Taxes aren’t fun to pay. You can’t really get around it. Especially when you are in the realm of crypto, there will be taxes involved. However, there are some cool strategies you can keep in mind moving forward that help you reduce your taxable amount. In fact, by the end of this article, you’ll know a few ways that you can actually pay 0% tax on your crypto gains.

Evading vs Avoiding (not financial advice)

Before we get too far into this topic, I want to explain what I mean when I say ‘avoiding taxes.’ There’s a difference between evading and avoiding. Evading is the act of using illegal methods to pay less taxes. Avoiding is using legal methods like loopholes or technicalities to avoid paying taxes. For example, if I bought a new car and said it was for WhiteboardCrypto, that would be evading. However, if I bought a new $3000 computer and only used it for creating more videos, that would be avoiding, because I could use the $3000 computer as a legal deduction. In short, one is legal, the other is not. In this video, I’m going to mostly cover the legal ways, but I’ll also cover some illegal ways so you know what not to do. Or at least that’s my intention, I’m just here to share information.

Don’t sell (long term vs short term)

The simplest advice to avoid tax is to not sell. Right now, at least in the US, crypto is treated as property and so you are only taxed when you sell your crypto and realize a gain or a loss. If you made money, the government wants their fair share, and if you lost money, well… hopefully you can use it to offset some of your other gains. So if you made $100k and lost $80k, then technically you only owe taxes on 20k of gains that year.

By not selling your crypto, you owe 0 taxes. Hopefully, if you’ve invested in a project you believe in long-term, then you have no problem waiting to sell. The best advantage to waiting to sell is that there may be a day in the future where a new crypto law is passed where we don’t owe any taxes, or that they are taxed in a better way. That’s probably unlikely to happen soon, so I’m going to share with you why holding your crypto can help your tax bill.

