Phemex is a Singapore-based cryptocurrency exchange launched in 2019 that specializes in spot and derivatives trading.

Note that Phemex is a global exchange and US residents are not allowed to use it. KYC (Know Your Customer) identity verification protocols are optional at Phemex, and recommended for increased security as well as additional features and benefits. Phemex is one of the fewer exchanges on the market that as of 2022 still offers access to 100X leverage.

History of Phemex

Phemex was founded by a group of former software developers and senior executives from Morgan Stanley (MS). Its CEO, Jack Tao, is a 11-year veteran executive from MS where he worked as the global development leader of the investment bank’s Electronic trading (MSET) Benchmark Execution Strategies (BXS). He recognized the limitations of the traditional banking ecosystem and envisioned a new financial paradigm that was more mature than the exchanges on the market at the time.

He assembled a team of more than 30 senior developers in 2019 and launched Phemex, initially offering up to 100X leverage to both retail and institutional investors in Bitcoin, Ethereum, and XRP derivatives contracts with functionality of over 300K transactions per second and order response times of <1 millisecond. By leveraging their strong technical backgrounds and decades of Wall Street experience, the founding team created Phemex.

The CEO has remarked that Phemex is the first exchange to bring Wall Street level sophistication to the global crypto derivatives markets. The team’s expertise allows them to compete with top-class architecture in high-frequency trading, stability, and low latency, along with functionality as expected. The exchange’s matching engine, trading engine, and risk engine are on par with Nasdaq as per the CEO.

In addition to cryptocurrency spot and futures products, users can also trade gold futures. The Phemex team has made comments that future trading products will include major stock indices, interest rates, FX, commodities, energy contracts, and more precious metals.

Phemex is best for:

- Beginner to advanced cryptocurrency traders and investors who desire access to both spot trading instruments and derivatives contracts without required KYC, with a core offering of major coins and futures pairs, a high-performance trading engine, highly secure custody protocols, and strong support presence

- Crypto-only traders (no stocks offered) who wish to obtain access to the entire Phemex suite of products – such as Academy, Learn & Earn, Simulated Trading, integrated charting with Tradingview, a mobile app, OTC desk, and more

- Active traders who desire a competitive, flat fee schedule not based on volume-tiered pricing

