Crypto.com is a cryptocurrency exchange that was founded in 2016 and today serves over 10M customers worldwide across 90 countries with a unique suite of cryptocurrency financial products and a full-featured mobile app.

As of Q4 2021, Crypto.com averages around $3-4B USD in daily trading volume, offering over 150 coins to trade, and serves over 10M users around the world.

Crypto.com requires all users to complete KYC (Know Your Customer) identity verification to comply with regulatory laws and is available to use for US investors except in New York state.

History of Crypto.com

Crypto.com was founded in 2016 in Hong Kong and originally called Monaco Technologies. Their founding mission was to speed up the world’s transition to cryptocurrency. Although the exchange began as a crypto payment product, it has now evolved into a full fledged crypto financial services platform and popular cryptocurrency exchange and hub.Crypto.com is headquartered in Singapore.

In Nov. 2021, Crypto.com made headlines across the crypto industry for purchasing the naming rights to the Staples Center in Los Angeles for 20 years for $700M USD, one of the richest sports naming rights deals in history. The company has aggressively pursued sponsorship and marketing deals throughout 2021, building crucial brand awareness to capture market share in the growing digital currency industry. The CEO today is Kris Marszalek, one of the original founders.

Crypto.com has focused thus far on making crypto more accessible to a mass audience and innovating in the realm of crypto financial services. The crypto.com ecosystem uses the native CRO coin for reduced fees across the exchange for stakers. CRO is an intermediary currency which allows cryptocurrencies to be converted into their fiat counterparts at a heavily reduced cost.

Crypto.com is best for:

- Investors and traders of all skill levels who desire an all-in-one crypto services platform offering trading, investing, lending, earning interest, DeFi, and NFTs, along with a mobile app with full functionality as well as an online platform for both spot investing and trading with extremely competitive fees that can be reduced further by staking CRO

- Beginners to cryptocurrency and US investors who do not need advanced margin and futures trading options, but rather prefer a simple buy/sell interface and desire the ability to dollar-cost average into the crypto market with a mobile app

- Crypto-only traders and investors who wish to get access to the entire Crypto.com suite of products including the Visa card with up to 8% CRO rewards on purchases, Crypto Earn, the lending program, NFT marketplace, and the DeFi suite of products

PROS

- Competitive fees

- 150 cryptocurrency market offerings

- Over 260 pairs

- Visa Debit card

- Crypto pay for business

- Spot and margin trading

- DeFi wallet and NFT marketplace

- Lending, staking, and OTC trading

- Mobile and browser-friendly

CONS

- Not extensive futures or leveraged tokens

- No advanced trading and charting platform

- Banned in New York

- 40 of the current coin offerings are restricted in the US

- Not very user-friendly UI

Pros & Unique Features

The biggest perks of Crypto.com are its competitive fees, service to US investors, moderate selection of listed cryptocurrencies and trading pairs, and its wide range of crypto financial services including several payment cards, crypto pay at checkout, and several ways to earn on your crypto assets.

Crypto.com offers over 150 cryptocurrency market offerings and over 260 pairs, which is a moderate and smaller selection as compared to exchanges such as Binance and KuCoin, but a decent selection and range for US investors.

For investing and trading, Crypto.com offers spot trading, margin trading that is limited to only BTC/USDT at the moment. There is not an extensive list of futures products or leveraged tokens offered however the exchange has recently added a BTCUSD perpetual contract with up to 50x leverage.

After account setup and KYC verification, users can trade crypto in the exchange or through the DeFi wallet which is a decentralized exchange that allows users to swap crypto with other users, giving them full control of their private keys.

Crypto.com also offers an easy-to-use user online and mobile app interface with full buy and sell functionality better suited for beginner traders or buy-and-hold investors, as the charting tools in the mobile app are limited, however the app offers full access to the exchange’s range of financial services, noted below.

