OKX, formerly known as OKEx, is a global cryptocurrency exchange founded in 2017 and based in Seychelles.

The exchange does not require KYC (Know Your Customer) identity verification or document protocols to be completed for use of the exchange, but note that US users are not allowed to use it as per regulatory compliance reasons.

History of OKX

OKX is owned by Ok Group, which also owns crypto exchange Okcoin. In 2018, the exchange expanded to Malta, given the country’s efforts to provide a sound regulatory framework for blockchain and digital asset businesses and exchanges. It soon became the world’s largest cryptocurrency exchange by repeated turnover volume.

The exchange rebranded to OKX as of January 2022 and serves millions of users in over 100 countries. The exchange’s CEO is Jay Hao and he is a firm believer in the potential of blockchain and a future of technology where all transaction barriers are eliminated, creating substantial improvements in the global economic system.

OKX is best for:

- All types of cryptocurrency spot investors who desire access to crypto instruments on a top-tier exchange by volume, along with a core offering of major crypto coins and high daily volume along with good liquidity

- Spot and derivatives traders who desire access to a competitive fee schedule, a range of trading product offerings, as well as access to the entire suite of OKX crypto financial services, including margin, futures, options, perpetual swaps, DeFi, lending, and mining services

PROS

- Over 330 coins and 530 trading pairs

- Margin trading and options

- Express interface