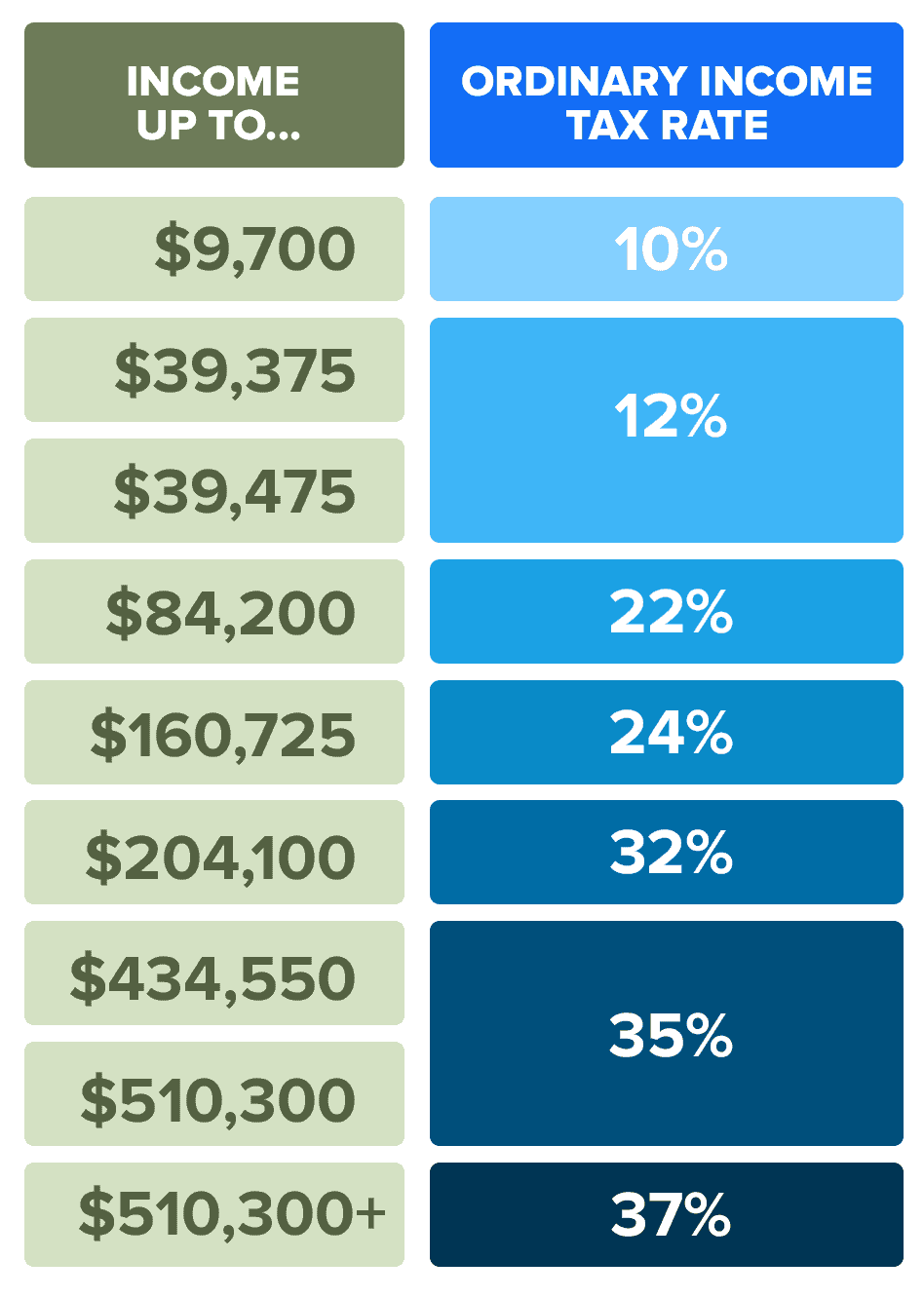

In the US, we have two classes of taxes, at least for things considered property. Crypto does, so it falls into these two classes. The first is called short-term capital gains. The capital gains is a fancy word meaning “you made money by buying something and then selling it,” and the short-term means you owned the property (or crypto) for less than a year. By holding it for less than a year before selling, technically, you owe a higher tax rate on it. Here’s a chart of the current 2021 short-term capital gains tax rate.

