As more and more people talk about how we’re becoming a cashless society, the tendency is to see paper bills as outdated. After all, paper money has been used for all our lives, and many people take it for granted.

However, for most of human history, commodities such as precious metals were used as money; paper money is a relatively recent invention that has only been used in the West for about the past five hundred years.

Who First Invented Paper Money?

The Chinese.

In fact, the concept of paper money was first introduced to Europe by someone you’ve probably heard of—the famous Venetian merchant and traveler, Marco Polo, who witnessed it during his stay in the court of Kublai Khan.

Paper money incorporated two of the four great inventions of Ancient China by combining papermaking and printing (the other two are the compass and gunpowder) and was first used in China over a thousand years ago.

In this article, we will look at the invention of paper money in China, including when it was invented, why it was invented, and the advantages and disadvantages of using paper money.

Promissory Notes

Before paper money was developed, promissory notes were used. These are basically I.O.Us in which one party puts their agreement to pay a certain amount to another in writing.

In China, these occurred as early as the Han Dynasty in 118 BCE. These were made of leather and used to acknowledge the debt of one individual to another.

China wasn’t alone in the ancient world using promissory notes. Ancient Roman banks would issue certificates of deposit that allowed customers to deposit a sum of money at one bank branch and withdraw it at another.

These certificates were made of a durable lightweight material and have been found as far away as London. There are also reports that Carthage used leather or parchment for promissory notes as far back as 146 BCE.

Paper Notes in China

Paper was invented in China around 105 CE and was first used as promissory notes during the Tang Dynasty which ruled China from 618 to 907 CE.

During this time, the common currency in China was copper coins minted by the government. These coins were circular but had a rectangular hole in the middle through which merchants could run a string for convenience.

However, merchants who were particularly wealthy found these strings to be burdensome.

To solve this problem, merchants would leave their coins with a trusted person. This person would provide the merchant with a receipt recording how much money had been deposited. When the person returned the piece of paper to that person, the coins would be returned.

Though these notes were not yet true paper money, they set the precedent that would evolve into paper money during the Song Dynasty.

Jiaozi – The First Paper Money

When the Song Dynasty came to power in 960 CE, the government got into the act. Instead of giving your money to someone you trusted, you could now give it to the government.

The Song Dynasty established specific, government-licensed deposit shops where you could leave your money in return for promissory notes.

A copper shortage encouraged the Song government to issue the Jiaozi—the world’s first proper paper currency. These notes were a form of representative money, with the government promising to redeem them at a later date for something of value.

The Jiaozi was widely circulated, though it did not replace the copper coins. Instead, it was used alongside them.

To produce these notes, the Song established factories located in Chengdu, Hangzhou, Huizhou, and Anqi. These factories used woodblocks to print the money with six different types of ink.

To discourage counterfeiting, each factory used different mixes of fiber in their paper. Also discouraging counterfeiting was the fact that you could be executed for it.

The Rise and Fall of a National Currency

Though early notes could only be used in certain parts of the Empire and expired after three years, the economic advantages of using paper money soon became apparent (more on that in a bit).

In 1265, the Song court issued a truly national currency. It was printed to a single standard, usable across the Empire, backed by gold and silver, and available in denominations between one and a hundred strings of coins. This currency only lasted nine years as the Song Dynasty was soon overrun by the Mongols.

Though the Song fell out of power, their idea of paper money continued. The Yuan Dynasty founded by Kublai Khan issued its own form of paper money known as the Chao. The Chao is the money that Marco Polo saw during his 17-year stay in Kublai Khan’s court. The main difference between the Jiaozi and the Chao is that the Chao was not backed by gold or silver.

This led the Yuan Dynasty to print more and more of the money, leading to runaway inflation. The inflation they experienced helped lead to the collapse of the Yuan Dynasty in 1368.

They were replaced by the Ming Dynasty who took some time to learn from the mistakes of their predecessors. They also began issuing unbacked paper money, though they suspended the program in the 1450s.

It would be almost four hundred years before paper money would return to long-term use in China.