Other main products offered by Crypto.com include the Visa card, with 5 card tiers offering up to 8% CRO rewards on purchases, depending on the amount of CRO staked by the user. The exchange also offers Crypto Pay, where users can buy gift cards with crypto or select crypto pay at checkout at certain retailers to pay using crypto. Crypto Earn is another offering, where users can earn up to 14% per annum on crypto deposits locked for varying lengths of time the user can pick from.

Crypto.com also offers the Syndicate, a discounted listing platform for the most popular crypto projects that allows users to buy top coins at up to 50% off by subscribing to new events. A trading arena for competitive trading is another product offering. The online site also recently launched Supercharger, another way to earn on deposited crypto.com with high APYs on several top cryptos.

Crypto.com has a DeFi and NFT suite of products as well: the exchange offers a DeFi wallet for users to retain full control of their cryptos and private keys, DeFi Swap, a fork of Uniswap, a popular decentralized exchange, that allows users to swap and farm DeFi coins, but this is not available in the US. DeFi Earn allows users to receive the best returns by depositing tokens into the highest APY protocol and it integrates with Aave, Yearn, and Compound, which are popular and established DeFi protocols on Ethereum, as well as with Cosmos Staking, and native CRO Staking. Crypto.com’s NFT marketplace allows users to access exclusive NFT collections and brands, buy NFTs using just their credit/debit card, and sell collectibles in the marketplace.

An OTC portal is also available for traders wanting to move large transaction volumes in large blocks with competitive rates, with a minimum order of 50,000 USD equivalent and maximum of 1M USD equivalent, and only a few key pairs are supported as of now. OTC trading is only available to selected institutional and VIP users.

For non-US based users, Crypto Lending is another product that allows users to borrow up to 50% of their crypto collateral with a crypto loan that must be repaid over a 12 month timeframe. Note that a select few cryptocurrency offerings are not available in certain US states and 22 coins are not available to US residents.

As for customer support, Crypto.com offers support tickets users can leave either online or through the mobile app. For user education, the app offers a feature called Mission that enables users to learn about the Crypto.com app features and get rewarded along the way.

Cons & Disadvantages

The main disadvantage of Crypto.com is that it is geared more to those wanting a complete crypto financial services platform or an exchange for buy-and-hold investors rather than one for highly active advanced traders looking for the most advanced trading and charting platform or for one offering an extensive list of advanced futures and leverage products.

While its financial services suite is impressive with the competitive Visa card rewards on purchases, crypto lending options, and the exchange offers a moderately large selection of cryptocurrencies, advanced traders looking for advanced charting, order types, and functionality will find the mobile app lacking and its margin system and futures products are not as extensive as compared to competitors like Binance or FTX.

The exchange can be difficult to navigate, the coins are not all universally available in the US, there is a lack of comprehensive educational resources that competitors Coinbase and Binance offer, however the benefits of staking the native coin CRO in reducing fees and improved rewards are impressive.

Note that US residents of New York cannot sign up to Crypto.com exchange and almost 40 of the coins offered are not available in the US due to regulatory concerns. US customers also at this moment do not have access to use their crypto assets as collateral to obtain a loan.

Crypto.com Fees

Crypto.com charges a minimum 0.4% spot trading fee and reduces this fee based on 30-day trading volume as well as amount of staked CRO coin. The user must stake at least 5000 CRO to reduce fees.

The unique fee schedule Crypto.com uses offers up to 100% off of the standard fee schedule if the user stakes CRO coins. KuCoin assigns Trading Fee Levels to users and uses the common maker-taker model to assign the fee schedule.

