![]()

Voyager is a US mobile-based cryptocurrency exchange that launched in 2018. Voyager is also a publicly traded company.

The exchange requires KYC (Know Your Customer) identity verification or document protocols to be completed for use of the exchange. US users can use the exchange unless they are residents of NY state.

History of Voyager

When Voyager launched in 2018, it did so with the aim of offering investors a no trading fee feature and as a mobile-first exchange. The company was co-founded in 2018 by now CEO Stephen Ehrlich as well as by Philip Eytan and Uber co-founder Oscar Salazer. The team is a combo of Wall Street and Silicon Valley entrepreneurs who teamed up to bring a better, more transparent, and cost efficient alternative for trading digital assets to the marketplace.

The company made the decision to go public early in company history, which was an unconventional choice for a crypto company. However, this provided users more transparency into the company’s financials, bridges the gap between traditional finance and crypto, and allows Voyager an alternative avenue for company growth while also empowering everyday equities traders and investors the opportunity to back an emerging crypto company.

At first, it was listed on the Canadian TSX.V (Toronto Venture Exchange) stock exchange under the symbol VYGR.V. In 2021, Voyager announced its approval to trade on the Toronto Stock Exchange (TSX) under the ticker VOYG. Voyager is also a FinCen registered Money Service Business now traded on US OTC markets under VYGVF.

Voyager has expanded since launch to most US states and soon plans to launch to Europe.

Voyager is best for:

-

All types of cryptocurrency spot investors and traders who desire access to a large variety of crypto coins for trading, earning interest with no lockups, and no crypto-to-crypto trading pairs

-

Spot traders and investors who desire a simple fee schedule, and competitive amount of crypto financial services, with the benefit of regulatory compliance of a public company

PROS

- No trading fees

- Simple UI

- Moderate crypto asset offering

- Earn program

- Mastercard debit card available

- Native token rewards

- Institutional client services

CONS

- Mobile-only

- Limited charting capabilities

- Marks up the spread on each order

- No crypto-to-crypto trading pairs

- Long verification waitlist

- Not every asset that is available for purchase can be withdrawn

Pros & Unique Features

The best features of Voyager are its simplicity and no trading fees. Voyager instead makes money on the spread (the bid/ask) of the coin being traded. The exchange is also very simple to use since it is a mobile-only exchange with an app available on both Google Play and the Apple App Store at the moment, but there are plans to add a desktop version in the future.

