Bybit is a Singapore-based cryptocurrency exchange launched in 2018 that specializes in derivatives trading and has recently expanded into the spot cryptocurrency markets. ByBit currently has more than 3M registered users.

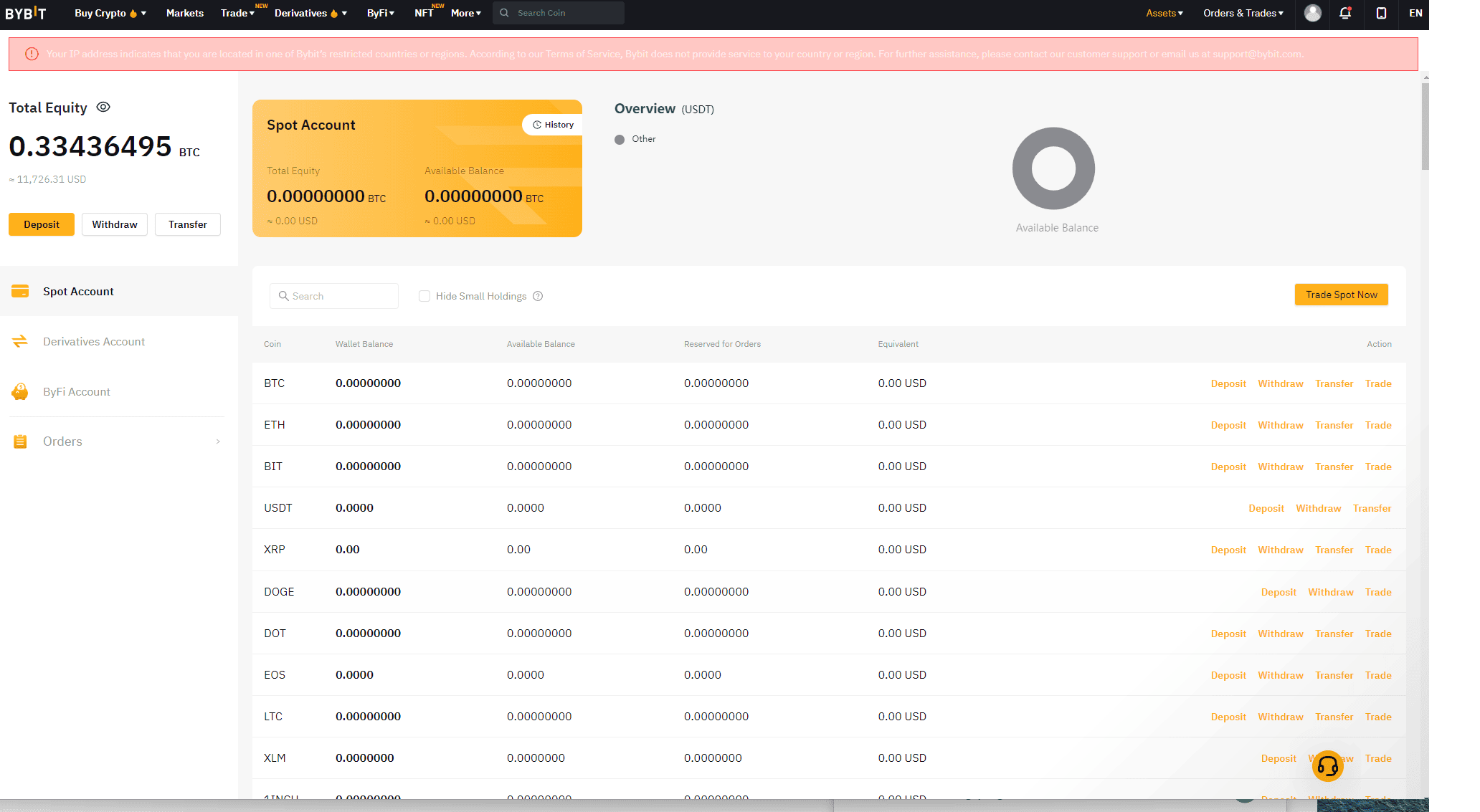

Note that ByBit is a global exchange and US residents are not allowed to use it. KYC (Know Your Customer) identity verification protocols are optional at ByBit, and recommended for increased security.

History of Bybit

The ByBit founding team consists of professionals from the FX and investment banking industries, as well as early blockchain adopters and industry enthusiasts. Today, Bybit boasts over 3M registered users around the world.

Bybit’s CEO is Ben Zhou who is known for making himself available on Twitter to interact with the cryptocurrency community.

Bybit’s mission is to provide a professional and innovative online trading, mining, and staking experience for retail and institutional clients around the world. The company is known for adding popular coins to its offerings and as a primary futures trading exchange for retail marketing participants even before its offerings grew extensive, having added an entire 120+ coins spot market that started in 2021 itself.