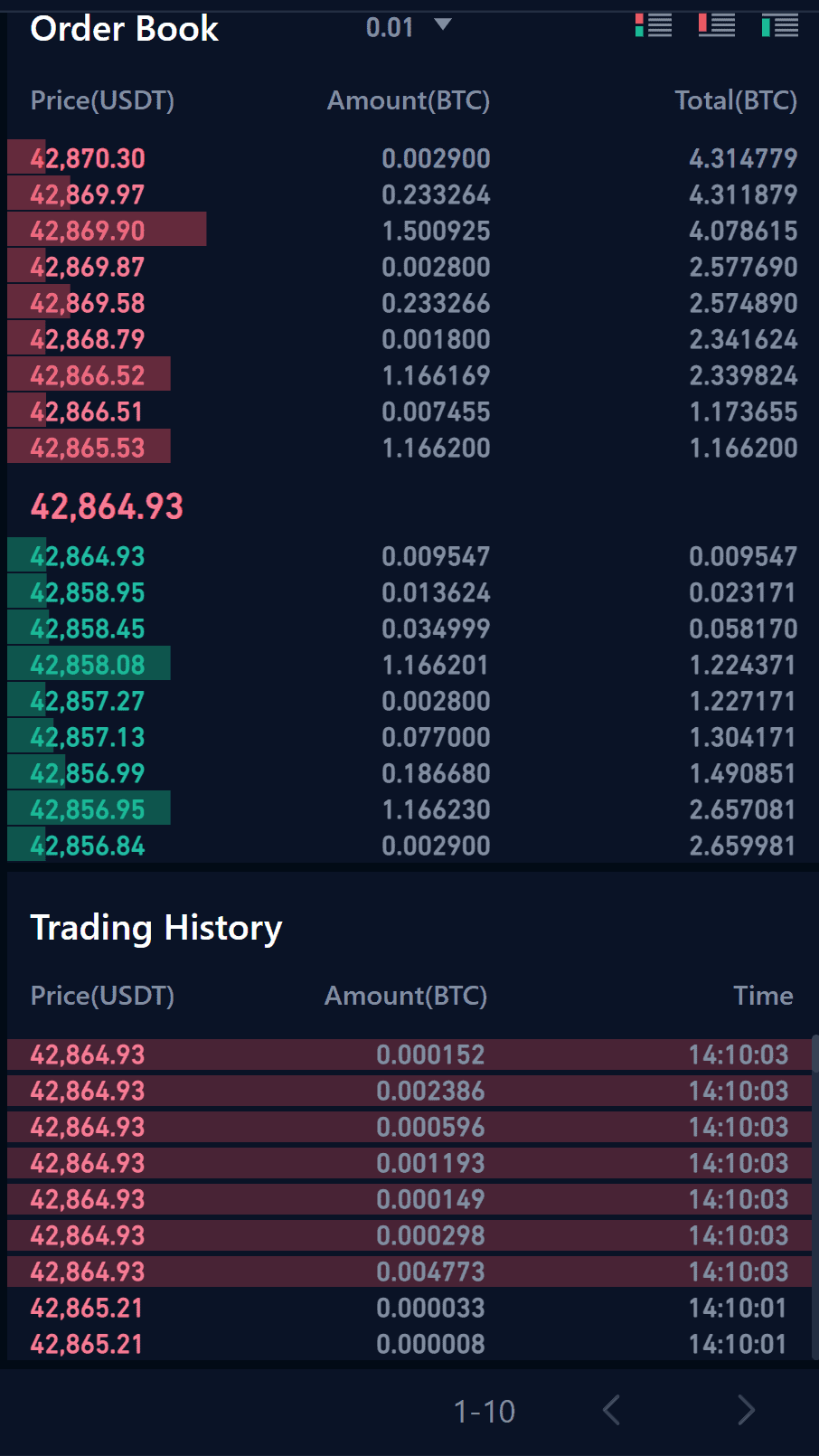

Taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (adding to the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook. If an order goes on the order book partially or fully (a maker order), any subsequent trades coming from that order will be as a “maker.”

Crypto.com’s spot trading fees are determined based on a user’s trading volume over a 30-day period (in USD) and the user’s staked CRO balance. The derivatives trading fees have higher minimum starting percentages but also offer the same reduced fee schedule in accordance with the staked CRO balance.

The table below shows the tiered fee structure for the standard fee schedule; the fee schedule reduced by staking CRO is shown in the next table.

