WhiteBIT is a crypto trading exchange that was founded in 2018 in Ukraine and is currently headquartered in Lithuania. Today, they serve over 190 countries, offers over 400 trading pairs, and has over 4M global users.

Note that WhiteBIT is a global exchange and US residents are not allowed to use it. The exchange does require KYC (Know Your Customer) identity verification and document protocols to be completed for use of the exchange. Restricted jurisdictions can be noted here. The exchange sees about $700M of 24H volume as of Q1 2022.

History of WhiteBIT

WhiteBIT was created in 2018, headquartered in Vilnius, Lithuania, and provides its clients with a range of crypto trading pairs and tools such as real-time order books, charting and technical analysis tools, automation features, and more.

The exchange is one of the biggest cryptocurrency exchanges in Europe and has two European licenses in custody and exchange, and a team of about 1000 employees. CEO Vladmir Nosov heads the WhiteBIT executive team. Vladimir is a serial entrepreneur and general management executive with experience in building companies in fast-growing markets using emerging technology.

WhiteBIT is best for:

- Intermediate to advanced cryptocurrency spot investors and traders who desire access to crypto instruments on a global, EU-compliant exchange, along with a core offering of major crypto coins and the WhiteBIT suite of services

- Active traders who desire a low latency platform, competitive trading fees with a clearly defined & fixed fee structure irrespective of volume for makers and takers

