There’s an old saying that goes, “Cash is king”. However, what would you do if society no longer had cash?

You’ve probably heard people talking about the possibility of a ‘cashless society’, but what does this mean? Are they talking about societies prior to the invention of money that relied on bartering as the sole means of exchanging goods and services?

As you’ve probably guessed—no.

In this a cashless society, “cash” refers to physical banknotes and coins. Thus, a “cashless society” is one that conducts its economic activity without relying on the use of paper money and coinage as a medium of exchange.

In this article, we’ll look at the pros and cons of such a society and why it is being so widely discussed.

What is a Cashless Society?

A cashless society is one in which physical forms of currency such as banknotes and coins are not accepted for any financial transactions. Instead, all money is stored in electronic form such as bank accounts or digital currencies.

All transactions, then, occur via digital transfer, either through debit or credit cards, electronic money transfers, cryptocurrencies, or online and mobile payment services such as Apple Pay and PayPal.

There are various measures of the cashlessness of a society, including:

- Percentage of citizens who used no cash in the last year or have stopped using cash completely

- The average proportion of cash payments

- Amount of cash in circulation

- Percentage of GDP represented by cash

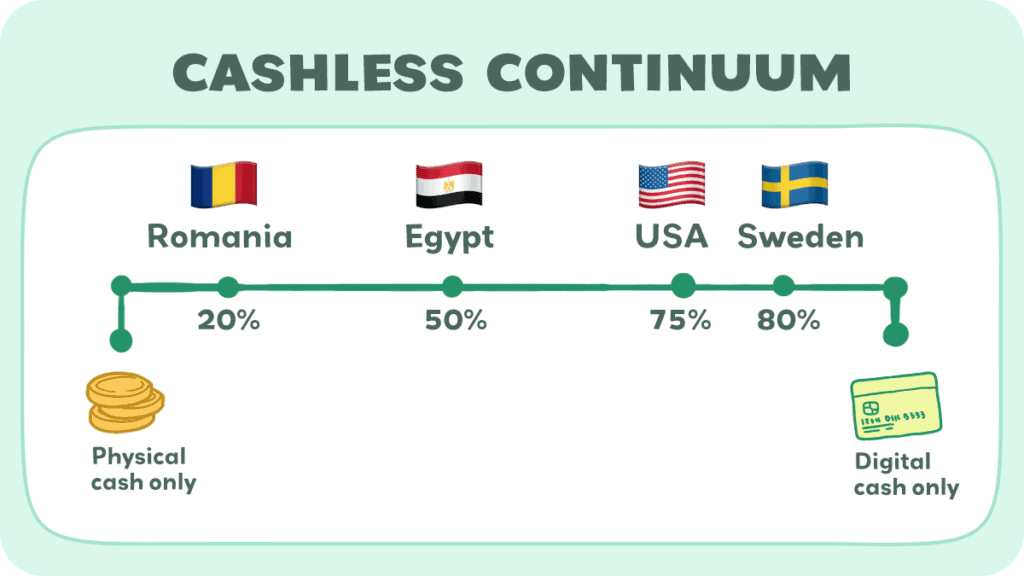

These measures are used to rank societies on a “cashless continuum.” A cashless society is one extreme of that continuum—it is an economy in which cash has been completely eliminated and all transactions are conducted digitally.

Why is this Relevant?

Although no country has yet to become completely cashless, every year society is moving closer and closer to this end of the continuum.

Most experts agree that Sweden has moved the closest to the cashless ideal. Cash is now used in less than 15 percent of transactions in Sweden, and the amount of cash in circulation has declined significantly, now representing only about 1% of Sweden’s GDP.

Furthermore, the Swedish government has taken several steps to facilitate or even encourage this transition. Swedish retailers and restaurants are now allowed to refuse cash payments by merely posting a sign stating this fact.

Even banks can refuse cash, with more than half of all bank branches in Sweden no longer handling cash. Finally, the Swedish government has tested the waters for the E-krona, a digital form of state money, and is one of the few governments to begin seriously exploring this option.

Pros of a Cashless Society

There are numerous benefits of a cashless society that proponents use to argue for its adoption.

The pros include:

- Convenience and efficiency

- Reduced criminal activity

- Easier cross-border transactions

- Reduced transmission of diseases

1) Convenience and efficiency

Let’s face it—it’s easier to swipe a card than it is to fumble around in your purse or wallet for exact change.

This goes beyond just convenience. The improved transaction speeds can result in real savings for businesses over time as they can get more customers through by reducing the average transaction time for each. It also saves time for the consumers by allowing lines to move more quickly.

More importantly, this reduces the cost of merchants having to collect money, count it, deposit it, and reconcile the books at the end of each period. Since cash is an easy target, banks and other businesses with large cash stores also have to employ security teams to protect against robberies.

Finally, the automatic paper trail created by electronic transfers makes budgeting easier, both for individuals and businesses.

Instead of having to keep track of their cash withdrawals and balance their checkbooks, individuals can simply go online to get all the information they need for their budgeting activities. The same goes for businesses.

