Coindirect is a UK-based cryptocurrency exchange that launched in 2017 that serves over 321k registered users. The exchange also has offices in South Africa but is headquartered in London.

The exchange requires partial KYC (Know Your Customer) identity verification protocols to be completed for use of the exchange, based on jurisdiction requirements. US users cannot use the services as per TOS.

History of Coindirect

Coindirect was born in 2017 and offers a range of tailored services for both private trades looking for all-inclusive pricing, and for businesses interested in deploying a white label exchange.

The company has grown to over 70 employees, and has moved more than 300M GBP. The exchange was started by co-founder Stephen Young who was interested in solving the instability of most African fiat currencies.

Coindirect is registered by the Isle of Man Financial Supervision Commission and uses the same security measures that banks use, among additional escrow features. Coindirect functions as both an exchange and peer-to-peer marketplace for individuals to directly trade and sell cryptos amongst one another with escrow services.

Coindirect is best for:

-

All types of cryptocurrency investors especially those desiring peer-to-peer trading with individuals directly with escrow services. Also useful especially for those in emerging markets such as South Africa who desire access to a full suite of crypto financial services and banking

-

Traders and investors who desire a transparent, quoted price with no hidden fees as well as flat 2.99% fees on credit card transactions

PROS

- Peer-to-peer crypto marketplace

- Escrow services

- Transparent quoted fees