PROS

- 270 coins and 350+ trading pairs

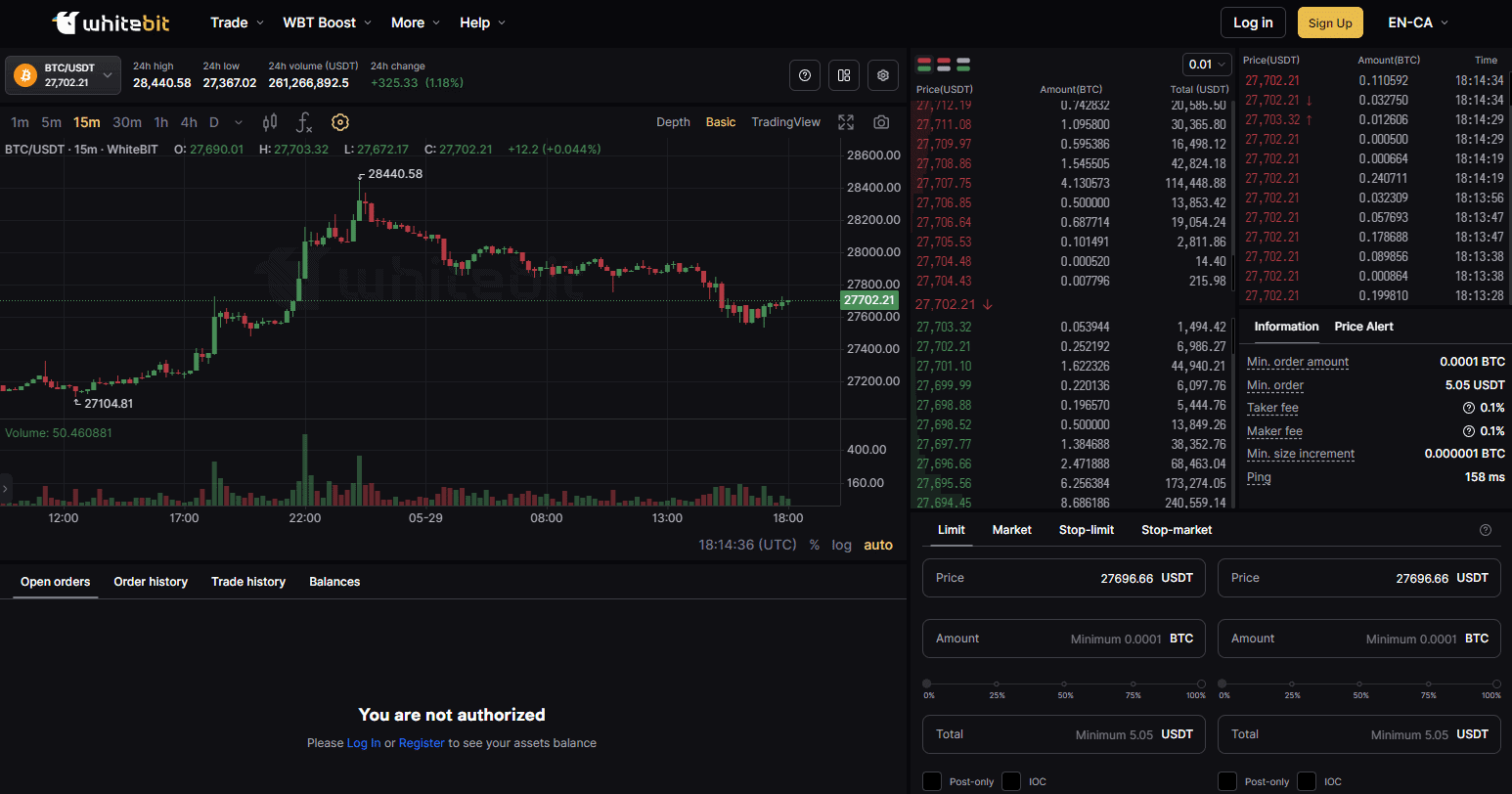

- Simple and convenient UI

- Advanced charting and trading options

- High speed platform

- Mobile and desktop friendly

- “Crypto Lending” product

- Hosts competitions

- Free demo functionality

CONS

- Not available to US residents

- Lack of volume-tiered fee schedule

- Staking service limited in scope

- KYC required

Pros & Unique Features

The biggest perks of WhiteBIT are its wide range of trading pairs and crypto market offerings, with 270 coins and 350+ trading pairs, its simple and convenient trading terminal that also has options for advanced charting and trading features, and the high speed and low latency execution the exchange offers. The exchange’s chief distinction is supporting the processing speeds of up to 10,000 trades every second and 1M TCP connections.

The exchange offers a full-featured mobile app with trading functionality as well, and the online trading portal offers depth of market and order books, advanced order types, and all other tools advanced traders may need. Spot and margin trading is offered with up to a max of 20X leverage, with KYC being required.

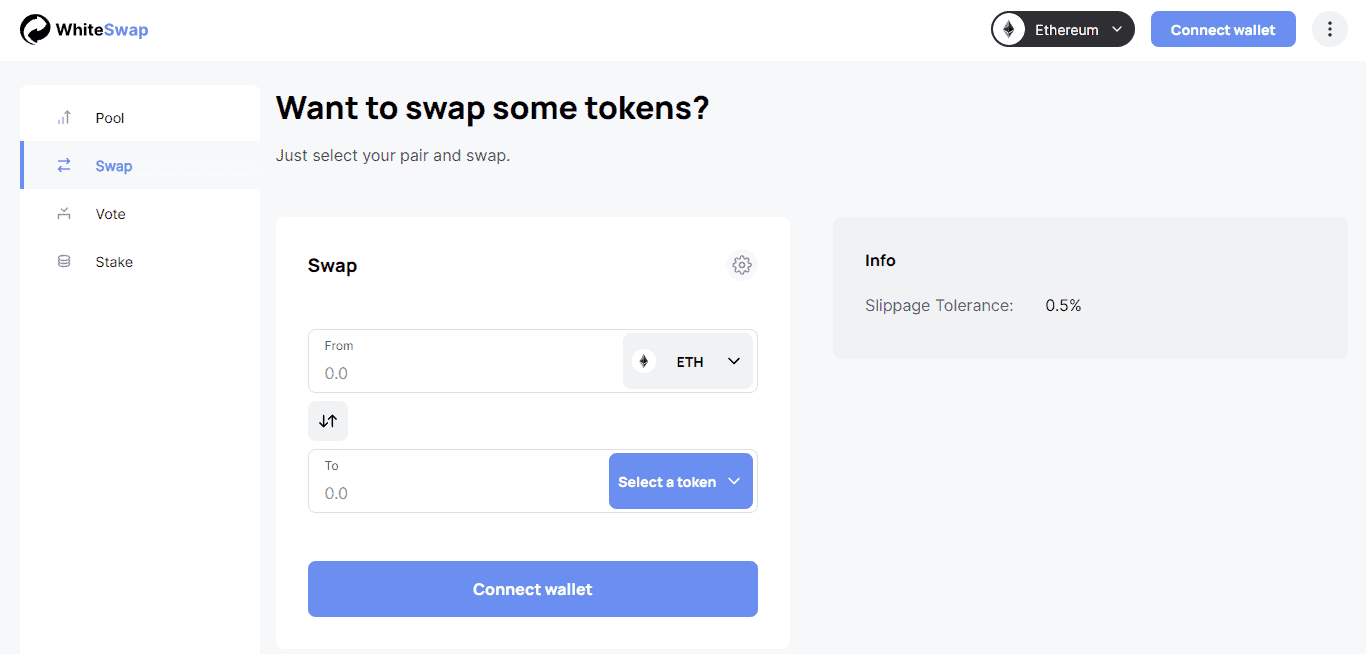

In essence, WhiteBIT is an equivalent exchange to other top contenders with strong spot offerings, such as Kraken, FTX, and others. There are a few trading layouts offered: Basic, Pro with more functionality, a simple exchange to quickly swap between cryptocurrencies a user holds within his or her exchange wallet, and a P2P market. WhiteBIT also offers a DEX (decentralized exchange) on the Ethereum blockchain.

