![]()

WazirX is an Indian cryptocurrency exchange that launched in 2018 that serves primarily the Indian crypto market. The exchange is headquartered in Mumbai, India.

The exchange requires KYC (Know Your Customer) identity verification protocols to be completed for use of the exchange. US users cannot use WazirX, but individuals from most countries are allowed to sign up for the exchange, except for these listed countries.

History of WazirX

WazirX was founded in 2018 by Nischal Shetty, Sameet Mhatre, and Siddharth Menon, and acquired by Binance in 2019. As of August 2021, WazirX had over 7.3M active users. Since WazirX is tailored to the Indian crypto audience, it follows regulation in India for Indian users and offers INR (fiat rupee) deposits and withdrawals, with ramp access to Indian banking.

WazirX also features its own native exchange token, called WRX, that is based on Binance Chain and Ethereum chain. Recently in March of 2021, the exchange launched its NFT platform.

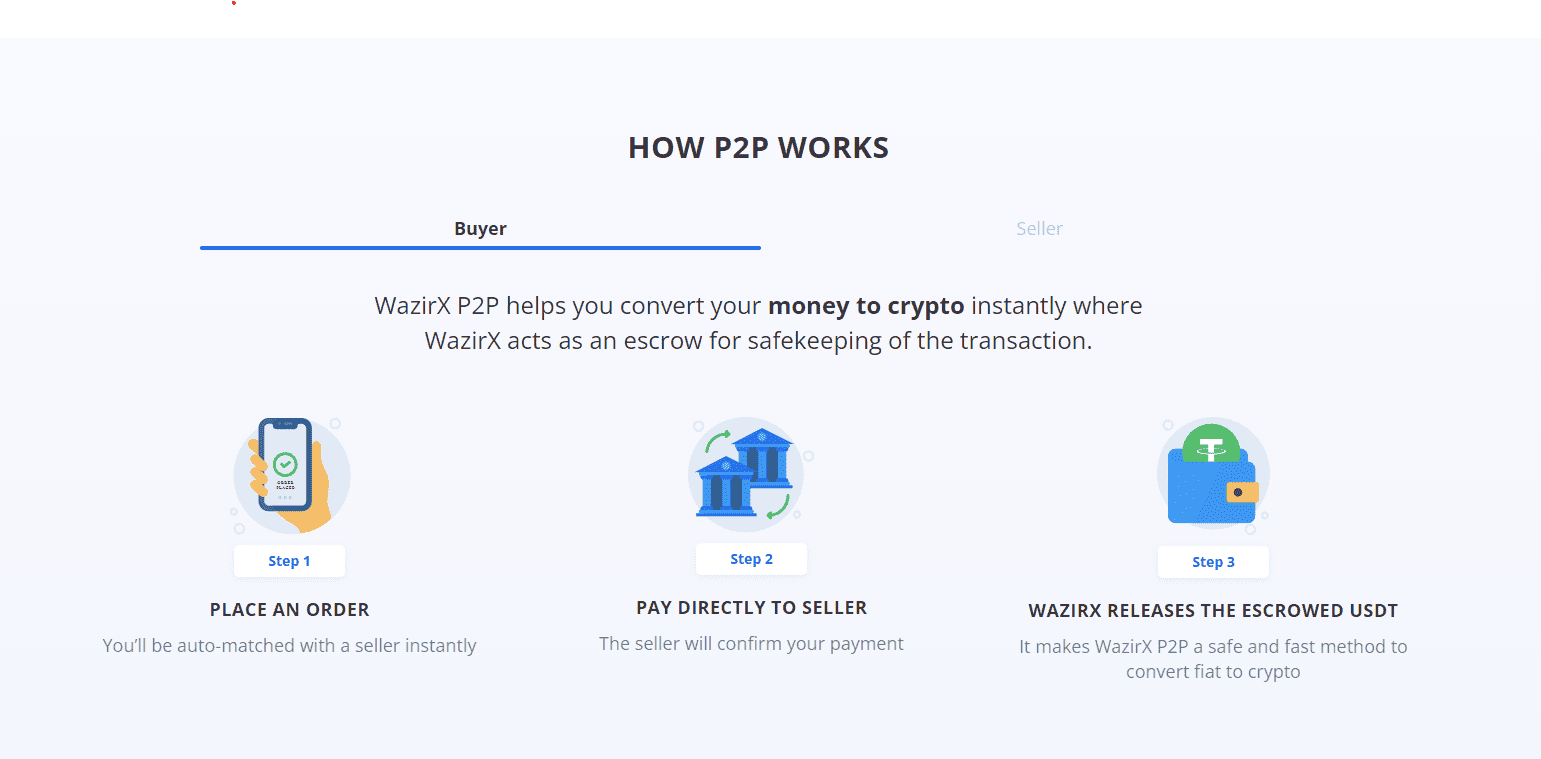

According to the founder, Shetty, WazirX has built the world’s first auto matching P2P engine that helps users with fiat to crypto (and vice-versa) conversions in a faster, cheaper, and safer manner. This was done in response to the Indian Central Bank banning banks in India from dealing with cryptocurrencies and their businesses.

As of January 2022, WazirX had over 60% of the Indian cryptocurrency trading volume and the largest NFT marketplace in India. Recently in February 2022, the exchange’s 24H trading volume reached $55M USD.

WazirX is best for:

-

Global cryptocurrency investors and spot/margin traders in emerging markets and especially in India (due to the easy access to INR payment off-ramps and on-ramps) who desire access to a large amount of crypto offerings and products

-

Traders and investors who desire the option between a standard 0.20% trading fee or 0.00% trading fees if exchanging using the exchange WRX token, on a high volume exchange, alongside the other range of products WazirX provides access to

PROS

- INR trading pairs

- P2P auto-matching service

- Integrated into Finance ecosystem

- Global audience

- Indian banking off- and on-ramps

- Advanced charting and trading features

- Large selection of coins and trading pairs

- Order book option

- OTC desk

- Corporate accounts

- Mobile and desktop friends

- Native token with discounts

- Referral program

CONS

- Only spot trading

- No margin or futures trading

- No lending or staking feature

- Flat maker-taker fee model

- KYC required

Pros & Unique Features

The best features of WazirX are its easily accessible INR trading pairs and high regarded P2P auto-matching service. WazirX also is integrated into the Binance ecosystem (and so assets can be transferred from Binance to WazirX without fees), and serves a global audience. WazirX also offers access to Indian banking off- and on-ramps for select banks.