- Mediocre cryptocurrency offerings

- Multiple payment options

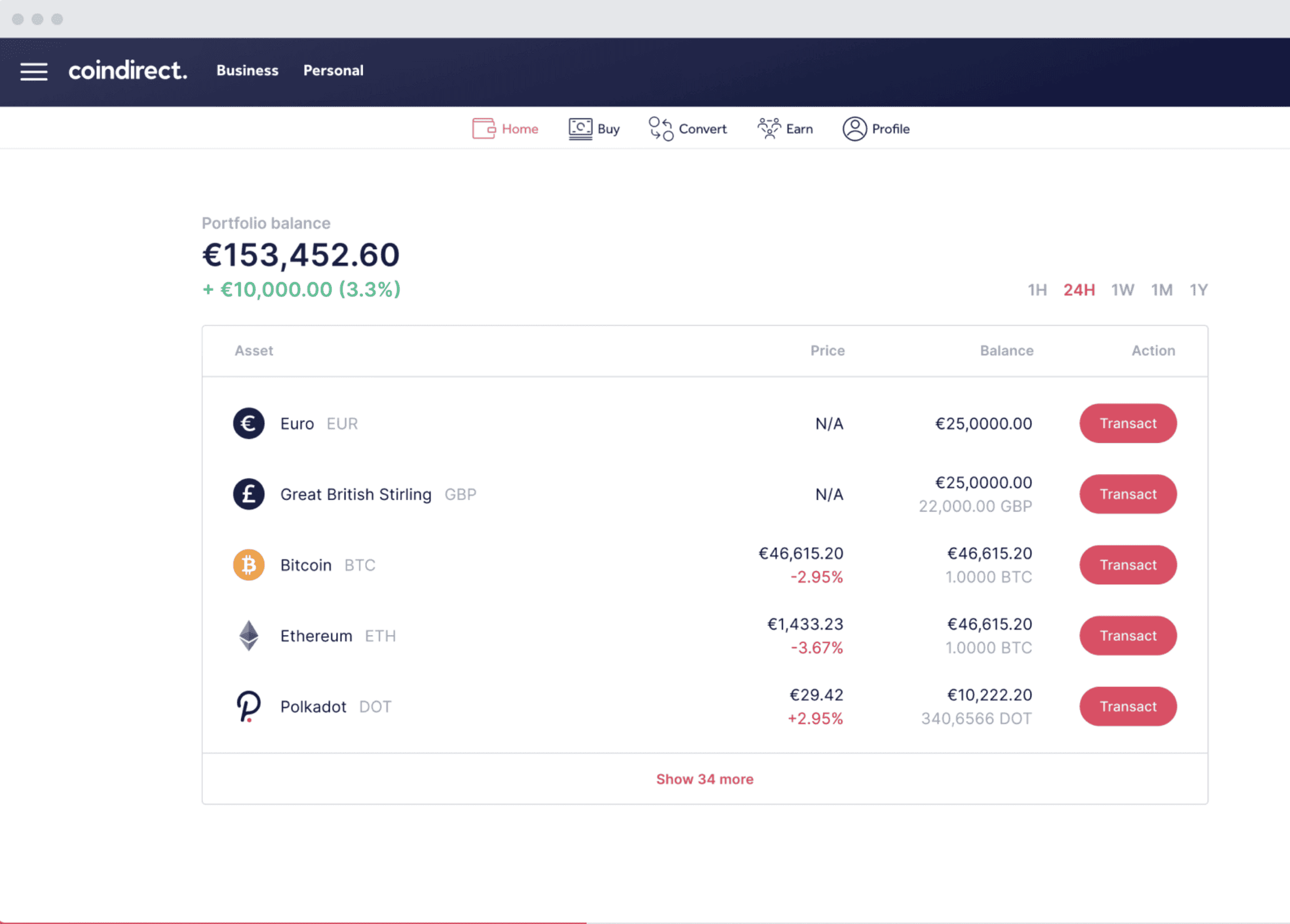

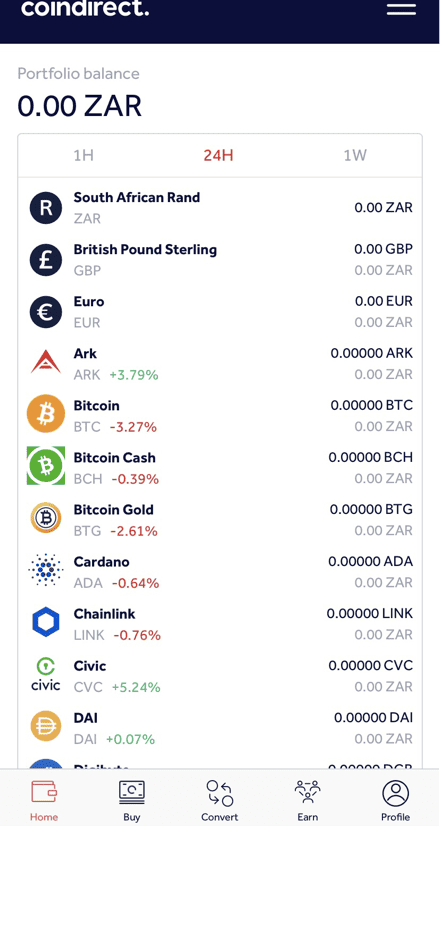

- Fiat support for ZAR, EUR, GBN, NGN, and more

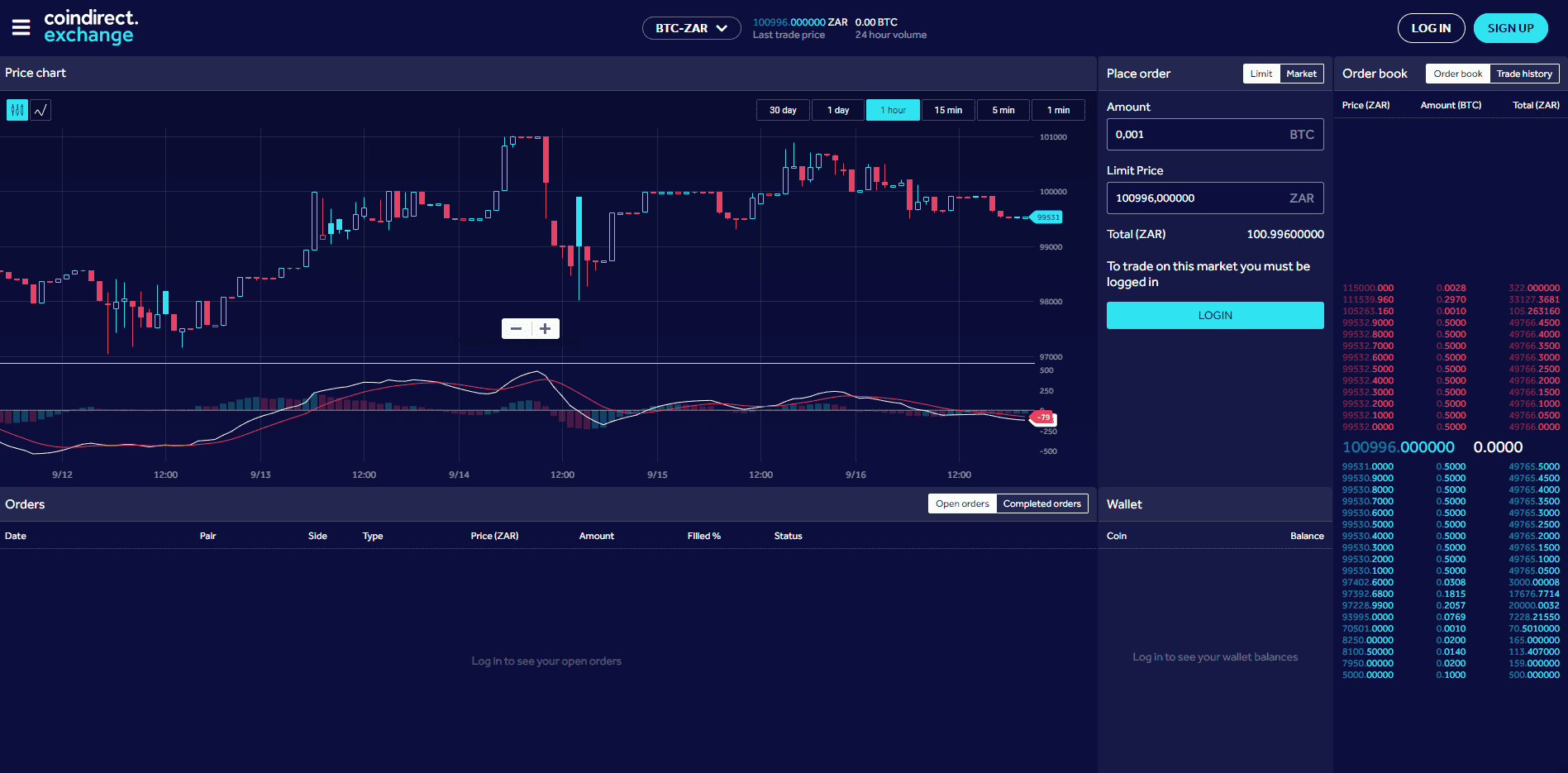

- Advanced charting

- Mobile and desktop friendly

- Advanced order types

- Business options

CONS

- Lack of crypto financial services

- No derivatives trading

- No USD fiat support

- US residents cannot use it

- No interest options

- Not listed on CoinGecko or CoinMarketCap

- Fees not publicly listed; only listed at time of transactions

- KYC required

Pros & Unique Features

The unique features of Coindirect are its peer-to-peer crypto marketplace services for users to transact with other users to buy and sell with escrow services available. The exchange offers transparent quoted fees before the transactions take place without additional hidden fees like some P2P marketplaces charge.

As far as its crypto offerings, the exchange does offer over 40 cryptocurrencies to trade as well as custodial services. Users can pay via bank transfer, SWIFT, Sepa, credit cards with 2.99% fees, or mobile money.

Another useful feature of Coindirect is that there is fiat support for ZAR, EUR, GBN, NGN, and other fiat currencies that are sometimes not supported amongst other top exchanges. Charting is integrated with TradingView and order books are present for more advanced traders to use. Coindirect also offers mobile apps for users to be able to trade and swap for both Android and iOS.

The exchange itself offers sufficient liquidity as reported on the website and uses an algorithm for advanced order execution. Users also receive virtual IBAN numbers for reconciliation. Private clients and businesses with concierge services can use OTC trading with insured custody as well.

Coindirect also offers white label exchange services for businesses and crypto exchanges with features including multi-currency wallets, institutional-grade security, and advanced trading tools.

As for customer support, Coindirect offers support via tickets and users can also access support via logging into the exchange. The CoinDirect team also maintains a blog with announcements. There also exists an extensive FAQ on their website which covers questions and materials about the exchange for users to learn.

Cons & Disadvantages

The main disadvantage of Coindirect is the lack of complicated derivatives trading products or even any crypto financial services beyond the P2P marketplace and exchange features.

Because of this, Coindirect is best suited to those looking for the support of key fiat currencies that are not supported elsewhere (such as ZAR), or specifically for a P2P escrow marketplace. Currently there is no USD fiat support.

Its host of crypto financial services are limited beyond its limited (40 or so) market offerings, and only spot trading is offered, with no margin or futures trading, and there is no feature for earning interest on holdings.

Another disadvantage is that because the exchange is not listed on CoinGecko or CoinMarketCap, two of the top cryptocurrency exchange review and aggregation sites for markets, it can be difficult to conclude the platform’s reputation and trustworthiness. There are some allegations on social media of Coindirect being possibly fraudulent or negative experiences on the exchange, so exercise caution.