PROS

- KYC optional

- Competitive, flat fee schedule

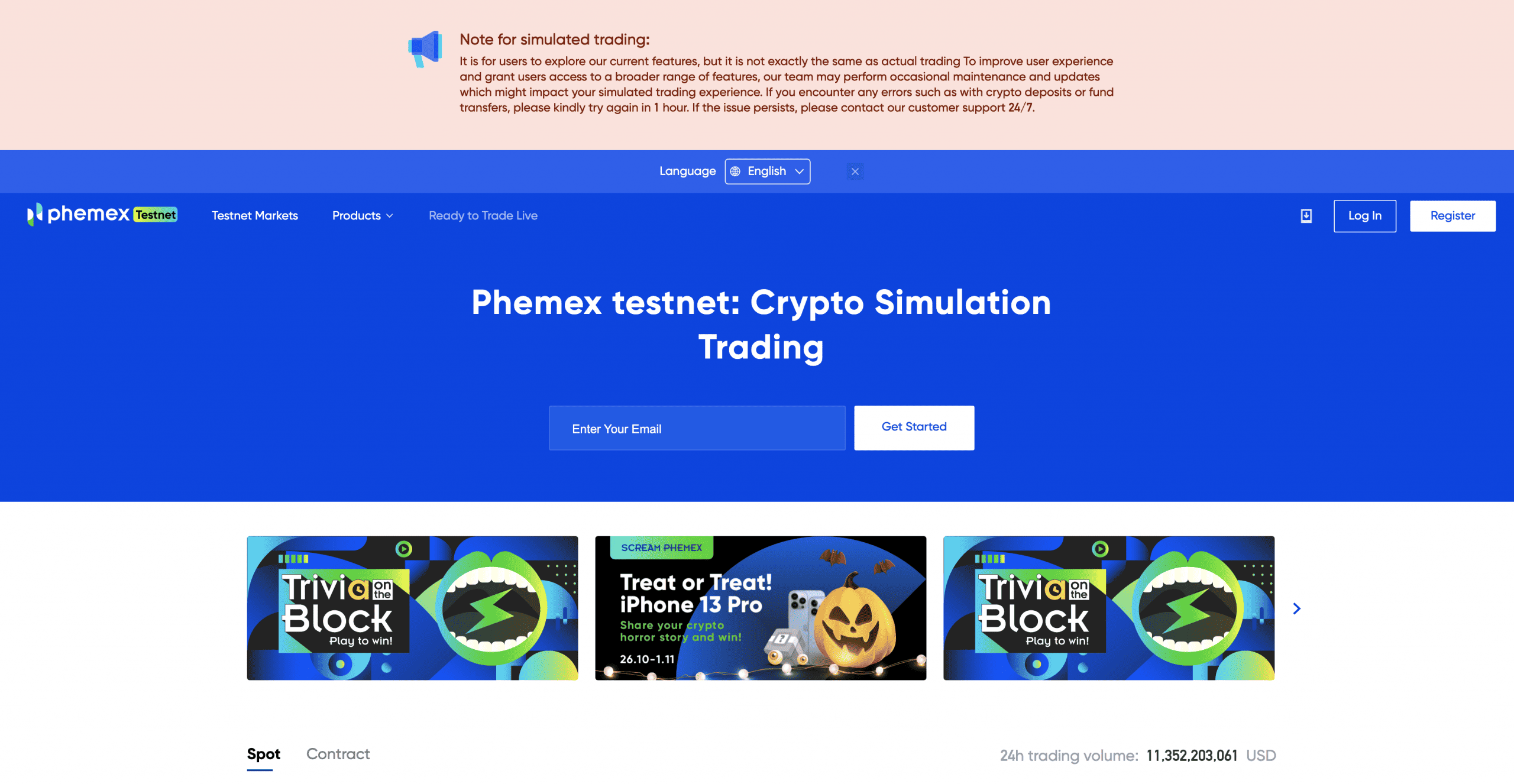

- Simulated Trading feature on testnet

- Leverage up to 100x

- Charting functionality

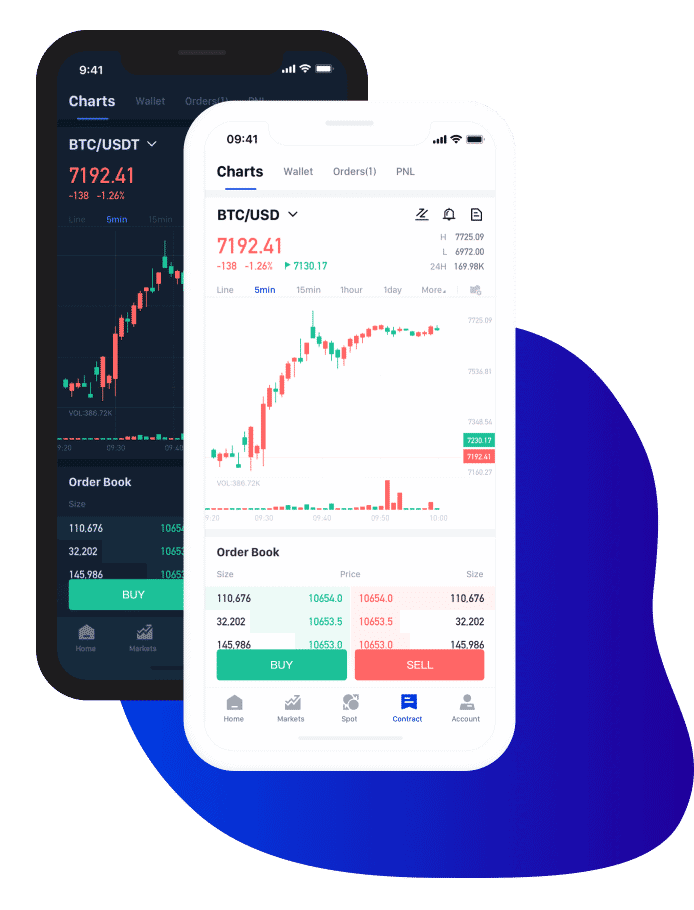

- Mobile and desktop friendly

- Subscription service with zero spot trading fees

- Inbuilt crypto converter

- Learn-to-earn program

- Referral program

- 24/7 multilingual support

- Futures contracts w/ fee rebate

CONS

- Not available to US residents

- Small cryptocurrency market offerings and trading pairs

- No extensive lending or staking services

- No volume-based fee reductions

- No leveraged token options

Pros & Unique Features

The biggest perks of Phemex are its competitive, flat fee schedule for its spot markets with fees at only 0.10% for both market makers and takers, with an additional premium tier (paid recurring subscription) that offers zero fees for spot trading. In addition, Phemex is well-suited as a derivatives platform for newer traders due to the unique feature of Simulated Trading on the Phemex testnet.