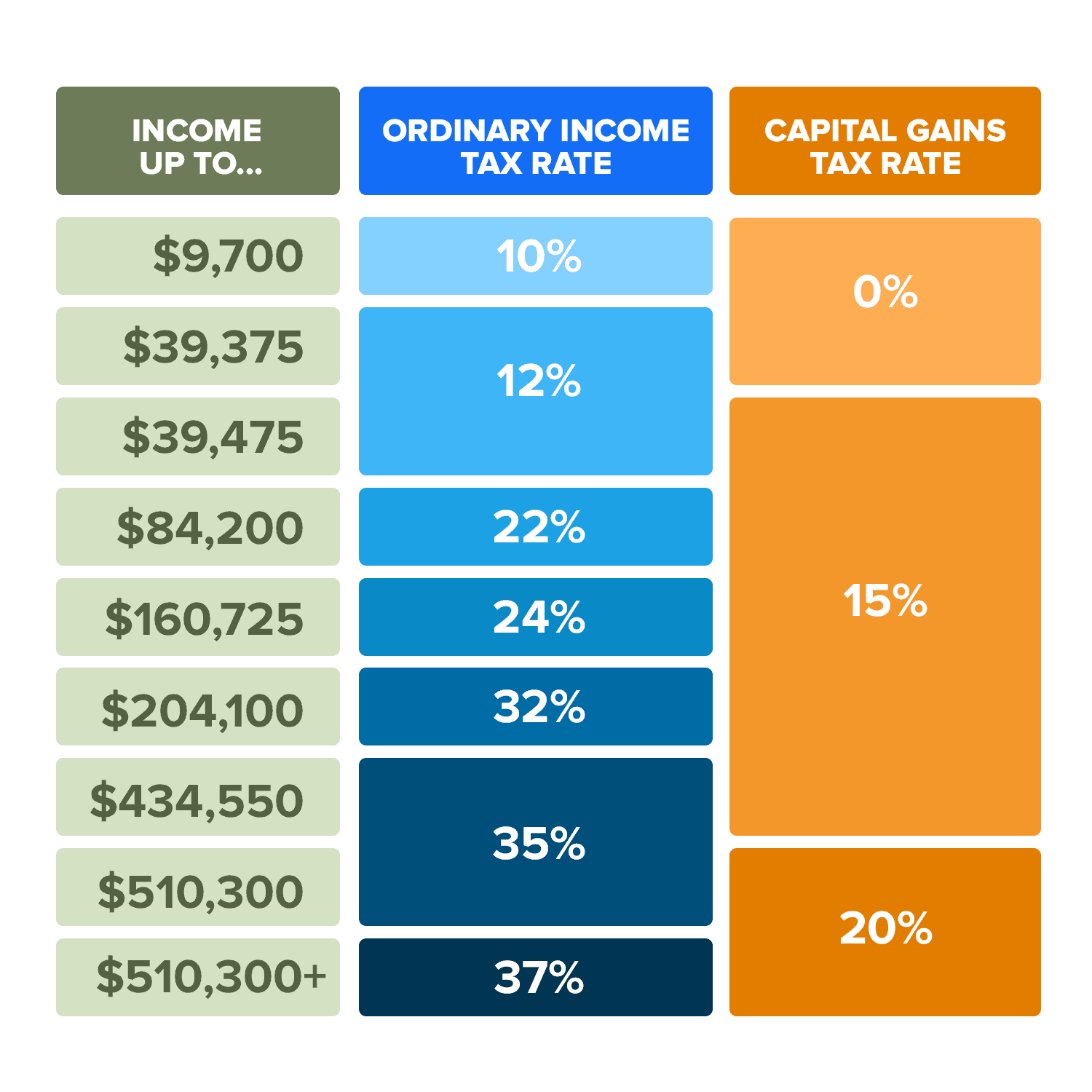

If you hold your crypto for longer than a year, it falls into the second category called long-term capital gains. When you hold your property (or crypto) for longer than one year, it gets taxed at a different, actually better tax rate. So holding from day 300 to day 366 can actually save you quite a bit on taxes, just keep this in mind. Here’s an image of the 2021 long-term capital gain tax rate, compared to the short-term rate. See the difference? If you’re a billionaire, you know all about this already.

Trades are actually taxable -> Sell then Buy example

One thing to note about taxes is that when it comes to crypto, any trade you make is also a taxable event. This is definitely true when you trade on an exchange like Binance, they will send your information, including your trades, to the IRS, who will be knocking at your door if you don’t explain them when reporting your taxes.

Trades on Decentralized exchanges that don’t collect your personal information are also considered taxable events. This means if I trade my Ethereum for Shiba Inu on Uniswap, then technically the IRS says I’m selling my Ethereum and buying Shiba Inu, and that I should be taxed like it. The thing here is, that since decentralized exchanges don’t collect user information and send it to the IRS, then trades that happen on it are the user’s responsibility to keep track of and report. If you don’t report, then the IRS may never know about it, but that’s not financial advice.

Unless you give the IRS a reason to start looking around, they are currently quite underfunded. They are also developing crypto tracking software, so I don’t want to scare you, but I also don’t want to give you the green light to do sketchy things on your taxes.

Get a Loan

You can really simply avoid capital gains taxes on your crypto by getting a loan on them. Just like with a house, when you get a mortgage, the house is the thing backing the loan, or if you get a car loan, the car is what’s backing it—you can take a loan out on your crypto, and this loan is technically not taxed. It means you can access the value of that crypto without needing to outright sell. Bonus points if what you’re borrowing against is a crypto you believe in, so you can access the value tax free, while also letting the crypto grow in value. There are many ways to do this, but you have to be careful when you set it up. It’s really simple, but most people don’t know it’s something you can do to avoid taxes.

