South Africa, known for its vibrant culture, diverse landscapes, and rich history, also boasts a fascinating currency system. The South African currency, the rand, carries a story of resilience, economic transformation, and international influence.

If you’re planning on a trip in South Africa, it is important to know its currency. This article delves into the significance of the South African currency, from its early days to the present, exploring the factors that have shaped its value and its role in the economy.

Historical Journey of South African Rand

The South African rand (ZAR) is the official currency of South Africa, as well as the neighboring countries of Namibia, Lesotho, and Eswatini. The name “rand” originates from Witwatersrand, meaning “white waters’ ridge” in English, which refers to the ridge on which Johannesburg is built, and where most of South Africa’s gold deposits were discovered.

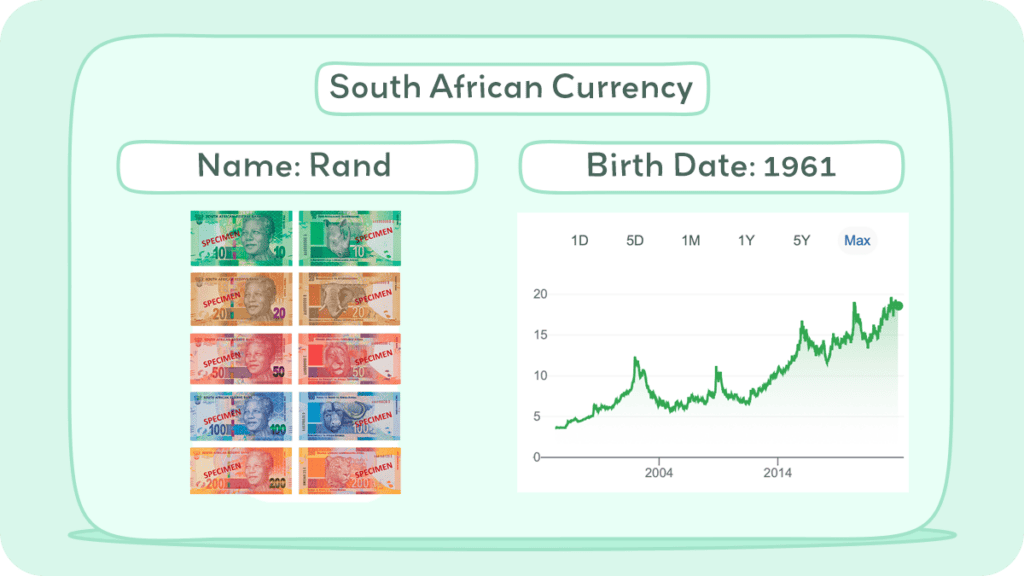

Introduced in 1961, the rand replaced the South African pound at a rate of 2 rand to 1 pound or 10 shillings to the rand. Over the years, the Rand has had its ups and downs. In the 1980s, it was hit hard by international sanctions against the apartheid regime, and its value plummeted. However, in the early 2000s, it made a strong comeback, and it is now one of the most traded currencies in the world.

History of Coins

South Africa boasts a vibrant history of currency, dating back to 1652 when coins were introduced. Over time, the country utilized various currencies made from copper, silver, and gold.

In the late 1950s, the Decimalisation Coin Commission explored the decimalization of South African currency. The resulting Decimalisation Coin Act of 1959 implemented their recommendations, marking a shift to a decimal system in 1961.

The first decimal coin series (1961-1964) saw the formal adoption of the decimal system when the Republic of South Africa was established in 1961. Coins were converted, like the one-pound becoming a two-rand coin. This system persisted until 1964.

The second decimal coin series (1965-1988) witnessed changes like the replacement of the two-and-a-half cent coin with the two-cent coin in 1965. In the late 1980s, rising copper and nickel prices prompted a committee to consider issuing a new series for cost-effectiveness and easier handling.

