![]()

MEXC (previously MXC) is a Seychelles-based cryptocurrency exchange launched in 2018, today serving over 6M+ users. MEXC sees around $1B trade volume every day.

The exchange requires KYC (Know Your Customer) identity verification to be completed for use of the exchange. US users may not use the exchange as per TOS.

History of MEXC

MEXC was founded in 2018 and today is present across continents obtaining key licenses and passing jurisdictions in countries such as Canada, Australia, Estonia, and the USA.

The exchange offers a high-performance trading engine that was developed by experts from the traditional banking industry. The trading engine is capable of completing 1.4M transactions per second, resulting in ground-breaking efficiency and enhanced performance.

The CEO is John Chen, and he has created a number of disruptive technologies in the med-tech industry prior to running a crypto exchange. In 2020, MEXC obtained an MSB license in the US, as regulated by FinCEN.

MEXC is best for:

- All types of cryptocurrency spot investors and traders who desire access to an all-around full-featured exchange with spot and margin crypto instruments and a high-performance trading engine and good liquidity.

- Traders and investors who desire a variable, volume-based fee schedule that is extremely competitive in its rates, alongside access to the entire suite of services MEXC offers, such as Launchpad, Kickstarter, MX-DeFi, institutional services, and more.

PROS

- Earn yield

- Huge coin and trading pair selection

- Spot, margin, and ETF markets

- 3x long and short positions

- Futures trading

- Native token for fee reductions, voting, lottery, and more

- Advanced charting and trading tools

- Good liquidity

- Launchpad for new project tokens and airdrops

- Liquidity mining and staking

- Mobile and desktop friendly

CONS

- Complex due to its wide range of offerings

- No partnerships so smaller liquidity than competitors

- Founding team and execs not overly interactive

- Flat fee schedule

Pros & Unique Features

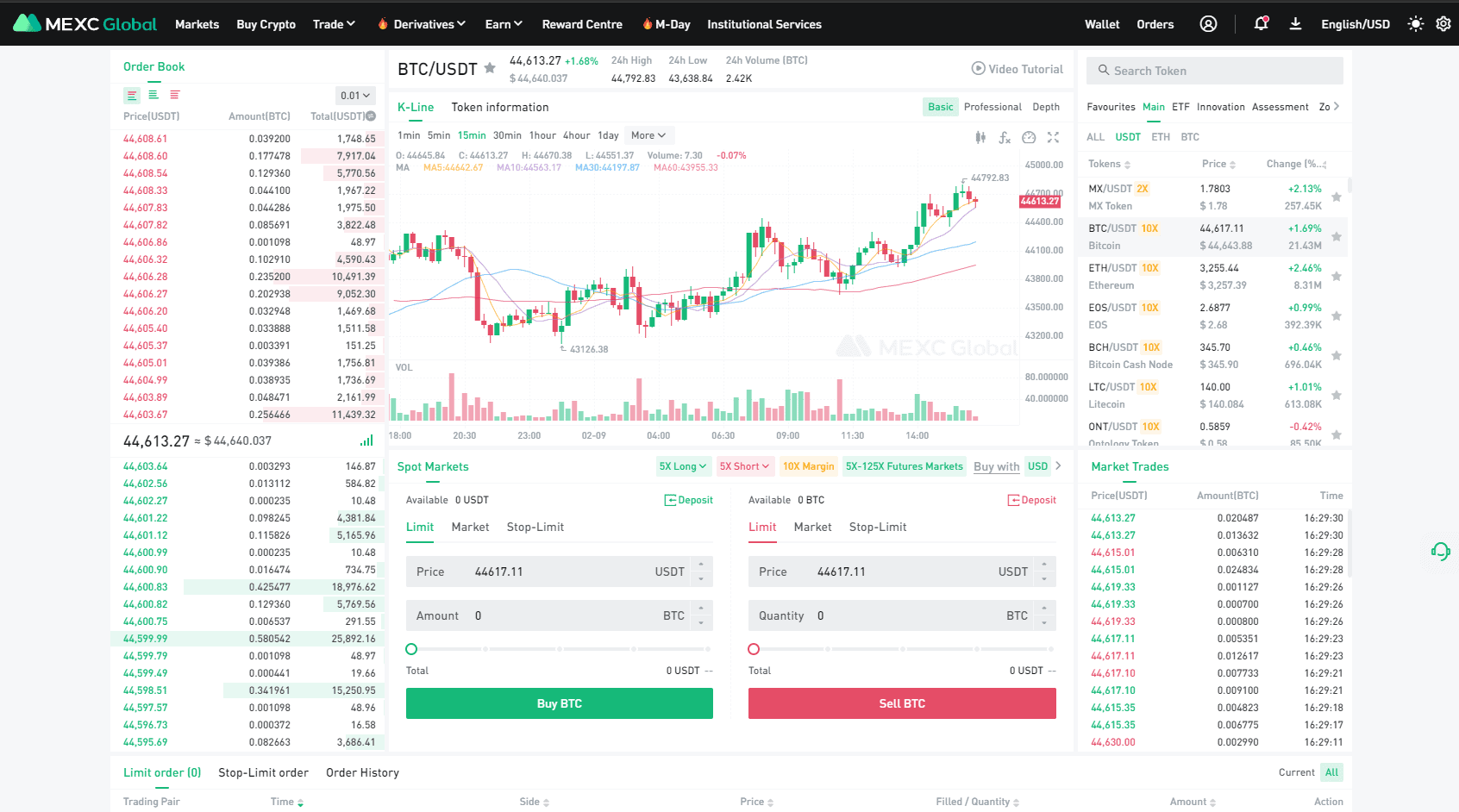

MEXC offers a lot of unique trading products as well as crypto financial services to earn yields and more. In terms of trading products, the exchange’s market offers 1106 coins and 1598 trading pairs alone, which is far more than most other centralized exchanges.