Additionally, fees for transfers and swaps are not publicly listed unless one is attempting to engage in a transaction, at which point the quoted price will be shown, so there is no set fee schedule that is standardized as is the case across many other exchanges.

Lastly, Coindirect does require KYC requirements to be completed to use the exchange for all jurisdictions as per its KYC/AML policy, so this may be a con for those looking for a KYC-free service or exchange.

Coindirect Fees

Coindirect charges a variable quoted price for wallet and marketplace transactions that is not standardized in a fee structure but rather may shift based on the transaction in question.

Hence, its public fee structure does not provide much information besides for credit card transactions, which involve a flat 2.99% fee.

Additionally, unlike other exchanges, Coindirect does not offer any additional rebates for market makers, which means it is not the ideal exchange for very high volume traders who could otherwise receive net rebates or pay 0 fees at other top exchanges.

Trading fees are incurred when an order is filled by the exchange’s matching engine or P2P service. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

Other Fees

Coindirect charges the following deposit, withdrawal, and other fees:

-

No account creation or maintenance fee

-

No deposit fees for any digital asset or for fiat deposits

-

Withdrawal fees for digital assets range depending on the asset in question and are not publicly listed

-

Credit card fees of 2.99% per transaction

There are 5 EUR per month fees for having an inactive account, but users may hold assets as long as desired.

Account Tiers & Limits

All users of Coindirect are required to undergo the same KYC verification procedures as per its KYC/AML terms. Users who perform successful KYC can enjoy increased transaction limits which are not publicly noted.

There are currently no minimum or maximum limits on how much you can deposit into your Coindirect ZAR wallet, however note that certain deposits may be subject to risk reviews with possible limitations and restrictions imposed on further transactions.

If a user would like to deposit ZAR in order to purchase digital currency, be aware of the minimum order limits on the marketplace. Also, please keep in mind that certain deposit methods may have daily limits depending on where users are depositing from.

The requirements for documents for KYC can be noted here.

For KYC, users are required to submit their name, address, DOB, nationality, government-issued ID, and a valid photo holding said ID, in addition to a valid email address and a mobile phone number.

As far as account limits, since all accounts must undergo KYC, account limits are the same across accounts once KYC is done. The limits for accounts before KYC are not clear or may not be functionable at all, however it is noted that users without KYC cannot sell any coins.

Crypto Security

CoinDirect claims to use the same security precautions that regulated banks use. User funds are also protected with cold wallet features that block their access from internet networks.

User accounts are secured with 2-factor authentication which is a standard for the industry.

A security feature unique to CoinDirect is that user funds for transactions are held in escrow until the transaction takes place on the platform. Since CoinDirect also deals with third party sellers and buyers, there is a rating system of up to 5 stars that users can use as a way to vet buyers and sellers.

There have been no reported hacks of CoinDirect and users are encouraged as always to use 2-factor authentication, secure passwords, a new email, and always check links for possible phishing attempts, as always.

More security information from the CoinDirect team can be found here.

Coindirect Review Conclusion

CoinDirect is an okay to sub-par overall choice of exchange primarily meant for South African customers needing ZAR fiat support. It can also work okay for the purpose of a P2P marketplace with escrow services for added security.

While KYC is needed for any significant functions including selling any coins at all, and fees are not clear publicly but are allegedly quoted before engaging in transactions, Coindirect’s 40+ coins market offerings are not very competitive for its exchange product if compared to competitors, and there are no other crypto financial services products offered.

Users will not have any market maker rebates nor volume incentives, so the only viable use of this exchange is for the P2P marketplace or unique fiat support and rails.

- Cooindirect offers access to 40+ cryptos and quoted trading fees for its P2P marketplace, with the addition of escrow services and ZAR or other rare fiat support

- Intermediate to advanced traders trading margin or futures who desire access to advanced trading tools, volume-based fee tiers would prefer to pick a different exchange especially if desiring one not requiring KYC

Other Alternatives

For customers who desire access to a much more comprehensive crypto exchange that also offers a host of financial services such as staking and cashback cards, either Vauld, Crypto.com, Gemini, or Coinbase can make alternatives.

Some of these, like Binance, also offer a greater amount of cryptocurrencies to trade along and better reputation and security. Comparably, the security features of Coindirect and its reputation are not very clear.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users—Coinbase offers 402 pairs vs. Coindirect’s 40+ coins which is a clear 10X advantage—and offers an advanced desktop trading interface as well as a mobile app, but no futures or margin.

Active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and most exchanges on the market use maker-taker fee schedules that give volume incentives.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Coindirect include OkCoin, Kraken, OKX, and eToro.