Crypto.com Spot Trading Fees Based on 30-Day Trading Volume (USD)

| Trading Fee Level | Spot Trading Volume Last 30-Day (USD) | Maker Fees | Taker Fees |

|---|---|---|---|

| LV1 | $0-25K | 0.40% | 0.40% |

| LV2 | $25K-$50K | 0.35% | 0.35% |

| LV3 | $50K-$100K | 0.15% | 0.25% |

| LV4 | $100K-$250K | 0.1% | 0.16% |

| LV5 | $250K-$1M | 0.09% | 0.15% |

| LV6 | $1M-$20M | 0.08% | 0.14% |

| LV7 | $20M-$100M | 0.07% | 0.13% |

| LV8 | $100M-$200M | 0.06% | 0.12% |

| LV9 | $200M and above | 0.04% | 0.1% |

Discounted Fee Schedule Based on Staked CRO

| Staked CRO Amount | Discounted Maker-Taker Fees |

|---|---|

| ≥ 0 CRO | 0% off |

| ≥ 5,000 CRO | 10% off |

| ≥ 10,000 CRO | 20% off |

| ≥ 50,000 CRO | 40% off |

| ≥ 100,000 CRO | 60% off |

| ≥ 500,000 CRO | 70% off |

| ≥ 1,000,000 CRO | 80% off |

| ≥ 5,000,000 CRO | 90% off |

| ≥ 50,000,000 CRO | 100% off |

Note that trading fee discounts noted above are given in the form of CRO rebates. To receive the CRO rebates, the user must take CRO on the crypto.com exchange and pay trading fees with CRO. The rebate amount is determined by the amount of CRO staked and trading fees paid with CRO the day before.

Crypto.com also assigns VIP tiers for users trading >1-3% of the total exchange volume and these users can enjoy reduced trading fees off of both spot and derivatives instruments.

Other Fees

Crypto.com charges the following deposit and withdrawals fees:

- No bank account deposit fees, retail accounts may deposit a minimum of 500 USDC equivalent, maximum 100k USDC per day, and maximum 250k USD per month. Retail accounts may withdraw a minimum of 500 USDC per day, a maximum of 50k USDC per day, and a maximum of 500k USDC per month. Note for bank transfers, a 25 USDC non-refundable fee is applied to every withdrawal.

- Institutional accounts may deposit a minimum of 500 USDC and there are no max limits; for withdrawal, institutional accounts may withdraw a minimum of 500 USDC and the daily maximum is 10M USDC per day

- No extra deposit fees on any crypto assets but note that the blockchain network the user is transacting in will charge fees

- Crypto withdrawal fees can be found here

- 2.99% debit/credit card transaction fee (waived for first 30 days on app)

- No ACH transfer fee, minimum of $20 required

- No wire transfer fee, minimum of $5000 required

- Sending crypto to other Crypto.com app users is free

- Exchanging crypto to crypto is free

There are no fees for signing up or for having an inactive Crypto.com account, nor any fees for holding funds in a Crypto.com account, and users may hold assets as long as desired.

Account Tiers & Limits

Crypto.com requires KYC identity verification for all users. The fee schedules are noted in the tables above based on 30-day trading volume.

“Advanced level” verified users can deposit, trade, and withdraw crypto, however withdrawals in cryptocurrency have a limit equivalent to 100 BTC per day. The required information to become an advanced level user is noted here. The majority of Crypto.com app users who connect their account to the Exchange will be at this “advanced” verification level.

Crypto Security

Crypto.com approaches security by screening all deposits for compliance and having a dedicated team monitor all transactions on the exchange.

100% of user cryptocurrency funds are held offline in cold storage wallets, as the exchange maintains a strategic partnership with Ledger, integrating its institutional-grade custody solution, Ledger Vault.

Crypto.com also uses techniques such as hardware security modules and multi-signature technologies. There is an insurance fund in the amount of $750M against physical damage or destruction of the cold storage, as well as third-party theft.

Only corporate funds are held in hot wallets, primarily for the purpose of ensuring smooth day-to-day withdrawal requests from customers. HSM, multi-signature, and key-generation technologies keep these funds secure.

