In this article, we are going to cover liquidity pools using stories, examples, and analogies so the concept is broken down so much your grandpa could understand it. At least, that’s what we keep saying.

If you don’t know what liquidity pools are, you should be excited to learn about them. Liquidity Pools are not imaginary pools filled with water, they are pools filled with money. In fact, they are actually smart contracts that allow traders to trade tokens and coins even if there are no buyers or sellers out there.

A liquidity pool is a collection of funds locked in a smart contract that provides liquidity to facilitate trading on decentralized exchanges. It allows users to trade assets without the need for a traditional buyer and seller match, by pooling their assets together and earning fees based on the trading activity in the pool.

Trading in the Traditional Stock Market

First, let me explain how the traditional stock market works. It uses what is called an “Order Book Model.” This means all the buyers and sellers write down and submit orders for how much of a stock they want to buy and at what price.

When two buyers and sellers meet at the same price, the trade is transacted. The buyer gets the stock and the seller gets the cash.

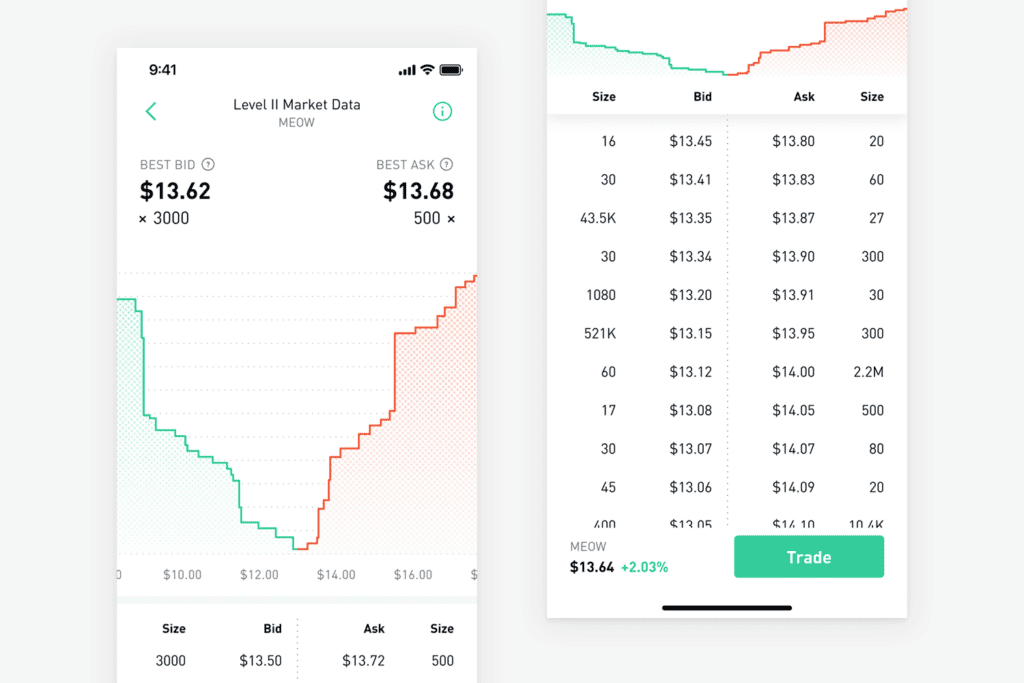

For example, an order book might look like this:

You can see someone is asking to buy 16 stocks for 13.45, and someone else is asking to sell 20 stocks for 13.80.

Essentially, when you want to buy a stock on Robinhood at “market price” you are just submitting an order to buy all the stocks at the current price that sellers are willing to sell for. If you look on this graph (the left one) you can see how many buyers and sellers there are at different prices.

This is very inefficient because you have to set a price that someone else is willing to buy—at least if you want to sell your stock or buy a stock immediately.

Liquidity Pools

So what’s the solution? It’s a liquidity pool that uses an algorithm. With this algorithm, we will ALWAYS be able to buy and sell an asset, no matter how high or low the price is, no matter what time of day it is, no matter if there is a buyer or seller to meet our needs.

A liquidity pool is a pool of money that contains both assets you are wanting to trade. For this example, we are going to be using ether (ETH) and Basic Attention Token (BAT).

Before we continue, you highly recommend reading our article on smart contracts because they are the technology that allows a liquidity pool to exist. A liquidity pool is nothing more than code. It is a smart contract written in a way that will hold funds, do math, and allow you to trade based on that math.

The pool starts off with an exact ratio of 50:50. This means if you wanted to give the pool $500 to trade with, you must give it $250 of Ethereum and $250 of BAT.

Why? Well, you’ll see in a minute.

Most liquidity pools use an algorithm called “a Constant Product Automated Market Maker” and if you have no idea what that is – we HIGHLY recommend you read our article on it because it breaks down the math using examples and the algorithm using an analogy. We think it’d be super helpful!

