Gemini is a US-based and regulated cryptocurrency exchange and custodian founded in 2014. It is available for residents of all 50 US states and 60+ countries, and lists 62 cryptocurrencies.

As of Q4 2021, Gemini averages around $100-200M USD in daily trading volume, which is outside the top 10 exchanges by trading volume. All users of Gemini are required to comply with Know Your Customer (KYC) regulations and checks in order to use the exchange and trade.

History of Gemini

Gemini was founded in 2014 by Tyler & Cameron Winklevoss, two prominent cryptocurrency early investors, public figures, and entrepreneurs. Gemini initially began to facilitate the purchase and storage of Bitcoin and in 2017 became the first exchange to launch bitcoin futures contracts. The Chicago Board Options Exchange (CBOE) uses Gemini today “as the basis for the daily settlement for the bitcoin futures.”

In 2016, Gemini was approved by New York state regulators as the first licensed Ethereum exchange. Gemini is known for its regulator-approved GUSD stablecoin, which maintains a 1:1 peg to the USD.

Today, Gemini is a New York trust company that is regulated by the New York State Department of Financial Services (NYDFS). Due to regulatory oversight, Gemini does not offer any margin or leveraged trading products.

Gemini is best for:

- Investors and traders of all skill levels who desire the choice between a simple and advanced platform for both investing and active trading, do not need a huge selection of cryptos and trading pairs, desire good liquidity, mobile apps access, and a solid security track record and US regulatory licensing

- Spot-only traders and investors who do not wish to have access to margin trading, leverage, or futures contracts