Bybit is best for:

- Beginner to advanced cryptocurrency traders and investors who desire access to both spot trading instruments and derivatives contracts without required KYC, with a core offering of major and newer (trending or hot) coins and futures pairs, a high-performance trading engine, secure custody, and strong support presence

- Crypto-only traders (no stocks offered) who wish to obtain access to the entire Bybit suite of products—such as Learn, dual asset mining, flexible staking, launchpool, Launchpad, and more

- Active traders who desire a competitive, flat fee schedule not based on volume-tiered pricing and the ability to earn market maker rebates for trading futures at any volume level

PROS

- Many spot trading pairs

- Built for futures and derivatives trading

- Fast to adapt new coins/tokens

- Little KYC

- Up to 100x max leverage

- Mobile and desktop-friendly

- Advanced charting functions

- Flat fee schedule max 0.10%

- 100k transactions per second

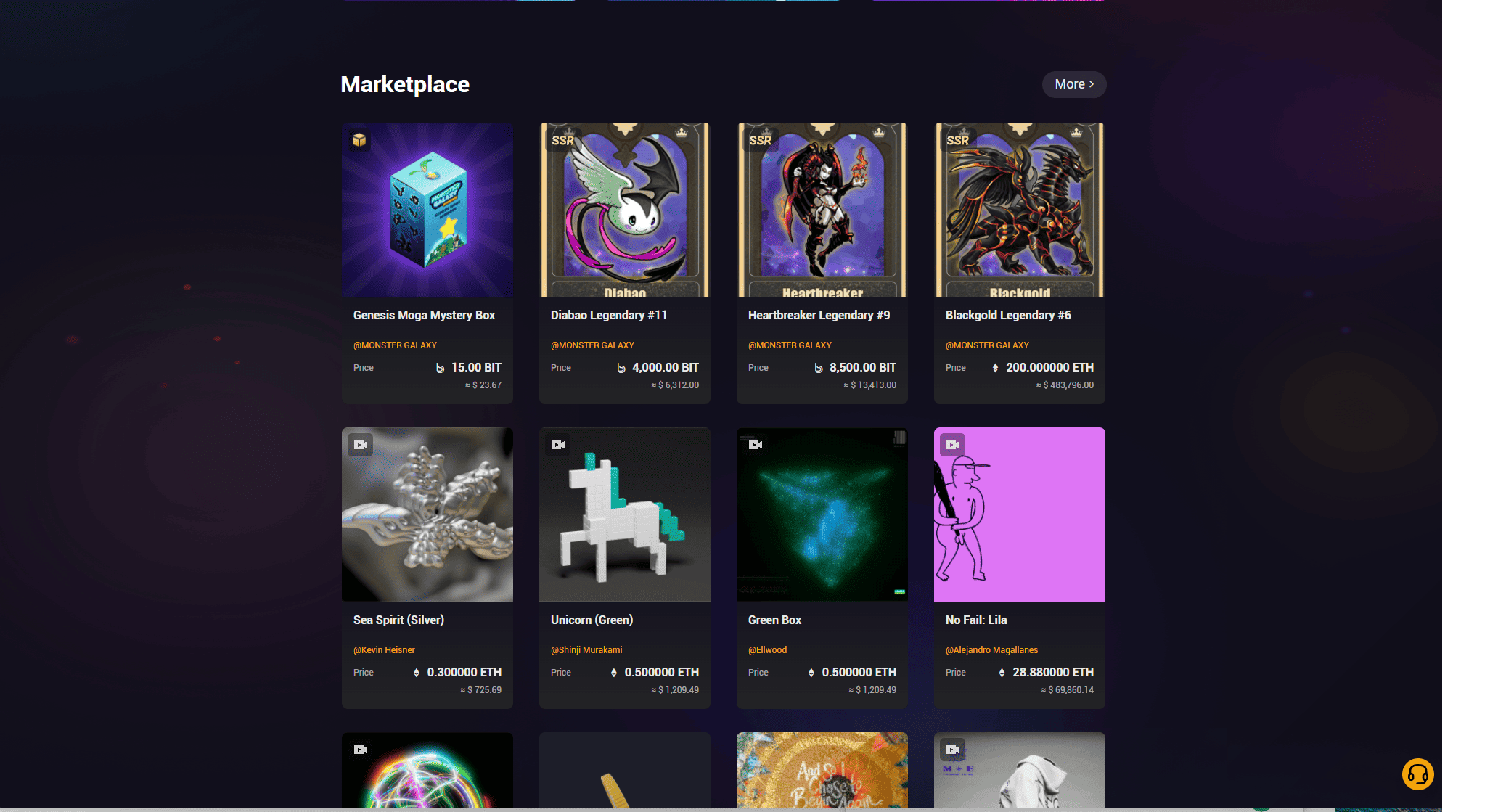

- NFT marketplace w/ zero transactions fees

CONS

- Technically not available in US

- Not as many spot trading options as some competitors

- No volume-based fee incentives

- No options or leveraged tokens

Pros & Unique Features

The biggest perks of Bybit are its extensive selection of futures and spot trading pairs and fast innovation to continually add new pairs and the hottest coins for active traders, as well as its lack of KYC requirements along with a max leverage offering of up to 100X, making it an extremely popular exchange for retail futures traders alike.