Coindirect vs Coinbase

Coinbase is better for many core aspects of crypto trading and products offered if compared to Coindirect, as it is a full-fledged crypto exchange with financial services as well.

Coinbase has a wider range of services suited for both new users and advanced users with Coinbase Pro, while Coindirect focuses more on emerging markets (ZAR) with more limited coins and a nonexistent scope of financial services.

Coindirect and Coinbase both offer only spot trading. Coindirect offers unclear fees, so at least Coinbase’s fee structure for spot trading is clearly laid out, albeit on the higher end for exchanges.

Coinbase also offers much more of a selection of trading pairs compared to that offered at Coindirect, with 440 trading pairs, compared to 40 coins at Coindirect, as well as advanced charting, accessible order books, and advanced order types.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Coindirect is not.

Advanced users who desire both competitive fees and a greater selection of trading products than what either Coindirect or Coinbase offer may find the choices below equally valuable.

Coindirect vs FTX

FTX will win against Coindirect for all intermediate or advanced traders, as FTX offers 323 coins and 492 trading pairs, which is far higher than Coindirect’s 40 spot coins and lack of any futures pairs or other strong product offerings. Plus, FTX offers access to more fiat rails than Coindirect’s ZAR-heavy offering.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since Coindirect’s offerings here are nonexistent. Meanwhile, FTX offers a max of 20X leverage.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, and traders can use third party bots at FTX as well, while Coindirect does offer charting at a basic level, but the exchange performance and reliability cannot be compared to that of FTX.

FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed. Neither exchange can be officially used by US persons and both require KYC.

International users who can use FTX International may prefer FTX. US users trading at FTX US need to do KYC procedures and would prefer it over Coindirect by far as well. Fees will be far more competitive at FTX as a trader’s volume is higher and the fee structure is transparent and clear, since FTX offers both fee incentives for volume and for holders of its FTT token.

Coindirect vs Gemini

Gemini is focused on its holistic crypto financial services for Americans, while Coindirect serves emerging countries with fiat rails (like South Africa) and is not regulated officially, unlike the Gemini brand.

Coindirect has no clear fee schedule, so unlike many other comparison, Gemini has the clear edge here for those who desire transparency. Despite this, the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, which is quite high.

There is also a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, while Coindirect charges unclear variable trading fees for both makers and takers, and does not seem to offer rebates or volume incentives at all.

US investors and traders are allowed to use Gemini with KYC verification only, since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products. Coindirect offers only spot offerings as well, does not allow US investors, and also requires full KYC to sell coins, but not to buy them.

Gemini offers 62 coins and 86 trading pairs which is a bit larger than the amount offered by Coindirect. Another difference is in Gemini’s presence of crypto financial services offerings, which Coindirect lacks.

Coindirect vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while Coindirect offers none. US users will prefer Kraken for its regulatory compliance and strong track record if they are traders especially.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is undoubtedly more competitive than Coindirect’s unclear fee schedule. Market makers enjoy reduced fees however at Kraken and fees also reduce with volume, which is not the case at Coindirect as far as volume tiers go.

Kraken offers a greater variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer Kraken over Coindirect.

If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may prefer other exchanges such as OKX, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while worldwide users can use Coindirect with KYC, but US users cannot.

Coindirect vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Coindirect—over 351 coins and over 1300 pairs.

The two exchange’s offerings are varied in their scope, with Coindirect being an exchange catering primarily to emerging markets like South Africa and ZAR fiat support, while Binance is focused on being a global leader and fast innovator in every crypto product with a notable brand name behind it.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs not found anywhere else besides potentially OKX or FTX.

Binance’s maker-taker fee schedule is unique in its competitiveness compared to that of other exchanges, starting at 0.1% which is the likely more competitive than the unclear and un-transparent fee schedule at Coindirect, plus Binance also offers further 25% reduction in fees if paid in BNB, alongside offering reduced fee tiers for higher volume and even maker rebates. Binance wins in the fee department easily due to its incentives and reductions.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Coindirect.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is still more than those of Coindirect, plus Binance US has a better reputation.

Binance requires full KYC now to trade even spot products, and Coindirect requires full KYC as well to sell coins, but not to buy them. Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is Coindirect Safe?

It is unclear how safe and trustworthy Coindirect truly is and all users should exercise caution with the custody of their funds with other counter-parties.

CoinDirect claims to use the same security precautions that regulated banks use. User funds are also protected with cold wallet features that block their access from internet networks.