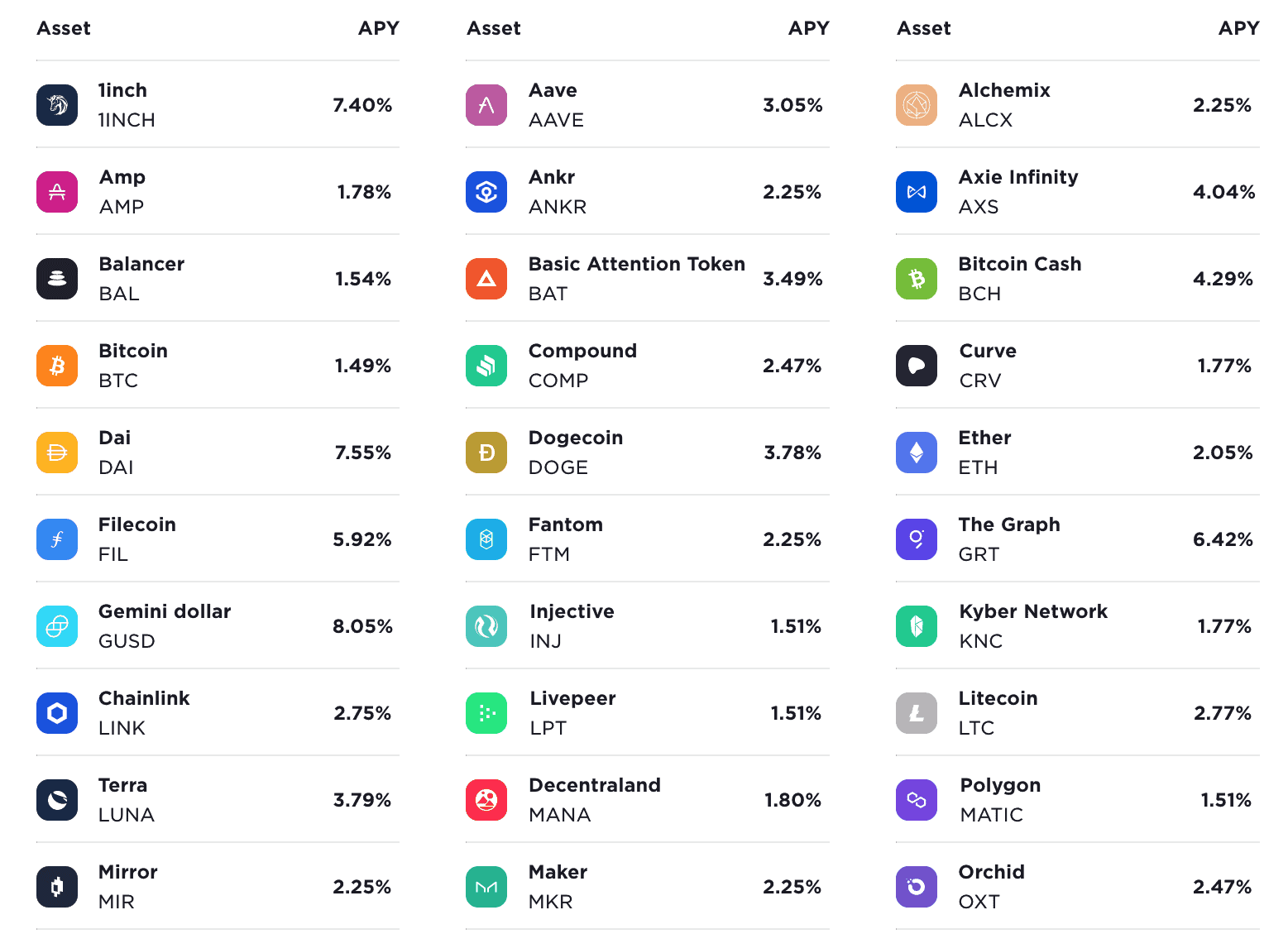

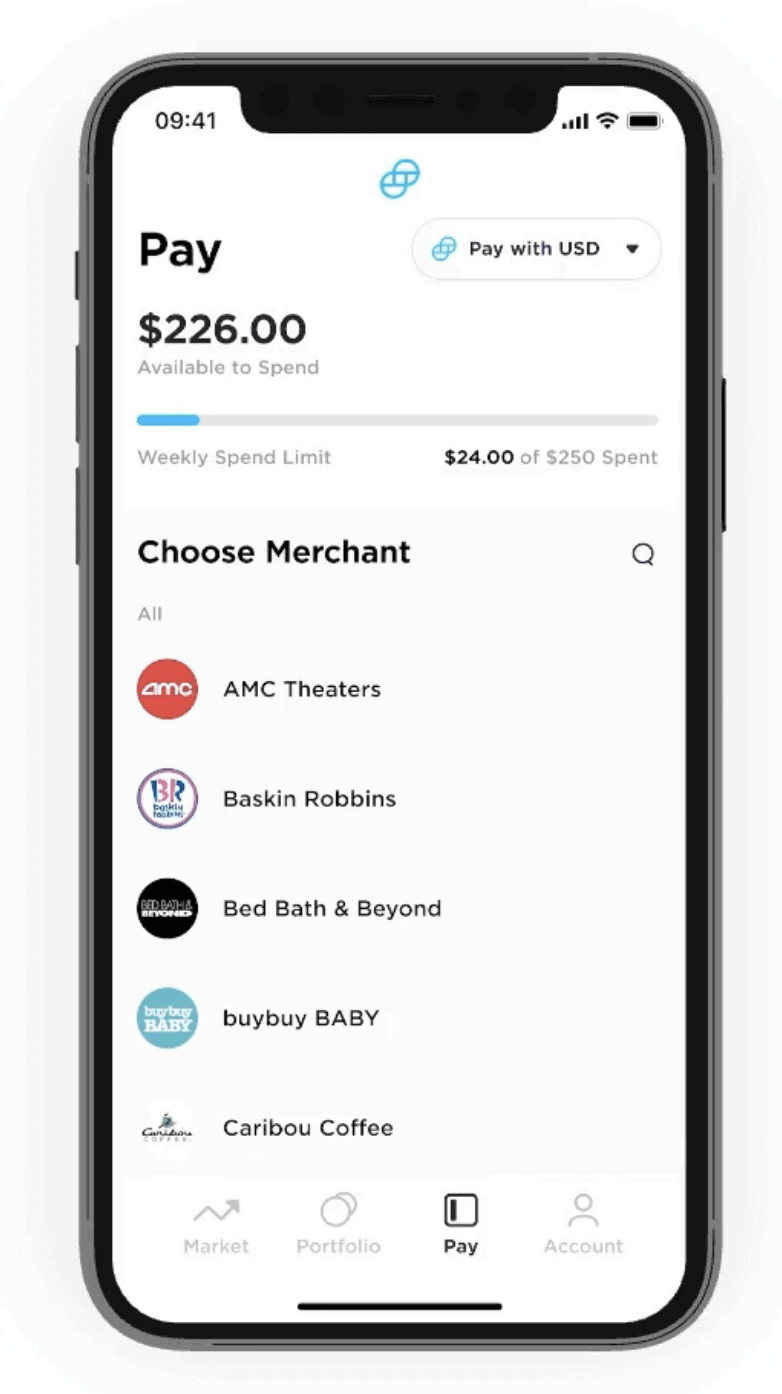

- Crypto-only traders and investors who wish to get access to the entire Gemini ecosystem and support services, including Gemini Earn to earn up to 8.05% APY on crypto assets, Gemini Pay, Gemini Wallet, and institutional-grade custody and security solutions