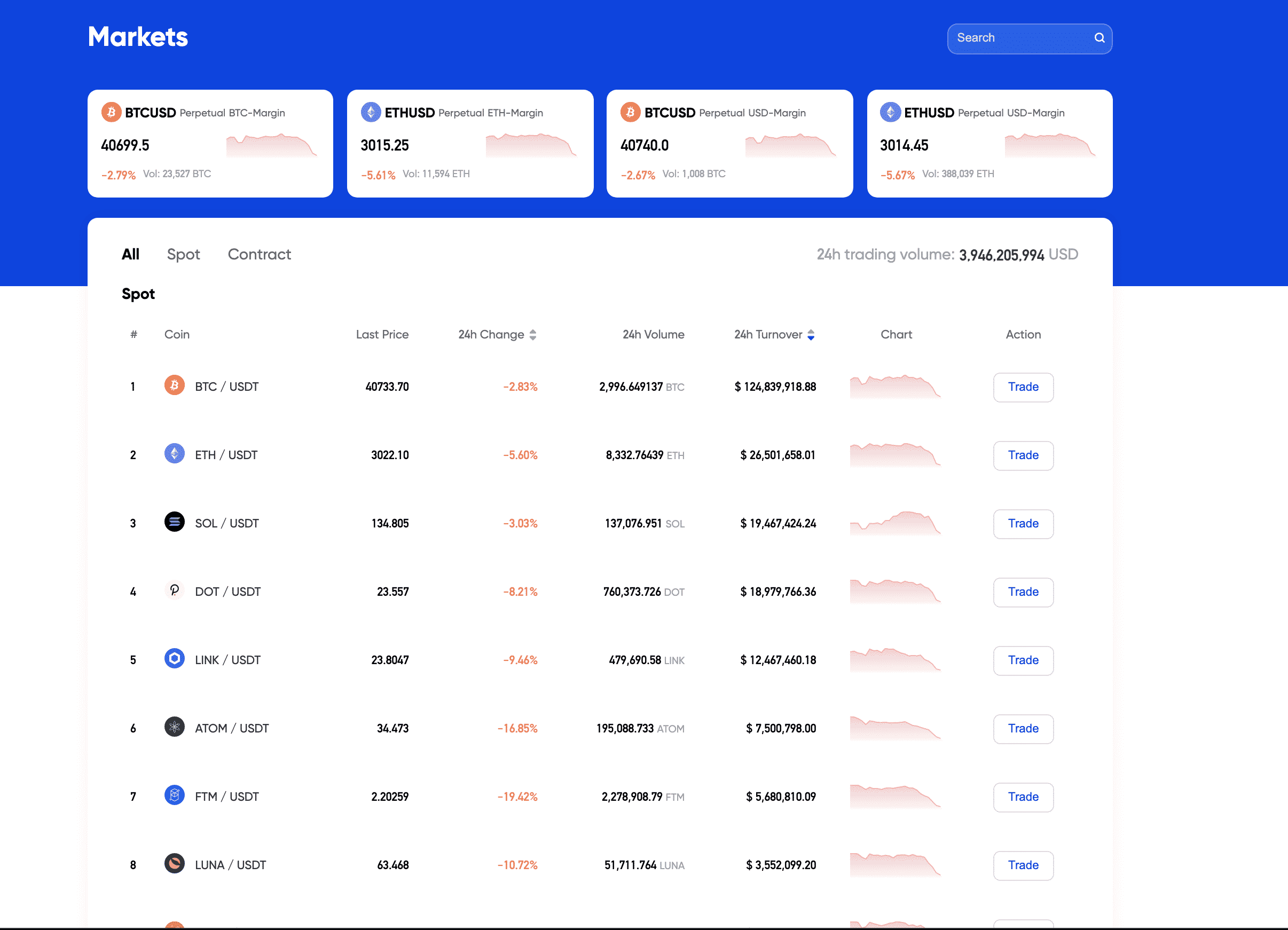

Phemex offers 41 cryptocurrency spot market offerings and 39 derivatives trading pairs with leverage up to 100X, which is higher than the leverage offered by competitors such as Binance and FTX. However, the selection of cryptocurrencies is not as high as these noted competitors, but is a decent selection for any crypto trader. It is therefore mainly meant to function as a trading-focused platform and not a full-service cryptocurrency financial services ecosystem.