The third decimal coin series (1989-today) comprises six coin denominations: 10c, 20c, 50c, R1, R2, and R5. Different sizes and rim finishes were introduced to aid visually impaired individuals in identifying denominations by touch. Circulation coins incorporate security features like ridges, rims, serrations, and varied metals.

Electroplated coins emerged in 1989 to address material costs and the risk of falsification. In 2004, a bi-metal R5 coin replaced the R5 nickel coin.

This series features coins with distinct designs and denominations, such as the R5 coin depicting the Black Wildebeest, the R2 coin featuring the Kudu, the R1 coin showcasing the Springbok, the 50c coin displaying the Strelitzia, the 20c coin adorned with the King Protea, and the 10c coin featuring the Arum Lily.

South Africa’s coin history reflects not only its economic evolution but also a vibrant tapestry of symbols and representations on its currency.

History of Bills

South Africa’s banknotes have a rich history, starting with the 1961 introduction of the first series in denominations of 1, 2, 10, and 20 rand. These notes shared designs and colors with preceding pound notes to ease the transition. Initially believed to feature Jan van Riebeeck, the first VOC administrator of Cape Town, it was later discovered that the image was Bartholomeus Vermuyden.

The 1966 second series departed from pound note designs, introducing new colors and denominations. The 1978 series simplified language variants, replacing the 1 rand note with a coin.

The 1990s brought a redesign with images of the Big Five wildlife species on 10, 20, and 50 rand notes, while coins replaced low-denomination notes for 2 and 5 rand due to wear and tear. In 1994, 100 and 200 rand notes were introduced.

The 2005 series maintained the principal design but added security features. In 2010, counterfeit concerns led to the withdrawal of the 1994 series 200-rand banknotes.

In 2011, defective 100 rand banknotes prompted a shift in printing location. In 2012, a new set of banknotes featuring Nelson Mandela’s image entered circulation, maintaining denominations of 10, 20, 50, 100, and 200 rand.

The 2013 update included the EURion constellation, and a special 2018 commemorative series honored Mandela’s 100th birth anniversary. This series depicted Mandela on the obverse and scenes from his life on the reverse.

Recently, on May 3, 2023, the South African Reserve Bank announced a new series featuring Nelson Mandela on the obverse and a family depiction of the Big Five on the reverse, maintaining denominations of 10, 20, 50, 100, and 200 rand.

Inflation and Buying Power of Rand

The South African rand has experienced inflation, leading to a decrease in its purchasing power over the years. Between 1958 and today, the rand had an average annual inflation rate of 7.55%, resulting in a substantial increase in prices.

For instance, R100 in 1958 is now equivalent to about R11,353.17. The inflation rate in South Africa has been volatile, with a range of 3% to over 20% in the past few decades.

According to the OECD and the World Bank consumer price index for South Africa, today’s prices are 113.53 times higher than average prices since 1958. Essentially, a rand today can only purchase 0.881% of what it could back then.

In 1958, the inflation rate was 3.46%, contrasting with the current rate of 5.45%. If this trend continues, R100 today will be equivalent in buying power to R105.45 next year.

To counter inflation and maintain the same purchasing power of rand, one would now need R11,353.17. The real value of a single South African rand diminishes over time, illustrating the impact of inflation on purchasing power.

The South African Rand (ZAR)

The South African Rand is called ZAR, because it is an abbreviation of the Dutch Zuid-Afrikaanse Rand (ZAR), which takes its name from Witwatersrand (the location of a majority of South Africa’s gold deposits).

On May 3, 2023, the South African Reserve Bank (SARB) introduced improved Mandela banknotes and a new fourth decimal coin series. These updates include fresh designs and advanced security features, utilizing the latest technology to safeguard our currency and uphold public trust.

The redesigned banknotes continue to honor Nelson Mandela, South Africa’s first democratically elected president, featuring his portrait on the front of all five denominations. Additionally, the notes showcase the Big 5 animals as a family.