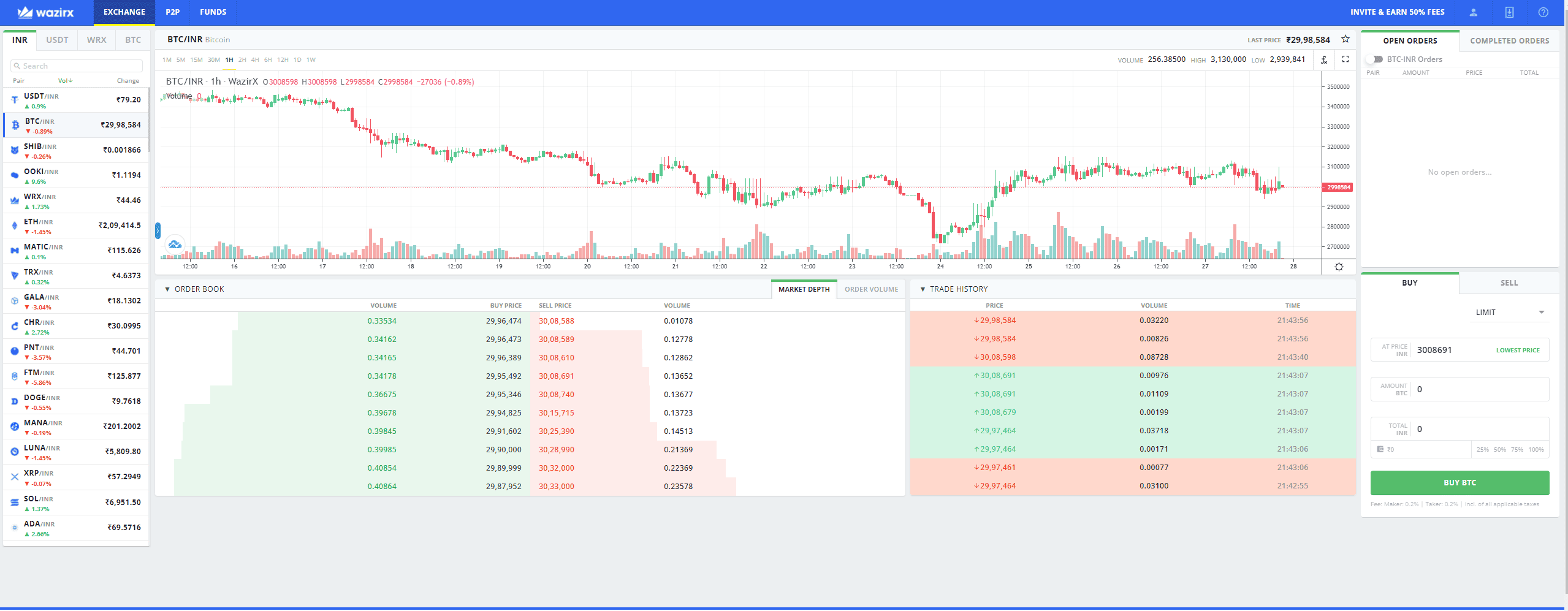

WazirX’s products include a full-featured exchange with advanced charting and trading features. The exchange offers only spot trading at this time, with 225 coins and 418 trading pairs, which is an extensive offering range.

Charting is integrated with TradingView and order books are present for more advanced traders to use, with trading pairs available in INR, USDT, WRX (exchange token), and BTC.

The exchange also offers an OTC desk with deep liquidity, personalized service, lower trading fees than the exchange and an additional 50% discount if paying trading fees with the WRX token, and an OTC-specific dashboard for tracking trades. OTC trades allow users to conduct orders outside of an exchange’s order book.

