In today’s dynamic real estate landscape, the emergence of tokenized real estate has revolutionized investment strategies and transformed traditional ownership models.

Traditionally, you would go to the real estate agent and purchase a house directly, or you might buy a share in a housing complex to invest in a larger development. But lately, people are getting more direct access to real estate, at much cheaper entry points.

Real estate investment is a popular way to grow your wealth, and it’s not as complicated as it might seem. In this article, I’ll share everything you need to know including the intricacies of tokenized real estate, its benefits, challenges, and the potential it holds for reshaping the future of property investment.

What is Tokenization?

Tokenization, in simple terms, is the process of turning something valuable from the real world into a digital token. These tokens live on a blockchain, which is like a super-secure digital ledger.

Imagine you have a house or a painting; tokenization lets you convert these into digital tokens. Each token represents a part of the real-world asset.

Traditional Real Estate Investment

Here’s a simple breakdown of the key types of real estate investment that have existed up until present day.

- Buying Property: The most direct way to invest in real estate is by purchasing property. This could be residential (like houses or apartments) or commercial (like office buildings or retail spaces). The idea is to buy a property and then make money from it, either through renting it out or selling it at a higher price later.

- Rental Income: If you rent out the property you own, you get regular income from the tenants. This rental income can be a steady source of cash, but it also comes with responsibilities, like maintenance and dealing with tenants.

- Appreciation: Over time, the value of real estate generally goes up. This increase in value is called appreciation. So, if you buy a property and sell it years later, you’ll likely sell it for more than you paid, making a profit.

- Real Estate Investment Trusts (REITs): If buying property directly seems too big a step, you can invest in REITs. These are companies that own or finance real estate. By investing in a REIT, you’re investing in the properties they own, without the hassle of buying or managing the property yourself.

- Real Estate Crowdfunding: This is a newer way to invest in real estate. Through crowdfunding platforms, you can invest smaller amounts of money in real estate projects. You’re essentially pooling your money with other investors to buy property or fund developments.

- Flipping Houses: This involves buying properties at a low price, renovating them, and then selling them for a profit. It requires a good understanding of the real estate market and renovation costs.

If you know what tokenization, you can probably start to imagine what each of these options would look like as digital assets. But let’s dive into what tokenization is before we get too creative with it.

Why Tokenize Assets?

It’s mainly about accessibility and efficiency.

For instance, selling a building can be a long and complex process. But if that building is tokenized, its tokens can be bought and sold much faster on the blockchain.

Not to mention, it can be cheaper on the blockchain since you don’t have to pay a third party, like a real estate agent, to manage the sale for you.

This is similar to how stocks in a company work but for physical assets. You can buy and trade company stocks on the stock market; and now you can buy and trade real estate on the token market.

These tokens are not just limited to buildings or art. They can represent a share in a variety of assets like gold, cars, or even collectibles.

This opens up investment opportunities to a wider audience. People who couldn’t afford to buy a whole building can now own a part of it through tokens.

Deloitte Report on Tokenization

A report by Deloitte reveals that the tokenization of real estate assets is anticipated to surpass $1 trillion in value by the year 2030.

The report additionally highlights that the Asia Pacific region is the frontrunner in the real estate tokenization market following the escalating integration of blockchain technology, particularly in nations such as China, Japan, and Singapore.

Key Takeaways from the Report:

- Tokenized real estate provides a gateway for a broader range of investors, allowing them to participate in high-value properties that may have been previously too expensive.

- Blockchain technology, which underpins tokenization, enables secure, transparent, and immutable record keeping of property ownership, thus eliminating the need for intermediaries, like lawyers or real estate agents, and reducing the risk of fraud or disputes.

- Tokenization of real estate allows investors to diversify their portfolios across various properties and geographic locations, mitigating risks associated with market-specific downturns.