- P2P exchange

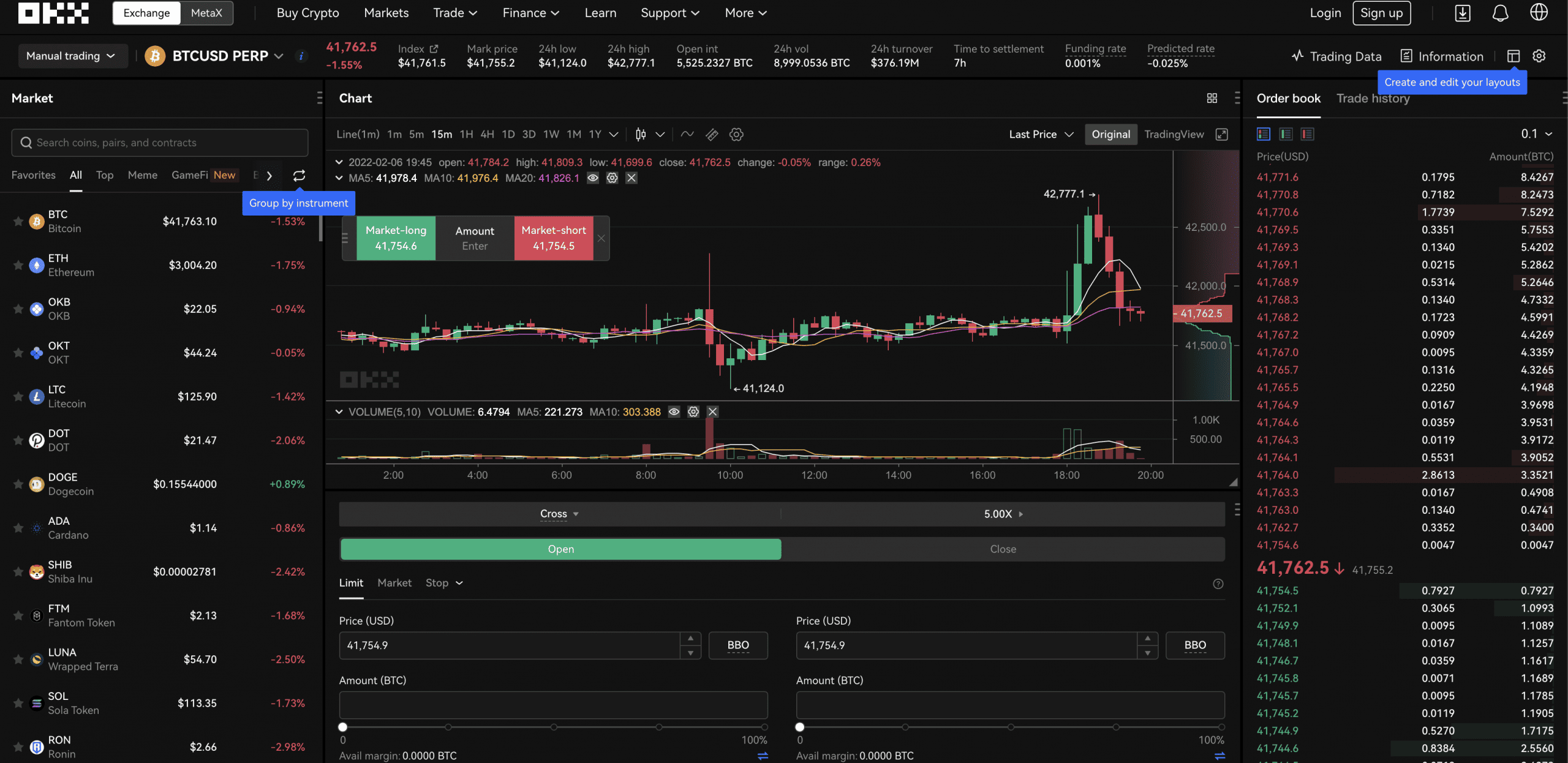

- Advanced charting tools

- Advanced order types

- Mobile and desktop friendly

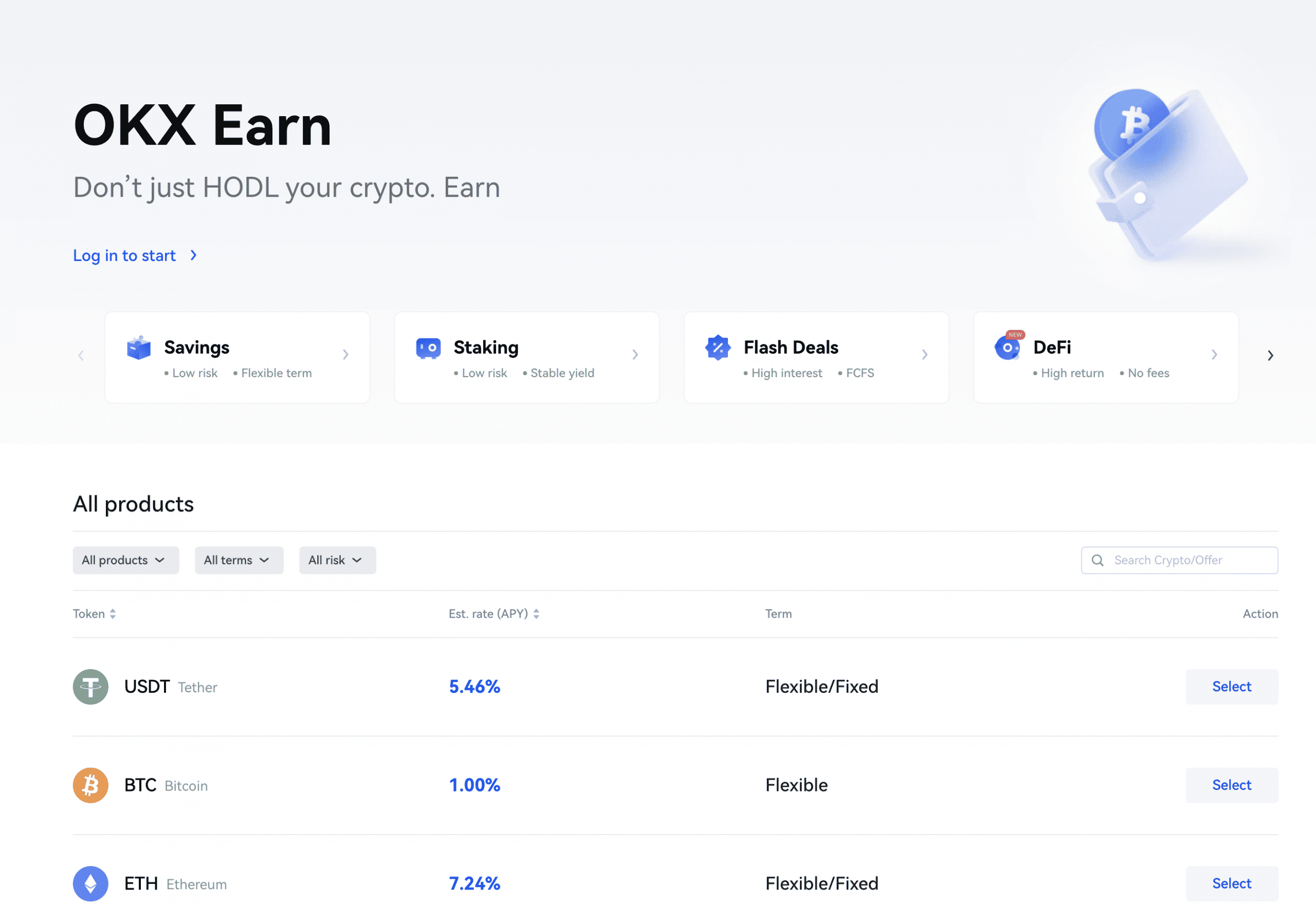

- In-app staking service

- Loans offered

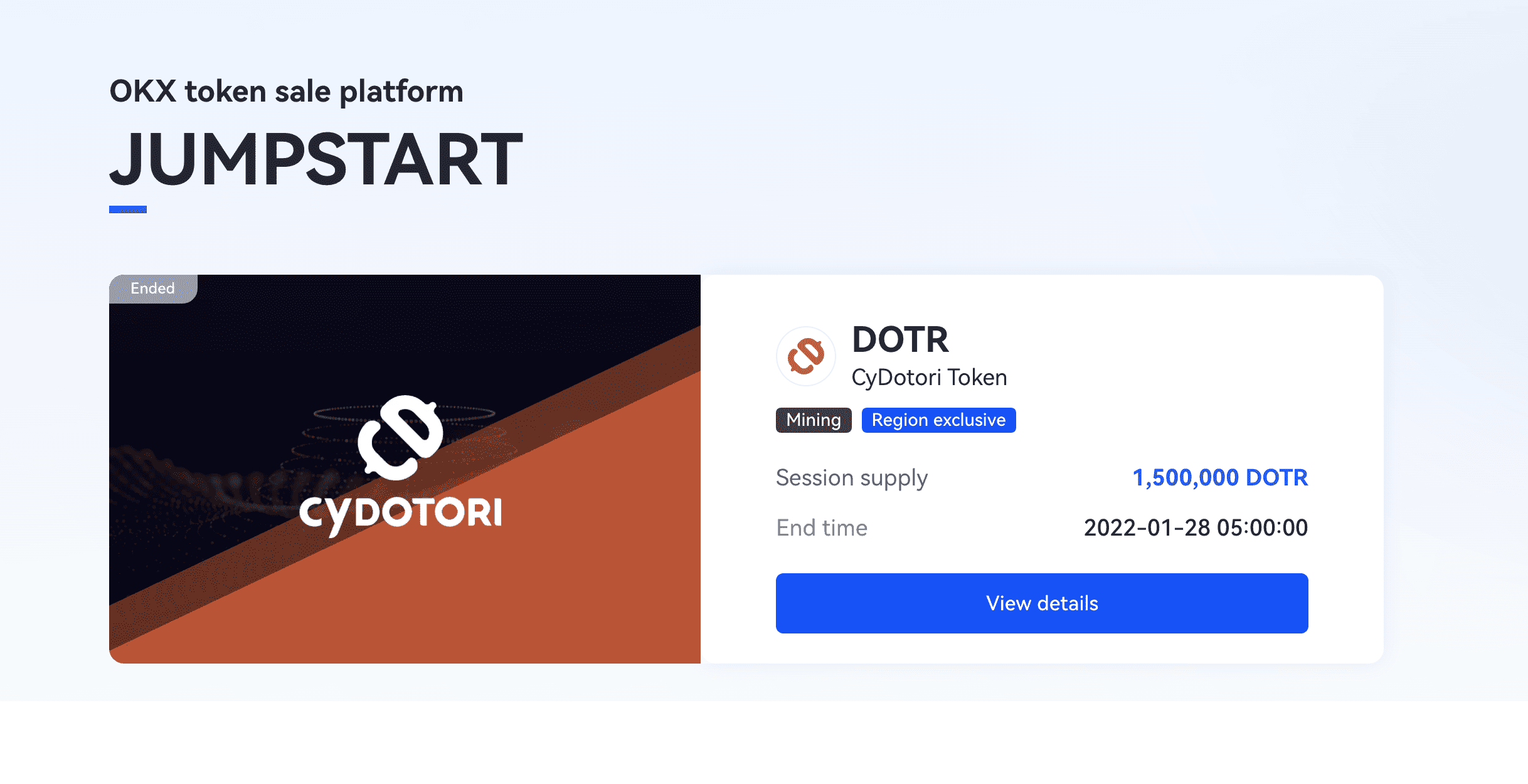

- New project launch platform “Jumpstart”

- Academy

- Mining pools

- In-house bridge

- Native token with discounts

- Broker for other exchanges

- Decentralized finance services & smart wallet

CONS

- Possibly too complex for beginners

- Not accessible to US users

- Complex fee schedule

Pros & Unique Features

OKX offers a wide range of advanced crypto financial services in addition to being a high quality exchange with the #2 leading daily trading volume, only behind Binance, making it one of the largest exchanges on the market.

