AAVE is a decentralized finance application that allows people to lend and borrow crypto in turn for getting and paying fees. AAVE is basically peer-to-peer lending using crypto as the asset that is traded, however AAVE uses an algorithm to determine lending rates and to match lenders and borrowers.

AAVE also has an associated AAVE Token, which is an Ethereum token that powers the governance of their platform. In short, the idea of the token is that token holders get to vote on changes to the application as time goes on.

Note: If you don’t want to read through this article, we have created an animated video that you can watch below instead.

How did AAVE get started?

Around 2017, there was a team of developers who created something called ETHLend. They essentially created a MVP platform that matched lenders to different borrowers. It wasn’t automatic, the borrowers had to wait around for a lender to meet them. Two big problems they faced where liquidity (which is the amount of money in the system) and actually matching borrowers to lenders.

So during the start of 2020, they overhauled ETHLend, creating AAVE. The creators said the bear market was the best thing to help them pivot their product.

AAVE utilized smart contracts, which are pieces of code that get ran automatically based on certain conditions to run the platform.

This time, instead of using peer to peer lending, where a borrower matched with a lender, AAVE used a peer to smart contract method. So lenders could deposit money into a smart contract and earn interest. Also, borrowers could deposit their collateral into another smart contract and borrow from one they wish to borrow with. They used new algorithms to determine the loan rates based on how much liquidity is in each smart contract.

Oh, by the way, AAVE is a Finish word that means ghost. The stuck with this for branding because when you lend your money or borrow your money, it’s all anonymous – no banks regulate it, nobody else can see what you’re doing… and specifically you don’t know who is on the other side of the contract.