PROS

- Established exchange

- Gemini Earn product

- Native credit card and stablecoin

- Spot trading, staking, and liquidity

- Mobile and desktop versions

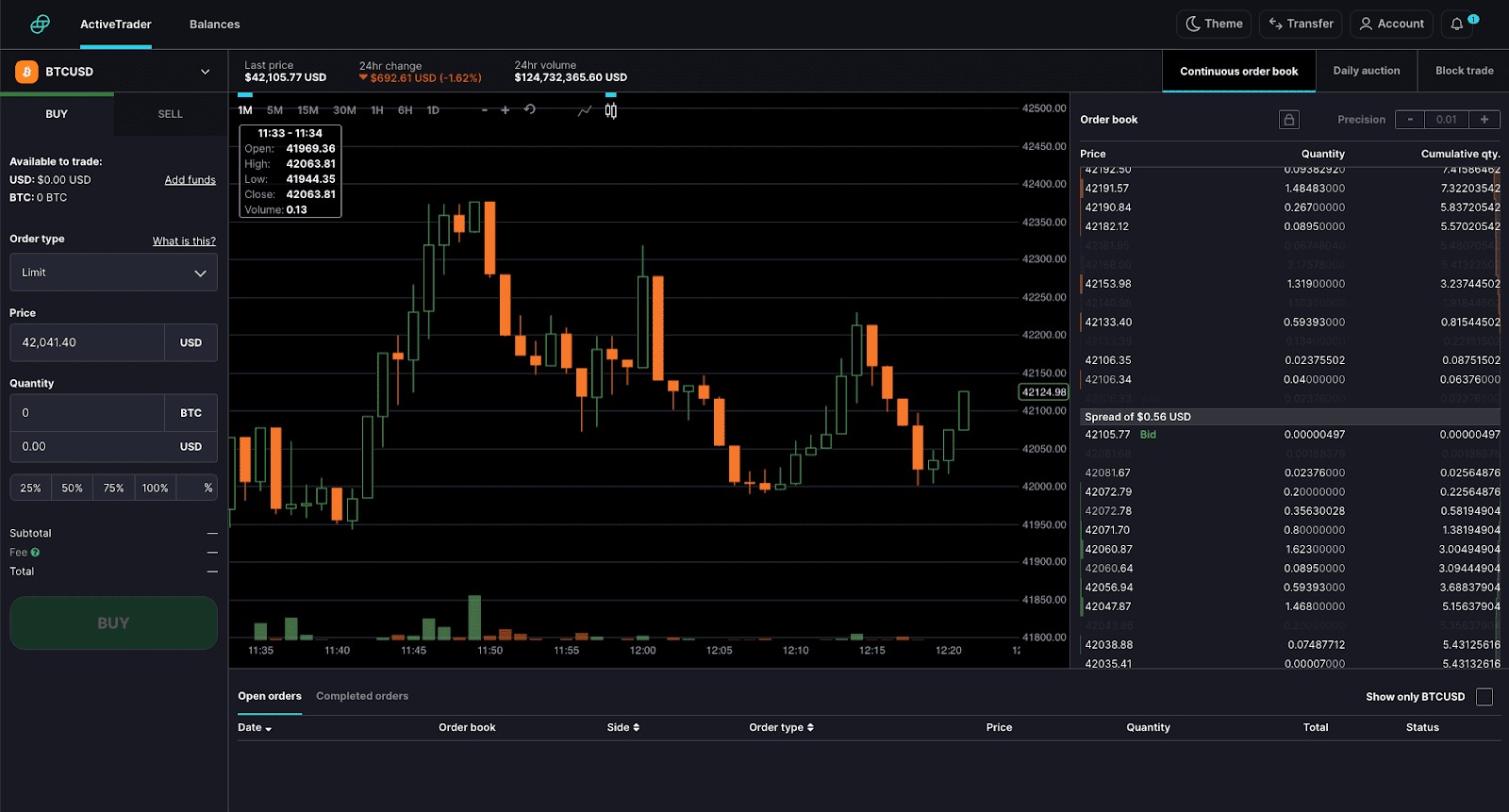

- ActiveTrader platform w/advanced charting

- Gemini Wallet hot crypto wallet

- Cryptopedia

CONS

- Small selection of cryptocurrency and pairs

- Higher fees than most competitors

- US-based and KYC required

- No margin trading or futures contracts

Pros & Unique Features

The biggest perks of Gemini are its all around established and regulated cryptocurrency exchange offerings, with options to earn interest on your crypto, and institutional-grade custody and security solutions.