The major benefit of using OKX is having a “one stop shop” for all your crypto needs, with the exchange’s market offerings totaling to over 330 coins and over 530 trading pairs, which rivals in quantity the offerings of other top tier exchanges such as Binance and FTX.

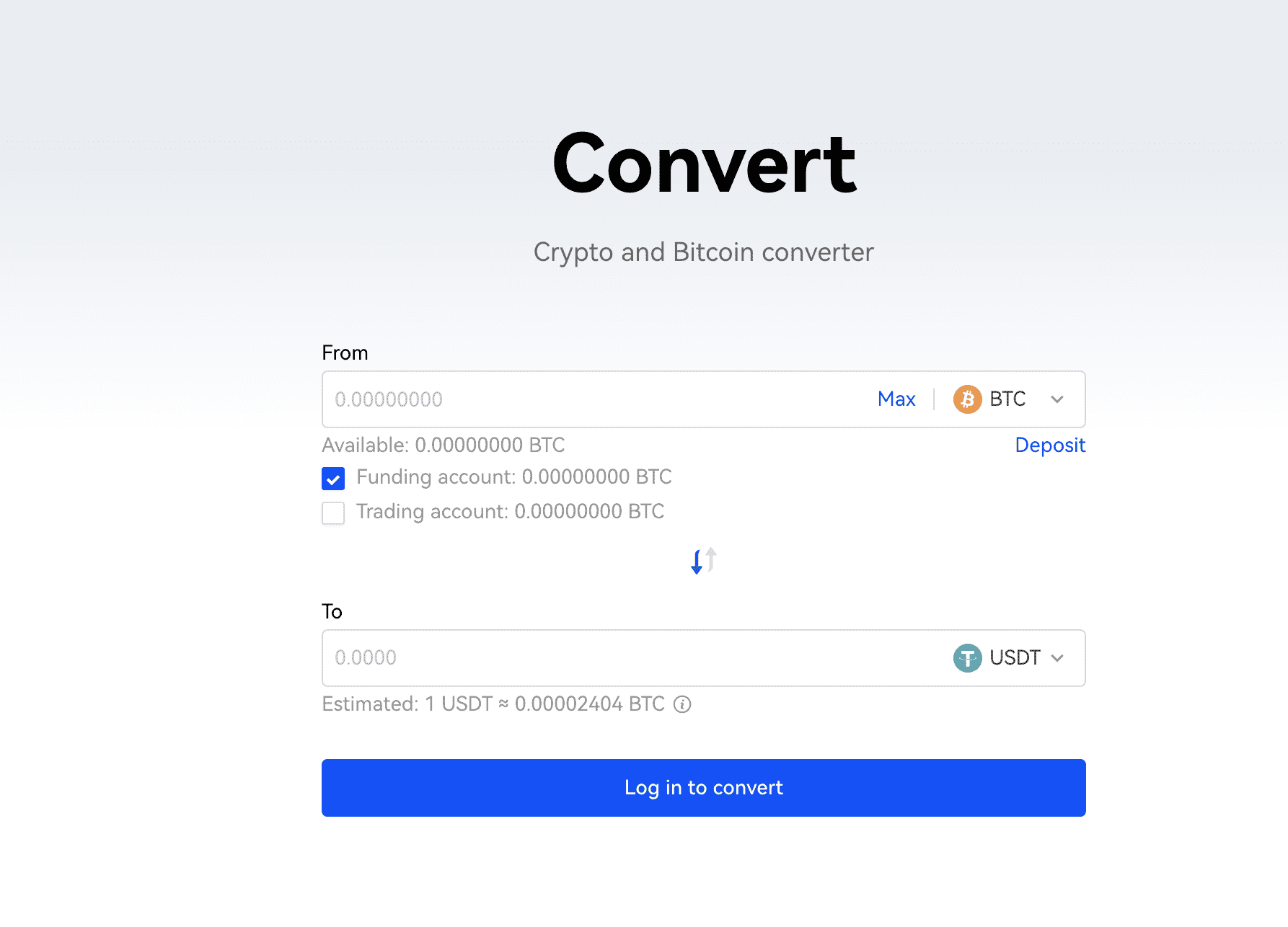

Besides offering classic exchange services involving trading spot cryptocurrencies with a basic “convert” interface, users can also engage in margin trading and options, and buy/sell cryptocurrencies with an express interface, as well as with a P2P exchange. Advanced charting tools, order book, advanced order types, and full-featured trading functionality are included in both the online platform and the mobile apps.

