Mining is what we call the activity of maintaining the security of and validating transaction on a Proof of Work blockchain. But mining can be expensive to get into because it takes a lot of computing power, so you’d need to get special hard drives and pay high energy bills to maintain it.

Imagine joining forces with others to mine cryptocurrency together. Instead of needing to buy a lot of expensive equipment yourself, you just use your own computer to contribute a small part of the power.

Together, everyone’s computers add up to a lot of power, making mining more effective and easier for each person involved. This is where mining pools come into play.

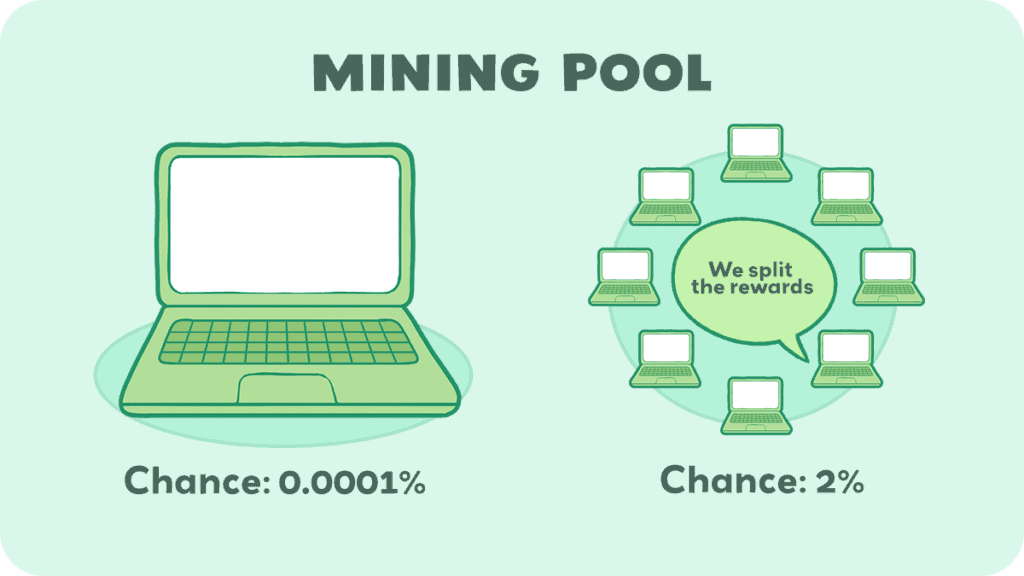

A mining pool is a group of miners who combine their computational resources over a network. By pooling their power, they increase their collective chances of successfully mining a block.

When a pool successfully mines a block, the reward is distributed among the pool members, proportionate to the amount of computational power each contributed.

How Mining Pools Work

A mining pool is like a team effort in cryptocurrency mining. Instead of mining alone, you join a group of miners who combine their computing power. This pooled power increases the group’s overall chances of validating transactions and earning rewards.

Each member contributes their computing power to the pool in a combined effort. When the pool successfully mines a block, the reward is split among the members. The division is usually based on how much computing power each miner contributed.

Mining pools offer more regular and predictable earnings compared to individual mining, albeit the rewards are smaller and shared. This is appealing for those who prefer a steady stream of income over the sporadic and uncertain rewards of solo mining.

For examples, instead of having to wait on average 10 days to get paid, a person could join a pool of 10 people, changing the average wait from 10 days to 1 day. However, they will also have to split the rewards between all the other miners in the pool.

Imagine there is a dice with 50 sides. They are all the same, except for one, the magical side has a special effect where when you roll it, you will get $1. How many times would you roll it?

You’d probably roll it a lot, that thing can just print money. However, you could roll it once, get paid, roll it 8 times, get paid again, then roll it 140 times without hitting the magical side until you rolled it the 141st time and got paid. Using statistics, we can say that probably every 50 times you roll it, you will win $1.

Now, imagine there is a mega magical dice, and it has 500 sides, but it pays you $10 every time you hit the magical side. You would have to roll it roughly 500 times to hit the $10 reward.