Advantages of Paper Money

Paper money brought with it several advantages that led to its adoption in China, such as…

Paper money can be controlled easily

We already talked about some of the measures the Chinese court took to ensure a monopoly on producing paper money. By using secret techniques, such as special fibers and specific woodblocks, the government can make sure that only it can produce paper money.

Killing anyone who attempts to replicate this process also helps deter competitors. This allows the government to control the supply of money.

Paper money is more stable (sometimes)

This control of the money supply allows the government to implement monetary policies to keep the value of money stable.

If there is too much money and it is losing value, the government can produce less or even remove money from circulation. Likewise, if there is too little, the government can simply produce more.

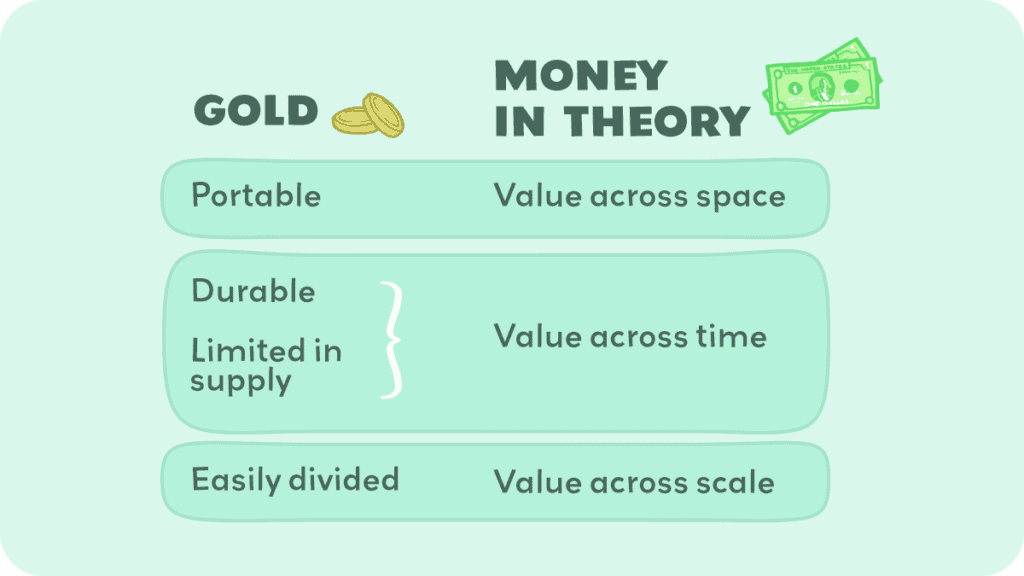

Contrast this with commodity money such as gold. Anyone who discovers a source of gold, such as a gold mine, can produce it. For example, when Spain raided the Americas for gold, so much of it was brought back that the value of gold greatly diminished.

Paper money is easily moved

One of the reasons paper money developed in the first place was that merchants didn’t want to carry around strings of copper coins. Paper money is extremely lightweight—thus, even large quantities are easy to carry.

Additionally, it is foldable, allowing it to be easily stored or even concealed in places such as wallets, purses, or even socks.

Paper money is easily countable

Remember that paper money replaced copper coins and that it came in denominations of strings of copper coins. Rather than having to count out each coin (or weigh gold or silver), merchants could simply lick their fingers and get to work, adding the total of the paper money.

This was quicker to count than having to lay out all the coins on the table and count each coin or string of coins individually. For example, if something cost a hundred strings of coins, it could be paid with a single bill instead of a mountain of coin strings.

Paper money is easily acceptable

Since you have one standardized, state-issued currency, there is no dispute over acceptability. Everyone accepts paper currency as money, either because the government mandates it or because, with everyone else using it, refusing to do so would essentially exclude you from the economy and make conducting business almost impossible.

Additionally, there is less risk of fraud, making verifying the veracity of the money unnecessary. This is due to the steps the government takes to prevent counterfeiting and the penalties for doing so.