Additionally, OKX offers a product called OKX Earn which is a staking service similar to that offered by many other exchanges today and allows users to earn yield from their crypto assets. Crypto loans are also offered to users.

Jumpstart is OKX’s token sale platform, which helps new projects launch and grow their communities. Jumpstart users are able to participate in campaigns by staking their OKB and receiving tokens from new projects based on their staked amounts. OKX also offered DOT & KSM Slot Auctions which allows users to vote for DOT and KSM projects to receive rewards.

For allowing and incentivizing users to learn about cryptocurrencies, OKX offered a product called the Academy. OKX also runs a leading mining pool for several cryptos that allows users to participate and earn with stable mining of crypto assets.

OKX also offers an in-house bridge, called the OKX Bridge, that allows users to transfer crypto assets across different blockchains, including OEC (a decentralized, borderless, trading blockchain network developed by OKX that is open-source. The exchange’s utility token is called OKB and holders of OKB can receive up to 40% discounts on trading fees, passive income with OKX Earn, and participate in token sales with Jumpstart. Users are also eligible for minor crypto rewards for completing tasks.

OKX also functions as a broker for other exchanges to use their programmable trading and cloud exchange solutions, as well as receive access to OKX liquidity and market depth. OKX’s MetaX product is new and allows users to access decentralized finance services as well as a smart wallet with support for 15+ blockchains and 1000+ DeFi protocols. Lastly, OKX runs their own venture capital fund called Blockdream Ventures.

As for customer support, OKX offers a support service centers customers can access via logging in and submitting a request, as well as the chance to connect with communities of other OKX users.

Cons & Disadvantages

The main disadvantage of OKX is its wide range of products and services that can be potentially too complex for a beginner cryptocurrency user and investor. Additionally, the exchange is not accessible to US users and has a more complex and multi-tiered fee schedule than many other exchanges.

Thus, OKX may be an exchange that is better suited to more advanced or experienced cryptocurrency users residing in countries in which the exchange is usable. The benefit is that it truly can become a user’s “one stop shop” of crypto financial services as well as provide major trading fee reductions for holders of the native OKB exchange coin.

US users who wish to transact with more functionality or trading pairs and access may opt to use competitors like KuCoin for futures or Bittrex for spot, thereby gaining access to an almost-equivalent selection of trading instruments such as margin and futures as well as low fees.

OKX Fees

OKX uses a variable, maker-taker fee model with tiers based on both transaction volume and the status of native OKB token holdings.

To make matters more complex, trading fees are different for regular and VIP users. Regular users are divided into tiers by their total OKB holdings, whereas VIP users are categorized by 30-day transaction volumes and daily asset balances, which are updated daily.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

Taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (adding to the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook. If an order goes on the order book partially or fully (a maker order), any subsequent trades coming from that order will be as a “maker.”

The fees also differ for spot, futures products, as well as for perpetual swaps, and for options. Additionally, even just for spot, the total crypto offerings are split into 3 classes: Class A, Class B, and Class C.

OKX Spot Trading Fees (Class A): Regular Users – Based on 30-Day Trading Volume or Total OKB Holdings

| Tier Name | Total OKB Holding | Asset (USD) | OR: 30-day trading volume (USD) | Maker Fees | Taker Fee | 24H Withdrawal Limit (BTC) |

|---|---|---|---|---|---|---|

| Lv 1 | < 500 | < 100k | < 10M | 0.08% | 0.100% | 500 |

| Lv 2 | ≥ 500 | < 100k | < 10M | 0.075% | 0.095% | 500 |

| Lv 3 | ≥ 1000 | < 100k | < 10M | 0.070% | 0.090% | 500 |

| Lv 4 | ≥ 1500 | < 100k | < 10M | 0.065% | 0.085% | 500 |

| Lv 5 | ≥ 2000 | < 100k | < 10M | 0.060% | 0.080% | 500 |

OKX Spot Trading Fees (Class A): VIP Users – Based on 30-Day Trading Volume or Assets (USD)