Advantages of Real Estate Tokenization

Advantages:

- lower barrier to entry

- ability to create liquidity

- lower transaction cost

- more efficient and transparent transactions

- decreased counterparty risk

- regulatory clarity

Tokenization enhances liquidity, accessibility, and efficiency in the real estate market, opening up new opportunities for investors to participate in property ownership with lower barriers to entry.

Tokenization also introduces the potential for increased transparency, security, and automation in real estate transactions.

Blockchain technology ensures transparency and security, and easily facilitates the process.

Smart contracts are self-executing pieces of code that play a pivotal role in tokenization. They define the rules and conditions governing the issuance, transfer, and management of these digital tokens.

You have to be careful though, because there are a lot of scams out there that use the code in smart contracts to do something you don’t expect it to. So if you decide to get involved, make sure you have the contract audited if you can’t read it yourself.

While all that is great, it’s also important to remember that a good investment portfolio includes many different kinds of assets so that you are less likely to lose everything.

If the value of real estate goes down, but you are also invested in companies or crypto, you won’t lose as much as you would if all your investments were in real estate. Investors can spread their capital across multiple properties or projects, lowering risk and optimizing their investment strategy.

Disadvantages of Real Estate Tokenization

Disadvantages:

- regulatory complexity

- compliance risks

- market volatility

- security concerns

- limited exit strategies

The regulatory environment surrounding tokenized real estate is still evolving and can vary significantly by jurisdiction. Navigating compliance requirements, such as securities laws and anti-money laundering (AML) regulations, can be complex and time-consuming.

And, failure to comply with these regulations can lead to legal and financial repercussions. Since other people might be in charge of the token pool, you might not know if they are fully compliant or not.

While tokenization is partially intended to increase liquidity—meaning, the amount of value in real estate—the real estate market itself can still be subject to value fluctuations. The hope is that the fluctuations would be felt less by each individual if there are more people involved.

However, since tokenization is still an emerging technology, there is no guarantee that more people will buy real estate just because it’s tokenized. In order to get out of the tokenized real estate—i.e. sell your tokens—you need someone who is willing to buy them. So there may be fewer options for exiting these investments.

The reliance on blockchain technology introduces its own set of risks. While blockchain is generally considered secure, it is not immune to potential vulnerabilities, such as smart contract bugs or security breaches. On top of that, the loss of private keys can lead to the permanent loss of assets.

Tokenized real estate projects often involve multiple stakeholders, including property owners, developers, platform providers, and investors.

While the smart contracts can automate a lot of the process, coordinating decisions and reaching agreements on matters such as who manages the property, renovations, and profit distribution can be complex and will require robust governance structures agreed upon before anyone invests.

So while there are downsides, they aren’t all exclusive to tokenization; a lot of them exist in traditional real estate investment too. Let’s take a look at how tokenization tries to address these concerns.

How Real Estate Tokenization Works

Here is a step-by-step explanation of how tokenized real estate works:

1) Selection of property: The process begins with selecting a suitable property for tokenization. It could be a residential, commercial, or industrial property.

2) Legal structuring: The property owner or developer works with legal and financial experts to structure the ownership and define the rights associated with the tokens. This may involve creating a special purpose vehicle (SPV) or similar legal entity to hold the property.

3) Due diligence: Thorough due diligence is necessary to verify ownership, clear any liens or encumbrances on the property, and ensure compliance with local regulations.

4) Smart contract development: Smart contracts are self-executing contracts with the terms directly written into code. They run on a blockchain and facilitate the tokenization process. Smart contracts govern how the tokens are issued, transferred, and the rights associated with them.

5) Tokenization: The property ownership is divided into digital tokens. These tokens are created on a blockchain using smart contracts. For example, if a property is valued at $1 million and 1,000 tokens are issued, each token may represent $1,000 worth of ownership.

6) Offering and investment: The tokens are offered for sale to investors through a platform or exchange. Investors can purchase these tokens using cryptocurrency or fiat currency. Each token represents a share of ownership in the property.