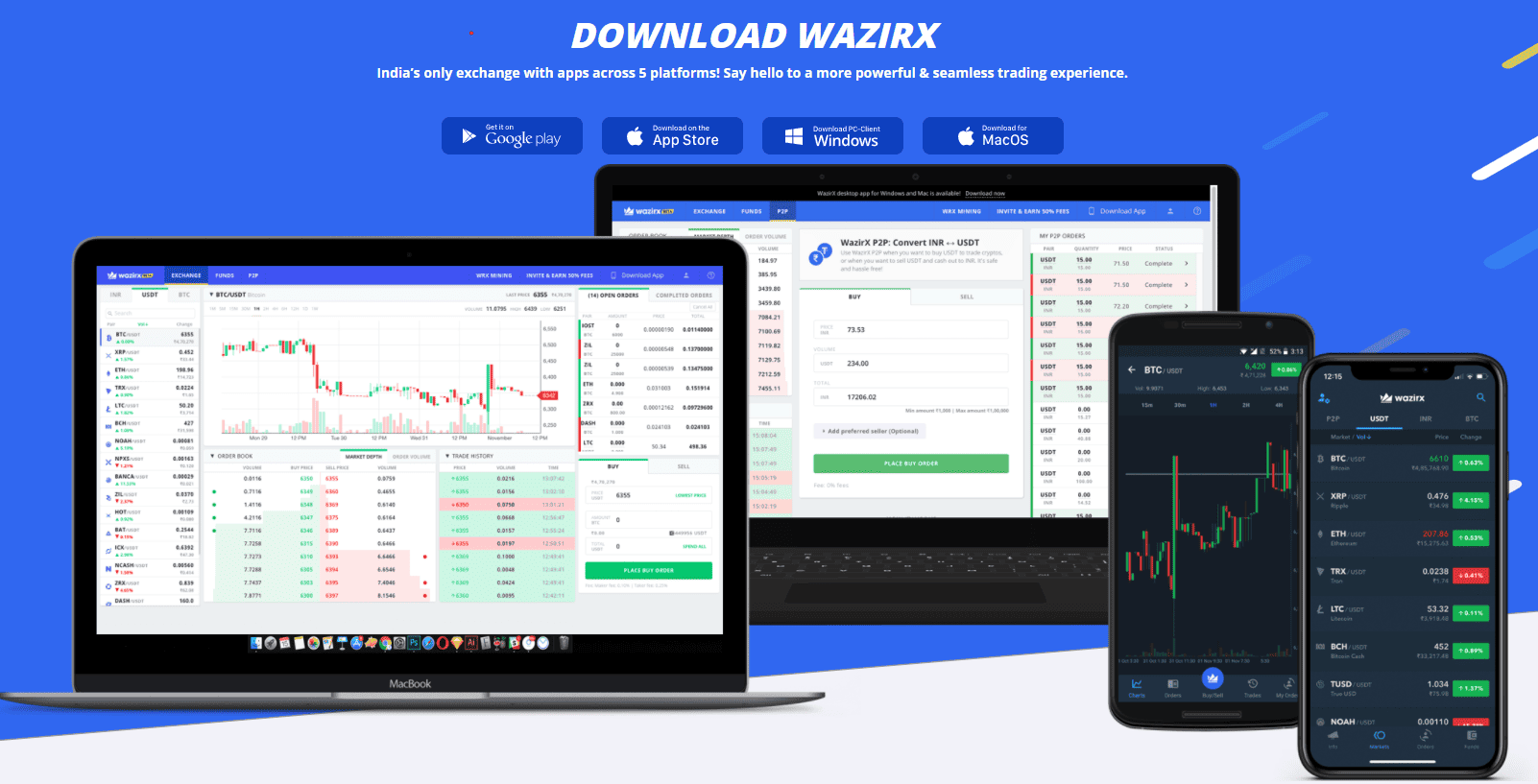

WazirX also offers corporate accounts, full-featured mobile apps for both Google Play and Apple, and desktop client apps for both Windows and Mac. All noted apps have advanced charting and trading capabilities. Additionally, there is a P2P trading service with instant auto-matching, zero transaction fees, verified traders, and where WazirX acts as an escrow for safekeeping and allows fast conversion of crypto to fiat.

WazirX’s exchange token, WRX, forms the backbone of the exchange. The maximum coin supply is fixed at 1 billion and it is meant to have utility on the exchange for future use. The WRX coin can already be used to pay trading fees on the exchange (50% discount on fees), and there exist trading pairs for cryptos against WRX that have zero trading fees offered. WRX can also be mined, be used to be eligible for token airdrops, and for voting power.

WazirX’s referral program allows users to refer their friends and earn 50% of their trading fees.

As for customer support, WazirX offers support via live chat and email, plus users can also access support via logging into the exchange. The team also runs a blog with announcements and offers an API.

Cons & Disadvantages

There are no major disadvantages of WazirX as it is an all-around top-tier choice for Indian crypto users, but is also open to the global crypto community, except for users from the USA and a few other countries.

While its host of crypto financial services are limited beyond its actual market offerings, and only spot trading is offered, with no margin or futures trading, the spot trading selection is still competitive with other top exchanges. There is no crypto lending feature or any other feature to allow users to earn interest or stake their crypto assets as of February 2022.

One disadvantage of Wazirx is in its flat maker-taker fee model, which is set at 0.20% for both makers and takers for all coins (except for WRX pairs, which have no trading fees), so this fee is on the higher side if compared to competing exchanges. However, users can receive discounts if paying trading fees in WRX token, and can use WRX to trade into these cryptos, in which case the trading fee is null.