Even though this has the same average payout, about 2 pennies each time you roll it, it will take you a lot longer to get a payout. This isn’t an issue if you’re rolling it all night long, but if you only roll it on your break at work, you could roll the whole time and not get a payout… or you could get the payout twice.

Take this example, and extend it to a dice with 500,000 sides, but pays you $10,000 on the magical single side if you hit it. Now it’s basically a lottery.

Would you rather roll this dice or the regular dice with only 50 sides? Even though, on AVERAGE, they pay you the same amount (2 pennies) for each roll, you want the smaller one because you would get paid more often.

This is what a mining pool is.

Getting Involved

By joining a mining pool, you can participate in cryptocurrency mining without the need for expensive hardware and with a more predictable income stream. It’s a way to be a part of the cryptocurrency ecosystem and contribute to the network’s security and efficiency.

Joining a Pool

To join a mining pool, you’ll need to follow these steps:

Research: Start by researching different pools. Consider their size, fee structure, payout methods, and reputation within the community.

Required Hardware: Depending on the cryptocurrency you wish to mine, you’ll need appropriate hardware. This could be a high-end CPU, a GPU, or specialized ASIC (Application-Specific Integrated Circuit) miners for more efficiency.

Mining Software: Install mining software compatible with your chosen pool and hardware. Many pools provide their own software, but there are also widely-used third-party options.

Join and Configure: Create an account on the mining pool’s website, and configure your mining software with your pool account details. This typically involves entering the pool’s address and port number, and your username and password.

Start Mining: Once everything is set up, start your mining software, and your computer begins contributing its computing power to the pool.

Important Considerations

- Pool Fees: Most pools charge a fee, usually a percentage of your earnings, for pool maintenance and operation.

- Payout Schemes: Understand the pool’s payout scheme. Some common methods include Pay-per-Share (PPS), where you get a fixed amount per share of work you contribute, or Proportional, where you earn shares in the round when a block is found.

- Security: Ensure your mining setup is secure to prevent unauthorized access and potential losses.

- Electricity Costs: Factor in the cost of electricity, as mining can be energy-intensive.

- Legal and Tax Implications: Be aware of any legal and tax implications of cryptocurrency mining in your jurisdiction.

It’s important to be aware that not all mining is necessarily profitable. As you can see, it has a high up-front cost, even if joining a mining pool, and has maintenance costs such as electricity and possible membership fees. These are just some things you should take into considering when deciding whether it’s better for you to mine or buy crypto.

We also created a handy spreadsheet you can use to do your own math. Just make a copy of it and plug in whatever details you have!

Technical Details

There are a few technical details to know before getting involved in a mining, or a mining pool. Namely, what Proof of Work is and what a hash is.

Proof of Work is when a computer is incentivized to solve a complex puzzle by guessing and checking until they get the right numbers.