WhiteBIT also offers a “Crypto Lending” product that allows users to stake USDT, BTC, ETH, and other top cryptos for predetermined plans and earn interest. Another benefit of WhiteBIT is that the trading fee is static for all pairs, set at 0.1%, however it does not reduce the trading fees for volume or maker incentives.

The team also hosts trading competitions for users to win real prizes by outperforming other traders. There are no other major crypto financial services offered besides these features, but the platform offers a strong API and highlights its support presence.

WhiteBIT also offers a Demo token which is a demonstrative virtual token that allows users to get acquainted with WhiteBIT’s financial instruments. Users can use this virtual token to test their trading strategies, and it is free to use.

As for customer support, WhiteBIT offers support via website or email, 24/7 in multiple languages.

Cons & Disadvantages

The main disadvantage of WhiteBIT is its lack of crypto financial services compared to other top comparable exchanges on the market, as well as its lack of futures and other advanced derivatives offerings. Thus, it may be an exchange that is better geared to investors and spot/margin traders, whereas advanced and high volume futures traders would prefer options such as BitMEX, FTX, or Binance. Another disadvantage is the lack of volume-tiered fee schedule that is common for crypto exchanges. WhiteBIT instead uses a flat fee of 0.10% for spot and 0.078% daily fee for using funds in margin trading, with no volume or market maker incentives offered, unlike other exchanges.

Its staking service is also quite limited in its scope and not as advanced as the offerings of other exchanges. In addition, US users are not allowed to use the exchange as per terms of service.

US users who wish to transact with more functionality or trading pairs without KYC may opt to use competitors like ByBit, thereby gaining access to a much wider selection of trading instruments such as margin and futures as well. European users would be compliant using WhiteBIT since it is licensed and regulated in the EU.

WhiteBIT Fees

WhiteBIT uses a flat fee model, charging a “standard trading fee.” This model is irrespective of trading volume or maker-taker status like with other exchanges.

Trading fees are 0.1% for most pairs and can vary across pairs, but it never exceeds 0.1%. The daily fee for using funds in margin trading is 0.098%. This fee schedule is simple and easy to understand, however lacks the benefits of reduced fees for higher volume traders.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled.

Other Fees

WhiteBIT charges the following deposit, withdrawal, and other fees:

- No deposit fees for most cryptos, except for some memecoins and low-cap coins—the full list of coins and their deposit fees can be found in this table

- No deposit fees for any stablecoins except for USDT (OMNI) – a 15 USDT deposit fee. USDT on other blockchain networks has no deposit fee

- Deposit fees for fiat range from 1.5%-4.5% depending on the method (credit card VISA/Mastercard) and the currency used. The full list of options and respective fees can be found here

- Withdrawal fees for crypto are present but are minimal and can be found here for each crypto asset

- Withdrawal fees for stablecoins range from none to 52 USDT, can be noted here

- Withdrawal fees for fiat can involve a flat $5 USD fee or range from 1.5-4%, depending on the currency and method, and fees can be noted here

There are no fees for signing up or for having an inactive exchange account, nor any fees for holding funds in an exchange account, and users may hold assets as long as desired.

Account Tiers & Limits

WhiteBIT does require KYC verification for traders and users of the exchange.

Crypto Security

WhiteBIT stores 96% of its digital assets on cold wallets and uses WAF to detect and block hacker attacks. The exchange also uses 2-FA and anti-phishing software to add another level of protection to user accounts. The assets stored on cold storage are protected with multisig access protection.

WhiteBIT has also formed an insurance fund to protect and secure the safety of user assets, which is replenished by contributions from transaction fees. The fund currency insured the assets on WhiteBIT’s cold storage under the coverage plan that amounts to 30M USD.

There is also a live bug bounty program with rewards contingent on the severity of the vulnerability exposed.

There have been no reported hacks or security breaches in the exchange’s history.