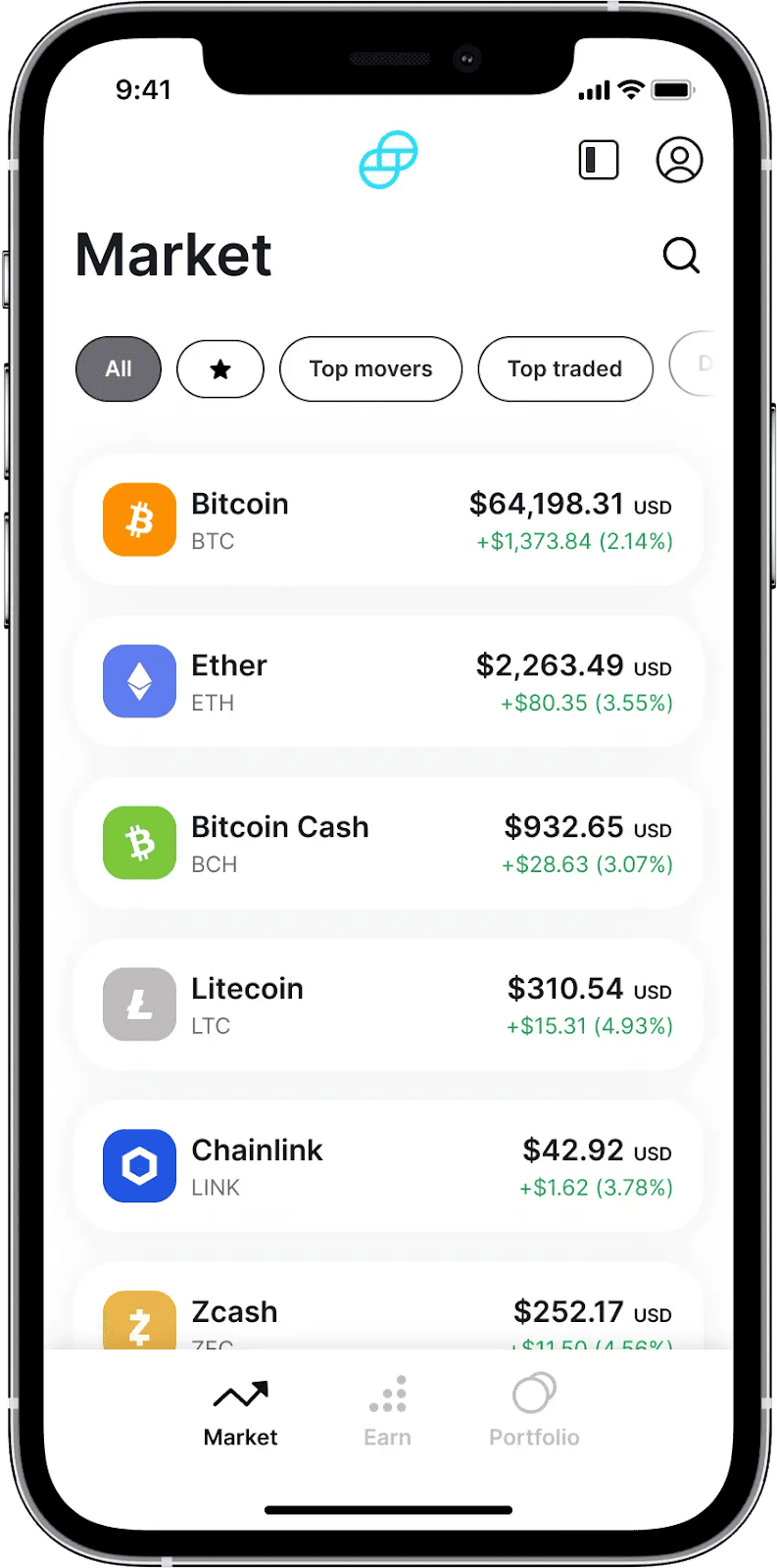

Gemini offers over 60 cryptocurrency market offerings and 80+ pairs, which is one of the smallest selections as compared to its competitors KuCoin, Binance, or Coinbase.

Gemini offers a product called Gemini Earn that allows users to earn up top 8.05% APY on their crypto balances, including on stablecoins. The Gemini credit card allows users to earn up to 3% instant crypto rewards in the cryptocurrency of their choice with no annual fee (US customers only, waitlist applies).

Gemini Earn interest rates

For trading, Gemini offers spot trading through its web exchange, ActiveTrader platform, and mobile app. The web exchange is the simplest setup meant for quick buy/sell orders or for dollar-cost average investing without complicated charting software. The ActiveTrader platform is a high-performance trading platform with advanced charting tools and order types for active traders, plus auctions and block trading.

Gemini dollar (GUSD) is the world’s first regulated stablecoin designed for scalability and usability in all kinds of transactions. GUSD can be deposited into and withdrawn from the exchange and traded on certain pairs in the exchange. Users can also use GUSD to trade and stake in DeFi, earn high yields on GUSD through Gemini Earn, and provide liquidity using GUSD. GUSD uses the Ethereum blockchain as an ERC-20 token for transfer and settlement, and the stablecoin is transparently audited.

Gemini Custody is a product that allows users to store and manage their digital assets using institutional-grade secure and compliant crypto storage. It offers same day withdrawals and instant liquidity on Gemini exchange, $200M in insurance coverage, and is regulated in New York state.

Other products include Gemini Pay to allow users to use crypto to pay for everyday purchases using a fast, secure, and convenient payment system that also works in brick and mortar US locations. Gemini Wallet is a safe, secure wallet infrastructure that supports all of Gemini’s listed assets. The hot wallet is insured against theft and Gemini also offers an institutional-grade cold storage system.

| 30-Day Volume (USD notional) | Maker Fee | Taker Fee |

|

|

|---|---|---|---|---|

| $0 | 0.25% | 0.35% | 0.25% | |

| ≥ $500K | 0.15% | 0.25% | 0.20% | |

| ≥ $2.5M | 0.15% | 0.25% | 0.10% | |

| ≥ $5M | 0.10% | 0.15% | 0.10% | |

| ≥ $10M | 0.10% | 0.15% | 0.00% | |

| ≥ $15M | 0.00% | 0.10% | 0.00% | |

| ≥ $50M | 0.00% | 0.075% | 0.00% | |

| ≥ $100M | 0.00% | 0.05% | 0.00% | |

| ≥ $250M | 0.00% | 0.04% | 0.00% | |

| ≥ $500M | 0.00% | 0.03% | 0.00% |

The fee rates for all block orders are fixed at 0.00% for takers and 0.00% for makers. Gemini’s block trading service is a way to trade large amounts of digital assets outside of the exchange’s continuous order books. It is meant for those trading larger size to be able to source liquidity.