Anyways, as you buy more and more BAT from the pool, by giving it ETH, it will slowly raise the price that you are paying for each BAT.

For example, the first BAT might be $1.20. The next BAT might be 1.20 and 1/10 of a penny, then the next BAT might be 1.20 and 3/10 of a penny…. and after you buy 100 BAT, the price might be $1.50.

So think about it like this: as you buy more and more BAT, the liquidity pool charges you more for each one. This is because it wants to keep a perfect 50:50 ratio of ETH and BAT.

Well, as you’re buying more BAT, you are giving it ETH, so it thinks the price of ETH is dropping, and to keep the 50:50 value ratio, it will raise the price of BAT.

If you’ve made it this far without reading our AMM article, congrats, but if you’re confused… go read that article and this one will make almost perfect sense.

Something to keep in mind with liquidity pools is that every transaction has a tax, it will cost a very small percentage of each trade to make the trade. We will go over where that money goes in a minute.

Routing

One thing I want to mention, is what if we have a bunch of Basic Attention Token and want to trade it for some of the Graph Token (GRT)? Well, most DEXes will just hook up two liquidity pools to allow you to perform that trade.

For example, you tell it you have BAT and want to buy GRT. It’ll do two swaps. The first one will be BAT to ETH, then it’ll do ETH to GRT. Essentially, it’s swapping out BAT for GRT for you.

The technical term for this is routing. The decentralized exchange will route some trades for you so that you can essentially trade any token on their platform for any other token.

Liquidity Providers

So now that you know roughly how a liquidity pool works, let’s go over why you would want to put money into one. When you put money into a liquidity pool, you are called a liquidity provider.

Remember how I said every trade takes a very very small fee? Well, as more and more people trade, those fees add up. Where do those fees go? They go to the liquidity provider.

So let’s say you put $500 of ETH and $500 of BAT into a pool. Your friend decides to join you, so now there is $2000 total in the liquidity pool.

As people are trading in and out all day long, let’s say you rack up $150 in fees. Well, since you owned 50% of that pool (because your friend owned the other half) you earn $75 for providing that liquidity.

Yes, these fees can add up to a substantial amounts—some DEXes offer up to 500% APR—this is because they are making a boatload of money from the fees and since this technology is new, there aren’t very many investors.

As more people join the pool, your cut gets less and less, but it also makes the price more stable. As the pool grows in liquidity, it takes much more money to move the price of both assets.

For example, if someone came to your $2000 liquidity pool and dropped in $500 to trade ETH for BAT, they could raise the price of BAT a whole bunch because they essentially bought a ton of it up. Now there’s not much in the pool, but there’s a ton of ETH, and because of how the AMM algorithm works, BAT will cost more, and ETH will be cheaper.

Well, if there was $5,000,000 of liquidity in the pool, that same $500 buy wouldn’t move the price much because it would barely take any BAT out, and barely give any ETH, in proportion of how big the pool is.

Price Impact

A term you need to know is Price Impact. This means “How much can I affect the price by buying from this liquidity pool?”

If the pool is small, there will be a high price impact —you will affect the price a lot—and in some cases you can double or triple the price of an asset very easily. However, as the pool gets larger and larger, the price impact gets smaller, and large buy-ins affect the price less.

Arbitrage Traders

Another thing worth mentioning is something called “artbitrage traders.”

Remember how I said if someone buys a bunch of BAT, that the price of ETH would drop? Well, at least in that pool. ETH might be $450 for each ETH in that pool after someone gave it a ton of ETH to buy BAT.

Well, what if you could sell ETH to Coinbase for $500? You could go buy a bunch of ETH from that pool and sell it to Coinbase and make $50 off every ETH you sell.

This is called arbitrage trading. And you might be like, “Why are they going to trade if all they are going to do is scoop up the profits?”

Well, that is exactly what they are doing, but they are also paying that .3% fee, AND they are helping to keep the pool prices the same as other exchange prices—they are essentially helping to keep a stable price of that token by ensuring it’s the same price among all exchanges. If it’s not, they can buy at a place that sells it cheap and sell at a place that buys it at a higher price.

One more thing about the power of liquidity pools. They can get very complicated very quickly. For example, Balancer is a platform that currently allows up to 8 assets in a single liquidity pool—the math on that is crazy, but it shows the limitless possibilities of DeFi.

Risks

There are also risks involved with investing in liquidity pools. For example, two big ones are Impermanent Loss and Rug Pulls.

Impermanent loss is when the value of an asset lowers or raises crazily. And rug pulls are when the pool doesn’t actually give any of the funds back.

Those are both topics for another video, but you should keep them in mind when investing in these highly profitable liquidity pools.

Conclusion

Liquidity pools are great ways to make money, but they are also great ways to facilitate more financial freedom.

Thanks so much for reading, we hope you learned something, and we’ll see you in the next article!