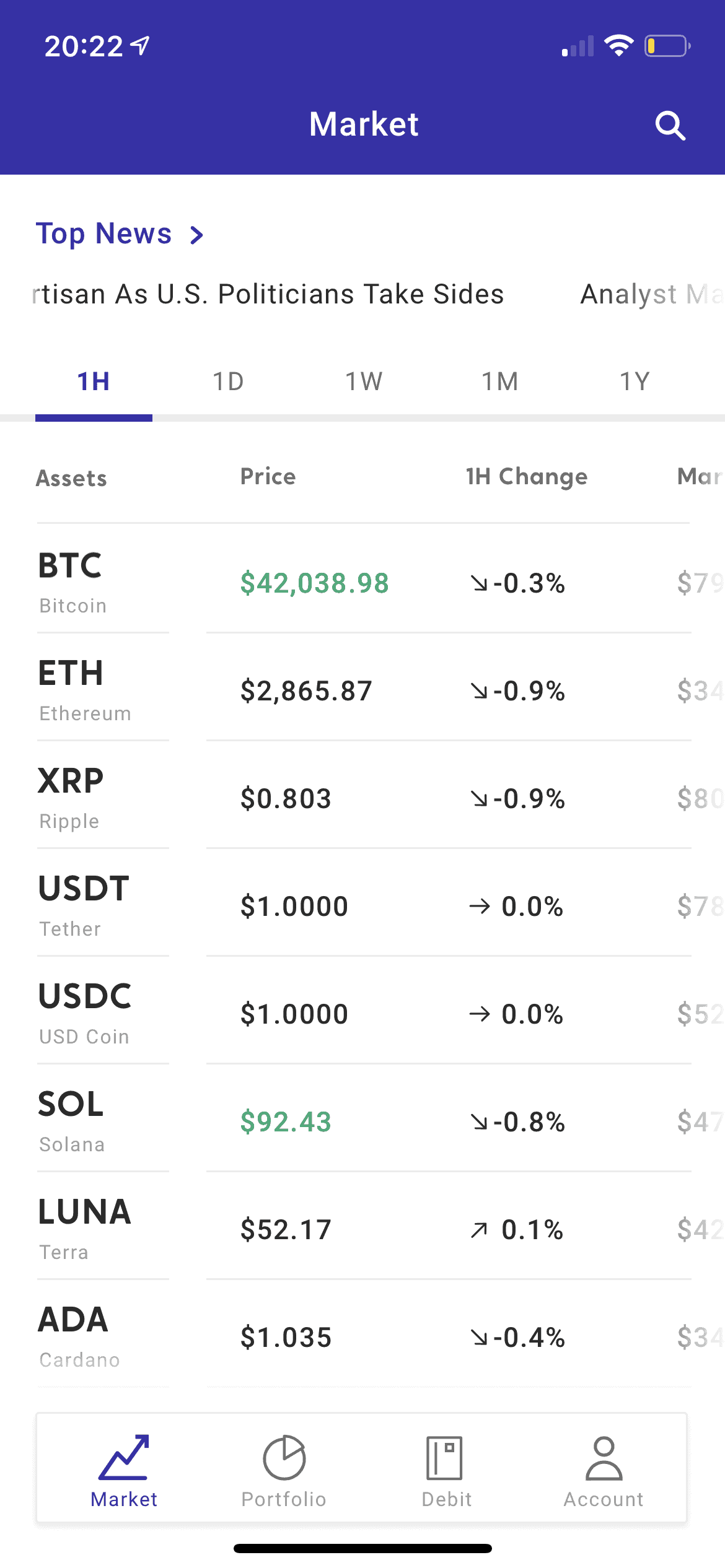

The mobile exchange offers over 80 crypto assets commission-free with full buy and sell functionality, but the trading interface cannot compare to one of a desktop exchange as the charting capabilities are limited, so Voyager is definitely suited better for investors or casual spot traders who are charting elsewhere.