Other security features include multi-factor and 2-FA verification using password, biometrics, email, phone, and Authenticator, in addition to mandatory address whitelisting through email verification and device management. The Crypto.com wallet provides private keys that are encrypted locally on the user’s device.

User’s fiat currencies are held in regulated custodian bank accounts. For US customers, USD balances are held at FDIC member banks and insured up to $250,000 USD. Crypto.com also provides 24/7 live customer support.

Crypto.com Review Conclusion

Crypto.com offers a competitive all-in-one platform of crypto financial services that shines in its native CRO staking incentives and Visa card offering up to 8% CRO rewards on purchases. All types of investors, beginner to advanced, will appreciate access to the suite of products including earning, staking, lending, loans, DeFi, and an NFT marketplace. Users who stake CRO will enjoy the competitive fees with higher volume staked.

While it does not have the most competitive fees unless a user stakes a large amount of CRO, Crypto.com offers a moderate amount of cryptocurrency selection and trading pairs that is more limited for US users, basic margin trading and 1 futures trading pair with 50X leverage max, competitive crypto interest options, and a well-functioning mobile app and online exchange.

- With a tiered fee schedule based on 30-day USD trading volume and reduced-fee structure if the user stakes CRO, Crypto.com’s trading fees compete favorably with other competitors such as Coinbase and Gemini, while also offering a similar amount of crypto coins and trading pairs, and more than US-specific competitors Binance US and FTX US, however the fees cannot compete with them

Other Alternatives

For customers who desire access to a more simple user interface without as many trading options or products, or those who do not desire to participate in cryptocurrency futures trading, Coinbase and Voyager can make great alternatives with a similarly competitive amount of cryptocurrencies offered to trade.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning, an area where Crypto.com lacks.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users and has a large selection of cryptocurrencies offered—405 pairs vs. Crypto.com’s 265 pairs—while active traders who need access to order books and advanced charting functionality will prefer using Coinbase Pro, FTX, Binance, or Kraken, though their fee structures differ significantly. Crypto.com’s mobile app does not offer advanced charting functionality, but their online exchange offers better charting.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Crypto.com include Gemini, Voyager, and eToro.

Crypto.com vs Coinbase

The main advantage Crypto.com offers over Coinbase is its slightly lower fee schedule along with the option to further achieve fee reductions in the amount of anywhere from 10-100% off fees with larger amounts of CRO staked, an option which Coinbase does not offer.

Coinbase’s fees start at 0.5% for both makers and takers for the lowest fee tier, while those of Crypto.com start at 0.4% for spot trading for both makers and takers, before any reductions from CRO staking are accounted for.

Both exchanges offer the option of advanced charting and crypto-to-crypto trading pairs using Coinbase’s Coinbase Pro product and Crypto.com’s online exchange, but the mobile app does not offer advanced charting. Coinbase Pro does not offer margin trading any longer, while Crypto.com offers margin spot trading only for BTC/USDT, and 1 futures pair with up to 50X leverage – neither options are open to US investors.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Crypto.com is a top 5 crypto exchange by daily trade volume, and is based in Singapore but serves US investors with KYC regulation.

Ultimately, advanced users who desire more competitive fees than what either Crypto.com or Coinbase offer will find the choices below more valuable.

Crypto.com vs FTX

Crypto.com and FTX are fundamentally exchanges with different intentions of product offerings—crypto.com is more featured on crypto financial services including staking and lending, while FTX is an exchange built for traders by traders and prides itself on the most liquid order books and extensive derivatives products on the market.

Both exchanges offer fee reductions if staking or paying fees using their native tokens, CRO and FTT, and FTX offers anywhere from a 3-60% fee reduction with holding varying amounts of FTT, and Crypto.com offers a 10-100% fee reduction if staking CRO.

FTX cannot be used by US persons, and instead offers a US version of its exchange whose trade offerings are much more limited than its parent global exchange. Both offer OTC portals for larger traders and advanced trading and charting platforms for advanced traders, though active and advanced traders will prefer the charting capabilities of FTX.