Disadvantages of Paper Money

However, paper money has some downfalls as well, one of which led to its discontinuation in China.

Paper money can be damaged or lost

When paper money first appeared on the scene in China, it was called “flying money.” This is because it had the tendency to blow in the wind, or ‘fly’ away.

Additionally, paper money can be damaged. Anyone who has forgotten to take their money out of their pants prior to putting them in the wash has experienced this firsthand.

Other forms of money, such as gold or copper coins, are considerably more durable and less likely to be blown away on a windy day or damaged by literal laundering.

Paper money can bring inflation

This is the big one and the reason for the discontinuation of paper money in China in the mid-1400s. Paper money—especially unbacked paper money—can be easily printed. Even if backed by gold or silver, it can be devalued.

The temptation of the government to keep printing money can easily lead to so much of it going into circulation that the money becomes worthless, collapsing the economy. In the same way that sound monetary policy can help stabilize a currency, poor monetary policy can lead to its ruin.

What happened in China was not an isolated incident. It has happened in recent times, including in 1920s Germany and within the past three decades in Zimbabwe.

Paper Money Today

Despite these drawbacks, the vast majority of nations today rely on paper money as their national currency. Not only do they use paper money, it is almost always the unbacked form of paper money known as fiat money.

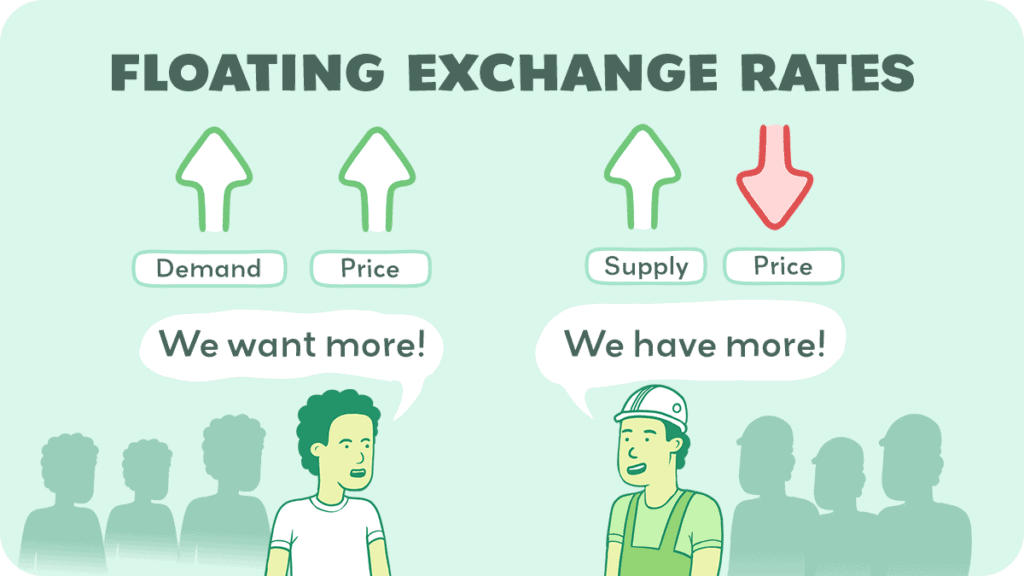

This paper fiat money and its system of floating exchange rates are at the center of the global economy. This is because of the advantages paper money provides in allowing central banks to conduct monetary policy.

Due to advances in economic understanding, central banks are usually able to conduct sound economic policies, taking advantage of the benefits of paper money while avoiding its pitfalls.

Conclusion

Since much of this paper currency is stored in banks, advances in technology allow much of our day-to-day transactions to occur in digital form. We simply swipe a card and tell our bank to transfer a set amount of money from our account to the account of another.

The emergence of Bitcoin and other cryptocurrencies has even encouraged certain nations, such as Sweden, to explore the idea of doing away with paper money and adopting a digital national currency. Whether they follow through with this remains to be seen.

We hope you enjoyed this article. To read others like it, please subscribe to our newsletter. Thank you for joining us, and we hope to see you again.