7) Compliance and regulation: It’s important to ensure compliance with local securities regulations, as tokenized real estate may be considered a security. This might involve regulatory filings and adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

8) Management and governance: Depending on the legal structure, there may be a need for a management team or entity to oversee the property, make decisions, and distribute profits to token holders. Governance mechanisms can be built into the smart contracts, but someone has to make sure they are acted out as well.

9) Trading and liquidity: Tokenized real estate offers increased liquidity compared to traditional real estate investments. Investors can buy, sell, or trade their tokens on secondary markets, potentially 24/7.

10) Distribution of profits: Rental income, capital gains, or other forms of income generated by the property are distributed to token holders based on their ownership percentage as defined by the tokens they hold.

11) Exit and liquidation: The proceeds of a sale are distributed to token holders based on their ownership share. The process can be automated through the smart contract.

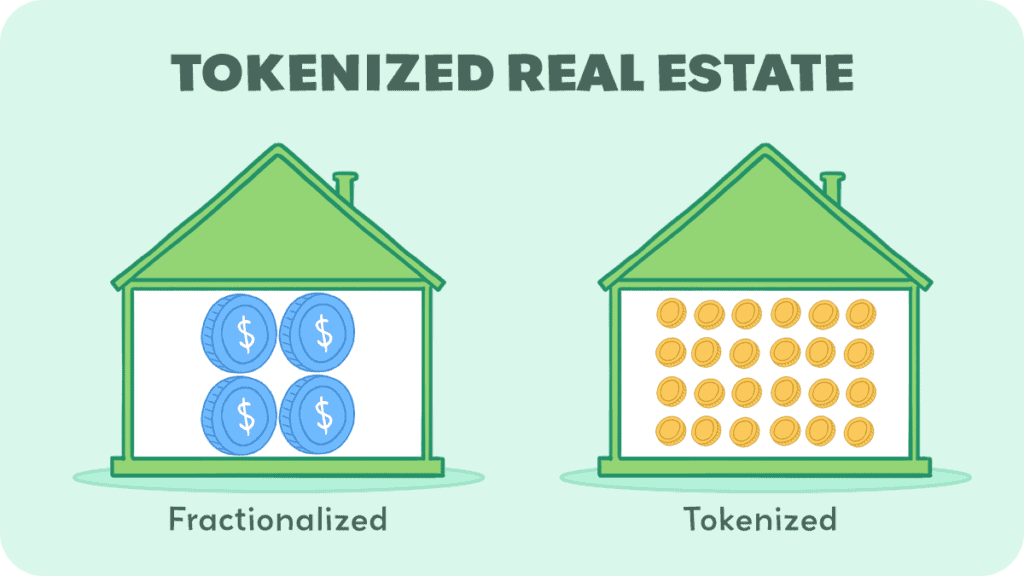

Real Estate Tokenization vs. Fractional Ownership

Real estate tokenization and fractional ownership are both innovative approaches to investing in real estate, but they have distinct differences.

Real estate tokenization involves dividing a property’s value into smaller, tradable tokens on a blockchain, with each token representing a fraction of ownership in the property.

Fractional ownership involves multiple investors collectively purchasing a property, with each investor owning a specific percentage or share of the property.

I know, that sounded pretty much the same. The three major differentiating factors are:

- Technology – Real estate tokenization relies on blockchain technology, while fractional ownership is based on legal ownership structures.

- Liquidity – Real estate tokens can potentially be traded on secondary markets, offering higher liquidity compared to fractional ownership arrangements.

- Regulation – Both approaches may face regulatory considerations, but the regulatory landscape for tokenized assets is still evolving.

Example Of Tokenized Real Estate

An ideal example of tokenized real estate would be a $100 million apartment building tokenized into 100 million tokens, each representing a $1 share of the property.

This allows several individuals to own tiny parts of the property by buying these tokens, thus democratizing real estate investment. The innovation could bring about a new sector of “real estate token hedge funds.”