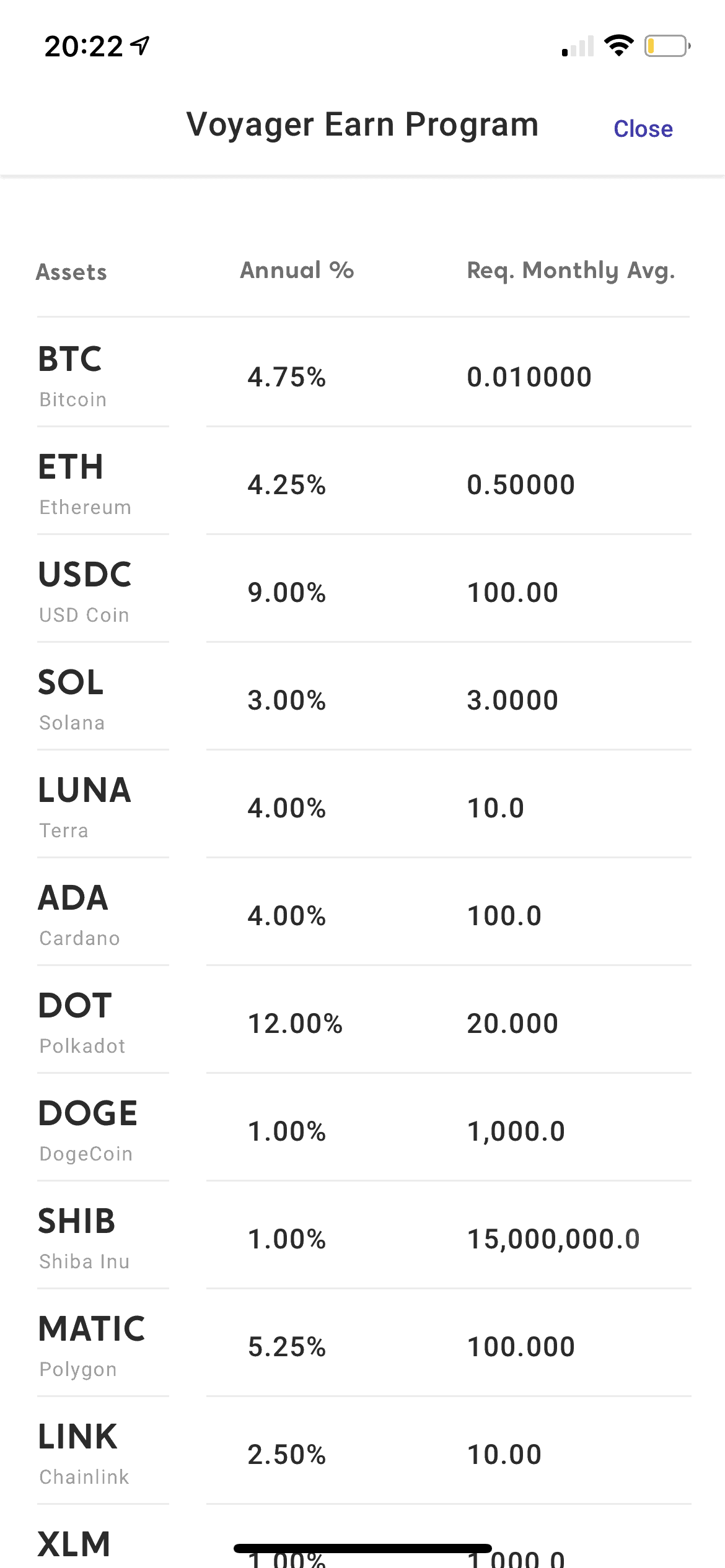

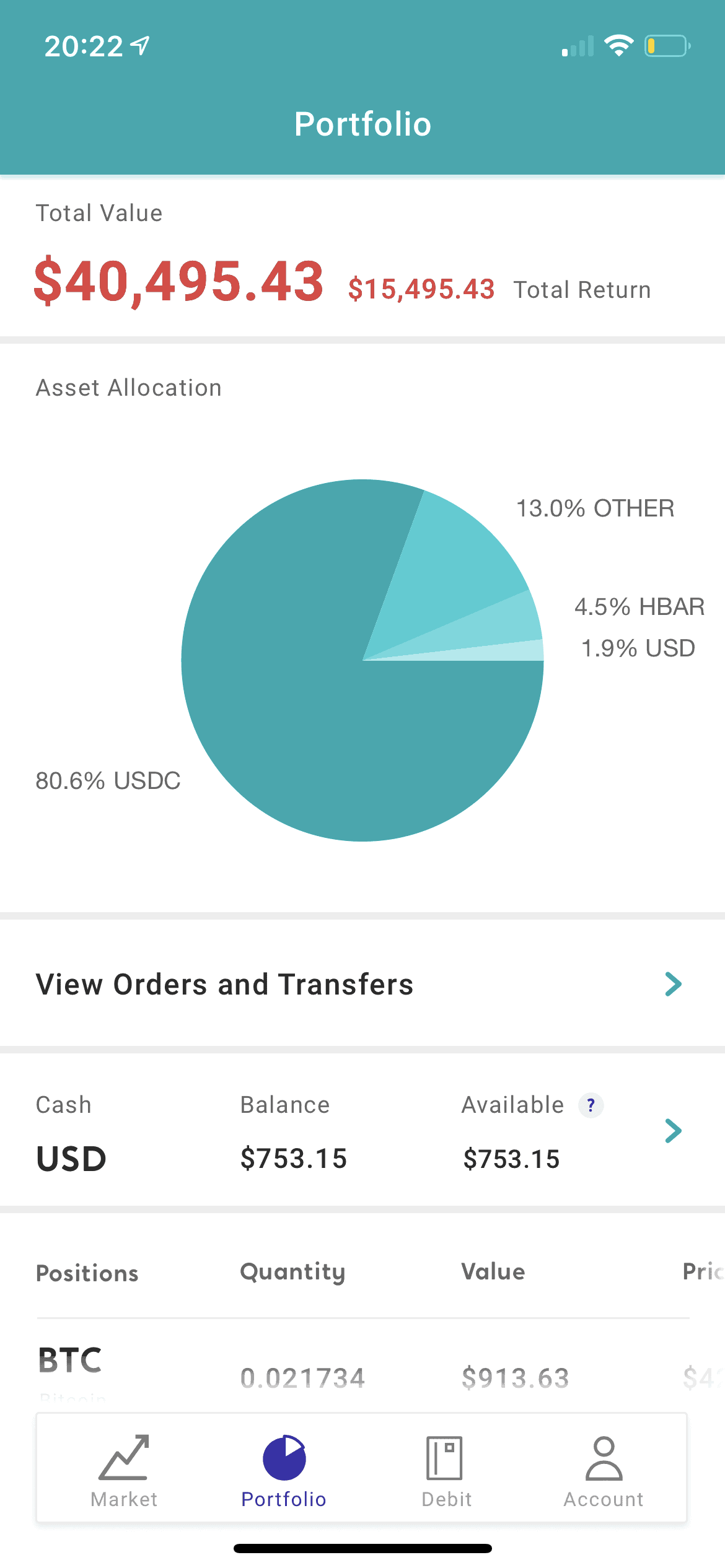

Voyager also offers its Earn program, which offers extremely competitive rewards (interest) on over 30+ coins that are on the exchange, with rates as high as 12% on some such as Polkadot and 9% on USDC stablecoin. Unlike other exchanges, there are no lockup periods required with this program.

Voyager also offers a Mastercard debit card with 9% cashback rewards and allows users to spend their USDC balance like cash. Rewards are earned in USDC.

Voyager also offers a competitive loyalty program that rewards holders of the native token VGX (Voyager Token) with special Voyager Debit Card bonuses, like a monthly rewards booster, crypto-back on purchases, and more. The new VGX 2.0 token boosts users’ crypto earning potential with 7% staking rewards and those on other cryptos on the exchange as well.

Along with services tailored for retail investors, Voyager also offers institutional client services that leverage the crypto trading technology behind the Voyager retail app. Voyager Institutional brings deeper liquidity, broader market access, and more effective trading to financial institutions and technology businesses.

As for customer support, Voyager offers a support service center users can access via logging into the app and submitting a query. The team also maintains a blog with news and reports.

Cons & Disadvantages

The main disadvantage of Voyager is that it is not a desktop based exchange with full-featured charting or trading capabilities or order book visibility for active traders.

As such, the app is best suited for investors or casual spot traders who don’t need advanced charting functionality, or have the ability to chart elsewhere.

Though Voyager charges no trading fees which is extremely competitive, it does mark up the spread (bid/ask) on each order by a small amount, so the prices at which assets may be bought and sold may differ slightly from those of other exchanges.

Other disadvantages of Voyager include the fact that there are no crypto-to-crypto trading pairs and the exchange may involve a long verification and/or waitlist period to create an account due to demand.

Unlike other mobile app exchanges such as Robinhood however, users actually own their crypto assets and can withdraw them or deposit them into their Voyager account, however not every single asset that users can trade or buy is available to be withdrawn from the exchange.