2) Reduced criminal activity

As we already mentioned, large cash stores in banks and similar businesses are a tempting target for robberies. Additionally, individuals carrying cash around are at risk of becoming targets for muggings. Eliminating cash can reduce these types of crime.

To demonstrate, researchers found that, by replacing cash welfare benefits with Electronic Benefit Transfer (EBT) cards, Missouri managed to reduce its crime rate by 9.8%.

Additionally, the elimination of cash would make financial crimes such as counterfeiting, money laundering, and tax evasion more difficult. Large denominations make it easy to move money without it being traced—to this end, the US has ceased printing all denominations over $100.

More to the point, the automatic paper trail created by digital transactions makes these crimes more difficult. It is harder to hide income and evade taxes when there is a record of every payment you’ve received, and money laundering is harder when the source of funds is always clearly identifiable.

The difficulty of money laundering also makes other types of criminal activity more difficult. It is no accident that illegal transactions often occur in cash as the fungible nature of cash makes it impossible to trace.

Eliminating cash can make profiting from dealing drugs or gambling activities more difficult, though there are alternatives like trading in commodities (such as diamonds) or Bitcoin.

3) Improved cross-border transactions

As the world becomes more globalized and more transactions occur across borders, a cashless society can help ease these transactions. When the transaction occurs digitally, the money can be automatically converted from the currency of the sender to the currency of the receiver. There are no calculations or exchanges of currencies that need to occur.

In addition to convenience, it is cheaper—a 2021 World Bank survey found that it is cheaper to send money through mobile payments than through a bank, post office, or money transfer operator.

4) Reduced disease transmittance

Let’s face it—cash is gross. It passes from one person’s hands to another, and who knows where those hands have been? To demonstrate even more vividly, how many people have you seen store money in their bra or their shoes? Cash travels around, accumulating germs and filth in the process.

In the post-COVID era, eliminating these vehicles of disease is one less avenue of infection to worry about.

Cons of a Cashless Society

Cashless societies aren’t all sunshine and roses, however.

There are a couple of drawbacks to keep in mind, including:

- Lack of privacy

- Social exclusion

- Coordination problems

- Centralized control

1) Lack of privacy

As with many things in law enforcement, digital transactions and automatic paper trails cut both ways.

For law enforcement, they make tracking and investigating criminal activity easier. The flip side is that they do this by sacrificing individual privacy. The more information you have floating around, the more likely it is to end up in malicious hands.

Maybe you have nothing to hide, but maybe you don’t want the world to find out about that payment to your mistress or your purchase of a My Little Pony onesie in an adult male size.

As with many things, the balancing act between the interests of law enforcement and individual privacy is a judgment call for you to decide. The point is that there is a tradeoff between the two.

2) Social exclusion

Despite the growth in digital transactions, there remain a number of people who are ‘unbanked’. These are individuals who do not use or cannot obtain a bank account. Since they are largely poor, this could exacerbate economic inequality.

For example, if smartphone transactions become the common means of exchange, those who cannot afford smartphones will be unable to make or receive payments and be left behind.

3) Coordination problems

Cashless societies may sound tempting when everything is working right, but as Murphy’s Law states, “Anything that can go wrong will go wrong.”

With cashless societies, the possibility exists for things to go very wrong. If the technological infrastructure goes down, the entire economy comes grinding to a halt.

If this information were lost or deleted, the result would be economic chaos. As you can imagine, this could easily become a tempting target for terrorists or anyone else looking to attack a nation economically.

Additionally, if an individual is targeted by hackers or cybercriminals, the results could be even more disastrous. At least if you’re mugged, the loss is limited to what you were carrying with you.

If you fall victim to crime in a cashless society, they could drain everything and you would have no alternative to fall back on. Even a lost or stolen phone or a dead battery could leave you penniless.

4) Centralized control

Because all your money rests with the banks or whoever controls your money supply, this leaves individuals vulnerable to the whims of the powerful, particularly if the government chooses to monopolize the cashless payment system.

The government could choose to issue a transaction tax on every person-to-person payment. For example, even if you just want to give a family member a couple of bucks, it could be subject to a government tax.

Governments could also institute negative interest rates to spur the economy, in which the amount you have in your account declines over time rather than accruing interest. This would prompt people to spend money even if they don’t want to, since leaving it in their accounts loses it and there is no way to withdraw it.

In addition to the mass surveillance conducted by the government we discussed with privacy concerns, a cashless society could also allow the government to shut down your access to funds with the click of a button.

Though this could be helpful to law enforcement hunting criminals, it could leave you in quite a bind if you’re wrongly suspected of criminal activity. You’d be unable to spend any money until you clear your name and the government admits and corrects their error, which often takes some time.

Conclusion

As more and more people opt for the convenience of digital payments, we continue to gravitate towards a society in which cash becomes obsolete. At some point, it may become time to eliminate cash entirely as fewer and fewer people accept or use it as a medium of exchange, making it less effective as money.

We hope this article helped you weigh the pros and cons of such a transition. You can make your own decision as to whether this transition is a good or bad thing, but we hope that this article helped make your opinion a more informed one.

To learn more about related topics, please subscribe or check out our other articles. Thank you for joining us, and we hope to see you again.