A real life example of tokenized real estate is the “Aspen Digital” project, which involved the tokenization of the St. Regis Resort in Aspen, Colorado. In 2018, a luxury hotel in Aspen, Colorado, was tokenized on the blockchain.

The ownership of the hotel was divided into digital tokens, allowing investors to buy and hold shares in the property through a platform called Indiegogo.

This tokenization allowed investors to have fractional ownership of the hotel. They could potentially receive a portion of the rental income generated by the property.

Conclusion

While we saw just one example, there are many other tokenized real estate projects around the world. In fact, the tokenized real estate market is projected to surge to a staggering $18.2 billion by 2032!

Nonetheless, it is super important to remember that while the future looks promising, regulatory frameworks and technological developments will play pivotal roles in shaping the trajectory of this upcoming industry.

As investors and stakeholders navigate this exciting frontier, it is crucial to stay informed, exercise due diligence, and seek professional advice to make the most of this new era in real estate investment.

With careful consideration and strategic planning, tokenized real estate has the potential to redefine the landscape of property ownership and investment for years to come.

FAQs

1) What is tokenizing real estate?

Tokenizing real estate involves converting ownership of a property into digital tokens on a blockchain. Each token represents a share of the property’s value, facilitating easier investment and trading. The process enhances liquidity and accessibility for investors.

Furthermore, tokenization also provides a transparent and secure ledger of ownership, reducing the need for intermediaries and increasing trust in the investment process.

2) What are the benefits of tokenized real estate?

The benefits of tokenized real estate include lower barrier to entry, ability to create liquidity, lower transaction costs, more efficient and transparent transactions, better liquidity and opportunity for small-scale investors.

Other benefits include a decrease in counterparty risk to enhance security and trust, regulatory clarity, and the transformative potential of “smart contracts.”

3) What platform is used to tokenize real estate?

Several platforms and blockchain networks are used for tokenizing real estate. Some popular ones include:

- RealT – It specializes in fractional ownership of rental properties. It allows investors to purchase digital tokens representing shares in specific real estate properties, earning them a portion of the rental income generated.

- Brickblock – Brickblock is a platform focused on tokenizing various types of assets, including real estate. It aims to provide a seamless and secure way for investors to buy, sell, and manage digital assets.

- Propy – Propy is a blockchain-based real estate marketplace that facilitates the purchase of properties using smart contracts.

- RedSwan – RedSwan is a commercial real estate tokenization platform that allows investors to buy and trade shares of institutional-grade properties. It provides fractional ownership opportunities in high-value real estate assets.

- Blockimmo – This Swiss-based platform for real estate tokenization allows property owners to issue tokens representing shares in their properties, making it easier for investors to participate in the real estate market.

Others include:

- SolidBlock

- Reido

- lice

- BlockSquare

- BrickTrade

4) What is the difference between NFTs and tokenization in real estate?

NFTs (Non-Fungible Tokens) and real estate tokenization are both related to using blockchain technology, but they serve different purposes.

An NFT is a unique, indivisible digital asset that represents ownership of a specific item or piece of content, often used for digital art, collectibles, music, and other unique digital assets. Real estate tokens can be NFTs, but are not always.

NFTs aren’t interchangeable with each other on a one-to-one basis, as each one has its own distinct value and characteristics. They’re typically used to establish ownership and authenticity of digital assets in a verifiable and secure way. But this is changing. Increasingly, NFTs also can represent real-world things, such as artwork or sports paraphernalia.

On the other hand, real estate tokens are usually divisible, meaning they can be divided into smaller units, allowing for fractional ownership. The purpose of real estate tokenization is to increase liquidity and accessibility to real estate investments, as well as automate certain aspects of property management.

5) How much real estate is tokenized?

As of 2020, the tokenized real estate market was roughly US$200 million. By 2022, the size of the market was $2.7 billion. According to projections, there’ll be a surge to a staggering $18.2 billion by 2032.