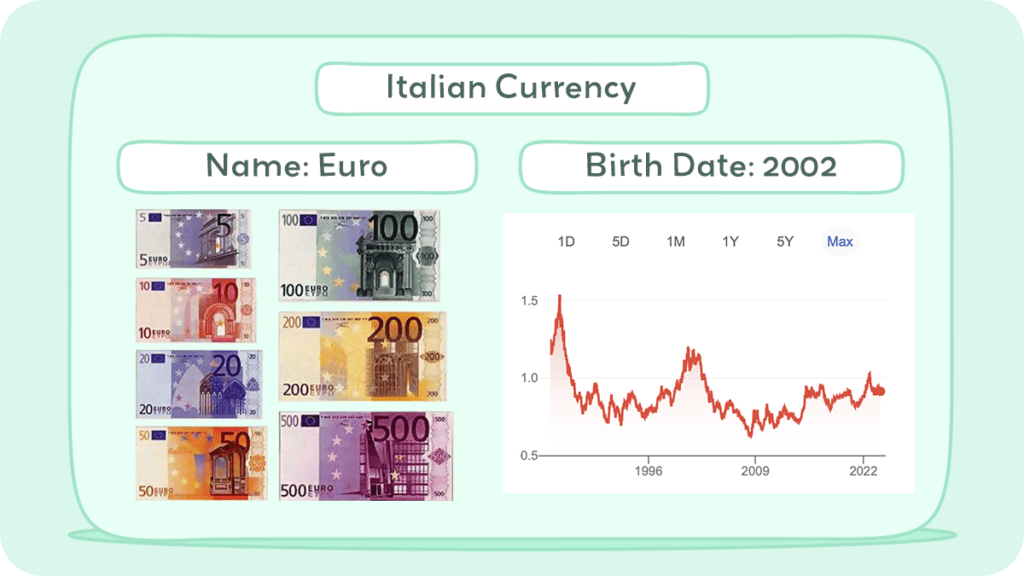

The Italian currency is the Euro (EUR). The euro is the official currency of 19 of the 27 European Union countries, collectively known as the Eurozone. It replaced the Italian Lira in 2002.

In Italy, you’ll find banknotes in denominations of 5, 10, 20, 50, 100, 200, and 500 Euros, and coins in denominations of 1, 2, 5, 10, 20, and 50 cents, as well as 1 and 2 Euro coins.

When traveling to Italy, it’s important to have a basic understanding of the Italian currency. This article will let you know what to expect and how to exchange your currency so you can ensure that your trip goes smoothly and you’re able to purchase the things you need while you’re in Italy.

Historical Journey of the Italian Currency

Italian currency has a long and interesting history that dates back to ancient times. The first Italian coins were minted by the Etruscans in the 6th century BC. These coins were made of bronze and were used for trade and commerce.

Over the centuries, Italian currency evolved and changed hands many times. The Roman Empire introduced the denarius, a silver coin that was used throughout the empire. After the fall of the Roman Empire, Italian currency was dominated by the Byzantine Empire, which introduced the solidus, a gold coin that was used throughout Europe.

In the Middle Ages, Italian city-states began to mint their coins. These coins were often decorated with images of local rulers or landmarks. The most famous of these coins was the florin, which was minted in Florence in the 13th century. The florin became the standard for European coinage and was used for trade throughout the continent.

Italian Lira

The Italian lira, used from 1861 to 2002, was introduced by the Napoleonic Kingdom of Italy in 1807, equal to the French franc. It became the currency of the Kingdom of Italy in 1861 and was also used in Albania from 1941 to 1943. The lira, subdivided into 100 centesimi, evolved from the libra of the Carolingian system, which also influenced the French livre and the pound sterling.

The lira underwent significant changes over the years. Initially, it replaced various regional currencies. In 1865, Italy joined the Latin Monetary Union, equating the lira to the French, Belgian, and Swiss francs, with the U.S. dollar being worth about 5.18 lire until 1914. World War I disrupted this system, leading to inflation in Italy. Mussolini’s regime in 1926 pegged the lira to sterling and later to the U.S. dollar, but these rates changed, particularly during and after World War II.