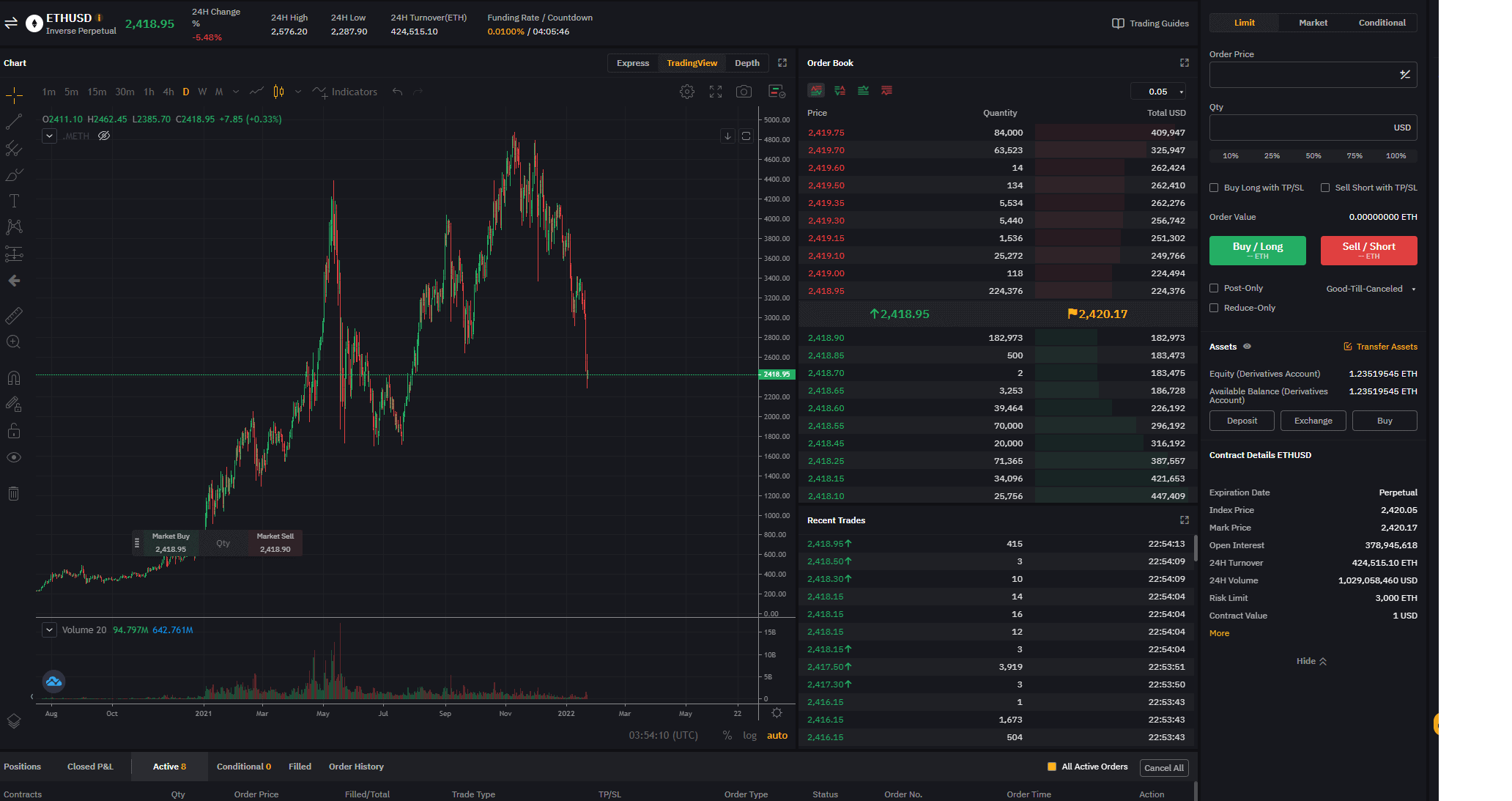

Bybit is primarily a derivatives exchange built for futures trading and catering to high leverage futures traders wanting to trade the newest coins, but since 2021 has expanded to adding spot offerings for the first time.

As of Jan. 2022, its spot cryptocurrency offerings have gotten extensive, with over 129 coins as spot offerings alone on the exchange. As far as futures trading instruments and pairs, there are over 100 futures pairs offered that can be found here for a full list, and the list includes both USDT-margined contracts, as well as inverse contracts margined in the native cryptocurrency of the contract being traded.

Bybit offers a web exchange portal – advanced charting functionality and full access to advanced trading tools such as integrated Tradingview charting and indicators, cross and isolated margin, advanced order types, and other features. There is also an easy-to-use Bybit mobile app interface with full buy and sell functionality for both spot and futures markets with order access and real time market data, charting, and deposits and withdrawals.

Bybit offers a competitive, flat fee schedule for its spot markets with fees at only 0.10% for both market makers and takers, with slightly lower fees for derivatives contracts, for which market makers of any volume receive rebates. Hence, it is better to use limit orders and provide market liquidity if trading futures on Bybit, regardless of the trading volume.

