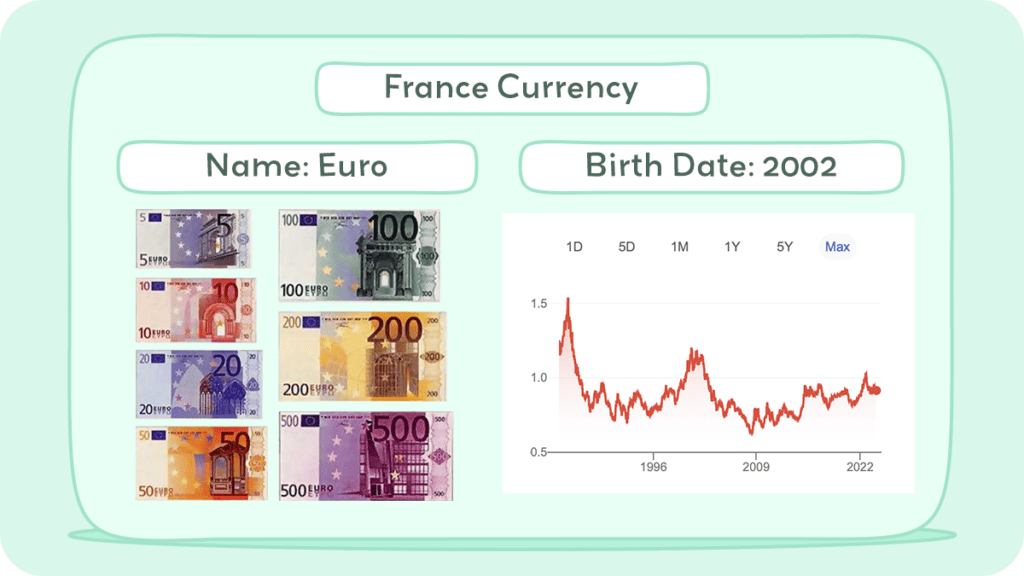

In France, the currency used is the Euro (€), which has been the official currency since January 1, 2002. The Euro replaced the French Franc, which was the country’s currency for many years.

As a member of the European Union, France adopted the Euro to facilitate easier trade and economic coordination with other EU member states. The Euro is used in 19 of the 27 EU countries, known collectively as the Eurozone.

In this article, we examine the French currency, the Euro, delving into its historical background and key facts. We trace the Euro’s origins back to its predecessor, the Franc, exploring its evolution and eventual adoption within the Eurozone.

Historical Journey of The France Currency

France’s currency history mirrors its economic and political changes. Initially, France used livres, sous, and deniers, a system rooted in medieval times. After the French Revolution in 1795, they switched to the franc to simplify and stabilize the economy.

The franc, which was divided into 100 centimes, saw many changes, especially during major events like the World Wars. In 1960, the new franc was introduced to counter inflation, worth 100 old francs. Finally, in 2002, France joined other European Union countries in adopting the euro, marking a major shift from a national to a shared European currency.

Franc

The French Franc, a historic currency of France, has a rich history that dates back to the Carolingian monetary system established in the 8th century. Originally, it was linked to the Livre Tournois, a unit from this system. The franc’s name first appeared around 1360, denoting coins worth 1 livre tournois, and it continued to be used for centuries, evolving in value and form.

Charlemagne’s monetary system, introduced in 781 AD, was foundational for the franc. It involved a Livre (pound) of silver, which was subdivided into 20 Sols or Sous (shillings) and further into 12 Deniers (pennies). For a long time, the denier was the only actual coin, with the sou and livre mostly serving as accounting units.

Over the years, the value of the Livre Tournois fluctuated, especially during times of economic and political turmoil. During the reign of King Louis IX in 1266, the silver Gros tournois was issued, which later became France’s preferred accounting system. The 15th and 16th centuries saw further debasements and revaluations of the currency, influenced heavily by wars and economic crises.

The French Revolution brought significant changes, introducing the decimal “franc” in 1795 as a unit of 4.5 grams of fine silver, slightly less than the livre. This move marked the end of the ancien régime’s practice of not stating denominations on coins and manipulating their values. Decimalization was a major step, aligning France with a system that was becoming standard across many countries.