| Tier Name | Asset (USD) | OR: 30-day trading volume (USD) | Maker Fees | Taker Fee | 24H Withdrawal Limit (BTC) |

|---|---|---|---|---|---|

| VIP 1 | ≥ 100K | ≥ 10M | 0.060% | 0.080% | 600 |

| VIP 2 | ≥ 500K | ≥ 20M | 0.040% | 0.075% | 800 |

| VIP 3 | ≥ 2M | ≥ 50M | 0.020% | 0.070% | 1,000 |

| VIP 4 | ≥ 5M | ≥ 100M | 0.00% | 0.060% | 1,200 |

| VIP 5 | – | ≥ 200M | -0.002% | 0.050% | 1,500 |

| VIP 6 | – | ≥ 500M | -0.005% | 0.040% | 1,800 |

| VIP 7 | – | ≥ 1B | -0.010% | 0.030% | 2,000 |

| VIP 8 | – | ≥ 10B | -0.010% | 0.025% | 2,000 |

Fees for Class B and Class C cryptos can be found here. Fees for futures, perpetual swaps, and options can also be found here on the fee schedule page.

In regards to “Total Asset Balance (USD)”, OKX takes a snapshot of users’ assets from different types of coins at 4:00 pm UTC every day and converts their value to USDT and then into BTC. The system will then further convert the value to USD as per the daily BTC/USD middle price (BTC/USD middle price = (opening price + closing price)/2).

Snapshot assets include those held in classic accounts (spot, margin, futures, perpetual swap and options), trading accounts (unified accounts), funding accounts and finance accounts. Assets borrowed for leverage and/or loans will not be counted.

For margin trading, OKX charges margin interest rates, which can be found and noted here. For reference, the basic daily rate for both VIP and regular users is at 0.0028% on USDT and most other assets.

Other Fees

OKX charges the following deposit, withdrawal, and other fees:

- No deposit fees for any digital asset

- Withdrawal fees depend on the asset in question but are minimal (as low as 0.0002 BTC).

There are no fees for signing up or for having an inactive exchange account, nor any fees for holding funds in an exchange account, and users may hold assets as long as desired.

Account Tiers & Limits

Account limits depend on KYC verification levels, among other factors. Withdrawal limits can also be changed by contacting support.

24h withdrawal limits are different for different verification levels. For personal information (level 1), the limit is ≤ 200 BTC. For photo verification (level 2), it’s ≤ 500 BTC.

The daily withdrawal limits can be noted in the Fees section for regular and VIP users.

For KYC Level 0: the allowed account functions are deposit, withdrawal (24H limit of 10 BTC), spot trading, and futures trading. Users without KYC verification cannot trade P2P. For their own benefit, users are encouraged to complete KYC to improve their account security level and enjoy more transaction eligibility.

KYC Level 1 asks users to verify their personal information and increases the daily withdrawal limit to 200 BTC.

Requirements for documents for KYC verification can be noted here and here for both individual and corporate accounts.

Crypto Security

OKX practices both online and offline storage for crypto assets. For its online storage, the exchange uses its own semi-offline multi-signature mechanism which supports quick, secure, and convenient deposits and withdrawals. Multiple risk management methods also verify deposits and withdrawals before sending them to the blockchain.

Private key storage is secure, semi-offline signatures are used, distributed authorization is used, as lastly, emergency backups are used. For its offline storage design, OKX uses cold wallets that are not connected to the internet.

OKX’s security program encompasses all aspects: platform, assets, data, and access security. They are transparent and public with their protocols that guarantee complete protection of funds on OKX. Multiple backups, bank vaults, and storage limits are only some of the measures taken.

More security information can be found here.

OKX Review Conclusion

OKX is a great choice of exchange for those seeking a full-featured, all-in-one crypto financial services exchange with an extremely wide range of crypto spot and margin offerings as well as the entire suite of OKX products such as the token launchpad, mining pools, the bridge and decentralized OEC blockchain, OKX Earn for staking, and more.

Though US users are not allowed as per TOS on the exchange, OKX does not require KYC to use the exchange and still allows relatively higher limits for non-KYC accounts as compared to other exchanges, along with futures trading still allowed without KYC. The one drawback is its entire range of products can be complex for new users to cryptocurrencies, and its fee schedule is complicated with many classes and tiers for regular and VIP users.

US users looking for lending, borrowing, and staking options as well as access to a wide range of crypto trading pairs may find other US exchanges equally valuable.