However, unlike many other top exchanges, there are no tiered volume incentives or market maker rebates or reduced fees for makers. Hence, there is no incentives for liquidity providers or for high volume traders to participate more in this exchange, while other competitors such as Binance and FTX do offer both features.

Lastly, WaxirX does require KYC requirements to be completed to use the exchange for all jurisdictions as per its KYC/AML policy, and as per its TOS, US users and those of a few other countries may not use the exchange.

WazirX Fees

WazirX utilizes a flat fee schedule on trading fees, with the fee being the same for market makers and for market takers.

Trading fees are 0.20% for both market makers (providers of liquidity) and the same for market takers (takers of liquidity). There are no incentives or tiers based on trading volume, unlike at many other exchanges.

The trading fees for Crypto/WRX (exchange coin) trading pairs are 0.00% for both makers and takers.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

WazirX does offer reduced trading fees for users holding its exchange token WRX. Trading fees can be paid using WRX in the USDT, BTC, and WRX markets. However, in the INR market, trading fees can only be paid with INR.

Trading fee reductions for WRX holders are dependent on the WRX holdings of the user. For users holding 10-20 WRX, there is no deduction. For users holding 20-200 WRX, the trading fee payable is reduced to 0.17%, down from the standard 0.20% fee. For users holding >200 WRX, the trading fee is reduced to 0.15%.

Other Fees

WazirX charges the following deposit, withdrawal, and other fees:

-

No account creation or maintenance fee

-

No deposit fees for any digital asset

-

Withdrawal fees for digital assets depend on the asset in question and are linked. The fee for BTC withdrawal is 0.0006 BTC

-

Withdrawals to Binance from a WazirX exchange wallet using the “Transfer Funds to Binance” feature are free and instant

There are no fees for signing up or for having an inactive account, nor any fees for holding funds in an account, and users may hold assets as long as desired.

Account Tiers & Limits

All users of WazirX are required to undergo the same KYC verification procedures.

For KYC, users are required to submit their name, address, DOB, nationality, government-issued ID, and a valid photo holding said ID, in addition to a valid email address and a mobile phone number.

There are no limits on INR deposits from a linked Indian bank account, but there are limits on P2P buy orders, which depend on the user’s portfolio value. The P2P order limits can be found here.

Crypto Security

WazirX is rated as a secure exchange and the most trusted exchange in India. There has never been a reported large-scale hack of the exchange.

As per its security precautions, WazirX stores 95% of the funds in cold storage. The platform is also enabled with a two-step verification feature to provide enhanced security to customer accounts. It also utilizes a multi-signature wallet system and adheres to strict KYC/AML guidelines.

Users are always encouraged, as with all exchanges, to use 2-factor authentication with either an authenticator application or with a hardware authenticator key, instead of with SMS, to limit potential SIM swap attacks. In addition, users should use complex passwords, unique email addresses, and be wary of phishing attempts.

More security precautions can be noted here.

WazirX Review Conclusion

WazirX is an excellent choice of crypto exchange especially for Indian crypto market users who wish to transact with INR or otherwise global users who may want access to the exchange’s P2P auto-matching service and other products.

WazirX does offer over 200 coins and over 400 trading pairs which is a moderate to strong amount of coins if compared to other exchanges, and the fee structure is very simple to understand, at a flat 0.20% trading fee for both makers and takers for all coins, with fees reduced to 0.17% and further to 0.15% for holders of the exchange WRX token.

While these fees leave incentives to be desired for higher volume trades and for market makers providing liquidity, WazirX’s ease of access to Indian banks for fiat, moderate spot trading features, and strong trading platform support and features make it a great overall exchange, with room to grow in their crypto financial services over time.

International users looking for further lending, borrowing, and staking options, which WazirX lacks, may find competitors more valuable, but this is the top exchange of choice for Indian crypto users.

