If you’re searching for ways to make money with crypto, hopefully you don’t rely on the old buy-and-sell method. Timing the market is a game of luck rather than skill.

Using Decentralized Finance (DeFi), there are much better and safer ways to earn. DeFi is transforming the way we think about and interact with money. It opens up a universe of possibilities, from earning interest on your digital assets to borrowing, lending, and even trading in ways that were unimaginable a decade ago.

And the best part? You don’t need to be a tech whiz or a finance guru to start.

Whether you’re new to the crypto scene or looking to expand your knowledge, this article will walk you through the basics of making money with crypto in the world of DeFi. We’ll explore the various avenues available to you, demystify the jargon, and provide practical tips to get you started.

So, grab a cup of coffee, settle in, and let’s dive into the exciting opportunities that DeFi offers to anyone willing to learn and explore. (And if you are interested in a more in-depth guide, you can join our WhiteboardCrypto Club!)

What is DeFi?

Most people we’ve talked to over the years think that to make money with crypto you have to buy it and sell it—you know, “buy low, wait for Elon to make a tweet about it, and sell high to make a nice profit.”

This is kinda sad, because most people lose money with this route. You can’t make Elon tweet, and you don’t know if the price will actually rise. Instead, if you learn about DeFi, you can find more consistent, reliable ways to make money.

We do need to note that there is no guarantee this will make you money. Crypto is risky, you can always lose what you put in, so don’t invest what you can’t afford to lose.

The ways to make money with DeFi that we’ll cover are: lending, borrowing, trading, and investing.

Lending

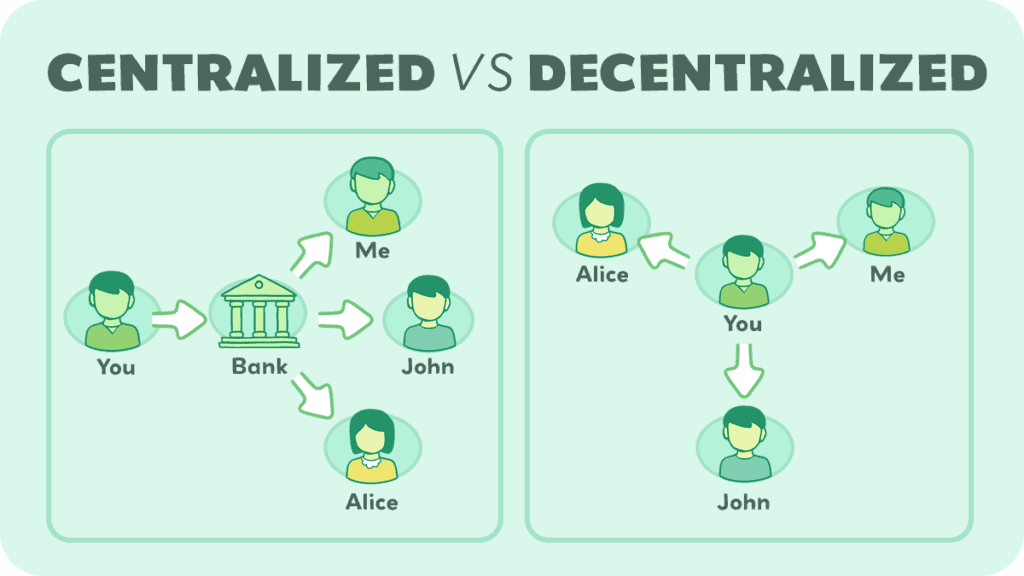

Lending means letting other people borrow your crypto. You may have heard about this through things like Binance referrals, but this is NOT DeFi. In fact, this is CeFi (Centralized Finance).

In DeFi, you control your own money, you can move it when you want, and don’t need anyone’s approval for any of this. When you use a company like Coinbase, you are actually giving them your crypto. And I think they have a waiting period to withdraw, and technically they have to approve it.

CeFi’s rates are usually around the same average return as the regular stock market—or less!—so there’s not much benefit to using them.

There are three benefits to lending with true DeFi:

1) Higher rates

DeFi will always have higher rates than centralized options. The big reason is that fewer people are accessing them, so there is more money to be earned per person.