AAVE Lending

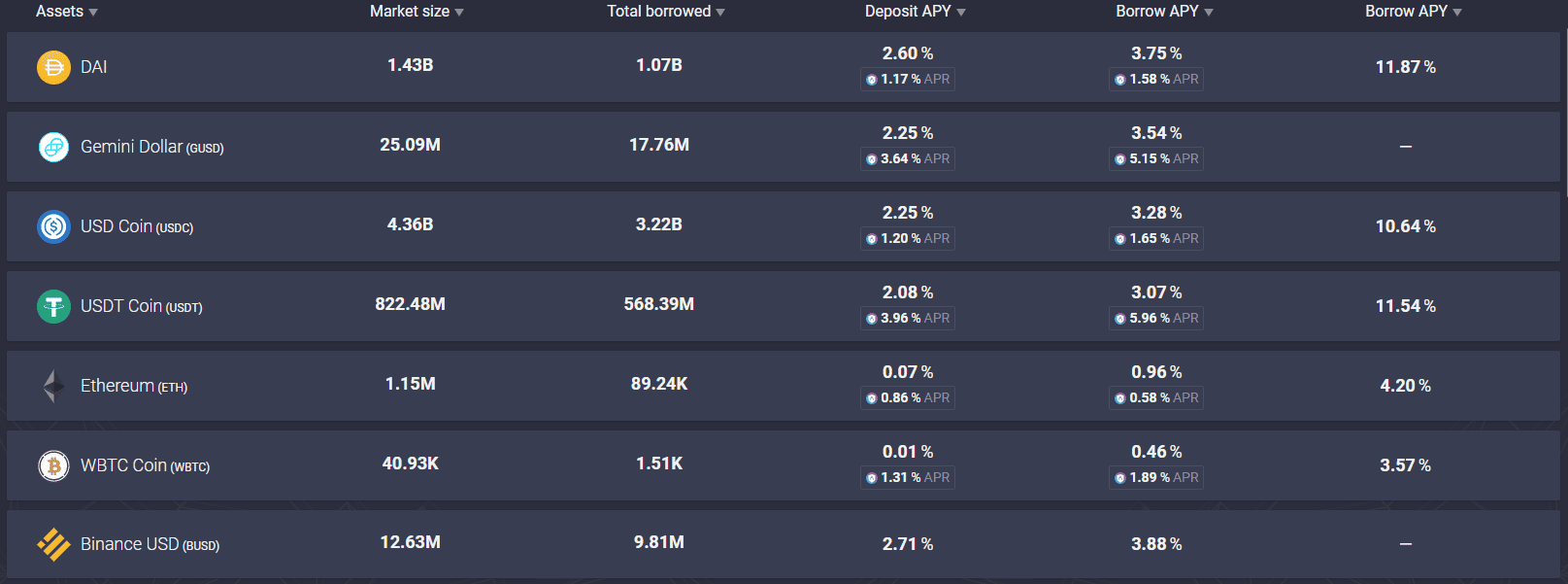

If you go to app.aave.com/markets, you can see the current rates for borrowing and lending. For example, if you look at the example below you can see USDT, which is Tether is offering a pretty decent deal, and then also that Ethereum is offering a quite low rate. This is because Tether is a stable coin and won’t move in price much, but Ethereum is very volatile at the moment.

Open Full Image

These numbers are always changing and tend to go up and down with what need is in the market, so don’t expect the numbers to stay the same.

So with lending, comes borrowing.

After you deposit some of your crypto to AAVE, you can also decide to borrow against it.

Overcollateralized Loans

So when you borrowed the 80% of your house to make payments to it – the house was collateral. This means if you couldn’t pay your loan back, the bank would just kick you out and take your house. They have collateral they can take if you don’t pay.

Crypto loans don’t work like this. If you want to borrow crypto, you have to be “overcollateralized”. This means if you want to borrow $100, you must give the bank $120. You might think this is crazy – why in the world would you give someone more money than you want to borrow?

Well, imagine if I gave you $100 worth of Ethereum and you lent me $80 worth of Tether, which is a stablecoin pegged to the US Dollar. You use that $80 for a few months, then decide to pay it back and get your ETH. Well, ethereum has doubled in price by then, and so you cash out your $100 of ethereum, you actually get $200 because ethereum raised in price.

This is a double edged sword though, because AAVE has something called a “liquidation threshold” where they will automatically sell your collateral to cover the loan you have. This way investors never lose money.

Let me use an example. So you put up $100 of ETH, and the “Maximum LTV” of ETH is 80%, which means you can borrow 80% of that $100, so you borrow $80 of Tether. Well, if that Ethereum price drops to more than 82.5% of it’s value, AAVE will automatically take it and pay back the lender. However you get to keep your $80 that you borrowed.

Leveraged Lending is Possible

Using AAVE, you can create a very leveraged position, essentially borrowing on steroids.

Let’s go over an example really quick.

So you have $100 of ETH. You deposit your ETH to AAVE and withdraw $80 worth of USDC, an ethereum stable token. You take that $80 of USDC to Uniswap, and trade it out for more ETH, which you take back and deposit to AAVE.

Now you have $180 of ETH, and you can still take out 80% of your $80 deposited USDC, which is $64. You take that $64 of USDC, trade it for more ETH and add it to your account on AAVE.

Now you have $244 Eth that you’ve borrowed against, even though you only had an original $100.

If Eth goes up 10%, you gain $24.4 instead of your original $10. However, if the price goes down, all I can say is you’re screwed if you pass that liquidation threshold.

Paying back Loans

You might wonder how you pay back what you borrowed. Well, since you already put up more than 100% of the loan, you just have to log into AAVE and repay the loan back every now and then and check up on it.

AAVE loans aren’t like traditional loans where you have to pay it all back by a certain date.

When do I need to pay back the loan?

There is no fixed time period to pay back the loan. As long as your position is safe, you can borrow for an undefined period. However, as time passes, the accrued interest will grow making your health factor decrease, which might result in your deposited assets becoming more likely to be liquidated.

AAVE Flash Loans

AAVE also has a new feature that is one of their main selling points. It’s called a flash loan.

In short, a flash loan is a loan where you can borrow up to millions of dollars without putting up any collateral. Here’s the catch, a flash loan must be paid back in the same block that it was borrowed at.

Why would you need one of these? Well say you could buy ETH at Binance for $1 and sell to Coinbase for $1.01. Each time you did that, you would make a penny. Imagine if you use millions of dollars to do that millions of times? This is why you would want to take out a flash loan, which you would have to pay back in around 13 seconds, if you used it on the Ethereum network.

There’s a lot more to flash loans, but this article is about AAVE and we’ve covered almost all there is to know about it. So as we end this article, we want to thank you for reading and supporting our site, and most of all – we hope you learned something!