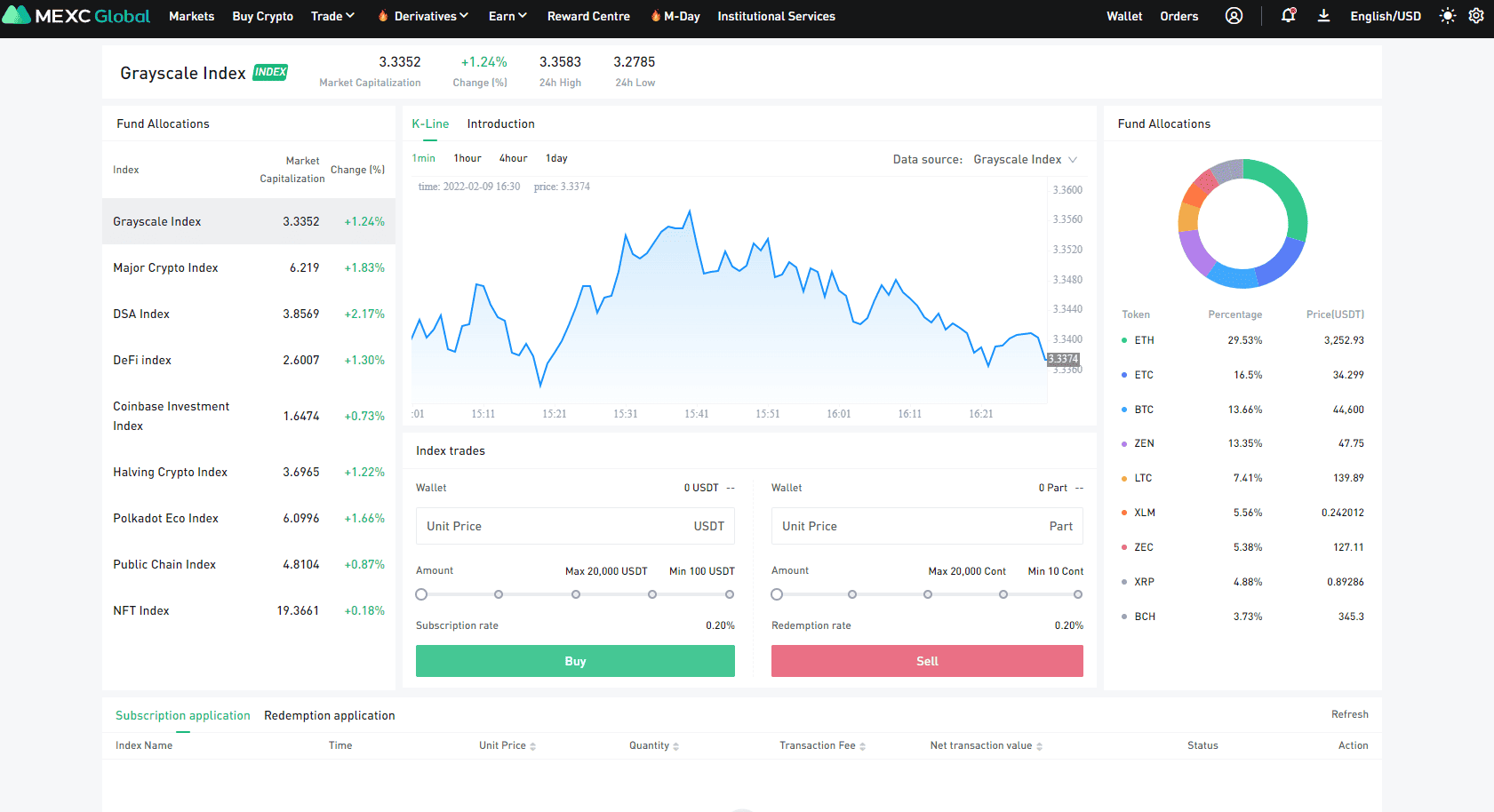

These offerings range from spot products, margin, ETF markets (similar to those at Binance and FTX) that allows users to take 3X long and short positions on various coins with a single product, and a large variety of futures trading markets as well, with both USDT-margined and coin-margined options with up to 125X leverage max, which is higher than offered at many other exchanges.

The exchange’s native token MX plays a role in fee reductions for trading fees, in project voting and renewal, new lottery bonuses, and more. As for trading functionality, there are platforms available on the exchange with advanced charting and trading tools with advanced execution functionality.

The exchange also has a high speed trading engine and good liquidity for investors and traders, and with several other features for users to be able to earn crypto on their holdings or otherwise participate in the ecosystem.