WhiteBIT Review Conclusion

WhiteBIT is a good general choice of crypto exchange for investors and spot or margin traders who wish to trade in a permissionless manner, and for accessing some unique memecoins that are offered on WhiteBIT. The exchange has a moderate selection of cryptos offered, and offers some unique features like a demo token for paper trading, as well as full-featured advanced charting and trading tools along with a fast execution trading engine.

However, traders and investors alike who value access to an extensive spot market selection, advanced trading tools with high liquidity in major futures markets plus advanced derivatives products such as leveraged tokens, with volume-tiered fee models and rebates may prefer other crypto exchanges.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable.

- WhiteBIT offers access to 101 coins and 199 trading pairs, for both spot and 5X margin trading

- Intermediate to advanced traders trading margin who desire access to advanced trading tools and charting, alongside the entirety of the WhiteBIT suite of products such as staking and demo trading will enjoy using WhiteBIT’s fast execution trading engine, in an EU-compliant and licensed exchange

Other Alternatives

For customers who desire access to a simpler user interface with far more trading pairs, or those who do not desire to participate in cryptocurrency futures trading either Bittrex, Coinbase, and Voyager can make decent alternatives with a more competitive amount of cryptocurrencies offered to trade and similarly competitive trading fees and functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a much larger selection of cryptocurrencies offered compared to WhiteBIT—402 pairs vs. WhiteBIT’s 101 coins—while active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ, and they all use volume-tiered fee schedules unlike WhiteBIT, which uses a flat fee structure.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to WhiteBIT include Bybit, Phemex, and Kraken.

WhiteBIT vs Coinbase

The major advantage WhiteBIT offers over Coinbase is its availability of margin trading.

WhiteBIT also offers a slightly lower flat fee schedule, but both exchanges offer the option of advanced charting and crypto-to-crypto trading pairs using Coinbase’s Coinbase Pro product and WhiteBIT’s online pro/margin trading and mobile platform.

However, whereas Coinbase offers no margin or futures products, WhiteBIT offers up to 5X leverage. Coinbase however offers a far more extensive selection of spot crypto coins however.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while WhiteBIT is not regulated in the US and US users cannot use it.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either FTX or Coinbase offer may find the choices below equally valuable.

WhiteBIT vs Gemini

WhiteBIT and Gemini are two exchanges with major differences in their fee structure, crypto financial services offers, and regulatory clarity.

There is a slight difference in fees to start: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, which WhiteBIT offers flat fees irrespective of volume or rebates.

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, but WhiteBIT does offer up to 5X margin, but US users are not allowed to use it as per the TOS.

Gemini offers 62 coins and 86 trading pairs which is smaller compared to that of WhiteBIT’s 101 coins and 199 pairs offering, and Gemini’s Gemini Earn product has far more staking selection and higher APY offered than WhiteBIT’s staking services and other financial services products currently offered.

WhiteBIT vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, which is the exact same as WhiteBIT’s 5X leverage for margin traders, but not for US users. Simply put, US users may prefer Kraken for its regulatory compliance and strong track record.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is not quite as competitive as the fee schedule for WhiteBIT which uses a flat fee schedule, at 0.10% standard trading fees. Kraken offers no other fee incentives such as rebates or reductions except for volume, but WhiteBIT only uses a flat fee structure.

Kraken offers a much larger variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin may be ok with either exchange depending on their willingness to KYC and jurisdiction. If an active trader wishes to trade other instruments beyond crypto, he or she may prefer WhiteBIT, but if he or she prefers a much larger selection of crypto only instruments, Kraken wins.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while WhiteBIT is not.

WhiteBIT vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than WhiteBIT—over 351 coins and over 1300 pairs.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs that are not offered even on WhiteBIT or on FTX, the other derivatives leader, at the moment.

Binance’s base maker-taker fee is equivalent in its competitiveness as that of WhiteBIT, starting at 0.1%, however Binance offers further 25% reduction in fees if paid in BNB, so this is a win for Binance, alongside its offering of reduced fee tiers for higher volume and even maker rebates.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to WhiteBIT. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs.

Binance requires full KYC now to trade even spot products, as does WhiteBIT.

Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is WhiteBIT Safe?

Yes, there have been no reported hacks or security breaches in the exchange’s history.

WhiteBIT stores 96% of its digital assets on cold wallets and uses WAF to detect and block hacker attacks. The exchange also uses 2-FA and anti-phishing software to add another level of protection to user accounts. The assets stored on cold storage are protected with multisig access protection.