Bybit claims to offer a 100K TPS (transactions per second) matching engine so users never have to worry about overloads nor unfair liquidations with the dual-price mechanism. High-frequency traders can leverage the API as well. Bybit claims to have 99.99% uptime due to the grey release feature and hot patches being released on the fly. There is also a risk-free testnet site offered for users to test strategies and learn to trade without risking real money.

Bybit’s ByFi Center allows users to grow their crypto holders with crypto financial services that have minimal barriers to entry, security, and a variety of high-yield product offerings including a launchpool which allows users to stake and harvest new tokens for free, dual asset mining with which users can earn floating returns with a non-principal protected investment product, and DeFi mining. Users can also stake USDT, ETH, BTC, and other coins to earn stable yields with flexible staking.

Bybit offers a VIP program that offers at the time of this writing a limited-time promotion of taker fee discounts of up to 30%, priority customer support, and the chance to obtain a dedicated VIP ambassador. The Bybit Launchpad allows users to gain early access to tokens from promising projects directly on Bybit. The Rewards Hub allows newly signed up users to take advantage of generous bonuses for completing tasks and for meeting signup bonus requirements.

Bybit has recently added an NFT marketplace to the exchange, with NFTs priced in both BIT tokens and in USDT and ETH. The platform offers zero transaction fees on NFT transactions, access to NFTs from worldwide creators. The NFTs that are able to be listed and traded cover digital art, collectibles, GameFi, the metaverse, and more.

Bybit Learn offers users tutorials and articles to learn about cryptocurrency assets and markets from a well-curated source of information. Like many other futures exchanges, Bybit offers traders to participate in a referral program and an affiliate program to refer other traders to join Bybit and earn the referral’s trading fees.

As for customer support for users, Bybit offers 24/7 multilingual support. Users can request team support via exchange chat or email 24/7. The Bybit team also runs a blog with industry-related updates and Bitstamp company news. The CEO also makes himself available for public discussion on Twitter at @benbybit.

Cons & Disadvantages

The main disadvantage of Bybit is that it is not technically available to US investors however KYC is not required to trade spot nor to trade futures. Also, the exchange does not prevent a user who is deemed to be logging in from the US from executing trades like other exchanges do, though this could change in the future due to regulatory pressure.

The only other disadvantage to using Bybit is that while in the past it was not an exchange well-suited to spot trading, as of recent times it has significantly expanded its spot trading offerings and become competitive as a result with other top spot exchanges, albeit not quite to the extent of Binance or KuCoin’s extensive offerings.

Bybit’s fees are certainly competitive to its competitor exchanges or in the expected fee range, however there are no volume-based incentives that advanced traders who are used to scaling price tiers based on volume may have come to value on other top derivatives exchanges. For trading spot instruments, there is no separation in fee structure between market makers and market takers so high volume market makers who are used to seeing incentives such as rebates or at least lower fees will not receive them at Bybit. However, for futures, makers receive rebates (great for low volume traders since the rebate % is the same flat percentage regardless of cumulative trading volume) and takers pay fees that are smaller than paid on spot trading pairs.

The selection of cryptocurrencies offered in the spot instruments is a bit limited compared to other top exchanges, but is standard and competitive in the derivatives pairs, and even more extensive in spot offerings as compared to some exchanges. However, there are no options or leveraged tokens offered as there are with competitors such as FTX or Binance.

Bybit Fees

Bybit uses a flat fee schedule without volume tiers nor maker-taker model designation for its spot trading fees, instead of the common volume-tiered maker-taker model of many other exchanges. For futures trading, Bybit does offer separate percentage-based fees for market makers and takers, however there are no volume tiers.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled.

In general, for a maker-taker fee schedule, taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (adding to the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook.

At Bybit however, fees for spot trading (but not for futures trading) are the same for both makers and takers and this is a disadvantage for high volume professional market makers, because exchanges usually provide much lower fees for the highest volume market makers, including market rebates and other incentives to drive higher liquidity on their platforms. However, for futures trading, all market makers enjoy maker rebates and no fees, regardless of their trading volume, so this is a great benefit for any participant trading any amount of volume – it pays to use limit orders on Bybit instead of market orders.

The section below shows the fee structure for Bybit’s spot and futures markets and can be found here.

Bybit Spot Trading Fee Schedule

All market makers and market takers currently pay 0.1% in trading fees for spot, regardless of their volume.

Bybit Futures Trading Fee Schedule

All users trading any of Bybit’s futures pairs pay the a fee that is percentage-based instead of being dependent on volume, and is separate for market makers and takers. Makers receive a rebate in the amount of 0.025% (the total fee for market makers providing liquidity on futures is -0.025%). Takers that remove liquidity from the order book are charged a 0.075% transaction fee for each execution.

There are also additional funding fees as is standard for futures trading pairs across all crypto exchanges. Funding fees are charged or issued between long and short positions holders every 8 hours, at 1600 UTC, 0000 UTC, and 0800 UTC.