The fourth decimal coin series centers around the theme of deep ecology, celebrating the interconnectedness of humans and other living organisms within the environment.

10 rand

The 10 rand banknote features a green color with Nelson Mandela on the obverse and a Rhinoceros on the reverse. It consists of languages English, Afrikaans, and Swati.

20 rand

The 20 rand banknote features a brown color with Nelson Mandela on the obverse and an Elephant on the reverse. It consists of languages English, Tswana, and Ndebele.

50 rand

The 50 rand banknote features a purple color with Nelson Mandela on the obverse and a Lion on the reverse. It consists of languages English, Xhosa, and Venda.

100 rand

The 100 rand banknote features a blue color with Nelson Mandela on the obverse and a Cape buffalo on the reverse. It consists of languages English, Pedi, and Tsonga.

200 rand

The 200 rand banknote features an orange color with Nelson Mandela on the obverse and a Leopard on the reverse. It consists of languages English, Zulu, and Sotho.

Currency Usage in South Africa

When traveling to South Africa, it’s important to understand the currency used in the country. The official currency of South Africa is the South African Rand (ZAR). The rand is divided into 100 cents, and coins are available in denominations of 5c, 10c, 20c, 50c, R1, R2, and R5. Banknotes are available in denominations of R10, R20, R50, R100, and R200.

Is USD Accepted in South Africa?

While the South African rand is the official currency of the country, the US dollar (USD) is also widely accepted in many places, especially in tourist areas. However, it’s important to note that you may not get the best exchange rate when paying with USD, and some places may not accept USD at all. It’s always a good idea to have some local currency on hand when traveling in South Africa.

It’s recommended to exchange some money into South African rand before traveling to the country. You can exchange currency at banks, exchange bureaus, and some hotels. ATMs are also widely available throughout the country, and many accept international debit and credit cards. Just be sure to check with your bank about any fees or restrictions for using your card internationally.

Currency Exchange

If you are planning a trip to South Africa, you will need to exchange your currency for the South African Rand (ZAR). In this section, we will cover what you need to know about exchanging currency in South Africa, including where you can exchange South African currency and what you should know before exchanging. There are several options available for exchanging currency in South Africa.

Where can I exchange South African currency?

You can exchange your currency at banks, exchange offices, and some hotels. Banks usually offer the best exchange rates, but they may charge higher fees. Exchange offices and hotels may offer more convenient locations and longer hours, but they may have less favorable exchange rates and higher fees. ATMs are also widely available, and they offer a convenient way to withdraw cash in the local currency.

What to know before exchanging currency in South Africa?

Before exchanging your currency, you should be aware of the current exchange rate. The exchange rate is the value of one currency concerning another. You can check the current exchange rate online or at a bank or exchange office.

You should also be aware of any fees associated with exchanging currency. Banks and exchange offices may charge fees for exchanging currency, and some may charge additional fees for using a credit card or debit card.

Choosing between USD and ZAR in South Africa

When choosing between USD and ZAR in South Africa, it’s important to consider the exchange rate. While the exchange rate may fluctuate, it’s generally more cost-effective to use the local currency when paying for goods and services in South Africa.

Exchange Rate

The exchange rate for South African rand (ZAR) fluctuates daily. It is important to check the current exchange rate before exchanging your currency. You can check the current exchange rate online or at a bank or exchange office.

Convenience

While USD is widely accepted in South Africa, it is recommended that you use the local currency for most transactions. This is because some vendors may offer unfavorable exchange rates or charge high fees for USD transactions. Additionally, using USD may not be accepted in some places, particularly in rural areas.

Fees

Exchange rates can also affect the fees and tips you pay when you travel. For instance, if the rand is weak, you may need to pay more fees to convert your money into the local currency. This can increase your travel expenses. Similarly, if the rand is weak, you may need to pay more tips to service providers such as hotel staff, taxi drivers, and restaurant servers. This can increase your overall expenses.

