertise this channel on the Brave web browser, I could do so easily with my Basic Attention Token. In other words, utility tokens can actually do something. Security tokens don’t do anything, you just buy and hold them, but a utility token can actually be used for a commercial intent.

Governance tokens

Governance tokens allow token holders to vote on certain things.

For example, Uniswap could be a governance token in a future version of the Uniswap Exchange. Token holders could choose to vote to raise the fee of a uniswap trade from .3% to .6%, and everyone with a token could vote on the change. The decision with the most votes chooses the winner – you have more voting power by holding more tokens. Obviously there is a reason to hold more tokens – by holding more, you can actually control the platform more.

Now that we’ve went over the different types of tokens, hopefully you understand why we need them and how some of them work. If you’ve enjoyed this article, we highly recommend checking out some of our other articles, which are created in a similar animated manner.

Thanks so much for reading, we hope that you learned something, and we hope to see you soon!