-

WazirX offers access to 200+ cryptos and reduced trading fees as low as 0.15% for spot trading or 0.00% for trading pairs for its native exchange token

-

Intermediate to advanced traders trading margin or futures who desire access to advanced trading tools, volume-based fee tiers, or market maker incentives would prefer to seek another exchange, especially if preferring not to undergo KYC procedures

Other Alternatives

For customers who desire access to a more comprehensive crypto exchange that also offers a host of financial services such as staking and cashback cards, either Coinbase, Gemini, FTX, and Binance can make good alternatives, and all of these also offer greater amount of cryptocurrencies to trade along with varying fee structures that can mean lower fees for trading, and a greater selection of trading products as well.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Voyager and Coinbase with their brand presence, US regulatory approval, and security.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users—Coinbase offers 402 pairs vs. WazirX’s 225 coins—and offers an advanced desktop trading interface as well as a mobile app, but no futures or margin.

Active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and most exchanges on the market use maker-taker fee schedules that give volume incentives, unlike WazirX which uses a flat fee model set at 0.20% for standard trading.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to WazirX include CoinDCX, Unocoin (both of the previous names are Indian exchanges as well), OKX, Bitvavo, and Binance.

WazirX vs Coinbase

Coinbase is better for many crypto products offered if compared to WazirX, since it focuses on a wider range of services suited for both new users and advanced users with Coinbase Pro, while WazirX focuses on serving primarily the Indian market and is not as advanced yet in its other product offerings beyond coins being listed.

WazirX and Coinbase both offer spot trading, and neither offer margin or leverage, so this is a tie. Coinbase however offers a more robust fee schedule, albeit starting at a much higher 0.50% fee rate for the lowest volume tier.

However, an advantage for high volume traders will be the volume-tiered fees (and market maker incentives) at Coinbase, which decrease most rapidly over $20M in 30-day trading volume. Both exchanges require KYC to use so this is also a tie.

Coinbase also offers much more of a selection of trading pairs compared to that offered at WazirX, with 440 trading pairs, compared to 225 coins at WazirX, as well as advanced charting, accessible order books, and advanced order types, which both exchanges offer.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while WazirX is not known nor used much outside of India.

WazirX vs FTX

FTX will win against WazirX for all intermediate or advanced traders, as FTX offers 323 coins and 492 trading pairs, which is higher than WazirX’s 225 coins and nonexistent futures offering.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX for this reason, alongside its more extensive suite of products, such as FTX Pay, and others.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while WazirX does offer advanced charting and order books access, but the exchange performance and reliability cannot be compared to that of FTX, given that FTX works directly with and was founded by the top market makers in the crypto space.

FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed. Neither options can be used officially by US users.

FTX offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection, and are more limited than what WazirX offers, though it remains competitive in its fee. FTX US wins for US users over WazirX for this reason.

International users who can use FTX International may prefer FTX. US users trading at FTX US need to do KYC procedures and KYC is required for all users for WazirX as well as for FTX. Fees may be slightly more competitive at FTX as a trader’s volume is higher, since FTX offers both fee incentives for volume and for holders of its FTT token.

WazirX vs Gemini

Gemini is more focused on its holistic crypto financial services for Americans, while WazirX serves primarily the Indian market, and lacks a lot of the developed services Gemini offers, such as Gemini Earn, and the regulated custodian status that Gemini enjoys.

There is a difference in fees to start, giving WazirX the edge: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, while WazirX charges flat 0.20% trading fees for both makers and takers, which is still lower than Gemini, even without any volume-based incentives.

Gemini offers volume incentives while WazirX does not, both as far as fees go, neither platform is competitive as compared to the global crypto market offerings.

US investors and traders are allowed to use Gemini with KYC verification only, since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products. WazirX offers spot products only as well and also requires full KYC.

Gemini offers 62 coins and 86 trading pairs which is smaller than what WazirX offers.

WazirX vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while WazirX offers only spot trading and does not serve US users.