Exchange rates can have significant implications on your financial life in South Africa. Understanding the impact of exchange rates on your purchasing power, convenience, fees, and tips can help you make informed financial decisions when you travel or import/export goods.

Tips

When exchanging currency in South Africa, it’s essential to follow a few tips to ensure a smooth transaction. Start by checking the current exchange rate to have an accurate understanding of the value of your currency. Additionally, compare exchange rates and fees offered by various banks and exchange offices to find the most favorable option.

Be cautious of any additional fees associated with using credit or debit cards for currency exchange. To further assess the exchange rate and service, consider exchanging a small amount of currency initially before proceeding with larger transactions. This way allows you to test the waters and make informed decisions for your currency exchanges.

Cost of Living in South Africa

When it comes to the cost of living in South Africa, it is generally considered to be quite affordable. According to Expatistan, a single person’s estimated monthly costs are around R22,800, which is cheaper than in 81% of countries in the world. However, it’s important to note that the cost of living can vary depending on the region you are in and your lifestyle choices.

One of the biggest factors that can affect your cost of living in South Africa is housing. Rent prices can vary greatly depending on the location, size, and quality of the property. According to Numbeo, the average rent for a one-bedroom apartment in the city center is around R7,500 per month, while outside of the city center it’s around R5,000. If you’re looking to buy a property, the average cost per square meter in the city center is around R20,000, while outside of the city center, it’s around R10,000.

Food and groceries are generally affordable in South Africa. You can find a variety of fresh produce, meat, and dairy products at reasonable prices in supermarkets and local markets. According to Expat Focus, a single person can expect to spend around R2,000 to R3,000 per month on groceries.

Transportation costs can also vary depending on your location and mode of transportation. Public transportation in major cities like Johannesburg and Cape Town is relatively affordable, with a one-way ticket costing around R10 to R15. If you plan on driving, fuel prices are also relatively affordable, with the average cost per liter around R17.

Overall, while the cost of living in South Africa can vary depending on your lifestyle and location, it is generally considered to be affordable compared to other countries in the world.

Don’t Get Scammed Tips

When exchanging currency in South Africa, it is important to be aware of scams. Some exchange offices may offer high exchange rates to lure customers in, only to charge high fees or provide counterfeit currency. Here are 5 tips to avoid scams:

- Use reputable and licensed currency exchange services

Stick to well-known banks, official foreign exchange bureaus, or authorized currency exchange providers. They are more likely to offer fair and transparent rates while minimizing the risk of fraud. Some exchange offices may offer high exchange rates to lure customers in, only to charge high fees or provide counterfeit currency. To avoid scams, it is recommended that you exchange your currency at a reputable bank or exchange office, and always count your money before leaving the premises.

- Research current exchange rates

Make sure you are aware of the current exchange rates before you arrive in South Africa. This will help you determine if the rates offered to you are fair or if you are being scammed. Always ask for a receipt when exchanging currency. This will provide proof of the transaction and can be helpful if any issues arise.

- Be cautious of street vendors

Avoid exchanging currency on the street or with unauthorized individuals. These transactions are often associated with scams and can result in counterfeit money or receiving a lower amount than expected.

- Validate the authenticity of banknotes

Learn how to identify the security features on South African banknotes to avoid receiving counterfeit money. Look for features like watermarks, security threads, and raised printing.

- Be vigilant at ATMs

When using ATMs, be aware of your surroundings and check for any suspicious devices attached to the machine, particularly card skimmers. Cover your hand while entering your PIN and avoid assistance from strangers. When making purchases or paying for services, consider using credit cards or digital payment methods like mobile banking apps. These secure methods offer greater protection against scams and counterfeit money.

Exchanging currency in South Africa is relatively easy, but it is important to choose the right place to exchange your currency and be aware of potential scams. By following these tips, you can ensure that you get a fair exchange rate and avoid any issues with your currency exchange.