Another reason is that increasingly more money is being thrown into it so to encourage users to use their platforms, developers offer higher rewards, and sometimes even for free! (You can see our article about airdrops to understand how that works)

2) True control

If I deposit my money onto an exchange like Binance or Coinbase, they ultimately control it. They could technically lend it to someone overseas, get in trouble with the SEC, file bankruptcy and then leave the country so I never actually get my money back.

In DeFi, the only person who can send your funds is the person with the private keys, which should only be you—unless you give them out. Not even the government can step in and take your crypto, unless they can force you to give up your private key.

3) It’s all collateralized

Remember how in 2008 we had the big mortgage crisis? To sum it up, this happened because a lot of people were taking out loans that they could never pay back. To put it bluntly, you cannot do this in crypto.

Every crypto loan is actually over-collateralized, meaning if you want to borrow $100, you need to deposit $120 first. This is in case the markets go crazy and prices suddenly change, the lender (the person you’re borrowing from) will always have access to their funds.

If there is ever a time where what you have borrowed is worth less than what you deposited, you will be liquidated, meaning the smart contract you made the deposit and withdrawal with will automatically give the lender the initial value back.

You may be asking why you would pay $120 just to borrow $100? The answer is pretty simple: maybe you want to deposit ETH and then borrow USDC. You are actually creating a leveraged position. Or maybe you want to do it the other way around to deposit USDC and borrow ETH, creating a margin position.

Either way, it means that for us lenders, we make money for the rates the borrowers pay us, and the risk is super low. This is already probably getting too confusing if you’re new to this, so let’s move on.

Where to Lend?

There are actually two big lending platforms in the DeFi world: Aave and Compound. But this video is just to lead you down that rabbit hole. If you want your hand held, you might want to join our WhiteboardCrypto Club we mentioned in the intro.

Providing Liquidity

The next way to make money after lending is called providing liquidity. Now generally, providing liquidity is a little more risky, but let me explain what it means.

In the old financial world, the way we sold things like stocks was literally to match a buyer with a seller. A buyer put up an order, like “I wanna buy 5 stocks for $100.” And then they just had to wait for some seller to agree to that sale, and then the trade would happen.

In crypto, we have developers using code and programming to make this process way better. In the world of DeFi, we use special algorithms like automated market makers, but we get into that on its own page as it’s pretty complicated for this already long article.

So, in DeFi, we use pools of money. You can go to a pool and say “I have this much money, how many tokens can you give me?” The pool would do some calculations and say “I can give you this much.” Then you can either agree or decline.

The big question is, how do you make money with this? The answer is simple. You give your money to that pool. Since every trader who uses the pool pays a fee, some of that fee goes to you. This is very similar to how lending works.

The downside is that there’s this thing called impermanent loss. This means that if one of the tokens you gave to the pool goes way up or way down, you would not make as much money as if you had just bought and held the tokens.

Usually, the trading fee you earn from lending to the pool is much more than impermanent loss. Nevertheless, we’re here to deliver value, so let’s go over three specific ways to provide liquidity going from the least risk to the most.

1) Providing liquidity to stablecoins

The safest way to provide liquidity is to provide two stablecoins. This is because the price of both tokens will hopefully always equal $1. Meaning you won’t gain any price appreciation, and that the value of your initial deposit will remain stable.

What I mean by this, is that you can deposit Tether, or USDT, and USD Coin together to let other people trade back and forth with your money. Some guy comes along and wants USDT but has USDC, so he trades.

Some other guy comes along and trades them back, all the while, they’re paying small fees that you earn. So even if the crypto market tanks 50% or even 80%, you’ll still have your initial deposit without a fear of losing it with the crypto crash, since the stablecoins should stay at $1.

2) Providing liquidity to strong pairs

Next up, you can provide liquidity to strong assets that are somewhat tied to each other, to still have exposure to these coins, while also earning the trading fees.

The Curve Finance pool called aTriCrypto is a great example. You deposit 33% stablecoins, 33% ether, and 33% bitcoin, and then earn the fees that traders pay to make swaps of your money. Generally, ether and bitcoin will trade together, as they are both big cryptocurrencies.

By doing this, you can reduce your risk of one of these coins completely collapsing. You’ll also earn a decent fee because there are a lot of people trading in between these 3 tokens all the time.