US users will prefer Kraken for its regulatory compliance and strong track record if they are traders especially.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is about the same as WazirX’s 0.2% flat fee schedule. Market makers enjoy reduced fees however at Kraken and fees also reduce with volume, which is not the case at WazirX as far as volume tiers go, though WazirX offers fee reductions for WRX token holders and 0% fees for WRX trading pairs.

Kraken offers a greater variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer Kraken over WazirX.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while worldwide users can use WazirX with KYC, but US users cannot use it.

WazirX vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than WazirX—over 351 coins and over 1300 pairs. WazirX was acquired by Binance and users of WazirX enjoy fee-free transfers into the Binance exchange as a result.

The two exchange’s offerings are varied in their scope, with WazirX being an exchange catering primarily to Indian markets (with INR trading pairs), while Binance is focused on being a global leader and fast innovator in every crypto product.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs not found anywhere else besides potentially OKX or FTX. WazirX itself offers only spot trading with no margin or futures.

Binance’s maker-taker fee schedule is unique in its competitiveness compared to that of other exchanges, starting at 0.1%, plus Binance also offers further 25% reduction in fees if paid in BNB, alongside offering reduced fee tiers for higher volume and even maker rebates.

This gives Binance an edge in the fees department, unless traders are seeking to trade WRX trading pairs and obtain 0% trading fees at WazirX. WazirX also offers fee reductions for holders of its native exchange token, but they are not as extensive in reducing fees as much as at Binance.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to WazirX. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is less than WazirX, but US users cannot use WazirX anyway.

Binance requires full KYC now to trade even spot products, and WazirX requires full KYC as well to use. Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance, unless they are in India and specifically seeking INR pairs.

FAQ – Frequently Asked Questions

Is WazirX Safe?

Yes, WazirX is rated as a secure exchange and the most trusted exchange in India. There has never been a reported large-scale hack of the exchange.

As per its security precautions, WazirX stores 95% of the funds in cold storage. The platform is also enabled with a two-step verification feature to provide enhanced security to customer accounts. It also utilizes a multi-signature wallet system and adheres to strict KYC/AML guidelines.

Users are always encouraged, as with all exchanges, to use 2-factor authentication with either an authenticator application or with a hardware authenticator key, instead of with SMS, to limit potential SIM swap attacks. In addition, users should use complex passwords, unique email addresses, and be wary of phishing attempts.

More security precautions can be noted here.

How long does WazirX Withdrawal take?

As per this support documentation, WazirX processes crypto asset withdrawals always within 30-60 minutes. If the withdrawal is not processed instantly, then it is retired after some time.

INR fiat withdrawals are processed near instantly, meaning they are directly sent to the bank for processing.

However, this does not guarantee that your Withdrawal has been processed by the bank.

There are only 2 reasons because of which the INR withdrawal can get stuck in the Almost done/Processing stage

1) Banking issue: Happens when your banking network is down and such withdrawals get updated by the banking network within 3 Banking days as per NPCI

2) Linked Bank account is incorrect: if the Bank account linked is invalid/incorrect the transfer will get failed and the status for the same gets updated by the bank within 48 hours.

All crypto transactions on average can take from 30 minutes to several hours for a transaction to be confirmed due to the blockchain after the exchange processes the withdrawal, depending on the blockchain network traffic. Please note that for crypto, the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

Is WazirX a good exchange?

WazirX is an excellent choice of crypto exchange especially for Indian crypto market users who wish to transact with INR or otherwise global users who may want access to the exchange’s P2P auto-matching service and other products.

WazirX does offer over 200 coins and over 400 trading pairs which is a moderate to strong amount of coins if compared to other exchanges, and the fee structure is very simple to understand, at a flat 0.20% trading fee for both makers and takers for all coins, with fees reduced to 0.17% and further to 0.15% for holders of the exchange WRX token.