The fee schedule for using Gemini’s website application involves both a convenience fee and a transaction fee. The user is quoted a firm price before placing a web order. The transaction fee is determined according to the amount of the order.

Gemini Web Trading Fees

| Web Order Amount (USD) | Transaction Fee in USD |

|---|---|

| ≤ $10 | $0.99 |

| $10-$25 | $1.49 |

| $25-$50 | $1.99 |

| $50-$200 | $50-$200 |

| $200+ | 1.49% of the web order value |

|

|

Web order fees for other currencies and crypto conversions can be found here. Mobile order fees may be found here.

Other Fees

Gemini charges the following deposit and withdrawals fees:

- No deposit fees on all crypto assets but note that the blockchain network the user is transacting in will charge fees

- No fees on depositing via ACH or GUSD (Gemini dollar)

- No fees on wire transfer deposits

- 3.49% fee on total purchase amount for debit card transfers

- Most withdrawals less than or equal to 10 withdrawals per calendar month are free, but over that amount may incur small charges for both individual and institutional customers

- $125 administrative withdrawal fee

- No market data fees, no connectivity fees

- Fees charged for using Gemini Earn can be found here

There are no fees for signing up or for having an inactive Gemini account, no minimum balance, however there is a 0.4% custody fee that is annualized and deducted in the respective digital assets held in the user’s Custody Account.

Account Tiers & Limits

Gemini requires KYC identity verification for all users due to regulatory oversight.

There is a $1k daily limit for debit card purchases. Debit cards may only be used to complete a trade and are not available for lone deposits or withdrawals.

Maximum daily transfers are $5k per day and $30k per month for deposits, and $100K daily for withdrawals via ACH.

For wire transfers, there are no limits on deposits for individual or institutional accounts. There is a minimum withdrawal amount for wire transfers in the amount of $50 for USD; other currencies can be found here.

For cryptocurrency deposits, there are no limits for individual or institutional accounts. Users are given 10 complimentary withdrawals of cryptocurrencies, of whatever volume, per month. Once a user withdraws 11 or more times in a calendar month, the user is notified for each withdrawal and charged a fee, noted in the section above. Withdrawals for GUSD (Gemini dollars) do not count towards complementary withdrawal limits.

Here is the noted information required for KYC verification to use Gemini for both US applicants and international applicants.

Crypto Security

Gemini offers industry-leading security with account level security, internal controls meant to mitigate risk of insider threats, asset level security, and compliance standards.

Two-factor authentication (2FA) is required by default on accounts and withdrawals, with included support for hardware security keys like Yubikey. Address whitelisting, multiple signatories required to transfer cryptocurrency out of the cold storage system, and perform other sensitive functions is also a feature.

All private keys are stored offsite at high-security data centers. Gemini works closely with regulators in the US, Singapore, and the UK to comply with security requirements and hires independent third parties to perform penetration tests annually in order to identify and resolve vulnerabilities.

Gemini has never been the subject of a cybersecurity breach and has always operated with a security-first approach. As for operational compliance, the exchange has been awarded the ISO 27001 certification, among others. Gemini is the world’s first cryptocurrency custodian and exchange to demonstrate this standard of both financial operations and security compliance.

Gemini Review Conclusion

Gemini is a good overall choice of exchange for beginner to experienced investors and traders who desire access to a simple, small to moderate selection of cryptocurrency coins and trading pairs, and users who value security, good liquidity, and the chance to earn interest on their crypto assets with an exchange and custodian possessing US regulatory licensing and a solid brand reputation.

- With a tiered fee schedule based on 30-day USD trading volume for ActiveTrader, Gemini’s trading fees are higher than most other competitors, in addition to an auction fee, but still trend to 0 at the higher volume levels for market makers. For users using the web platform for simple buy/sell transactions, they can expect to pay flat fees for transactions under $200 and 1.49% transaction fees for amounts over that.