WhiteBIT has also formed an insurance fund to protect and secure the safety of user assets, which is replenished by contributions from transaction fees. The fund currency insured the assets on WhiteBIT’s cold storage under the coverage plan that amounts to 30M USD.

There is also a live bug bounty program with rewards contingent on the severity of the vulnerability exposed.

How long does WhiteBIT Withdrawal take?

Withdrawals are processed as requested but can take up to 24 hours to fully process. On average, it takes from 30 minutes to several hours for a transaction to be confirmed. However, sometimes it can take from 2 to 14 days if the network is overloaded.

Please note that the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

After processing, the usual timeframe for ACH withdrawals to reach the user’s bank is 2-4 business days, excluding weekends and holidays.

Is WhiteBIT a good exchange?

WhiteBIT is a good general choice of crypto exchange for investors and spot or margin traders who wish to trade in a permissionless manner, and for accessing some unique memecoins that are offered on WhiteBIT.

The exchange has a moderate selection of cryptos offered, and offers some unique features like a demo token for paper trading, as well as full-featured advanced charting and trading tools along with a fast execution trading engine.

However, traders and investors alike who value access to an extensive spot market selection, advanced trading tools with high liquidity in major futures markets plus advanced derivatives products such as leveraged tokens, with volume-tiered fee models and rebates may prefer other crypto exchanges.

Where is WhiteBIT located?

WhiteBIT is registered and located in Tallinn, Estonia. The exchange is covered by two European licenses.

Does WhiteBIT require KYC?

Yes, WhiteBIT does require KYC.

What are the Deposit and Withdrawal Methods and Fees for WhiteBIT?

WhiteBIT offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto asses: deposits and withdrawals—no deposit fees for most cryptos, except for some memecoins and low-cap coins—the full list of coins and their deposit fees can be found in this table

- Withdrawal fees for crypto are present but are minimal and can be found here for each crypto asset

- Stablecoins: no deposit fees for any stablecoins except for USDT (OMNI)—a 15 USDT deposit fee. USDT on other blockchain networks has no deposit fee

- Withdrawal fees for stablecoins range from none to 52 USDT, can be noted here

- Fiat: Deposit fees for fiat range from 1.5%-4.5% depending on the method (credit card VISA/Mastercard) and the currency used. The full list of options and respective fees can be found here. Methods include bank transfer, or using credit/debit cards.

- Withdrawal fees for fiat can involve a flat $5 USD fee or range from 1.5-4%, depending on the currency and method, and fees can be noted here

What is the Minimum Withdraw Amount for WhiteBIT?

The minimum withdrawal amount for each crypto asset and fiat currency ranges, and can be found here in this fee table in detail for each crypto. For reference, the minimum withdrawal amount for BTC is 0.001 BTC.For stablecoins, the minimum withdrawal amount ranges from 10-50 USDT/USDC. For fiat, it ranges from 10-20 USD or EUR equivalent.

How do you withdraw from WhiteBIT?

Instructions for withdrawing from users accounts can be found here from official support sources.

Users can withdraw from the wallet by navigating to the main page of their account and clicking the “Spot Balance” area and then clicking “Withdrawal” for the currency they wish to withdraw.

From there, the user should select the destination address to which he or she wishes to withdraw. Then, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal.

Is WhiteBIT a wallet?

No, WhiteBIT is a full-featured cryptocurrency trading exchange, but offers users wallets as part of its exchange services with which to custody cryptocurrency for trading.

How to use WhiteBIT?

Using WhiteBIT can be done by going to whitebit.com, creating an account on the platform, depositing any trading funds into the account via crypto assets or via third party payment processors if using debit/credit cards, and then getting access to the market offerings and begin trading.

User Reviews

- The official subreddit for WhiteBIT can be found here for user discussion: https://www.reddit.com/r/WhiteBIT/

- u/cheezsandywich reminds other users that there are limits to how many coins or tokens you can withdraw at a time, using the example of the memecoin HOGE.

- A user complains about the hoops they have to jump through to get their assets off the exchange, and that their assets are locked, “I can’t even safely remove my HOGE from their exchange.” But, a commenter replies, rightly, “So you lied about not being a U.S. resident when you signed up for your account, but they’re the ones who are sketchy??”

- u/ranmakane asks if anyone has used WhiteBIT to purchase Safemars, noting it was (at the time of the post) the only place other than PancakeSwap where they could get it. Commenters replied that they had success doing so: “I like whitebit. Dont need to buy binance and send it to whitebit. You can purchase usd on whitebit and exchange it to safemars.”