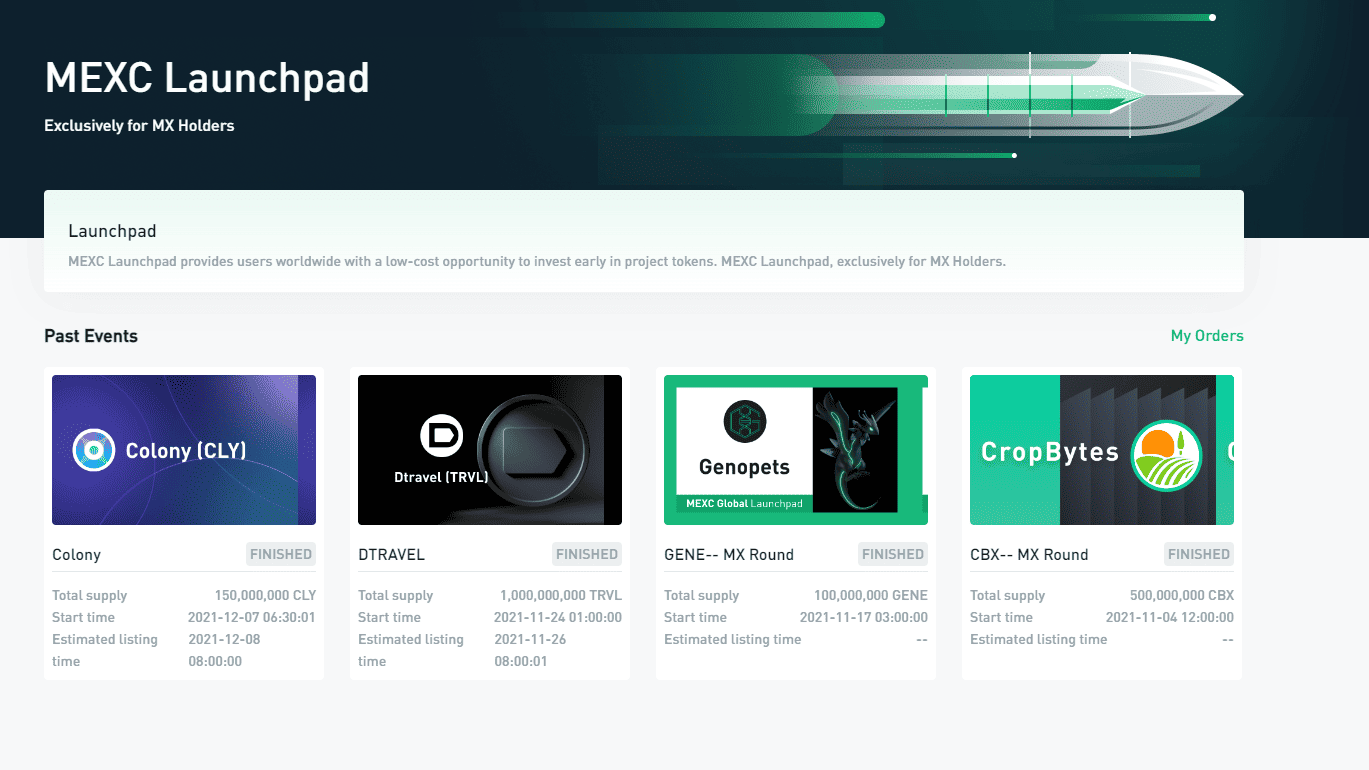

Some of these features include MEXC Launchpad, which provides users worldwide with a low-cost opportunity to invest early in project tokens. Another product is called Kickstarter, which is an event done during the pre-launch stage of a project in which the project initiates voting for the launch on MEXC, and then airdrops its tokens for free to all successful voting users. This is designed to attract premium projects to list on MEXC and also to provide free airdrops to reward MEXC users.