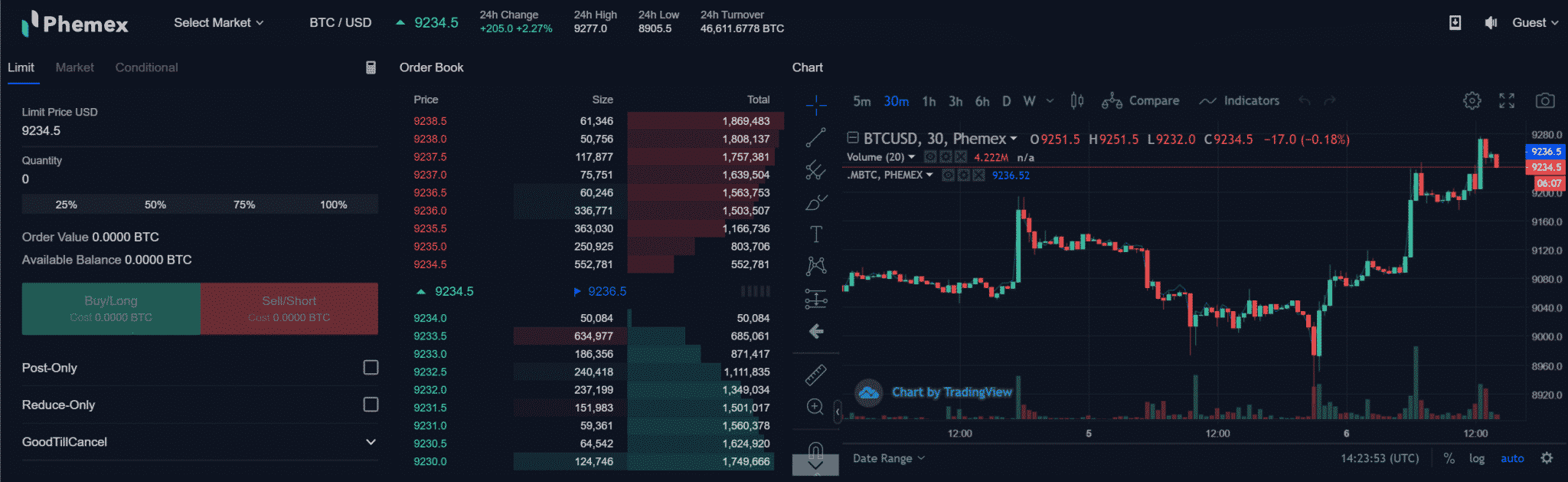

Phemex also offers an integrated TradingView charting and its trading engines are quoted to be at least 10x faster than competitors. The unique trading engine recovery system gives users 99.99% uptime with additional hot and warm backups running for the exchanges so users will never notice system maintenance periods or upgrades. This is crucial for the volatile and 24/7 nature of the crypto markets when other exchanges go down during heavy volatility or performance upgrades.

There is also an easy-to-use Phemex mobile app interface with full buy and sell functionality for both spot and futures markets with order access and real time market data, charting, and deposits and withdrawals.

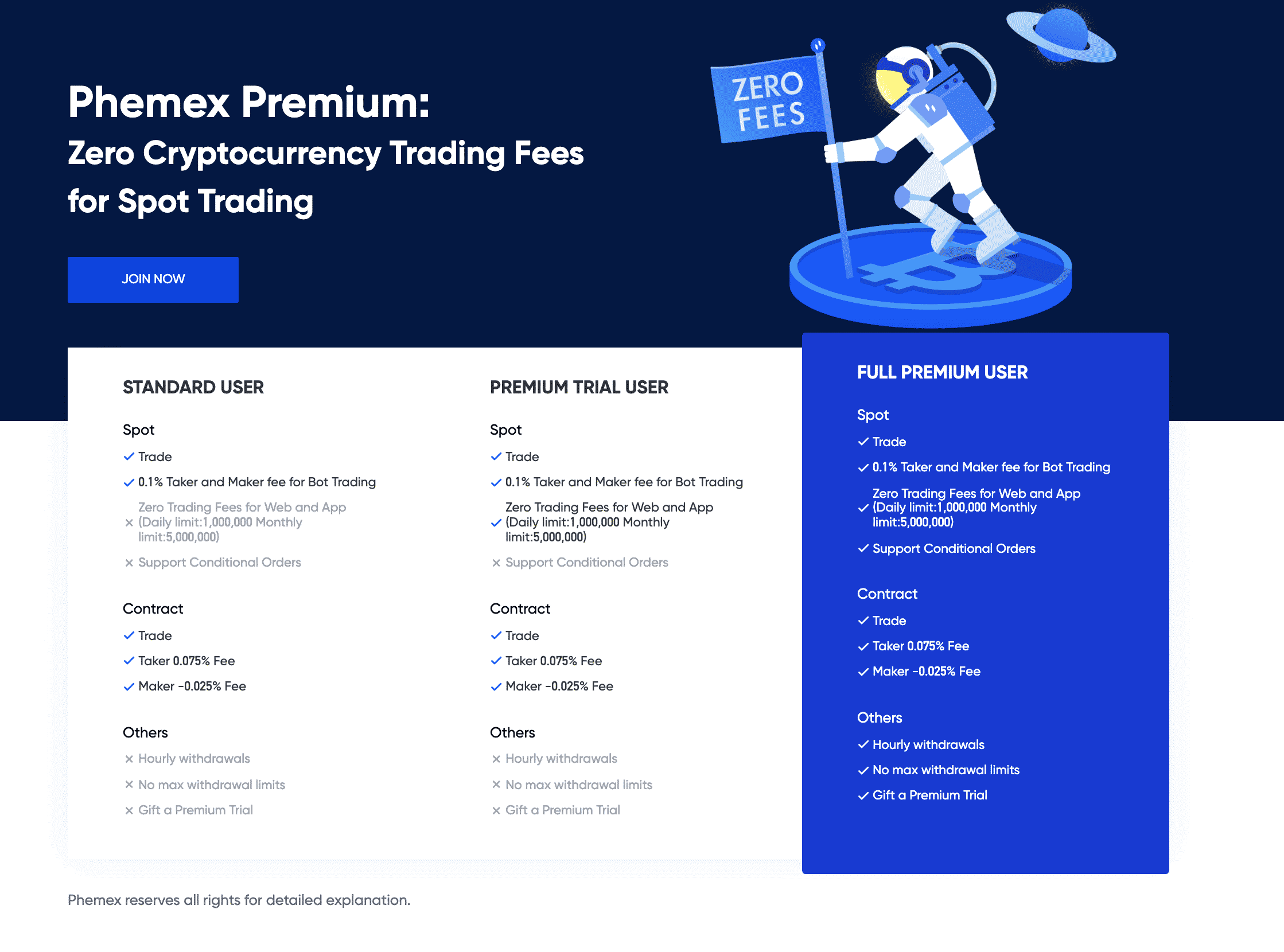

Phemex also offers a Premium subscription service for $9.99 per 30 days (or $19.99 for 3 months, $69.99 for 1 year) that reduces fees for spot trading to zero, supports conditional orders, and expands withdrawals to hourly instead of the standard 3x/day, while also removing withdrawal limits. For all users, there is an inbuilt Crypto Converter to instantly convert between fiat and cryptos.