There have been reports in the past of customer support taking very long to reply to users but this was due to surges in customer demand and signups during 2020-2021. Support is only available via email that can be accessed through inputting a request within the app and self-custody is not available as Voyager is not a non-custodial wallet, but rather an exchange that offers a custodial wallet as part of its services.

Overall, Voyager uses excellent security features and is a great mobile exchange/app with a great reputation.

Voyager Fees

Voyager charges no fees on trading commissions, but instead marks up the spread (bid/ask prices) by a very small amount for executing orders. However, the effective fees are still smaller than paid at other major exchanges such as Coinbase.

Spread fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point in the case of a resting order, or it can be canceled.

Any other fees that may apply are detailed in the Voyager Terms of Service.

Other Fees

Voyager charges the following deposit, withdrawal, and other fees:

-

No account creation or maintenance fee

-

No deposit fees for any digital asset

-

Withdrawal fees for digital assets depends on the asset. USDC is $20, for example. This fee is determined by the blockchain network fees and may vary depending on network usage.

-

No fee for wire deposits but there is a $50 fee for wiring USD out of the account, with a $10K minimum amount on outgoing wires

-

No fees on ACH withdrawals or deposits for fiat

There are no fees for signing up or for having an inactive account, nor any fees for holding funds in an account, and users may hold assets as long as desired and automatically earn interest on them without having to lock assets in a separate account or opt in. Users may also opt out to earn interest in the app settings.

Account Tiers & Limits

KYC verification is mandatory at Voyager as it is a regulated public company and US-compliant exchange.

New accounts have a daily deposit limit of $10K. There are no limits on crypto deposits.

The withdrawal limits are as follows: $25K maximum market value on withdrawals within a 24-hour period, and a maximum total of 20 withdrawals in a 24 hour period.

There are no further account tiers or limits.

Crypto Security

Voyager practices extensive security with 2-FA enabled for all user accounts with SMS by default, but users are encouraged to change this to an authenticator app due to the risk of SIM swap attacks.