Post-war, Italy faced high inflation, leading to suggestions to redenominate the lira, which were eventually abandoned in favor of adopting the euro. The euro replaced the lira in 1999 as the official currency, with a conversion rate of €1 = Lit 1,936.27, and the lira ceased to be legal tender in 2002.

The lira had no standard symbol, but various abbreviations like Lit., L., ₤, or £ were used. Coins and banknotes of the lira underwent several changes, reflecting Italy’s economic and political shifts. Notable coins include the bi-metallic 500 and 1,000 lire, and the first coin featuring braille. The Bank of Italy and the government issued various banknotes, with the last series circulating until the euro’s introduction.

The euro’s introduction marked the end of the lira, with the Bank of Italy exchanging old lira notes and coins until December 6, 2011. The shift to the euro was significant, reflecting Italy’s economic integration into the European Union and the end of a currency that had been a central part of Italian life and history for over a century.

Euro

Italy adopted the euro on January 1, 2002, following a three-year transitional period where it was used as ‘book money’. During the initial phase, both the euro and the Italian lira were legal tender until February 28, 2002. The Banca d’Italia continued to exchange Italian lira banknotes and coins until February 29, 2012.

Euro coins

The euro, introduced in 1999, is the official currency of the Eurozone, consisting of 20 member countries. It is divided into eight coin denominations, ranging from one cent to two euros, each featuring a common reverse side depicting a map of Europe.

However, the obverse side varies among member countries, showcasing unique designs. In addition to Eurozone members, four European microstates (Andorra, Monaco, San Marino, and Vatican City) use the euro with their own designed coins. The coins are minted at national mints, adhering to strict quotas, while the European Central Bank manages the common side.

Over the years, the euro’s design has evolved, with changes in 2007 reflecting the EU’s enlargement and updates in 2017 for some denominations. The euro’s introduction aimed to foster economic and monetary union, contributing to stability and collaboration among member states.

The coins incorporate security features, and their design considers tactile elements for the visually impaired. While national sides of regular coins can be updated every 15 years, commemorative coins may vary more frequently. As of 2023, 24 countries issue euro coins with their national sides, reflecting the diversity within the Eurozone.

Euro bills

Euro banknotes, the common currency of the eurozone, have evolved since their 1999 inception. Initially, under ES1, these €5 to €500 notes featured a uniform design with the European flag, a map, and “euro” in Latin and Greek.

The designs, by Robert Kalina, resulted from a 1996 competition. ES1, made of pure cotton, excluded non-EU Cyprus and Malta. ES2, or Europa series, introduced size changes and enhanced durability with updated security features. Reinhold Gerstetter redesigned the notes, featuring Mario Draghi’s signature post-March 2012.

Anticipated in 2024, the third series will redesign notes based on public-voted themes. Security features include confidential elements like holograms and watermarks. The Europa series introduced Europa’s face, reflecting EU expansion and adding Bulgaria’s Cyrillic alphabet. Circulating since 2013, it phased out the €500 note due to concerns about criminal use.

Security features include watermarks, holograms, color-changing ink, and more, with consultation for the visually impaired. A 2021 plan outlines the next redesign with potential themes like “European culture.” The ECB monitors euro banknote circulation and stock, ensuring integrity since its 2002 introduction. The euro’s history involves expansion, formalized political authority through the Lisbon Treaty, and usage across multiple EU countries. The seven denominations feature stylized historical European architectural illustrations on both sides.

Inflation and Buying Power of Euro

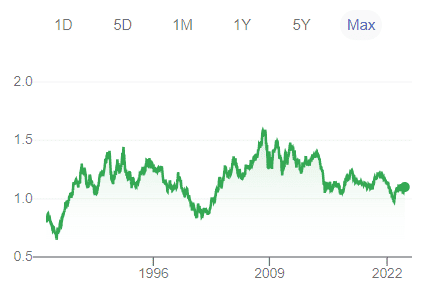

According to Trading Economics, between 1960 and 2022, Italy’s inflation rate ranged from -0.1% to 21.1%. In 2022, it was 8.2%. The average yearly inflation rate during this period was 5.8%, leading to an overall price increase of 2,904.77%. This means an item costing 100 euros in 1960 would cost 3,004.77 euros in early 2023. By October 2023, the year-over-year inflation rate had dropped to 1.7%.