- OKX offers access to over 300 coins and 500 trading pairs, for spot, margin, futures, and options trading

- Beginner to advanced traders trading margin who desire access to advanced trading tools and charting would enjoy using OKX, without KYC being a necessity even for futures trading, which is rare in today’s market

Other Alternatives

For customers who desire access to a simpler user interface with an almost equivalent amount of trading pairs, or those who do not desire to participate in cryptocurrency futures trading either Bittrex, Coinbase, and Voyager can make decent alternatives with a competitive amount of cryptocurrencies offered to trade and competitive trading fees and functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a similar selection of cryptocurrencies offered compared to OKX—402 pairs vs. OKX’s 300+ coins—while active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ, and they all use volume-tiered fee schedules just like OKX.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to OKX include Binance, KuCoin, and Kraken.

OKX vs Coinbase

OKX and Coinbase are both very competitive exchanges with similar product offers and it depends on what a user values more as well as ease of access to OKX based on jurisdiction of the user.

OKX offers margin trading while Coinbase does not, and OKX wins in the fee department easly over Coinbase, whose lowest volume tier is much higher than that of OKX. OKX additionally offers maker rebates and incentives for OKB token holders, which Coinbase does not.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while OKX is not regulated in the US and US users cannot use it.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either OKX or Coinbase offer may find the choices below equally valuable.

OKX vs FTX

FTX may win against OKX for advanced traders who are seeking the best liquidity and lowest fees, as FTX offers 323 coins and 492 trading pairs, which is very similar and competitive to OKX’s 300+ coins and 500+ trading pairs.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options may prefer FTX since OKX offers all of the above except for leveraged tokens, but FTX is better known for being a futures trading exchange listing new pairs. Volume on OKX Futures is very high comparably as well, however.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while OKX also offers a full-featured trading experience with top 5 exchange trading volume, however FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed.

Neither OKX nor FTX can be used by US persons, and FTX instead offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection.

US users trading at FTX US need to do KYC procedures. Fees are slightly more competitive at FTX with volume and token holder incentives.

OKX vs Gemini

OKX and Gemini have some similarities in their offerings, but OKX has a far more developed financial services infrastructure and more competitive fees.

There is a difference in fees to start: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, which OKX starts fees at 0.1% at the lowest volume tier, making this category a clear win for OKX.

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, which is another clear win for OKX.

Gemini offers only 62 coins and 86 trading pairs which is far more limited and smaller as compared to that of OKX’s 300+ coins and 500+ trading pairs. Both exchanges offer staking services and top-tier security.

OKX vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, so US users may prefer Kraken for its regulatory compliance and strong track record. However, Kraken’s margin offerings cannot compare to those of OKX, which is a derivatives leader next to the status of Binance and FTX.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which less competitive even at the entry volume tier level than OKX’s 0.10% highest fee for their lowest volume tier. Kraken offers no other fee incentives such as rebates or reductions except for volume, while OKX does.

Kraken offers a much smaller variety of cryptocurrencies and pairs (only about 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer OKX, depending on their jurisdiction.

If an active trader wishes to trade without KYC, he or she may prefer OKX or other exchanges such as Bybit, but if he or she is a US user who prefers a large selection of crypto only instruments and does not mind KYC, Kraken wins.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while OKX is not.

OKX vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a similar large selection of cryptocurrencies as compared to OKX—over 351 coins and over 1300 pairs.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only may prefer Binance, as it offers many USDT futures pairs that are not offered even on FTX, the other derivatives leader, at the moment.

Binance’s base maker-taker fee is better in its competitiveness compared to that of OKX, starting at 0.1% for both, however Binance offers further 25% reduction in fees if paid in BNB, alongside its offering of reduced fee tiers for higher volume and even maker rebates, which OKX also offers, so this a tie for both exchanges.

Binance and OKX both offer an extensive web and ecosystem of products, support, and liquidity, especially given their larger daily volume as compared to other exchanges. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs. OKX has no US-compliant site.

Binance requires full KYC now to trade even spot products, and OKX still allows usage and even futures trading without KYC, so this is a major win for many users.

Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products may pick between both Binance and OKX equally.

FAQ – Frequently Asked Questions

Is OKX Safe?

Yes, OKX practices both online and offline storage for crypto assets. For its online storage, the exchange uses its own semi-offline multi-signature mechanism which supports quick, secure, and convenient deposits and withdrawals.