During the Napoleonic era, significant reforms were introduced, including the establishment of the Franc germinal in 1803, a gold franc containing 290.034 mg of fine gold. This era saw the introduction of modern gold coins denominated in francs and the shift to bimetallism, where gold and silver-based units circulated interchangeably.

In the 19th century, France joined the Latin Monetary Union (LMU), standardizing the franc across several European nations. The LMU marked a significant step towards economic integration, using the franc as a common currency base.

World War I and II profoundly impacted the franc. The wars led to severe devaluations and changes in the coinage system. During the Nazi occupation, the franc was pegged to the German Reichsmark. Post-WWII, France underwent several devaluations within the Bretton Woods system, adjusting the franc’s value against other currencies.

In 1960, the new franc (nouveau franc) was introduced, worth 100 old francs. This change was part of a broader effort to stabilize the currency and control inflation. Despite these efforts, the franc continued to experience devaluation, and in 1999, it was replaced by the Euro at a rate of 6.55957 francs to 1 euro.

The transition to the Euro marked the end of the French Franc as a currency, though it left a lasting legacy in France’s economic history. The Franc was more than just a currency; it was a symbol of France’s national identity and sovereignty, reflecting the nation’s tumultuous history through its economic ups and downs.

Euro

France has gone through several currency changes over the years, including the introduction of the Euro in 1999. The Euro became the official currency of France in 2002, replacing the French Franc. Today, the Euro is the official currency of France and is used by millions of people every day.

The Euro is divided into 100 cents. Coins come in denominations of 1, 2, 5, 10, 20, and 50 cents, and 1 and 2 Euros. Banknotes are available in 5, 10, 20, 50, 100, 200, and 500 Euros, although the 500 Euro note is no longer being issued since 2019, it remains legal tender and can still be used.

Euro coins

The euro, introduced in 1999, is the official currency of the Eurozone, consisting of 20 member countries. It is divided into eight coin denominations, ranging from one cent to two euros, each featuring a common reverse side depicting a map of Europe.

However, the obverse side varies among member countries, showcasing unique designs. In addition to Eurozone members, four European microstates (Andorra, Monaco, San Marino, and Vatican City) also use the euro with their own designed coins. The coins are minted at national mints, adhering to strict quotas, while the European Central Bank manages the common side.

Over the years, the euro’s design has evolved, with changes in 2007 reflecting the EU’s enlargement and updates in 2017 for some denominations. The euro’s introduction aimed to foster economic and monetary union, contributing to stability and collaboration among member states.

The coins incorporate security features, and their design considers tactile elements for the visually impaired. While national sides of regular coins can be updated every 15 years, commemorative coins may vary more frequently. As of 2023, 24 countries issue euro coins with their national sides, reflecting the diversity within the Eurozone.

Euro bills

Euro banknotes, the common currency of the eurozone, have evolved since their 1999 inception. Initially, under ES1, these €5 to €500 notes featured a uniform design with the European flag, a map, and “euro” in Latin and Greek.

The designs, by Robert Kalina, resulted from a 1996 competition. ES1, made of pure cotton, excluded non-EU Cyprus and Malta. ES2, or Europa series, introduced size changes and enhanced durability with updated security features. Reinhold Gerstetter redesigned the notes, featuring Mario Draghi’s signature post-March 2012.

Anticipated in 2024, the third series will redesign notes based on public-voted themes. Security features include confidential elements like holograms and watermarks. The Europa series introduced Europa’s face, reflecting EU expansion and adding Bulgaria’s Cyrillic alphabet. Circulating since 2013, it phased out the €500 note due to concerns about criminal use.

Security features include watermarks, holograms, color-changing ink, and more, with consultation for the visually impaired. A 2021 plan outlines the next redesign with potential themes like “European culture.” The ECB monitors euro banknote circulation and stock, ensuring integrity since its 2002 introduction. The euro’s history involves expansion, formalized political authority through the Lisbon Treaty, and usage across multiple EU countries. The seven denominations feature stylized historical European architectural illustrations on both sides.