- Investors and traders of all skill levels who desire the choice between both a simple web interface, mobile app with buy/sell functionality, and high-performance advanced charting and trading platform for both spot investing and active trading will appreciate Gemini.

- Crypto-only traders and investors who wish to get access to the entire Gemini brand’s suite of products including staking with Gemini Earn, payments with Gemini Pay, block orders for off-order book transactions, institutional-grade and regulated custody solutions for both individual and institutional accounts, the Gemini wallet, and the Gemini crypto credit card with up to 3% instant rewards and no annual fee will value the Gemini experience.

Other Alternatives

For customers who desire access to both a simple user interface for buy-and-hold functionality as well as an advanced charting and trading platform, with a far wider selection of cryptocurrencies, Coinbase make a great alternative, offering a much larger and more competitive amount of cryptocurrencies to trade, as well as a competitive fee schedule.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, similar status of US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning.

Active traders who need access to order books, advanced charting functionality, margin trading with leverage, and futures trading pairs will prefer using Coinbase Pro, FTX, Binance, or KuCoin, although their fee structures differ significantly and Gemini’s fees are generally higher than all of these noted competitors.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Gemini include Crypto.com, Voyager, and eToro.

Gemini vs Coinbase

Gemini offers little competitive advantages over Coinbase besides its slightly lower fee schedule for ActiveTrader, as Coinbase’s fees start at 0.5% for both makers and takers for the lowest fee tier, while those of Gemini start at 0.25% for makers and 0.35% for takers alongside an auction fee, trends to 0 for makers at higher levels of volume, is simple to understand as compared to the fee schedule Coinbase uses.

However, for users using the simple web interface, they may end up paying higher fees due to the flat transaction costs for transactions below $200 and the 1.49% fee for transactions above $200.

Both exchanges offer the option of advanced charting and crypto-to-crypto trading pairs using Coinbase’s Coinbase Pro product. Coinbase Pro does not offer margin trading any longer, and Gemini does not offer any margin or leverage trading products either.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Gemini is also a regulated US-based exchange but private company.

Ultimately, advanced users who desire a larger selection of cryptocurrencies will prefer Coinbase which offers 139 coins and 402 pairs compared to Gemini’s much smaller 62 coins and 85 pairs. Advanced users desiring lower fees and more extensive cryptocurrency products will find the choices below more valuable than either options.

Gemini vs FTX

FTX offers some of the most competitive options for low trading fees and is known for their cryptocurrency derivatives and futures trading products, while Gemini offers none. Both exchanges utilize a similar fee structure, with FTX’s based on 30-day USD trading volume, but FTX offers fee reductions if paying fees using their native token, FTT, in the amount of anywhere from a 3-60% fee reduction with holding varying amounts of FTT, while Gemini has no such feature.

FTX cannot be used by US persons, and instead offers a US version of its exchange whose trade offerings are much more limited than its parent global exchange, offering only 24 coins and 53 pairs, which is even smaller than Gemini’s offerings.

Gemini offers 62 coins and 85 trading pairs which is a slightly more broad selection than FTX US but nowhere near as broad of a selection as FTX which offers 307 coins and 472 trading pairs.

Gemini vs Kraken

Kraken may be a better choice than Gemini if considering trading fees and cryptocurrency market selections and trading pairs. The minimum fee tier at Gemini starts at 0.35% for takers and 0.25% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200.

Kraken, in contrast, starts at 0.16% for makers and 0.26% for takers, with no flat transaction fees unless using the Instant Buy feature of the exchange.

Both Kraken and Gemini offer staking services that allow users to earn interest on their holdings. Note that US persons are allowed to use both Gemini exchange which is based in and regulated in the USA and Kraken exchange which is also based in and regulated in the USA.

For US users, Kraken does offer margin trading with up to 5X leverage and futures trading with up to 50X leverage for only non-US users.

In comparison to Kraken’s large selection of coins and trading pairs, Gemini only offers 62 coins and 86 trading pairs which is substantially lower, so traders outside of the US looking for a large selection of coins, and margin and futures trading, will prefer to use KuCoin or another option like Binance.