Other features include a Learn & Earn program for users to get paid to learn cryptocurrency by watching videos and completing quizzes. There is also Phemex Academy which is a free and comprehensive resource for blockchain and crypto knowledge that is maintained by the Phemex team, with resources in areas from DeFi to technical analysis to other beginner concepts. Phemex offers an OTC trading service as well with low fees and deep liquidity for large transactions.

Phemex still offers trading functionality for users without having to KYC, but KYC provides access to increased security along with additional trading volume and withdrawal features, such as being able to access the premium subscription membership.

For referral programs, Phemex offers commission as high as 50% for their highest level referral tier called the Phemex All-Star Program, which requires a separate, short application process.

For earning up to 8.5% APY interest with fixed and flexible accounts, Phemex recently introduced a Flexible Saving product that allows users to earn interest on cryptos without long-term commitments. Users can still withdraw or deposit at any time, while still experiencing a good rate of return while the funds are held. To use this product, the user will need to transfer funds from their exchange spot wallet to their Flexible Savings Account. Phemex also offers a Fixed Saving product, which allows for higher levels of interest on only BTC and USDT invested for a specified period of time. Users must subscribe to this option for a fixed period of time before earnings can be redeemed.

As for customer support for users, Phemex offers 24/7 multilingual support and the CEO is available on Twitter and Telegram which is unique to crypto companies due to the communities. Users can request team support via chat or or email 24/7. Users can access support via the mobile app or the online interface. The Phemex team also runs a blog with industry-related updates and Bitstamp company news.

Cons & Disadvantages

The main disadvantage of Phemex are the fact that there are no extensive lending or staking services (but there are some) or other crypto financial services that can be found on other exchanges, but that’s because Phemex is focused on being a high-performance trading platform for active traders, not necessarily for long term investors and those who desire such an extensive ecosystem.

Phemex’s fees are certainly quite competitive to its competitor exchanges, however there are no volume-based incentives. For trading spot instruments, there is no separation in fee structure between market makers and market takers so high volume market makers who are used to seeing incentives such as rebates or at least lower fees will not receive them at Phemex.

For futures contracts, the standard fee for market makers involves a rebate regardless of the volume tier, so that is quite advantageous and a major advantage for Phemex.

The selection of cryptocurrencies offered in the spot instruments is a bit limited compared to other exchanges, but is standard and competitive in the derivatives pairs. However, there are no options or leveraged tokens offered as there are with competitors such as FTX or Binance.

Phemex Fees

Phemex uses a flat fee schedule without volume tiers nor maker-taker model designation for its spot trading fees, instead of the common volume-tiered maker-taker model of many other exchanges. For futures trading, Phemex does offer separate fees for market makers and takers, however there are no volume tiers.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled.

In general, for a maker-taker fee schedule, taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (adding to the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook.

At Phemex however, fees for spot trading (but not for futures trading) are the same for both makers and takers and this is a disadvantage for market makers, especially those trading high volumes, because exchanges usually provide much lower fees for the highest volume market makers, including market rebates and other incentives to drive higher liquidity on their platforms. However, for futures trading, all market makers enjoy maker rebates and no fees, regardless of their trading volume, so this is a great benefit for any participant trading any amount of volume—it pays to use limit orders on Phemex instead of market orders.

The section below shows the fee structure for Phemex’s spot and futures markets and can be found here.

Phemex Spot Trading Fee Schedule

All standard users (without the premium subscription) currently pay 0.1% in fees for both market makers and takers, regardless of their volume.

Premium subscription members are not charged any spot transaction fees on the Phemex website or app, but those using the API (both takers and makers) are still charged the same 0.1% fee even if they are a premium subscriber. The minimum order value for all spot trading instruments is 10 USDT.

Phemex Futures Trading Fee Schedule

All users trading any of Phemex’s 39 futures pairs pay the same fee that is separate for market makers and takers. Makers receive a rebate in the amount of 0.025% (the total fee for market makers providing liquidity on futures is -0.025%). Takers that remove liquidity from the order book are charged a 0.075% transaction fee for each execution.

There are also additional funding fees as is standard for futures trading pairs across all crypto exchanges. Funding fees are charged or issued between long and short positions holders every 8 hours. Phemex does not charge any overnight fees.

Other Fees

Phemex charges the following deposit, withdrawal, and other fees:

- No withdrawal fees on BTC or USD from your trading account to your exchange wallet, and no maximum deposit limit

- Transaction fees for withdrawing from your exchange wallet depend on the blockchain in question and can be found here. There are withdrawal fees for all cryptos on the exchange except for NEO and USDT-TRC20.

- Minimum trade limit of $500 using the OTC service

There are no fees for signing up or for having an inactive Phemex account, nor any fees for holding funds in a Phemex account, and users may hold assets as long as desired.

Account Tiers & Limits

Phemex does not require full KYC identity verification for all users wishing to participate in trading or buying spot on the exchange, however fully verified users enjoy access to increased security and limits.