Other Fees

Bybit charges the following deposit, withdrawal, and other fees:

- No deposit fees

- Withdrawal fees are minimal and dependent on the cryptocurrency being withdrawn, with BTC being 0.0005 BTC, 0.005 ETH for ETH, 0.25 XRP for XRP, 0.1 EOS for EOS, 10 USDT for ERC20 USDT, 1 USDT for TRC20 USDT, and 5 dogecoin for dogecoin

- No minimum deposits required, but minimum withdrawal amounts do exist and can be found here

There are no fees for signing up or for having an inactive Bybit account, nor any fees for holding funds in a Bybit account, and users may hold assets as long as desired.

Account Tiers & Limits

Bybit does not require full KYC identity verification for all users wishing to participate in trading or buying spot on the exchange, however fully verified users enjoy access to increased security and limits.

Users without KYC cannot withdraw more than 2 BTC per day but otherwise can have full functionality of the exchange features.

Level 1 KYC users enjoy a 50 BTC per day withdrawal limit, and Level 2 KYC users enjoy a 100 BTC per day limit.

The documents required for KYC verification include the user’s current and valid government identity document such as a passport or driver’s license and a proof of residency document such as a bank statement.

Crypto Security

Bybit’s hardware cold wallet system is claimed to guarantee the safety of client funds. For general best security practices for user accounts, Bybit maintains an extensive instructional list on how to best protect one’s Bybit account.

2FA is offered and encouraged via authenticator apps such as Google Authenticator or Authy for securing user accounts.

In addition, 100% of traders’ deposit assets are segregated from Bybit’s operating budget for increased financial accountability.

For Bybit wallet 2.0 to support immediate withdrawal, only a small percentage of coins will be held in the hot wallet. As a way to protect the client’s funds, the remaining will still be kept in the cold wallet.

Bybit carries out withdrawals processed 3x/day and scrutinized for suspicious activity by operators.

As far as its security record, Bybit has never been hacked.

Bybit Review Conclusion

Bybit is an overall great exchange of choice mainly for active spot and derivatives traders who value a high-performance trading engine with a simple, flat fee structure that provides incentives such as market maker rebates in futures pairs even for the lowest volume traders, and the same fee structure across spot pairs regardless of volume or maker/taker status.

High volume spot market makers will not benefit from no changes in fee structure with the lack of volume incentives, and same with high volume futures market makers (but they will receive a rebate regardless).

Bybit may be the preferred futures trading exchange for many retail users due to its reputation of listing trending and hot coins regularly as well as its slick user AI and mobile app that also offers trading and trade management functionality.

In addition, Bybit provides access to up to 100X leverage which is becoming rarer in the crypto markets today and depth of market order book data that can be hard to otherwise find.

While its spot trading selection is below average when compared to top exchanges such as Binance or KuCoin, it is adequate for those interested in trading the top 50-70 coins and the fees are extremely competitive.

Bybit also offers impressive exchange functionality and latency that was built by software developers and executives from the traditional finance space. The only disadvantage is that Phemex lacks the overarching ecosystem of products and services that an exchange like Binance offers. However, Phemex does offer a lending/staking service as well as a few other crypto financial services.

- Bybit offers 129 spot cryptocurrencies and 100+ futures trading pairs, so while its selection is not as extensive as that of Binance or KuCoin for example, it offers the core top cryptocurrencies for spot investors and a fair amount of futures trading pairs, geared towards quickly listing new pairs but also offering both USDT-margined and coin-margined typical pairs with good liquidity

- Investors and traders of all skill levels – everyone from low volume beginner traders to high volume advanced traders will benefit from Bybit due to its attractive non-tiered fee schedule, high-performance platform for both spot and futures trading, a full-featured mobile app and web interface, a great support experience, advanced charting functionality, and lack of KYC requirements to use the exchange except for higher limits for withdrawal only

- Advanced traders who wish to use up to 100X leverage futures trading that can no longer be had on FTX nor Binance may prefer Bybit or Phemex, with the selection of futures pairs being more competitive on Bybit than on Phemex.

Other Alternatives

For customers who desire access to a simple user interface with even more spot-only trading pairs, or those who do not desire to participate in cryptocurrency futures trading, either Bittrex, Coinbase, and Voyager can make good alternatives with a more wide range of cryptocurrencies offered to trade and similarly competitive trading fees and functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning, similar to Bybit’s Learn product.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a much larger selection of cryptocurrencies offered compared to Bybit—402 pairs vs. Bybit’s 129 pairs—while active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and all offer volume-based incentives, while Bybit has a flat fee structure that offers even the lowest volume traders the same fees.

Bybit’s order and trade matching engine compares favorably in performance and liquidity to futures trading competitors like Phemex and FTX, and Bybit offers a wider range of newly-listed and trending coins. Assets are listed regularly on Bybit whereas they may take longer on other exchanges.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Bybit include Crypto.com, Kraken, and Binance.

Bybit vs Coinbase

The main advantage Bybit offers over Coinbase is its much lower starting fee schedule, however Coinbase differentiates between makers and takers, while Bybit has the same fee for both for spot markets, albeit starting much lower than that of Coinbase.

Coinbase’s fees start at 0.5% for both makers and takers for the lowest fee tier, while those of Bybit are at 0.1% for all volume tiers for both makers and takers.