Gemini vs KuCoin

KuCoin’s fees are far more competitive than Gemini and KuCoin boasts arguably the most extensive cryptocurrency trading selection on the entire market of centralized exchanges.

KuCoin also uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is more competitive than the fee schedule for Gemini, even before taking into account the fee reductions offered by KuCoin. Gemini does not have provisions for free reductions, while KuCoin offers a flat 20% fee reduction from holding its native token KCS.

Gemini offers a small variety of cryptocurrencies and pairs (62 coins, 85 pairs), so users who value a large selection and advanced traders who seek margin would prefer and enjoy using KuCoin but sacrifice the US regulatory oversight advantage that Gemini offers.

Most notably, advanced users will value the selection of cryptocurrency coins and trading pairs that KuCoin offers (562 coins and 1095 trading pairs), as well as their selection of rare and hard-to-find low market cap. cryptocurrencies for which KuCoin is known.

Gemini is accessible in 50 US states and is regulated and licensed in the USA, while KuCoin is not regulated nor licensed in the USA, but US customers are not barred on KuCoin’s end from using its services.

Gemini vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies – over 351 coins and over 1300 pairs, which is the second most extensive selection on this list, behind KuCoin. Binance also offers a more extensive list of cryptocurrency financial services and products than Gemini.

The Binance and Gemini brands are well-known and respected in the industry, both offer an array of products with Binance’s being more extensive in DeFi as well, both options offer support and great liquidity, but Binance may win in the liquidity and volume department because it is the highest volume exchange by a large margin, while Gemini is often outside of the top 10 exchanges by daily trading volume as of Q4 2021.

Hence, advanced traders moving large transaction volumes for whom liquidity may be a concern may prefer Binance, but for smaller or intermediate traders, this will not be a concern as Gemini’s volume and liquidity is enough to support the average person’s activity, especially for the major trading pairs offered.

Binance also offers access to as much as 20X leverage on futures pairs, while Gemini offers no margin nor futures trading pairs. The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, making it slightly more competitive to Gemini’s offering of coins, and Binance US also has markedly lower fees than Gemini, so US users who value a US licensed and regulated exchange may prefer Binance US.

Gemini’s minimum fee tiers start at higher percentages for both makers and takers, while Binance starts lower at 0.1% for makers at 0.1% for takers and additionally offers fee reductions for -25% off fees paid in BNB, while Gemini has no such functionality, so overall Binance wins in the fee department.

Binance’s network of products is more extensive at this moment, with offerings such as crypto-collateralized loans, its own smart contracts platforms for access to DeFi with Ethereum compatibility and very low fees, while Gemini focuses only on staking services (Gemini Earn), a crypto credit card, institutional custody services, Gemini Pay, Gemini Wallet, and a mobile app, all of which Binance also offers at a well-developed level as well in its ecosystem.

In summary, advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will value both exchange offerings but may lean towards Binance or Binance US for the edge in products and lower fees, or towards Gemini if they prefer to use a US regulated and licensed exchange and prefer the Gemini brand and its compliance standards.

Gemini User Reviews

- Users on the Gemini subreddit compare top exchanges against Gemini, with u/danielryre stating: “Coin base offers more coins/tokens to trade than Gemini at the moment. That’s the only advantage I could think of.”

- Reddit user u/DaveisUnknown asks if Gemini is good for beginners, though notes the higher-than-average fees. A Redditor responds: “Gemini is my go-to for crypto for a couple reasons – limit orders, stops, OCO’s etc compared to Coinbases extremely limited functionality with purchases. Money clears from Gemini into my checking usually within a business day. Gemini doesn’t have all coins or markets I wish they had but they’ve added a ton the past year and half,”

- Redditors wonder why more people do not use Gemini, noting its similarity to Coinbase, high interest rates, rewards card, and the twins that created the platform. The community concludes it is largely due to its limited coin selection and high fees.

- Redditors warn to stay away from Gemini in the r/CryptoCurrency subreddit. This is mostly due to the “ridiculous 1.5% plus a convenience fee”—the convenience fee changes based on the app or the browser. “In total, the fees could be anywhere from 2-2.5% which is absolutely ludicrous compared to the rest of the competition.”