Crypto Roth IRA

A Roth IRA is actually a traditional finance tool. First, let me explain the IRA part. So none of this is financial advice, but IRA stands for Individual Retirement Account, and is a tool that you can use to get a tax cut for money you invest specifically for your own retirement. The default, original IRA account is called a Traditional IRA account and here’s how it works. Let’s say you invest $5000. It grows to $20,000 by the time you retire.

Well, technically, that first $5000 you invested, you get to write off on your own personal income tax, which means however much money you owe taxes on to the government, they say “subtract $5000 from it, we don’t want taxes on that yet.” Then, whenever you go to take some money out because you’re retired, you pay taxes on that. So maybe you want to take out $4000 of the $20,000 that it’s grown to. On that $4,000 you withdraw, you will owe income taxes. The money you invested can pretty much be in anything, whether it’s stocks or gold or crypto, but you get a tax cut when you invest into this account and then you have to pay taxes when you withdraw. There are special rules for IRAs, so I highly recommend consulting a professional regarding this.

Now, here’s the ROTH part. With a ROTH IRA, the taxed part is flipped. So when you invest $5000, you pay taxes on it, you don’t get to deduct it from your yearly income. However, when you retire and that initial investment grows to $20,000, and you want to take out $4,000… you now don’t have to pay taxes on that!

It’s a little confusing, but the main difference between a ROTH IRA and a traditional IRA is when you pay your taxes. There technically isn’t an advantage to either, you’ll end up paying the same taxes if you’re in the same tax bracket when you invest and withdraw. The trick here, is that if you think you’re going to be in a higher tax bracket when you retire, you want to deposit in a ROTH IRA to save money.

If you think you’ll be in a lower tax bracket, the Traditional IRA is more advantageous. Anyways, I probably should make an entire video on this topic, so leave a comment below if you want one. IRAs aren’t really in the crypto space, but according to the comments, I’m good at explaining stuff like this if I dedicate some time to it.

Here’s where the crypto part comes in. Remember how I said you could set up a crypto IRA? Personally, next year I will probably be setting up a crypto ROTH IRA so that I can buy crypto and use it as my retirement account. There’s another advantage to a ROTH IRA, and that is that it can technically be a savings account. So let’s say you put in $6000 this year and $6000 next year, you’ll have $12,000 total deposited. Well, anytime you want, since that initial $12,000 has already had taxes paid on it, you can take up to that much money out of your account for any reason, at any time.

Personally, I will keep depositing money into this account until I’m like 55 or whatever the eligible age when I get that old, then I can withdraw money from it tax free, since I technically already paid taxes on it. Right now there’s a $6000 yearly limit on contributions, and this stuff can get complicated, so don’t use this video as financial advice, but more as an arrow pointing you to talk to a professional about this stuff. I’m just saying a crypto-based retirement account that can act as a savings account, which is also beneficial to my future taxes is something that needs to be on this list.

Charitable Remainder Trust

This is a very advanced strategy that you’ll definitely want to reach out to an accountant for, maybe even a few… and is mostly used for accounts with over $500,000 in crypto. In fact, this is probably best for people who bought bitcoin a few years ago and are now sitting on a big pile of unrealized cash.

Let’s get into it. So the first thing this strategy requires is setting up a trust called a Charitable Remainder Trust. Once it’s created with the help of a professional, you’ll gift it your crypto. There is no tax when you give a “charity” your crypto, in fact you actually get a tax deduction from giving that gift, but there is a limit to that, I believe it’s around 30% of the total donation.

After that, the next step is for your Charitable Trust to sell your crypto so it has cash. So now you personally don’t own any crypto, but you also don’t owe any tax. Then the Trust has your crypto, but sold it, so it has cash, but it also hasn’t paid any tax since Charities don’t really pay tax.

Now, you set up a fancy thing called an annuity, which is basically a word for passive income. The Charitable Remainder Trust annuity can pay you up to 7% of its value each year as an annuity, so if it has $1,000,000, it can give you $70,000 per year. The Charity isn’t taxed, but you are taxed on that $70,000. “But Theodore, you said this was to avoid taxes,” you’re right… you didn’t pay any long term or short term capital gains tax, all you owe now is income tax. Well, remember how I said you could deduct around 30% of the gift from your taxes?