Users without KYC cannot purchase access to the premium subscription which in addition to zero fees for spot trading, also provides expanded access to withdrawal processing times compared to the standard 3 withdrawal times per day.

Standard and premium trial users can only withdraw up to 2 BTC per day and withdrawal processing times are 8AM UTC, 4PM UTC, and 11PM UTC. Premium users have no withdrawal limits and enjoy hourly withdrawal reviews.

The documents required for KYC verification include the user’s current and valid government identity document such as a passport or driver’s license and a proof of residency document such as a bank statement. Users who do not complete KYC will also not be eligible for various bonuses.

Crypto Security

Phemex stores assets using a “Hierarchical Deterministic Cold Wallet System” which means Phemex assigns separate cold wallet deposit addresses to each user. All the deposits are periodically gathered in the exchange’s multisignature cold wallet via offline signature. Phemex processes withdrawal requests only 3 times a day at noted times and each request is scrutinized by operators.

Since the team has risk control experience in traditional finance, they are well-equipped to detect any malicious actions to protect user assets. Qualified withdrawal requests are also processed via offline signature, and all assets remain 100% stored in a cold wallet system with all operations conducted offline.

Phemex secures its machines on the AWS cloud service and uses firewalls to separate machines for different trading purposes. There also exist multiple levels of security and internal network access management protocols to control the accessibility of one instance to another.

For securing user accounts, Phemex offers 2FA (2-factor authentication) for critical account features such as login, funding, withdrawals, or password changes. Phemex also uses a bank-level double-entry bookkeeping system to prevent the tampering of records.

As far as security of the trading engine, there is seamless data recovery in addition to high performance. Each trading engine runs with multiple hot and warm backups at the same time.

As far as its security record, Phemex has never been hacked.

Phemex Review Conclusion

Phemex is an overall great exchange of choice mainly for active spot and derivatives traders who value a high-performance trading engine with a simple, flat fee structure that provides incentives such as market maker rebates in futures pairs even for the lowest volume traders, and the same fee structure across spot pairs regardless of volume or maker/taker status. High volume spot market makers will not benefit from no changes in fee structure with the lack of volume incentives, and same with high volume futures market makers (but they will receive a rebate).

In addition, Phemex provides access to up to 100X leverage which is becoming rarer in the crypto markets today, as well as a unique premium subscription product which reduces spot trading fees to zero and adds more functionality.

While its spot trading selection is below average when compared to top exchanges such as Binance or KuCoin, it is adequate for those interested in trading the Top 40 coins and the fees are competitive.

Phemex also offers impressive exchange functionality and latency that was built by software developers and executives from the traditional finance space. The only disadvantage is that Phemex lacks the overarching ecosystem of products and services that an exchange like Binance offers. However, Phemex does offer a lending/staking service.

- Phemex offers 41 spot cryptocurrencies and 39 futures trading pairs, so while its selection is not as extensive as that of Binance or KuCoin for example, it offers the core top cryptocurrencies for spot investors and a fair amount of futures trading pairs

- Investors and traders of all skill levels—everyone from low volume beginner traders to high volume advanced traders will benefit from Phemex due to its attractive non-tiered fee schedule, high-performance platform for both spot and futures trading, a full-featured mobile app and web interface, a great support experience, advanced charting functionality, and lack of KYC requirements to use the exchange except for higher limits

- Advanced traders who wish to use up to 100X leverage futures trading that can no longer be had on FTX nor Binance may prefer Phemex, however the selection of futures pairs is slightly more limited.

Other Alternatives

For customers who desire access to a simple user interface with even more trading pairs, or those who do not desire to participate in cryptocurrency futures trading either Bittrex, Coinbase, and Voyager can make great alternatives with a more competitive amount of cryptocurrencies offered to trade and similarly competitive trading fees and functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning, similar to Phemex’s Learn & Earn product.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a much larger selection of cryptocurrencies offered compared to Phemex—402 pairs vs. Phemex 42 pairs—while active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and all offer volume-based incentives, while Phemex has a flat fee structure that offers even the lowest volume traders the same fees.

Phemex’s order and trade matching engine compares extremely favorably in performance and liquidity to any competitor, however the range of offerings cannot compete with other top exchanges. For users who have had bad experiences with latency and uptime during volatile crypto market movements, they may prefer to try out Phemex which prides itself on latency and uptime during such movements.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Phemex include Bitstamp, Crypto.com, and Bybit.

Phemex vs Coinbase

The main advantage Phemex offers over Coinbase is its much lower starting fee schedule, however Coinbase differentiates between makers and takers, while Phemex has the same fee for both for spot markets, albeit starting much lower than that of Coinbase.

Coinbase’s fees start at 0.5% for both makers and takers for the lowest fee tier, while those of Phemex are at 0.1% for all volume tiers for both makers and takers.

Both exchanges offer the option of advanced charting and crypto-to-crypto trading pairs using Coinbase’s Coinbase Pro product and Phemex’s online platform or mobile app. Phemex offers a moderate amount of futures trading pairs while Coinbase only offers spot trading without margin.