Both exchanges offer the option of advanced charting and crypto-to-crypto trading pairs using Coinbase’s Coinbase Pro product and Bybit’s online platform or mobile app. Bybit’s offers a large amount of futures trading pairs while Coinbase only offers spot trading without margin.

Bybit offers 129 spot coins and ~140 pairs to trade, while Coinbase offers 139 coins and 402 pairs, so Coinbase’s selection is much more extensive for the average investor and spot-only trader.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Bybit is not regulated in the US nor US-compliant, and is not a public company either.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either FTX or Coinbase offer may find the choices below equally valuable.

Bybit vs FTX

FTX International compares favorably to Bybit for advanced traders, offering 323 coins and 492 trading pairs. Derivatives traders who want to trade options or leveraged tokens will prefer FTX since Bybit does not offer any of those options. The reputation of FTX for futures trading as “built for traders, by traders” is also more highly esteemed, while Bybit is geared more towards lesser experienced, higher risk retail traders hence the 100X leverage staying on the platform despite FTX reducing the max leverage offered.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while Bybit does have a high performance order matching engine, but cannot compare in trade volume, nor selection of cryptos and trading products, but compares very favorably in fees for futures, especially for low volume traders.

FTX cannot be used by US persons, and instead offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection, and FTX International’s fees are more competitive than FTX US’s low fees. Bybit (spot) offers a greater selection of coins to trade as FTX US, with futures offerings that FTX US does not offer, and is available for US persons to use with a VPN since KYC is not mandatory, but this is technically against the exchange TOS.

Bybit vs Gemini

Bybit and Gemini are similar exchanges in terms of the ranges of their product offerings, though Gemini is more suited to investors and those seeking US regulated custody and interest-earning services as well that are more extensive than those offered by Bybit, while Bybit is better suited to active and derivatives traders, as Gemini offers no futures trading.

There is a major difference in fees: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, which Bybit does not have due, but all of the fee tiers at Bybit are flat at 0.10% for both makers and takers, with no volume incentives (for spot).

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products. US users can use Bybit with a VPN and without KYC but note it is not regulated in the US.

Gemini offers 62 coins and 86 trading pairs which is similar but less to that of Bybit, offering 129 spot coins, so Bybit wins in the selection department, and both exchanges offer staking selection with varied APY.

Bybit vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while Bybit offers up to 100X leverage on futures trading without KYC being required. If strictly seeking the highest accessible margin, Bybit is a good choice. Plus, Kraken will not list new and trending futures pairs as quickly as Bybit does.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is less competitive than the fee schedule for Bybit. Kraken offers no other fee incentives such as rebates or reductions except for volume, which is typical of volume-based maker-taker fee schedules.

The benefit market makers will have using Kraken is the reduced fees for makers, while Bybit charges the same trading fees for both market makers and takers and they start quite small at only 0.1% for spot trading, with rebates for makers in futures pairs for every volume level, which is a win for Bybit in the fee department.

Kraken also offers a large variety of cryptocurrencies and pairs (93 coins, over 400 pairs), so users who value a large selection and advanced traders who seek some margin up to 100X may prefer using Bybit, unless compliance is preferred.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while Bybit is not compliant in and not regulated in the USA. Neither Bybit nor Kraken have ever reported any large scale hacks.

Bybit vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Bybit—over 351 coins and over 1300 pairs, which is only beaten by KuCoin when it comes to centralized exchanges.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products may prefer FTX, however Binance Futures offers many USDT futures pairs that are not offered on FTX at the moment.

Binance Futures undoubtedly offers a greater selection of trading pairs than Bybit offers, and Binance is known to list new pairs and coins quickly, similar to Bybit’s reputation as of late.

Binance’s base maker-taker fee is also similar to that of Bybit, starting at 0.1%, and offering further 25% reduction in fees if paid in BNB, which is an incentive and reduction that Bybit does not offer. Bybit has the same fee for both makers and takers and offers no other fee reductions, even for volume—0.1% for spot.

The Bybit brand has existed since 2018 while the Binance brand is slightly more established, since 2017, as well with a much more extensive network of crypto financial services and product offerings. Binance offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Bybit.

Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs. The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs.

Binance requires full KYC now to trade even spot products, and Bybit still as of Q1 2022 does not require KYC to trade spot or futures, but requires it for users wishing to withdraw greater than 2 BTC per day, though exchange functionality is in no way limited.

In summary, advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will prefer Binance, but traders who just desire a no-frills futures or spot exchange with cheap fees and a sizeable selection of both futures and spot pairs as well as high quality order matching engine and exchange technology will appreciate the offering of Bybit.

FAQ – Frequently Asked Questions

Is Bybit Safe?

Yes, it is safe as Bybit employs a founding team consisting of professionals from the FX and investment banking industries, as well as early blockchain adopters. Bybit boasts over 3M registered users around the world and has never been hacked. The exchange also uses a cold wallet setup for all funds and allegedly guarantees no loss of funds from custody issues.

In addition, 100% of traders’ deposit assets are segregated from Bybit’s operating budget for increased financial accountability.