Other security features include advanced fraud protection that uses technology to prevent hackers. USD deposits are FDIC insured up to $250K USD and held by a US banking partner, so the cash users hold in Voyager is protected, however it should be noted that this does not apply to stablecoins, but only to fiat USD.

Voyager is publicly traded, licensed, and regulated, which means the exchange is audited to ensure that every asset is accounted for in the exchange’s secure system.

User’s personal information is secured via state-of-the-art security protocols, including the transmission of data via HTTPS with SSL/TLS and the storage of data on a secure AWS cloud server that is encrypted at rest. The data is only accessible to those at Voyager who need to know the information for a particular business purpose.

Voyager also pays bug bounties to incentivize users and white hat security experts to report potential security flaws.

Voyager Review Conclusion

Voyager is an excellent choice of multi-purpose crypto exchange for all types of crypto investors and spot traders who don’t need to use the platform for advanced charting or order types.

The best features of Voyager include the commission-free trading making it the most competitive US-regulated exchange option on the market, however users should note that Voyager does change the spread (bid/ask) and users may pay slightly more for assets as a result or get paid slightly less when selling them than market price.

Voyager offers an excellent mobile app and is a mobile-only exchange at the moment with plans to launch a desktop trading platform in the future, but even so offers 80+ coins and shines in its competitive rewards and interest-earning program with rates as high as 12% for many crypto assets, without the need for lockups or opt-ins, unlike most other exchanges.

For US users who desire access to a high quality exchange that is also a publicly trading company, Voyager makes a great choice if users are willing to forego some features such as advanced charting or futures trading. Voyager also offers a debit card with up to 9% cashback so there is no shortage of crypto financial services. KYC is required.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable as Voyager is only available for US users outside of NY state, and those in US territories, but the exchange has plans to expand to Canada and Europe later this year.

-

Voyager offers access to 80+ crypto coins and USD trading pairs, for only spot trading, with commission-free trading and otherwise very low fees on a high quality mobile app platform

-

Intermediate to advanced traders trading margin or futures who desire access to advanced trading tools and charting would prefer to pick a different exchange especially if desiring one not requiring KYC, as Voyager is best suited for investors or more casual spot traders

Other Alternatives

For customers who desire access to a desktop-based user interface with even more trading pairs and advanced order types, and those who do not desire to participate in cryptocurrency futures trading either Bittrex, Bitstamp, Coinbase, and Binance US can make great alternatives with a similar or greater amount of cryptocurrencies offered to trade along with trading fees but also more functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Voyager and Coinbase with their brand presence, US regulatory approval (both are publicly traded companies, being the only crypto companies to achieve this as of 2022), and cryptocurrency education.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a much larger selection of cryptocurrencies offered compared to Voyager—402 pairs vs. Voyager’s ~80 coins—and offers an advanced desktop trading interface as well as a mobile app.

Active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and will charge users likely more commission than Voyager given its 0 commission fee schedule, as they all use volume-tiered fee schedules.

However, the end result users pay in fees may be the same since Voyager charges based on the spread instead of a fee system, and high volume traders may pay less fees on a net basis at a low-fee competitor such as KuCoin or FTX.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Voyager include Crypto.com which also offers a similar full-featured app and crypto financial services, Kraken, and Gemini.

Voyager vs Coinbase

Coinbase is better in all aspects of functionality and range of trading coins and products offered if compared to Voyager, since it is more of a desktop-first exchange compared to Voyager being a mobile-only exchange.

Both exchanges offer no margin trading, but Voyager easily wins in the fee department, as it has 0 commission trading fees which is much lower than at Coinbase. An advantage for high volume traders will be the volume-tiered fees at Coinbase, which decrease most rapidly over $20M in 30-day trading volume.

Coinbase also offers about 6x the selection of trading pairs as is offered at Voyager, with 440 trading pairs, compared to 80 at Voyager, as well as advanced charting, accessible order books, and advanced order types.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Voyager is also a publicly traded company that is similarly audited and reputable. However, Voyager still lacks the brand presence that Coinbase has achieved.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either FTX or Coinbase offer may find the choices below equally valuable.

Voyager vs FTX

FTX will win against Voyager for all intermediate or advanced traders, as FTX offers 323 coins and 492 trading pairs, which is again far higher than Voyager’s 80+ coins offering.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since Voyager offers only spot trading and no derivatives instruments of any kind.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while Voyager only offers basic buy/sell functionality with basic market/limit orders so it is not suited for anything beyond casual spot trading, but rather better suited for investing.