Phemex only offers 40 coins and 42 pairs to trade, while Coinbase offers 139 coins and 402 pairs, so Coinbase’s selection is much more extensive for the average investor and spot-only trader.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Phemex is not regulated in the US nor US-compliant, and is not a public company either.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either FTX or Coinbase offer may find the choices below equally valuable.

Phemex vs FTX

FTX International really shines against Phemex for advanced traders, offering 323 coins and 492 trading pairs. Derivatives traders who want to trade options or leveraged tokens will prefer FTX since Phemex does not offer any of those options.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while Phemex does have a high performance order matching engine, but cannot compare in trade volume, nor selection of cryptos and trading products, but compares very favorably in fees for futures, especially for low volume traders.

FTX cannot be used by US persons, and instead offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection, and FTX International’s fees are more competitive than FTX US’s low fees. Phemex offers a similar selection of coins to trade as FTX US, with futures offerings that FTX US does not offer, and is available for US persons to use with a VPN since KYC is not mandatory, but this is technically against the exchange TOS.

Phemex vs Gemini

Phemex and Gemini are similar exchanges in terms of the ranges of their product offerings, though Gemini is more suited to investors and those seeking US regulated custody and interest-earning services as well that are more extensive than those offered by Phemex, while Phemex is better suited to active and derivatives traders, as Gemini offers no futures trading.

There is a major difference in fees: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, which Phemex does not have due, but all of the fee tiers at Phemex are flat at 0.10% for both makers and takers, with no volume incentives (for spot).

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products. US users can use Phemex with a VPN and without KYC but note it is not regulated in the US.

Gemini offers 62 coins and 86 trading pairs which is similar but more to that of Phemex, offering 40 coins and 42 pairs, so Gemini wins in the selection department, and Gemini’s Gemini Earn product has far more staking selection and higher APY offered than Phemex’s staking services.

Phemex vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while Phemex offers up to 100X leverage on futures trading without KYC being required. If strictly seeking the highest accessible margin, Phemex is a good choice.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is less competitive than the fee schedule for Phemex. Kraken offers no other fee incentives such as rebates or reductions except for volume, which is typical of volume-based maker-taker fee schedules. The benefit market makers will have using Kraken is the reduced fees for makers, while Phemex charges the same trading fees for both market makers and takers and they start quite small at only 0.1% for spot trading, with rebates for makers in futures pairs for every volume level, which is a win for Phemex in the fee department.

Kraken also offers a large variety of cryptocurrencies and pairs (93 coins, over 400 pairs), so users who value a large selection and advanced traders who seek some margin will prefer using Kraken.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while Phemex is not compliant in and not regulated in the USA. Neither Phemex nor Kraken have ever reported any large scale hacks.

Phemex vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Phemex—over 351 coins and over 1300 pairs, which is only beaten by KuCoin when it comes to centralized exchanges.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products may prefer FTX, however Binance Futures offers many USDT futures pairs that are not offered on FTX at the moment. Binance Futures undoubtedly offers a much greater selection of trading pairs than Phemex offers, and Binance is known to list new pairs and coins quickly, while Phemex has stuck to established pairs and a more limited selection, but still has enough for the average trader who desires to trade the top coins.

Binance’s base maker-taker fee is also similar to that of Phemex, starting at 0.1%, and offering further 25% reduction in fees if paid in BNB, which is an incentive and reduction that Phemex does not offer. Phemex has the same fee for both makers and takers and offers no other fee reductions, even for volume—0.1% for spot.

The Phemex brand has existed since 2019 while the Binance brand is more established, since 2017, as well with a much more extensive network of crypto financial services and product offerings. Binance offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Phemex.

Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs. The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs.

Binance requires full KYC now to trade even spot products, and Phemex still as of Q1 2022 does not require KYC to trade spot or futures, but encourages it for access to a larger selection of trading products and pairs and heightened security and functionality.

In summary, advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will prefer Binance, but traders who just desire a no-frills futures or spot exchange with cheap fees and a simple selection yet advanced order matching engine and exchange technology will appreciate the offering of Phemex.

FAQ – Frequently Asked Questions

Is Phemex Safe?

Yes, it is safe as Phemex employs institutional-grade security standards given the founders’ background in risk control in traditional finance on Wall Street for 11 years.

Phemex has reported no hacks to date and assigns separate cold wallet deposit addresses to each user as well as a multi-sig cold wallet, with withdrawals processed 3x/day and scrutinized for suspicious activity by operators. Its machines are secured on the AWS cloud service and firewalls are used for different trading purposes, plus there exist more levels of security and internal network access management to control accessibility from employees.

Users with accounts on Phemex should employ standard security precautions such as a strong password and using 2-FA using an authenticator or a hardware security key such as a Yubikey, not using only SMS.

How long does Phemex Withdrawal take?

For standard users, Phemex processes withdrawals 3 times a day at 8AM UTC, 4PM UTC, and 11PM UTC.

Standard and premium trial users can only withdraw up to 2 BTC per day. Premium users have no withdrawal limits and enjoy hourly withdrawal reviews so they can withdraw more frequently.