Inflation and Buying Power of Euro

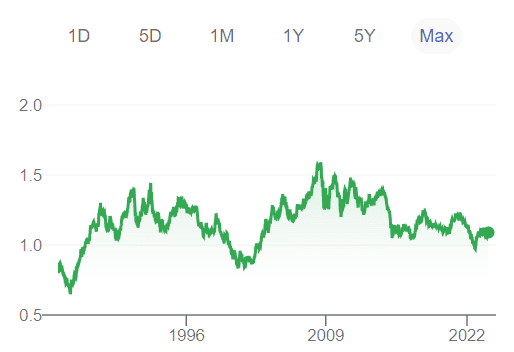

In France, the purchasing power of the Euro has fluctuated notably between 2007 and 2022. After a significant decline, there was a minor recovery in 2014 with a 1.2% increase. The most substantial drop occurred in 2013, more severe than during the 2008 financial crisis and the 2020 COVID-19 crisis.

Inflation was highest in 2008 at 2.8% and rose again between 2015 and 2018 in France. Despite these inflationary changes, the average household income in France has remained fairly stable since 2005.

Purchasing power has been a major issue in French public discussions, especially during the 2019 Great National Debate following the Yellow Vests movement. Many French citizens believe that President Macron’s economic policies have negatively affected their purchasing power.

The French central bank forecasts an economic recovery by 2025, with decreasing inflation and increasing consumer purchasing power. This prediction is more conservative than the government’s, which expects higher growth rates.

The central bank’s report suggests that if growth aligns more with its forecast than the government’s, additional budget savings might be needed to keep deficit reduction on track.

Inflation is expected to decrease from 5.7% to below 2% by early 2025, which should lead to wage increases outpacing inflation, enhancing purchasing power. This could result in higher consumer spending and boost economic growth to 1.3% in 2025 and 1.6% in 2026.

Currency Usage in France

The adoption of the Euro has facilitated easier travel and business across much of Europe, as people no longer need to exchange currencies when moving between most EU countries. The European Central Bank is responsible for the monetary policy of the Eurozone, including France.

In terms of digital payment methods, France has seen a significant increase in the use of credit and debit cards, mobile payments, and online banking services, especially in urban areas. However, cash is still widely used for smaller transactions, especially in rural areas and among older populations.

Is USD accepted in France?

The euro (EUR) is the main currency in France thus unfortunately, USD is generally not accepted. Most places only accept euros. It’s rare to use USD in France, even in tourist areas. To use your USD, you can exchange it for euros at currency exchange bureaus, banks, or ATMs.

Using a credit or debit card without foreign transaction fees is another convenient option. You might also be able to pre-pay for some services like hotels or tours in USD to avoid currency exchange later.

Exchanging Currency in France

When traveling to France, you will need to exchange your home currency for Euros. The easiest and most convenient way to do this is to use an ATM or debit card to withdraw Euros from a French bank. This method usually provides the best exchange rate and saves you from carrying large amounts of cash.

If you prefer to exchange cash, you can do so at a bank or exchange bureau. Banks generally offer better exchange rates than exchange bureaus, but they may charge a fee. Be sure to compare rates and fees before making a transaction.

Where can I exchange France currency?

You can exchange currency at various locations, such as banks, where most offer this service at local branches. Specialized currency exchange offices, known as bureaux de change, are also available in airports, city centers, and tourist areas.

While international airports commonly provide currency exchange services, rates may be less favorable there. Some online platforms allow currency exchange, but it’s essential to use reputable services for secure transactions.

Certain hotels offer currency exchange services to guests, though rates may not be as competitive as dedicated exchange offices. Before exchanging currency, compare rates, and be aware of fees or commissions. It’s advisable to check rates and fees in advance, as they can vary.

What to know before exchanging currency in France

When exchanging currency in France, it’s important to understand the exchange rate and any associated fees. Exchange rates can change daily, so check the current rate before exchanging. Some banks and exchange bureaus may charge commissions or fees, so inquire about these beforehand. Ensure also the security of your personal and financial information by exchanging currency only at reputable institutions.

Note that some businesses may not accept large Euro notes (e.g., 100 or 200 Euros), and prices are often rounded to the nearest five cents due to the absence of one or two cent coins.

Credit cards are widely accepted, but having some cash for small purchases or places that don’t take cards is a good idea. ATMs are available but may have withdrawal fees. Being familiar with the Euro and its access options will make your trip to France smoother and more enjoyable.

Choosing Between USD and Euro in France

When traveling to France, it’s important to understand the exchange rate between your home currency and the Euro. The exchange rate is the value of one currency compared to another. For example, if you are from the United States, the exchange rate between the US dollar and the Euro determines how many Euros you will receive in exchange for your dollars.