FTX offers 316 coins and 484 trading pairs which is a more broad selection than Crypto.com which offers 150 coins and over 260 trading pairs.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while Crypto.com only offers 1 futures contract with up to 50X leverage, which is currently larger than FTX’s max 20X leverage due to recent regulatory decisions. Crypto.com is better suited for the investor who desires financial services ranging from Visa payment card with rewards, to staking on crypto assets, and more.

Crypto.com vs Gemini

Crypto.com and Gemini are comparable in regards to fees. The minimum fee tier at Gemini starts at 0.35% for takers and 0.1% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200.

Crypto.com, in contrast, offers drastic fee-reductions for staking CRO, while Gemini has no such option and only reduces fees with higher trading volume. Crypto.com wins in the transaction fee department as compared to Gemini.

Both Crypto.com and Gemini offer staking or lending services that allow users to earn interest on their holdings and US investors are allowed to use both exchanges.

In comparison to Crypto.com’s larger selection of coins and trading pairs, Gemini only offers 62 coins and 86 trading pairs which is substantially lower, so traders looking solely for the most trading options, will prefer to use either Crypto.com or other options such as Binance or KuCoin.

Crypto.com vs Kraken

Kraken offers margin trading at up to 5X leverage and several margin offerings, while Crypto.com only offers one margin pair to trade.

Kraken also uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is more competitive than the fee schedule for Crypto.com, even before taking into account the fee reductions offered by staking CRO.

Kraken also offers a large variety of cryptocurrencies and pairs (93 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin may enjoy using Kraken but sacrifice the other web of crypto financial services Crypto.com has made itself known for.

Kraken is accessible in 48 US states and is regulated and licensed by FinCEN in the USA, while the only US state barred from using Crypto.com is New York.

Crypto.com vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a large selection of cryptocurrencies—over 351 coins and over 1300 pairs, which is only beaten by KuCoin when it comes to centralized exchanges. Traders looking solely for the most trading options will prefer Binance, and Binance’s base maker-taker fee is also much lower than that of Crypto.com, starting at 0.1% instead of 0.4% like for Crypto.com, and offering further 25% reduction in fees if paid in BNB.

Both the Binance and the Crypto.com brands are well-known and respected in the industry, both offer an extensive web and ecosystem of products, support, and liquidity, but Binance may win in the liquidity department because it is the highest volume exchange by a large margin. Hence, advanced traders moving large transaction volumes for whom liquidity may be a concern will prefer Binance, but for smaller or intermediate traders, this will not be a concern as Crypto.com’s volume and liquidity is enough to support the average person’s activity.

Crypto.com also offers access to as much as 50X leverage on only one futures pairs, while Binance lowered their maximum leverage offering to 20X in 2021 for regulatory reasons however Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs. However, it is regulated in the US and US persons can perform KYC without an issue.

In summary, advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will likely prefer Binance unless they have a specific product that Crypto.com offers in mind or would like to take advantage of anywhere from 10-100% off of fees by staking CRO.

Crypto.com User Reviews

- Reddit user u/shinjur disapproves of the trading experience with limited order functionality and order types, however notes improved customer service in the past year and notes Crypto Earn as the best feature: “If you aren’t at Tier 3 (Jade/Indigo) level yet, work to get there if you can because it’s a real game-changer for the higher Earn rates (among other benefits). 6.5% interest on BTC and ETH are FANTASTIC.”

- A Reddit user complains about the high spread seen on crypto.com offerings and slow fiat withdrawals: “The price to buy a crypto is always higher on crypto.com then other platforms and lower then other platforms when you sell.”

- A customer using the Crypto.com Visa card asks if they should increase their CRO stake to get a better card, despite the reviews they see about people not being able to withdraw their funds. Responses range from complaints to praises, but most tend to agree that “Never had issues withdrawing and I’ve withdrawn thousands…”

- u/Blu-Ray-Waffles posts in the crypto.com subreddit asking if they should make the switch to the exchange from Coinbase. The overwhelming response is “Yes, trust me.”