Multiple risk management methods also verify deposits and withdrawals before sending them to the blockchain. Private key storage is secure, semi-offline signatures are used, distributed authorization is used, as lastly, emergency backups are used. For its offline storage design, OKX uses cold wallets that are not connected to the internet.

OKX’s security program encompasses all aspects: platform, assets, data, and access security. They are transparent and public with their protocols that guarantee complete protection of funds on OKX. Multiple backups, bank vaults, and storage limits are only some of the measures taken.

More security information can be found here.

How long does OKX Withdrawal take?

Once a user has requested a withdrawal, the status is shown in the user’s account.

Withdrawal transfers are usually credited within 48 hours of being requested, but users can submit a support ticket if this is not the case.

Withdrawals are processed as requested. For crypto withdrawals, on average, it takes from 30 minutes to several hours for a transaction to be confirmed.

Please note that for crypto, the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

As for processing fiat withdrawals, the usual timeframe for ACH withdrawals to reach the user’s bank is 2-4 business days, excluding weekends and holidays.

Is OKX a good exchange?

OKX is a great choice of exchange for those seeking a full-featured, all-in-one crypto financial services exchange with an extremely wide range of crypto spot and margin offerings as well as the entire suite of OKX products such as the token launchpad, mining pools, the bridge and decentralized OEC blockchain, OKX Earn for staking, and more.

Though US users are not allowed as per TOS on the exchange, OKX does not require KYC to use the exchange and still allows relatively higher limits for non-KYC accounts as compared to other exchanges, along with futures trading still allowed without KYC.

The one drawback is its entire range of products can be complex for new users to cryptocurrencies, and its fee schedule is complicated with many classes and tiers for regular and VIP users.

US users looking for lending, borrowing, and staking options as well as access to a wide range of crypto trading pairs may find other US exchanges equally valuable.

Where is OKX located?

OKX has located its headquarters in Valletta, Malta and also in Seychelles.

Does OKX require KYC?

No, KYC is not required at OKX to use most exchange services including deposits, withdrawals, and even futures trading.

For KYC Level 0: the allowed account functions are deposit, withdrawal (24H limit of 10 BTC), spot trading, and futures trading.

Users without KYC verification cannot trade P2P. For their own benefit, users are encouraged to complete KYC to improve their account security level and enjoy more transaction eligibility.

KYC Level 1 asks users to verify their personal information and increases the daily withdrawal limit to 200 BTC.

Requirements for documents for KYC verification can be noted here and here for both individual and corporate accounts.

What are the Deposit and Withdrawal Methods and Fees for OKX?

OKX offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto assets: deposits and withdrawals – no deposit fees. Withdrawal fees depend on the asset in question. 0.0004BTC for BTC, 0.003 ETH for ETH for withdrawal fees. Other fees for withdrawals for crypto can be found here.

- Fiat: No deposit or withdrawal fees noted

What is the Minimum Withdraw Amount for OKX?

The minimum withdrawal amount at OKX is: 2 USDT for USDT-TRC20 and 11 USDT for USDT-ERC20. The minimum withdrawals for other crypto assets and fiat depends on each individual currency, but is similar in its value. Some crypto assets may not have a minimum withdrawal on OKX.

How do you withdraw from OKX?

Instructions for withdrawing from users accounts can be found here from official support.

Users can withdraw from the wallet by navigating to the top right side of their Main Account Page Menu and select the “Withdrawal” button.

From there, the user should select the currency to withdraw, then select the destination address to which he or she wishes to withdraw, or the linked and verified bank account for fiat withdrawals. Then, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal.

Is OKX a wallet?

No, OKX is a full-featured cryptocurrency trading exchange, but offers users several custodial wallets as part of its exchange services.

How to use OKX?

Using OKX can be done by going to okx.com, creating an account on the platform, undergoing KYC verification procedures if desired (NOT required for trading or deposits), depositing any trading funds into the account, and finally getting access to the market offerings to begin trading.

User Reviews

- OP reviews trading options on OKX, especially compared to Deribit, and finds that “Overall I rather deribit but also trade OKex for the lower fees and to spread the counter party risk.”

- Most users on Trustpilot rate OKX (formerly OKEX) as excellent or great.

- Some users report issues with having their account frozen. One user goes so far as to say that they rebranded to avoid this type of bad reputation: “Don’t use that exchange. Look up the reviews for OKEx.”

- Redditors discuss a liquidation on OKEx exchange from 4 years ago, which explains how OKX does their futures contracts.