While these fees leave incentives to be desired for higher volume trades and for market makers providing liquidity, WazirX’s ease of access to Indian banks for fiat, moderate spot trading features, and strong trading platform support and features make it a great overall exchange, with room to grow in their crypto financial services over time.

International users looking for further lending, borrowing, and staking options, which WazirX lacks, may find competitors more valuable, but this is the top exchange of choice for Indian crypto users.

Where is WazirX located?

WazirX is located in Mumbai, India with its headquarters.

Does WazirX require KYC?

Yes, all users of WazirX are required to undergo the same KYC verification procedures. For KYC, users are required to submit their name, address, DOB, nationality, government-issued ID, and a valid photo holding said ID, in addition to a valid email address and a mobile phone number. These requirements may differ depending on the user’s country.

What are the Deposit and Withdrawal Methods and Fees for WazirX?

WazirX offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto assets: deposits and withdrawals—no deposit fees (free). Withdrawal fees depend on the asset (and blockchain network) in question, listed in this table. Many cryptos have no withdrawal fees, but some do. The BTC withdrawal fee at this time is 0.0006 BTC.

- INR Fiat withdrawal and deposits are supported and instructions can be found here. Deposit fees are not publicly noted but are upto or less than 20 INR per deposit, but there is a deposit minimum of 100 INR and a maximum of 4.99 lakh INR via net banking (Indian banking system). No maximum deposit limits apply.

- Withdrawal fees for INR withdrawal range from 5-10 INR per withdrawal and maximum withdrawal limits apply at 1 Crore INR per day, and a maximum of 2 or 50 lakh INR per transaction, depending on the method.

What is the Minimum Withdraw Amount for WazirX?

The minimum withdrawal amount for crypto assets at WazirX is listed for each asset in this page.

For crypto assets, the minimum withdrawal depends on the asset in question.

The minimum withdrawal amount for INR fiat is 1000 INR.

How do you withdraw from WazirX?

Users can withdraw from the wallet by navigating to the “Funds” section of their account page, then clicking the crypto or INR fiat the user wishes to withdraw.

From there, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed. The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

If withdrawing INR, click the linked bank account, or link it at this time.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal. The 2FA code is also required for security if this feature is turned on by the user.

Once WazirX approves the transaction, it will show in the blockchain network in question and process therein.

Is WazirX a wallet?

No, WazirX is a cryptocurrency trading exchange that also offers a custodial wallet for trading services, but is not a non-custodial standalone wallet.

How to use WazirX?

Using WazirX can be done by going to http://wazirx.com, clicking the “Sign Up” link on the top right, creating an account on the platform, first undergoing KYC verification procedures, waiting for verification to complete, and then depositing any crypto asset trading funds into the account (or INR fiat) and then getting access to the market offerings and begin trading.

User Reviews

- Users on the India subreddit report positive experiences with WazirX. u/satyamsid says, “Wazirx is safe/ safer than the rest. Crypto is the Wild West of investing and no one knows any better. Just a word of caution.”

- User on the BitcoinIndia subreddit discuss using WazirX and its features. OP says, “I can’t figure out the best way to buy btc in India. Lot of people are recommending Wazirx but I don’t understand why their prices are so high.” u/kshitiz_arora replies, “Brother, CoinDCX is better than wazirx as per my experience. Most of the time you can’t deposit money from wazirx and even withdraw it.There are a lot of technical issues you will experience while using wazirx. Not to mention the high fees, CoinDCX also has kinda similar fees but good user experience with no hassle.”

- Users on Quora report positive experiences with WazirX and recommend using it, though note that the customer support can get overwhelmed so may have slow responses.

- A user on reddit compares two Indian crypto exchanges, WazirX and Coinswitch Kuber. “WazirX is pretty great at everything else but every time there is a market crash and people try to invest I see that WazirX has suddenly removed all practical ways to do it. … Now usually one would suggest to switch to another app and the second biggest one is Coinswitch Kuber. But Coinswitch Kuber is one terrible exchange with their behaviour bordering on dishonesty.”