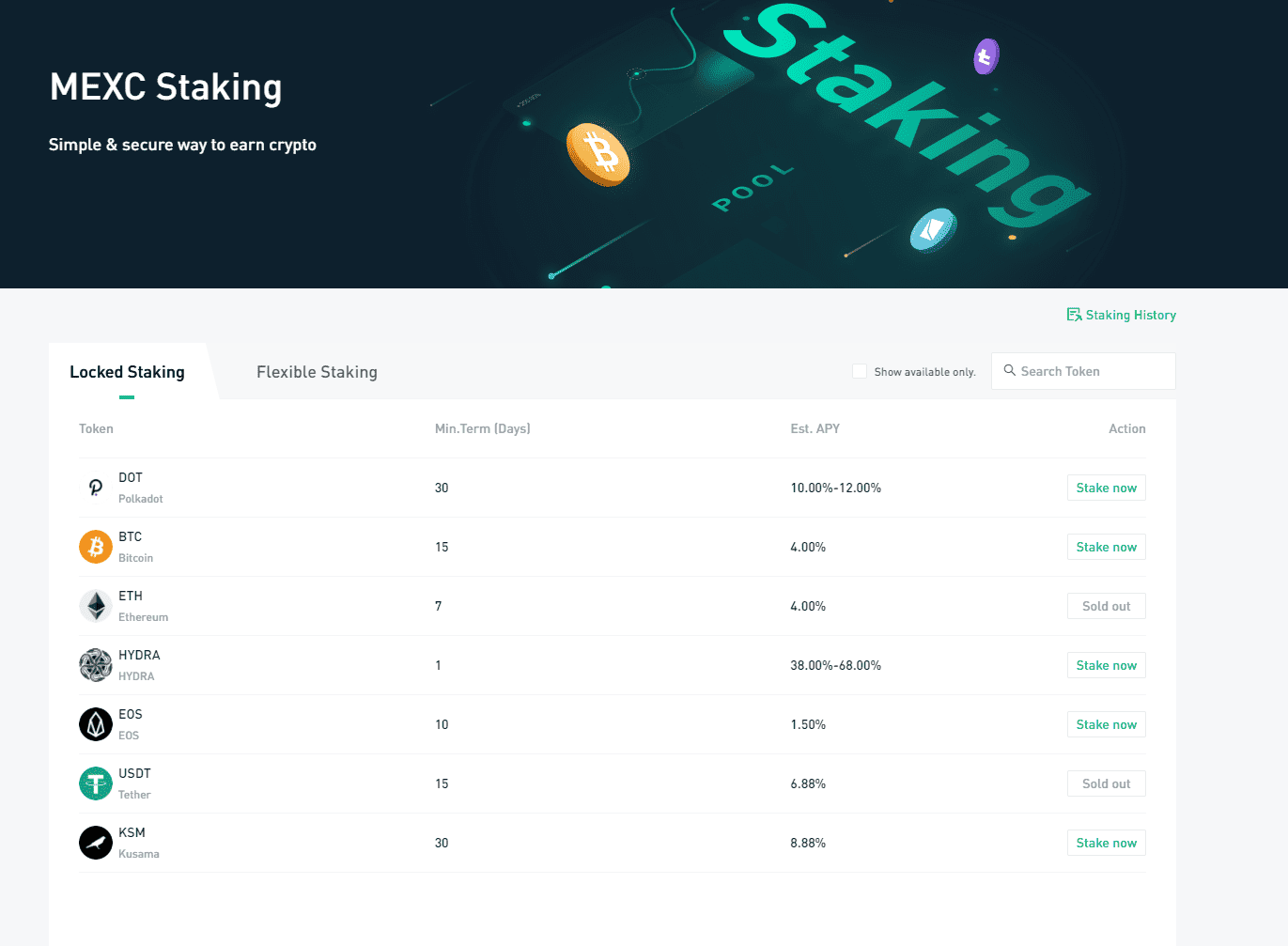

A DeFi product called MX DeFi allows users to conduct liquidity mining and earn rewards from mining and staking tokens. There are additional DeFi and earning products offered, among them are access to DOT & KSM slot auctions, MEXC Staking, and ETH 2.0 staking services.

MEXC also offers a chance for new users to learn about the exchange and complete assigned tasks to receive free bonuses for futures trading via missions.

Market makers and institutional parties also received preferred and exclusive service at MEXC.

Lastly, the exchange offers a full-featured mobile app for both iPhone and Android with trading functionality as well.

As for customer support, MEXC offers a support service centers customers can access via logging in and submitting a request.

Cons & Disadvantages

The main disadvantages of MEXC are its huge range of crypto trading pairs and products that may make it too complex or confusing to use for newer entrants to the crypto markets.

The exchange also lacks major partnerships and liquidity as compared to the leaders in the space such as Binance, FTX, and others, despite offering more spot and margin trading products. Its founding team and executives are also not as public and interactive as that of these other top exchanges.

Another disadvantage is in regards to MEXC’s fee schedule. While the fee schedule is simple and easy to understand as it is a flat 0.20% for both makers and takers, it lacks the benefits of reduced fees, rebates, or preferable rates for liquidity providers (market makers). It also makes no provisions for volume-based tiers which is standard as major exchanges, so traders with higher volume are not rewarded, in contrast to the fee schedule at exchanges like Binance or FTX.

This makes the exchange functionality suited more to more curious and risk-driven crypto investors who are seeking obscure coins that are harder to find on these major exchanges such as Binance. However, MEXC does fill a gap in the market as it still does not require full KYC to use the exchange and even offers products similar to leveraged tokens (ETF’s) and a large variety of futures pairs to trade.

MEXC Fees

MEXC uses a flat fee model with the same fees for both market makers and market takers.

This fee is set at 0.20% for market makers and 0.20% for market takers for spot instruments.

The fees for trading leveraged crypto ETFs also incur the same 0.20% trading fees, in addition to a dynamic management fee based on the movement of the crypto market.