3) Providing liquidity to risky pairs

Finally, if you really want to ape into DeFi and earn some crazy fees like 400%, you can provide liquidity to tokens that are much riskier.

Usually unprecedented rewards are given to incentivize people to provide liquidity to either new tokens or risky tokens. The tradeoff is that you get a very high fee, however you risk one of the tokens in the pool dropping in price significantly.

It’s also worth noting that when providing liquidity, you’re exposed to a magical effect that hardly any beginners understand called ‘impermanent loss’. This happens when you provide liquidity and the total value of your share is less than if you had simply held the tokens you provided.

It matters most when a token more than doubles in price or drops by 25% or more. If you’re interested, I’ve actually coded a unique calculator to help people understand how it works. On that page, I spend a lot of time making it so simple that any beginner could read through it, test out the calculator, and hopefully get a decent understanding of Impermanent Loss.

Incentives

This one is really simple, but the thing is you just have to know about it. For this section, I’m going to explain two sides, one is incentives and the other is airdrops.

So imagine if you’re in charge of advertising a blockchain network so that more people will know about it and use it. How do you do it? Well, you could buy a billboard, that might work, but the issue is 99% of people that see that billboard won’t know anything about crypto, because we’re so early.

Another thing you could do is buy ads on the internet. The issue with this is that there were a ton of scams that happened in 2017 and 2018 because they would just run ads for their scam, cash out, and then hide for the rest of eternity, so a lot of places on the internet don’t allow crypto ads.

Even more so, we can assume TV ads or radio ads wouldn’t work. So, what do you do?

What if you just took that advertising money and literally just gave it to the people using your blockchain? This way they get excited, and tell their friends or family, AND you can literally prove that your marketing dollars are working because they HAVE to use your blockchain to get the money.

This is exactly what is happening right now in the crypto world. In fact, one blockchain called Avalanche announced something called the Avalanche Rush incentive program, where they gave away a bunch of tokens for free, just for using them.

When they launched it, the total amount was worth $180,000,000, but now it’s valued at over $720,000,000.

The NEAR blockchain just announced an $800,000,000 incentive program too. The Fantom network is taking a different approach by offering millions of dollars to developers who create certain applications on their blockchain.

Money is being given to people just for using the blockchains and trying out platforms, and you can be one of those people.

Speaking of trying out platforms, the second part of this includes airdrops. Let me explain this simply. Let’s say you’re a company, but you want to go public. You sell your shares, and people who buy your shares get access to the company’s profits, but more importantly they get a vote in the decisions of the company.

If they hold a large amount, their decisions really matter. For crypto applications, they don’t have companies or stock. Instead, they have tokens. So if you hold a bunch of tokens, you get some of the profit from the platform, and also you get to make decisions to the platform moving forward.

A few weeks ago, a platform called ENS launched a token so that holders could make decisions to their platform. Instead of straight up selling it, they just said “we’re going to take a look at who has used our platform, and give the users our tokens”. And they did that.

That is called an airdrop. Everyone who used the platform before a specific date earned free tokens. Personally, I got 213 tokens, and sold them within a few hours for a nice $5000.

The issue is, if I held them, they’d be worth a lot more, but I incorrectly assumed if everyone was getting $5000, they’d sell too. Maybe they did, but big companies like Coinbase and other large market movers bought them up.

Because of this, the price spiked all the way up to $80. One of our viewers who contacted me on Discord said he sold his 200ish tokens for a nice $17,000 during the peak. It was actually surreal to me when he said these exact words: “It was because of your ENS video that I bought my domain.”

Anyways, this is actually the second valuable airdrop I have received. The first was for using a blockchain bridge and it was worth around $1500.

Conclusion

Wrapping this up, there is so much money being moved into the crypto and blockchain space that just by being around and keeping your eyes open, you can probably earn some decent money.

The trade off is that as more people get into the space, these incentives, airdrops, and even lending rates will start to drop. There will also be more scams.

Regarding that, I want to make a quick note that I will NEVER contact you in the comments or in DMs. Those are scammers and impersonators.

I highly recommend never to reach out to anyone in the Youtube comments. They are there to take your money.

Thanks for reading, we hope you enjoyed it, and we really hope you learned something.