Technically, you can split this deduction up between a 5 year period. So 30% of 1 million is $300,000 and then if you split that up between 5 years, you get a deduction of $60,000… meaning you get $70k from the annuity, with a $60,000 deduction, so you only have to pay taxes on the 10k difference. So you effectively avoided, or transferred your crypto tax into income tax, and also created an entity that will basically pay you for life. Here’s another bonus, if you want, you can set up a life insurance fund with the initial annuity payments, and you can superfund it in a way that an amount of the initial investment, or $1 million goes to your spouse or family tax free in the case that you die, which means your family won’t owe any tax on it either.

Another big benefit of this trust is that it’s asset-protected which means even if you declare bankruptcy or get sued out the wazoo, nobody can touch this money or the annuity paid to you. Wrapping this up, I’ll be honest with you, 99% of you watching this, you will not need this strategy. Yet. But you might.

Leaving US

If you’re a crypto millionaire in the United States, something you might consider doing is leaving the US. Since capital gains and income tax in the US could eat up to over 50% of your gains, it might be advantageous to consider moving to a different country.

Puerto Rico

Puerto Rico is a common country to move to, since they have favorable crypto laws and decent tax rates. One rule here is that if you’re already a crypto millionaire, and you’re leaving the US, you will probably still owe taxes in the US. Another technicality is that you must live in Puerto Rico for at least 183 days per year to get most of the benefits.

In fact, if you’re already in Puerto Rico, they have a 0% tax on capital gains trades, which means you don’t get taxes for your crypto gains anyways.

There’s a few other countries you could move to, but honestly it might be worth me researching them and creating an entire video discussing the pros and cons of each country, so we’re going to move on.

Evading

Like I mentioned in the beginning, evading your taxes is using illegal methods to avoid paying your taxes. These are not clever loopholes, but more outright stealing money that is owed to your government. I can’t endorse any action like this, but I also can’t help but share with you some examples. So that you know not to do them. Please don’t do these probably illegal things that will allow you to get out of paying taxes on your gains.

Buying something that doesn’t have KYC (giftcards)

If you were to go to BitRefill.com and purchase some giftcards to popular places like Amazon, technically BitRefill doesn’t report to the IRS, and so the IRS wouldn’t know that you realized your gains, which would technically be a taxable event in the US. If you didn’t report this, it would technically be tax evasion, however there doesn’t seem to be a way that the IRS could easily find this out. They are working on crypto-tracking software, so this could change.

Newegg

Newegg is another popular online store that allows you to buy electronics like computers, computer parts, dishwashers, and other big high-ticket items with crypto. A real money-laundering tax-evading crypto could make a whole business out of buying these and then selling them for cash, but again, that is very illegal and the longer you did it, the higher your chances of a three-letter agency knocking on your door.

Gifting to friends

I think the rule is now that you can gift up to $15,000 to someone and you don’t have to report the gift. So theoretically, you could give $15,000 of gains to your friend, and not report that you technically ‘sold’ these gains to give to a friend. Then, your friend could cash out these gains as if they just bought them at market price, claiming no capital gains tax, but simply an income tax, which may be lower. It would definitely be illegal, and probably immoral to use your friends like this, but it is one way you could get around paying the full tax bill on your crypto gains.

My Plan

Personally, I plan on holding long enough that one day I can either move to a country that doesn’t care about crypto taxes or that crypto will be so mainstream they won’t want to collect tax on it or that I can use it for everyday things without worrying about tax. I know this is risky, but it helps me keep a long-term vision on my portfolio and my larger crypto decisions. Either way, I keep good accounting of my purchases and trades, so that if the laws are similar to what they are today, I’ll be in the clear.

Anyways, if you want to learn more about making money with crypto, I actually have a free course that literally over 10,000 people have already gone through, and you can grab it for free. Just go to whiteboardcrypto.com and enter your email, you’ll sign up for our newsletter, get a link to join our free discord, and of course, be able to go through that free DeFi course.