For Bybit wallet 2.0 to support immediate withdrawal, only a small percentage of coins will be held in the hot wallet. As a way to protect the client’s funds, the remaining will still be kept in the cold wallet. Bybit carries out withdrawals processed 3x/day and scrutinized for suspicious activity by operators.

Users with accounts on Bybit should employ standard security precautions such as a strong password and using 2-FA using an authenticator or a hardware security key such as a Yubikey, not using only SMS.

How long does Bybit Withdrawal take?

Bybit supports immediate withdrawal, however some withdrawals are processed 3 times a day at 8AM UTC, 4PM UTC, and midnight UTC.

The withdrawal cutoff time is 30 minutes before the listed withdrawal processing time. Withdrawals for crypto are credited to the user’s wallet within 1-2 hours, due to the time needed for the manual oversight process and pending transactions on the blockchain network.

The usual timeframe for ACH and wire transfer withdrawals to reach the user’s bank can be up to 2-5 business days, excluding weekends and holidays. The transfer is executed at the times listed on Bybit’s end, however the banking system might need a few additional days to credit the funds to the user’s bank account.

Is Bybit a good exchange?

Yes, Bybit is an overall excellent choice of cryptocurrency exchange for all types of beginner to advanced cryptocurrency traders, but it’s best for active traders (due to its low fees regardless of trading volume), and for derivatives traders since it offers up to 100X leverage.

It is best thought of as a active spot and futures trading exchange, but its selection of cryptocurrencies and trading instruments cannot compare with other exchanges that also offer competitive fees, such as Binance, KuCoin, and FTX, though it has made strides in its spot offerings over the last year and is known for being sometimes the first exchange to introduce a new futures pair for a trending or hot coin on the market.

If a user is looking for extensive bells and whistles such as payment cards and crypto loans, those are not available at Bybit and better choices may be Crypto.com or Binance.

Where is Bybit located?

Bybit is located in Singapore.

Does Bybit require KYC?

No, KYC is not mandated to use Bybit services. As of Q1 2022, users without KYC can use the spot and futures trading pairs without KYC without a problem or any limitations in functionality.

The documents required for KYC verification include the user’s current and valid government identity document such as a passport or driver’s license and a proof of residency document such as a bank statement.

Users who provide KYC enjoy higher withdrawal limits. Non-KYC users can only withdraw up to 2 BTC per day. Level 2 KYC users have withdrawal limits of up to 50-100 BTC per 24 hour period.

What are the Deposit and Withdrawal Methods and Fees for Bybit?

Bybit offers the following deposit and withdrawal methods, with the corresponding fees and limits listed here for expanded detail:

- No minimum deposit required for any crypto assets

- Withdrawal fees on BTC are 0.0005 BTC

- Withdrawal fees on ETH at 0.005 ETH

- Withdrawal fees on XRP are 0.25 XRP

- Withdrawal fees on EOS are 0.1 EOS

- Withdrawal fees on USDT ERC20 are 10 USDT

- Withdrawal fees on USDT TRC20 are 1 USDT

- Withdrawal fees on dogecoin are 5 dogecoin

- Transaction fees for withdrawing from your exchange wallet depend on the blockchain in question and can be found here