User accounts are secured with 2-factor authentication which is a standard for the industry.

A security feature unique to CoinDirect is that user funds for transactions are held in escrow until the transaction takes place on the platform. Since CoinDirect also deals with third party sellers and buyers, there is a rating system of up to 5 stars that users can use as a way to vet buyers and sellers.

There have been no reported hacks of CoinDirect and users are encouraged as always to use 2-factor authentication, secure passwords, a new email, and always check links for possible phishing attempts, as always.

More security information from the CoinDirect team can be found here.

How long does Coindirect Withdrawal take?

All crypto transactions at Coindirect are alleged to be instant but fiat withdrawals are noted to be able to take up to 5 business days for bank transfers to complete.

Users should still note that crypto transactions on average can take from 30 minutes to several hours for a transaction to be confirmed due to the blockchain. Once on the blockchain, the transaction needs a number of network confirmations before it’s completed.

Is Coindirect a good exchange?

CoinDirect is an ok to sub-par overall choice of exchange primarily meant for South African customers needing ZAR fiat support. It can also work ok for the purpose of a P2P marketplace with escrow services for added security.

While KYC is needed for any significant functions including selling any coins at all, and fees are not clear publicly but are allegedly quoted before engaging in transactions, Coindirect’s 40+ coins market offerings are not very competitive for its exchange product if compared to competitors, and there are no other crypto financial services products offered.

Users will not have any market maker rebates nor volume incentives, so the only viable use of this exchange is for the P2P marketplace or unique fiat support and rails.

Where is Coindirect located?

CoinDirect is located in London, UK and has offices in South Africa.

Does Coindirect require KYC?

Not entirely, but users who perform successful KYC can enjoy increased transaction limits and selling functionality. Coindirect does require KYC to effectively use its P2P marketplace in this case.

What are the Deposit and Withdrawal Methods and Fees for Coindirect?

Coindirect offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto assets: deposits and withdrawals—no deposit fees (free). Withdrawal fees depend on the asset (and blockchain network) in question and are dynamic and not listed.

- Only ZAR, EUR, and GBP fiat deposits and withdrawals seem to be supported at this time, but support for more fiat rails is coming (no USD)

- Users may purchase crypto with a credit or debit card with a 2.99% fee

What is the Minimum Withdraw Amount for Coindirect?

The minimum withdrawal amount for crypto assets at Coindirect is listed for each asset is nonexistent. Crypto assets and fiat have no minimum withdrawal amount.

How do you withdraw from Coindirect?

Users can withdraw from the wallet by navigating to the “Profile (name)” section of their account page, then clicking the “Manage Bank Accounts” section for which the user wishes to withdraw.

From there, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed, or add or pick the correct bank account for a fiat withdrawal. The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal. The 2FA code is also required for security if this feature is turned on by the user.

The transaction will show in the blockchain network in question and process therein.

There are instructions from support for withdrawal here.

Is Coindirect a wallet?

No, Coindirect is a cryptocurrency trading exchange and P2P marketplace that also offers a custodial wallet for trading services, but is not a non-custodial standalone wallet.

How to use Coindirect?

Using coindirect can be done by going to https://www.coindirect.com/signup, clicking the “Get Started” button on the top, creating an account on the platform, first undergoing KYC verification procedures, waiting for verification to complete, and then depositing any crypto asset trading funds into the account (or ZAR, EUR, or GBP fiat which is the only accepted fiat at this time) and then getting access to the market offerings and begin trading.

User Reviews

-

Users on Reddit discuss Coindirect’s inactive account fee: “What kind of “maintenance” does an inactive account need? It’s just an entry in a database.” And another, “Does anyone have info on how to close a coindirect account? I’ve been trying to find it from the dashboard and also contacted coindirect but cant figure it out.”

-

Users on Reddit discuss their experience buying altcoins on Coindirect. OP says: “I checked out the site you can buy 25 different cryptocurrencies but when you want to sell a cryptocurrency you have to convert it to the equivalent bitcoins.” u/twoheadedheaded responds, “I’ve never used it, I’ve heard several horror stories but they could be unfounded”

-

Users discuss their frustrations on Reddit about Coindirect. “The only reason to use it over Coinbase is Doge.”

-

There are a mix of positive but mostly negative reviews on Trustpilot for Coindirect. It rates 3.6/5 stars with over 450 reviews, but 40% of reviews are 5 stars and 40% are 1 star.