Meanwhile, FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed. FTX cannot be used by US persons but Voyager can, though FTX offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection, and are less than what is offered at Voyager, though it remains competitive.

International users who can use FTX International may prefer FTX for these reasons over Voyager. US users trading at FTX US need to do KYC procedures and likewise for Voyager. Fees may be slightly more competitive at FTX, since FTX offers both fee incentives for volume and for holders of its FTT token, and FTX will charge clear trading fees, not based on the spread alone like Voyager does.

Voyager vs Gemini

Voyager and Gemini are similar in being US-compliant exchanges with full-featured mobile apps and a basic range of crypto financial services offered.

There is a slight difference in fees to start giving Voyager the edge: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, while Voyager charges 0 trading fees and only minimal fees based only on the spread.

US investors and traders are allowed to use Gemini with KYC verification only, since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, and neither does Voyager.

Gemini offers 62 coins and 86 trading pairs which is similar to the amount offered by Voyager. If we compare the staking and interest programs of the two exchanges, Voyager offers better rates at up to 12% with no lockups or opt-in required, while Gemini’s Gemini Earn product requires lockups and offers lower rates.

Voyager vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, which is a win over Voyager’s lack of any margin or leverage offerings. US users may prefer Kraken for its regulatory compliance and strong track record if they are traders especially.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is not quite as competitive even as Voyager’s 0 fee schedule, however overall compared to the market it is still competitive, especially since Kraken does not charge any extra fees on the spread unlike Voyager. Market makers enjoy reduced fees however at Kraken.

Kraken offers a much larger variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer Kraken by far.

If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may prefer other exchanges such as Bybit or OKX, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while US users can also use Voyager and Voyager is a public company that is also audited and regulated in the USA.

Voyager vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Voyager—over 351 coins and over 1300 pairs. The two exchange’s offerings are fundamentally different in their scope, with Voyager being a mobile-only exchange catering to investors and casual traders, while Binance is focused on being a global leader and fast innovator in every crypto product.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs not found anywhere else besides potentially OKX or FTX.

Binance’s maker-taker fee schedule is unique in its competitiveness compared to that of other exchanges, starting at 0.1%, plus Binance also offers further 25% reduction in fees if paid in BNB, alongside offering reduced fee tiers for higher volume and even maker rebates. However, Voyager still wins in the fee department by offering 0 trading fees. However, if users desire a clear fee schedule, Binance is better, since Voyager charges fees on the spread that are not clearly defined.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Voyager. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is still more than that of Voyager, so Binance US still wins if compared to Voyager.

Binance requires full KYC now to trade even spot products, and Voyager requires full KYC compliance as well to use, being a public US company.

Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is Voyager Safe?

Yes, Voyager takes extensive security precautions and is regularly audited in its reserves and financial statements of the company given that it is a publicly traded company.

Voyager practices extensive security with 2-FA enabled for all user accounts with SMS by default, but users are encouraged to change this to an authenticator app due to the risk of SIM swap attacks.

Other security features include advanced fraud protection that uses technology to prevent hackers. USD deposits are FDIC insured up to $250K USD and held by a US banking partner, so the cash users hold in Voyager is protected, however it should be noted that this does not apply to stablecoins, but only to fiat USD.

Voyager is publicly traded, licensed, and regulated, which means the exchange is audited to ensure that every asset is accounted for in the exchange’s secure system. User’s personal information is secured via state-of-the-art security protocols, including the transmission of data via HTTPS with SSL/TLS and the storage of data on a secure AWS cloud server that is encrypted at rest. The data is only accessible to those at Voyager who need to know the information for a particular business purpose.

Voyager also pays bug bounties to incentivize users and white hat security experts to report potential security flaws. There have been no reported hacks of Voyager.

How long does Voyager Withdrawal take?

Voyager manually approves all withdrawals as part of the AML process, so all withdrawals may take up to 24 hours. There have been reports in the past of users having had to wait several days for withdrawals of crypto assets due to surges in demand during 2021, however this has since been resolved.

For crypto withdrawals, once they are approved based on AML procedures, on average, it takes from 30 minutes to several hours for a transaction to be confirmed due to the blockchain.