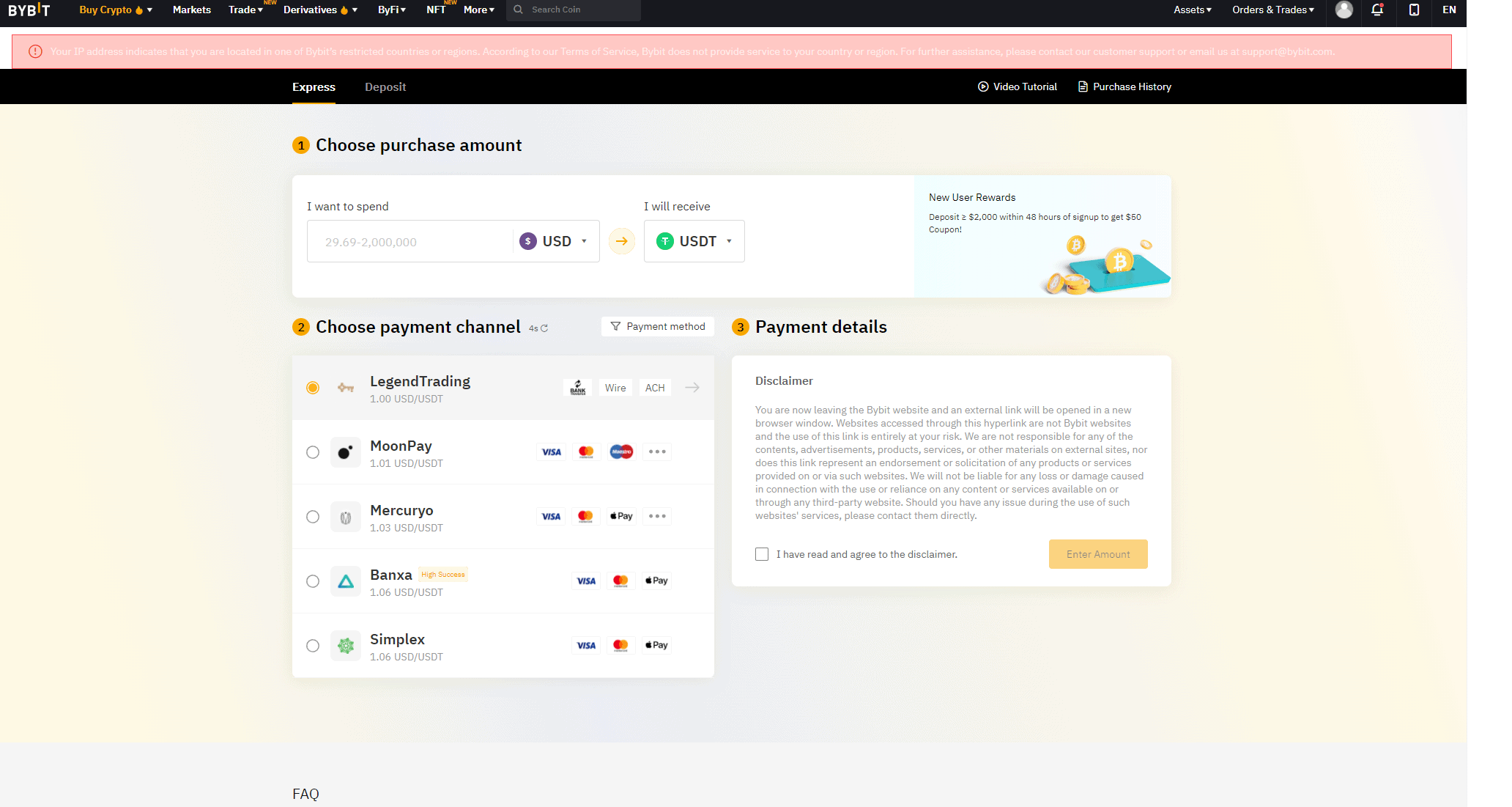

Deposit and withdrawal methods that are supported include: Bybit Fiat Gateway (via third parties, using cards allowed—only for deposits), transfer crypto assets or stablecoins, or via OTC.

What is the Minimum Withdraw Amount for Bybit?

The minimum withdrawal amount for Bybit may be found here for each cryptocurrency. It can range from 0.001 BTC for Bitcoin to 10 USD for USDT on the TRC20 network, and similar equivalency across other crypto assets.

How do you withdraw from Bybit?

Users can withdraw from Bybit by logging into their official website, navigating to the “Assets” section on the top right corner, clicking the “Withdraw” column of the currency desired to withdraw.

Then, the user can add a withdrawal address with the desired coin and address. Then, the user must confirm this with 2-FA and email verification. Once this is done, the user may withdraw.

Here is the official support page for how to withdraw from Bybit support.

Is Bybit a wallet?

No, Bybit is a cryptocurrency exchange which provides a multicurrency wallet inside of the user’s spot and futures trading accounts for custody with the exchange. Users may transfer funds without fees between the spot wallet and the futures wallet.

How to use Bybit?

Using Bybit can be done by going to bybit.com, creating an account on the platform, undergoing the KYC procedures to use the account if desired (not required to use the platform), deposit any trading funds into the spot account or futures account, transfer them to the trading account for futures trading if needed, and then get access to all of the market offerings and begin trading with up to 100X leverage access offered for futures.

User Reviews

- A user on Reddit brings up some concerns, including order book depth, insurance fund, less support access than some other CEXes, and strange in-app promos. A Bybit support rep responds:”Every of Bybit’s order book details are transparent and publicly available. Even without creating an account on Bybit, users can access the order book details by clicking on the ‘Square-like Expand’ icon located on the top right corner of the order book.” Read more of their response here.

- Users who have been liquidated (since most users on Bybit are retail participants) discuss trading methods and review Bybit. OP says: “For the Bybit reps here: Buckle up, because you’re going to *learn* a few things about the mechanics of your platform that you might not actually know. At least, if you *DO* know about them then there’s a severe issue with transparency surrounding the risks associated with using your platform…” But they also say: “If I’m so frustrated and uncertain about ByBit as an exchange, why have I continued to use it? Like everything, it’s not all bad -and in fact, ByBit’s platform offers a ton of great features & design that I prefer.”

- u/Particular-Region933 says: “I’m trying to make a withdrawal from by bit and they are asking for kyc when they claim not to have kyc now my funds are locked for 5 days until my kyc can be checked and they say it can take upto 96 hours to reply to an email will definitely be avoiding by bit in the future so much for no kyc”. A mod responds:

- The Bybit subreddit is often monitored by official Bybit support representatives answering questions and queries.

“If one violates Bybit Terms of Service we may require KYC (do check paragraph 2.10) https://help.bybit.com/hc/en-us/articles/360020645374-Bybit-Terms-of-Service

Also, make sure to check the list of countries we do not provide services. If a user is from one of those countries we may require KYC as well https://help.bybit.com/hc/en-us/articles/360039750013-Service-Restricted-Countries”