The fees for futures trading are tiered based on the futures account balance in USDT or the futures trading volume in the trailing 30-day period (in USDT). Discounts for fees range from 5-30%, as seen in the table below.

| Level | Futures Account Balance (USDT) | Futures Trading Volume in 30-day Period (USDT) | Discount |

|---|---|---|---|

| Lv 1 | ≥ 10,000 OR | ≥ 10M | 5% |

| Lv 2 | ≥ 20,000 OR | ≥ 20M | 10% |

| Lv 3 | ≥ 50,000 OR | ≥ 50M | 15% |

| Lv 4 | ≥ 100,000 OR | ≥ 100M | 20% |

| Lv 5 | ≥ 200,000 OR | ≥ 200M | 25% |

| Lv 6 | ≥ 500,000 OR | ≥ 500M | 30% |

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

Other Fees

MEXC charges the following deposit, withdrawal, and other fees:

- No account creation or maintenance fee

- No deposit fees

- Withdrawal fees depend on the asset in question and are dynamically calculated based on the network demand and traffic. The fee list can be found here.

There are no fees for signing up or for having an inactive exchange account, nor any fees for holding funds in an exchange account, and users may hold assets as long as desired.

Account Tiers & Limits

MEXC does not require KYC identity verification to access trading, however completing KYC allows users to access additional assets and other privileges.

MEXC offers three levels of account tiers: Unverified (no KYC), Primary KYC, and Verified Plus.

Accounts that are unverified may deposit crypto assets and trade spot and derivatives products, as well as withdraw 10 BTC per 24 hour period.

Accounts at the Primary KYC verification level require personal information and can increase their 24-hour withdrawal limit up to 40 BTC.

Accounts at the Verified Plus level require facial recognition in addition to personal information and can increase their 24-hour withdrawal limit up to 100 BTC.

KYC information and requirements can be noted here.

Crypto Security

MEXC allows users to add 2-factor authentication methods via Google Authenticator, as well as set anti-phishing codes, mobile verification, and more.

As far as the exchange itself, MEXC uses a multi-tier, multi-cluster system with security protection functions. MEXC has never been the target of a large-scale public hack.

MEXC Review Conclusion

MEXC is a great choice of exchange for those seeking access to a large amount of crypto spot and margin trading products, with access to 1100+ coins and 1590+ trading pairs and 125X max leverage, without the requirement of KYC.

In addition, MEXC offers unique margin products and ETF markets as well as a large variety of futures markets with both USDT-margined and coin-margined options. The main drawback of MEXC is its lack of volume-tiered fee schedule, as both market-makers and market-takers pay 0.20% fees regardless of volume, which is disadvantageous to traders who trade high volume as well as to those providing market liquidity.

In addition, MEXC may be too broad and complicated in its offerings for users that are newer to cryptocurrencies, and it also lacks regulatory clarity and clarity in its security precautions as compared to top US-compliant and international exchanges such as Binance and FTX.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors equally valuable, and US users looking for a simple exchange may prefer other options.

- MEXC offers access to 1100+ coins and 1500+ trading pairs, spot and derivatives trading with access to 125X max leverage and unique instruments such as ETFs

- Intermediate to advanced traders trading margin or futures who desire access to advanced trading tools and charting without any KYC requirements, as well as high withdrawal limits without KYC may find MEXC to be a great exchange

Other Alternatives

For customers who desire access to a simpler user interface with far more trading pairs, or those who do not desire to participate in cryptocurrency futures trading either WhiteBIT, OKX, Coinbase, and Voyager can make great alternatives, albeit with a smaller amount of cryptocurrencies offered to trade, though with more competitive trading fees and functionality than what MEXC offers.

In addition, the 125X max leverage offered at MEXC exceeds that seen elsewhere on the market in the present day and may be unnecessary for most participants. Binance and FTX now offer max 20X leverage.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users, though it has a much smaller selection of cryptocurrencies offered compared to MEXC—402 pairs vs. MEXC’s 1000+ coins—while active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ, but they all use volume-tiered fee schedules unlike MEXC, so high volume traders and market makers may prefer other exchanges.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to MEXC include Bittrex, Upbit, and Kraken.

MEXC vs Coinbase

Coinbase is better in some aspects of functionality and regulatory approval compared to MEXC.

Coinbase offers no margin trading, but MEXC does and offers up to 125X leverage, a win for MEXC. Though Coinbase does not offer as many complicated trading instruments as MEXC, it still has a wide selection for most traders and investors.