Please note that for crypto, the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

After processing fiat withdrawals, the usual timeframe for ACH withdrawals to reach the user’s bank is 2-4 business days, excluding weekends and holidays.

Is Voyager a good exchange?

Voyager is an excellent choice of multi-purpose crypto exchange for all types of crypto investors and spot traders who don’t need to use the platform for advanced charting or order types.

The best features of Voyager include the commission-free trading making it the most competitive US-regulated exchange option on the market, however users should note that Voyager does change the spread (bid/ask) and users may pay slightly more for assets as a result or get paid slightly less when selling them than market price.

Voyager offers an excellent mobile app and is a mobile-only exchange at the moment with plans to launch a desktop trading platform in the future, but even so offers 80+ coins and shines in its competitive rewards and interest-earning program with rates as high as 12% for many crypto assets, without the need for lockups or opt-ins, unlike most other exchanges.

For US users who desire access to a high quality exchange that is also a publicly trading company, Voyager makes a great choice if users are willing to forego some features such as advanced charting or futures trading. Voyager also offers a debit card with up to 9% cashback so there is no shortage of crypto financial services. KYC is required.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable as Voyager is only available for US users outside of NY state, and those in US territories, but the exchange has plans to expand to Canada and Europe later this year.

Where is Voyager located?

Voyager Digital Ltd. maintains its headquarters in Jersey City and NYC, in the USA.

Does Voyager require KYC?

Yes, KYC verification is mandatory at Voyager as it is a regulated public company and US-compliant exchange.

What are the Deposit and Withdrawal Methods and Fees for Voyager?

Voyager offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto assets: deposits and withdrawals—no deposit fees. Withdrawal fees depend on the asset in question: the fee list is here and the fees are minimal. USDC is $20, for example. This fee is determined by the blockchain network fees and may vary depending on network usage.

- Fiat deposits via wire transfer and ACH bank transfer are free, withdrawals are free for ACH but $50 for wire withdrawals to bank accounts.

- No option to purchase crypto with a credit or debit card

What is the Minimum Withdraw Amount for Voyager?

The minimum withdrawal amount for crypto assets or stablecoin is equivalent to $10.

How do you withdraw from Voyager?

Instructions for withdrawing from users accounts can be found here from official support.

Users can withdraw from the wallet by navigating to the “Transfer Cash or Crypto” page under the Account icon on the bottom of the app interface. Then, the user should select the asset the user wishes to send—either crypto or fiat.

From there, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal.

Is Voyager a wallet?

No, Voyager is a mobile cryptocurrency trading exchange and app that also offers a custodial wallet solution with interest-earning features as part of its services, but is not a non-custodial standalone wallet.

How to use Voyager?

Using Voyager can be done by going to investvoyager.com, clicking the respective link to either the Apple App Store or the Google Play store to download the app, creating an account on the platform, first undergoing KYC verification procedures, waiting for verification to complete, and then depositing any trading funds into the account (either crypto assets or fiat via connecting one’s bank account) and then getting access to the market offerings and begin trading.

User Reviews

- u/DoubleR90 says that “The only reason to ever use Voyager is if you feel it is a secure enough platform to leave crypto on long-term that you are planning to HODL, and you want to earn a competitive interest rate without going through the hurdles of actually staking your crypto on it’s own blockchain, or moving your crypto to a platform like BlockFi/Celsius.”

- A user who had used the exchange for a few months details their experience, summarizing with, “Overall, solid and reliable platform from my experience. … Ease of use with a very user friendly interface.”

- A user in the major Bitcoin subreddit asks for others’ feedback on the Voyager exchange. Responders mentioned positively their security, the fact they are a real company, and their interest options for hodling coins.

- A user contrasts Voyager with Crypto.com, which also offers an app with a strong offering of crypto financial services. “Today, I was talking to my doctor and talked about crypto. He showed me how much interest rate he gets for USDC and CRO on crypto.com. And I realized that Crypto.com has little better interest rate than Voyager. Crypto.com seems to have higher fees, and has to stake their coin to get better rate.” u/CeFi_Rates says, “The highest USDC rate from crypto.com would require owning $40,000 worth of CRO and locking assets for 3 months. Some don’t want to own platform specific tokens, and some don’t want to lock assets. If comparing the base rates, Voyager is actually higher. You also can get a boost on USDC when owning VGX tokens. So there’s a few factors to take into account just for determining which is the higher rate.”