The withdrawal cutoff time is 30 minutes before the listed withdrawal processing time. Withdrawals for crypto are credited to the user’s wallet within 1-2 hours, due to the time needed for the manual oversight process and pending transactions on the blockchain network.

The usual timeframe for ACH and wire transfer withdrawals to reach the user’s bank can be up to 2-5 business days, excluding weekends and holidays. The transfer is executed at the times listed on Phemex’s end, however the banking system might need a few additional days to credit the funds to the user’s bank account.

Is Phemex a good exchange?

Yes, Phemex is an overall excellent choice of cryptocurrency exchange for all types of beginner to advanced cryptocurrency traders, but it’s best for active traders (due to its low fees regardless of trading volume), and for derivatives traders since it offers up to 100X leverage available.

It is best thought of as a active spot and futures trading exchange that also offers trading gold futures and with plans to add other products such as FX and commodities, with a state-of-the-art order matching engine and trade performance, but its selection of cryptocurrencies and trading instruments cannot compare with other exchanges that also offer competitive fees, such as Binance, KuCoin, and FTX.

If a user is looking for extensive bells and whistles such as payment cards and crypto loans, those are not available at Phemex and better choices may be Crypto.com or Binance.

Where is Phemex located?

Phemex is located in Singapore.

Does Phemex require KYC?

No, KYC is not mandated to use Phemex services. However, the exchange encourages the use of KYC for increased access to functionality such as its premium subscription service and heightened security protocols. However, as of Q1 2022, users without KYC can use the spot and futures trading pairs without KYC without a problem.

The documents required for KYC verification include the user’s current and valid government identity document such as a passport or driver’s license and a proof of residency document such as a bank statement.

What are the Deposit and Withdrawal Methods and Fees for Phemex?

Phemex offers the following deposit and withdrawal methods, with the corresponding fees and limits listed here for expanded detail:

- BTC deposit and withdrawal, the minimum deposit is 0.00000001 BTC, the minimum withdrawal limit is 0.001 BTC, the withdrawal fee is 0.00057 BTC

- USDT deposit and withdrawal, for both TRC20 and ERC20 networks. The minimum withdrawal limit for both is 2 USDT and the withdrawal fee for USDT-TRC20 is 0, while that of USDT-ERC20 is 10 USDT. Users should withdraw with USDT-TRC20 when possible to save on this fee.

- No withdrawal fees on BTC or USD from your trading account to your exchange wallet, and no maximum deposit limit

- Transaction fees for withdrawing from your exchange wallet depend on the blockchain in question and can be found here. There are withdrawal fees for all cryptos on the exchange except for NEO and USDT-TRC20.

What is the Minimum Withdraw Amount for Phemex?

The minimum withdrawal amount for Phemex may be found here for each cryptocurrency. It can range from 0.001 BTC for Bitcoin to 2 USD for USDT and similar equivalency across other crypto assets.

How do you withdraw from Phemex?

Users can withdraw from Phemex by logging into their official website, navigating to the “Assets” section on the top right corner, clicking the Address Management link on the top right side, then add a withdrawal address with the desired coin and address.

Then, the user must confirm this with 2-FA and email verification. Once this is done, the user may withdraw.

Here is the official support page for how to withdraw from Phemex support.

Is Phemex a wallet?

No, Phemex is a cryptocurrency exchange which provides a multicurrency wallet inside of the user’s exchange account for custody with the exchange, as well as a trading account wallet for futures trading. Users may transfer funds without fees between the exchange wallet and the trading account.

How to use Phemex?

Using Phemex can be done by going to phemex.com, creating an account on the platform, undergoing the KYC procedures to use the account if desired (not required to use the platform), deposit any trading funds into the exchange account for spot trading, transfer them to the trading account for futures trading, and then get access to all of the market offerings and begin trading with up to 100X leverage access offered for futures.

Phemex User Reviews

- A beginner subreddit for Bitcoiners asks if Phemex is a safe exchange to use, with good responses detailing experiences. “I’ve been trading on Phemex a bit. It does not require KYC. It has a good matching engine and some other good perks, but the liquidity is lower than some of the other big players. Overall, I like it.” However, one user claims: “They use reverse psychology to tell you that your withdrawl (sic) didn’t transfer and that it’s your own fault. When actually their system is rigged to cause the problem with your transaction.”

- A beginner user asks if transferring his crypto to Phemex is better over Kraken or Exodus because of the fees. u/bitusher replies: “You should consider using a better exchange that offers free withdrawals”.

- A user cautions against Phemex: “Most of the people I see here are having their accounts locked like mine or facing other problems…so I think one should be cautious before using it.” u/Adsnipers is a little less warry: “I’ve been seeing everybody complaining on social media, I believe Phemex is a legitimate exchange and something is going on with their Anti-fraud systems. maybe people trying to scam the system causing them to have to be more strict on freezing accounts. I trust the exchange for now but I am a little bit worried to withdraw”.

- A new Phemex user asks how the referral codes work. u/Potential_Reveal_358 replies: “I’m not sure about the specific referral codes that you found, but there’s a ‘Bonus’ section in their app where you can opt to receive various bonuses once you meet the criteria for each one.FYI All of the bonuses or incentives they pay you must be used entirely within their exchange”.