Coinbase may win in the fee department however, as it offers market maker rebates and volume tiers, though its base tier starts at more than double the fee as compared to MEXC’s 0.20% flat rate.

An advantage for high volume traders will be the volume-tiered fees at Coinbase if they can cross 100K in 30-day volume, which puts maker fees at only 0.10%, since MEXC does not differentiate between liquidity providers and liquidity takers.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while MEXC has an MSB license in the US.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either MEXC or Coinbase offer may find the choices below equally valuable.

MEXC vs FTX

FTX may win against MEXC for some traders, even though FTX offers 323 coins and 492 trading pairs, which is far lower than MEXC’s offerings.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will find both MEXC and FTX quite competitive, as both offer innovative trading products, though those of FTX are more highly regarded.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while MEXC proclaims to also have a high-performance trading engine. FTX is widely known for catering to active derivatives traders and optimizing for high order volume and trading execution speed.

FTX cannot be used by US persons and neither can MEXC officially, though FTX offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection.

US users trading at FTX US need to do KYC procedures, but US users could unofficially use MEXC without undergoing KYC, but there is a risk. Fees are much more competitive at FTX, since FTX offers both fee incentives for volume and for holders of its FTT token.

MEXC vs Gemini

MEXC and Gemini are two exchanges with very different offerings fundamentally.

First, the difference in fees: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, while MEXC offers a very simple flat fee schedule for all traders at 0.20%, regardless of maker-taker or volume.

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, and MEXC cannot officially be used by US users, but KYC is not required.

Gemini offers only 62 coins and 86 trading pairs which is much smaller as compared to that of MEXC’s 1000+ coins and 1500+ trading pairs. Both exchanges offer some crypto financial services such as staking, though those of MEXC are more complex than those of Gemini.

MEXC vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, though MEXC offers up to 125X leverage, but not for US users, though KYC is not required.

Simply put, US users may prefer Kraken for its regulatory compliance and strong track record as an exchange, as compared to MEXC.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is slightly more competitive even at the entry volume tier level than MEXC’s flat 0.20% fee structure which does not give incentives.

Market makers enjoy reduced fees however at Kraken whereas at MEXC they pay the same fee rates as market takers.

Kraken offers a much smaller variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin may prefer MEXC for obscure coins.

If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may also prefer other exchanges such as Bybit or OKX, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins in terms of a great, stable exchange with clear security procedures, which MEXC lacks.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while MEXC is not.

MEXC vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a competitive selection of cryptocurrencies but not as wide as that of MEXC—over 351 coins and over 1300 pairs for Binance.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only may enjoy both MEXC and Bunance, as they both offer many USDT futures pairs and coin-margined pairs.

Binance’s maker-taker fee schedule is better in its competitiveness compared to that of MEXC, starting at 0.1% which is half of that of MEXC’s flat fee rate, however Binance also offers further 25% reduction in fees if paid in BNB, so this is a win for Binance, alongside its offering of reduced fee tiers for higher volume and even maker rebates.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to MEXC. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is not at all comparable to MEXC, but it is US-compliant and regulated.

Binance requires full KYC now to trade even spot products, and MEXC requires no KYC and offers large withdrawal limits.

Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products can enjoy both exchange options, but may go with Binance if regulatory stability and reputation is a concern.

FAQ – Frequently Asked Questions

Is MEXC Safe?

It is hard and unclear to find any information about security precautions that MEXC takes as described on their public site or from support. However, MEXC allows users to add 2-factor authentication methods via Google Authenticator, as well as set anti-phishing codes, mobile verification, and more.

As far as the exchange itself, MEXC uses a multi-tier, multi-cluster system with security protection functions. MEXC has never yet been the target of a large-scale public hack.

Compared to other more established exchanges such as Binance or FTX, MEXC is not quite at the same level of safety, but if the user uses 2-FA and avoids phishing risks, his or her funds may remain relatively safe, but precaution should be used.

How long does MEXC Withdrawal take?

For crypto withdrawals, on average, it takes from 30 minutes to several hours for a transaction to be confirmed.

Please note that for crypto, the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

After processing fiat withdrawals, the usual timeframe for ACH withdrawals to reach the user’s bank is 2-4 business days, excluding weekends and holidays.