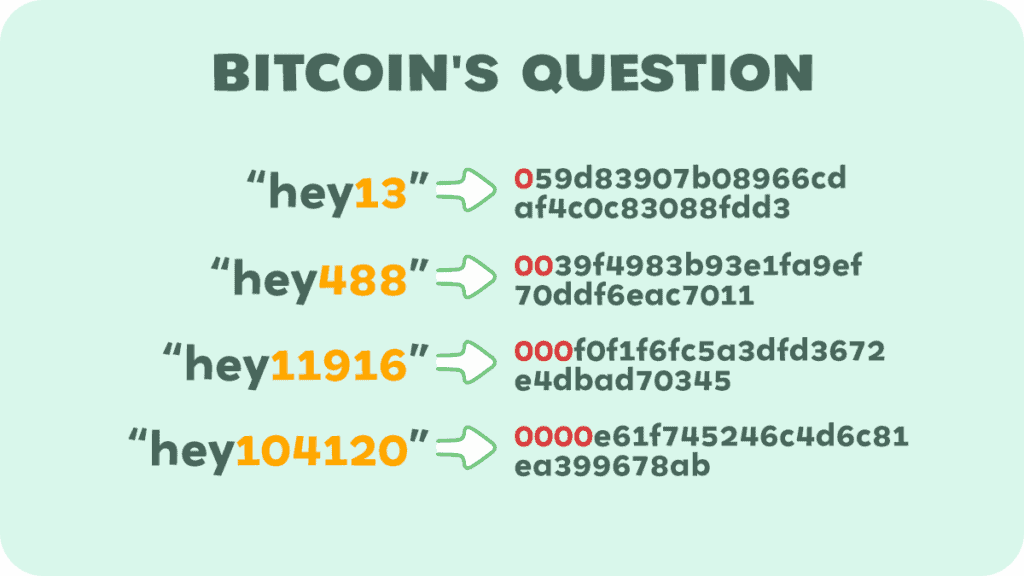

In the case of Bitcoin, you are trying to find a random mix of numbers and letters you can put into a magical black box, so that it outputs a certain number of zeros. This is called a hash.

If you get the right number of zeros, you win the lottery, as we say. Then, when you prove you did it right, you have solved that block and it gets added to the blockchain.

Solving it means you get a reward. For Bitcoin, in 2023, that reward averages 6.25 bitcoins per block. Jackpot!

Bitcoin Halving: It’s important to note that this block reward halves approximately every four years in an event known as the “Bitcoin halving.” The halving reduces the rate at which new bitcoins are created and is a key feature of Bitcoin’s economic model, designed to mimic the scarcity and deflationary characteristics of precious metals like gold. The next halving is expected to occur around 2024, at which point the block reward will decrease to 3.125 bitcoins per block.

Here’s the issue though. If you used a general personal computer to try mining Bitcoin, it would take you about 10,683 days to solve a block on your own. This means you could solve it in 3 days or solve it in 29 years, but on average, that is how long it would take you.

The problem is, we want to mine and get rewarded for it now, instead of playing the luck game.

So, we take a ton of people who want to mine, group them together and then work towards the block all at once. This takes the average time down from 10,693 days to a few hours.

Then when the group finds the reward, it splits it up between everyone who mined with us, even if they weren’t the person who found the successful solution. Those who work harder get a larger percentage, so it is fair to them.

Is it Possible to Cheat?

What if someone says they were mining harder than they actually were? That would actually be really easy to code.

Instead of coding at 30 megahashes a second, we could easily write a program that tells the pool we are mining at 30000 megahashes a second, and then get the majority of the reward.

So, instead of taking their word for it, the pools came up with something clever.

Let’s say that to solve the current block, we need 20 zeroes in the hash. What the pool does is takes any solution you have that has at least 10 zeros and gives you a “share.”

So you’re mining away, and you find one with 10, one with 12, one with 18, one with 13, and one with 17 before the block is solved. Since these shares prove that we were actually mining, we submit those as proof that we worked towards finding the solution, instead of just having the pool take our word for it.

Think about it like this. Instead of just you rolling your 500,000 face die for the $10,000 reward, you roll with a group of a hundred people, and when someone wins the $10,000 reward, everyone gets a fair share based on how many times they rolled.

How can you tell how often they rolled? Every time someone rolls any number that is a multiple of 10,000, they take a picture of it. And then how many pictures they have when someone rolls the winning roll, you get a reward based on that.

For example, if there’s 100 people rolling those special dices, and they together have like 200 pictures of their dices on numbers like 30,000 and 270,000… and you have 3 pictures when you dice landed on multiples of 10,000. This means you get 3/200 of the $10,000 reward, which is $150.

Instead of getting paid once per year, the purpose of mining pools is to get paid once per hour, even if what we are getting paid is a smaller amount, it is much more reliable.

Conclusion

As you can see, mining pools can be a good way to get into mining without needing a whole setup yourself, and without having to wait 29 years to get a reward.

But they come with their own risks, too, and hefty startup costs. So for a lot of people it’s actually more rewarding to buy and hodl (and sell at the right time—good luck!) rather than mine.

Thanks for reading, we hope you enjoyed it, and we really hope you learned something.