In November 2023, Italy’s annual inflation further decreased to 0.7%, the lowest since February 2021 and below the anticipated 0.8%. This is part of a broader disinflation trend in the Euro Area, influenced by high base effects and the European Central Bank’s (ECB) prolonged restrictive monetary policy. Net inflation in Italy also decreased to 3.6%. Significant price reductions occurred in energy, food, and various services. Italian consumer prices fell by 0.5% from the previous month, continuing a downward trend.

The Euro Area’s annual inflation rate also decreased to 2.4% in November 2023, the lowest since July 2021. Slower price increases were seen in services, non-energy industrial goods, and food, alcohol, and tobacco. Energy prices slightly declined. The annual core inflation in the Euro Area was confirmed at 3.6%. ECB President Lagarde indicated that inflation might increase in December 2023 due to base effects for energy costs. For 2024, a slower decline in inflation is expected due to additional base effects and the end of fiscal measures to mitigate the impact of energy price shocks.

Currency Usage in Italy

In Italy, many small businesses and markets may not accept credit or debit cards. However, major towns and cities generally have no problem accepting card payments. It’s always a good idea to carry some cash with you, especially if you plan on traveling outside of the major cities or venturing into the countryside. ATMs are widely available in Italy, and you can withdraw Euros using your debit or credit card.

Is USD Accepted in Italy?

If you are planning to visit Italy, you might be wondering whether you can use US dollars instead of the Italian currency. While some places may accept USD, it is always better to have Euros in hand.

While a few places like popular tourist spots, big hotels, and international shops might take US dollars (USD), it’s rare and not recommended to rely on this. The exchange rate for USD in these places is usually not as good as at banks or currency exchange services. Travelers to Italy are advised to use Euros for their purchases, either in cash or with credit/debit cards.

Exchanging Currency in Italy

One of the easiest ways to exchange currency in Italy is to use an ATM. Most ATMs in Italy accept foreign cards, and you can withdraw euros directly from your account. This is often the cheapest and most convenient way to get euros. However, remember that your bank may charge you fees for international withdrawals.

Another option is to exchange Italian currency at a bank. Banks usually offer competitive exchange rates, but they may charge fees or require a minimum exchange amount. Be sure to check with your bank before you leave to see if they have any partnerships with Italian banks that could help you save on fees.

Finally, you can exchange currency at a currency exchange booth. These booths are often located in tourist areas and airports, and they can be convenient if you need to exchange currency outside of regular banking hours. However, be aware that currency exchange booths often charge high fees and offer poor exchange rates.

Where Can I Exchange Italian Currency?

If you need to exchange euros back into your home currency, you can usually do so at a bank or currency exchange booth. Some banks may require you to have an account with them to exchange currency, so be sure to check beforehand.

If you have leftover euros, you can often exchange them at your home bank or a currency exchange booth. However, keep in mind that you may not get the same exchange rate that you received when you exchanged your home currency for euros.

What to Know Before Exchanging Currency in Italy

Before you exchange currency in Italy, there are a few things you should keep in mind. Be sure to check the current exchange rate before you exchange currency. This will help you avoid being ripped off by a currency exchange booth or bank.

Currency exchange booths at airports often charge high fees and offer poor exchange rates. If possible, wait until you get into the city to exchange currency. Banks and currency exchange booths may charge fees for exchanging currency.

Be sure to check the fees before you exchange currency to avoid any surprises. Using a credit card can be a good way to avoid currency exchange fees. However, be sure to check with your credit card company to see if they charge foreign transaction fees.

By following these fundamentals, you can ensure that you get the best exchange rate possible and avoid unnecessary fees when exchanging currency in Italy.

Choosing Between USD and Euro

When it comes to choosing between USD and Euro, it is always better to use the local currency. This is because using the local currency will save you money on exchange rates and conversion fees.