Exchange Rate

Exchange rates fluctuate constantly, so it’s important to check the current rate before exchanging currency. You can check the exchange rate online or at a currency exchange office. Keep in mind that the exchange rate you see online may not be the rate you receive when exchanging currency.

Currency exchange offices often charge a fee or commission for exchanging currency, which can affect the exchange rate. You can check the current exchange rate on websites such as XE.com.

It is best to exchange your currency for France currency before traveling to France. Be sure to consider the exchange rate and any fees associated with exchanging your currency.

Convenience

When visiting France, using euros (EUR) proves more convenient than US dollars (USD). The euro is the official currency in France and across most European Union countries. This choice offers several advantages:

Firstly, euros enjoy widespread acceptance in France, covering various transactions from dining at restaurants to shopping and transportation.

Secondly, opting for euros helps avoid additional fees associated with currency conversion that may occur when using USD. Withdrawals from ATMs or card payments in euros generally provide more favorable exchange rates.

Furthermore, having euros readily available simplifies daily activities, eliminating concerns about locating currency exchange offices or dealing with frequent money exchanges.

Lastly, local banks or ATMs often offer better currency exchange rates compared to exchange offices in your home country. It is recommended to withdraw euros from ATMs in France for more favorable rates.

Before your trip, inform your bank about your travel plans to ensure seamless card transactions in France. Consider carrying a small amount of euros in cash for situations where card payments may not be accepted.

Fees

When exchanging currency, be aware of any fees or commissions charged by the currency exchange office. Some offices may advertise “no commission” but offer a lower exchange rate to make up for it. It’s important to compare exchange rates and fees at different locations to get the best deal.

It is also important to consider any fees associated with exchanging your currency. Some banks and currency exchange services may charge a fee for exchanging your currency. It is recommended to compare fees and exchange rates before exchanging your currency.

Tips

When visiting France, use Euros for payments. Exchange your money at banks or exchange offices for better rates; avoid hotels and airports. Carry some cash since small shops might not take cards or have minimum amounts.

Cost of Living in France

When it comes to the cost of living in France, it is important to note that the country is generally more expensive than other European countries. However, the cost of living can vary depending on the city and region you are in. For example, Paris is known to be one of the most expensive cities in France, while smaller towns and cities tend to have a lower cost of living.

According to Numbeo, a family of four can expect to spend an estimated monthly cost of €3,406.1 without rent, while a single person can expect to spend an estimated monthly cost of €952.4 without rent. These estimates include expenses such as groceries, transportation, and utilities.

Housing costs in France can also vary greatly depending on the location. According to International Living, the median purchase price for a pre-existing home in Toulon is €468,000 ($513,791), while in the Marseille/Aix-en-Provence area it’s €400,000 ($439,138), and Montpellier comes in at €418,000 ($458,899). However, looking for housing 30-40 minutes away from the seacoast can produce a significant decrease in price.

In terms of spending, it is important to note that France uses the Euro (€) as its currency. Credit cards are widely accepted in most places, but it’s always a good idea to carry some cash on hand, especially when visiting smaller towns and markets. ATMs are also widely available throughout the country.

Overall, while the cost of living in France may be higher than in other European countries, it is still possible to live comfortably while sticking to a budget. By doing some research and being mindful of your spending, you can enjoy all that France has to offer without breaking the bank.

Don’t Get Scammed tips

France is generally a safe country for tourists, but it’s always a good idea to be cautious when it comes to handling money. Here are some tips to avoid getting scammed:

- Always be aware of your surroundings, particularly in crowded areas like tourist spots and on public transportation. Secure your valuables in a money belt or zipped bag and avoid displaying expensive items.

- Watch out for common scams. Be cautious of pickpockets in busy areas, and beware of scams like the ‘distraction and steal’ tactic, where someone distracts you while an accomplice steals your belongings, or the ‘petition scam’ where signing a petition is used as a ploy for theft.

- Use ATMs in secure areas and avoid them at night to prevent card information theft. For transportation, only use licensed taxis from official stands and agree on fares beforehand to avoid being overcharged.

- Use reputable websites or book directly with hotels when booking accommodations, , and be mindful of hidden fees in the booking terms.

By following these tips, you can avoid common currency mistakes and make the most of your trip to France. Remember to always be aware of exchange rates and watch out for scams, and you’ll be well on your way to a successful trip.