Is MEXC a good exchange?

MEXC is a great choice of exchange for those seeking access to a large amount of crypto spot and margin trading products, with access to 1100+ coins and 1590+ trading pairs and 125X max leverage, without the requirement of KYC.

In addition, MEXC offers unique margin products and ETF markets as well as a large variety of futures markets with both USDT-margined and coin-margined options.

The main drawback of MEXC is its lack of volume-tiered fee schedule, as both market-makers and market-takers pay 0.20% fees regardless of volume, which is disadvantageous to traders who trade high volume as well as to those providing market liquidity.

In addition, MEXC may be too broad and complicated in its offerings for users that are newer to cryptocurrencies, and it also lacks regulatory clarity and clarity in its security precautions as compared to top US-compliant and international exchanges such as Binance and FTX.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors equally valuable, and US users looking for a simple exchange may prefer other options.

Where is MEXC located?

MEXC is located in Seychelles, with headquarters in Mahé.

Does MEXC require KYC?

No, MEXC does NOT require KYC identity verification to access trading, however completing KYC allows users to access additional assets and other privileges.

MEXC offers three levels of account tiers: Unverified (no KYC), Primary KYC, and Verified Plus.

Accounts that are unverified may deposit crypto assets and trade spot and derivatives products, as well as withdraw 10 BTC per 24 hour period.

Accounts at the Primary KYC verification level require personal information and can increase their 24-hour withdrawal limit up to 40 BTC.

Accounts at the Verified Plus level require facial recognition in addition to personal information and can increase their 24-hour withdrawal limit up to 100 BTC.

KYC information and requirements can be noted here.

What are the Deposit and Withdrawal Methods and Fees for MEXC?

MEXC offers the following deposit and withdrawal methods, with the corresponding fees:

- All crypto asset and fiat deposits are free, credit card deposits using third-party payment processors may be charged a variable fee depending on the processor

- Crypto asset withdrawal fees change dynamically based on the network activity. The average withdrawal fee for BTC is 0.0005 BTC, and that for USDT is 1 USDT on TRC-20 network.

What is the Minimum Withdraw Amount for MEXC?

The minimum withdrawal amount for USDT is 5 USDT. The minimum withdrawal amount for crypto assets is 0.001 BTC for BTC. For other crypto assets, it ranges based on the crypto and can be noted in the withdrawal area in the user’s wallet.

How do you withdraw from MEXC?

Instructions for withdrawing from users accounts can be found here from official support.

Users can withdraw from the wallet by navigating to the “Assets” page, selecting their virtual currency, and then selecting the “Withdrawal” button.

From there, the user should select the destination address to which he or she wishes to withdraw or click “register an external address,” go to the user’s email inbox to verify.

Then, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal.

Is MEXC a wallet?

No, MEXC is a cryptocurrency trading exchange, but offers users a custodial exchange and futures trading wallet as part of its exchange services.

How to use MEXC?

Using MEXC can be done by going to mexc.com, creating an account on the platform, undergoing KYC verification procedures if desired (NOT required), and then depositing any trading funds into the account (either crypto assets or fiat) and then getting access to the market offerings and begin trading.

User Reviews

- A user on Reddit notes that their MEXC withdrawal was “”Under Review” for 48H+.” A responder states that there are four statuses, “The status always goes through something like “Under Review” – “Packaged (?)” – “Pending” – “Block confirmations”; You can cancel your transactions in the first two stages,” and that “If accumulated withdrawl (sic) is high enough even though the transfer amount is below your daily non-KYC limit, the transaction is going to be stuck in “Under Review”.”

- Another user on Reddit notes his funds at MEXC were frozen for review: “3 days ago the withdrawals of my tiny funds were stopped and put under review, no matter what coin I tried.” It seems they wanted advanced KYC in order to release the funds.

- When a user asked on Solana’s subreddit if MEXC was a scam or legit, and most people say they are legit, though one notes that “MXC (the name before rebranding) was on an investor alert list from Singapore.”

- A user on the Yieldly subreddit asked if MEXC was a good exchange to purchase the token on, and how the setup was. Almost all the commenters said it worked well and they only supplied their email and phone number.