If you are planning to exchange USD for Euros in Italy, make sure to compare exchange rates and fees at different places. Banks and money exchange offices usually offer better rates than hotels and airports.

In addition, you can also use credit or debit cards in Italy. Most places accept major credit cards such as Visa and Mastercard. However, make sure to inform your bank before you travel to Italy to avoid any issues with your card.

Overall, it is always better to use the local currency when you travel to Italy. This will save you money on exchange rates and conversion fees. Make sure to carry some Euros with you when you travel and compare exchange rates before exchanging money.

Exchange Rate

When exchanging currency, it is important to be aware of exchange rates and fees of the Italian currency. Banks and currency exchange offices may charge fees for exchanging currency.

It is recommended to compare exchange rates and fees before exchanging currency to get the best deal. Additionally, some credit cards may charge foreign transaction fees, so it is important to check with your credit card company before using your card in Italy.

Italy is a beautiful country with a rich history and culture. While the cost of living may be higher than in some other countries, it is possible to live in Italy on a budget. Keeping an eye on exchange rates and fees can also help you save money when traveling in Italy.

Convenience

The most convenient way to pay for things in Italy is with a credit or debit card. Most places accept major credit cards, such as Visa and Mastercard, as well as debit cards. You can also use your card to withdraw cash from ATMs, which are widely available in cities and towns.

Another convenient option is to use a travel money card, such as the SoFi Money card or the Wise travel card. These cards allow you to load money in advance and use it like a debit card. They often offer competitive exchange rates and low fees, making them a good option for budget-conscious travelers.

Fees

When using a credit or debit card in Italy, you may be charged foreign transaction fees or ATM withdrawal fees. These fees can add up quickly, so it’s important to choose a card that offers low or no fees for international transactions.

If you plan to exchange currency, be aware that exchange bureaus often charge high fees and offer poor exchange rates. It’s best to avoid these and instead use ATMs or travel money cards to access cash.

Tips

When paying with cash in Italy, it’s customary to round up to the nearest euro or leave a small tip for good service. However, tipping is not mandatory and is generally less common than in other countries.

It’s also a good idea to carry small bills and coins, as many places may not accept large bills or be able to make changes for them.

By following these practical tips, you can ensure that you have the right currency and payment methods for your trip to Italy, and avoid unnecessary fees and inconvenience.

Cost of Living in Italy

Italy is a country with a relatively high cost of living. The cost of living in Italy varies depending on the region, with the northern regions generally being more expensive than the southern regions. According to Numbeo, the cost of living index in Italy is 67.29, which is lower than the cost of living index in the United States. However, some items such as groceries, transportation, and restaurants are more expensive in Italy than in the United States.

If you are planning to live in Italy, it is important to budget accordingly. Housing is one of the biggest expenses in Italy, with rent prices being higher in cities like Rome and Milan. If you are looking to save money on housing costs, consider living in smaller towns or suburbs. Additionally, buying groceries and cooking at home can help you save money on food expenses.

Don’t Get Scammed Tips

- Use official currency exchange services: When exchanging money, always use official currency exchange services, such as banks or authorized exchange offices. Avoid exchanging money on the street or with unauthorized individuals, as they may offer you a better rate but could be trying to scam you.

- Check the exchange rate: Before exchanging any money, check the current exchange rate to ensure you’re getting a fair deal. You can find the current exchange rate online or by asking at an official exchange office.

- Be careful with ATMs: When using ATMs, be aware of your surroundings and make sure no one is watching you enter your PIN. Also, be wary of ATMs that look suspicious or have been tampered with.

- Count your change: When making a purchase, always count your change to make sure you’ve received the correct amount. Some vendors may try to shortchange you, especially if you’re not familiar with the currency.

- Be cautious with credit cards: When using a credit card, make sure it’s only used for authorized transactions. Keep an eye on your card at all times and don’t let it out of your sight. Also, be wary of any suspicious charges on your card and report them immediately.

By following these tips, you can help protect yourself from scams when dealing with Italian currency. Remember to always be aware of your surroundings and trust your instincts if something seems suspicious.